Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors.

Overview of Digital Asset Custody for Institutional Investors.Author: Aspen Digital

With the increasing popularity of digital assets, the demand for institutional-grade digital asset custody is rapidly increasing among family offices, high-net-worth individuals, and external asset managers. Recently, PWC and Aspen Digital jointly released a 39-page report titled “Current Status of Digital Asset Custody”. The report provides an in-depth analysis of how digital asset custody can help institutional investors in Asia achieve growth and seize emerging opportunities in the digital asset ecosystem.

The report starts by giving an overview of the recent development of digital asset custody from several perspectives, including the development of institutional investors, key challenges faced by digital custody, and how institutional investors should choose the appropriate custody model.

01. Current Status of Digital Asset Custody

The development of digital asset custody has gone through three distinct stages. It started with the self-custody solutions in the custody 1.0 stage, followed by the emergence of institutional-grade solutions. In the custody 1.0 stage, self-custody was the main approach, which included hardware wallets, software wallets, and paper wallets (physical prints of public and private keys). In this stage, users were responsible for managing their own digital assets by safeguarding their private keys. This method was simple and decentralized, but lacked security and efficiency. It was also susceptible to hacker attacks (such as the infamous Mt.Gox incident in Tokyo in 2014, where the Bitcoin exchange suffered a hack and lost approximately 850,000 bitcoins, leading to its bankruptcy).

- Robert F. Kennedy Jr Will Support the US Dollar with Bitcoin if Elected President

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors

- The Battle for the Throne between Bitcoin and Ethereum What are the determining factors for victory?

Since 2016, third-party custodians began offering offline cold wallet solutions, marking the beginning of the institutional digital asset custody 2.0 stage. However, the complexity of operations failed to meet the convenience needs of institutions. In 2017, the Chicago Mercantile Exchange launched Bitcoin futures, leading to a significant increase in institutional demand for digital assets, as well as for regulated digital asset custodians. To meet the demand, custodians adopted technologies such as Hardware Security Modules (HSM), Multi-Party Computation (MPC), and multi-signature to provide compliant and secure custody solutions. They also offered institutional-level asset control models, such as insurance, compliance tools, and customized trading strategies. The diversification of custody choices and the introduction of multi-party security and operational layers are important features of the custody 2.0 stage.

In the custody 3.0 stage, digital asset custodians help institutions participate more deeply in the growing Web 3 ecosystem. With the rise of “DeFi summer” in 2020, as well as the emergence of metaverses and the gaming industry in 2021, institutions have increased their demand for more flexible asset custody methods. The role of institutional-grade custodians is to provide one-stop services. At the same time, the demand from high-net-worth individuals and family offices is also increasing. They require not only the security of digital asset custody but also appropriate governance levels and flexibility in asset transfers (allowing assets to be transferred between multiple wallets, such as cold wallets, hot wallets, and spot trading accounts). These are key features of the custody 3.0 stage.

Overview of Digital Asset Custody Landscape and Differences from Traditional Custody Solutions

As of April 2023, there are over 120 digital asset custody service providers, mainly divided into self-custody solutions and third-party service providers.

Third-party service providers include digital asset custodians and exchange custodied wallets, which hold users’ private keys. However, exchange custodied wallets are more vulnerable to hacking attacks. In contrast, digital asset custodians offer comprehensive services to institutions, including trading digital assets, and only charge a certain service fee. Self-custody solutions require users to protect their assets themselves, usually through passwords and mnemonic phrases. However, if lost, users may not be able to recover their digital assets. These characteristics demonstrate the clear differences between digital asset custody and traditional custody solutions.

Unlike traditional financial service custodians who use centralized clearing and settlement systems to custodian stocks, bonds, commodities, etc., most institutions choose third-party digital asset custody services, with the custodians responsible for managing clients’ private key information, thus controlling and accessing their assets. Institutions also tend to choose licensed or regulated custodians to protect their assets.

02. Development of Institutional Investors

With more and more investors entering the market, especially institutional investors such as family offices and high-net-worth individuals, the form of digital asset custody needs to change to adapt to market changes.

Trend 1 | Ethereum Merge Sparks Institutional Investor Interest in Staking

The Shanghai upgrade and transition from proof-of-work to proof-of-stake of Ethereum have sparked institutional investor interest in staking Ethereum. Since the Ethereum merge in 2022, the total number of ETH deposited in its network has reached 22.9 million. Institutions usually choose decentralized staking pools, cryptocurrency exchanges, and digital asset custodians as centralized third-party providers for staking. However, as the variety of DeFi products increases, managing multiple private keys for different blockchain protocols becomes a challenge, especially for family offices and asset management firms with limited resources and time. This includes selecting validators, understanding the risks involved in decentralized staking, and having awareness of risks such as smart contract security.

