Smart contracts eliminate information asymmetry, build trust, and upend traditional insurance models

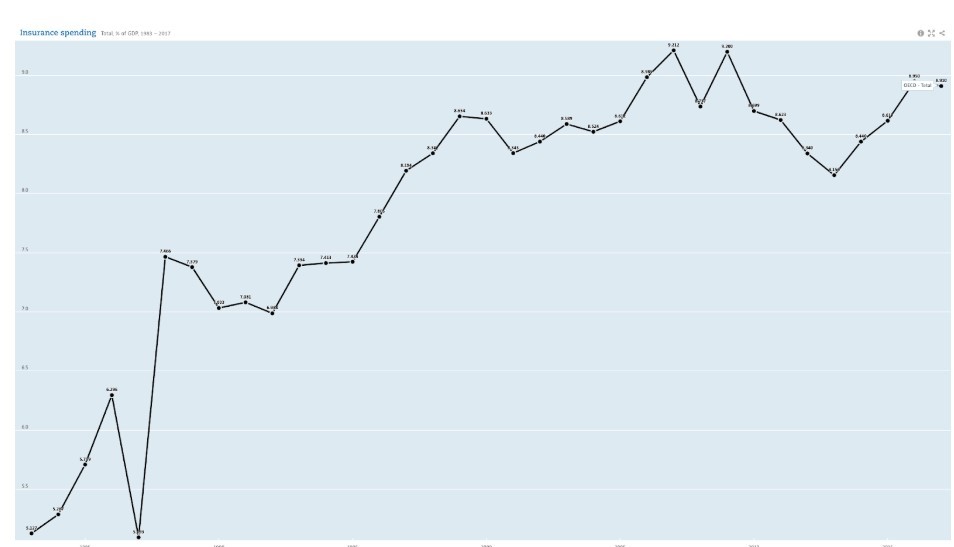

Insurance costs account for nearly 10% of global economic activity. According to OECD data, total premiums account for about 9% of global GDP.

(Insurance costs as a percentage of global GDP from 1983 to 2017, source: OECD) Insurance is driving economic growth because most economic activities depend on insurance services to achieve large-scale growth. If there is no savings insurance, bank customers will not deposit money in the bank; if there is no product recall insurance, car manufacturers will not provide customers with product warranty.

Insurance is both a prerequisite for the widespread application of innovative technologies and a major way to protect consumers. However, trust issues in the insurance industry itself have prevented it from achieving its full economic potential. Combining distributed ledgers, smart contracts, and decentralized oracles can upgrade the traditional insurance industry's infrastructure and benefit both insurance companies and insurance customers.

- Is there any change in the cooperation between the self-built blockchain team of Zhongzhuang Construction and Yange Information?

- Gates and Li Ka-shing's blockchain business: one in the chain and one in the currency

- Let's talk about DAO from a human perspective

New digital insurance products will bring unprecedented security and will:

New insurance model for uninsured people

Unblockchain products and services attract more new users

This article believes that the next generation of digital insurance contracts and risk transfer products will disrupt the future insurance industry. Renat Khasanshyn, the founder of the decentralized insurance platform Etherisc, also made the same predictions for the future integration of the insurance industry with smart contracts and the cryptocurrency economy.

Prediction 1: By 2022, new automated and semi-automated insurance products will be launched.

1. Parametric insurance model will be largely or even completely driven directly by data

2.Transfer of claims process from centralized organization to decentralized agreement

Prediction 2: By 2025, there will be at least five decentralized autonomous organization (DAO) model insurance cooperatives or unmanaged risk pools (also known as open finance or DeFi). Participants can:

Share risk with others

2. Passing on risk to venture capital markets (ie traditional capital markets such as cryptocurrencies or reinsurance, and insurance securities such as disaster bonds)

Prediction 3: By 2030, digital insurance contracts will be used to rebuild traditional insurance products:

1. Upgrade traditional insurance contracts to digital insurance contracts to achieve unprecedented privacy, transparency, and certainty.

2. Digital insurance contracts achieve flexible decentralization, eliminate the risk of single point of failure, significantly reduce direct and indirect compliance and regulatory costs, and reduce premiums for those who cannot afford insurance.

In order to better understand these predictions, let's take a closer look at the bottlenecks and potential solutions of the current insurance industry.

Information asymmetry

The following situations may cause insurance customers to use this information to make claims for themselves. First, they will selectively share information with insurance companies to get the best premiums. Secondly, due to the low probability of insured accidents, insurance customers often pay their premiums every month without seeing any actual returns. In addition, claims from insurance customers need to be approved by the insurance company. In summary, it is very likely that insurance customers will not be able to withhold the information.

