New cryptocurrency travel regulations take effect in the UK, comparing the similarities and differences in travel regulations among countries.

New cryptocurrency travel regulations in the UK and international comparisons.This article aims to explore the concept of travel rules and their application in the cryptocurrency industry, analyze the progress, differences, and challenges in implementing travel rules in different regions, evaluate the effectiveness and limitations of travel rules, and propose corresponding prospects.

In recent years, the development and popularization of virtual assets have attracted the attention of countries around the world and brought new challenges and risks to financial regulation and anti-money laundering (AML)/counter-terrorism financing (CFT) efforts. In response to this, the Financial Action Task Force (FATF) has extended the traditional financial sector’s “travel rules” to the virtual asset field, requiring that when a virtual asset transaction exceeds a certain amount, the identity information of the parties to the transaction must be transmitted along with the transaction, which is referred to as the “travel rule”.

This article aims to explore the concept of travel rules and their application in the cryptocurrency industry, analyze the progress, differences, and challenges in implementing travel rules in different regions, evaluate the effectiveness and limitations of travel rules, and propose corresponding prospects.

1 Concept and Background of Travel Rules

1.1 Overview of Travel Rules: From Traditional Finance to Cryptocurrency

In summary, the Travel Rule is an international standard for anti-money laundering and counter-terrorism financing. It requires that when a financial transaction exceeds a certain amount, the identity information of the parties to the transaction must be transmitted along with the transaction (hence the term “travel”) so that regulatory authorities can track and prevent illegal activities.

- Hong Kong proposes four innovative policies to promote economic development in the Web3 era.

- EU Cryptocurrency Regulation Entering the Era of Unity Historical Review and Future Outlook

- TaxDAO’s Response to the US Senate Finance Committee on the Issue of Taxation of Digital Assets

The Travel Rule was initially proposed by the Financial Action Task Force (FATF) in 1996 for banks and other financial institutions in the traditional finance sector, and was revised in 2001 and 2012. With the rise and development of cryptocurrencies, FATF recognized the money laundering and terrorist financing risks in the field of virtual assets and expanded the Travel Rule to Virtual Asset Service Providers (VASPs) in June 2019. VASPs refer to entities or individuals that provide cryptocurrency trading, transfer, custody, and other services.

1.2 How FATF Promotes the Implementation of Travel Rules for Virtual Assets

FATF is an intergovernmental policy-making body composed of 39 member countries and regions. Its goal is to develop and promote international standards and measures for combating money laundering, terrorist financing, and the financing of weapons of mass destruction proliferation. Established in 1989 and headquartered in Paris, FATF is currently the most influential and authoritative international organization in the field of anti-money laundering and counter-terrorism financing.

The 40 recommendations issued by FATF are internationally recognized standards for anti-money laundering and counter-terrorism financing, covering areas such as legal systems, preventive measures, international cooperation, and regulatory supervision. The “Travel Rule” is the 16th recommendation among the 40 recommendations.

In June 2014, FATF issued the “Virtual Currencies: Key Definitions and Potential AML/CFT Risks”, which was the first time that FATF defined and analyzed virtual currencies, pointing out the risks of virtual currencies being used for illegal purposes and recommending countries to take appropriate regulatory measures. This means that FATF recognizes the impact of the development and popularization of cryptocurrencies on the global financial system and cross-border payments.

Subsequently, in June 2015, FATF issued the “Guidance: Risk-Based Approach to Virtual Currencies”. This was the first time that FATF proposed an AML/CFT regulatory framework for virtual currency activities and service providers, which means that the requirements for customer due diligence, record keeping, reporting, and supervision that originally applied to traditional financial institutions also apply to virtual currency activities and service providers. However, the definition of “virtual currency” in this framework is relatively narrow and does not coordinate well with the regulation of virtual assets.

Finally, in June 2019, FATF issued the “Interpretive Note and Guidance on Virtual Assets and Virtual Asset Service Providers” (hereinafter referred to as the “Guidance”), renaming virtual currencies as virtual assets and including virtual assets and virtual asset service providers (VASPs) within the scope of regulation. This means that the FATF regulatory framework for virtual assets has been standardized and matured. The “Standards” include guidance principles for applying the travel rule to the cryptocurrency field. The travel rule requires VASPs to collect and transmit the identity information of the originator and beneficiary when processing cryptocurrency transfers of over $1,000 or equivalent, in order to prevent money laundering and terrorist financing activities. In 2021, FATF revised the “Standards” to better regulate the rapidly developing virtual assets.