Trend 2 | Family Offices Favor Digital Asset Staking Services Offered by Technology Service Providers

With the growing interest in digital asset staking, family offices and external asset managers are more inclined to choose technology service providers that can offer secure, user-friendly, and diversified services. These providers not only offer digital asset staking but also provide one-stop services including compliance, trading, fiat currency exchange, and tokenization. Compared to self-custody solutions, technology platforms provide more secure measures and user-friendly interfaces for implementing decentralized financial protocols for staking and earning strategies. Additionally, built-in approval limits and multi-signature authorization provide extra security protection for decentralized financial protocols.

Trend 3 | Institutions Focus on NFT and Metaverse

Institutional investors are closely watching the NFT and metaverse space, seeking new business utilities and investment opportunities. Well-known brands such as Starbucks and Nike have already utilized NFTs to enhance customer engagement and develop new revenue streams. However, for newly-entered institutions, the self-custody services of NFTs may pose challenges. The Chief Operating Officer of a family office in Hong Kong pointed out that self-custody solutions have certain issues in managing private keys. On the other hand, NFT custody solutions provided by third-party service providers allow institutional clients to hold NFTs without managing private keys themselves, and also enable institutions to access multiple decentralized markets for direct trading of NFTs, thus gaining industry recognition. In addition, institutions are also seeking investment opportunities in NFT collectibles and virtual land within the metaverse. It is estimated that by 2030, the market value of the metaverse will exceed trillions of dollars, with 82% of executives planning to incorporate the metaverse into their businesses within three years.

03, Key Challenges Facing Digital Asset Custody

[1] Security

In recent years, hackers’ attacks on cryptocurrency exchanges have resulted in significant losses, leading to further demand for digital asset custody. Meanwhile, although exchange wallets are convenient, their security relies on the reputation and infrastructure of the exchanges. For example, the closure of FTX exchange in 2022 lacked proper governance and risk management, which may have caused substantial devaluation of customer assets. Therefore, institutions are increasingly inclined to use self-custody solutions or reputable digital asset custody institutions rather than solely holding assets with exchanges. A family office in Hong Kong revealed that it is considering transitioning from cold wallets to digital asset custody services to more easily manage its expanded digital investment portfolio. Additionally, digital asset custody services achieve a balance between security and availability through Multi-Party Computation (MPC) technology, which divides and disperses private keys, thereby avoiding comprehensive failure even if some private keys are leaked.

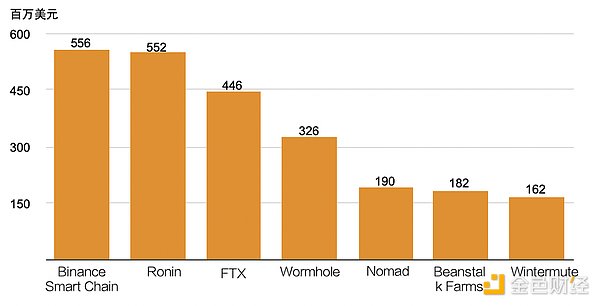

Chart: Losses from Digital Asset Hacks (2022) | Source: Decrypt

[2] Regulatory Fragmentation

The report shows that the current main concerns of family offices are the security, operational framework, and availability of digital asset custody, and after communication with multiple custody service providers, it was found that these are the obstacles that are difficult to overcome at present. Furthermore, in terms of regulation, although the global legal environment has become more accommodating towards digital assets, the regulation of digital asset custody is still fragmented and requires clearer provisions. Many family offices and investment funds have business operations spanning the globe, so choosing digital asset custody services within jurisdictions with different regulatory policies also poses certain difficulties.

【3】 Comprehensive Insurance Policies

Comprehensive insurance policies are crucial for customers who choose digital asset custody services because they provide a safety net for unexpected events and help establish trust in asset security. Despite limited experience in managing digital assets in the private wealth sector, comprehensive insurance policies can protect practitioners from human errors and negligence.

The report also points out that digital asset custody service providers and technology service providers offer a wide range of insurance policies. The following criteria can be considered when evaluating:

-

What is the cumulative limit of the custodian’s policy?

-

Are customer wallets kept separate?

-

Which insurance company underwrites the policy?

-

Does the insurance policy cover external digital asset theft?

-

Does the insurance cover internal theft? Executive internal theft?

-

Does the insurance cover private key loss/damage due to natural disasters?

-

Does the insurance cover losses caused by software vulnerabilities?

-

Does the insurance cover cold wallets, hot wallets, both, or neither?

-

Which legal entities are covered by the insurance policy? Does it match the legal entities that customers sign service agreements with?

-

Does the custodian or exchange allow you to purchase additional insurance?

04, Choose Custody Model

In the context of the accelerated development of the ecosystem and the widespread adoption of encrypted assets, custody, as the foundation of the digital asset ecosystem, has become a challenge that needs to be addressed. Because blockchain does not have a clearing mechanism and a security control system like traditional finance, its transactions are irreversible, and investors need to track their own transactions and take responsibility for them. Therefore, we recommend formulating strategies and models to address the challenges faced by digital asset custody and seek a balance between operational efficiency and security.

