Is your cognitive growth keeping pace with the development of the cryptocurrency market?

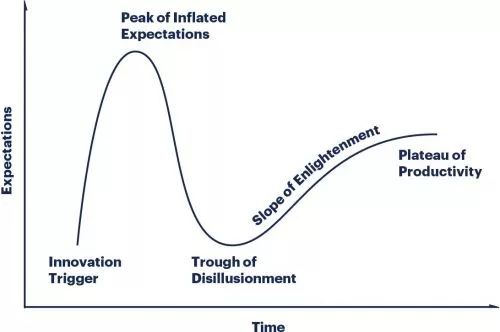

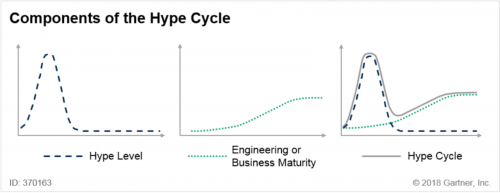

In a sufficiently long timeframe, if the project achieves its goals and their technology is finally adopted, a balance can be struck between concept hype and technology maturity. However, traders who only focus on hype during this transition period may be those who have been forced to pick up the mess after the dust settles.

Encryption technology maturity three-level pendulum system is in full swing

- Initial public interest;

- Rising expectations finally peak (optimistic);

- Expected decline, eventually bottoming out (pessimism);

- Adjust expectations based on actual adoption (realism).

- Read the digital securities and blockchain in one article: opportunities, challenges and risks

- Brazil plans to abandon its existing payment system and launch an instant payment system based on blockchain technology

- Libra Association members secret: Facebook's shadow is everywhere

In the cryptocurrency market, hype cycles can occur simultaneously on at least three levels of different maturity. The first is the entire cryptocurrency market (currently dominated by bitcoin) and its technology maturity curve. Followed by different cryptocurrency and blockchain use cases (such as infrastructure, intermediary devices, dApps, stable coins, securities tokens, collectibles, etc.) in the industry, each use case has its own technical maturity curve. The third is that individual projects try to stand out and compete for capital, market share and adoption rates – again, each project has its own technology maturity curve. Each layer (the entire encryption market, use cases, projects) adds a pendulum to the chain, and it is impossible to try to determine the position of a particular project in a particular technology maturity curve in the chaos.

Even more confusing is that the expectations for any particular project may be overestimated or underestimated, depending on who you are asking. Everyone in the public, cryptocurrency traders, blockchain developers, project proponents, and competitors can hold very different views and understandings, and these ideas can be amplified and filtered through social media. Shills and trolls [Note: 1] shills, the “childcare” we call everyday, such as selling a house in a commercial activity, pretending to be an unrelated person in front of the buyer, using language, action Other ways to mislead people who use other people to buy goods; 2) trolls, refer to people who initiate or promote topics, often post in a harmless way to cause confusion] when making virtual calls between them, almost impossible to find What is valuable information.

Looking forward to filling the gap in maturity

Although exchanges and commercial organizations engaged in the integration of market data attempt to recreate the experience, the cryptocurrency market is not a stock market. Both are speculative, but the stock price (at least to some extent) is based on objective data: including mandatory disclosures; company profits, assets and valuations; clear development by courts, legislatures, and regulators Rules and rights; and supported by experienced long-term investors. Stock prices are usually stable due to a well-founded, professional market.

On the other hand, the price of cryptocurrency is not as stable and measurable. The new blockchain entrepreneurship project presents exciting ideas on paper that, once implemented, will prove to be incredibly destructive. However, traders are often seldom able to estimate the value of a project based on (if any) objective data, valid products, or significant use cases. Most projects do not make any disclosures about their own funds, income, losses or expenses. When robots and whales manipulate exchange price, institutional investors who may bring stability to the market are on the sidelines due to regulatory uncertainty. One-sided emphasis on potential high returns, while ignoring the high risks that follow, has led to overconfidence among retail investors. In reality, if there is no strong anchor, there is no upper limit to the high expectations and prices.

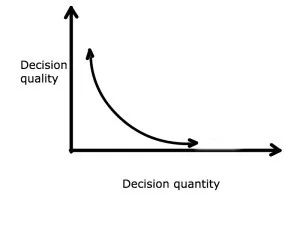

Due diligence on blockchain projects is still very difficult. Find basic information about the project (token usage, supply curve and distribution, development schedule, future roadmap, team qualifications, consensus mechanisms, positive partnerships, and usage statistics) often in multiple white papers, explorers, tweets, blogs , podcasts, videos, and news reports sort through a lot of information — and this is based on the assumption that information is available and accurate at the outset. When traders try to evaluate a project with competitors, the burden will multiply, and even identifying competitors will pose a challenge.

There are also many people who are not confident enough about projects that have produced tangible results. These projects are now experiencing the difficult process of building a vision and attracting users, which takes a considerable amount of time, effort and collaboration. They have already passed the “high expected peak'' at this time, so the expected value is facing a downward trend, at the lowest point or moderately falling back to a position more in line with its outcome, depending on their maturity. For most traders, it's as exciting as watching the paint dry: after experiencing peak expectations, while the team continues to move toward product maturity, holding these established projects The cryptocurrency is seen as an opportunity cost, and at this time the shiny new projects can only achieve price gains from the inflated expectations.

Cracking the trader's mind is easier than cracking their wallet

When faced with too much (or even too little) information, we will turn to the shortcuts of thinking to guide our decisions. This may be practical and efficient, but many projects and their sponsors cater to these heuristics, thereby gaining people's excessive attention or distracting their own weaknesses.

Protecting your brain is like protecting your private key.

