Litecoin’s LTC20 protocol: the next speculative market with hundredfold or thousandfold growth?

Is Litecoin's LTC20 protocol the next big thing, with potential for significant growth?1 New Narrative of Encryption —— A New Paradigm for Investment Opportunities

In the past two weeks, the BRC market has exploded, creating many myths of sudden wealth. You may have seen comments like: “If in March, you spent $300 on ordi inscriptions on BRC20, calculated at a cost of $3 per 1,000, it is now worth $1.5 million.”

The occurrence of each cycle of wealth creation in the currency circle is essentially the “evolution of token distribution methods”, which is also the best production line for every cycle to produce crypto-rich.

Mining currency through POW algorithm in 2016, ICO (ETH exchange project token) in 2017, IEO (exchange platform coin exchange project token) in 2018, Fcoin trading mining (mainstream coin exchange platform coin), VDS resonance mode, DeFi (providing liquidity in exchange for tokens), air drop (gas fee project token) in 2020 ……

Then, there is the recent BRC20, which deploys, mints, and transfers inscriptions on Bitcoin. It is a more decentralized and fair way of token distribution.

- Blocking Daily Report | Bitcoin Mining Difficulty Increased by 3.22% to 49.55T; LayerZero Launches Bug Bounty Program of up to $15 Million

- DeFi on Bitcoin: Is BTCFi a breakthrough or a bubble?

- From the perspective of “de-dollarization” in Web3, speculate on the ultimate form of currency in the future

Its principle is similar to signing a hundred-dollar bill with the signature of Yi Yangqianxi. The inscription is limited to four characters and is limited in quantity. Therefore, its value is higher than that of a hundred-dollar bill of equal face value because it has a basis for speculation. The premium is dynamically determined by multiple factors such as narrative, scarcity, and consensus basis.

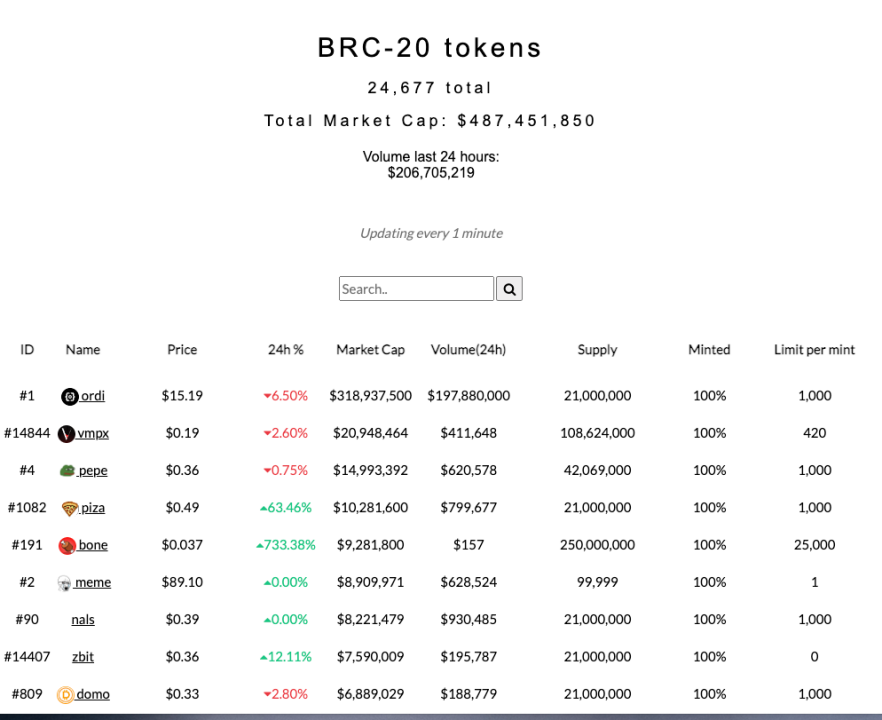

BRC20’s current market value is approximately $487 million.

2 Replicable Success Model —— Time Machine Investment Rules

Timing is the hardest part of investment, followed by pricing.

It is difficult to grasp whether a new track will erupt and when it will erupt. In the 0-1 process, it may cost a lot of time and capital on countless 0s before 1 appears.

Therefore, whenever a new paradigm opportunity appears in the market, it is a relatively simple and high-risk way to find and bet on the second dragon in the racecourse.

