Development trends of NFT trading market: multi-functional aggregation and multi-chain competition

NFT trading trends: multi-functional aggregation and multi-chain competition.Author | nobody (Twitter: @defioasis)

Editor | Colin Wu

Last month, I took stock of the current situation in mainstream NFT trading markets in first- and second-tier cities. There are strong competitors such as Blur and OpenSea, those who are stuck in the transaction mining dead end like LooksRare and X2Y2, and some small and beautiful platforms that are not well-known. After experiencing the May Bitcoin Ordinals craze and the explosion of Blend lending share, the future competition trend of NFT Marketplace has also become more apparent. This article will focus on this.

Trend 1: Multi-functional aggregation-type NFT trading markets will become mainstream

As an NFT trading market, spot trading is the foundation, and how to provide users with high-quality and comfortable trading experience is the key to market competition. The NFT spot trading function module has undergone at least two improvements, from a single one to diversification. The first is transaction aggregation. In the initial trading process, the seller was dominant, and the listing was the basis for trading, while the buyer’s quotation was non-mainstream. Users have gone through the process from the seller on a certain independent platform to all market aggregations on a certain aggregation platform, and buyers choose to buy. The second is Bid Pool. Bid Pool has brought about a fundamental change in the trading mode, and the buyer’s quotation has become a liquidity pool. The buyer transfers the right to choose to the seller, and the seller can choose to continue to list and wait or directly throw it to the buyer Bid Pool for cash. Differentiation of rarity/pictures is no longer the focus of attention, and the greatly shortened waiting time for transactions has replaced it.

- Financial giants flock to Bitcoin ETF: Making money is the real deal

- Early layout of BRC20, comparing three Bitcoin mnemonic wallets

- Why has Bitcoin returned to $30,000 and its market share soared?

Bid Pool was first launched by Blur, and transaction aggregation was also promoted by Blur. Today, OpenSea/Pro has also integrated these two transaction methods, and it is difficult for later comers to bypass them. Open API is the new open source, and both the new NFT Marketplace and the old generation will be mutually aggregated; introducing the concept of liquidity pool in DeFi to NFT trading, there are many places worth exploring, such as how to establish a pool on NFT rarity feature trading.

The path of NFT trading market is actually no different from CEX. Expansion is a powerful means of adding market discourse groups. After spot trading, leverage is almost inevitable. At present, there are two paths, one is biased towards on-chain DeFi lending, and the other is like perpetual contracts.

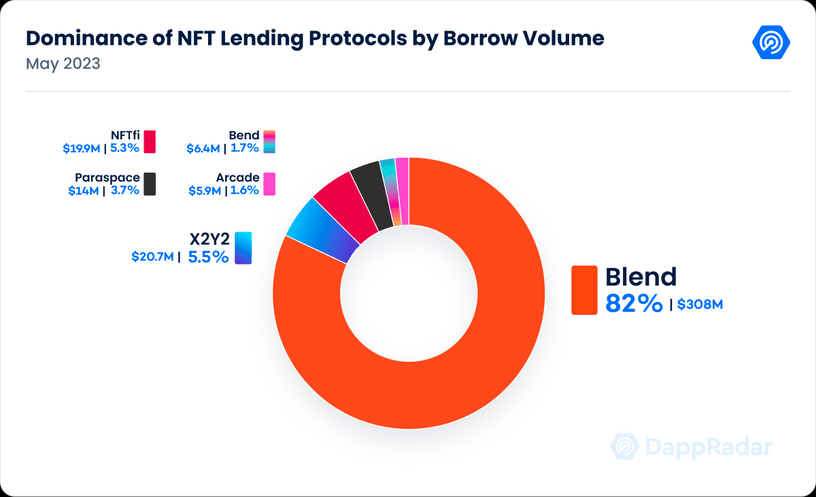

For NFT lending, X2Y2 and Blur are the only two mainstream NFT marketplaces, with X2Y2 being the earliest to establish its lending market. However, unlike X2Y2fi, whose lending market share has been difficult to shake for a long time, Blur quickly eroded the original lending market after launching Blend. According to DappRadar data, since its launch 22 days ago, Blend has accounted for 82% of all NFT lending protocol borrowing volume, and gradually caught up with Blur’s spot trading volume in lending trading volume. Despite the boost from Blur points, under the bearish trend, it is also necessary to acknowledge that leverage is indeed a good business for increasing platform increment. In addition, Binance, as a benchmark in the cryptocurrency field, although its NFT market has been tepid since its launch, it also launched NFT lending in late May, undoubtedly further validating the trend.

Data source:

https://dappradar.com/blog/blur-dominates-82-of-the-nft-lending-market

Futures are one of the important hot directions for NFT infrastructure entrepreneurship. In the past few months, relatively good NFT futures protocols such as NFTPerp, NFEX, and tribe3 have emerged. According to the revenue structure analysis of CEX, futures are the most important trading contribution form that far outweighs spot trading. The high leverage and small bets offered by contract trading amplify the gambling mentality in human nature. Volatility is the soul of futures, and for NFTs with fewer quantities and poorer depth, they have higher volatility than FT. The Blur Bid Pool not only makes real-time NFT trading possible, but also with the use of futures tools, major players can easily manipulate the NFT floor price to make a profit. However, on the positive side, futures provide ordinary users with opportunities to enter high-net-worth NFTs, and it is also a good way for trading markets to obtain user increments.

