BTC short-term Air Force debut, but has seen $80,000 in the long-term

On the night of the 10th, Bitcoin plunged, falling nearly 1,500 US dollars in 7 hours, hitting a short-term low of 11560, a drop of more than 12%, causing market panic. Recently, the analysis of bearish bitcoin has also emerged in an endless stream. Bitcoin failed to break, big sell-offs appeared frequently, and USDT now has a premium… There are indications that the "bomb" of the market is about to be detonated.

Although the short-term Air Force seems to have appeared, in the long run, Bitcoin's upside is still huge, and many analysts have seen as much as 80,000+.

From the end of 2020 to the beginning of 2021, Bitcoin will be five times more and will be rushed to $80,000.

Bitcoin was initially only about 0.5 cents. Although it has plunged for many years, it has risen tens of millions of times. Despite the opposite of current market views, many cryptographic analysts still hold a bullish view of Bitcoin's future.

In 2018, the bitcoin price rebounded rapidly after falling to $3,150, and the rebound was more than three times. At present, bitcoin prices are still above $10,000, which is already a very high price for many people. But the cryptocurrency idealist does not agree. They think this is just the beginning of Bitcoin, and bitcoin prices are expected to continue to rise. This may sound dramatic, but what they say is not unreasonable.

- Bitcoin profit-taking, no systemic risk

- US President Trump: Bitcoin is not a currency, it is an "air coin"

- Video|"8Q" PlatON Cloud CSO Xiao Ziwen: What can we do in the face of the giant's extraction?

CryptoHamster, a cryptocurrency analyst, recently posted a chart on Twitter. The chart predicts that the current round of the market may end at the end of 2020 to the beginning of 2021, when Bitcoin can reach a peak of about $80,000. From the current 13,000 US dollars to 80,000 US dollars, which means that the bitcoin price can be at least five times!

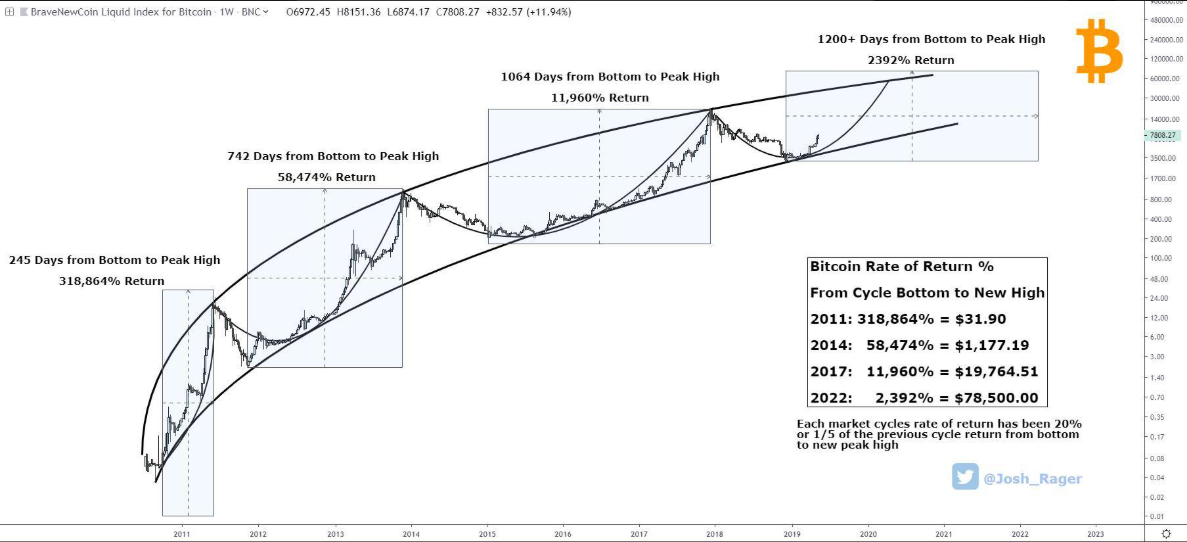

But the idea that Bitcoin broke through $80,000 is not the first time it has appeared. According to EWN's previous report, Josh Rager pointed out that according to three complete market cycles of Bitcoin:

In 2011, the rate of return was 3,200 times; in 2014, the rate of return was 585 times; in 2017, the rate of return was 120 times. Therefore, if the history is repeated, Bitcoin will rebound 24 times from the bottom in 2022, reaching a potential high of $78,500, or nearly $80,000.

Earlier this year, the famous trader Galaxy said that the current trend of bitcoin is very similar to the trend in 2015.

This is very important. In 2015, the bitcoin market was similar to this year (the pressure of selling was also broken by a big Yangxian line). After the emergence of the Yangxian line, the price of Bitcoin rose by 6500% in the next two years. Therefore, Galaxy said that if the history reappears, the continuation of the previous bull market is expected to make Bitcoin break through $330,000 by the end of 2021. But now, it seems that there is still some optimism.

What is driving the rising price of Bitcoin?

Mark Yusko and Anthony Pompliano, co-founders of Morgan Creek Digital, gave the answer. They said that because Bitcoin is an asymmetric asset, adding bitcoin to the asset allocation can increase the overall value of the asset and reduce risk. Digital assets also help investors grasp the direction of future financial development, enjoy relatively loose fiscal policy, and a large number of investment institutions continue to invest in bitcoin, so the demand for bitcoin is quite large in both the short and long term.

This article Source: Shallot APP

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ieo, which used to be ten times easier, is there anyone else involved?

- Semi-annual report | Who is the first city of blockchain application? In the first half of the year, Shenzhen and Beijing led, followed by Hangzhou and Shanghai.

- A brief history of the books: from the Babylonian Lamb to Bitcoin

- Can the digital currency of the future be popular?

- Blockchain judicial deposits are becoming more and more popular, and traditional Internet companies are entering the market.

- Read the connection between the technological revolution and financial capital: the world is changing, and the world should be changing.

- Bitcoin plunged 12%, and futures broke nearly 3 billion. What is the market?