Opinion | Professor of the Chinese People's Congress: China needs to promote the construction of a sovereign digital currency to build a fair and just new international political and economic order

Editor's Note: The original title was "Sovereign Digital Currency, Fintech Innovation, and the Reform of the International Monetary System-Also on the Issuance, Circulation, and Internationalization of Digital RMB"

Author: Paul built cloud

Source: Beijing Institute of International Economics and Trade

[Keywords] sovereign digital currency, financial technology innovation, digital renminbi, international currency system reform

- The secret history of Bitcoin: those who leave a message on the Bitcoin blockchain

- 4D Interview | Reveal the story behind "crypto cat" and the killer of "Flow"

- Counter-mainstream, new commune and blockchain: a movement spanning 60 years

[Summary] Sovereign digital currency is the product of fintech innovation, especially the development of blockchain technology, and is bound to become a key tool to promote the reform of the international monetary system and the reform of the global financial governance system. Digital RMB, as a representative of the sovereign digital currency of a large country, can become a measure of international trade, cross-border capital flows, multi-industry investment, payment and settlement, and can play an important role as a reserve currency in the international community. The issuance, circulation, and internationalization of digital RMB can promote the role of RMB as a currency that "serves the Chinese people and the people of the world."

Constructing a cross-border digital RMB issuance and circulation platform supported by blockchain-based technology is not only an important way for RMB internationalization, but also a strategic measure for the construction of a world sovereign digital currency system and the reform of the international currency system. The issuance, circulation, and internationalization of sovereign digital currencies represented by digital RMB are conducive to changing the shortcomings and deficiencies of the international monetary system dominated by the currencies of a few Western countries represented by the US dollar, and promoting the establishment of a fair, just, and efficient new international monetary system perfect.

With the development of high-speed Internet technology, blockchain, big data, cloud computing, and artificial intelligence technologies represented by 5G and their applications in the financial field, modern financial technology innovation is changing the way of financial activities in human society and international currencies. The system and promote the reform of the global financial governance system. The construction and application of sovereign digital currencies are the direct result of contemporary fintech innovation and the reform of the global financial governance system.

As a fast-rising emerging power, China is facing competition pressures and even suppression challenges brought by the United States-based defending powers and its ally system. The most typical example is the US-led global trade friction initiated by the Trump administration. The United States comprehensively uses its existing advantages in the fields of trade, finance, industry and science and technology to comprehensively curb China's development. It is worth noting that the United States is making full use of the US dollar's international reserve currency status and its right to speak in the contemporary international financial governance system. Financial hegemony hinders the internationalization of the RMB and changes in the global financial governance system.

China needs to make full use of the latest achievements of contemporary fintech innovation to promote the construction of a sovereign digital currency based on RMB, promote the reform of the international monetary system and the global financial governance system, and contribute to China's plan and China for the establishment of a fair and just new international political and economic order. power. Therefore, systematically studying the correlation between sovereign digital currencies and fintech innovation from a theoretical and policy perspective, the possible paths and policy measures for the reform of the international monetary system and the global financial governance system are urgent issues facing both Chinese academics and decision-makers.

I. Fintech Innovation and the Construction of Sovereign Digital Currency

Fintech innovation provides technical support for the construction of sovereign digital currency. The Financial Technology Innovation (FTI) in this article refers to the scientific and technological innovations that serve the financial markets and financial products. The fintech innovations in contemporary international society are mainly represented by big data, cloud computing, artificial intelligence, high-speed Internet and districts. Modern cutting-edge technologies such as blockchain are introduced into financial markets to improve the efficiency of financial markets, and financial products are introduced to increase the degree to which financial products meet social needs. The driving force of fintech innovation is to improve the efficiency of resource allocation in financial markets and reduce financial markets. Operating costs and the extent to which financial products meet customer needs. The current technological and financial innovation has five significant characteristics: First, big data and cloud computing provide data and algorithm support for financial product innovation. Second, high-speed Internet and blockchain technology provide network service tools for distributed financial transactions and financial account management. Third, artificial intelligence and quantum computing provide intellectual support and technical support for the design innovation of ultra-large-scale financial market institutions and the design innovation of complex financial products. Fourth, high technology was first introduced into financial market competition and financial product design competition to promote the technological integration of financial market competition and financial product design. Fifth, networking, intelligence, internationalization and marketization are the salient features of financial technology innovation. Fintech innovation is the technical foundation and driving force for the construction of digital currency, and it is also an important part of the financial infrastructure of sovereign digital currency.

This article's sovereign digital currency (Sovereign Digital Currency, SDC) refers to the type of digital currency issued and circulated with national sovereignty as the ultimate credit source and credit basis. National sovereignty as the ultimate credit guarantee and credit benchmark are the salient features of sovereign digital currency. The digital currency (Digital Currency, DIGICCY) in this article is a collective name for digital value symbols and value tools. It is a substitute currency for Electronic Currency and other currencies. It is also a special type of virtual currency. Sovereign digital currency Compared with other digital currencies, it has five significant features:

First, the taxation rights, coercive power, and national security capabilities of sovereign countries build the credit source and credit base of sovereign digital currencies. The credit sources and credit bases of digital currencies issued by countries with different credit types show significant differences. The credit source and credit base of the currency show significant differences, and the non-state and non-governmental characteristics of other digital currencies are even more significant.

