JPEX bankruptcy, Hong Kong SFC plans to issue a blacklist for virtual asset exchanges.

JPEX bankruptcy prompts Hong Kong SFC to consider virtual asset exchange blacklist.After the implementation of the Virtual Asset Service Providers (VASP) regime in Hong Kong, the regulatory authority, the Securities and Futures Commission (SFC), has begun to address the risks of unregulated and suspicious platforms in accordance with the Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance, which took effect on June 1.

According to the latest announcement from the SFC on September 25, the SFC plans to release the “List of Licensed Virtual Asset Trading Platforms,” “List of Closed Virtual Asset Trading Platforms,” “List of Authorized Virtual Asset Trading Platforms,” and “List of Virtual Asset Trading Platform Applicants” in order to optimize regulation during the transition period of VASP applications and ensure transparency of information for investors.

In addition, the SFC will also release a separate “List of Suspicious Virtual Asset Trading Platforms” to provide early warnings to the public.

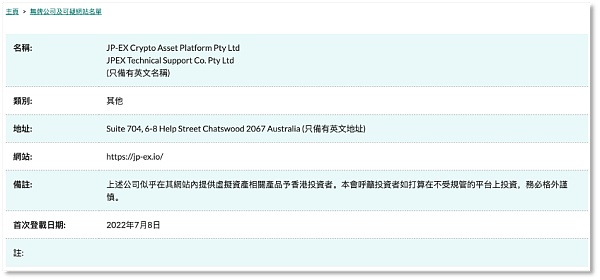

JPEX, which operates for Hong Kong investors, has become the first “suspicious virtual asset trading platform” targeted by the SFC.

- Crypto Security Differences Between Hacker Attacks and Fraud

- Conduit Elector Introduction How to bring high availability sorter and zero downtime deployment to Superchain?

- Co-founder of AirBit Club Ponzi Scheme Sentenced to 12 Years in Prison

On September 13, the SFC stated that JPEX, which relies on celebrities and internet celebrities for promotion, made false and misleading statements such as “licensed” and “entered into business cooperation with Hong Kong listed companies,” and its entities have not submitted any license applications for virtual asset trading platforms to the SFC. As early as July 2022, the platform was included in the SFC’s “List of Unlicensed Companies and Suspicious Websites.”

After being named by the SFC, JPEX users encountered difficulties in withdrawing funds. According to the Hong Kong police, there have been more than 2,000 reports involving a total amount of over 1.4 billion Hong Kong dollars, and 12 suspects have been arrested. This case has also been referred to as the “largest financial fraud case in history” by the Hong Kong media.

The JPEX incident and the SFC’s latest “4+1” list measures have also sounded the alarm for virtual asset trading platforms operating in Hong Kong, urging those who want to apply for Hong Kong VASP to abandon unconventional means of promotion as soon as possible.

SFC plans to release “4+1” lists to increase transparency

On September 25, the SFC held a press conference to once again emphasize the need for the public to be vigilant against local platforms operating without licenses or using suspicious practices. SFC’s Chief Executive Officer Ashley Alder also stated that the regulation of virtual asset trading will be further optimized.

According to the SFC’s statement, the optimization measures include four lists of virtual asset trading platforms:

- List of Licensed Virtual Asset Trading Platforms;

- List of Closed Virtual Asset Trading Platforms, which refers to the names of virtual asset trading platforms that are required to wind up within a specified period under the legislation;

- List of Authorized Virtual Asset Trading Platforms, which refers to the names of virtual asset trading platforms authorized as of June 1, 2024, and when the license application of a previously recognized licensed virtual asset trading platform is approved, withdrawn, or refused, the name of the platform will be transferred to the “List of Licensed Virtual Asset Trading Platforms” or “List of Closed Virtual Asset Trading Platforms”;

- List of Virtual Asset Trading Platform Applicants.

In addition to these four lists, the SFC will also release a list specifically targeting suspicious virtual asset trading platforms. This list will be published on the website of the Hong Kong Securities and Futures Commission for easy reference. The SFC will also consider providing more information about unregulated virtual asset trading platforms, in order to raise public awareness early and ensure information is published in a clear, transparent, and timely manner.