For example, when speculating on the prophecy machine track in 2020, if you missed the leader$link (9 times in 130 days), you could still invest in $band (16 times in 35 days); during the DeFiSummer, if you missed the leader uni, there was later the cake of the BSC chain (the second level highest increase of nearly 100 times); if you missed crypto punk, there will be boring apes, Azuki, and so on.

Capital is more inclined towards verified business models and products, and prefers to do certain replication rather than high-risk and high-investment innovation. A shortcut to winning is to conduct continuous research on successful tracks and bet on projects with similar soil using the “time machine investment rule”.

Three L TC 20—— Best Speculative Pit

Bitcoin, Litecoin. If you missed Bitcoin’s BRC20, don’t miss Litecoin’s LTC20.

Advantages of LTC20

The various xRC protocols that have sprung up like mushrooms are a concrete manifestation of the market Fomo, and users are urgently looking for the next hundredfold or thousandfold opportunity. LTC20 is the best solution at present.

On May 2nd, the Litecoin community released a forked version of the BRC20 standard called “LTC20”.

Compared with BRC20: Litecoin produces one block every 2.5 minutes (Bitcoin 10 minutes), which can obtain faster transaction confirmation, and the gas fee is extremely low (less than 0.1u per transaction, while Bitcoin ranges from several u to hundreds of u per transaction), and it has more advantages in terms of block speed, flexibility, and transaction fees.

Compared with DRC20: The DRC20 protocol launched by the Dogecoin community currently has no official leadership, and all parties are in a state of fragmentation and scattered troops. LTC20, on the other hand, is a market with official organization and platform. Secondly, the gas fee per transaction of Dogecoin is about three times higher than that of Litecoin.

Compared with ORC20: ORC20 is a supplement to the BRC20 ecology, with more flexible issuance of tokens and no naming space restrictions. Orc20 is more like an Ethereum ERC20 representation on Bitcoin. To some extent, it deviates from the basic disk of inscription speculation. One problem it brings is, if you ERC20-ize Bitcoin, why don’t we just use Ethereum’s ERC20?

The rise of BRC20 has been touted as a movement to resist centralization and wealth whales. The essence behind it is that retail investors hope that the serfs will sing and let institutions, main forces, and exchanges pick up everyone’s plates.

Markets without the participation of large funds are like scattered sand.

The core advantage of LTC20 over other xRC protocols is the Litecoin halving narrative in August, which will focus market funds and traffic on Litecoin. With the driving force of the BRC20 protocol and the blessing of the halving narrative, LTC20 will become a reservoir of capital outflows. There is also a chance to attract main players, institutions and exchanges to enter.

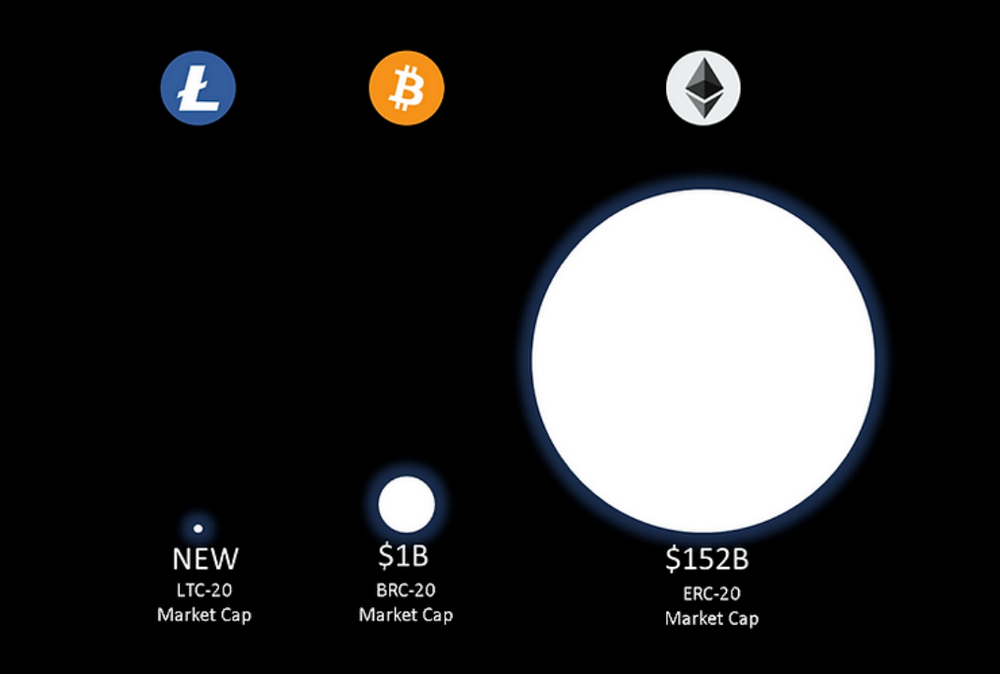

The market value of LTC is about 6.8 billion US dollars, and the overall market value of BRC20 is about 500 million US dollars. If only a small amount of market overflow funds are injected into LTC20, it can create many investment opportunities with hundreds or even thousands of times returns.

