From the perspective of “de-dollarization” in Web3, speculate on the ultimate form of currency in the future

Consider the future form of currency from the "de-dollarization" perspective in Web3.Source: The Paper News

Author: Bi Lianghuan, Chief Researcher of Ouke Cloud Chain Research Institute

This article is jointly released by The Paper Technology and Ouke Cloud Chain Research Institute

- “In the United States, there is chaos and a lack of regulatory clarity. Some companies have made every effort to comply with regulatory requirements, but have been arbitrarily punished by US regulators.” “Innovators will leave the United States and go to other countries. This will have a negative impact on the US dollar hegemony globally and create more opportunities for other countries.”

- In the Web3.0 field, from a technical perspective, there are two main paths for “de-dollarization”: one is the encrypted asset path used to increase the diversity of asset reserves and reduce reliance on the US dollar, and the other is the digital currency CBDC issued by central banks to replace SWIFT.

On the morning of May 17, the US Securities and Exchange Commission (SEC) rejected Coinbase, the largest cryptocurrency exchange in the United States, submitted a petition to establish specific regulations for digital assets in July 2022. Since the end of last year, US regulations have been frequent. In May of this year, Bittrex Inc. and its affiliates, which closed their US business due to regulatory crackdowns, announced bankruptcy. In addition, Ripple, an early head cryptocurrency project, has spent $200 million in its lawsuit with the SEC. These events have sparked discussions among industry experts about the US financial status and cryptocurrency regulation, and these issues have also become hot topics at the “Consensus 2023” cryptocurrency industry event at the end of April. David Shrier and Austin Campbell, who spoke on this topic, also visited Ouke Cloud Chain Research Institute in Austin, USA.

- Layout for many years but little known? Exploring the full picture and opportunities of the Japanese Web3 encryption market

- PA Daily | Tether will allocate 15% of its net profits to purchase Bitcoin; Ripple acquires crypto custody company Metaco for $250 million

- Jump Trading’s Crypto Waterloo: Forced to Exit US Crypto Trading Market, Facing Terra Class Action Lawsuit

"Consensus 2023" was held in Austin, USA in April.

This article will speculate on the future form of currency through the analysis of the “de-dollarization” path of Web3.0.

The US cryptocurrency market has been “enduring” a regulatory environment with a lack of clear regulatory rules, and with the deterioration of the macro environment, some Web3.0 companies have begun to flee the United States. At the same time, some government agencies have also been reducing their reliance on the US dollar since 2008. Recently, US Treasury Secretary Yellen has issued consecutive warnings, stating that the risk of US debt default will cause a greater economic disaster. Currently, more than 25 countries use the renminbi for trade with China, and Russia and India, two giant emerging economies, have also begun to use currencies other than the US dollar for commercial transactions.