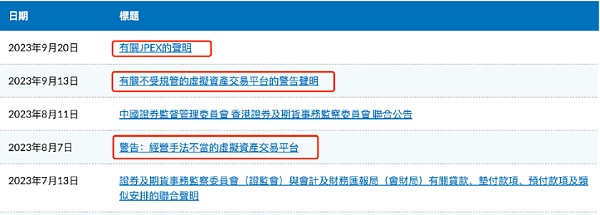

In fact, this “4+1” list is an important supplement to the implementation of the Virtual Asset Service Provider (VASP) license in Hong Kong and the one-year transition period for license application. The SFC has continuously demonstrated its regulatory authority over virtual asset trading since the new policy.

Starting from June 1st this year, Hong Kong has established a new licensing system for centralized virtual asset trading platforms. All virtual asset trading platforms operating in Hong Kong or actively promoting their services to Hong Kong investors must apply to the SFC and obtain a digital asset license and a Virtual Asset Service Provider (VASP) license.

After the policy was introduced, many virtual asset trading platforms claimed that they “will apply for VASP license”. As a result, various cryptocurrency exchanges rushed to Hong Kong, making it difficult for the public to distinguish which platforms are actually applying for licenses and fulfilling their compliance obligations. The SFC has apparently noticed this and has been continuously issuing risk warnings to the public since August.

The SFC has issued consecutive warning statements.

On September 13th, JPEX appeared in the SFC’s warning statement, becoming the first virtual asset trading platform to be named as “unregulated” and “suspicious” by the SFC. This platform was almost the catalyst for the SFC’s “4+1” list measures.

JPEX has been under scrutiny and exposed after being named by the SFC

For JPEX, it may not be unfamiliar to Hong Kong citizens. The advertisements of this trading platform were once widespread in major mainstream districts and subway stations in Hong Kong. Hong Kong celebrities such as Cheung Chi-lam and model Prudence Chan have endorsed it, and local Hong Kong internet celebrities “Coin Young Master” Huang Zhejie, Lin Zuobang, and other KOLs have repeatedly promoted JPEX on social media.

JPEX advertisement that appeared on the streets of Hong Kong

“Actively promoting the platform’s services and products to the Hong Kong public through social media influencers and over-the-counter virtual asset currency exchange businesses” is one of the reasons why JPEX has caught the attention of the Hong Kong Securities and Futures Commission. It is worth noting that as early as March 2022, this platform had already come into the view of the SFC and was included in the SFC’s “List of Unlicensed Companies and Suspicious Websites,” warning the public that the platform is not regulated.

JPEX was included in the SFC “blacklist” in July last year.

JPEX, which was included in the “blacklist,” did not stop operating in Hong Kong. After SFC obtained regulatory authority over virtual asset trading in June this year, it began to take action against JPEX.

On August 7th, SFC officially warned the public of the risks, stating that some unlicensed virtual asset trading platforms falsely claimed to have submitted license applications to the Securities and Futures Commission, leading the public to mistakenly believe that these platforms comply with the regulatory requirements of the Securities and Futures Commission.

On September 13th, SFC directly named the trading platform and clarified that none of the entities under JPEX Group have obtained a license from the Securities and Futures Commission, nor have they applied for a license to operate a virtual asset trading platform in Hong Kong. The operating methods, including the use of internet celebrities for promotion, have many suspicious aspects, including “claiming to have obtained licenses to operate virtual asset trading platforms from several overseas regulatory agencies” and “entering into business cooperation and receiving investments from a Hong Kong-listed company,” and false publicity claiming “extremely high returns” for some products. Retail investors have complained about “reduced account balances and changes.”

In response to this statement, JPEX announced its intention to apply for a license and expressed “extreme disappointment” with the Securities and Futures Commission’s unfair practice of disrupting market order.

On September 20th, SFC issued another statement reiterating that JPEX has not obtained a license, has not applied for a license, and also disclosed that the trading platform has never contacted the Securities and Futures Commission regarding the possible license application. SFC further revealed that “the information subsequently obtained by the Securities and Futures Commission raises suspicions of fraud in this case, so it has been referred to the police for further investigation.”

According to Hong Kong media reports, as of September 23rd, the Hong Kong police have received more than 2,300 reports related to JPEX, involving an amount of over 1.4 billion Hong Kong dollars. Twelve suspects have been arrested, including internet celebrities Lin Zuo, Chen Yi, and Huang Zhengjie, who were involved in attracting users to JPEX and operating off-exchange currency exchange shops.