When you see these hackers, please recognize them so that you can see through them. This is not a comprehensive list, but it describes some of the more common cognitive biases among traders:

1) Anchoring

The first decision will affect all subsequent decisions. The price of a particular cryptocurrency at the time of the first sale/distribution may affect our perception of the current price, even if the initial price is arbitrarily set at the outset.

2) Availability deviation

We focus on price anomalies, such as historical highs and lows, because they are prominent and easy to find. Often, these data points reflect the current larger cryptocurrency market, supply dynamics, or market conditions, rather than the current strengths of the project.

3) Scarcity prejudice

You may have heard of some versions of a cryptocurrency that "only 1/x of the world has 1". Limited supply means scarcity, which implies higher value and creates the urgency of buying. But a graffiti I made before, although rare, is not worth it for anyone.

4) sunk cost

We insist on what we have invested in, “often you only realize the loss when you sell it,” but now selling at a lower price is better than selling it at a lower price in the future.

5) Dunking-Kruger effect or DK effect

As our knowledge grows, the gap becomes more apparent. The more we know, the less confident we may be; the less we know, the more confident we are. Community members who have a thorough understanding of the project's fundamentals may be more conservative and cautious about their expectations, while community members who are relatively unaware of the situation may make bolder predictions.

6) Group thinking

The loudest, most confident, or the earliest voices often guide the team's decisions, but because of the Dak effect, these sounds are often uninformed, which can lead to decision-making mistakes. Objective assessments and critical thinking within the project community should be encouraged to counter tyranny from the majority (or a few loud people).

7) Social proof deviation

We tend to rely on others to guide our behavior. Partnerships, support from influencers, and social media forces can bring credibility to a project, but this support can be superficial and driven by ulterior motives.

We need a better way to evaluate (or scoring)

Deloitte wrote an article about innovation hype last year and proposed some of the criteria we should consider when evaluating new technologies. These standards go beyond the scope of speculation and involve the adoption of an innovation and its longevity. problem.

1) Complexity and compatibility

How hard is it to use? How many existing habits do users need to change? “Being your own bank” sounds great, but for most consumer end users, managing and protecting private keys, guiding transactions, and running all the necessary software can be difficult.

2) Observability and communication

How hard is this concept to explain? Can we see its role? The higher the learning curve that understands the value of innovation, the less likely it is to adopt this innovation.

3) Testability

Can people test or try this technology before investing time, effort or money? Is there a test network and documentation for new developers to experiment with? Providing users with the opportunity to “try before you buy” helps reduce perceived risk, attract interest and demonstrate value.

4) Comparative advantage

What are the benefits of using the cost and effort to change the status quo? If the advantages of a new system are only trivial, and the current treatment is “good enough,” the dynamics of change may be low.

5) Perceived risk

What are the possible disadvantages when using? There may be financial, social, outdated, and performance risks that offset the potential benefits of avoiding losses.

6) Personalization and customization

How flexible is technology to meet user needs and desires? Just because a project has a solution doesn't mean it fits all the problems. A rigid format can stifle users who want to “think out of the box” and apply innovation in new and unique ways.

7) Embrace the subculture of innovation

How large is the group of adopters? How much influence do they have in this industry and throughout the public? Is it growing? The social media army may have effectively increased market awareness, but has little influence on adoption rates other than transactions.

8) Focus on potential phenomena and side effects

Bitcoin is a classic example of blockchain and cryptocurrency, but blockchain technology has a broader meaning than Bitcoin itself. The current hype surrounding distributed finance is unique to its use case? Is it based on the success of the Ethereum network? Or is it a real miracle that is a wide range of automated, untrusted transactions supported by smart contracts?

In a long enough period of time, the technology that is not actually available will die out. No matter how much publicity a project has started, how promising it seems, if people other than the niche groups that dominate the market, such as traders, robots, and whales, don’t buy and use it, Eventually, when the market saw that new blood did not appear, most participants lost their escape. Projects with a thriving ecosystem and the ability to attract new users will bring new value and fuel to keep their economic engines running.

The blockchain won't become mainstream until it becomes boring. It must be such a subtle and universal thing that most people don't know that they are using it or how it works — and don't need to know.

We can continue to burn money on high-risk “white papers and dreams” projects, hoping to seize the opportunity of speculation before it reaches its peak (sell before it falls). However, those experienced projects that are still open and adopting signs despite low expectations have less long-term risks and deserve further study. A healthy cryptocurrency market requires flexible and growing projects, and it's time to start treating them more seriously.

This is a review article. None of the above is considered as legal or financial advice. Although the author is a lawyer, he is not your lawyer, so you should consult one-on-one with your professional about your situation before making any major legal or financial decisions.

[This document contains forward-looking statements that involve future events and circumstances that have not occurred, inherently contain known and unknown risks and uncertainties, and are subject to factors beyond the author's control. Actual events and circumstances may differ materially from those described herein. Past performance does not imply or guarantee future results. Please do not rely on any of the statements in this document as a guarantee that any future event or situation will exist or in any way affect the performance of any investment. The author of this article holds Aion and Ether. 】

This article is compiled from Medium in the financial network chain and does not represent the financial position of the financial network.

Author: Joseph P. DiPasquale

Original link: https://medium.com/swlh/crypto-traders-need-to-grow-up-before-crypto-markets-can-grow-7d2edb36dcac

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | Bitcoin's cultural type and its historical location

- Babbitt column | Questioning and thinking about Staking: Why is it not a good model?

- Opinion | ZEC and XMR: Privacy is important, but it is not all

- IMF's point of view: "Synthesis of central bank digital currency" will be the future central bank currency?

- Bitcoin position analysis: the collapse of the market, the characteristics of various accounts are obvious

- Blockchain entry | Blockchain 51% power attack is not so terrible

- Detailed explanation of the FundWin vulnerability system: Can the project party be suspicious of “doing evil”?