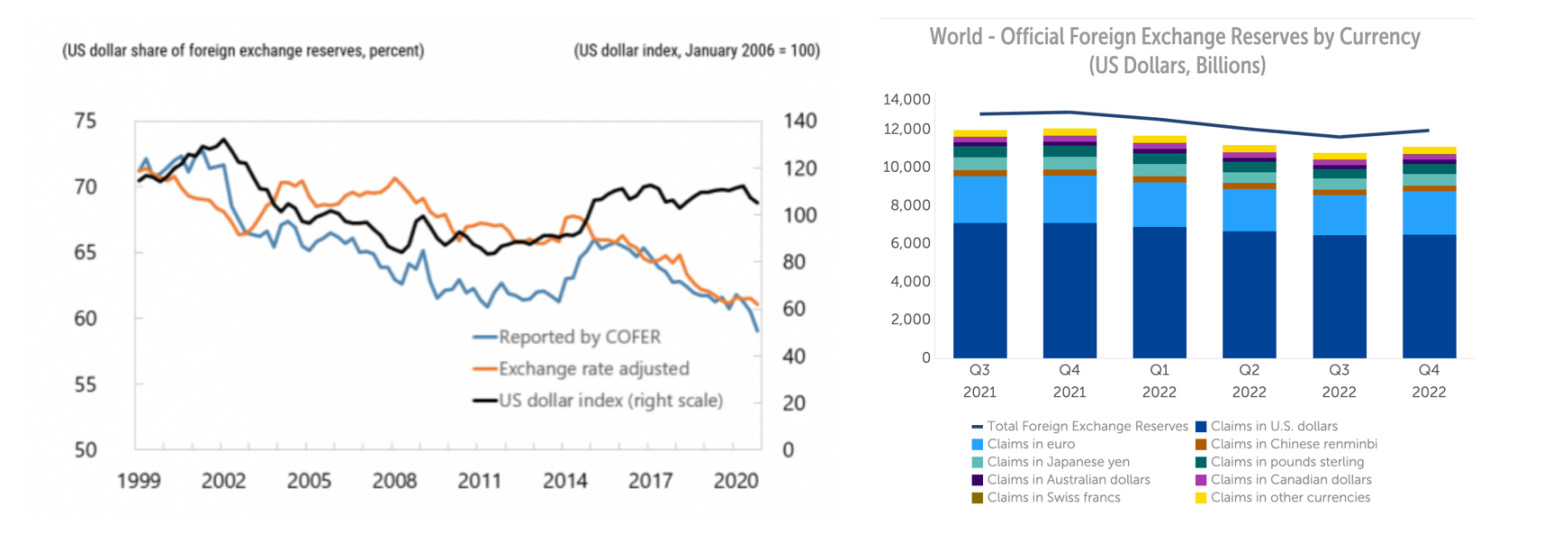

In global foreign exchange reserves, the proportion of the US dollar has declined from over 70% to over 40%, and this downward trend from 2021 to 2022 is continuing. Source: IMF

The de-dollarization of traditional financial markets is not a new phenomenon, but the de-dollarization of Web3.0 is currently underway. In 2023, “de-dollarization” has become a hot topic on the internet, seemingly signaling the end of the era of US financial prosperity. Austin Campbell, a professor at Columbia Business School and founder of Zero Knowledge Advisors, commented on a statement made by a US congressman, saying that “this is the best argument I have seen in favor of de-dollarization.”

The Decline of the “Currency King”

After World War II, the United States, with its strong economic and military power and its gold reserves accounting for over 80% of the world’s total, established the Bretton Woods system, which was based on the US dollar and made the US dollar the world’s most important reserve currency, replacing the pound as the “currency king”. In addition, SWIFT, created in 1973, is responsible for settlement between global systems, and this tool, which provides transaction services to more than 200 countries and regions, has a significant component in the US’s large-dollar clearing system, which means that SWIFT has long been a tool for the United States to sever all information flow connections between sanctioned countries and regions and the US dollar.

In recent years, as the global economy has slowed down, the demand for the US dollar by countries around the world has gradually decreased. Coupled with the large-scale quantitative easing policy adopted by the US Federal Reserve before the pandemic, which has led to a large amount of liquidity flooding the market, the current scale of US government debt has exceeded 31 trillion US dollars, and the huge financial derivatives that come with it have made the overall US economy extremely sensitive to changes in the basic interest rate. In order to cope with the economic consequences of the loose policy, the largest interest rate hike policy in 40 years has recently been implemented, which has further attracted global capital to flow back to the US market, causing many economies to fall into a liquidity trap. Therefore, emerging economies have also recognized the risk of holding large amounts of US dollars and have begun to reduce their holdings of US dollars. Ultimately, the direct cause of this round of de-dollarization is the US Federal Reserve’s interest rate hikes.

The US macro economy is facing multiple challenges, such as interest rate hikes, inflation, and high unemployment, which are spreading in the squeezed US economy. Although some companies are innovating in emerging core technology fields such as AI, brain-machine interfaces, and space technology, new technologies bring not only economic growth but also problems. For example, in the recently popular AI technology, according to the latest report by Goldman Sachs, 300 million people in Europe and the United States will be unemployed due to AI, which will further deepen the macroeconomic difficulties. “We need to come up with solutions to deal with this in the next 5 to 10 years, not 30 years from now. Otherwise, we will face large-scale problems such as social unrest, famine, and government collapse.” commented Professor David Schrier of Imperial College London.

Against this backdrop, US regulators seem to still adhere to past rules, that is, regulatory policies will only be introduced after major financial crises such as the Great Depression, the 1987 stock market crash, 9/11, the Great Recession, and the Covid-19 pandemic. Regarding the cryptocurrency industry, the latest regulations are restrictions on the cryptocurrency market. From the current situation, unclear regulations seem to be “adding fuel to the fire”, accelerating the innovation of Web3.0 and the escape of the uncertain US “gray area”. Coinbase is considering launching an overseas trading counter under the push of regulatory uncertainty in the United States. Circle, the issuer of the USDC stablecoin, is opening a new office in Paris.

In addition, the asset shortage caused by global interest rate hikes has also led regulators to “target” one of the most active markets-cryptocurrencies. “Unfortunately, in the United States, there is confusion and a lack of regulatory clarity. Some companies have tried their best to comply with regulatory requirements, but have been arbitrarily punished by US regulators.” Professor Schrier expressed concerns about the current situation in the United States, “Innovators will leave the United States and go to other countries. This will have a negative impact on the US dollar hegemony worldwide and create more opportunities for other countries.” Professor Campbell analyzed the root cause of this regulatory chaos-“The root cause of this chaos is designed by the US political system.”

