MakerDAO 4D Depth Report: The Value Analysis and Enlightenment of Ethereum's Largest Stable Coin

Recently, the Institute of Science and Technology of the United States has conducted in-depth research on the MakerDAO project. This article is based on the research results and compiled the MakerDAO In-Depth Report. The report is divided into four chapters that explain the following four parts to the reader:

- The existence of stable currency

- Research value of MakerDAO

- MakerDAO's analysis framework

- System goal

- product analysis

- Governance mechanism

- The implications of MakerDAO

Stabilizing coins as a new payment tool based on blockchain technology is of great significance. As one of the earliest decentralized autonomous organizations, MakerDAO provides stable coins for Ethereum, the system runs for a long time, the governance structure is continuously optimized, and new proposals are gradually integrated, which has certain research value. We hope that through in-depth research on MakerDAO, we can bring some enlightenment to the dilemma faced by the entire encryption asset industry.

Author: tequila, william, cj

The existence of stable currency

- Ethereum USDT additional flow analysis: the third increase of 100 million, 28 hours finished?

- The currency security gives up 80 million BNB team share, is it really good?

- Which block of platform application is strong? Ali is the first, Thunder, peace and follow

1.1 Origin

Through its ever-increasing market capitalization, Bitcoin has entered the mainstream capital vision from the initial password punk and geek circle. In the past decade or so, the blockchain technology that supports Bitcoin operation has not achieved real large-scale applications. However, the ecology of crypto assets derived from its ideas or technical architecture is particularly endless. We have observed that a consensus on the application of cryptographic assets is gradually being formed among early prospectors, namely “stabilized coins” – a new payment instrument based on blockchain technology.

"Stable currency" is one of the many metaphors that people have come up with in the development of cryptographic assets based on blockchain technology. Just like other metaphors, these new nouns are not used to be unconventional or ambiguous. Their real purpose is to allow people with different backgrounds and experiences to intuitively understand things with imagination and symbols without the need for analysis and overview. Metaphor is a means of managing technological innovation. People can put tacit knowledge and explicit knowledge together and start to communicate.

1.2 analogy

In order for new species to be accepted more quickly by the public, people are often accustomed to highlighting their advantages by comparing existing things. However, this approach often limits our judgment and understanding of new species. In the modern mature business system, we have long been accustomed to using legal currency as a payment instrument. However, the blockchain technology that accompanied the growth of Bitcoin gives the advantage of “stabilizing coins” to arouse our demand for this new payment instrument. Before answering this question, we still need to understand how Bitcoin is solved. What are the problems that traditional payments cannot achieve. Bitcoin is an uncensored electronic cash that enables peer-to-peer online payment without financial intermediation, while blockchain technology helps it avoid the double-spending problem in the payment process. Although Bitcoin has no responsible entity, this does not prevent it from coexisting with the traditionally regulated traditional financial system for more than ten years. However, since the birth of Bitcoin, the controversy over its use has never stopped, and this disagreement is also reflected in its violently fluctuating prices, making it difficult for people to use it as a value store or deferred payment tool.

Therefore, people naturally expect to create a relatively stable payment instrument through the blockchain technology and Bitcoin design concept, which everyone calls "stabilized currency." Through the study of various stable currencies in the market, we found that the following requirements are more mainstream:

1) Locking Profits: In a crypto-equity exchange that lacks a pair of legal currency transactions, speculators and traders need to convert volatility-encrypted assets into stable currencies with less price volatility to lock in the proceeds. In addition, miners need to reduce the risk of mining gains due to volatility in the price of encrypted assets.

2) Price arbitrage: When the price of the stable currency is uncoupling or encounters large fluctuations, the arbitrageur expects the project party to take action to maintain the stability of its price and thus implement arbitrage.

3) Stable tax avoidance: By converting the legal currency into a stable currency, the holder can evade the financial system of his location to regulate its profit.

4) Payment channels outside the banking system: Miners, speculators and users of partially encrypted assets may not have accounts of domestic commercial banks. By holding stable currency, they can realize payment, transfer and remittance in any place with network. Features. Its advantages are also reflected in the 7*24-hour uninterrupted market and unaudited features.

5) Anti-Malignant Inflation: In some countries where the inflation rate is extremely high, the free exchange of their national currency will also be restricted. Some stable currencies anchored with the dollar have become the currency hedging tools of these hyperinflation countries.

1.3 Evolution

Within the dynamic crypto-asset ecosystem, many stable currency projects focus on short-term goals on payment instruments and place their ambitious long-term goals on global clearing and settlement tools. In order to achieve these “unbelievable” goals, the project founding team borrowed the “money stabilization mechanism” of various traditional foreign exchange markets in an attempt to test the best combination of strategies. According to people's expectations, the destination of stable currency will be a huge market, so that traditional capital giant JP Morgan and mainstream social media Facebook are also actively involved. We classify them into the following categories based on the endogenous credit entities of the stable currency:

1) Stabilizing coins that rely on credits issued by third-party institutions: It is characterized by the need for trusted third parties to endorse and host credit assets.

a) Stabilizing coins issued by traditional financial institutions. Banks offer new deterministic billing methods based on blockchain technology such as Silvergate Network (SEN) payments and JPM Coin. In the future, such tokens have the potential to provide enterprise-class users with access to the field of encrypted assets.

b) Stabilizing coins issued in accordance with the issuer's legal currency deposits in third party bank accounts. The risk of such stable currencies mainly comes from the solvency risk of the account escrow bank and the issuer's self-monitoring and auditing risks, such as Tether.

c) Commodity-type stable currency anchored to external assets other than legal currency. Such stable currencies are often issued on the basis of high-quality liquid assets pledges, such as government bonds, commodities, stocks, etc.

2) Stabilizing coins with a single or a basket of encrypted assets as value anchors: characterized by a lack of long-term price stability mechanisms, and the higher correlation coefficient between crypto assets directly limits the risk dispersion of a basket of portfolios. Representative projects for such stable coins are MakerDao et al.

3) Algorithm-based stable currency: It is characterized by controlling the supply of money by setting rules with protocol codes to keep its price stable. From the point of view of the failure of the representative project Basis, the feasibility of using only code to avoid risks is still low.

Research value of MakerDAO

2.1 positioning

As mentioned above, the stable currency issued by credit endorsements using traditional financial institutions or other third-party institutions does not escape the risk of centralization. Moreover, this type of stable currency is unable to meet the needs of the stable tax avoidance mentioned above, the payment channel outside the banking system, and the anti-malignant inflation. Most of the stable currency projects based on crypto assets in the market try to design a stable mechanism by referring to the traditional exchange rate system, so design defects are inevitable. Among them, the stable currency, which focuses on the soft exchange rate peg mechanism, faces the same challenges as the legal currency foreign exchange market, such as speculative attacks. Considering the development potential of crypto assets, we believe that the latter is more valuable.

Among the many stable currency projects, we believe that Maker has certain research value. It is one of the earliest decentralized autonomous organizations (DAO), mainly providing stable coins for Ethereum. The decentralized stable currency in the Maker system is Dai. The whole project was launched in March 2015, and the test version Dai was released in 2017. In December of the same year, Dai main online line. Dai is a decentralized stable currency, anchored with a dollar of 1:1. In order to balance the value of Dai's value with the US dollar, Maker has designed an extremely complex governance mechanism. From September 2017 to the present, in order to make the system run better, its governance structure is constantly optimized and integrated into new ones. Proposal.

2.2 Market

In the one and a half years since the birth of MakerDao, the core team and community activity of its ecosystem is still high. In addition, even during the period of plunging and plunging of crypto assets, Dai's demand and overall stability of the system showed strong resilience and superiority to peers.

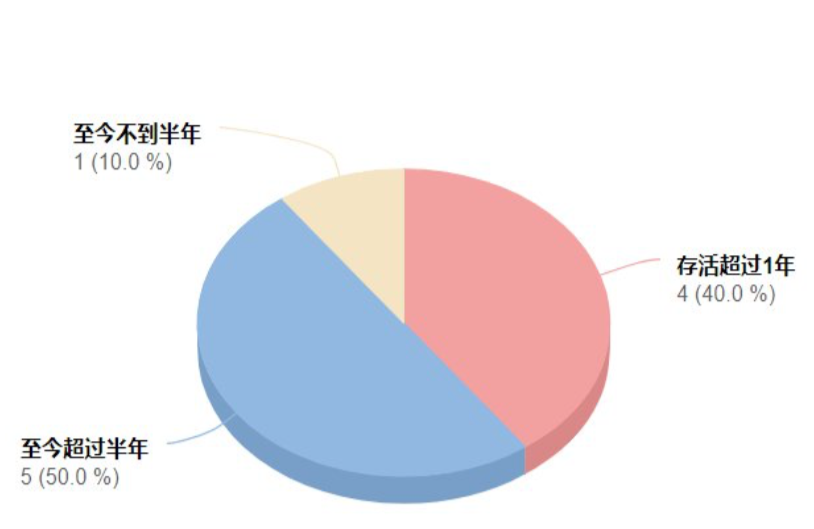

We have compiled the stable currency projects from May 18 to May 19 and divided them into three categories:

- a project that has survived for more than 1 year;

- Projects that have been on the market for more than half a year;

- And items that have been listed for less than half a year.

We found that most stable coins have a short life cycle. As of the end of the month, there were only four stable currency projects in the market that survived for more than one year, namely: Dai by MakerDAO, USDT issued by Tether, BitUSD issued by BitShares, and TUSD issued by TrueUSD. There is only one stable currency listed on the market this year: USDS issued by Stable. There are only 5 stable currency projects listed last year and have survived to this day.