On the other hand, incidents of insurance companies being deceived are endless. In the United States, insurance fraud other than health insurance causes insurance companies to lose about $ 40 billion a year and account for 10% of the prime minister's compensation. Insurance customers usually exaggerate their personal information in order to obtain lower premiums; they also exaggerate the severity of insured accidents to obtain higher claims; sometimes even multiple claims for the same accident. The insurance industry has expended a lot of resources to crack down on insurance fraud, which has also led to rising premiums to cover the costs of administrative management, underwriting, claims settlement and dispute resolution.

Information asymmetry causes policy price and value imbalances. Although many insurance customers are honest, insurers have to consider potential insurance fraud when calculating the premium baseline, so premiums must be increased in order to protect profit margins. Information asymmetry also causes the underwriting and claims process to be costly and complicated. Increased premiums and longer claims periods have infringed on the trust relationship between insurance companies and customers and plunged them into a vicious circle. And this problem can be solved with technology.

Re-establish trust

Digitalization: Although insurance contracts will become the DAO model in the future, most insurance contracts, especially commercial insurance contracts, are legal contracts that require both parties to sign and confirm. Therefore, there is an urgent need to develop a contract that can be understood by humans and machines. This type of contract is also called a Ricardo contract. Ricardo contracts can not only digitize physical contracts, but also quickly modify contracts in all formats, and there can be both coded and non-coded terms in the contract.

Startups such as OpenLaw and Clause (note: they set up a legal template project called the Accord Project) are developing new solutions that combine existing legal contracts with new distributed ledger technologies.

Decentralized infrastructure: Smart contracts are software programs that are run and stored on a distributed ledger (such as a blockchain). The contract uses the distributed ledger as the back-end technology, which can obtain the value that traditional back-end systems do not have, such as high certainty, tamper resistance and reliability.

In a decentralized infrastructure, the maintenance, execution, and delivery of smart contracts are performed automatically based on data, without any human intervention. This kind of infrastructure can improve the processing capacity of the contract and make it have storage redundancy and tamper resistance. The two parties to the contract cannot interfere in the execution process.

Data-driven: At present, insurance contracts rely on claims specialists to make claims for judgment, while smart contracts are executed entirely based on data, such as directly triggering life insurance claims based on death certificates. Insurance smart contracts directly driven by data will help eliminate information asymmetry. The data that triggers contract execution is generated by trusted entities, such as various IoT devices, so insurance companies can fully trust its accuracy. This will significantly reduce the cost of manual claims processing and bring the ratio of perceived risk to actual risk closer to 1: 1.

In order to protect user data privacy, insurance smart contracts allow users to choose whether they want to share private data in order to obtain more insurance products or better premiums. For example, users can choose to share automotive IoT data to get premium discounts.

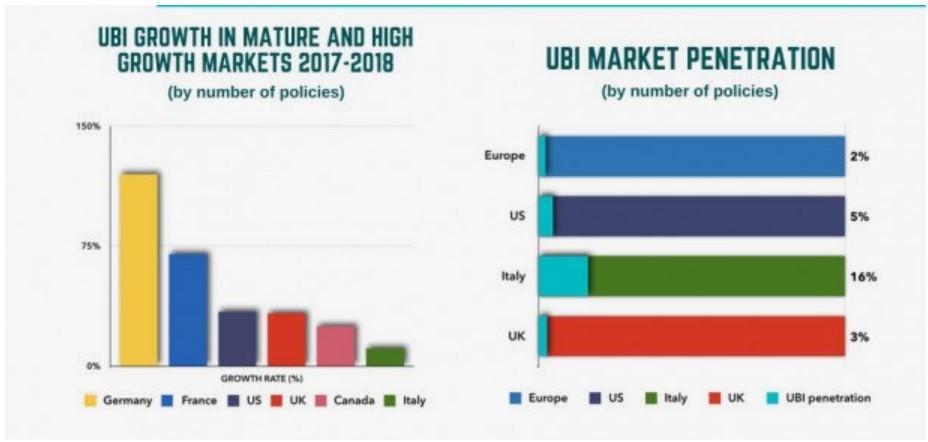

(2017-2018 UBI auto insurance growth rate and UBI product penetration in mature and high-growth markets, source: Ptolemus Consulting Group) Streamlined processes: Because smart contracts are executed automatically and stored in a distributed network, it is faster, cheaper, and has a lower error rate. Automation technology can streamline the claims process, and real-time data can be used to verify claims. Many insurance contracts can use Boolean logic of smart contracts to gradually replace back-end workload. This will save the insurance industry billions of dollars in claims, management, legal and labor costs. The savings can be used to reduce premiums for customers and speed up the claims process.

