Inspiration of stablecoins: analysis of the "Black Thursday" crisis and construction of a new borrowing and buffering model

Editor's Note: The original title was "Inspiration for Stable Coins-Building a New Debt Buffer Model". This article has been deleted without changing the author's original intention.

Decentralized stablecoins seem to be contradictory: although their goal is to create non-regulated assets, they can only achieve complete stability by adding unrelated assets (centralized / regulated assets, such as Maker's recently added USDC as a collateral asset). In fact, this problem is more widespread in synthetic assets and cross-chain assets. We have developed another market-based mechanism to enhance the stability of assets in crisis, while ensuring no regulation. This creates a buffer that distinguishes those who are willing to exchange stablecoins for regulatory assets during the crisis (in exchange for the continued gains of option buyers) from those who want to be completely decentralized.

Historical price of ETH: On March 12, 2020 (Black Thursday), the price of Ethereum was almost cut, triggering a large-scale liquidation of DeFi and CeFi (Chart: OnChainFx).

- Bitcoin as ransom, WannaRen ransomware hits twice

- "Digging" 500 years to recover the cost of equipment? V God calls HTC mobile mining a fool's game

- Learn about Utreexo, an improved MIT Bitcoin solution in 5 minutes

background

On March 12, 2020, COVID-19 caused panic in the market and ushered in "Black Thursday", the price of cryptocurrency plunged by about 50% on the day. This led to large-scale liquidation of major cryptocurrency leverage platforms, including centralized platforms such as exchanges and a new type of decentralized finance (DeFi) platform that promotes excess mortgage loans on the chain. On this unusual day, Maker's stablecoin Dai was also inevitable, falling into a deflationary settlement spiral. This led to a high degree of volatility in "stable" assets and the collapse of collateral clearing procedures. As network congestion exacerbated the lack of market liquidity, some collaterals were liquidated at prices close to zero. As a result, there was a shortage of collateral in the system, prompting the project party to take emergency response measures and must recapitalize by selling new tokens similar to stocks.

Dai historical price, note the high volatility curve starting from March 12, 2020 (chart: OnChainFx).

During this time, Dai ’s demand grew. It became an asset with higher risk and higher volatility, but the transaction premium was high and the loan interest rate reached about double digits. Leverage speculators must repurchase Dai to deleverage, which exhausts Dai ’s liquidity and pushes up Dai ’s price, thereby increasing future liquidation costs. Deeper reason). These speculators are beginning to realize that in this case, they face the risk that a debt relief of $ 1 may bring a huge premium. In the end, a new external stable asset must be injected—the USDC-regulated stablecoin USDC as a new collateral to stabilize the system.

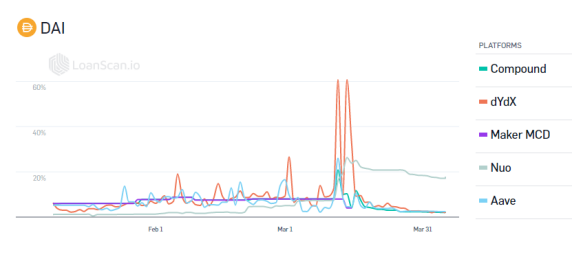

Dai ’s historical loan interest rate, note the double-digit interest rate starting March 12, 2020 (chart: LoanScan).

In addition to the panic caused by COVID-19, bitUSD, bitBTC, Steem Dollars and NuBits have also experienced major decoupling events in 2018.

Stability results

In this article, we modeled the incentive mechanism of stablecoin speculators (CDP owners) like Dai to analyze a crisis like "Black Thursday." These speculators determine the supply of stablecoins by optimizing the profitability of leveraged positions and combining expectations of future collateral liquidation costs.

Explanation of stable and unstable areas of stablecoins: In stable areas, stablecoins perform well, and the price of stablecoins has a high probability of matching the anchor currency, with minimal fluctuation. Outside the stable area, the stablecoin may not be very stable, and the price fluctuations are significantly larger, which may be similar to the ETH fluctuation level.

