Review of the DApp ecosystem in 2019-the market trend is highlighted, relying on phenomenal games to survive?

When everyone is talking about DeFi (Decentralized Finance), the once popular fried chicken chicken DApp ecology will be a bit lonely.

Originally, DeFi should also belong to a branch of the DApp ecosystem, but I don't know since when the fate of DApps is firmly linked to the lottery games (that is, spinach), spinach Xing DApp Xing, spinach Xing DApp perish. The reality is that the focus of the entire industry is now focused on the DeFi field, and lottery games have become as old as ever, and due to this, the DApp ecosystem is no longer as popular as it was in the past.

DAppTotal analyzes the data performance of the three major public chains of ETH, EOS, and TRON over the past year, and focuses on the data dissection analysis of two types of DApps, such as DeFi and sweepstakes, and finds that DApp has set off waves in the market in the past year. In fact, It focuses on the games of the two tracks of DeFi and sweepstakes, and three phenomenal DApp games of EIDOS, FairWin, and just.game.

I. Overview of DApp data

According to data from DAppTotal.com, as of now, there are 4,018 DApps in the three networks of ETH, EOS, and TRON, of which 2,500 are DApps in ETH ecosystem, 655 are DApps in EOS ecosystem, and 691 are in TRON ecosystem.

- A road to smart hospitals: regulatory audits made easy

- "Steemit lightning seizure of power" has triggered a big discussion on public chain governance. Where does the individual "voting right" go?

- EY and ConsenSys announce the launch of the baseline protocol to ensure the safe and efficient use of the Ethereum mainnet by enterprises

1) Daily activity

As shown in the figure below, the DAU of the EOS DApp ecosystem has always been ahead of ETH and TRON, but since EIDOS was launched on November 02, due to the influx of the Wool Party, the EOS main network has been blocked, so DAU has experienced a cliff-like decline. . The ETH DApp ecosystem originally had a low DAU, but since the second half of the year, it may have been boosted by DeFi projects and the overall market rise. The overall DAU of ETH has continued to rise, even surpassing the EOS and TRON companies. In comparison, the TApp public chain DApp ecosystem is relatively stable, but the DAU in the second half of the year is significantly lower than the first half.

(DApp Daily Activity in 2019)

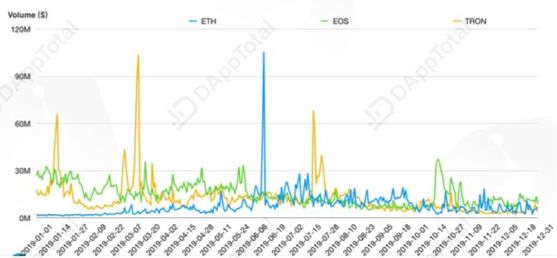

2) Daily transaction amount

As shown in the figure below, the overall transaction volume of the DApp ecosystem in the second half of the year decreased significantly from the first half. Compared with ETH and TRON, the transaction volume of EOS is more stable, and the average annual transaction value is slightly higher than both. TRON's ecological transaction volume has experienced three significant data explosions, which is considered to be the reason for the amount of data in individual DApp games.

(DApp daily transaction amount in 2019)

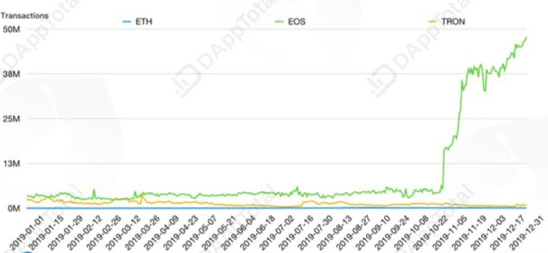

3) Daily transactions

As shown in the figure below, the EOS DApp ecosystem has significantly increased since EIDOS went online, mainly due to the influence of the EIDOS transaction mining model. We will focus on this below.

(DApp Daily Trading Volume in 2019)

4) DApp category

After further dividing the total number of DApps by different types, we have the following findings:

1. ETH Ethereum's public chain is dominated by games, accounting for about 42.54%, while DeFi (financial), which supports Ethereum's sky, only accounts for 3.79%.

2. The EOS public chain is dominated by lottery games, accounting for about 54.42%. Lottery games occupy half of the EOS DApp ecosystem.

3. The high-risk category on the TRON public chain is 43% of funded games, while the lottery games account for 33.59%. If the lottery category is also defined as high-risk, almost two-thirds of the DApps on the TRON public chain The models are worrying.