2. Development status of LTC20

The recent rise in LTC has led to a surge in speculative interest in the token. The nominal value of LTC’s open interest (OI) has risen to the highest level since the bull market in 2021, reaching 435 million US dollars.

The rise in price and OI indicates that more funds have entered the market and traded the Litecoin halving market.

Data source: Coinglass

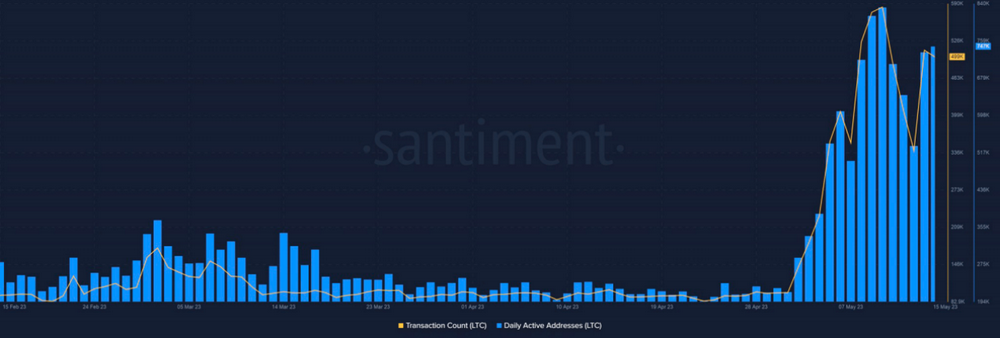

One of the key indicators of network growth is the number of new addresses. LTC’s network activity has exploded to unprecedented levels. On May 10, the number of daily active addresses reached a historical high of 832,000, and the daily trading volume also peaked on the same day, while Bitcoin only had 331,000. This is an important milestone for Litecoin.

Data source: Santiment

Unlike Bitcoin and Ethereum, Litecoin users have not experienced an increase in transaction fees during network congestion.

LTC20 Inscription Concept Overview:

The LTC20 ecosystem is still in its very early stages, the infrastructure is not yet perfect, and there is no dedicated trading market. The official announcement of the trading market is expected to open in about three weeks.

LTC20’s market development space

The participation threshold of LTC20 is very low, with a minimum entry fee of just a few US dollars to enter the Litecoin inscription market.

If users can make high profits with a small cost, they may become addicted and ignore their own costs. If there is an uninterrupted wealth effect, LTC20 has the opportunity to become the largest inscription speculation market and traffic pool.

Brc20 and LTC20 are not in a competitive relationship, but rather mutually dependent and developing together.

What Litecoin needs to do is to make the inscription market, which originally only 1% of people played, become more popular, reaching 5%, 10% or even higher, and making it more accessible to the public in the future, through a lower threshold and smoother user experience.

From this perspective, if Brc20 targets the NFT market, LTC20 is more like a decentralized digital collection market. Brc20, as the leader, determines the upper limit of the track, while LTC20 and other xRC protocols horizontally expand the entire market size, feed back to Brc20, and expand the cake together.

Four , Halving is Litecoin’s biggest narrative

As one of the biggest narratives in the cryptocurrency world, the entire market’s capital and attention will be focused on Litecoin’s halving. The halving is expected to take place on August 3. If the interest groups behind Litecoin want to make a move, now is the best time.

The market always moves in the direction of least resistance. We can try to jump out of the fixed mindset and shift the bet on whether Litecoin has a halving market from the LTC token price itself to LTC20.

Considering the cost of hype, the related inscriptions of the rising halving narrative are the best way to make a small investment pay off.

LTC20 is a very small fulcrum. With a market making of several million to tens of millions of US dollars, it can ignite the market and even leverage Litecoin’s market value of 6.8 billion US dollars.

Taking the inscription $HALF, which is based on the halving concept of Litecoin, as an example, the total amount is 21 million, and the cost of minting one (1,000 coins) is 1u. Assuming the main force uses tens of millions of US dollars to push the market value of $HALF to 100 million US dollars, $HALF will increase by about 5,000 times, and LTC20 will create a new wealth myth and eventually form a flywheel effect.