Currently, there are no native NFT marketplaces that have launched or integrated with futures markets. In addition, based on the development experience of CEX, paths such as Bitget, which first developed futures and then gradually added spot trading, may not be unsuitable for NFT trading markets. Will there be NFT futures protocols gradually adding spot trading and competing for spot trading market share in the future? This is worth paying attention to.

LaunchBlockingd has been receiving more attention from NFT marketplaces such as OpenSea, which places projects on the UI homepage and takes up a large amount of space, and Element, which has launched equity Blockingss cards EPG/EPS for NFT issuance. There are also dedicated trading platforms such as Mint Fun that focus on LaunchBlockingd. Previously, project issuance was often only the concern of the project itself, but if trading platforms can use their influence and resources to guide the process, they may be able to create more high-quality projects and drive the overall development of the market.

In the future, NFT trading markets will be multi-functional, one-stop markets that integrate diversified spot trading (order placement + pool + rarity trading), leverage (borrowing + futures), and LaunchBlockingd.

Trend 2: Multi-chain narrative will evolve into multi-chain war

Over the past month, we have witnessed the rise of Bitcoin Ordinals and BRC-20. According to CryptoSlam data, the NFT trading volume of Bitcoin in the past 30 days has reached 189 million US dollars (including BRC-20), and the first ORDI of BRC-20 has reached 40 million US dollars. Bitcoin has also officially surpassed Solana to become the second largest NFT trading public chain after Ethereum, accounting for nearly 50% of Ethereum’s NFT trading volume. Currently, in addition to the native mainstream market UniSat Marketplace, NFT trading markets such as Magic Eden, Element, and OKX NFT Marketplace have integrated Ordinals NFT or BRC-20 or both, and Bitcoin NFT has become an indispensable part of the market.

Since Ordinals only follows the security and rules of the Bitcoin network and does not rely on any centralized power to participate, it has almost a natural advantage in storing NFTs. Therefore, many communities believe that Bitcoin NFTs will be the key to driving the next round of NFT bull market and that there will be high-net-worth NFT collections. It should be noted that the Bitcoin NFTs mentioned in this article refer to the collection of Bitcoin Ordinals NFTs and BRC-20. The discussion about whether BRC-20 belongs to the general understanding of NFT is often debated, and a differentiated feature for trading markets focusing on Bitcoin NFTs may emerge in the future.

Polygon is also not to be ignored, as it has become the first choice for Web2 companies to enter the NFT market due to its almost imperceptible gas fees and fast transactions. For example, Starbucks has launched an Odyssey stamp collection based on Polygon for loyal customers, and Platinum Group, the main ticket issuer for Formula One (F1), has launched NFT tickets based on the Polygon chain for global racing events.

Currently, many NFT marketplaces are multi-chain. OpenSea supports 8 different public chains including Ethereum, Polygon, Arbitrum, and Optimism. OKX NFT Marketplace supports 5 different public chains including Ethereum, Polygon, Avalanche, BNB Chain, and Bitcoin. Element supports 7 different public chains including Ethereum, BNB Chain, zkSync, and Bitcoin.

When taking stock of the current situation, it’s worth noting that the multi-chain approach is an important narrative in the context of the NFT bear market. This is because the multi-chain strategy is an inevitable result of internal competition. When the competition on the main chain is limited or there’s not enough incremental market share on the main chain, platforms can expand to other chains by using the experience they’ve gained from competing on the main chain. They can use dimensionality reduction strategies (such as incentives and subsidies) and their brand recognition to attack other native platforms on that chain and gain market share. This strategy is particularly suitable for small platforms that can’t get a piece of the pie in the competition on the main chain. When more main chain platforms realize this and expand to other chains, a war to gain native users on those chains will be inevitable.

As the functionality of single NFT trading markets continues to increase and the multi-chain process accelerates, this is essentially a battle for the discourse power of the trading platform. However, there’s still a long way to go before they can truly have sustainable pricing power. OpenSea, with its first-mover advantage, defined royalty income for projects, but SudoSwap, X2Y2, Blur and others subsequently launched zero-royalty initiatives. While this weakened OpenSea’s discourse power, they haven’t found other sustainable income paths for project creators and artists. Blur introduced the Bid Pool, which made real-time NFT trading possible, but it became a tool for NFT whales to manipulate the market’s dump and pump. Ordinary users can only clench their teeth and bear it, exacerbating the continued loss of NFT users.

On the other hand, trading markets and other stakeholders should participate in the definition of industry standards to inject new vitality into the market. UniSat launched the BRC-20 protocol for the Ordinals market, which led to a Bitcoin NFT boom. The introduction of the Metaplex protocol brought together Solana NFT players who were previously scattered.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is it good or bad that Wall Street giants are taking over cryptocurrency with ETF and EDX?

- Ethereum Inscriptions: Continuation of Bitcoin’s Order or Regression of History?

- Bitcoin returns to $29,000, can the old narrative of institutional entry ignite a new bull market?

- Understanding EDX Markets: 10 questions about behind-the-scenes investors, compliance, and more after a night on the headlines

- Research: Which cryptocurrencies are included in the recognized token index in Hong Kong? An industrial analysis of the indexing economy.

- EDX Markets, a trading platform supported by Wall Street, has arrived! It is designed for institutional use and operates on a non-custodial model.

- Asset management companies WisdomTree and Invesco have resubmitted their application for a physically-backed Bitcoin ETF.