Data connection and privacy protection

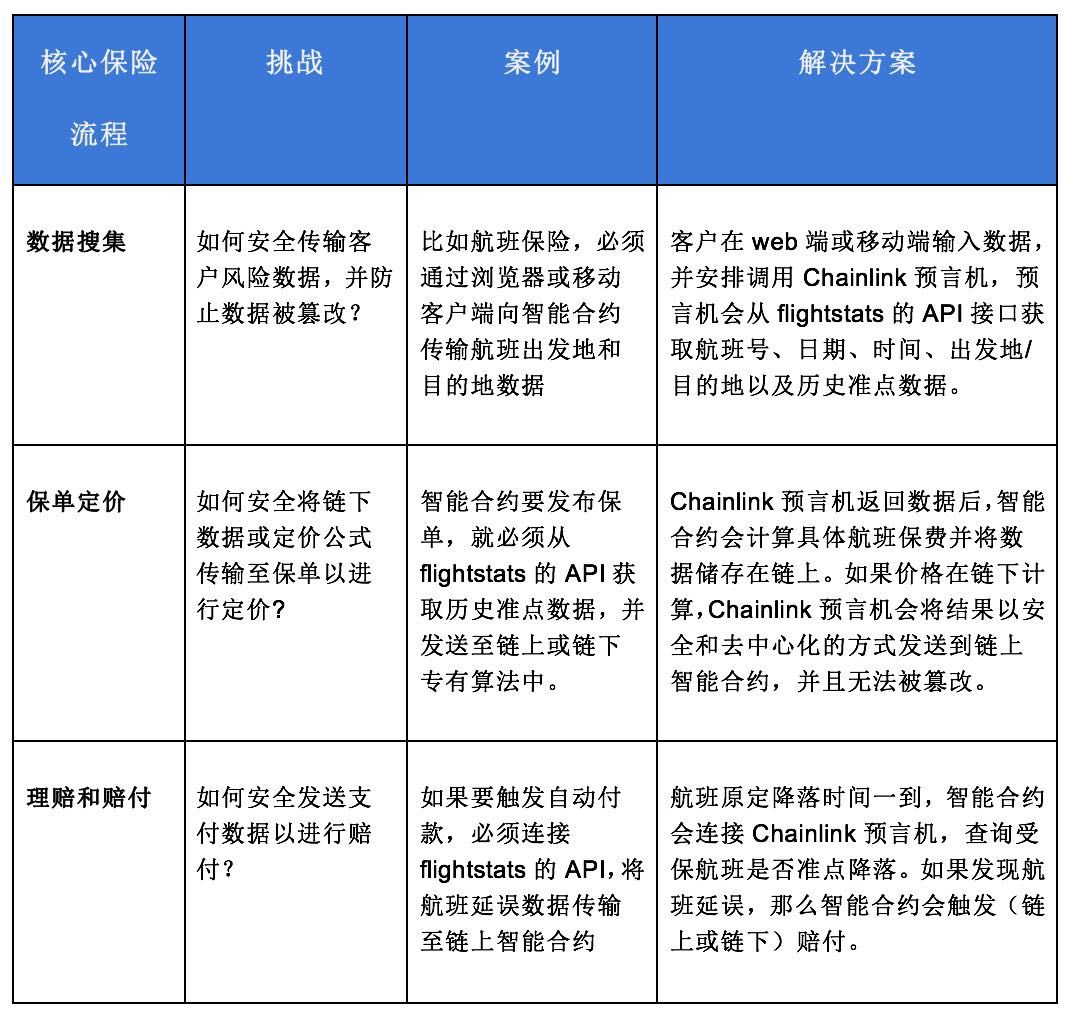

Data connection: Insurance smart contracts require external data to function. It not only needs to input external data to trigger contract execution, but also needs to output to external systems to trigger contract delivery. Therefore, insurance contracts must have the same characteristics as smart contracts when they connect to external data interfaces, namely: high degree of certainty, tamper resistance and reliability.

Chainlink established the first decentralized oracle network to provide decentralized data input and output for smart contracts. Chainlink can connect insurance off-chain smart contracts to data such as off-chain IoT sensors, web APIs, and satellite / drone images, and trigger contract execution. In addition, it can connect to many settlement APIs for smart contracts, including payment systems, other blockchains, and back-end databases such as the cloud. Smart contracts can be securely and reliably connected to any API through the Chainlink oracle.

Privacy protection: Trusted hardware such as Intel SGX can provide a Trusted Execution Environment (TEE) for Chainlink oracles (Note: A trusted execution environment refers to a protected environment in which code is run). TEE provides sufficient privacy protection for the input and output of smart contract data, and even the oracle itself cannot view the data.

A oracle such as Town Crier , which runs in a trusted execution environment, can verify data integrity and ensure that data has not been tampered with. The oracle in a trusted execution environment can process sensitive data such as IoT devices, personal login information or DLT identities, and is used for signature approval of smart contracts.