Diversifying Cryptocurrency Reserves and Replacing CBDC “Weaponization” with Web3.0

While countries and regions are pushing for de-dollarization to resist risks, nothing happens overnight. The US dollar still accounts for the majority of global foreign exchange reserves, and the process of de-dollarization is just in its beginning stage. From a technical perspective, there are two main paths for “de-dollarization” in the Web3.0 field. One is the path of increasing diversified asset reserves and reducing dependence on the US dollar through cryptocurrency assets. The other is the path of replacing SWIFT with CBDC (Central Bank Digital Currency) issued by central banks. Its core lies in the application of blockchain technology, which can build a decentralized or multi-centralized financial system, making countries or institutions no longer dependent on the US dollar or other centralized currency systems, thus reducing risks.

Cryptocurrency assets have built a new trust in the financial market due to the characteristics of the underlying blockchain technology. Modern finance is essentially a credit transaction, and market trust is one of the core factors affecting the stability of the financial market. The sanctions, incitement of unrest and other means adopted by the United States in the past have caused the loss of market trust, which is also the fundamental reason for de-dollarization. Therefore, in addition to using various currencies to replace the US dollar to resist risks, digital assets have also become a means of choice for institutions, especially developing countries whose own currencies have not been operating well. As early as 2021, El Salvador became the first country to officially include Bitcoin in its balance sheet and store it in reserves. The world’s largest sovereign fund, the Norwegian government pension fund, also includes Bitcoin as one of its asset allocations.

The blockchain technology of cryptocurrency assets makes transaction data publicly recorded on a decentralized network, and anyone can view and verify transaction records, enhancing users’ trust in transactions. In addition, cryptographic algorithms are used to protect transaction security, making transaction records tamper-proof. These characteristics of decentralization can to some extent impact an institution’s control over the currency system. Cryptocurrency assets are gradually entering people’s vision and becoming an alternative asset allocation in diversified asset allocation. Of course, new types of assets naturally bring new risks. Due to the anonymity and difficulty in tracing transactions of cryptocurrency assets, they may become tools for money laundering and terrorist financing. Therefore, anti-money laundering and anti-terrorist financing have also become the focus of regulation for various countries and institutions involved in cryptocurrency assets.

CBDC, which has been deeply explored and practiced by various countries and regions, has become another path for some countries and institutions to de-dollarize. The “Petro” was first introduced in 2018 by Venezuela as a “petrol coin” to bypass U.S. sanctions. As a digital currency issued by a central bank, CBDC has the characteristics of convenient transaction, smaller transaction friction, and transparency. There are three reasons for de-dollarization: first, it can help countries achieve local currency settlement transactions, reduce dependence on other currencies or dominant settlement tools such as the U.S. dollar, and improve payment efficiency; second, in cross-border trade, it can help reduce exchange rate risk; third, for some countries that are currently using the U.S. dollar as their legal currency, CBDC can also help solve cash liquidity problems and improve financial inclusiveness. In February of this year, Japan, the United Kingdom, Canada, Switzerland, and the European Central Bank jointly formed a small group to develop digital assets, hoping to bypass the U.S. dollar through digital assets and form a multilateral trade based on digital assets.

“If CBDCs in different countries are built on different chains, how to achieve interoperability between them will become a problem,” said Sergey Nazarov, co-founder of Chainlink, at this year’s Consensus conference. In order to solve this problem, international parties not only conduct multilateral negotiations, but also explore and implement technical cooperation. For example, the Project Icebreaker completed by the Innovation Center Nordic Center of the Bank for International Settlements (BIS) and the central banks of Israel, Norway and Sweden; and the mBridge project jointly initiated by the Hong Kong Monetary Authority (HKMA), the Bank of Thailand (BOT), the Central Bank of the United Arab Emirates (CBUAE) and the Digital Currency Research Institute of the People’s Bank of China.