The second is the distributed data storage and centralized credit guarantee to jointly build the digital and credit distribution characteristics of the sovereign digital currency, and the decentralized, networked and flat distributed data network to build the data foundation for digital currency issuance and circulation.

Third, the sovereign digital currency of a large country can become a tool for transnational financial transactions and payment settlement. It has a substitution effect on existing non-digital currencies of cross-border payment settlement, can break through the barriers of existing non-digital currencies in cross-border settlement, and promote the digitalization of multinational debt and debt settlement. .

Fourth, sovereign digital currencies can break the monopoly and discriminatory effects of hegemonic currencies on cross-border payments, cross-border settlements, and cross-border investments, and promote the fairness, diversification, diversification, and demonopoly of cross-border payments, cross-border settlements, and cross-border investments. To promote the orderly flow of capital in the international community and eliminate the irrational interference of financial hegemonism and financial protectionism on transnational trade and capital flows.

Fifth, sovereign digital currencies can make up for the shortcomings of sovereign non-digital credit currencies, promote the diversification of payment instruments, settlement instruments and investment instruments, improve the efficiency of financial market operations, promote the design and development of emerging financial transaction products and related financial derivative transaction products, and promote Development and innovation of international social financial markets. Contemporary fintech innovation not only provides technical support for the construction of sovereign digital currencies, but also provides increasingly complete financial infrastructure conditions for the issuance and circulation of sovereign digital currencies.

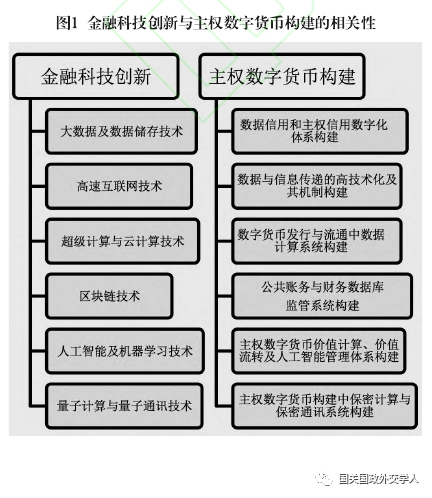

The development of contemporary fintech in the fields of Big Data and its storage technology, high-speed Internet, data transmission and Internet of Things technology, supercomputing and cloud computing technology, blockchain technology, artificial intelligence, quantum computing and quantum communication technology, etc. Most significant. The impact of fintech on the construction of sovereign digital currencies has been most significant in six areas.

First, big data and data storage technologies provide data credit support for sovereign digital currency issuance. Big data refers to a large amount of standard structured data and non-standard data. The data resources owned by a sovereign country in the contemporary international community constitute an important resource and source of data credit for the sovereign country. Data storage technology provides data credit support for the issuance of sovereign digital currencies by sovereign countries and promotes the digitization of sovereign national credits, while digital sovereign national credits can become the credit source and credit foundation for digital currency issuance and circulation.

Second, high-speed Internet, data transmission, and Internet of Things technologies provide high-speed data transmission channels and services for the issuance and circulation of sovereign digital currencies. The development of high-speed Internet technology, especially the development of 5G and even 6G technology in the future, has provided technical support for timeliness, continuity, low-latency and even zero-latency data transmission. It is a sovereign digital currency that spans time, space and even full time, Global circulation provides digital transmission support, which improves the efficiency and physical coverage of data transmission. It is conducive to the seamless and global coverage of global physical space, and promotes the globalization and circulation of sovereign digital currencies.

Third, supercomputing and cloud computing technologies provide algorithmic tool support for large-scale computing in the issuance and circulation of sovereign digital currencies. The development of supercomputing technology and cloud computing technology has provided a data processing and calculation basis for the issuance and circulation of sovereign digital currencies, and has broken the restrictions on the calculation technology of the issuance and circulation of traditional non-digital currencies (such as financial currencies, banknotes and electronic currencies). It improves the calculation efficiency and saves the calculation cost. It also breaks through the limitations of traditional computing technology, making possible the currency transactions, financial settlement and market investment behavior that traditional non-digital currencies cannot achieve, and promoting the innovation of currency transactions and financial markets.

Fourth, blockchain technology provides an efficient public ledger system and credit management database system for the creation of sovereign digital currencies. The development of Blockchain technology provides the technical basis for bookkeeping credit and account management for the issuance and circulation of sovereign digital currencies. In fact, the blockchain is a distributed ledger system and database system that can be shared by many people. Blockchain technology involves many applied technologies and theoretical fields such as modern mathematics, Internet technology, computer technology, cryptography and digital anti-counterfeiting. With the help of blockchain technology, a global public ledger system and value of sovereign digital currencies can be created. Circulating database system.

Fifth, artificial intelligence and machine learning technologies provide technical support for value calculation and value circulation for the issuance and circulation of sovereign digital currencies. The development of artificial intelligence and machine learning technology provides technical support and efficiency in the calculation, supervision and management of digital currency issuance and circulation. Artificial intelligence can partially replace some human functions in currency issuance and circulation, reducing currency issuance and circulation. And regulatory costs to improve the efficiency of currency issuance and circulation.

Sixth, the development of quantum computation and quantum communication technology provides the basis for the application of secure computing and secure communications for the issuance and circulation of sovereign digital currencies. Quantum computing is more efficient than traditional classical computing. Quantum Communication can solve the problems of confidentiality and security of communication and data transmission. A large number of data calculation, data transmission and digital communication issues are involved in the process of the issuance and circulation of sovereign digital currency. The introduction of quantum computing and quantum communication technology can not only improve the efficiency of data calculation, but also ensure the information in the process of data calculation and information transmission and sharing. And communication security issues.

