Inventory: 2019's biggest winners and losers in the crypto industry

Text: Jinia Shawdagor

Compile: L

Source: Cointelegraph Chinese

Editor's Note: The original title was "The Biggest Winner / Losser in the Crypto Industry in 2019"

- Fuzhou strives to exceed 430 billion yuan in digital economy in 2020, and accelerates the layout of the blockchain industry

- Ants start rendering blockchains: three major strategic speedup leads?

- Babbitt Column | Blockchain industry to land, these areas still need to be greatly improved

Although the ups and downs of the cryptocurrency industry are not new, 2019 is the most surprising year. Market analysts have called the year of the ongoing bear market 2018 a year of regulatory liquidation, and many jurisdictions aren't sure how to treat cryptocurrencies until the end of the year.

However, as big tech giants such as Facebook shift their ban on cryptocurrencies to accept, 2019 has also become a comeback year for the industry.

Although the gradual escalation of global events such as trade frictions between some major countries this year has reversed investors' views on the utility of cryptocurrencies such as Bitcoin, there are still many difficulties that need to be overcome, such as the SEC Continue to reject every Bitcoin ETF proposal.

As this year comes to an end, the following will lead readers to take stock of enterprises, individuals and various cryptocurrency projects that stand out or fail to leave a glorious sum in 2019.

Winner

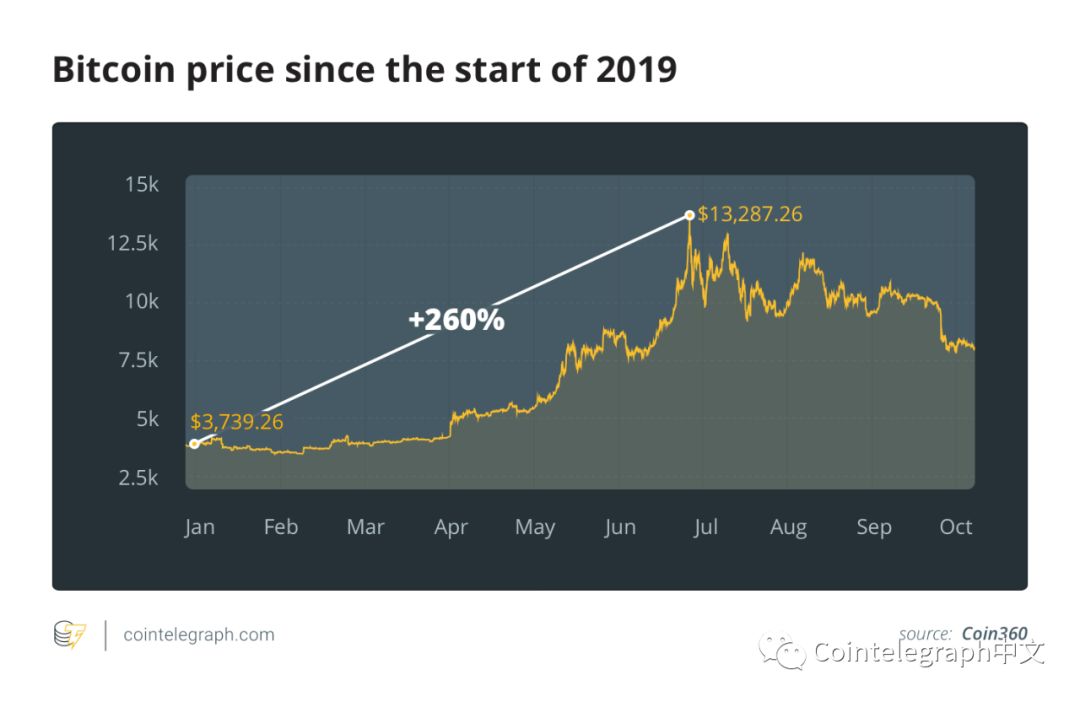

Bitcoin doubles growth

In 2019, the 10th anniversary of Bitcoin and the entire blockchain and cryptocurrency industry celebrates, which proves that Satoshi Nakamoto's creation is quite resilient. But in early 2019, the cryptocurrency industry has just recovered from the so-called 2018 cryptocurrency winter. Fortunately, bitcoin kicked off 2019 in a bull market, and by the end of the first quarter, its price rose by about 11%. Anthony Pompliano, co-founder of Morgan Creek Digital Asset Management, shared his perspective with Cointelegraph:

The price of Bitcoin has risen sharply in 2019 as there are more net buyers than sellers this year.