The biggest risks faced by users and private keys include confidentiality (the risk of unauthorized access to private keys and backups), availability (the risk of private keys and backups becoming unavailable), and integrity (the risk of private keys or backups being altered and unreadable). To address this threat, secure custody controls can be implemented, such as:

-

Private key management throughout the entire period

-

Appropriate technical infrastructure

-

Separation of duties

-

Limiting the number of accounts with access to the keys

-

Transaction initiation/audit process

-

Asset isolation

-

Identity and intent verification

-

Establishing strict transaction processing rules

Should Institutions Seek Internal or External Cryptocurrency Custody Solutions?

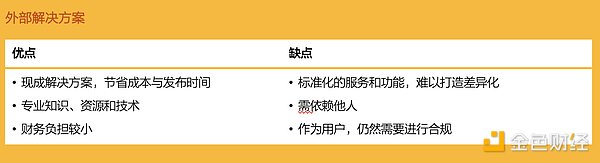

Building an internal custody solution requires certain knowledge, experience, and team resources. If a third-party solution is used, custody can be entrusted to a qualified third-party service provider. However, even in this case, users still need to bear the ultimate responsibility and related risks, such as the selection and management of suppliers, asset security measures, and internal control systems for digital assets.

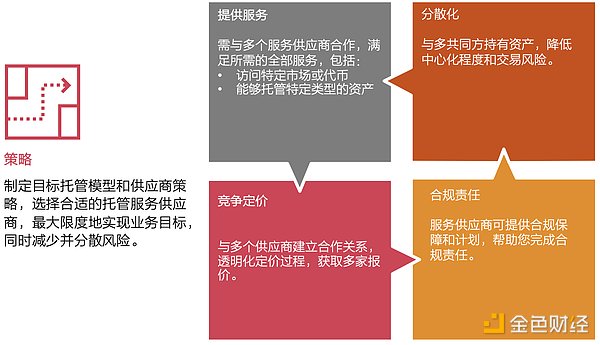

Determining Custody Models and Vendor Strategies

Before choosing a specific custody service provider, institutions should formally determine their target custody model and vendor strategy. As mentioned above, outsourcing the custody model is the best choice for institutional investors. However, after choosing the outsourcing model, the vendor strategy still needs to be considered. Institutions should evaluate which functions and operating methods need to be retained and compare them with the third parties they want to outsource to.

Factors to Consider When Looking for a Custodian:

When selecting a digital asset custodian, institutions should consider the following key factors:

-

Reputation: Evaluate the custodian’s market position and reputation based on its history and background

-

Custody and Trade Execution: Understand the custodian’s operating model, whether it provides additional security measures and transaction speed. For large exchanges that provide trading and custody services, it is necessary to ensure the secure storage of digital assets and the ability to quickly access these assets when needed for trading

-

Compliance: Look for custodians with built-in compliance operations to reduce reputational risks. Check whether the custodian has been or is currently subject to regulatory investigations and whether it has obtained relevant regulatory certifications or licenses

-

IT and Network Security: Understand the custodian’s network security measures, including the security of hot wallets or cold wallets, as well as system compatibility and security features such as multi-signature

-

Service Suitability: Evaluate whether the custodian’s business model meets your own needs, including the types of digital assets supported, prioritization of cold wallets or hot wallets, and business continuity

-

Commercial Terms: Understand the custodian’s fee structure, including storage, deposit, and withdrawal fees, as well as rights and obligations in the commercial terms, especially in disputes and unpaid events

-

Ownership and Legal: Understand the custodian’s legal structure and jurisdiction, as well as the impact of these factors on the management of digital assets

-

Financial Stability: Evaluate the custodian’s financial strength and the feasibility of its business model, especially regarding asset access issues when the custodian ceases operations. A financially stable custodian with sufficient funds and a viable business model can minimize obstacles in the provision of services

Summary

The digital asset industry is currently in a phase of rapid development and innovation, with Hong Kong performing particularly well. Within the digital asset ecosystem, custody services play a crucial role. In light of the impact of bank failures and market turbulence, more institutions are choosing to explore the digital asset space. Institutional-grade custody solutions have become a strong market demand, aiming to help investors seize vast investment opportunities in a secure and controlled manner.

When designing operational models, institutional investors should have a global perspective and choose third-party providers for digital asset custody. Implementing appropriate digital asset custody solutions is essential for capturing market investment opportunities and preventing significant asset losses.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Good news for Bitcoin? Understanding the upcoming Nakamoto version of Stacks with one article

- The US instant payment system FedNow is here! But it is not a rival to cryptocurrencies.

- Blockchain Gaming June Monthly Report Market Analysis, Opportunities, and Challenges

- Binance Research An Illustrated Guide to Cryptocurrency Data Tools Track

- Paris The Fashion Capital, Embarking on a New Web3 Feast

- Review of Yuga Labs’ Ecological Development and APE Token Market Performance

- Converting mnemonic words into a set of colors? Developers launch Bitcoin mnemonic tool BIP39Colors.