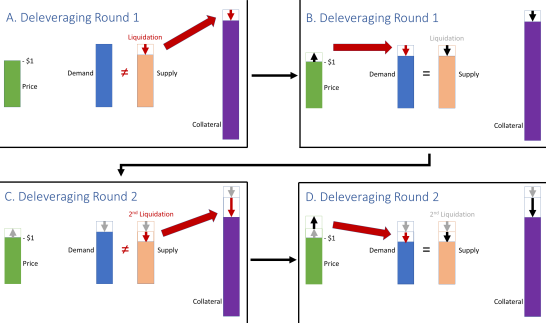

This instability is triggered by several factors: huge potential price volatility, ETH crash, and liquidity problems caused by deleveraging during the crisis (which may lead to deflation deleveraging spirals). In order to liquidate CDP, speculators need to buy back stablecoins to repay their debts. If speculators want to deleverage a lot, whether they are marginal speculators who want to increase leverage and issue new stablecoins, or stablecoin holders who want to sell their stablecoins, they cannot find a balance point, and then speculators eventually Will increase the price of stablecoins. Essentially, in this case, as Black Thursday shows, speculators need to pay a premium for deleveraging.

The picture above is a visual explanation of the deleveraging spiral. To deleverage, when market liquidity is exhausted, CDP holders need to buy back stablecoins at an increased price.

These triggers are the actual operation in the cryptocurrency setting. They proved to be relatively likely events for a long time. Therefore, we can neither ignore them nor expect them to change, we must adapt ourselves to them. We can concentrate on expanding the width of the stable area. The size of the stable area depends on the precise market structure. Under idealized (unrealistic) settings, the currency is stable over a large area. However, it is important that even the ideal environment deteriorates when prices collapse. Therefore, there are not many speculators who want to issue stablecoins, because this is related to the risk positions they think are not profitable.

Our analysis may be more applicable to data-driven stablecoin risk tools, for example, to estimate the probability of leaving the peg and infer when to cross the barrier and leave the stable area. But there is an obvious warning here: specific numerical results may be highly correlated with the model and are very sensitive to the market structure and the distribution of underlying assets. Our focus is on analyzing these systems and how to mitigate the crisis.

One solution: integration with regulatory assets

The deleveraging effect brings a fundamental trade-off in decentralized design. One way to make stablecoins closer to a "perfect" stable state is to increase the degree of adaptability (elasticity) of demand to supply.

The medium- and long-term elasticity depends on irrelevant alternatives other than stablecoins. Since all non-regulated stablecoins may face similar deleveraging risks, greater flexibility depends on the exchange of regulatory stablecoins or fiat currencies. Even if long-term demand is flexible in principle, the short-term can be tricky. Most of the supply of stablecoins is locked in other applications, such as loan agreements and lotteries. These applications (in a sense) ensure the security of the value of excess mortgages, but do not guarantee the liquidity of withdrawals. In addition, Ethereum transactions cannot be executed in parallel. During periods of volatile market conditions, transactions may be delayed due to network congestion, resulting in immediate transaction failures (especially transfers to or from centralized exchanges). This will happen even if these markets are liquid in principle.

Another way to bring stablecoins closer to "perfect" stability is to increase marginal speculators who are willing to use leverage and issue more stablecoins. Since there are no countless speculators with high expectations for ETH (especially during the long bear market), this requires relying on holding other collateral assets. Since all decentralized assets are highly related, this also relies heavily on holding regulated mortgage assets, such as the USDC recently added by Maker. Of course, it should be noted that supervised assets also carry risks, which may not be related to those extreme crises. Such as transaction party risk, bank operation risk, asset seizure risk and the impact of negative interest rates. However, there may be some substantial diversification potential.

Dai adds USDC as collateral

Although the integration of these measures with regulatory assets can enhance stability, it has caused greater centralization and removed the system from "non-regulatory" status. This seems to create a contradiction: Although the goal is to create non-regulated assets, these assets can only be completely stabilized by adding unrelated assets (currently centralized / regulated assets).

Alternative: Unregulated insurance pool

We propose another alternative: set up a buffer to suppress deleveraging effects without directly merging regulatory assets. The role of the buffer is to distinguish those who are willing to exchange stablecoins for regulatory assets in the crisis (to enable CDP holders to obtain sustained benefits) from those who want to achieve complete decentralization.