1.3 Overall Impact of the Travel Rule on the Cryptocurrency Industry

1.3.1 Reporting Obligations of VASPs

In the revised “Guidance” in 2021, FATF defines VASPs as “businesses that conduct one or more of the following activities on behalf of others or for their own account”, including:

– Exchanging or transferring virtual assets

– Safeguarding and/or administering virtual assets or instruments enabling control over virtual assets

– Participating and providing financial services related to the issuance and/or sale of virtual assets by issuers

The document also states that VASPs do not include entities that solely provide technical support or communication services, entities that solely provide virtual asset wallet software or hardware, or individuals or legal persons who only use virtual assets for themselves.

VASPs that meet the above criteria have corresponding obligations under the travel rule, namely: when processing virtual asset transactions of over $1,000 or equivalent, they must collect and transmit the identity information of the originator and beneficiary in order to prevent money laundering and terrorist financing activities. Specifically, VASPs should collect the following information.

-

Name, account, and address of the initiator (or nationality, date of birth, ID number, etc.)

-

Name and account of the beneficiary

-

Transaction amount and asset type

VASPs should send this information along with the transaction to the next participant or provide it to the relevant authorities upon request. VASPs should also retain this information for at least five years and take appropriate measures based on risk assessment and regulatory requirements.

1.3.2 Overall Impact of VASP Reporting Obligations

On the one hand, the Travel Rule benefits the transparency and trustworthiness of the cryptocurrency industry, preventing virtual assets from being used for money laundering and terrorist financing activities, and promoting interoperability between the cryptocurrency industry and traditional financial systems.

On the other hand, the Travel Rule to some extent diminishes the anonymity of virtual assets. The Travel Rule requires VASPs to report the identity information of traders and retain it for at least five years. Therefore, the cryptocurrency industry needs to balance the users’ demands and expectations for data security and privacy rights.

2 Application of Virtual Asset Travel Rule in Different Countries

2.1 International Regulatory Direction of FATF 40 Recommendations

The FATF 40 Recommendations are not legally binding mandatory regulations. They belong to a policy framework voluntarily followed by countries, requiring each country to formulate and enforce corresponding laws and regulatory measures based on its own legal system and actual situation. The FATF conducts comprehensive evaluations of member countries or regions’ anti-money laundering and counter-terrorist financing systems and measures at regular intervals to examine whether they comply with the FATF’s 40 Recommendations and other relevant standards, and publishes assessment reports.

If a member country fails to meet the FATF’s requirements, it may be included in the list of high-risk or non-cooperative countries or regions. These countries or regions may face sanctions or restrictions from other countries or regions, such as increased due diligence, reduced financial transactions, asset freezes, etc.