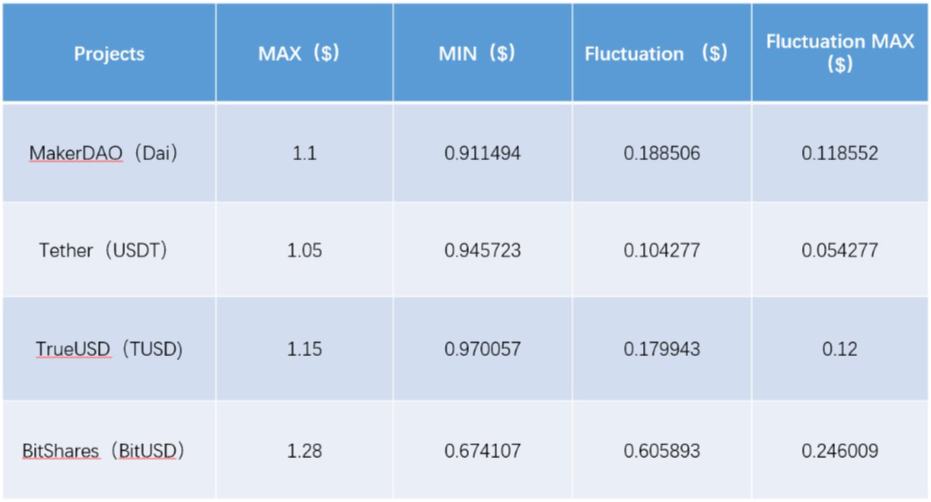

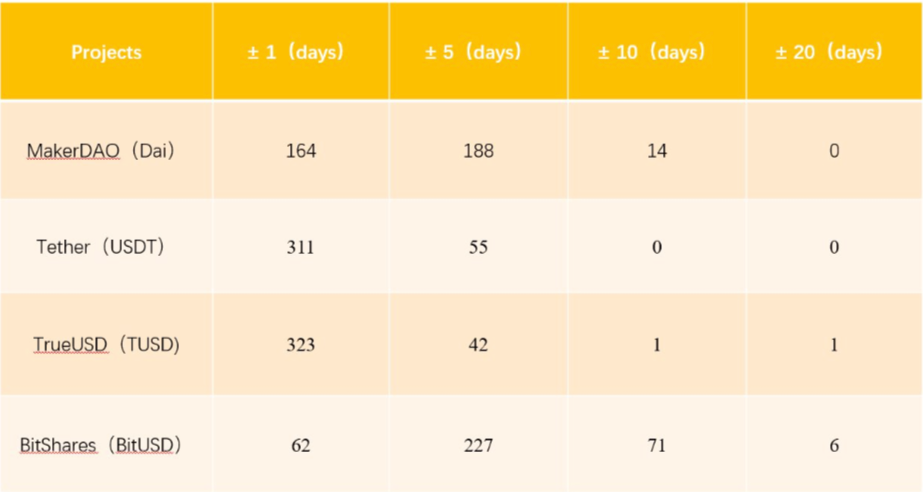

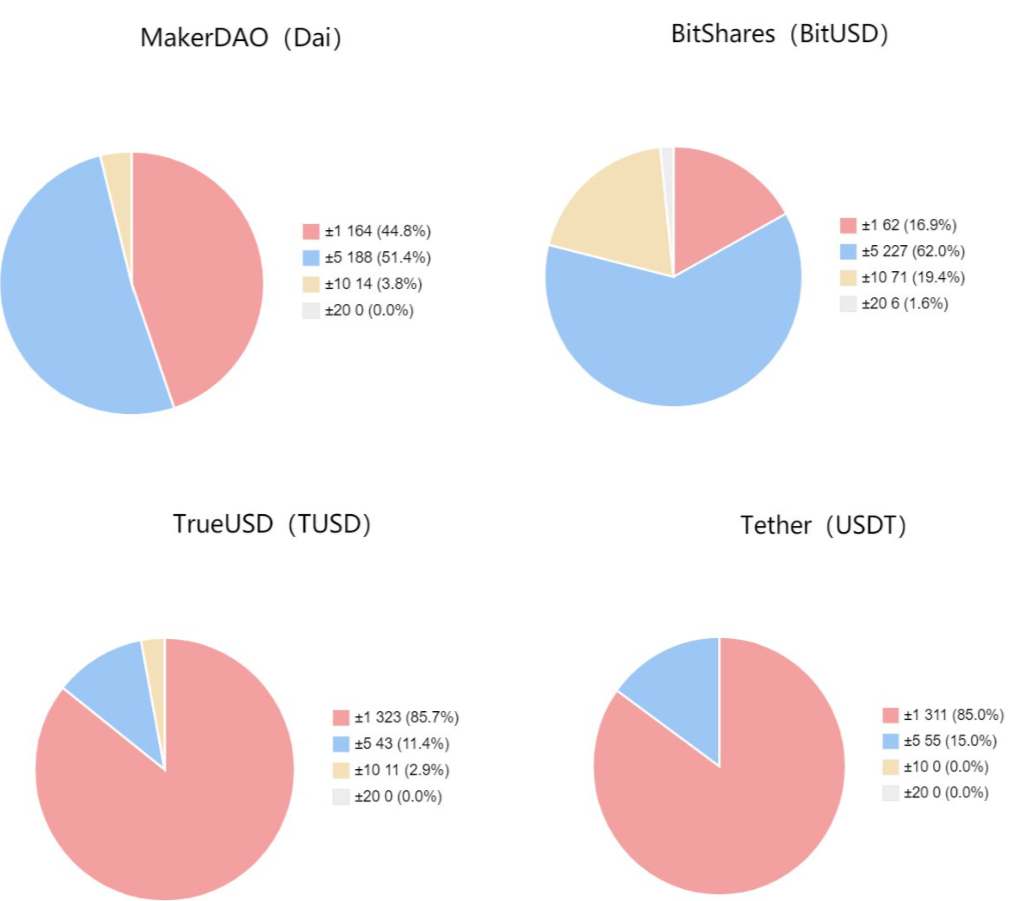

The longer the stable currency that survives, the stronger its vitality and the more research value it has. Two important factors in assessing stable currency are price volatility and its changes. We will further analyze and compare the market performance of Dai, USDT, BitUSD and TUSD. As shown in the following chart:

- Dai's $1 premium is relatively low, but the discount is slightly inferior.

- Dai's highest and lowest spreads during the year did not perform well.

- Dai's maximum deviation between the lowest and highest prices on the day of the year is good.

- Overall, Dai's performance is second only to the USDT released by the centralization agency to host the US dollar.

Remarks:

- MAX: the lowest price of each stable currency in the past year

- MIN: the highest price of each stable currency in the past year

- Fluctuation: the difference between the lowest and highest prices of all prices in the past year

- Fluctuation MAX: The maximum deviation between the lowest and highest prices of each stable currency in the past year

Remarks:

- ± 1%: The number of days between the lowest and highest price of each stable currency in the past year is about 1% (± 1% interval: ± 1% ≤ 2.5%)

- ± 5%: The number of days between the lowest and highest price of each stable currency in the past year is about 5% (± 5% interval: 2.5%<± 5%≤7.5%)

- ± 10%: The number of days when the lowest price and the highest price of each stable currency deviate by about 10% in the past year (± 10% interval: 7.5%<± 10%≤15%)

- ± 20%: The number of days when the lowest and highest price of each stable currency deviates by about 20% in the past year (± 20% interval: 15%<± 20%≤25%)

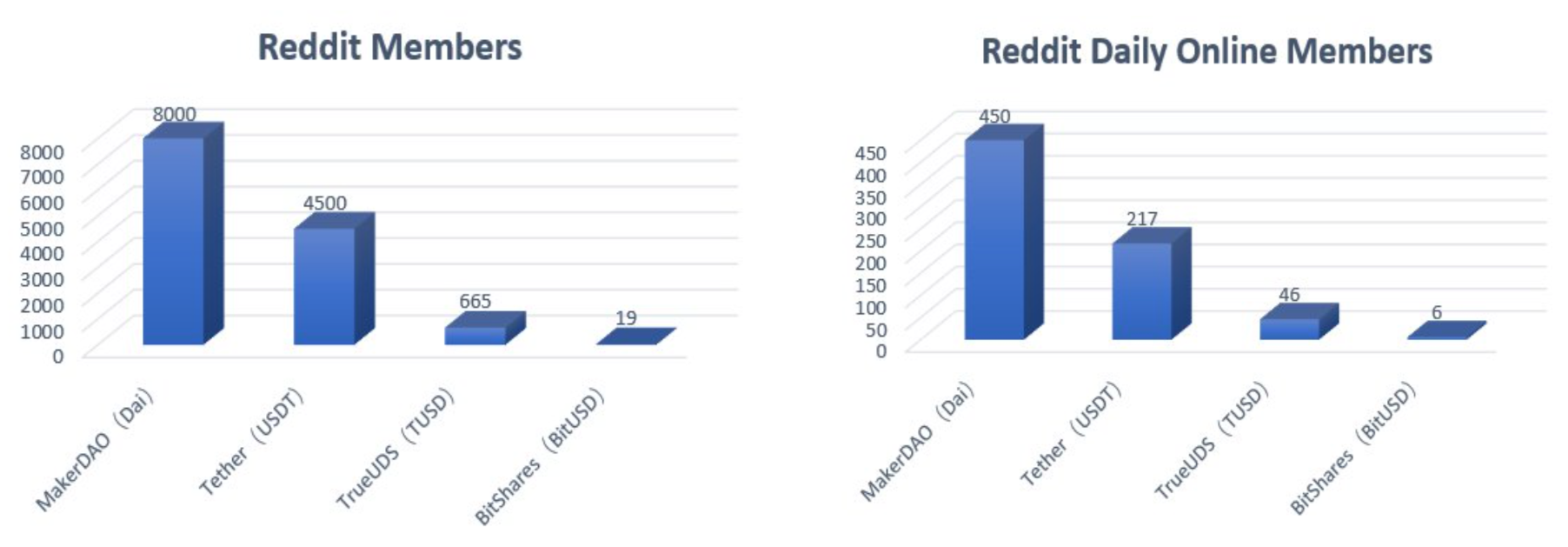

In addition, the performance of the project in the community media is also part of the project's vitality. As shown in the figure below, we observed from reddit that the MakerDao project has a high fan activity.

MakerDAO's analysis framework

3.1 System objectives

The official website slogan of the Maker project is to build transparent and sustainable finance through decentralized stable tokens, mortgages and community governance. To achieve this vision, the Maker team developed a stable token system called Dai. The goal is to create a price-consistent medium (decentralized cryptographic asset) for value exchange in the Ethereum ecosystem and the broader blockchain economy. The Maker team believes that Dai's creation, exchange and destruction mechanisms, as well as the direct risk management role of MKR holders, will enable self-interested system caregivers to maintain Dai's price stability over the long term.

Through the performance of the Maker system in the past year, we observed that the system's mechanism design has better resilience. However, Dai's stability mechanism is difficult to achieve long-term anchoring with the US dollar, and the system does not have strong anti-speculation. Attack ability. In addition, even though Maker's governance structure adopts a transparent and open management model, its decision-making process still has obvious centralization features.

From the point of view of product design, the system is against the risk of centralization in order to achieve decentralization, which makes Dai's asset side difficult to expand. On the other hand, the correlation coefficient between crypto assets is very high, which greatly reduces the anti-risk ability of a basket of encrypted asset portfolios. In addition, most traditional assets are difficult to avoid the risks of centralization and supervision. This will hinder Dai's supply and limit its applicable scenarios and scope. The nature of blockchain technology, while providing transparency and consistency benefits for billing, also makes the risk framework design flaws of the Maker system more vulnerable to speculative attacks. In the following sections, we will attempt to discuss the sustainability and achievability of system goals by analyzing the governance structure of Maker and its product design.

3.2 Product Analysis

The Maker system is an open platform designed to provide the public with transparent and sustainable financial services that enable everyone to enjoy high-quality financial services, including fair credit, on an equal basis. To achieve this goal, the system created a stable and decentralized currency, Dai. Dai can help individuals and businesses get the benefits of digital currency without the risk of asset fluctuations, and thereby change the status quo of the financial industry.

3.2.1 Design principle

Anyone can leverage the collateral assets generated by the DAI on the Maker platform, through Maker's exclusive Smart Contracts (Collateralized Debt Positions, CDP). The Mortgage Debt (CDP) holds the mortgage assets stored by the user and allows the user to generate Dai, but generating Dai means generating a debt. This debt will lock the mortgage assets in the CDP until the user repays Dai and can get back the mortgage assets. Effective CDP is over-collateralized, which means that the value of the collateral is higher than the value of the debt. Dai is issued, reimbursed and destroyed through the above methods throughout its life cycle.

In the transitional mechanism phase of the single asset mortgage phase, Ether Pool (PETH) will be the only accepted type of mortgage asset. At this stage, users who wish to create CDP and generate Dai first need to have PETH. The operation is very simple, the user only needs to put the ether (ETH) into a special smart contract, this smart contract will integrate all the ethers stored by the user into the ether pool (PETH), giving the user the corresponding ETH value of PETH. If the market price of ETH suddenly drops and the debt of the mortgage debt exceeds the value of its mortgage assets, the Maker platform will automatically dilute the ethanol pool (PETH) for asset restructuring. This also means that the number of convertible ethers in PETH will decline. After the Maker system is upgraded to multiple mortgage assets, the Ethernet Pool (PETH) will be removed and replaced by Ether and other mortgage asset types.

When the mortgage rate falls below the built-in parameters (150%), the system automatically triggers the clearing, which allows the system to generate sufficient guarantee capabilities. When the collateral price plunges rapidly and falls below the mortgage rate, and the smart contract cannot repurchase enough Dai in the market, the system will face the risk of insufficient mortgage. The solution for the "Black Swan" event is to turn on global clearing. Global clearing is the last resort to ensure that the target price of the Dai holder can be redeemed. When liquidation occurs, the system is gradually closed, and both Dai and CDP holders receive the net worth of the convertible. This process is completely decentralized and the MKR holder manages the system and ensures that it is only enabled in severe emergency situations. For example, long-term market irrationality, system security is attacked and system upgrades.

Currently, the Maker system is gradually entering Dai's multi-asset mortgage phase as planned. At this stage, the system will need to add some new risk parameters and mechanism design. By increasing the diversity of mortgage assets, Dai's supply bottleneck has been broken. At the same time, it can also meet the long-term margin requirement of various assets and increase Dai's ability to resist risks. In the multi-asset mortgaged item stage, the Maker team will face greater challenges when designing risk control parameters such as debt caps, pledge rates, stabilization fees, and penalties based on the attributes and correlations of different assets. Risk parameters are primarily modified through governance mechanisms, and MKR holders have the ability to use voting to add or modify CDP types. Given the special attributes of these assets, the Maker team plans to design a common risk management framework to systematically set risk parameters for CDP types and use this framework to set risk parameters for new CDP types. The new CDP type can be a new collateral or add other risk assets to the current collateral type.

When Dai is liquidated under various mortgage phase mechanisms, the Maker platform purchases the collateral in the CDP and gradually sells it through automated auctions. The auction mechanism allows the system to process CDP even when price information is not available. This mechanism covers the bidding process on two chains:

1) Debt bidding: In order to be able to repurchase the mortgage assets in the CDP and use them for sale, the system will first raise enough Dai to pay the CDP's debt. The offering can be sold to the auction participants by issuing additional MKR offerings and selling them.