With the increase in trading volume and market value throughout the second quarter, Bitcoin led the market with a 165% increase, and its price soared from $ 4,103 to $ 10,888. In addition, Bitcoin's total market capitalization increased from 54.6% to 65%.

Despite the market downturn, one of the reasons driving the continued rise of BTC is that it is believed that this digital currency can be used as a hedging tool in the face of increasing global uncertainty. This year, in the context of trade frictions between certain major powers, most investors have used Bitcoin and gold as hedging tools. Pompliano also told Cointelegraph that there were other contributing factors:

The most important moments were mostly around the launch of Libra and the ensuing mixed reactions from different people in the traditional and cryptocurrency markets.

However, for the whole of 2019, the market for bitcoin is not bright. In the third quarter, the price of Bitcoin dropped sharply, and Bitcoin's market value evaporated by 100 billion US dollars. A bearish trend appeared. Fortunately, the market is trying to reverse the situation from short hands. Bitcoin not only minimized losses in a timely manner at the end of the quarter, but also occupied an additional 5.4% of the total market value. Ultimately, of all cryptocurrencies, Bitcoin's performance is still the best so far.

Compared to assets in other markets, Bitcoin's performance throughout the year is also not bad. For example, although gold is considered a reliable store of value, its price has risen by only 17% since January. Even the S & P 500 has performed very well with a + 21% increase, which is in line with Bitcoin's full-year increase. Dwarfed. Bobby Lee, CEO of crypto wallet Ballet, told Cointelegraph that in addition to price, Bitcoin has also benefited from the development of several major technologies:

Advances in the open source ecosystem have created a bumper 2019 harvest for Bitcoin bulls. The Lightning Network is improving Bitcoin's transaction capabilities, and wallets (Wasabi and Samourai) with built-in user-friendly features are improving privacy.

Coinbase continues to expand

In the past, Coinbase has maintained its reputation by adopting a highly selective strategy of constantly adding currency types to exchanges. As one of the big exchanges in the cryptocurrency space, Coinbase is also known for having encountered only a few major hacking incidents. During this year, other mainstream exchanges like Binance have become victims of large-scale security breaches and caused thousands of bitcoin losses. Coinbase stands out as a reliable and secure platform.

However, this year Binance was also heavily scrutinized by Twitter users for its acquisition of Neutrino, a startup that uses blockchain to collect cryptocurrency transaction data. For most Twitter users, the acquisition of the company seems to help the exchange monitor customers.

However, according to Coinbase's blog, the company hopes to support all assets while complying with applicable laws, and the acquisition of Neutrino is one such move. In addition to the acquisition of Neutrino, Coinbase has been very active in doubling the number of cryptocurrencies listed on its exchange since 2018, adding currencies such as Dash, Cosmos, and Waves. Here are just a few examples.

From acquisition to refusal to purchase, plus multiple patents throughout the process, Binance has been in constant news throughout the year. At the same time, Coinbases' Visa debit card solution has also grown exponentially this year and is now available in more countries.

In May 2019, the company also expanded its business to more than 100 countries, while making its USDC stablecoin (previously only available in the United States) available in 85 of these supported countries. In contrast, Coinbase was only available in about 32 countries last year. The company's aggressive expansion appears to be competing directly with other global players like Binance.

Further expansion of Binance

Regardless of which market analyst they consult, they will recognize that the initial transaction offering (1EO) has grown into a big business in 2019. There are reports that from the first quarter to the third quarter of 2019, IEO market demand is high, not to mention that they have raised more than $ 1.5 billion in the market in the first half of 2019 alone. Unlike 1CO, if IEO wants to succeed, the biggest determinant is effective liquidity, and what better way to get liquidity than launching IEO on a popular exchange.