Overview of key DApp types

1.DeFi DApp

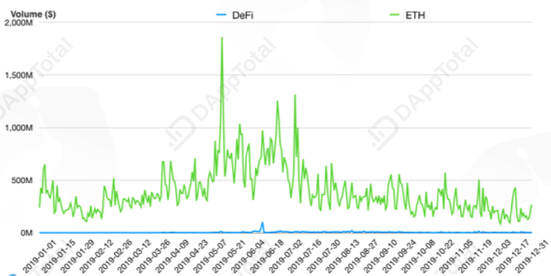

As stated in DAppTotal's latest DeFi Research Report 2019, 2019 is the first year of DeFi. DeFi has gradually replaced lottery games from the niche area at the beginning of the year and has become the industry focus. From this perspective, the impact of DeFi on the Ethereum ecology must not be ignored. We marked out the DeFi projects in the Ethereum ecosystem, and compared the data with the Ethereum mainnet from the three basic dimensions of daily life, transaction volume, and transaction volume.

As shown below: On the data level, DeFi projects account for a small proportion of the Ethereum mainnet, whether it is daily activity or transaction value. DeFi has a high role and value for the Ethereum network, but from the data level Judging from the fact that the proportion of DeFi is not large.

This is because:

2. DeFi financial products are still in the stage of collateralized assets. The data extracted by pure DApps based on contract interactions and transaction amounts may not be suitable for the logic of financial products.

(2019 DeFi DApp Daily Activity)

(2019 DeFi DApp Daily Transaction Situation)

(2019 DeFi DApp daily transaction volume)

2. Lottery DApp

1) EOS public chain

The EOS public chain was once considered a spinach public chain, because lottery games require second-level lottery and feedback, and the EOS second-level packaging block frequency can also meet the needs of the lottery DApp. For the EOS public chain, the activity of lottery games will directly affect the situation of the EOS DApp ecosystem.

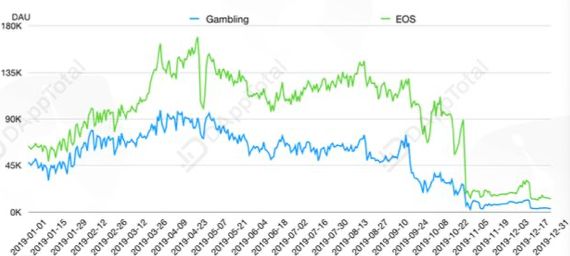

As shown in the figure below: The trend of each indicator data of the lottery DApp game is basically consistent with the overall trend of EOS DApp. As for the large difference in the number of transactions, it is because after the EIDOS went online, the overall transaction volume of the EOS mainnet was soared, which caused the lack of EOS CPU resources, which in turn affected the data of each dimension of the lottery DApp.

(2019 EOS Raffle DApp Daily Activity)

(2019 EOS Raffle DApp Daily Transaction Situation)

(2019 EOS Raffle DApp Daily Trading Volume)

2) TRON public chain

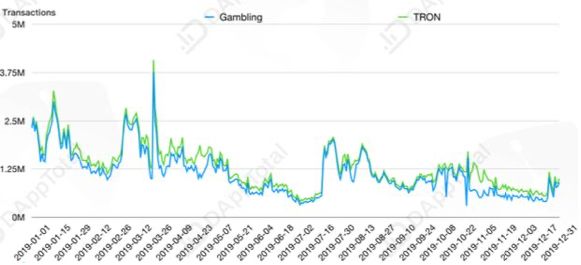

As shown in the figure below, it is no different from the EOS public chain. The TRON public chain is also a spinach public chain. What is more exaggerated than EOS is that the transaction data of the TRON lottery DApp and the data of the TRON public chain are almost perfect, which means:

2. The data reflected by other types of DApps in the TRON ecosystem, such as exchanges, are not very optimistic.

(2019 TRON Raffle DApp Daily Activity)

(2019 TRON Raffle DApp Daily Trading Volume)

(2019 TRON Raffle DApp Daily Transaction Amount)

Third, the phenomenon of DApp

The three major public chains all look forward to the birth of a killer DApp application, which will bring huge user volume and transaction value, and promote the overall stability of the overall ecological market. However, almost without exception, they did not wait for the killer application in the end. Instead, it summoned a killer.

