Interpretation and Comparison of the EU’s Cryptocurrency Market Regulation Act (MiCA)

Interpretation and Comparison of the EU's MiCA Cryptocurrency Market Regulation ActAuthor: TaxDAO

1 Introduction

In recent years, the development of the cryptocurrency capital market has been rapid, becoming the object of pursuit for young investors in the West. However, the bankruptcies of cryptocurrency exchanges such as FTX have raised concerns among financial regulatory agencies in various countries. The European Parliament has approved the first cryptocurrency regulation, the Markets in Crypto Assets Regulation (MiCA) (MiCA is expected to come into effect in January 2025. However, the stablecoin-related rules may come into effect in mid-2024 after a 12-month transition period), making it the first major jurisdiction to introduce comprehensive cryptocurrency regulations. This article will analyze the background, main content, and comparisons with other international regulatory frameworks (FSM Bill, CARF, CRS) of this regulation.

- Halving Narrative and Reflexivity LTC falls instead of rises, can BTC halving still bring a bull market?

- Hashed Partner The next bull market will be mainly driven by the Asian market, and bottom-up innovation may emerge in Asia.

- Fortune Magazine From ambitious to defensive, what twists and turns has the crypto queen Katie Haun experienced?

2 Background of MiCA Implementation

The launch of MiCA aims to provide a legal framework for crypto assets that are not covered by existing financial services legislation in the European Union (EU); to establish a robust and transparent legal framework to support innovation, promote the development of crypto assets, and facilitate the wider use of distributed ledger technology (DLT); to ensure appropriate consumer and investor protection and market integrity; and to enhance financial stability considering that some crypto assets may become widely accepted.

MiCA also faces challenges and risks during its implementation. As the crypto asset market continues to evolve and new technologies emerge, ensuring consistency between regulations and market practices may be difficult. The implementation of MiCA may exacerbate market monopolies or oligopolies, as only a few large enterprises may have the capacity to meet regulatory requirements. If the regulatory standards of MiCA differ from those of other countries or regions, the European crypto asset market may face international competitive pressure, and companies may prefer to transfer related assets to regions or countries with lower compliance costs and regulatory requirements. The implementation of the regulation imposes higher requirements for active cooperation and effective enforcement among the competent authorities of EU member states, and any differences in the execution of MiCA may affect regulatory consistency and effectiveness.

3 Content of the MiCA Regulation

MiCA mainly covers three types of crypto assets:

Asset-Referenced Tokens (ART): Crypto assets that stabilize their own value by referencing the value of another fiat currency, commodity, or crypto asset (one, multiple, or a combination), such as Digix (DGX), which is backed by an equivalent gold reserve.

E-Money Tokens (EMT): Tokens that stabilize their own value by referencing the value of another fiat currency. The difference between E-Money Tokens and Asset-Referenced Tokens lies in the underlying asset allocation for price support. ART uses non-cash assets or a basket of currencies, while EMT uses only a single currency, closer to the concept of electronic money, such as Alipay or WeChat Pay.

Other Cryptographic Assets: Other cryptographic assets that do not fall under the category of asset-reference tokens and electronic money tokens, such as utility tokens, are intended to provide digital access rights to goods or services, enabling their use on distributed ledger technology (DLT).

MiCA does not cover other regulated cryptographic assets such as DeFi, NFTs, and security tokens. In addition, MiCA does not cover central bank digital currencies (CBDCs) or digital currencies issued by other international public organizations such as the International Monetary Fund.

In addition to defining the scope of application, MiCA also specifically regulates abusive practices in the crypto market to prevent market manipulation and fraud, protect the interests of investors, and ensure the stability and transparency of the crypto asset market. MiCA explicitly prohibits any form of market manipulation, including but not limited to:

-

Disseminating false or misleading information, including false advertising, misleading statements, or other fraudulent behavior, to influence the price of crypto assets or guide other market participants to make incorrect investment decisions

-

Trading on the basis of undisclosed insider information to gain unfair trading advantages

-

Manipulating the supply and demand of crypto assets by manipulating trading volumes or other means to manipulate prices

-

Exploiting market shortages or other loopholes to gain undue advantages

According to the provisions of MiCA, token issuers need to obtain authorization to provide services in the European Union. To obtain authorization, an application must be submitted to the competent national authority of the issuer’s country, which should include detailed information related to its business and services, including but not limited to business models, technical implementation, whitepapers, investor information, etc. There may be requirements for the qualifications of token issuers, such as financial requirements and organizational operations, to meet the requirements of relevant financial and risk management, compliance, corporate governance, etc., to ensure that token issuers can comply with relevant regulations, have sufficient financial strength to fulfill their commitments, and protect the rights and interests of investors. Subsequently, it will enter the review process, and the competent national authority may review the application materials, consult the European Securities and Markets Authority (ESMA) for opinions, conduct interviews and investigations with the applicant to ensure compliance with the provisions of MiCA. If the issuer of electronic money tokens fails to meet the requirements of MiCA or violates the regulations during operation, the competent national authority has the right to revoke its authorization and prohibit it from providing services within the European Union.