That's why 2019 is one of the historic years for Binance and its native cryptocurrency BNB

. As one of the largest markets for digital assets, Binance occupies a large share of transaction volume. The exchange has performed so well that the price of BNB has increased by 150% in the past year. If you consider all the circumstances and the year-on-year growth, BNB's performance is even slightly better than Bitcoin.

In addition, Binance has expanded its business by launching a fully independent US branch of its trading platform. Even if there is huge regulatory pressure in the United States, making Binance Exchange unable to conduct business in New York and other states, but so far, the company's cooperation with the US registered currency service provider BAM has provided a certain amount of room for the exchange.

loser

Facebook is not sure about launching Libra in 2020

Facebook's announcement of the cryptocurrency Libra has been one of the major events of 2019. However, following the launch of Libra as a stablecoin backed by multiple national currencies, U.S. lawmakers have raised doubts and summoned Facebook CEO Mark Zuckerberg to attend multiple hearings .

In essence, Libra is a stablecoin supported by real money, and users have almost zero handling fees when making cross-border purchases, sales or remittances. According to the project's white paper, Libra's overall mission is "to provide a simple global monetary and financial infrastructure to support thousands of users."

Libra's white paper further states that it will use "new decentralized blockchains, low-volatility cryptocurrencies, and smart contract platforms" to support approximately 1.7 billion people without bank accounts-all of which will be made possible by users using Facebook's WhatsApp, Messenger, and Calibra (a digital wallet designed for Libra users).

Despite Libra's ambitious plans to support people without bank accounts, the Libra project is not only subject to scrutiny by lawmakers, but also faces its own internal problems. While sharing his opinion with Cointelegraph, Lee of Ballet Digital Wallet expressed optimism about Libra, saying that “While both US and European lawmakers and regulators know that non-governmental currencies pose a threat to their power, over time, Government opposition will be less and less. " Lee further explained:

The government will change its position because they will understand that they cannot control or block Bitcoin. They are more willing to let citizens use the currency of centralized enterprises, because these currencies are easily regulated, monitored, and anchored in fiat currencies.

The US Congress has asked Facebook to suspend further development of the Libra project, and some cynics believe that the project will not move to the next stage without government approval. After increasing scrutiny by government regulators, some well-known supporters of Libra, such as Visa, eBay, MasterCard and PayPal, have abandoned the project.

A difficult year for Circle

In October 2018, headquartered in Boston, Circle, a cryptocurrency company backed by Goldman Sachs, partnered with Coinbase to launch the Center consortium. The two companies aim to advance cryptocurrency adoption with their reputation as one of the most well-funded cryptocurrency startups. Coinbase and Circle will issue a stablecoin named "USD Coin" under the name of the Center consortium, thereby increasing the liquidity of the cryptocurrency industry.

In July this year, Coinbase and Circle expanded the market participation of their consortium, which means that they will allow other financial entities interested in this project to issue USD Coin. In the announcement, Centre's website mentioned that "the next natural step is to imagine a new global digital currency", which will include a basket of tokens supported by various stablecoins. In short, Centre's plan is to mimic Facebook's approach to creating global currencies.

However, Circle has had a difficult time in 2019. Although Center claims that USD Coin has been used to clear on-chain transfers worth more than 11 billion U.S. dollars, which has earned the stable coin a good reputation, Circle closed its mobile app and reduced its fundraising target by 40%. Lay off nearly 10%. Just recently, the company fired 10 employees on grounds of trying to streamline services.

The latest news about Circle's layoffs came after the company's co-founder Sean Neville moved from his CEO position to the company's board of directors. However, a representative from Circle denied any connection between the recent layoffs and Sean's position shift, and told Cointelegraph:

It has nothing to do with Sean no longer serving as co-CEO. Sean will continue to serve on Circle's board of directors.