As the confrontation between the two sides intensifies, JPEX users have found it difficult to withdraw their virtual assets stored on the platform. First, users need to fill out an application form to make withdrawals from JPEX. Some users also claimed that the platform limited the withdrawal amount to 1000 USDT (equivalent to about 1000 US dollars), and the withdrawal fee was increased to 999 USDT, so users can only withdraw a maximum of 1 USDT.

Users are trapped in the “withdrawal difficulty,” but JPEX has been observed to have a large amount of USDT outflows and abnormal frequency.

Bitrace, a blockchain data analysis company, conducted an audit of two JPEX fund transfer addresses on the TRON network and found that between September 14th and 20th, one of the transfer addresses transferred 1.5482 million USDT to 11 addresses after the 14th, and then transferred to multiple trading applications and platforms; during the same period, the other transfer address transferred over 7.21 million USDT to 7 addresses, “These funds are neither user withdrawals nor platform’s normal business activities, but abnormal outflows.”

The latest on-chain fund audit by Bitrace points out that JPEX-related addresses have received over 190 million risky USDT in the past 20 months, involving activities such as online gambling, money laundering, and gray/black production.

Individuals involved in JPEX may face criminal responsibility at the center of the storm.

According to the Hong Kong Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance, operating and providing virtual asset services without a VASP license will be considered a criminal offense after June 1, 2023.

If convicted through a trial, a fine of HKD 5 million and 7 years of imprisonment can be imposed. For continuous offenses, an additional fine of HKD 100,000 can be imposed for each day of the offense. If convicted through summary proceedings, a fine of HKD 5 million and 2 years of imprisonment can be imposed. For continuous offenses, an additional fine of HKD 10,000 can be imposed for each day of the offense.

Regulatory Thunder: Caution for License Applicants

From issuing warnings and naming suspicious platforms to joint operations with the police, the SFC has shown a thunderous attitude towards unauthorized virtual asset trading service providers, sending a signal that platforms operating virtual asset trading in Hong Kong must comply with the SFC’s regulations, and unlicensed exchanges operating in Hong Kong will face considerable risks.

“Investor protection” is an important principle of the SFC’s regulatory enforcement.

On September 18, Hong Kong Legislative Council Member Wu Chi-wai held a press conference to respond to the alleged fraud incident involving the JPEX virtual asset trading platform, stating that this incident has had a significant impact on the development of virtual assets in Hong Kong, and the government should do more to protect small investors. On September 19, the Chief Executive of the Hong Kong Special Administrative Region, Carrie Lam, also stated that this incident reflects the importance of regulation, including the need to choose regulated and licensed trading platforms for investment, and investors should have an understanding of virtual assets and related risks.

Under the new regulatory system, obtaining a VASP license is not easy. Virtual asset trading platforms need to meet various conditions in terms of company qualifications, investor protection, anti-money laundering, risk management, internal monitoring, network security, etc., in order to obtain a license. Currently, no exchange has obtained a VASP license, and holding this license also requires obtaining License No. 1 (Securities Trading) and License No. 7 (Provision of Automated Trading Services) issued by the SFC.

According to the SFC’s previous statement, only two virtual asset trading service providers have obtained License No. 1 and 7. These two companies are OSL Digital Securities Limited and Hash Blockchain Limited.

JPEX’s high-profile and divisive marketing and promotion strategies have collided with the “gun.” The SFC’s joint operation with the police carries a sense of “killing a chicken to scare the monkeys.” The clear stance, attitude, and measures have also sounded the alarm for virtual asset trading platforms planning to operate in Hong Kong.

With the implementation of the “4+1 List” measure, the information disclosure of virtual asset trading platforms in Hong Kong will be increasingly improved. It is foreseeable that, following the precedent set by JPEX, virtual asset trading platforms intending to operate in compliance in Hong Kong will maintain a low profile before obtaining a license, and another corner of the encrypted world’s wilderness will disappear.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuaiWeb3.0 Daily | Binance will support the Celo (CELO) network upgrade and hard fork

- Multicoin Capital The Dawn of Fhenix and On-chain Fully Homomorphic Encryption

- The epitome of CEX behind OKB destruction The investment logic behind platform tokens

- Bybit’s suspension of operations is just the beginning an analysis of the UK’s new regulatory policies in October

- It’s time to have a discussion about the current state of the metaverse.

- Overview of the Latest Situation of Hong Kong’s First Licensed Virtual Asset Exchanges

- Sei Ecosystem Review What ‘New Things’ are Being Created on L1 for Trading?