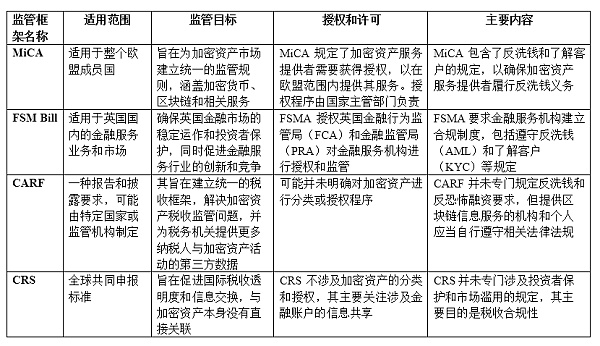

4 MiCA and other international tax regulatory frameworks

The following will compare and analyze MiCA and the UK Financial Services and Markets Bill 2022-23 (FSM Bill 2022). MiCA and FSMB both involve relevant content related to the management of cryptographic assets. Especially against the background of Brexit, the differences between the UK and the EU MiCA in terms of cryptographic asset management have attracted the attention of consumers and investors.

FSM Bill 2022 and MiCA both define the digital representation of value or rights, but the difference is that the definition of encrypted assets in FSM Bill 2022 is more extensive. Whether or not it is protected by encryption, as long as it can be used for payment, transferred, stored or traded electronically, or recorded or stored data using technologies such as distributed ledger, it falls within the scope of encrypted assets. Therefore, FSM Bill 2022 may also apply to other digital or encrypted assets that meet the above conditions, in addition to stablecoins. MiCA, on the other hand, emphasizes the use of distributed ledger technology or similar technologies, and provides specific classifications for encrypted assets, as well as corresponding regulatory rules and requirements for different types of encrypted assets.

Both MiCA and FSM Bill recommend regulating the issuance of encrypted assets when they enter regulated trading venues or are publicly offered. In MiCA, the main requirement is to provide disclosure documents in the form of a ‘white paper’. The UK has indicated that it may adopt a similar approach, but further evaluation is still needed. It may consider imposing ongoing requirements on issuers, as the UK believes that traditional securities disclosure regulations may not be well applicable to encrypted assets.

MiCA and FSM Bill have different regulatory requirements for overseas issuers and service providers. In MiCA, issuers must establish a legal entity in the European Union; similarly, encrypted asset service providers must have an ‘actual management’ in the European Union; at least one director must reside in the European Union and have a registered office in an authorized member state. In FSM Bill, the UK explicitly wants to regulate activities “in” or “towards” the UK. It is not clear whether it is necessary to establish a physical entity in the UK.

Table 1: Comparison of Major Encrypted Asset Regulatory Frameworks

Conclusion

There is no doubt that the “Cryptocurrency Market Regulation Act” will help improve the transparency and credibility of the cryptocurrency market, and to a large extent protect the rights and interests of consumers and investors. However, the implementation of the act will also face many unknown new issues, leading to short-term fluctuations in the market. In conclusion, the implementation of this act will be groundbreaking and may have a profound impact on the cryptocurrency market, and it deserves continuous attention from all parties.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- From hard forks to the Lightning Network, who is supporting the Bitcoin ecosystem?

- Semafor The US Department of Justice is considering fraud charges against Binance, but is concerned about a FTX-style run in the market.

- MicroStrategy plans to sell stocks to raise $750 million to purchase Bitcoin.

- Wu said July mining news Smagma big order and Samsung’s new technology, mainland promotes Fil mining machine, Little Deer Bhutan mining fund, etc.

- Cathie Wood’s latest interview Investors changing Wall Street are betting on Bitcoin and artificial intelligence

- Opinion If Curve dies, the entire DeFi market will need a considerable recovery period.

- Next BRC20? Understanding the Bitcoin Upstream Game Asset Minting Protocol Ord Games in 3 Minutes