Craig Wright's court battle

As early as 2015, when Australian technical expert Craig Wright claimed that he was Satoshi Nakamoto, most people in the cryptocurrency community expressed doubts about it and were completely dismissive.

Most people want Satoshi Nakamoto's imitators to disappear quickly. However, Wright and his statement have dominated the headlines throughout 2019. Wright claims to have invented Bitcoin ten years ago and has mined more than 1 million BTC with his late business partner Dave Kleiman. After Kleiman's death in 2013, Wright stated that he had put the mined bitcoin into the "Tulip Trust Fund".

However, the Australian entrepreneur and computer scientist was sued in 2018 for Kleiman's estate management company for alleged theft of up to 1 million bitcoins. It is said that in the past Wright and Kleiman worked together to develop Bitcoin. According to the Kleiman family, Wright stole 550,000 to 1 million bitcoins worth about $ 10 billion.

This ongoing case was ultimately judged by District Court Judge Bruce, assuming that Wright was Satoshi Nakamoto, and ordered him to transfer half of the bitcoin and intellectual property held before 2014 to Kleiman. On October 31, the case was reopened after Wright abandoned the settlement agreement and confiscated half of Bitcoin and intellectual property.

In addition to the court battle mentioned above, Wright also accused Peter McCormack in another case, in which Wright provided some documents to prove that he was Satoshi Nakamoto, but those documents were considered forged and He has also been subject to scrutiny by the cryptocurrency community. In this case, Wright sued McCormack over and over again stating that he was not Satoshi Nakamoto's conduct which damaged his reputation. Recently, Wright submitted another document that allegedly proves how he came up with the pseudonym Satoshi Nakamoto.

SEC continues to reject Bitcoin ETF proposal

Even though U.S. regulators have always left room for future approval of bitcoin exchange-traded funds, every licensing attempt for a bitcoin ETF has so far failed. In October this year, the ETF proposal submitted by Bitwise Asset Management and NYSE Arca was rejected by the Securities and Exchange Commission for failing to meet legal requirements to prevent illegal market manipulation. In fact, all bitcoin ETF proposals submitted to the SEC were rejected because of concerns about fraud and market manipulation. One of the main criteria for approving ETFs is the establishment of a new commodity-based ETF base market.

If the underlying market is resistant to manipulation, then regulators can approve ETFs. But the complexity of the Bitcoin market seems unlikely to be licensed by the SEC. Although Bitwise's application was rejected early, the SEC subsequently announced that it would review Bitwise's proposal again.

Charles Lu, CEO of fintech toolkit provider Findora, talked to Cointelegraph about the actual time frame for a Bitcoin ETF to be approved for the first time. It is not for the SEC to see market manipulation. "Lu believes that ratification will not come soon because the SEC requires a" monitoring sharing agreement "with large exchanges.

2019 and 2020

Overall, the cryptocurrency industry has shown substantial growth in 2019. Despite its instability, Bitcoin has also shown clear signs of growth. More and more institutional investors are exploring this industry to gain more ways to invest. Even if the market value and transaction volume both have a downward trend, well-known traders believe that the opportunity to reverse the situation will appear in the next moment, especially for Bitcoin holders.

Of all the winners and losers in 2019, Facebook's Libra is perhaps the most influential in 2020. For most onlookers, it's fun to see if the Libra project will be reborn and successfully launched in 2020. Indeed, even if you look at the industry as a whole, major changes are very likely to happen.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum price history: from 2015 to 2020

- 66% of Bitcoin transactions have adopted Segregated Witness (SegWit), more mainstream exchanges will support

- Viewpoints | Difficult to Buy Insurance? Buying insurance in the blockchain era will be as easy as taxiing in the internet era

- Bitcoin: 2020 debut

- New Diss Chain in Blockchain Industry: Fundamentalism vs Industrial Trends

- Introduction | Liquidity and Bank Run Risks in DeFi

- Analysis | "Sea Urchin" Project-Digital Currency of the Bahamas Central Bank