2) Mortgage asset bidding: The CDP debt and liquidation penalties will be used to repurchase and destroy the MKR. This can directly offset the MKR issued in the debt auction. If there is enough Dai to pay the debt in the CDP plus the clearing penalty, the mortgage auction will switch to the reverse auction mechanism, and the least collateral will be sold – any remaining collateral will be returned to the original owner of the CDP .

3.2.2 Stabilization mechanism

In the Maker system, the Dai target price has two important functions:

1) The proportion of mortgage debt used to calculate the mortgage debt. 2) Determine the value of the mortgaged assets that the Dai holder will receive during the global liquidation. The initial target price will be set at 1:1 against the US dollar and will gradually be anchored to the US dollar. However, whether it is Dai's soft anchor or target price change rate feedback mechanism, there are inherent defects. We will analyze the dilemma of the stability mechanism from the following aspects:

1) Collateral risk

In the absence of mortgage anchoring with traditional assets, most cryptographic assets issued based on blockchain technology lack public consensus on their intrinsic value. Even though such crypto assets do have real needs and have evolved over the years, the market has yet to form a more uniform consensus on the valuation system for such assets. At this point, it is more difficult to build a relatively complete risk framework for such collateral. This means that long-term price stability is difficult to achieve even with over-collateralization, and the ability to use a basket of highly correlated crypto assets as collateral is very limited. In a way, Dai is more like a discounted ETH in the Dai 1.0 version. In the case of market forces, demand is always uncertain, and relying solely on MKR tokens and CDP holders is not enough. Absorb all risk of fluctuations. Excess mortgages need to be combined with other long-term and short-term hedging strategies to reduce the risk of collateral price volatility. For example, the margin call mechanism, etc., but the effective condition of this mechanism is that the mortgaged assets have sufficient liquidity, which will be a long-term challenge for the entire encrypted asset type.

2) Arbitrage and stability

Almost all stable currencies need to motivate market participants to arbitrage based on their anchor prices. Arbitrage and stability speculation will only work if it provides a long-term stable mechanism. Therefore, unless there is already some other powerful mechanism, it will not be a strong stability mechanism. We now divide Dai's arbitrage motive into two categories for specific discussion:

- Stabilizing the currency arbitrage. Dais who bought them before the current market price is higher than the anchor price can also be shorted after borrowing from Dai. Or, buy Dai when the current market price is lower than the anchor price, and sell it after its value returns to the anchor value. However, the above arbitrage mechanism requires speculators to be very confident in the return of prices. Therefore, it is necessary to cooperate with an additional stability mechanism to boost confidence.

- Debt arbitrage. In this section, we will give an example of how CDP holders can influence the price of Dai through debt arbitrage. Assume that the cost of Dai obtained by the CDP holder when opening the contract is $1, and the release of Dai with a total debt value of $100 is released:

- When Dai fell to $0.98, the debt required by CDP holders was reduced, but when they bought Dai, they might push up Dai's market price. If the price of Dai returns to $1, the CDP holder can choose to pay off the debt and close the contract. At this time, its debt arbitrage gain is (1-0.98)/1 = 2%. However, the actual situation is:

- If the CDP holder still needs Dai, then the new CDP will still be opened after the debt is paid off.

- This set of profit behavior only has the motivation to operate when the price of Dai is lower than the issue price when CDP is opened.

- If CDP holders expect Da's price to continue to fall, they will not immediately purchase Dai, which is already below their issue price.

- The above arbitrage behavior will increase the volatility of Dai, as the issue price varies.

- When Dai fell to $0.98, the debt required by CDP holders was reduced, but when they bought Dai, they might push up Dai's market price. If the price of Dai returns to $1, the CDP holder can choose to pay off the debt and close the contract. At this time, its debt arbitrage gain is (1-0.98)/1 = 2%. However, the actual situation is:

- When the Dai price rises to $1.02, CDP holders may be motivated to short the Dai. Or sell a Dai with a cost of $1, and then buy Dai after the price is lower than the issue price. At this time, its debt arbitrage gain is (1.02-1)/1 = 2%.

- As the arbitrage space will become narrower and narrower, the demand for Dai in the arbitrage process will be temporary. The CDP is closed when the arbitrage ends.

- These arbitrage behaviors will increase the volatility of Dai, making it lose its competitiveness and stability.

3) Clearing mechanism

When global liquidation occurs, the holder of Dai will be able to obtain the target value of Dai with collateral, which is expected to help Dai return to the anchor price. Since Dai's holders have the right to acquire collateralized assets equivalent to $1, this market is expected to increase market efficiency and the holders are very motivated to participate in price arbitrage. However, if the settlement occurs at an unknown time, since Dai's due income is $1, Dai's market price will be discounted to $1, considering the time value of the currency. However, market expectations for global liquidation, depending on expectations of the “global liquidator” behavior, will result in many uncertainties. This mechanism is too indirect and too dependent on expectations of "human behavior."

4) Unable to pay off the risk

The loans of most mortgage assets are liquidated and the liquidation is the key to maintaining price stability. That is, if you deposit $1 in the bank, you will receive the corresponding deposit certificate. This means you can go to the bank to take out the $1 deposit at any time. This method of liquidation ensures the stability of the price of the bank voucher relative to the dollar price.

Payable is the guarantee that the arbitrageur buys or sells when the asset price deviates from the anchor, thus bringing the price back to the anchor level. Arbitrage will continue to be carried out under the condition that the arbitrage gain is greater than the transaction cost and the market liquidity is sufficient. Dai's holder could not redeem Dai, which is worth $1, to the system for $1 in cash, so he could not arbitrage through the settlement mechanism.

5) Management under the chain

The early market value of MKR tokens is much higher than the market value of Dai. It is not excluded here that the Foundation uses various methods to sell MKR to stabilize the price of Dai, and when the price of Dai deviates, it is stabilized by large purchase orders. This will make Dai become more “centralized” and face a huge risk of opponents. After the foundation's exit chain governance, this makes early system behaviors have no reference value for predicting future risks. In addition, more artificial uncertainty brought about by the possibility of collusion under the chain cannot be ruled out here.

3.2.3 Demand Analysis

Dai's users rely mainly on CDP holders to distribute Dai. Dai's supply is always subject to the total amount of collateral assets, and if the demand for CDP contracts is not high, it will limit the supply of Dai. The CDP mechanism has limited capacity to develop in the traditional lending market. The development of token assetization may be slower and has greater compliance risks. In addition, mortgage assets are unlikely to cover traditional physical assets. The mortgage market for existing physical assets has been monopolized by giants, and operating efficiency and cost are more advantageous than MakerDao. Centralized trading experience with all major customer services, leveraged products and low cost. Considering that Dai's asset issuance is decentralized, each Dai's production needs to be realized by opening a CDP contract. Therefore, we believe that the weaker counterparty risk is almost the core advantage of the Maker system as a leveraged product. Another noteworthy advantage is that when the “black swan” event occurs, the smart contract financial instruments on eth enter faster than the centralized exchanges need to be recharged, allowing users to respond more quickly to market changes. .

We observed that the main purpose of most CDP holders to issue Dai is still to make leveraged investments. The reason why CDP holders are not willing to sell mortgage assets directly may be optimistic about their appreciation prospects. However, in order to avoid high fines, CDP holders are basically far above the system's pledge rate. Obviously, the system's pledge rate limits the leverage ratio. From this point of view, the capital utilization rate of the entire Maker system is low. We estimate that one of the main motivations for investors to be willing to accept such leveraged products in this situation may be to seek to maximize leverage. We divide Dai users into the following two groups:

- Stabilized currency users: There is no need to deal with Dai's fee mechanism (stability fee, fine, etc.), just buy and sell on the exchange.

- CDP holder: The operation is cumbersome and requires an understanding of the operating mechanism of the MakerDao system.

3.2.4 Income Distribution

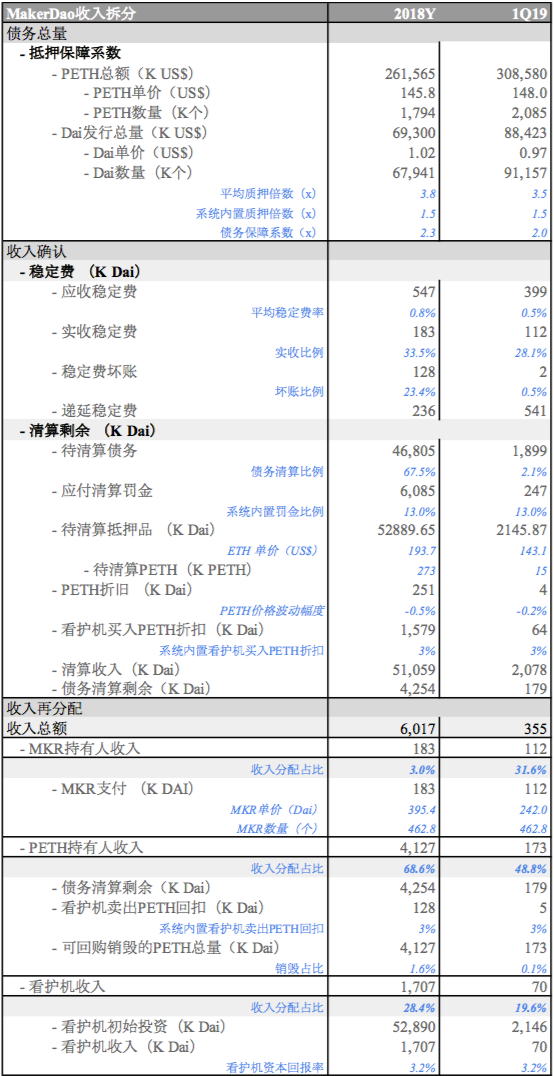

After referring to Marc's revenue analysis of the Maker system, we reconstructed the revenue distribution model based on the data provided. Through the observation of the model, we analyze the potential benefits and risks of the future from the perspective of three stakeholders:

1) MKR holder perspective.

MKR holders are not only sharers of stable fee income, but also important players in system governance. However, this group accounted for only 3% of the system's overall income in 2018. As of the first quarter of the 19th year, MKR holders benefited from the ever-increasing stable rate, which has a relatively large change in revenue, reaching 31.6% of the comprehensive income. We believe that the future development of the Maker system will still depend to a large extent on the active participation and contribution of MKR holders. Therefore, insufficient incentives for MKR holders will pose a threat to the system. As planned, the Maker system eliminates PETH in multiple asset collateral stages and gives this portion of the proceeds to the MKR holder. However, the unpredictability of the volatility risk of collateral will also expose MKR holders to the huge collateral auction risk.

2) The angle of the care machine.

The 2018 annual income distribution of the nursing machine accounted for 28.4% of the comprehensive income, and fell to 19.6% in the first quarter of the year. In a market with insufficient liquidity, the compensation for the care machine is more substantial. However, when the Maker system enters a multi-asset mortgage phase, the new auction mechanism will reduce the rebate for the collateral traded by the caregiver. The care machine has a huge contribution to the liquidity of the collateral, and this part of the incentive design will also greatly affect the systemic risk of Maker.

3) PETH holder angle.

PETH holders were the winners with the largest income distribution in 2018, with a combined revenue of 68.6% and a fall of 48.8% in the first quarter of the year. From this point of view, PETH holders' income is clearly higher than the other two ecological roles. However, PETH revenue will be cancelled under various asset collateral stages. This portion of the proceeds will be allocated to the MKR holder. Under the new allocation mechanism, Dai's deposit interest may be compensated as a PETH holder. PETH holders have a decisive influence on the supply of Dai in the system, and this part of the incentive mechanism will bring bottlenecks to Dai's supply.

3.3 governance mechanism

We observe that a major difference between crypto assets and traditional assets is reflected in the organizational form of their issuers. The Maker team uses the structure of foundations, risk committees, and communities to collaborate to manage, develop, and sell the loan product “Dai”. Although its organizational structure is different from traditional financial companies, the two goals are similar and similar, that is, to provide a financial product and service to the society – a product and service that can "win" the market.

In order to attract people with lofty ideals to participate in system governance, the Maker team will issue a token called MKR to grant holders the right to vote in organizational decisions. In addition, MKR token holders have the right to share system profits – the stability fee (loan interest rate). This makes the function of the MKR token very similar to the equity of the traditional enterprise, and the equity is the shareholder's right to obtain economic benefits from the company and participate in the company's management.