It can be seen that modern financial technology innovation provides technical support and technical support for the issuance, circulation and cross-border circulation of sovereign digital currencies, and solves the issue of the digitization of sovereign credit, the high-speed data transmission channel and efficiency issues during the issuance and circulation of sovereign digital currencies. Large-scale supercomputing problems, public ledger systems and financial credit data management problems, value calculation and value circulation problems, confidential calculation and confidential communication problems.

It can be seen from Figure 1 that fintech innovation provides financial infrastructure guarantee and technical support for the issuance and circulation of sovereign digital currencies, making the creation of sovereign digital currencies technically feasible and actionable in terms of financial infrastructure protection. ). Of course, the creation of sovereign digital currency is also a process of contemporary fintech innovation and application in financial practice. The issue and circulation of sovereign digital currency has two effects on the issuance and circulation of existing non-digital sovereign credit currency: First, the division of labor and Complementarity, division of labor and cooperation with each other and complement each other; the second is competition and substitution, the issuance and circulation of sovereign digital currency can replace some functions of existing non-digital sovereign credit currency.

Analysis of the correlation between sovereign digital currencies and related currencies

The issuance and circulation of sovereign digital currencies have brought challenges to traditional national sovereign currencies, especially the dominant currencies of major countries in the international community. The substitution effect produced by them will have a profound impact on the international monetary system and even the international financial governance system.

Sovereign digital currency and traditional sovereign credit currency, although both rely on the sovereign state credit as the basis for currency issuance and circulation, but there are significant differences between the two, the former has a significant substitution effect on the latter, of course, the two also There is some sort of division of labor and cooperation. The difference between sovereign digital currency and traditional sovereign credit currency is shown in five aspects:

The first is that the digital currency of the sovereign digital currency is used to trade. The users of the digital currency of the sovereign trade or circulate through the digital symbol of the value. The traditional sovereign credit currency is coins, banknotes, demand deposits, time deposits, bonds. Bank and securities are trading or circulation media. Of course, traditional sovereign credit currency can also be used as an electronic medium. For example, electronic money (such as credit cards) enters transactions and circulation, but it is still based on traditional sovereign currency accounts.

Second, the circulation of sovereign digital currencies relies on modern high-speed Internet, blockchain, big data, cloud computing and artificial intelligence technologies, which breaks through the technical limitations of traditional sovereign credit currency issuance and circulation, and can overcome the physics of traditional geographical space and sovereign territorial space Restrictions, especially the development of blockchain technology, provide technical support for the establishment and supervision of open and shared account systems for sovereign digital currencies, reducing the issuance and circulation costs of sovereign digital currencies, while the circulation costs of traditional sovereign credit currencies are relatively low. Higher.

Third, sovereign digital currency issuance regulates the digital currency credit scale of commercial banks through sovereign digital currency accounts set up by the monetary authorities of sovereign countries, while sovereign digital currency traders conduct point-to-point digital currency transactions through sovereign digital currency wallets issued by commercial banks, and Traditional sovereign credit currencies regulate the credit scale of commercial banks through the statutory reserve ratio, rediscount rate and open market operations set by the monetary authorities (central banks) of sovereign countries.

Fourth, sovereign digital currencies can be issued and exchanged across borders through a sovereign digital currency alliance established between central banks. Blockchain, as an open and shared account system and database system, has distributed data storage and decentralized transactions. The comparative advantage has created good international financial infrastructure conditions for multinational digital currency payment, digital currency settlement, and digital currency investment, while traditional sovereign credit currency multinational payment, multinational settlement, and multinational investment are subject to various political, economic, and technical conditions. In particular, large traditional international reserve currency countries such as the United States will also use the sovereign credit advantage of their currencies in the international community to limit and suppress the cross-border transactions and circulation of currencies of competitors.

Fifth, compared with traditional sovereign credit currencies, the issue and circulation costs of sovereign digital currencies are lower and the circulation speed is faster, which is conducive to improving transaction efficiency and providing new currency trading conditions for the optimization of resource allocation. Sovereign digital currencies serve as a digital value The circulation of symbols can more easily break through geographical, physical, rule and institutional restrictions, cultural and customary restrictions, promote the optimal allocation of economic resources in a wider geographical space, and break through the increased efficiency of market allocation of resources over time.

It can be seen from Table 1 that the biggest difference between a sovereign digital currency and a sovereign non-digital currency is that the former is characterized by the issuance and circulation of digital digital symbols, while the latter is a combination of traditional physical currency and electronic money. Sovereign digital currency represents the evolution direction of sovereign credit currency, and sovereign credit currency is the basis for the issuance and circulation of sovereign digital currency.

In addition, although sovereign digital currency and non-sovereign digital currency have common characteristics, the differences are also very significant, mainly in six aspects:

First, sovereign digital currencies use national sovereignty as the main source of credit and credit base, but non-sovereign digital currencies are based on non-sovereign credit, such as personal credit, corporate credit, market credit, and other forms of credit. Persistence, but the stability and durability of non-government credit are affected and restricted by a variety of factors, with significant volatility and phase characteristics.