The trusted execution environment may have great significance for the future insurance industry. Insurance companies can use the trusted execution environment to accurately assess personal risks without accessing user sensitive data. For example, insurance customers can share health data on sports bracelets with insurance companies through oracles in a trusted execution environment. In this way, customers can prove to the insurance company that they can enjoy premium discounts for their exercise volume, and that the insurance company has no access to the customer's private health data. Digital entities and IoT devices transmit data to insurance contracts on the premise of ensuring data integrity and data privacy, which will greatly reduce the probability of fraud.

New insurance model

Internet of Things : IoT devices include sensors and actuators that collect various external event parameters. Common parameters for IoT devices include speed, location (GPS), sound, precipitation, electricity, magnetism, distance, pressure, and chemical composition. The IoT data will be transmitted to the insurance smart contract to determine whether an event actually occurred. If a specific event agreed in the contract occurs, then the contract will automatically pay the relevant parties.

· Auto insurance smart contracts use IoT sensors to monitor driving behavior, collision situations, and road conditions to accurately determine insurance discount rates and accident claims.

· Large-scale equipment monitoring system with built-in sensors fails and triggers warranty claims or automatically applies for maintenance.

· Smart home equipment detects indoor hazards such as fire, flood, and airlessness, and claims are based on data.

· IoT wearables and other biotechnology sensors connect to health insurance contracts, trigger health checks and calculate premium discounts based on parameters such as daily exercise, weight and heart rate

Web API: Insurance smart contracts use mainstream web API data to trigger many different types of policies.

· Life insurance contracts access various data such as death certificates, cremation records, obituaries, and police reports to determine death cases and make claims to relevant parties.

Flight and train insurance access to transportation department timetable data for claims for delays and cancellations.

· Crop insurance uses weather data, GPS or drone images to confirm weather conditions and make claims.

Etherisc is a decentralized flight insurance product recently released on the Ethereum testnet Rinkeby. This product is connected to Chainlink's decentralized oracle and accesses flightstats.com's web API to access flight status data. Please visit Etherisc's recent blog for more details.

Decentralized insurance: Smart contracts will bring disruptive new insurance products, such as microinsurance, P2P insurance, and a decentralized automated insurance pool. Decentralized insurance decentralizes insurance responsibilities, has flexible design models (such as pay-per-use models), and can expand into new customer markets.

"The foundation of insurance is that people work together to resist risks. Now with blockchain technology, the scope of the community has expanded to all parts of the world. Ethereum allows people to bypass centralized insurance companies to directly gather risks and share them together. This is the core of insurance. Therefore, members of Nexus Mutual have 100% ownership and decision-making power over it.

Using Ethereum technology to share risk among members, this model will pose a challenge to the traditional insurance industry. This will not only bring customers cheaper insurance products, but also enter new markets at a rapid rate. This technology has revolutionized the insurance industry and will continue to evolve over the next decade. — Hugh Karp, founder of Nexus Mutual

Breaking Information Asymmetry

The focus of the claims process will also shift from manual judgment to direct execution of contracts based on IoT data (while protecting user privacy). Once the result is sent to the blockchain, neither party to the contract can tamper with it, so both parties will regain trust. Since the entire process is automated, efficiency will increase dramatically. In addition, as the probability of fraud is greatly reduced, the premiums paid by customers and the cost of insurance companies will decrease.

Distributed ledger technology will bring information fairness to the insurance industry and establish a more fair and transparent insurance model. This shift will not happen overnight, but requires the establishment of uniform technical and regulatory standards across the industry. However, insurance companies should actively explore the tremendous value of Chainlink smart contracts for their business models and customer relationships in order to stay ahead of the competition.

Building the next generation of insurance products

Next step

Step 1: Determine the application scenarios for insurance smart contracts

Step 2: Check whether Chainlink has developed a oracle for this application scenario. If not, check how to develop the corresponding external adapter.

Step 3: For convenience, we can first use the Flightstats adapter to learn how to get data on the testnet through the Chainlink node.

Step 4: Learn how to pay with various tokens on Ethereum. You may need to use some exchange rate conversion tools, such as the Ethereum to USD tool.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dialogue | The epidemic connects everyone more closely to the digital world blockchain makes it more credible

- You "don't need" DAO: What is the necessity of DAO?

- Industrial Blockchain Weekly Report | The first batch of virtual banks has been internally tested, and the ICT Institute launches a blockchain-based resumption platform

- Under the epidemic, how can blockchain make public welfare easier?

- Dialogue | Community epidemic prevention on the chain, data security can be checked

- What is a block of credit? Speaking from Lightning Loan

- Talking about DAO Governance: "Man Rule" + "Autonomy" —— Evolving Way of DAO Governance