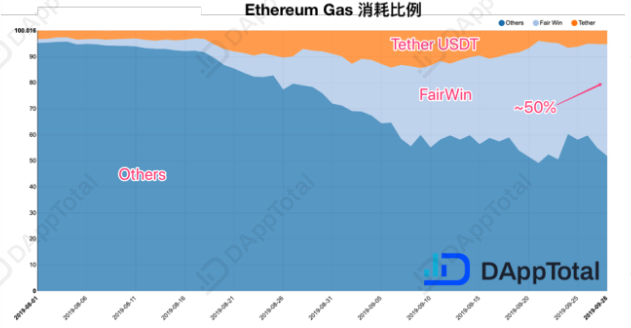

1) FairWin

FairWin is a "money disk" platform on the Ethereum network. Its rules are simple. Users invest 11 Ether in the contract and get a return of 0.11 Ethereum per day, with an annualized return rate of more than 300%. The 11 Ethereum are locked for 5 days, and after 5 days, the user returns to the account, and the user can choose not to play or continue to invest.

Obviously, this is a typical drum-and-fancy Ponzi scheme. The money made by the previous people comes from the input of the people behind it. As long as there are people behind to participate in the market and the capital chain is healthy, the project can continue to run.

According to DAppTotal statistics, FairWin has continued to grow since it was launched on July 27. Until the end of September, the number of active users has collapsed, and the balance in the original FairWin contract has been cleared. Level DApps have also been announced for the time being.

The reason why FairWin has caused heated discussions is that since August 26, the daily Gas consumption of the Ethereum network has been continuously in a high saturation state, and the daily Gas consumption accounts for the total amount of Gas that the Ethereum network can carry. More than 90%, causing abnormal network congestion.

The large proportion of gas consumption means that FairWin's users trade more frequently, and there is the possibility of artificially increasing the gas fee and grabbing the order of betting. This will greatly affect the balance of the original ecological order of Ethereum, and have a direct impact on other DApps on Ethereum.

2) EIDOS

On November 01, Aiden Pearce, who once produced the best airdrop in history, brought the new airdrop project EIDOS online. As long as the user sends any number of EOS to the smart contract account eidosonecoin, the contract will immediately return all of it to the user account, and at the same time, 0.01% EIDOS of the eidosonecoin account balance will be sent to the user account. In fact, 0.01% EIDOS is obtained at zero cost. This means that as long as users keep sending transactions to eidosonecoin, they can get project airdrops for free.

According to data from DAppTotal, since the launch of EIDOS, its 24H active users have been 1,260, 24H transactions have been 1.89 million times, and 24H transactions have been 1,770 EOS. Its degree of madness is far beyond the existing applications of the EOS DApp ecosystem such as Dice, HashBaby, EOS Knights.

As shown in the figure above, on the day of EIDOS's launch, DAU rushed to the top, and the number of participants was around 5,000. In the following months, the number of active participants gradually declined, but its transaction volume was always on the rise. This shows that a large number of wool parties are very enthusiastic about participating in EIDOS mining.

According to the early warning information of the blockchain security company PeckShield, the EIDOS airdrop attracted a large amount of woolen party wool while at the same time, causing the CPU price to skyrocket, which caused ordinary EOS accounts to fail to transfer and use normally due to insufficient CPU. Equivalent to the unexpected popularity of EIDOS, the entire EOS network has fallen into a state of continuous congestion.

2) Most users are unable to participate in DApp games such as lottery, which leads to abnormal congestion of the entire EOS main network.

According to the EOS CPU congestion index introduced by DAppTotal, due to the continued influence of EIDOS games, the EOS main network congestion index has been at a high saturation level of over 100. This will also directly threaten the health and balance of the EOS DApp ecosystem.

3) just.game

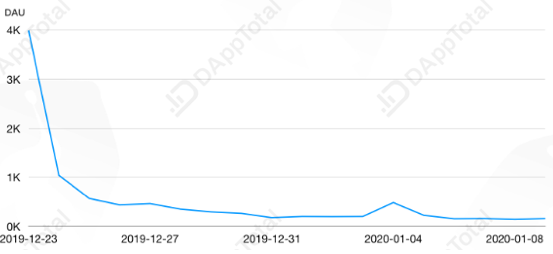

The previous year, the Team just team created the game Fomo3D, which once exploded the currency circle, which made the Team just team famous. Last July, the Team just team announced the move to the TRON network. However, it was not until late December that just.game came online.

Just.game is also a money game. Players can spend 25 TRX to buy a box; each box can enjoy the dividends of those who buy the box later, and the dividends can be accumulated without limit; you can actively open the box at any time to get 2 times the dividend, but the box is randomly destroyed; Opening the box and purchasing the box will last 30 seconds for the game; after the round of the game, the 100 players who bought the box will divide up a prize pool, and the last player will have additional rewards.