Second, the value of sovereign digital currencies, especially the sovereign digital currencies of large countries, is relatively stable, because national sovereign credit, especially the sovereign credit of large countries, can maintain relative stability, but non-sovereign digital currencies are easily affected by market fluctuations and speculation. Significant volatility, such as Bitcoin and other non-sovereign digital currencies, show high frequency and substantial volatility due to the effects of speculative factors.

Third, the government has a relatively high degree of supervision of sovereign digital currencies. Sovereign digital currencies are guaranteed by national sovereignty and government credit. In order to maintain the currency credit of sovereign countries and their governments, the government will inevitably strengthen the supervision of the issuance and circulation of sovereign digital currencies. Activities to prevent various possible risks of uncertainty, especially various types of speculative risks. Relatively speaking, non-sovereign digital currencies are highly vulnerable to the influence of various speculative currencies because they have no government letter as a guarantee, and the government's regulatory activities also show time differences, space differences, and Means difference.

Fourth, sovereign digital currencies are more likely to become the global cross-border payment, settlement and investment currency. As the global cross-border debt and debt settlement, payment and investment currency, it must have wide acceptance, sufficient liquidity, value stability and value-added, Because non-sovereign digital currencies do not have sovereign states as credit guarantees, their acceptance in the international community is relatively limited. They are susceptible to speculative shocks and show currency volatility and instability. In order to maintain the stability of financial markets and crack down on underground economic activities, governments of various countries It will strengthen the financial supervision of non-sovereign digital currencies, which have weakened the functions of non-sovereign digital currencies in cross-border settlement, payment and investment.

Fifth, it is easier for sovereign digital currency issuers to form a sovereign digital currency alliance. Countries have the enthusiasm for promoting international cooperation and internationalization of sovereign digital currencies. As a sovereign digital currency issuer, a sovereign country can make full use of the sovereign digital currency. The division of labor and cooperation, as well as the political, diplomatic and military relations, reached a consensus on transnational currency cooperation, promoted the cooperation of sovereign digital currencies, and promoted the internationalization of sovereign digital currencies.

Sixth, the sovereign digital currency is not only subject to the financial supervision of the sovereign country, but also faces the transnational regulatory issues of relevant international organizations. This will necessarily affect the flexibility and efficiency of the issuance and circulation of the sovereign digital currency, but it is also conducive to maintaining the sovereign digital currency. Standardization of issuance and circulation and currency credit stability.

It can be seen from Table 2 that although the sovereign digital currency and the non-sovereign digital currency are closely related to each other, for example, both types of digital currencies are based on the blockchain and high-speed Internet, and both use the digital symbol of value to realize currency For payment, settlement and investment functions, the sovereign digital currency is built on the basis of learning from the development experience of non-sovereign digital currencies, but the differences are also significant. The fundamental reason is that the sovereign digital currency uses national sovereignty as the source of credit and the credit base, making up for The non-sovereign digital currency credit base has insufficient speculation, volatility, and risk, and the stability of the sovereign digital currency's credit and currency value is more conducive to its functions of international payment, settlement, investment, and reserve currency.

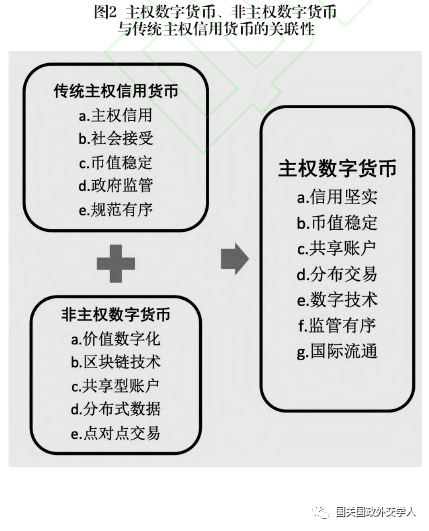

In fact, the sovereign digital currency is an emerging currency form based on the integration of traditional sovereign credit currency functions and non-sovereign digital currency functions. It is the latest achievement of the evolution and development of human social currency shapes. It can not only absorb traditional sovereign credit currencies at the same time. The advantages of non-sovereign digital currencies can also make up for the shortcomings and deficiencies of traditional sovereign credit currencies and non-sovereign digital currencies. The effect of the sovereign digital currency on the traditional sovereign credit currency and non-sovereign digital currency can be illustrated in Figure 2.

It can be seen from Figure 2 that the sovereign digital currency inherits the advantages of non-sovereign digital currency and traditional sovereign credit currency. At the same time, it discards the defects and deficiencies of the two. It has an alternative impact on non-sovereign digital currency and traditional sovereign credit currency. The effect represents the future direction of human society's monetary system innovation and currency evolution. Of course, sovereign digital currencies are not able to be issued and circulated in any sovereign country. They need to have the necessary technical, market, and institutional conditions. Countries or regions with backward technological conditions, small market sizes, and backward financial supervision are difficult to issue and circulate sovereign digital currencies. Currency Only a sovereign country with developed blockchain and Internet technologies, a large market size, and efficient financial regulation can have the technical basis and market conditions for the issuance and circulation of sovereign digital currencies. As a global emerging economic power, China has advanced Internet and blockchain technology, especially 5G communication technology. It has a global leading position. The commodity market and financial transaction market are vast. China's supervision of financial markets is efficient and orderly, and it has the sovereignty of issuance and circulation. Technical and political economic conditions of digital currency. The Digital Currency Electronic Payment (DCEP) scheme proposed and researched by relevant Chinese departments and research institutions [1] is undoubtedly an important effort towards the construction of a sovereign digital currency.