2.2 Countries and Regions Implementing the Virtual Asset Travel Rule

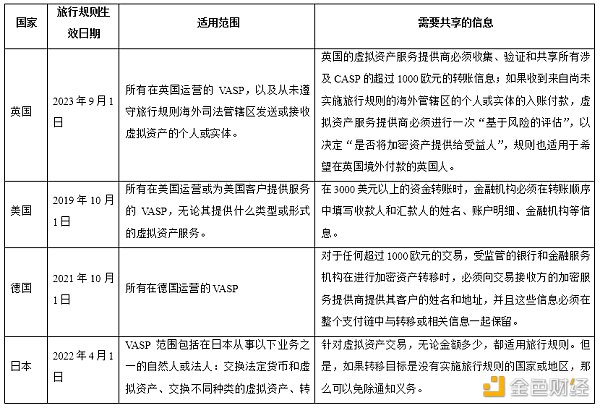

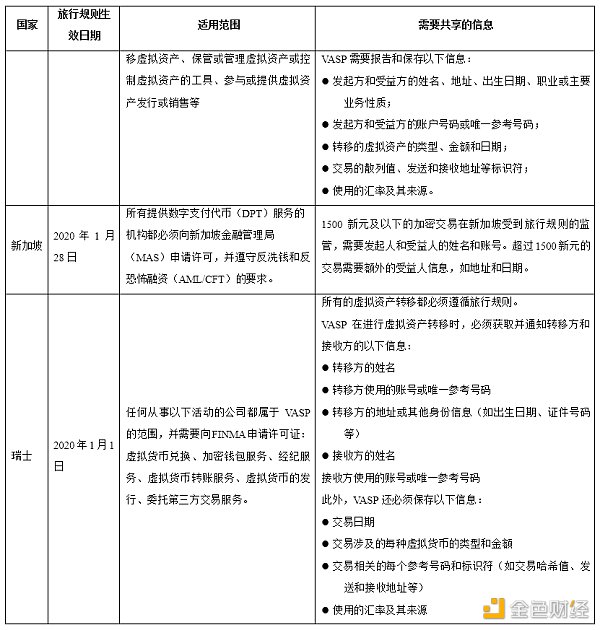

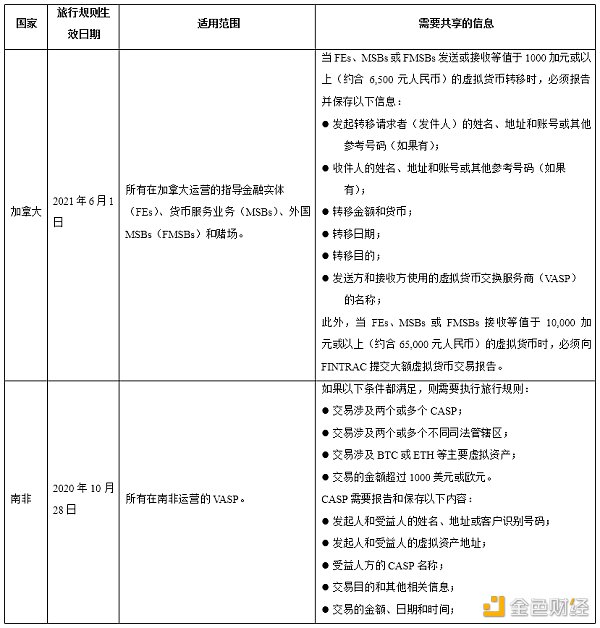

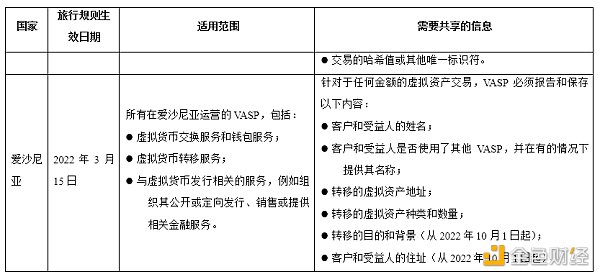

This article compiles the countries and regions that have implemented the virtual asset travel rule as of September 3, 2023, as shown in the table below.

It is worth noting that the EU’s Markets in Crypto Assets Regulation (MiCA) also provides corresponding guidance on the Travel Rule. According to MiCA, the Travel Rule will be extended to all cryptocurrency transactions that meet its definition and exemptions for minimum transaction thresholds and minimum transfer values will be canceled. MiCA is expected to come into effect in February 2024, by which time the Travel Rule in EU member states will be more coordinated and unified.

3 Conclusion and Outlook

3.1 Effectiveness and Limitations of the Travel Rule

The Travel Rule has certain effectiveness in the field of cryptocurrency. It mainly manifests in promoting the standardization and professionalization of the cryptocurrency industry, and improving the compliance awareness and capabilities of Virtual Asset Service Providers (VASPs). The Travel Rule provides VASPs with a clear regulatory framework and standards, enabling them to conduct self-discipline management and risk control in accordance with unified requirements. This also helps to enhance the fairness of competition and market order among VASPs, and avoid regulatory arbitrage or unfair competition.

However, the Travel Rule also has some limitations in the field of cryptocurrency, mainly in the following aspects:

Firstly, it undermines the anonymity and decentralization features of cryptocurrencies, compromising users’ demand and expectation for data security and privacy rights. The Travel Rule requires VASPs to report traders’ identity information and retain it for at least five years. Therefore, the personal information of cryptocurrency users may be leaked or abused, resulting in infringement of their privacy rights. At the same time, the Travel Rule is also contradictory to the decentralized spirit of cryptocurrencies, subjecting cryptocurrency transactions to regulation or intervention by centralized institutions, and restricting their autonomy and freedom.

Secondly, it increases the operating costs and compliance risks of VASPs, which may lead to some VASPs exiting the market or entering the underground economy. The Travel Rule requires VASPs to establish and maintain a complex system for information collection, verification, transmission, and storage, which requires a significant investment of manpower, material resources, and financial resources, increasing the operating costs of VASPs. At the same time, the Travel Rule also exposes VASPs to higher compliance risks. If the Travel Rule cannot be timely or accurately implemented, VASPs may face penalties such as fines or license revocation. This may cause some VASPs to be unable to withstand the pressure brought by the Travel Rule and exit the market, or enter the underground economy, thereby affecting the development of the cryptocurrency industry.