Since products and services are themselves used to meet consumer demand, why is MKR token management more applicable to the development and sale of products and services than traditional equity governance? This article is not black. White's answer, because compared to the traditional enterprise system of a hundred years of history, the new governance method adopted by Maker did not form enough data to prove a more scientific result. But we will try to analyze two issues from the governance dilemma that the Maker team has encountered:

• Is this problem encountered in the traditional corporate system?

• How does Maker's governance make this problem easier to solve?

3.3.1 Organizational Structure

3.3.1.1 Single asset mortgage phase

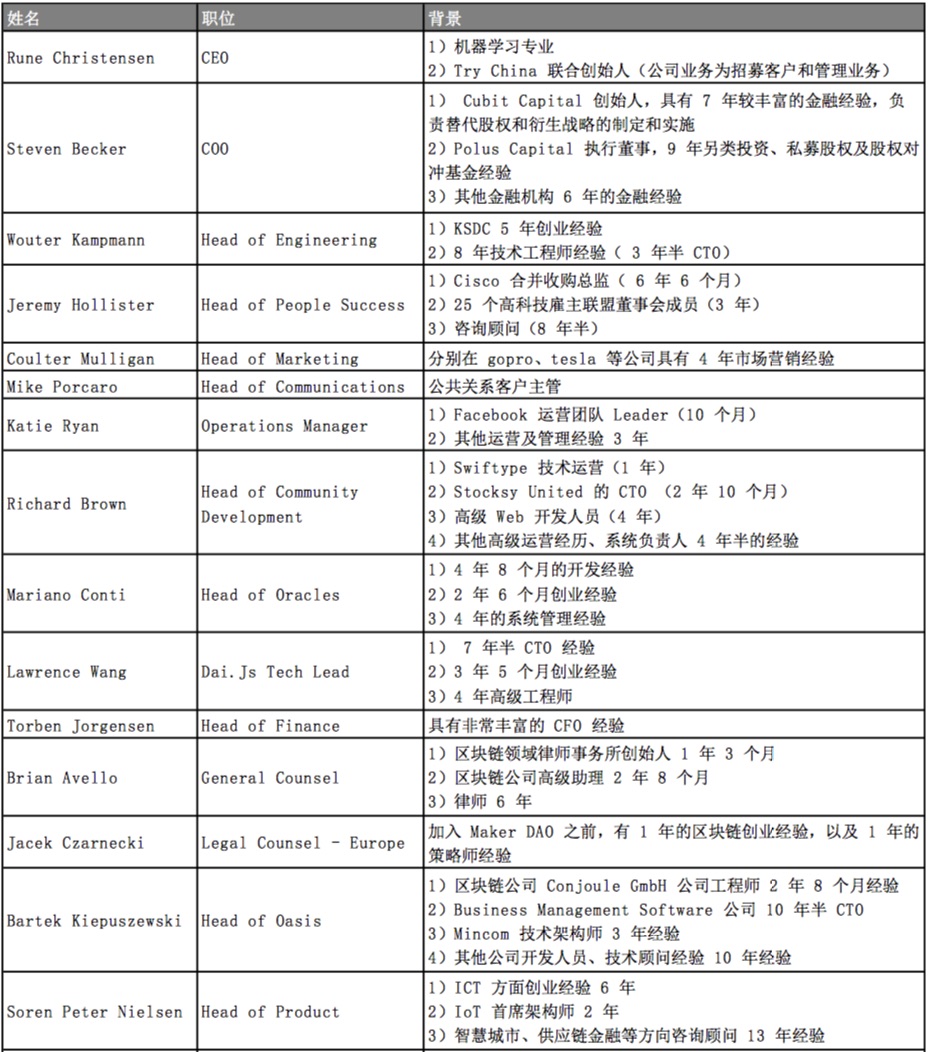

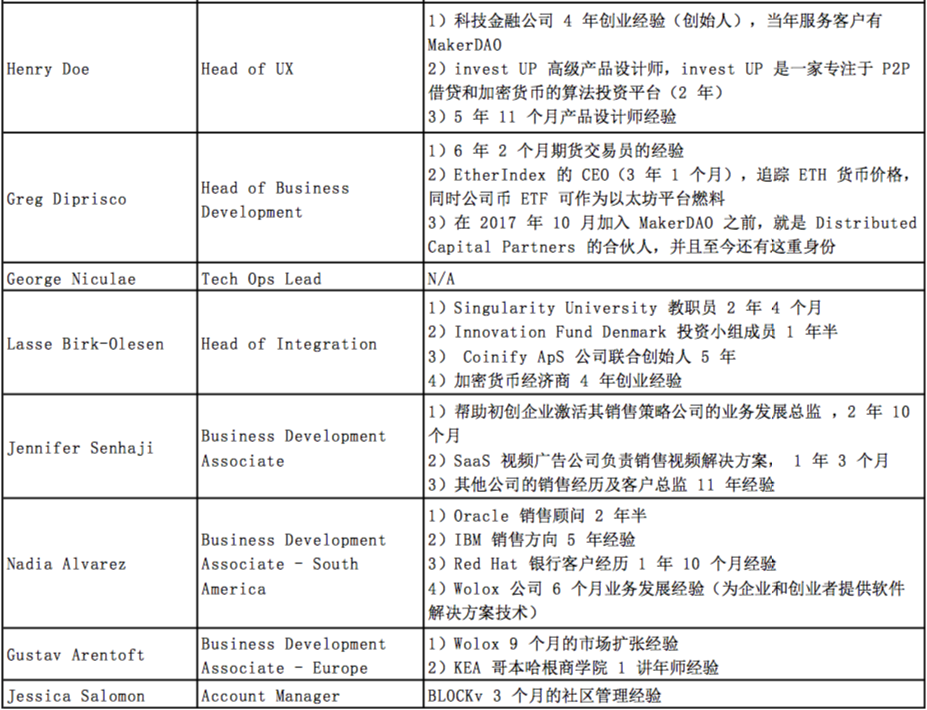

1) The Maker Foundation has a core leadership of 19 people. There are 4 teams responsible for business development and 7 community operations teams. The Maker team claims that its Foundation members are not privileged and do not fully control the governance of the entire Maker system. Governance rights are in the hands of holders of MKR tokens. At present, the main responsibilities of the Foundation are as follows:

- System design, such as Dai's infrastructure and governance elements (governance interaction pages, leveraged products, etc.);

- Ensure that the system can operate normally under decentralization;

- Serve the community to balance information through internal research and marketing teams;

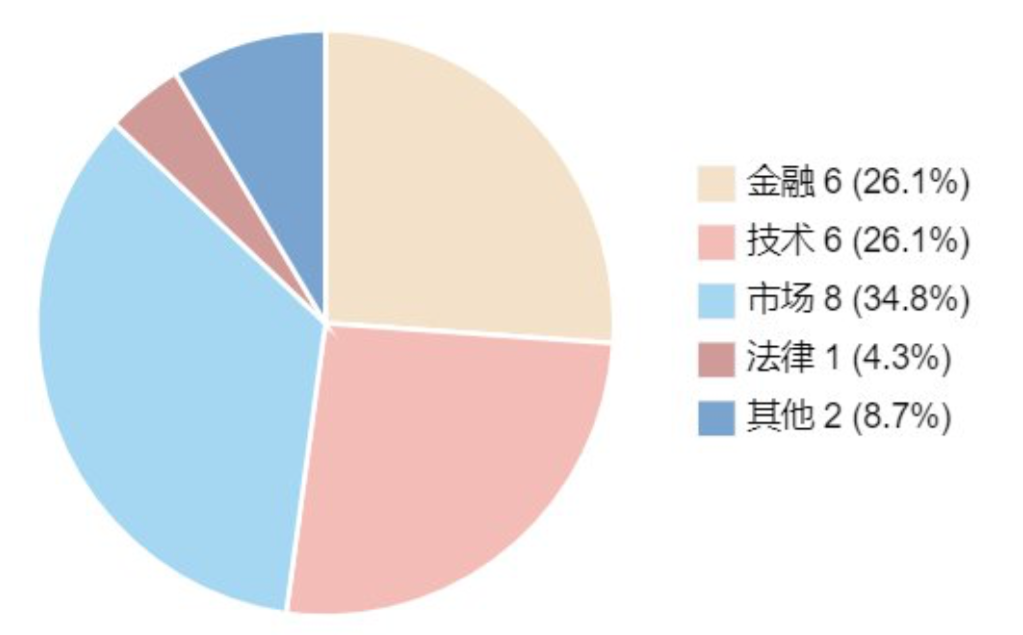

The curriculum vitae form and occupational distribution map are as follows:

Among the 23 members of the Foundation, the following core figures are worth noting:

1. CEO: Rune Christensen, COO: Steven Becker, Head of Community Development: Richard Brown, and the responsibility of the Risk Committee, attend and host each risk meeting.

2. Henry Doe founded Point before joining MakerDAO. The company specializes in providing financial product solutions to its customers, and MakerDAO is one of its customers. Prior to starting a business, this person worked as a senior product designer at invest UP, providing P2P solutions to clients. We boldly speculated that at the beginning of MakerDAO's product design, the startup team did not have strong financial product design capabilities, so it reached a cooperation with Point, the main financial product design company.

3. Greg Diprisco was a partner of Distributed Capital Partners before joining MakerDAO, and Distributed Capital Partners was one of MakerDAO's first round of venture capital firms.

2) MKR token holders have the right to participate in the management of the system voluntarily and receive income from the stabilization fee. The holder can vote to enforce administrative rights to the Maker Smart Contract. The parameters that can be modified by voting include CDP's mortgage rate, collateral variety, emergency closure, and access to risk committees. In the event of insolvency risk arising from improper management of collateral, MKR tokens will be automatically released and diluted by their holders to raise sufficient funds for asset restructuring. This risk control mechanism aligns the interests of MRK holders with the overall interests of the system.

3) The Maker team has set up its risk committee as a decentralized risk management community. The start of the risk governance community is guided by the foundation, but as planned, MKR holders will eventually vote to select different risk team leaders, along with third-party independent risk assessors. Members of the risk team can challenge existing risk frameworks and introduce new risk management models, data sources and results. Data can be exogenous data, such as price data, or endogenous data, such as qualitative analysis that determines a parameter. From the current weekly governance and risk meeting, the main leader is the early core leadership of the Maker team.

4) Maker's community members are made up of individuals and organizations such as supporters and users, including members of the Maker Foundation and MKR holders. Maker has a total of seven community operations heads around the world who work primarily locally and participate in Tuesday's community meetings through teleconference access. The main discussion is as follows:

- Recent and future activities

- Answer community community questions

- Interview new team members

- Communicate with special guests

- The latest version of the demo product

3.3.1.2 Multi-asset mortgage phase

To promote the sustainability of Maker Ecology in a multi-asset mortgage phase, the Maker team created the MEGF-Maker Ecosystem Growth Foundation by the end of 2018. The fund will be responsible for managing the MKR tokens that promote decentralized MakerDao protocol applications. At the same time, the Growth Foundation created a board that the Maker team claimed would be different from the board of traditional companies. The board of directors consists of nine engineers who are responsible for using the multi-signature technology to secure the fund. At the same time, in order to adapt to the rapid growth of global business needs, the Foundation's Board of Directors needs to introduce experts other than technology to improve execution, operations, compliance and supervision. Maker hopes that the reconstituted board will not only represent the needs of decentralized stakeholder groups (including technology contributors and security experts), but also the elements of a traditional board structure, including independent directors.

To ensure greater transparency in governance, the Maker team plans to release more about strategy, finance, partnerships, economic growth metrics and team composition, while ensuring that there is no negative impact on the primary task of issuing multiple asset-backed Dais. Data and reports, and provide technical status and roadmap updates. The Maker team believes that by continuously improving the existing foundation structure, the goal of an open and inclusive financial system can be achieved and the project will be more resilient and efficient.

The above announcement confirms to us that the Maker team is aware of the governance deficiencies brought about by the original organizational structure, and they are trying to adjust management methods to improve system efficiency and service. However, can a team that is more and more like a traditional corporate governance structure realize the “decentralized” financial products and services that traditional financial companies have not realized for a long time? We believe that there may be internal The contradiction of nature, therefore, remains to be seen.