Opportunities and challenges facing the issuance and circulation of RMB sovereign digital currency

As the world's second fastest-growing economy, the world's largest trader of goods, the world's largest manufacturing country, and the world's major reserve country, China is a global player in high-speed Internet technology, big data, supercomputing, artificial intelligence, and quantum communication technologies. Leading big countries not only have the technical and market conditions for the issuance and circulation of RMB-based sovereign digital currencies, but also the conditions and practical necessity for promoting the internationalization of RMB-based sovereign digital currencies based on RMB.

This article refers to the RMB sovereign digital currency as Digital RMB or Digital Renminbi (DRMB). In fact, this article believes that the English abbreviation of Digital RMB can also be expressed as DPD (Digital People's Dollar), which means "currency for the people That is to say, digital RMB is not only a currency for the Chinese people, but also a currency for the people of the world. There are five conditions and opportunities for constructing RMB sovereign digital currency.

First, the central government's strong national governance capabilities and efficient financial market supervision capabilities have created a solid sovereign credit foundation for digital RMB issuance. The successful issuance of sovereign digital currency is inseparable from a solid sovereign credit foundation. In any country where sovereign sovereignty is not independent or not completely independent, the main dilemma faced when issuing sovereign digital currency is the lack of sovereign credit or incomplete sovereign credit. Only a sovereign digital currency issued by a large country with independent sovereignty and a central government with full credit ability can have a complete sovereign credit base. China is a fast-growing emerging power with independent sovereignty. The central government has strong international governance capabilities and efficient administrative execution. It has accumulated rich historical experience in the supervision of domestic financial and currency markets, and can effectively resist and Prevent all possible domestic and foreign financial and currency risks. Therefore, China's promotion of the issuance of a digital sovereign currency, the digital RMB, has a solid and solid foundation for sovereign credit.

Second, the development of mobile payment, blockchain and high-speed Internet technology has created mature and systematic technical conditions for the circulation of RMB digital currency. Sovereign digital currency circulation must have good high-speed Internet and mobile payment conditions. At the same time, it must be able to take full advantage of the distributed data storage, peer-to-peer transactions, shared accounts and database systems provided by blockchain technology, mobile payment, internet and blockchain technology. Any lags and defects in the system will hinder the circulation of sovereign digital currencies, weaken the functions of sovereign digital currencies, and even lead to systemic and non-systematic currency flows and related financial risks that are difficult to prevent. As a country with the fastest growing mobile currency for mobile payments, China has leading and first-mover comparative advantages in the fields of high-speed Internet technology, big data, cloud computing, and artificial intelligence technologies represented by 5G, creating a system for the domestic circulation of digital RMB. Technical infrastructure conditions.

Third, the broad market application prospects have created the market size and increasing returns for digital RMB. Only when the issuance and circulation of sovereign digital currency relies on a broad market size and massive market transactions, can it fully utilize the network scale effect of sovereign digital currency, and it is also possible to increase the circulation speed and circulation scale of digital currency. Without a broad market scale and massive market transactions, the low-cost, high-efficiency circulation advantages of sovereign digital currencies cannot be exerted, and the comparative advantage in the competition with traditional sovereign credit currencies and non-sovereign digital currencies cannot be fully manifested come out. Affected by consumption and currency usage habits, if the sovereign digital currency cannot show faster circulation speed and higher transaction efficiency in circulation, it is likely to withdraw from the currency because it cannot compete with traditional sovereign credit currencies or non-sovereign digital currencies. In the market circulation, Gresham's Law in the field of sovereign digital currency circulation appeared, that is, the phenomenon of bad currency expelling good coins in the field of digital currency circulation. China has a huge consumer market with a population of 1.4 billion. At the same time, China is also the world's largest manufacturing country and the world's major producer of major industrial products, which is sufficient to support the market circulation of digital renminbi and achieve the goal of increasing the scale of sovereign digital currency circulation.

Fourth, the rise of China ’s trading powers and financial powers has created an international trade and financial market environment for the international circulation of RMB sovereign digital currencies. China has become the world's largest country for trade in goods. There are more than 100 countries in the world that use China as the largest country for trade in goods, far exceeding the number of countries that use the United States as the first country for trade in goods. The status of a country that trades in goods will be further consolidated. At the same time, China has become the first country to promote global free trade, creating a broad prospect for the international trade market for the circulation of digital RMB across the international market. In addition, China is not only the world's largest reserve asset country, but the renminbi has also become an international socialist currency for transactions, settlement and investment. Since October 1, 2016, the renminbi has officially joined the International Monetary Fund (IMF). Since the Special Drawing Right (SDR), the renminbi, as the world's five major reserve currencies coexisting with the US dollar, the euro, the pound sterling, and the yen, has continued its status and influence in the valuation, settlement, payment and investment of international transactions The increase has created favorable international financial market conditions for the international circulation of digital RMB.