Furthermore, it is difficult to adapt to the rapid changes and innovations in the field of cryptocurrency, such as DeFi, NFT, and other emerging forms that may not fall within the scope of VASPs or be applicable to the Travel Rule. The field of cryptocurrency is an area full of innovation and change, with constantly emerging new technologies, products, and services, such as decentralized finance (DeFi), non-fungible tokens (NFTs), stablecoins, etc. These emerging forms may not fall within the scope of VASPs or be applicable to the Travel Rule because they may not have centralized service providers or involve traditional identity information. This poses challenges and difficulties for the implementation and supervision of the Travel Rule.

Finally, it is difficult to achieve unified enforcement and supervision on a global scale. Different countries or regions have differences and difficulties in implementing the Travel Rule based on their own legal systems and actual conditions. Although FATF provides a common regulatory framework and standards, there are different progress, methods, and details in the implementation of the Travel Rule among countries. This brings complexity and uncertainty to cross-border transactions, and also poses obstacles to cooperation and communication between regulatory authorities.

3.2 Improvement Directions for Travel Rule

First, expand the scope of application of the travel rule, including more types or forms of crypto assets or service providers, such as DeFi, NFTs, stablecoins, etc. For example, DeFi has the advantage of providing higher efficiency, transparency, and fairness, but its drawback is that it is difficult to enforce the travel rule because it does not have clear service provider or customer identity information. This article suggests that the information-sharing platform or protocol inherent in DeFi can be utilized for on-chain verification, allowing DeFi traders to automatically collect, verify, transmit, and store identity information, thus achieving self-execution of the travel rule.

Second, lower the threshold for enforcing the travel rule, eliminate exemptions for minimum transaction amounts or minimum transfer values, and apply the travel rule to all amounts of crypto asset transactions. This is to address the increasing number and fragmentation of cryptocurrency transactions, as well as the regulatory challenges brought by cryptocurrency price volatility. This direction aligns with the direction indicated by MiCA.

Finally, establish unified technical standards and solutions, such as using blockchain, distributed ledger, smart contracts, and other technologies to ensure the secure transmission and storage of information. This is to address the technical barriers and security risks in information sharing among VASPs (Virtual Asset Service Providers), as well as to improve the efficiency and convenience of information sharing, which is beneficial to the operation and management of VASPs.

References

[1] FATF. (2019). Guidance for a risk-based approach to virtual assets and virtual asset service providers.

[2] FATF. (2021). Guidance for a risk-based approach to virtual assets and virtual asset service providers (Revised).

[3] UK Government. (2021). The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the LianGuaiyer) Regulations 2017.

[4] FinCEN. (2019). Application of FinCEN’s regulations to certain business models involving convertible virtual currencies.

[5] BaFin. (2020). Guidance notice on the interpretation of the term “crypto custody business” pursuant to the German Banking Act (Kreditwesengesetz – KWG) and on the authorisation requirement for crypto custody business.

[6] FSA. (2020). Amendments to the LianGuaiyment Services Act, etc. for strengthening the regulation of crypto asset-related businesses.

[7] MAS. (2020). LianGuaiyment Services Act 2019: Guidelines on licensing for LianGuaiyment service providers.

[8] FINMA. (2019). Guidance 02/2019: LianGuaiyments on the blockchain.

[9] FINTRAC. (2020). What you need to know about virtual currency transactions: Obligations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and associated regulations.

[10] FIC. (2020). Guidance Note 7A: The implementation of the travel rule in terms of section 29 of the Financial Intelligence Centre Act, 2001 (Act 38 of 2001) in relation to crypto assets and crypto asset service providers.

[11] FIU Estonia. (2020). Guidelines on anti-money laundering and terrorist financing measures for providers of services related to virtual currencies or issuers of virtual currencies.

[12] European Commission. (2020). Proposal for a regulation of the European LianGuairliament and of the Council on markets in crypto-assets, and amending Directive (EU) 2019/1937.

[13] 盖宁. (2021). 反洗钱视角下的虚拟货币监管:国际标准与中国实践

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- US House Financial Services Committee Regulatory agencies should cooperate with Congress to establish regulatory rules.

- Recognition of the Property Nature of Virtual Currency and Issues Regarding the Disposal of Assets Involved in Cases

- DAC8 enters the stage of opinion review, the EU’s encrypted tax regulation is coming

- Focus on the metaverse and generative AI, four departments issue the Implementation Plan for the New Industry Standardization Pilot Project.

- Digital Asset Anti-Money Laundering Bill Faces Obstacles in the U.S. Senate

- An in-depth analysis of Hong Kong’s Web3 policies since the release of the ‘Declaration

- Five key points to watch in Hong Kong’s cryptocurrency policy in the next year after opening up retail trading