According to DAppTotal.com data, in the 24 hours to date, Just.game has 4,045 daily active users and a daily transaction volume of 453 million TRX (equivalent to RMB 42.62 million). Driven by it, the daily transaction volume of the TRON main network also climbed linearly.

However, the good times are not long. As shown in the above picture, the daily life of the game went down sharply the next day. The reason is that 4,045 players participated in the game, but only 32 profitable players, accounting for 0.8%. This type of game is originally a type of capital disk, and it is especially critical to have a continuous influx of new traffic. However, on the first day of online, it was found that most people lost money. Everyone was waiting to sit in the sedan chair, and no one carried it. This made just.game a DApp with thunder and rain, but it disappeared in just a day or two.

In short, just.game has not become a killer DApp that revitalizes the entire TRON network. Instead, it has hurt the original fans of TRON, cutting these old leeks, which has negatively affected the overall TRON brand.

4. Summary of 2019 DApp Ecological Past and 2020 Trend Outlook

1, 2019 past summary

On the whole, the three key indicator data of the ETH, EOS, and TRON public DApp ecosystems are in a downward trend, which indicates that the DApp ecosystems of the major public chains have not achieved continuous steady progress as expected. Growth, on the contrary the overall data showed a downward trend of depression.

According to DAppTotal data analysts, there are two reasons for this situation:

1) The overall prosperity of the DApp ecosystem is directly related to lottery games, but the lottery game mode is relatively single and the user group is relatively narrow. This has led to the development of lottery DApps that are also competitions in the stock market. In the past, individual head DApps will Monopolized the market, and some new DApps lacked room for survival. In order to survive, some nascent DApps have entered the competition in a short-lived and improper mode of innovation. Therefore, winning games are also lottery games, and losing games are also lottery games. This is particularly obvious on the spinach public chains of EOS and TRON.

2) The new DeFi financial innovation has performed well, but it is not yet time to boost the DApp ecosystem. In the past year, DeFi has stood out in the DApp ecosystem and has attracted the attention of the industry. But at present DeFi is only common on the Ethereum network, and it is just the beginning on the other two public chains of EOS and TRON. On the ETH public chain, we have observed through data that DeFi, as a financial product, has completely different statistical logic from DApps in terms of active users and transaction values. The pure data performance at the DApp level cannot yet highlight the defi Boost effect.

2, 2020 trend outlook

In the new year, the DApp ecosystem still needs to see the further development of the DeFi industry. The current status of DeFi seems to be very small and the number of people involved is relatively small, but it is the most imaginative space for the application of blockchain technology in the next three to five years. field. Because DeFi is essentially a fat protocol and a thin application, based on various links such as current mortgages, loans, transactions, derivatives, insurance, etc., it can be freely combined like Lego bricks, resulting in many unknown and innovative gameplay and possibilities.

A while ago, the DeFi protocol bZx was hacked due to the lightning loan function. On the surface, this was caused by the new lightning loan function. In fact, it was an opportunity for market education in which innovative mechanisms forced the market to improve its liquidity. The similar function of Lightning Loan is just the beginning. I believe that in the next few years, DeFi will give birth to many innovative mechanisms that traditional financial finance did not have and cannot imagine, and there may be killer applications at any time.

The competition pattern of lottery-type DApps will gradually stabilize. Big game, Dice, EOS, and other head-drawing-type DApps will gradually form an oligopoly position. More developers may try other innovative applications, such as HashBaby that has appeared in the past year. Although DApps such as, LoreFree, etc. have not been able to explore a clear business model, their extended thinking and attempts in the traditional field combined with the characteristics of blockchain technology are worth learning.

In short, 2020 will also be a relatively quiet year for the DApp ecosystem, but whether it is the dusk of the gods or the darkness before dawn, there are more unknown expectations waiting for us to witness.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research | Interpreting the Prediction Market: Why is "stacking" important?

- Reflections on the "Wei Union Deletion Event": the advantages of blockchain technology and the disadvantages of blockchain industry

- Defi Attack: Open Finance for Open Finance

- Perspectives | DeFi Insurance Design: Always Start with General Equilibrium and Reduce Systemic Arbitrage

- On the road to industry, how does a decentralized blockchain replace the centralized Internet?

- Viewpoint | Blockchain is the only way to realize the digital economy in cyberspace

- Weekly | FCoin incident continues to ferment, 12 listed companies disclose blockchain business