3.3.2 MKR function

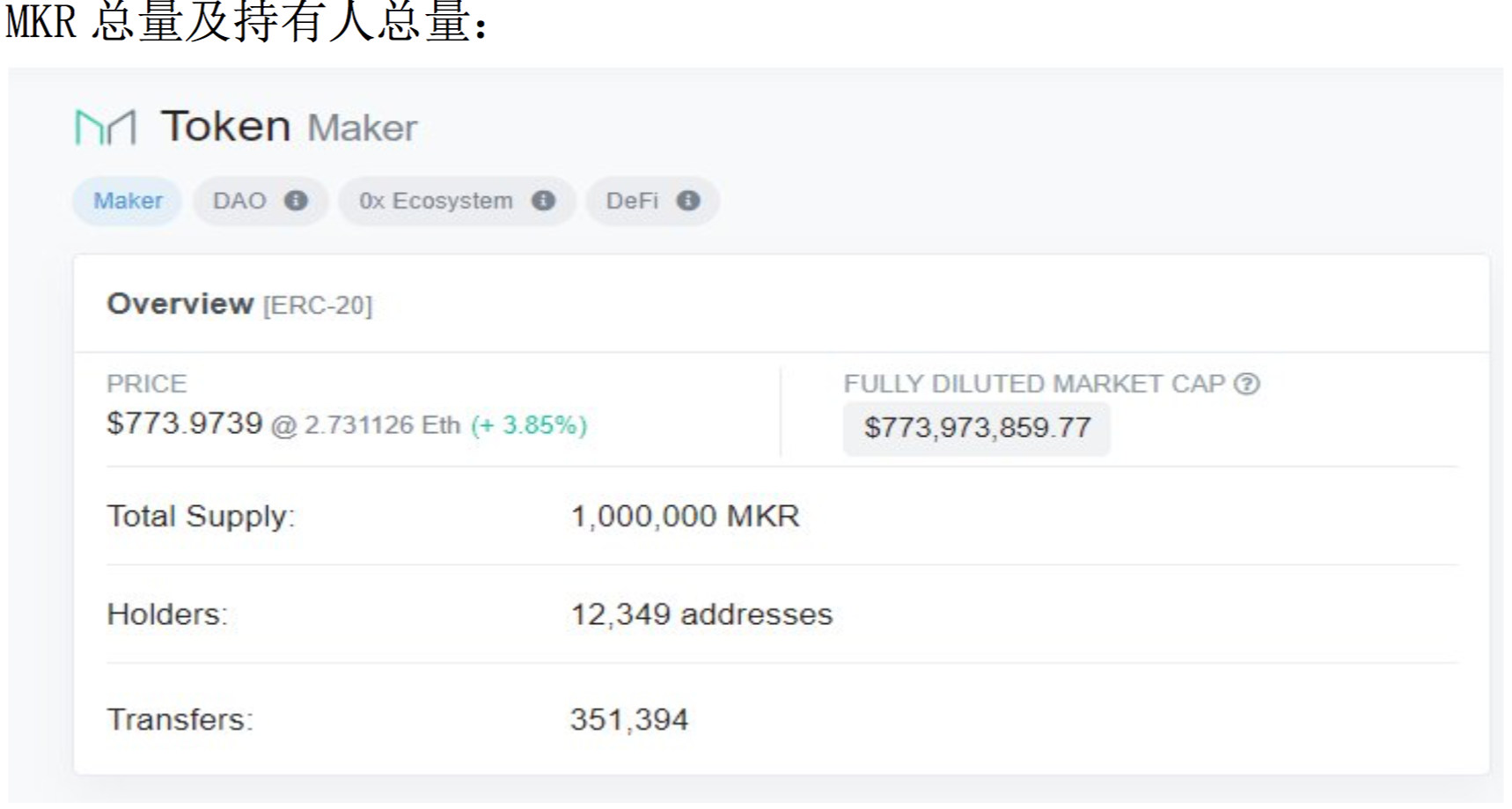

The initial circulation of MKR tokens is 1,000,000. MKR has three functions. The first one is governance. It is a symbol of power within the system. Holders can vote on the system to resolve issues within the system. The second is the stable fee payment function. When the user is repaying Dai and closing the CDP contract, the user needs to purchase the MKR token denominated by Dai to pay the stability fee, and the system will automatically destroy the received MKR token through the smart contract. The third is the clearing and repayment function. In the multi-mortgage stage, the liquidation of CDP contracts can be completed by issuing or destroying MKR.