Fifth, economic globalization and the construction of the “Belt and Road” initiative have created circulation channels and mechanisms for the internationalization and globalization of digital RMB. Economic globalization and regional integration are the trends and general trends of the contemporary world's economic development. If the currency of any country fails to comply with this historical development trend, it must be eliminated by history. Sovereign digital currencies are in line with economic globalization and regional development. The need for integrated development promotes global cross-border capital flows, settlement of claims and debts, trade payments and transnational financial investment activities through the digitization of value symbols. Although the trend of counter-globalization, populism, and protectionism has emerged in Western countries, it has not changed the overall trend of economic globalization and regional integration. It is only a transient abnormal phenomenon in a long history. The issuance and circulation of sovereign digital currencies, especially digital renminbi, is the product of the inevitable requirements of human social currency development to adapt to economic globalization and regional integration, and it is objective and inevitable. Since the Chinese leader proposed the “Belt and Road” initiative in 2013, the “Belt and Road” initiative has made positive progress, providing market access opportunities for the issuance and circulation of digital RMB.

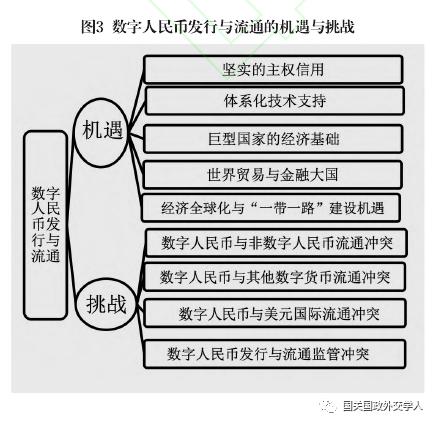

Of course, there are still many challenges and risks in the process of digital RMB issuance and circulation. How to prevent and control possible risks and deal with various possible challenges is the key to digital RMB issuance and circulation. Specifically, the risks and challenges of digital RMB issuance and circulation are mainly manifested in four aspects.

First, the circulation conflict between digital RMB and non-digital RMB. How to calculate and balance the relationship between traditional sovereign currency and sovereign digital currency faces multiple challenges. The sovereign digital currency issued by the currency authority of a country has similar characteristics with traditional credit currency, especially with certain characteristics similar to narrow currency. Traditional The narrow currency of sovereign credit currency includes coins, banknotes and demand deposits, which are the main forms of currency in circulation. The circulation of sovereign digital currency will inevitably have a substitution effect and a squeeze out effect on traditional sovereign credit currency. If the balance between the two cannot be balanced, The relationship may induce disorder and chaos in the currency circulation order and cause various currency circulation risks, that is, how to balance the circulation relationship between digital RMB and traditional RMB faces decision-making and execution risks.

Second, the circulation of digital RMB and other digital currencies conflicts. How to calculate and balance the relationship between sovereign digital currency and non-sovereign digital currency is also facing multiple challenges. It is clear that sovereign digital currency and non-sovereign digital currency have mutual substitution and squeeze-out relationship, and the circulation of sovereign digital currency is bound to be against Africa. Sovereign digital currency has a crowding-out effect, triggering various conflicts of interest, conflicts of interest, and interest games in the field of currency circulation, which may cause systemic and non-systemic risks to overlap in financial markets, magnify uncertainty risks, and even induce various uncontrollable risks. The political and economic events of the currency crisis not only affect the stability of the currency and financial markets, but may also impact the stability of social order, that is, how to balance the relationship between digital RMB and other digital currencies is facing challenges.

Third, the digital RMB conflicts with the international circulation of the US dollar. Sovereign digital currency cross-border transactions and circulation may induce international currency conflicts and risks of international financial turmoil. The issuance and circulation of digital RMB is conducive to the cross-border circulation of RMB and internationalization of RMB, and it will inevitably trigger RMB and other international circulating currencies, especially RMB and The currency competition and game between the major powers of the US dollar. In fact, the internationalization process of digital RMB is also a process in which digital RMB assumes the function of international currency and continuously replaces other international currency functions. The process of digital RMB internationalization first faces the challenge of dollar hegemony . As the world's leading international currency, the internationalization of digital RMB will inevitably lead to the substitution effect and squeeze-out effect of digital RMB against the US dollar, which will inevitably lead to US obstacles and suppression. How to respond to the US challenge of digital RMB internationalization will be the issue of digital RMB. The primary challenge with circulation over a longer period of time.

Fourth, the regulatory challenge of digital RMB. Compared with traditional sovereign credit currencies, the circulation speed of sovereign digital currency is faster, the circulation scale is changing more rapidly, and the circulation scope is wider. How to conduct effective supervision is an important challenge for the issuance and circulation of sovereign digital currency. If effective supervision is not possible, , It may not only induce chaos in the financial order, but also induce various types of currency and financial crises. In fact, the issuance and circulation of sovereign digital currencies may also induce various financial criminal activities if they cannot be effectively regulated. However, the regulatory measures for the issuance and circulation of traditional sovereign credit currencies may be ineffective for sovereign digital currencies. Institutional and technological innovations in financial and currency supervision need to be promoted, which is also a challenge to the supervision of digital RMB issuance and circulation.

In short, how can the issuance and circulation of digital renminbi, as a sovereign digital currency, seize every possible opportunity to advance steadily? How to prevent and control possible challenges and risks? It is a problem that China's central government and monetary authorities face and needs to be properly solved. It can be summarized and summarized with Figure 3.

