Introduction | Blockchain Project Financing Tool: SAFT

Author: Luo Tao, Chief Compliance Counsel block chain Global Compliance Alliance, Tahota (Beijing) Law Firm, [email protected]

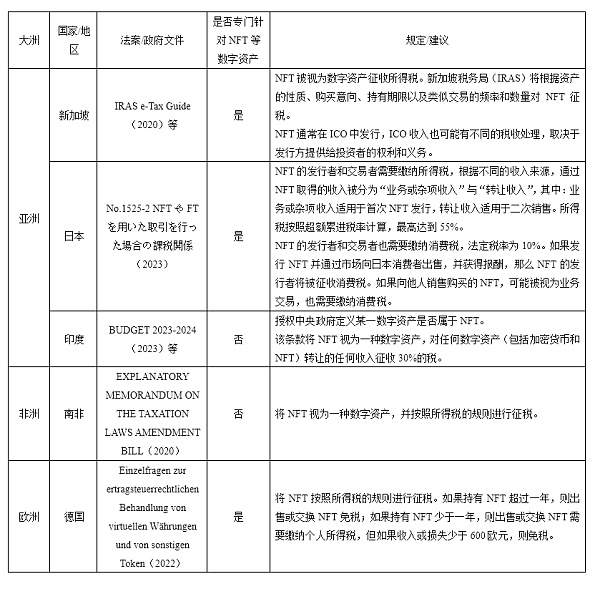

ICO as a new type of financing method was initially zero-regulated and zero-compliant. With the follow-up of regulations, ICO project parties tend to issue practical tokens for financing in safe havens, but this method still lacks supervision and scams are rampant. Has created a huge speculative bubble in 2017. With the bursting of the bubble and the continuous improvement of regulations, the project financing through tokens tends to adopt a highly compliant approach. For example, in the United States, STO—exemption of issuing securities tokens through securities laws—has gradually become mainstream. . In addition, another financing method, the SAFT protocol, is also widely used in foreign private equity financing of blockchain.

SAFT is the abbreviation of Simple Agreement for Future Tokens. It refers to the (equity) investment agreement signed by the blockchain project party and the investor. It is a business tool used to transfer the token rights before the development of the token function. The well-known incubator Y Combinator has been using Simple Agreement for Future Equity (SAFE) for many years.

- Blockchain Industry Weekly Report | Ministry of Industry and Information Technology: Guiding the Platform to Enhance New Technology Support Capabilities

- Smart contracts eliminate information asymmetry, build trust, and upend traditional insurance models

- Is there any change in the cooperation between the self-built blockchain team of Zhongzhuang Construction and Yange Information?

The origin of SAFT

SAFT was originally developed in Silicon Valley and later adopted and developed by Marco Santori, who was President and Chief Legal Officer of Blockchain and was a partner of Cooley LLP.

SAFT aims to enable the sale of practical tokens that have not been (ready to be developed), and blockchain project parties can complete financing without violating securities laws and other laws and regulations.

One of the biggest shortcomings of SAFT is that it focuses on US federal law without considering the different laws of other countries in the world. Another disadvantage is that only authorized investors can participate in SAFT, thereby excluding “ordinary people”.

How does SAFT work?

The specific steps of SAFT are as follows:

1. The project party releases their white paper, registers an American company, and performs KYC certification for qualified investors.

2. The project party signs an SAFT with the investor, which includes that the authorized investor supports the project with funds and obtains tokens at a discounted price someday in the future.

3. Projects that issue tokens are registered with the SEC and apply for SEC exemptions, including RegA, RegD, etc., which are the same as those applied for STOs. Therefore, the requirements for investors are the same as STOs, and most are limited to qualified investors .

4. The project owner uses the funds obtained to further develop the blockchain project. After the project was successfully launched and run, the project delivered tokens to investors.

In the United States, SAFT is itself a security, so it can be sold privately to qualified investors. The token that is ultimately delivered to investors should have practical functions, so it is not a securities required by US law. Outside the United States, the need to restrict SAFT or token investors to approved investors will depend on local law.

Compared with STO, the most important difference between SAFT and STO is the timing of token issuance. The STO project party will issue the corresponding token after the fundraising is completed, and SAFT will issue the token after the project development is completed.

The original intention of establishing SAFT

Simple Agreement for Future Tokens, as an investment contract, is a method developed for cryptocurrency startups to raise funds without violating the law.

Blockchain project owners use this SAFT to obtain funding to create and develop blockchain systems and technologies. After the project is launched, investors will receive the corresponding utility token and can sell the token.

The use of this two-tier model is intended to provide a financing model for token investment. Investors can participate in the development of the blockchain network and inject funds by purchasing tokens without incurring significant financial risks. In addition, SAFT aims to encourage more institutional investors to enter the market.

Existing risks

SAFT was developed to meet US securities regulations and may not meet the requirements of securities laws in other countries.

In addition, SAFT itself is a legal investment agreement, but if the developed token is recognized by the SEC as a security token, and no exemption is applied, it may be held accountable by the SEC.

—

Global Blockchain Compliance Alliance

"Establish blockchain industry standards, strengthen industry self-discipline, jointly maintain a good market order and industry environment, provide theoretical guidance for the healthy development of the industry, and promote the healthy and sustainable development of the industry."

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Gates and Li Ka-shing's blockchain business: one in the chain and one in the currency

- Let's talk about DAO from a human perspective

- Dialogue | The epidemic connects everyone more closely to the digital world blockchain makes it more credible

- You "don't need" DAO: What is the necessity of DAO?

- Industrial Blockchain Weekly Report | The first batch of virtual banks has been internally tested, and the ICT Institute launches a blockchain-based resumption platform

- Under the epidemic, how can blockchain make public welfare easier?

- Dialogue | Community epidemic prevention on the chain, data security can be checked