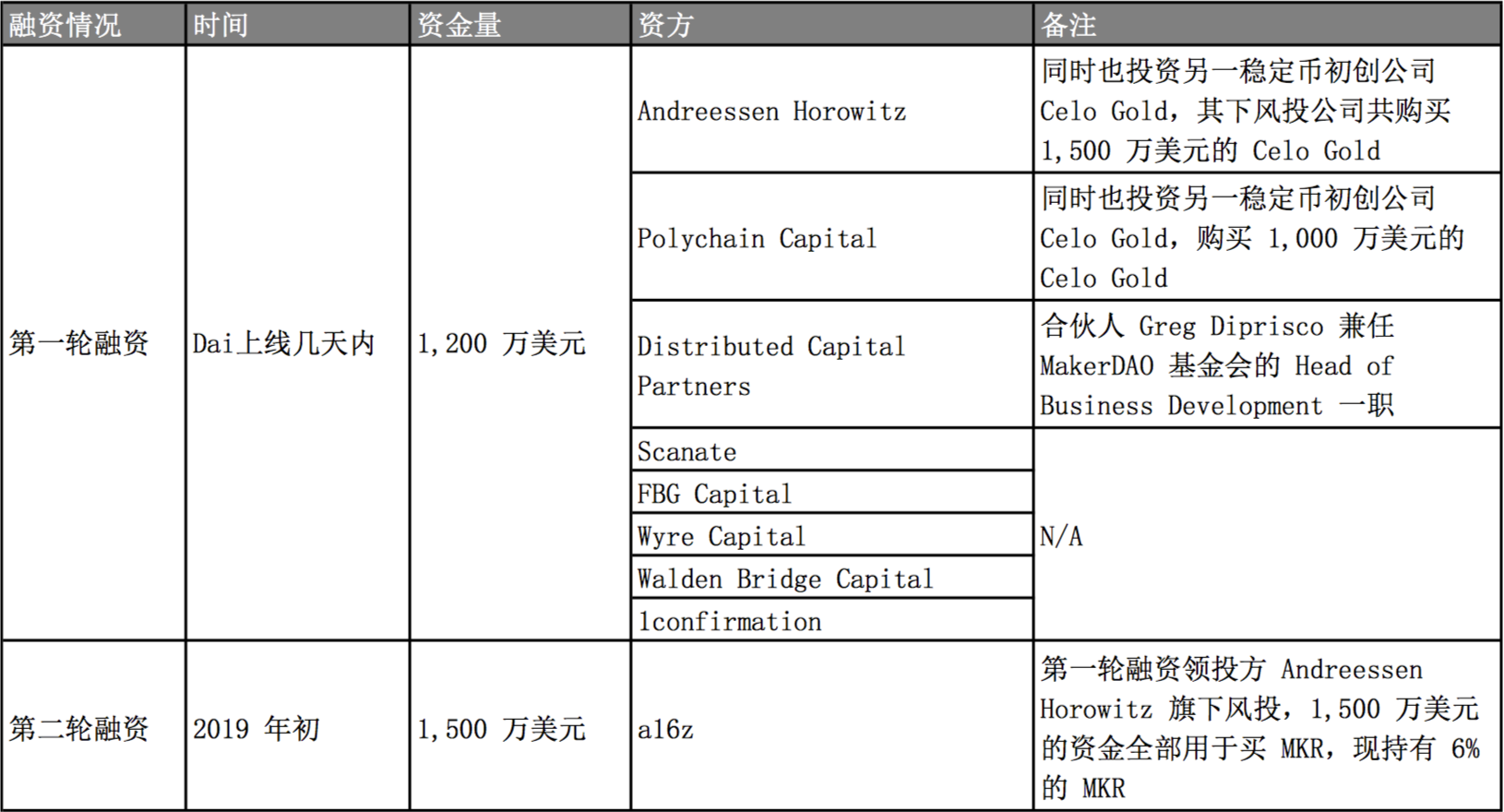

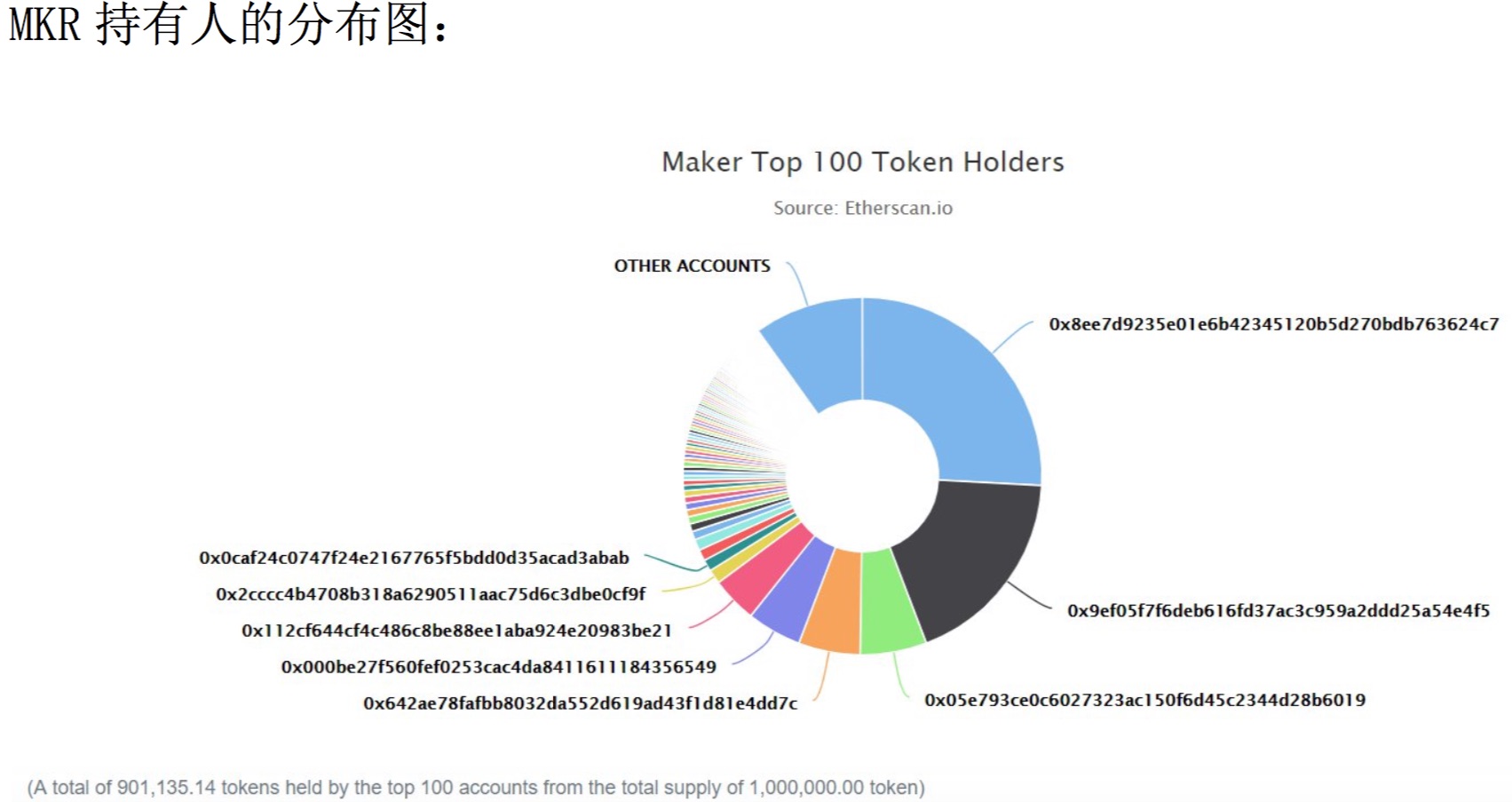

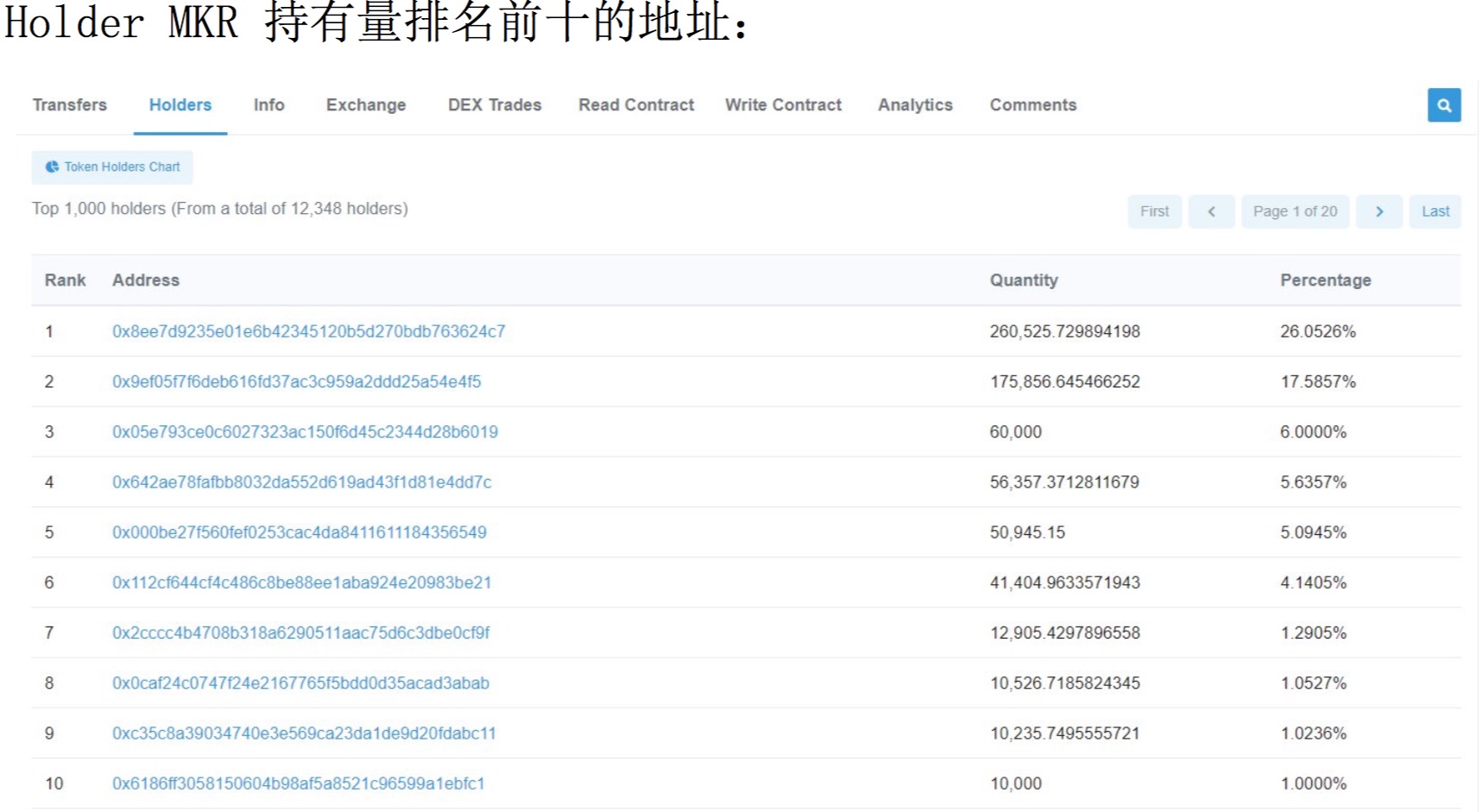

MKR has not conducted ICO, and its holders are mainly institutional investors. The total holding ratio of the top ten addresses reached 68.9%, and the proportion of holdings was higher. Considering the natural hosting limitations of cryptographic asset addresses, we can assume that even if the individual addresses are not individuals, but organizations, the high probability of individuals within the organization is also acquainted and may be consistent actors. This means that the remaining 31.1% of MRK holders have less influence during the voting process. The Maker team believes that this form of governance is not representative of democracy (a form of political system and political organization in which major representatives make major legislative and administrative decisions through discussion or debate), but more similar to the shareholder voting mechanism of listed companies. The goal of governance is to make the “interests” and “impact” of MKR holders proportional. The list of MKR investors and their time are as follows:

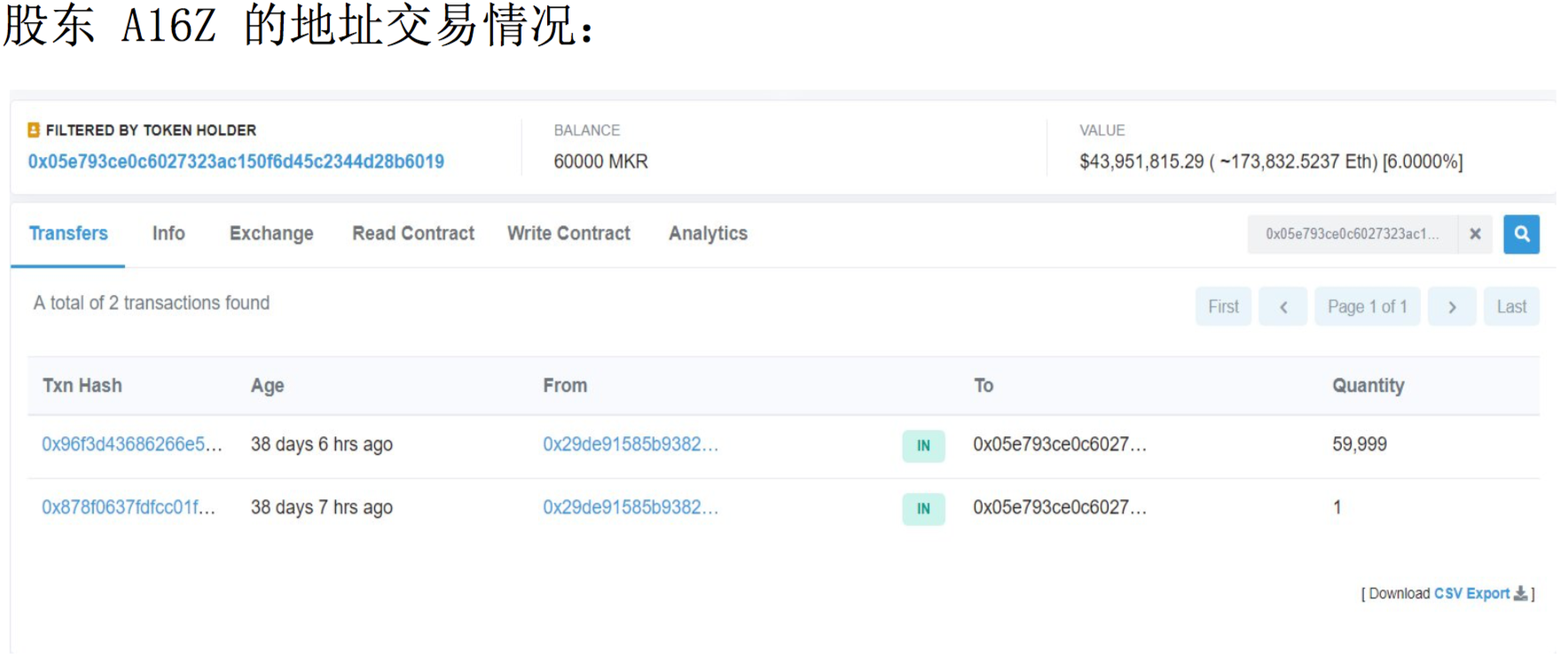

Based on the second round of financing information of MakerDAO and the currency of the address, we judged that the third-ranked address is the address of its investor A16Z, and A16Z holds 6% of MKR. From the address transaction situation, A16Z does not participate in the voting.

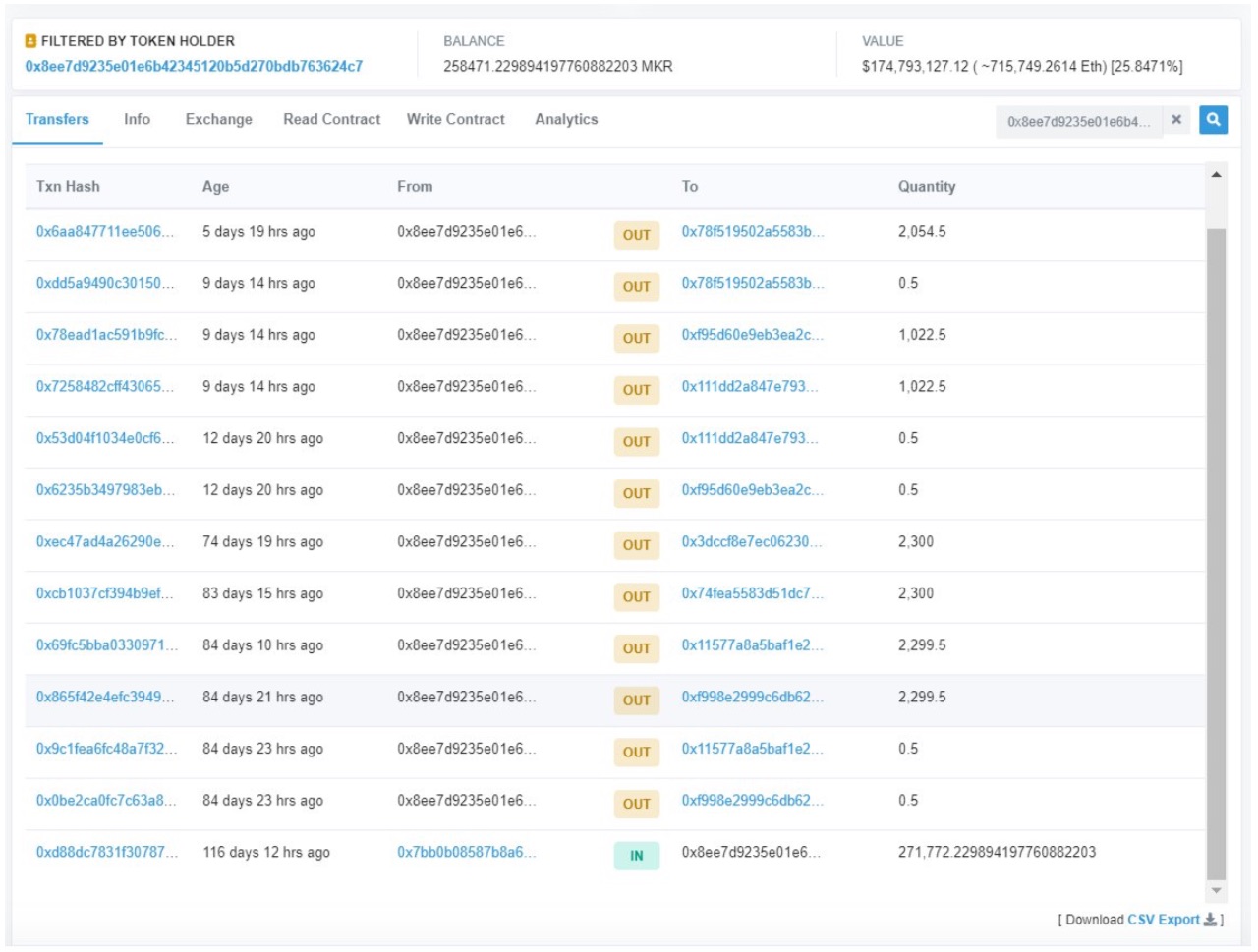

This address is the basis for the judgment of the Foundation's address and is from its official channel. The Foundation holds 25.8471% of MKR. From the point of view of address transactions, the Foundation does not vote.

Foundation address transactions:

3.3.3 Decision Mechanism

Throughout the governance process, the time nodes and frequency of voting are critical, which means that MKR holders need to have strong risk identification and control capabilities.

1) Voting forms are divided into governance voting and executive voting.

- The purpose of governance voting is to provide a solution, such as the introduction of a new Oasis or risk team.

- The purpose of executing a vote is to change the state of the system, such as changing the risk parameters of a certain collateral.

2) The voting mechanism is divided into time-limited voting and approved voting.

- Time-limited voting: The voting ends in a specific time, mainly used in the "governance voting" link.

- Approved voting: It is a single winner voting system. Each MKR holder can choose to “approve” any number of proposals, calculate based on voting weights, and finally win the most approved proposal. Such mechanisms are mainly used in the "execution voting" session.

3) Governance mechanisms also have two states: active and responsive

- Positive: Active governance encompasses debates, solutions, and automated execution, such as token selection for collateral, and changing risk parameters for collateral.

- Responsiveness: Responsiveness includes procedural interventions, such as risk adjustments due to changes in the amount of collateral and market value.