The halving inscription halves the wealth effect-Fomo funds poured into ltc20-the increase in use cases of ltc promotes the rise of ltc currency price-miners of Litecoin make money/exchanges gain traffic-Inscription Summer-Industry positive externalities(web2 traffic influx)

Perhaps the market’s bulls have not yet formed a powerful Shelly point that can push Litecoin’s market value to new highs, but this consensus Shelly point is enough to ignite Ltc20.

Five Speculative Games in Positive-Sum Games

Gambling is a zero-sum game, either you die or I die. The essence of speculation is “positive-sum game”. The result of a positive-sum game can be that the vast majority of participants are winners, which is the charm of speculation.

The big trend of LTC20 is a positive-sum game, incremental market.

If the market is regarded as a chess game, use “panoramic thinking” to analyze the core interests and goals of all parties in the market.

Litecoin officials and background institutions: The core interests are currency prices and ecology. As an old mining coin, if the halving every four years has no response, Litecoin will be eliminated by the market and gradually disappear in the history of encryption. The emergence of LTC20 has increased the usage scenarios and frequencies of Litecoin. The double narrative of halving + LTC20 has created network effects and marketing values that are much more useful than directly pulling up Litecoin itself for tens of millions to hundreds of millions of US dollars in the Litecoin inscription market.

Litecoin miners: The popularity of BRC20 has made Bitcoin miners the biggest beneficiaries, and the leader has played a demonstration role, which will make Litecoin miners and mining machine merchants more intuitively feel the benefits of promoting the development of LTC20.

Exchange: The exchange is essentially a flow business, and the core KPI is users and traffic. For projects that can create topic heat and attract users to trade, they are willing to promote. Whoever can become the core trading market of LTC20 tokens first will have the opportunity to become the next big traffic pool.

Media: The core appeal of the media is to chase hot spots and create topics. As one of the biggest encryption narratives in the next few months, Litecoin halving is a topic that all media cannot avoid. How to make the halving attractive and deep, ltc20 is a good material. This kind of publicity will in turn promote the development of LTC20.

Retail investors: FOMO psychology, missed out on BRC20’s wealth explosion, and are urgently looking for the next exit for their funds.

For the entire cryptocurrency industry: behind the user portraits of blind boxes, digital collectibles, card games, and trendy toys are mainly young people from Generation Z. Low investment, scarcity, curiosity, experiential consumption are the core reasons that attract them. As natives of the digital age, they are keen to explore new things and believe that everything can be speculated on. LTC20 has similar attributes and soil, and has the opportunity to become the next Web3 traffic entrance.

LTC20 is currently a blank market and a high-odds opportunity for multi-party market games. The cost of inscriptions only needs tens to thousands of dollars, and can gain a chance to earn hundreds or thousands of times.

The following figure shows the potential upward space of LTC20 if the trend of inscriptions continues. This is a blue ocean with a high probability of growing rapidly from 0 to several billion dollars in market value.

Predictive analysis of the development of things is undoubtedly important, but if the risk exposure is not calculated, it becomes a kind of self-brainwashing delusion.

A spark can start a prairie fire, provided that there is a source of that spark. The risk point of LTC20 is that the infrastructure is not perfect enough, such as the trading market of LTC20 has not been launched, and the 0-1 process cannot be carried out. Or when the market is launched, it happens to coincide with the cold market of BRC20 or $LTC, which are uncontrollable factors.

The market is a fickle thing, and money goes wherever the wind blows. Before time gives the final answer, any affirmative or negative remarks such as “the Litecoin halving market is long gone” and “LTC20 must be able to develop” are worthless nonsense.

True DYOR is not only forward-looking in predicting the development direction of things, but also doing risk control, confirming the maximum tolerable risk capacity, calculating the winning rate and odds, and finally deciding whether to get involved.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Layout for many years but little known? Exploring the full picture and opportunities of the Japanese Web3 encryption market

- PA Daily | Tether will allocate 15% of its net profits to purchase Bitcoin; Ripple acquires crypto custody company Metaco for $250 million

- Jump Trading’s Crypto Waterloo: Forced to Exit US Crypto Trading Market, Facing Terra Class Action Lawsuit

- With a massive user base in the world of cryptocurrency, could MetaMask become the Google of Web3?

- Inventory of the current situation of top NFT fragmentation protocols: the overall market has turned cold, with both trading volume and user activity plummeting.

- Is the BRC-20 that cuts through the night sky a nova or a meteor?

- Deep observation of the NFT market in 2023