It can be seen from Figure 3 that the issuance and circulation of digital renminbi needs to fully seize the opportunities while meeting various possible challenges and risks.机遇与挑战相伴而生,如果不能够抓住机遇,则可能错失数字人民币发行、流通与国际化的机会;如果不能够预防和控制各种可能的风险,则会导致国内外货币乃至金融市场的失序、混乱乃至引发各种货币、金融及经济危机。当然,数字人民币的发行、流通与国际化的过程,是中国在国际货币及金融市场的崛起过程,也是推动国际货币体系改革和全球金融治理变革的关键之举。

四、主权数字货币合作与国际货币体系改革:中国的优势与贡献

目前国际货币体系构建由西方国家主导,主要反映以美国和欧洲为代表的西方发达经济体的货币与金融利益,以中国为代表的新兴经济体及广大发展中国家是现存国际货币体系的利益受损者,如何改革不合理的国际货币体系是构建国际政治经济新秩序的关键,主权数字货币的创建与体系构建有利于推动国际货币体系改革。作为世界第二大经济体和快速崛起的新兴大国及广大发展中国家的代表,中国在主权数字货币发行与流通、世界主权数字货币体系构建方面能够发挥引领示范作用,成为国际货币改革的推动者和领导者。具体而言,在推动世界主权数字货币体系构建与国际货币改革中,我国可以采取如下五方面的战略举措。

First, leverage China's advantages as a global Internet power to promote the issuance and circulation of digital RMB. China has become the world's largest Internet application country, with the largest number of Internet users in the world. At the same time, it is also a major country in which global Internet technology leads and advances global Internet technology progress. China needs to take advantage of the technological comparative advantages of fintech innovation and take the lead in issuing and circulating sovereign digital currencies in the international community. China already has a comparative advantage in high-speed Internet, big data, cloud computing, artificial intelligence and blockchain technology. Promoting the issuance, circulation and internationalization of digital RMB will not only provide efficient currency and currency for the Chinese people but also the people of the world. Financial Services. Relevant departments in China have started the research work of the central bank's digital currency. Based on the preliminary research and a large number of experimental tests, especially the timely scene test, the issuance and circulation of digital RMB should be started when the conditions are ripe. China has built a relatively complete financial infrastructure, especially with the 5G network figure 3, the opportunities and challenges for the issuance and circulation of digital RMB have been launched across the country, a high-speed Internet that covers the vast majority of geospatial units across the country And the Internet of Things system is being increasingly formed and improved, creating a complete financial infrastructure and technical support system for digital RMB issuance and circulation.

Second, give play to China's advantages as a global trading power and promote the international circulation of digital RMB. China has become the world's largest trader of goods, occupying an important and indispensable leadership position in the international goods trade system. At the same time, China is also the main trade partner and even the first trade partner of most global economies. By using digital RMB in bilateral and multilateral trade settlements with major trading partner countries, this can not only promote the international circulation of digital RMB, but also avoid exchange rate conversion and exchange rate fluctuations caused by the use of third-party currencies, especially the US dollar, in international trade settlement. And policy risks, breaking the monopoly of currencies of Western countries, especially the US dollar, in the areas of international trade valuation, payment and settlement, promoting the diversification and diversification of international trade valuation, payment and settlement tools, and maintaining the international trade order and the international market competition system. It is worth noting that promoting the international circulation of digital renminbi in the field of international trade will also help the world economy to gradually get rid of the negative effects of the global trade war initiated by the United States with China as its main target of attack and promote the sustainable and stable development of world trade.

Third, give play to China's advantages as a global manufacturing power and promote the integration of digital RMB into the global real economy. As the world's largest manufacturing country, China is the country with the most complete industrial chains in the world, and the only country capable of producing all categories of products issued by the United Nations. China has the natural manufacturing advantage of promoting the integration of digital RMB into the global real economy, and can restructure the global supply chain and industry chain system, maintaining the security of the global supply chain and the integrity of our industry chain. China can introduce digital RMB as the main valuation, settlement and payment tool in energy and raw material import trade, intermediate product trade, and irreplaceable key product export trade to guide the dynamic adjustment of the global industrial chain, supply chain and value chain. Promote the development of the global real economy, free the world economy from the excessive virtual development path driven by the currencies of the Western countries represented by the US dollar, and promote the stable and sustainable development of the world's manufacturing industry.

Fourth, give play to China's advantages as a large global reserve and investment country, and promote digital RMB to become the world's major reserve currency and investment currency. As a large global reserve asset country and a major global foreign investment country, China needs to give full play to the comparative advantages of reserve currencies and large foreign investment countries. By building an international alliance of sovereign digital currencies, it will promote the issuance and circulation of sovereign digital currencies worldwide and weaken western countries. Dominate the monetary hegemony system, especially the United States, and promote the establishment of a fair and just new international monetary system. The current international monetary system is still the US-dominated dollar hegemonic system. The United States can use the international reserve currency and international currency status of the US dollar to impose financial and trade sanctions on other countries, which seriously interferes with the international monetary and financial order. The global trade war, financial war, and technology war launched by the Trump administration in the United States with China as the main attack target have not only seriously damaged the global free trade system, but have also severely disrupted the stability of the international currency and financial markets. Inducing a global economic recession and currency and financial crisis. The introduction of digital RMB into the global real economy will help the world economy to shake off the undue influence of protectionism, populism, conservatism, and unilateralism in the Western countries represented by the United States, and rebuild the monetary foundation of world economic growth.