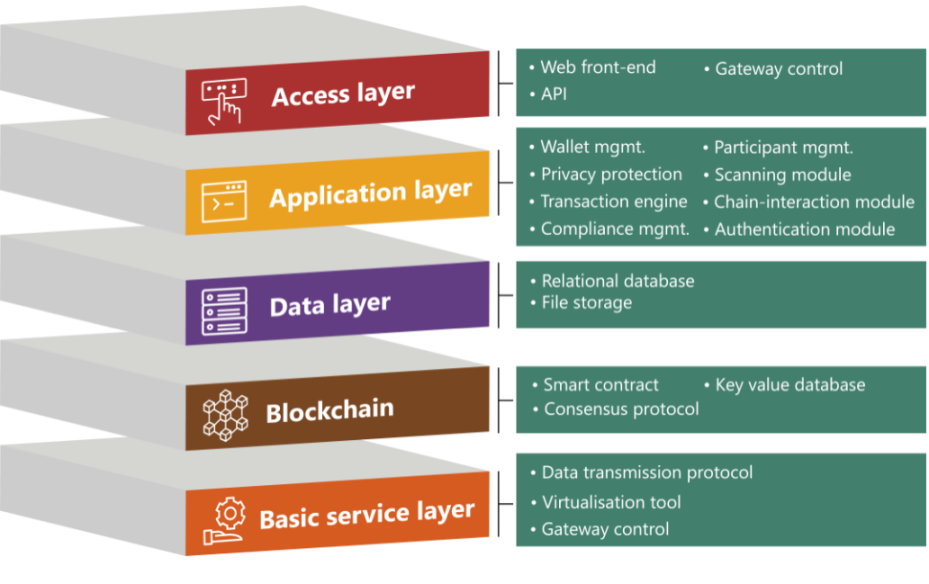

Taking mBridge as an example, the project developed a new local blockchain, mBridge Ledger (mBL), to meet the needs of central banks and commercial participants. The core of mBL is the central bank, each of which runs a validation node and jointly operates the consensus protocol of mBL. The validation nodes of central banks form a complete and connected graph, with a link between each pair of nodes. Each central bank can connect its domestic commercial banks to the platform, and each commercial bank in the jurisdiction is connected to the central bank, thus connected to the validation nodes. Moreover, in terms of technical architecture, a multi-layer structure is set up, from the basic service layer to the application layer and then to the permission layer. Only by adding business requirements such as compliance requirements (AML) that are particularly emphasized in the financial system can it be truly used by financial institutions. Compared with traditional fiat currency, CBDC has higher cross-border payment efficiency and transparency. By joining real-name authentication systems and mechanisms such as automatic detection and AML tools, the compliance cost of using CBDC is lower. Each commercial bank in the jurisdiction can be connected to the validation core of mBL to achieve interoperability between digital currencies. This process is like connecting multiple islands with bridges to form a continent, allowing digital currencies to circulate, transfer, and settle between different countries.

From August 15th to September 23rd, 2022, 20 commercial banks from Hong Kong, mainland China, the United Arab Emirates, and Thailand used CBDCs issued by their respective central banks on the mBridge platform to conduct payments and foreign exchange (FX) synchronous settlement (PvP) transactions on behalf of their corporate clients. “Interoperability is a key factor for CBDC to realize its full potential,” said Nazarov.

mBridge architecture. Source: BIS

Diversity in the Future of Currency

Economist Milton Friedman predicted in 1999 that a virtual currency would emerge in the future, which would become a globally universal currency that could be used for cross-border transactions and payments. Economist Fernando Alvarez also commented that “the form of future currency will become more diversified, digital currency and encrypted currency will become mainstream, but traditional currency will continue to exist, and the choice of currency will depend on market demand and personal preferences.” This currency world based on blockchain technology seems to be coming at us.

Currently, encrypted assets are still a niche asset, but digital assets, including CBDCs, are gradually emerging. In the future, digital assets may present a market structure in which private market fiat stablecoins coexist with CBDCs. From a global hedging perspective, in the first quarter of 2023, the global official gold reserves increased by 228 tons, setting a quarterly historical record. Central banks around the world are actively increasing asset diversity, and cryptocurrencies will also be increasingly considered for inclusion in diversified asset reserves due to their independence. The decentralization process will not stagnate due to restrictions in a single country, and digital assets will present a diversified form that is digital, decentralized, and not limited to fiat currencies.

“Currency is both a social structure and a government structure.” Christopher Giancarlo, former chairman of the Commodity Futures Trading Commission (CFTC), said at the Consensus conference that the meaning of currency itself is not limited to finance. The form of currency in the future will be continuously pushed by the big hands of macroeconomics, continuously evolving towards decentralization, and there will be no global reserve currency hegemony.

In March 2022, Zoltan Pozsar, a credit strategist at Credit Suisse, published a research memo titled “Bretton Woods III”. He believes that Western sanctions against Russia are a turning point that will push the economy into a new world currency order. This may lead to an accelerated trend of de-dollarization, but the dollar still has a large share. The advanced Web3.0 field is constantly developing, providing more possibilities and choices, more innovation and breakthroughs, like a sandbox simulation. We will witness this historic change and the emergence of more widespread financial innovation applications and a more inclusive, fair, and stable future for a diverse financial ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- With a massive user base in the world of cryptocurrency, could MetaMask become the Google of Web3?

- Inventory of the current situation of top NFT fragmentation protocols: the overall market has turned cold, with both trading volume and user activity plummeting.

- Is the BRC-20 that cuts through the night sky a nova or a meteor?

- Deep observation of the NFT market in 2023

- Opinion | When Bitcoin prices plummet in the next few years, gold will "land on the moon"

- Institutional investors boost Bitcoin to $ 7,000

- Babbitt column | How to predict the extreme price of cryptocurrency? Here are a few data to help you