4) Voting weight calculation mainly refers to the total amount of MKR that votes to a proposal.

- For example: 100 users hold a total of 600 MKRs and vote for proposal A, 50 users hold a total of 400 MKRs and vote for proposal B, then the proportion of votes for proposal A is 60% (600/1000=60%); Proposal B has only 40% of the voting weight, so the A proposal wins.

3.3.4 Doubtful Governance

In a network environment that lacks full legal supervision, most crypto asset holders do not have recourse to the issuer of the project, and many project parties do not have a clear responsibility. At this time, in order to obtain more trust under the chain, the project issuer will reduce the trust cost of users by adopting open and transparent governance. However, the so-called "transparency" here is not clearly defined, or just the customization of the project side. Due to the inability to obtain the MKR token weights as a relatively large address holder, our prevention and supervision of decision makers' collusion is weaker than that of traditional listed companies.

Another embarrassing phenomenon we observed was that although the function setting of many tokens is very close to that of listed companies, in order to avoid the regulatory suspicion of falling into “securities” assets, their rights and obligations and liquidity protection It is far worse than traditional equity. For traditional investors, this makes the attractiveness of such assets as tokens much lower than equity.

- Doubt 1: The hiring, recall and incentive rules of executives are opaque, and the contradiction of the entrusted agents is prominent.

- The Maker system provides users with a financial product and service that is executed and guaranteed by the code, which has high requirements for the financial knowledge and programming skills of the management team. For the employment of talents, it is necessary to have a professional ability to interview the person in charge. This judgment not only includes the objective background investigation of the corresponding candidates, but also depends on the interviewer's subjective experience to evaluate the candidate's comprehensive ability. Therefore, under a governance framework with unclear management's powers and responsibilities, the interviewer's representative interests and the recruitment of talents cannot be monitored and balanced by other stakeholders.

- Since the user and other holders who share the benefits in the system have no legal recourse to Maker's core management, when the interests of the system user are violated, or when the minority holder of the MKR token is voiced When they are overwhelmed, the protection they receive is weaker than that of traditional equity holders.

- In addition, how many system benefits the leadership has and how their work performance is evaluated and motivated will affect their business performance as system agents. As far as we can observe, this part of the information is not transparent. At least, the disclosure of the Maker team is incomplete.

- Since the holders of tokens in the system do not have the obligation to disclose their identity and share their shares, this will make the operation of the Maker system more challenging than the traditional listed companies. Two premise of principal-agent theory: 1) information asymmetry, that is, information asymmetry between shareholders and management, information asymmetry between major shareholders and minority shareholders; 2) inconsistent interests, that is, shareholders and management, between major shareholders and minority shareholders The interests are inconsistent. The core of the traditional Western principal-agent theory is how the principal (all shareholders) design an optimal governance structure and governance mechanism to ensure that the agent (operator) acts in accordance with the interests of the principal (all shareholders). However, listed companies in developing countries tend to have relatively concentrated or highly concentrated equity. In this case, it is not only necessary to resolve the conflict of interest between all shareholders and operators (in fact, it mainly solves the controlling shareholders or major shareholders and operators). Conflict of interest,), but also to resolve the contradiction between major shareholders and minority shareholders.

- The doubts of the above arguments will affect the interests of the entire system and the future direction of development.

- Doubt 2: Endogenous issues in favor of the voting mechanism.

- Analysis: In the process of Maker's governance voting and execution voting, it is not difficult to see the situation of sudden drop in participation and a high number of votes in favor. We believe this is due to the endogenous problems in favor of the voting mechanism.

- Let us first give a simple example to understand the endogeneity problem. Example: Does health care products make people healthier? There are endogenous problems in this problem. The reason is that people who eat health supplements must be those who value their own bodies. These people's bodies are definitely better than those who don't care about their bodies. So from the full sample, it's hard to say that health care products are healthy, unless you control all other influencing factors, such as each person's physique, diet, exercise, mood, family structure, etc. It can be compared, but it is difficult because there is not exactly one person in the world.

- Similarly, for the complex system of Maker, the decision content itself requires participants to have a certain knowledge structure in order to make a choice. In this way, those who come to vote may have paid more attention to and agree with these proposals, but this does not represent the wishes of everyone.

- When the proposal is too complex, higher cognitive barriers will reduce participation. A few token holders with weaker knowledge structures are even less motivated to participate. At this time, the vote will also fall into the political election predicament, and people may tend to favor better proposals that are easy to understand and market-oriented, whether or not such proposals are really conducive to the development of the system. Obviously, compared with traditional listed companies, the Maker system does not reduce the difficulty of dealing with these problems. Instead, it is not traceable due to the lack of responsible subjects, the centralization of proposals caused by decision-making lobbying, and the rights of holders with high MKR weights. Centralization, making governance issues more contradictory and complex

- Doubt 3: The inefficient system decision-making leads to the system's slow response to changes in the external financial market.

- The system's decision-making process includes proposals, voting, reconsideration, review, etc. It is lengthy and it is difficult to make decisions on many proposals at the same time. Democracy and efficiency are a very difficult relationship. Democracy emphasizes individualism and majority rule. In the case of diversified interests, democratic institutions may strengthen differences of interests, which may result in companies failing to make timely and prompt decisions, ultimately reducing corporate governance efficiency. As a system for serving financial markets, Maker's decision-making efficiency will drag down the market performance of its products.

According to the official voting history, it is not difficult to see that the voting of the two types of proposals shows evidence of the above doubts:

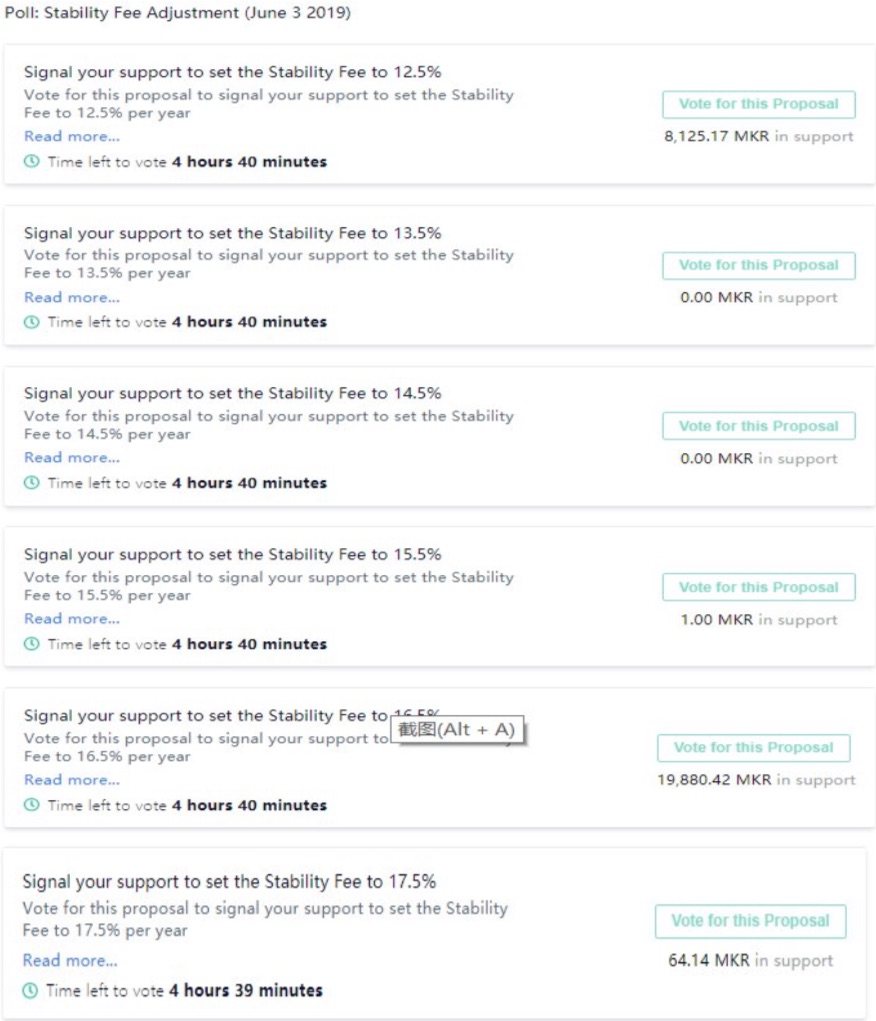

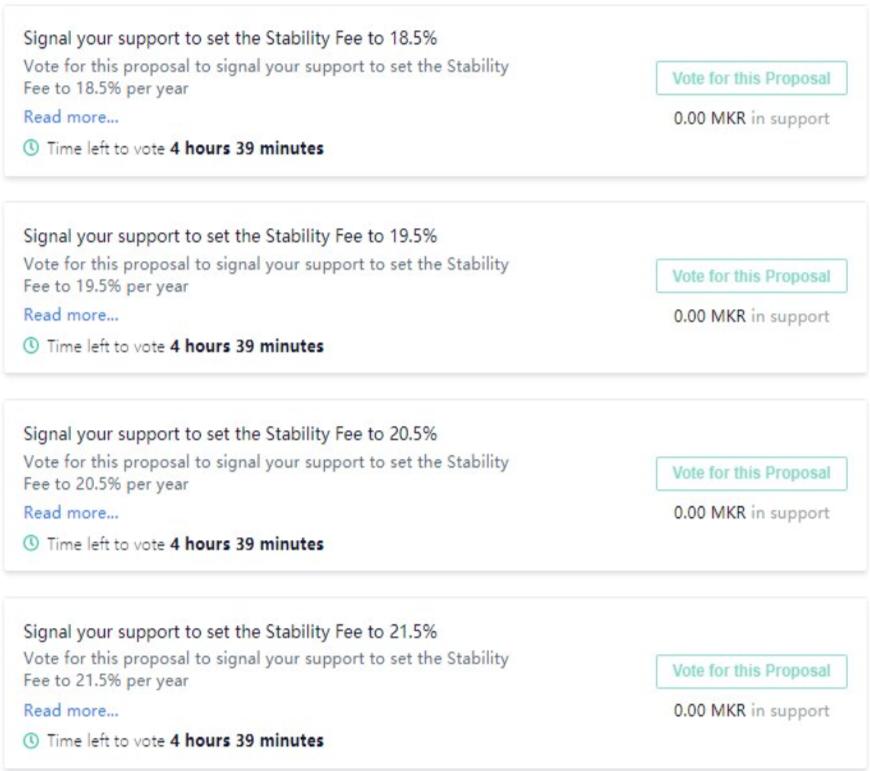

- The first type of voting proposes multiple proposals for one issue, and the MKR holder votes for the proposal in favor of it. As for the stable rate adjustment vote initiated on June 3, 19, a total of 10 optional proposals were proposed. As can be seen from the current number of votes, the voting is very concentrated, and a large number of votes are concentrated at 12.5% and 16.5%. The MKR support obtained from the 8 proposals is basically 0, as shown in the following figure:

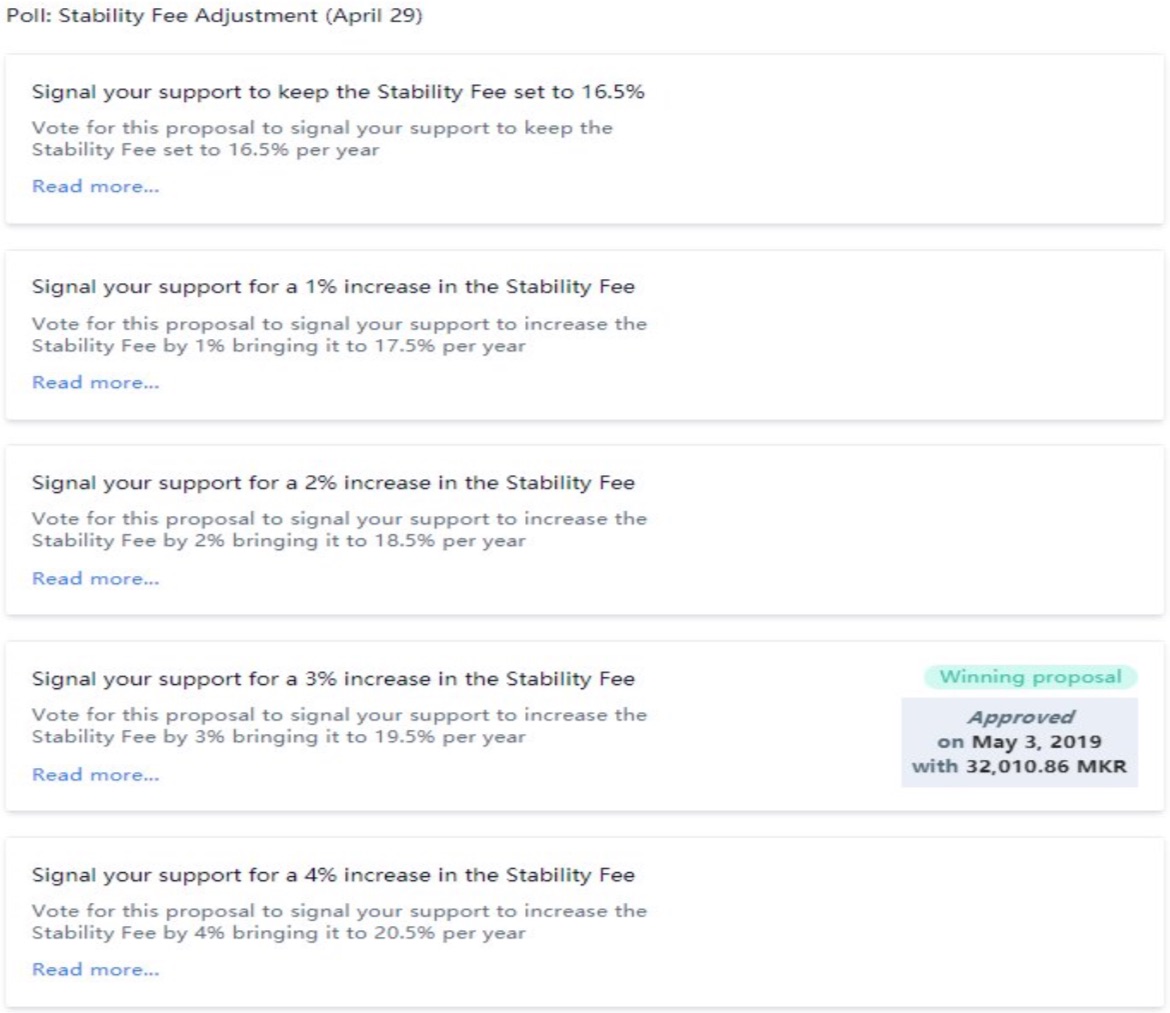

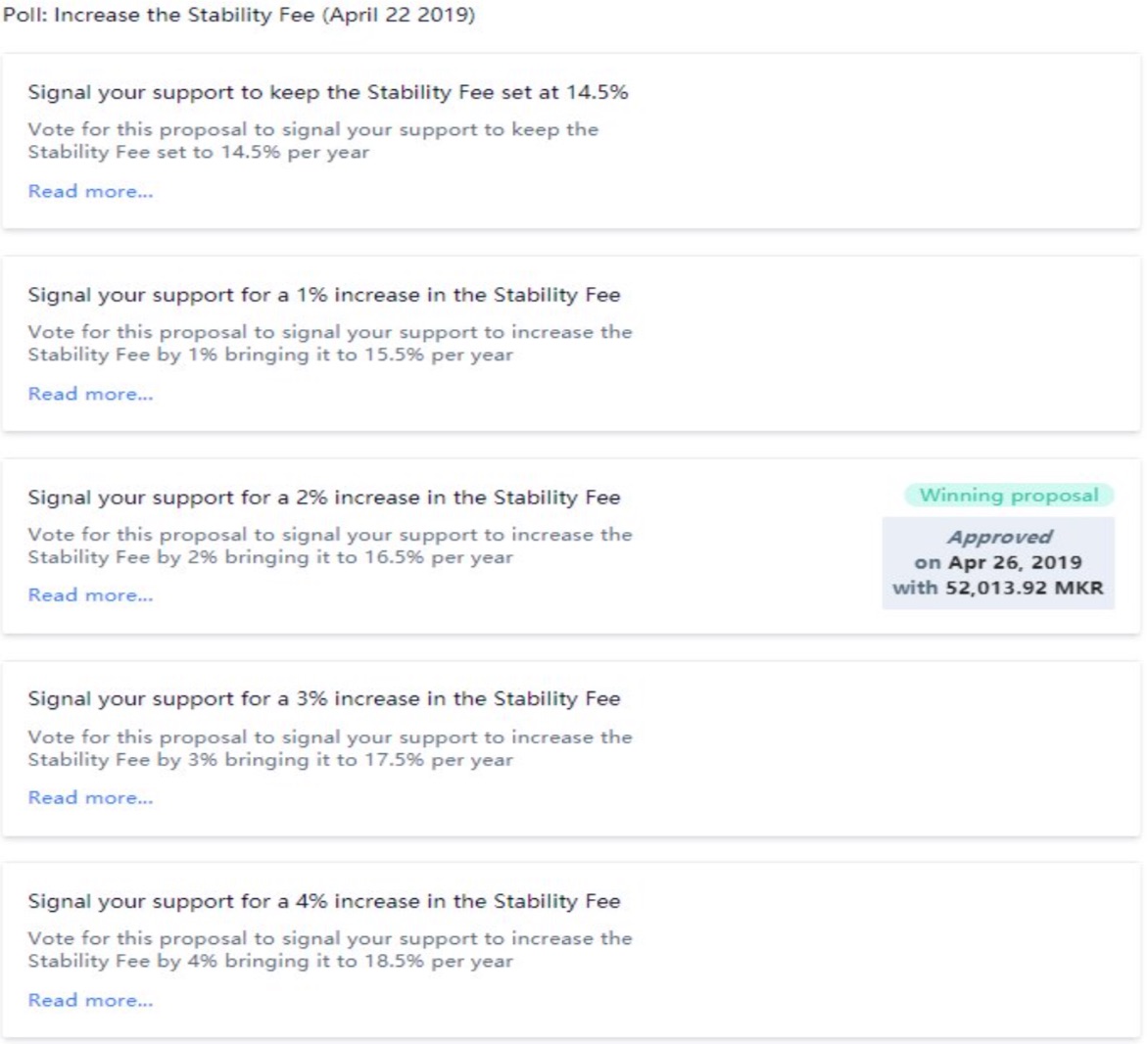

Since this vote is in progress, we can see the amount of support for each proposed MKR, and for this type of voting that has ended, we can't see how much MKR support is not approved, and we can only see it. How many MKR support is proposed, as shown in the following figure (all the proposals that have been adopted are this case, we have a few screenshots):

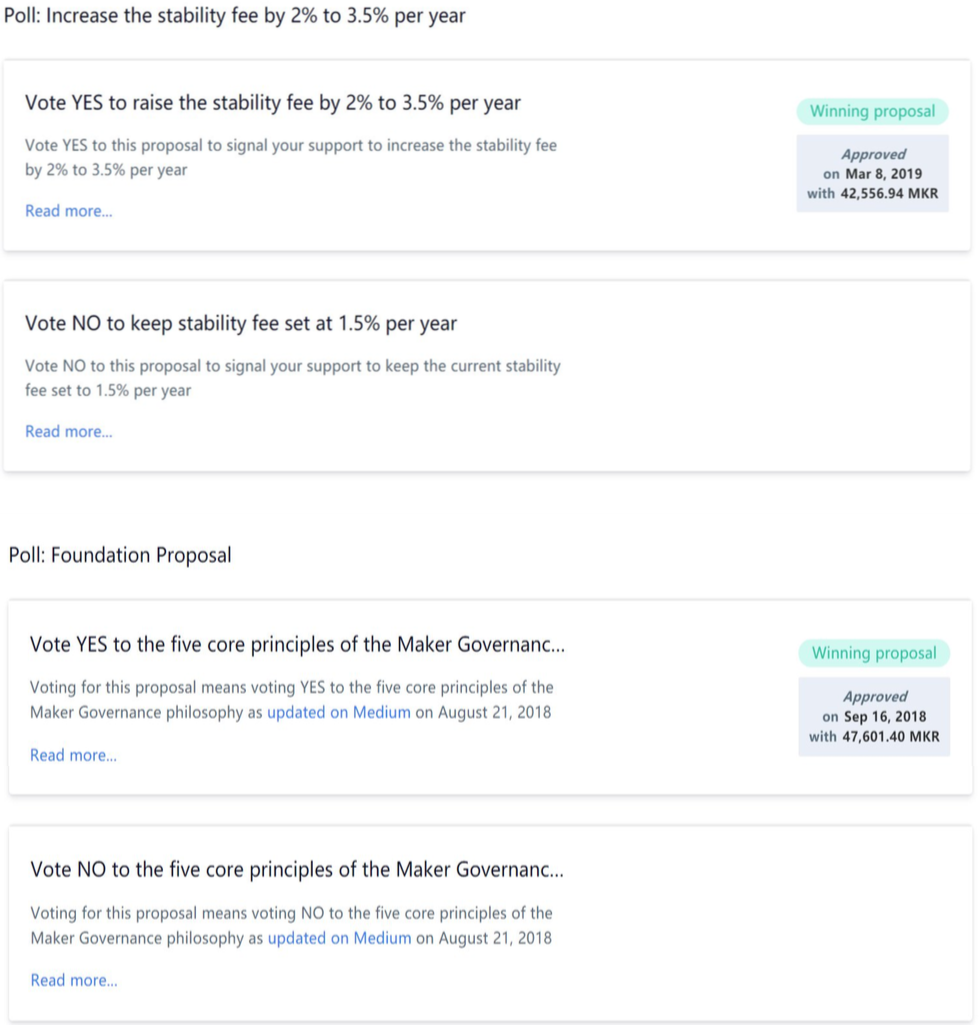

- The second type of voting is to propose a proposal with two options, YES and NO. The maximum number of MKR proposals is approved within a certain period of time. In this type of voting, in the official voting history of MakerDAO, we can see two historical records in total. The final result of both proposals is “YES”. The MKR is the most, and the proposals are also successfully passed, but we can't see the vote. The number of votes for NO" is as shown below:

The implications of MakerDAO

As an organization that provides financial products and services, the Maker team's existing operations management system still has a lot of room for improvement. In the absence of license plate protection or other hard barriers to entry, if an organization aims to provide a product or service to meet the needs of the market, it is impossible for the organization not to face competition. At this point, the competitiveness of products and services still depends on the coordination of management efficiency, core skills and resource networks to win the market. As far as the current situation is concerned, the management system of traditional enterprises is still more suitable for serving the organizational goals than the management framework of the Maker system. Due to the lag of legal regulation and the fact that cryptographic assets have not yet been transferred to traditional businesses, the cryptographic asset industry based on blockchain technology has developed a special organizational structure similar to the Maker system. At the same time, we believe that The evolution of organizational structure will be constrained by the speed of exploration of business needs and the progress of legal supervision for a long time to come. The Maker team must continue to learn and maintain sufficient patience and tenacity to achieve longer-term sustainability. Sexual development.

1. https://medium.com/@banteg/deep-dive-into-makerdao-governance- 437c89493203

2. https://medium.com/@nlw/we-talk-about-blockchain-governance-so- why-not-blockchain-politics-28f787bc9ff6

3. https://medium.com/makerdao/makerdao-governance-risk-framework- 38625f514101

4. https://medium.com/@marcandrdumas/makerdao-2018-revenue- analysis-55462642e2b9

5. https://medium.com/@marcandrdumas/makerdao-q1-2019-revenue-analysis-9afe82af3372

6. https://blog.zeppelin.solutions/technical-description-of-makerdao- governance-critical-vulnerability-facce6bf5d5e

7. https://blog.makerdao.com/making-maker-april-2019/

8. https://blog.makerdao.com/upgrades-to-maker-ecosystem-foundation-

Structure/

9. https://www.r3.com/press-and-media/page/3/

10. https://thecontrol.co/lessons-from-makerdao-a42081116e9a

11. https://www.theblockcrypto.com/2018/09/24/maker-gets-backing-from-

A16Z-crypto-but-the-move-raises-questions/#jump

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | Libra needs to go a long way to become a currency

- When does the altcoin catch up with Bitcoin? Not far away

- Opinions | Utilizing the China National Consensus and the Mining Council to deal with bitcoin network issues

- Fed Chairman Powell: Bitcoin is more like gold, it is not impossible to replace the dollar

- Oil giant Shell invests in US venture capital LO3 Energy to explore blockchain power platform

- Trump Trump: Data shows that "air" bitcoin wins over the dollar

- Comments | Lying Trump: What he is against is not a cryptocurrency at all.