Fifth, give full play to China's advantages as a governing country and promote the construction and improvement of the global sovereign digital currency regulatory system and risk governance mechanism and system. The issuance and circulation of sovereign digital currencies, while promoting the development of global cross-border pricing, settlement, payment and investment, will also stimulate global underground financial activities, such as capital flight, transnational financial fraud, transnational money laundering, transnational financial corruption, transnational smuggling. The active activities of various transnational financial crimes have induced various possible international currency and financial risks and even crises. It is necessary to build an efficient and orderly global sovereign digital currency supervision and risk governance mechanism as a countermeasure. China has unique advantages in the modernization of national governance system and governance capacity, especially in the accumulation of rich experience in the prevention and control of currency and financial risks, and can be used for the international community's sovereign digital currency issuance and circulation supervision mechanism and system construction. He has made unique contributions from major countries and has become a driving force and a leading country in the reform of the global financial supervision and governance system. In the process of promoting the issuance, circulation and internationalization of digital RMB, China should actively advocate the establishment of a global sovereign digital currency alliance, formulate corresponding standards and rule systems for the global sovereign digital currency issuance and circulation, regulate the global digital currency issuance and circulation order, and guide Countries jointly address various challenges and risks in the global digital currency issuance and circulation. In addition, in the process of digital RMB issuance and global circulation, it is necessary to face interference, obstruction and even destruction by vested interest groups in the global currency and financial markets represented by the United States. China needs to work with the BRICS countries, the Shanghai Cooperation Organization countries, The countries along the “Belt and Road” and other friendly countries have formed international monetary and financial cooperation alliances to jointly resist various interference and sabotage activities and maintain the stable operation of the international monetary and financial order.

Through the previous analysis, it is not difficult to find that China has the comprehensive comparative advantages of large countries, natural geographical location and market advantages in the fields of technology, trade, finance, industry and regulation in the process of promoting the issuance, circulation and internationalization of digital RMB. Sovereign digital currency issuance, circulation and supervision lead the country, becoming a leading country in the construction of a sovereign digital currency system and the reform of the international monetary system. Figure 4 can be used to summarize China's advantages and contributions in promoting the construction of a sovereign digital currency system and the reform of the international monetary system. From Figure 4, it can be seen that as a global Internet power, trading power, manufacturing power, international reserve and investment power, currency power and financial governance power, China has an irreplaceable power integration in global sovereign digital currency cooperation and reform of the international monetary system. Comparative advantages can make a unique contribution to the promotion of the construction of a global sovereign digital currency system and the reform of the global financial governance system.

V. Research conclusions

The issuance and circulation of sovereign digital currency is an inevitable product of contemporary fintech innovation, and it will inevitably have a profound impact on the international monetary system and global financial markets. As a representative of the sovereign digital currency of a large country, digital RMB can become international trade, transnational capital flows, and international industries The important valuation, payment and settlement tools for investment play an important role of reserve currency in the international community. Sovereign digital currencies and related currencies, especially traditional sovereign credit currencies and non-sovereign digital currencies, have a cooperation and complementary relationship with each other, as well as the effects of competition, substitution and crowding out. Digital RMB can draw on the functional advantages of traditional sovereign credit currencies and non-sovereign digital currencies. It must also abandon the shortcomings and limitations of related currencies, and become an international currency with a dominant alternative functional choice in the international community. The issuance, circulation and internationalization of digital RMB can promote the role of RMB in serving the Chinese people and the people of the world. While the issuance and circulation of digital RMB has opportunities, it also faces many uncertain risks, and it is necessary to formulate corresponding strategies and countermeasures to properly deal with them. As the world's second largest economy, the largest trader of goods, the largest manufacturing country, and the world's major Internet power, China has unique advantages in promoting global sovereign digital currency cooperation, global currency and financial regulatory cooperation, and reform of the international monetary system. The comprehensive comparative advantages of major countries can play a leading role, contribute to China's wisdom, and propose Chinese solutions. Sovereign digital currency cooperation will become an important part of international monetary and financial cooperation. The construction of a sovereign digital currency system will become an important part of the reform of the international monetary system. China needs to formulate corresponding strategic countermeasures. Building a cross-border digital RMB cooperation platform based on blockchain technology is an important strategic move to promote the international circulation and cooperation of digital RMB, and it is also an important content to build a world sovereign digital currency system and promote reform of the international currency system. China can promote the construction of a digital RMB cross-border payment blockchain platform system, a digital RMB trade payment blockchain platform system, a digital RMB financial investment blockchain platform system, and the “Belt and Road” national trade payment and settlement blockchain. Platform construction, "One Belt, One Road" financial cooperation, blockchain platform construction, and other aspects of the layout, through the digital RMB internationalization to promote the reform of the international monetary system, and make a major contribution to the establishment of a fair and reasonable new international currency order.

(Annotation is abbreviated; this article is a phased research result of the major planning project "Research on Game Theory and Big Data Methods in International Relations and Politics" coordinated by Renmin University of China to promote the construction of world-class universities and first-class disciplines, project approval number: 16XNLG11)

About the author: Professor, Ph.D. Supervisor, School of International Relations, Renmin University of China, Director of the Center for International Political Economy Research

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is the reason for Tether's crazy increase in USDT?

- Opinion: Miners surrender, hashrate plummets, selling pressure weakens, Bitcoin is expected to rebound in the near future

- Privacy solution ZK² Rollup: how to achieve high-speed, cheap privacy transactions on Ethereum

- CoinMarketCap reveals 0th cryptocurrency, ahead of Bitcoin

- Bitcoin experienced its worst plunge in March, will the cryptocurrency bubble burst?

- Market analysis: The resistance above BTC is large, waiting patiently for admission

- Asia has set off a boom in virtual banking, and native banks have broken the cocoon in the digital currency era