The Maker system charges speculators. If Dai holders lock Dai in the savings pool, then Dai holders can receive some rewards. By modifying the mechanism, this savings pool can provide a buffer for deleveraging effects. For example, if we allow speculators to buy Dai in the savings pool at a reasonable premium and use it for deleveraging, then the deleveraging effect will be limited by the amount of premium up to the size of the savings buffer. Dai holders participating in the savings pool will be compensated for offering repurchase options to speculators. Dai holders can choose to implement repurchase in mortgaged assets or other assets (such as regulatory stablecoins). In this way, the mechanism can provide "perfect" stability settings while allowing Dai holders to choose the degree of decentralization they want. Dai holders who do not need a high degree of decentralization can get compensation from the savings pool, while Dai holders who need a high degree of decentralization can not use the savings pool. Our model can be extended to incorporate this mechanism.

The implementation of this mechanism may be similar to the chai contract. First, speculators need to pay a certain fee to subscribe to the vault. In return for the subscription, they can choose to repurchase Dai. This option gives them the right to receive Dai in a crisis to repay Dai borrowed from the vault. Second, users can add Dai to this insurance pool. Dai in the pool earns interest on the Dai savings rate (when the interest rate is again above 0%); the pool can also earn interest by providing short-term loans. In addition, users can also get a second interest from the fees paid by speculators. Charged assets include asset pools provided by speculators, such as ETH, BAT or USDC. The interest rate can be adjusted according to the market mechanism of the pool: in a period of high insurance demand and low supply, in order to incentivize users to join, the cost will be high. When the demand is low, the fee will be adjusted accordingly. It is worth noting that by executing atomic functions on the Maker contract, we can ensure that the provided Dai can only be repurchased by the vault that currently subscribes to the pool.

Expansion to crypto assets other than stablecoins

The model / results (and the solutions proposed thereby) are more widely applied to synthetic and cross-chain assets and excess mortgage agreements that allow borrowing of illiquid and / or inelastic assets, as long as the mechanism is based on leveraged positions Endogenous prices of assets that have been created or borrowed. Synthetic assets usually use similar mechanisms, only with different anchoring targets. Cross-chain assets that port assets from a blockchain without a smart contract function (such as Bitcoin) to a blockchain with a smart contract function (such as Ethereum) also tend to rely on similar mechanisms. In a decentralized (or more precisely, on-chain custody) structure, the vault operator has to lock in ETH collateral in addition to deliverable BTC assets. They faced the risk of leveraged ETH / BTC exchange rate, and also faced the risk of similar deleveraging. Especially in order to reduce risk, they need to buy back cross-chain assets on Ethereum.

to sum up

We have built new modeling tools for stablecoins and other collateralized crypto assets, and demonstrated their value in understanding and preventing crises. We have developed a market mechanism that not only enhances the stability of assets in crisis but also ensures unregulated. This creates a buffer that distinguishes those who are willing to exchange stablecoins for regulatory assets during the crisis (in exchange for continued gains from option buyers) from those who need to be completely decentralized. Once the construction is completed, the long-term stability and survivability of non-regulated stablecoins will be improved.

Special thanks to Dominik Harz for his valuable comments and suggestions on the implementation of the Chai contract, and Georgios Konstantopoulos for his valuable feedback

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | Essential Knowledge of Encrypted Digital Currency Wallet: Divide Wallet Types and Their Advantages and Disadvantages by Terminal

- Observation | How have Chinese insurance technology giants used blockchain to transform?

- New Path of International Cooperation for Chinese Enterprises Against Globalization: Blockchain Industry Alliance

- This is the real blockchain! Tens of billions of dollars are put here, 4 industry experts bring you first-line experience

- FBI warning: under the new crown epidemic, beware of four encryption scams

- QKL123 market analysis | New days of global diagnosis? American Oolong! Data those things (0414)

- WBF founder Bella Fang: no evil + long-termism, the correct position of the encrypted derivatives track 丨 chain node AMA