Halving Narrative and Reflexivity LTC falls instead of rises, can BTC halving still bring a bull market?

Can BTC halving still bring a bull market if LTC falls instead of rises?Author: Deep Tide TechFlow Cleaning

At 23:00 on August 2nd, the block height of Litecoin (LTC), once known as “Bit Gold Lite Silver,” reached 2,520,000, and the block reward officially halved, reducing the mining reward from 12.5 LTC to 6.25 LTC.

The official Litecoin Twitter account also tweeted to celebrate.

- Hashed Partner The next bull market will be mainly driven by the Asian market, and bottom-up innovation may emerge in Asia.

- Fortune Magazine From ambitious to defensive, what twists and turns has the crypto queen Katie Haun experienced?

- From hard forks to the Lightning Network, who is supporting the Bitcoin ecosystem?

However, the market poured cold water on it, and LTC prices fell all the way, down 7% in 24 hours.

Although there can be a reasonable explanation, “good news is bad news,” everyone will sell after the halving, ending their profits. But the key issue is that LTC did not rise much before the halving, but rather followed the market’s fluctuations. So, most people were not “selling for profit” but “forced to cut losses.”

Whether it is digital silver or the halving narrative, both failed to stimulate the price of LTC. Of course, what people are more concerned about is whether Bitcoin’s halving next year still has a chance?

In the eyes of many, Bitcoin’s halving is undoubtedly a deterministic event that directly leads to price increases, but “correlation” does not equal “causality.”

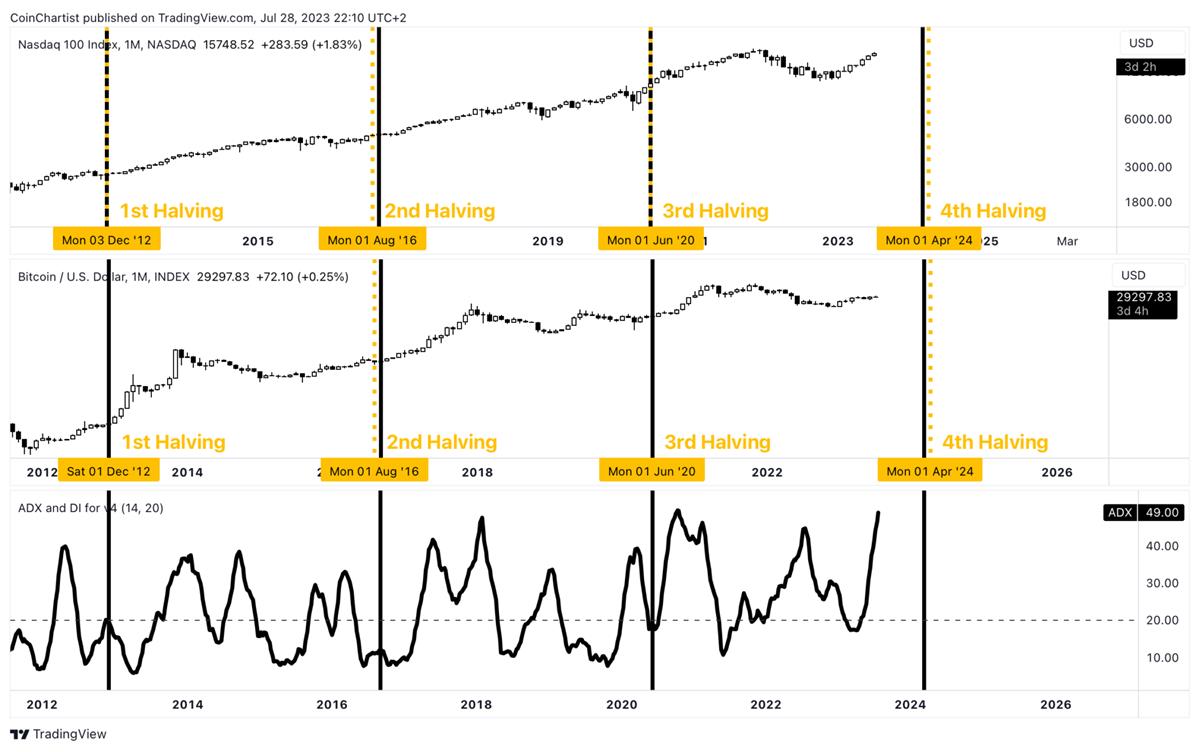

Looking at the timing of Bitcoin’s halving, the US stock market has also risen almost in sync. It is impossible to say that Bitcoin’s halving caused the rise in the US stock market, or to reinterpret it as “the rise in the US stock market driving the rise in Bitcoin.”

Prices are determined by both supply and demand. At the present moment, after Bitcoin’s third halving, the impact of Bitcoin’s halving on supply has become smaller and smaller. After Bitcoin’s halving in 2024, the individual block reward will decrease from 6.25 to 3.125.

Therefore, what will truly determine the price of Bitcoin will be demand, that is, whether there will be new external funds flowing in.

Looking back at the bull market of Bitcoin that started after the halving in 2020, people may not attribute it to the halving of Bitcoin, but to the “pandemic” and the “massive liquidity injection by the Federal Reserve.” Under extremely loose liquidity, the US stock market skyrocketed, a large amount of funds entered the Grayscale Bitcoin Trust, Grayscale continued to buy Bitcoin, and then Tesla also bought Bitcoin, driving the entire market into madness.

Therefore, where the “money” comes from is the key to determining whether there will be a crypto bull market or not.

Does this mean that the halving of Bitcoin is not important? No, the halving of Bitcoin still has a powerful “narrative” and “expectation” value.

In the crypto market, where there is almost no talk of fundamentals, price fluctuations often rely on “narratives” and “positive expectations” to drive them. It has been proven that narrative value is often effective.

When everyone is willing to believe that “Bitcoin halving” will bring a bull market, then everyone will rush to buy, thus really bringing a bull market.

This is also what Soros calls “reflexivity”.

Stock markets are the same. The stock market is also a voting machine. Because in the short term, what ultimately determines the rise and fall of stocks is the number of people buying stocks, not the performance of the company itself. The more people buy, the more the stock rises. So when buying stocks, most people are actually thinking about whether others will also think this stock is good and whether they will also buy this stock.

The financial market is the result of everyone’s consciousness playing games. I will think about how others think, and others are also thinking about how I think.

Under reflexivity, asset prices will never be equal to their intrinsic value. They mostly exist in a state of virtual high, and as they continue to rise, people will think more and more highly of the stock and continue to buy.

This cycle continues until the bubble bursts. The same applies to the downward process. This determines that prices will always oscillate around their value, moving from one extreme to another.

Therefore, from the perspective of the industry as a whole, it may be necessary to make most people believe that “Bitcoin halving” will bring a bull market in order to have a real bull market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Semafor The US Department of Justice is considering fraud charges against Binance, but is concerned about a FTX-style run in the market.

- MicroStrategy plans to sell stocks to raise $750 million to purchase Bitcoin.

- Wu said July mining news Smagma big order and Samsung’s new technology, mainland promotes Fil mining machine, Little Deer Bhutan mining fund, etc.

- Cathie Wood’s latest interview Investors changing Wall Street are betting on Bitcoin and artificial intelligence

- Opinion If Curve dies, the entire DeFi market will need a considerable recovery period.

- Next BRC20? Understanding the Bitcoin Upstream Game Asset Minting Protocol Ord Games in 3 Minutes

- Ord Games Introducing Bitcoin into the Gaming Protocol