QKL123 market analysis | Fed suddenly cuts interest rates unexpectedly, global panic has not retreated (0304)

Abstract: Facing the downside risks of the global economy, countries may implement both monetary and fiscal stimulus; while the Federal Reserve slowed down several beats, yesterday ’s emergency and ultra-conventional interest rate cut, but the capital market is not paying for it; the current performance of bitcoin has risks The dual attributes of assets and safe-haven assets may be sought after.

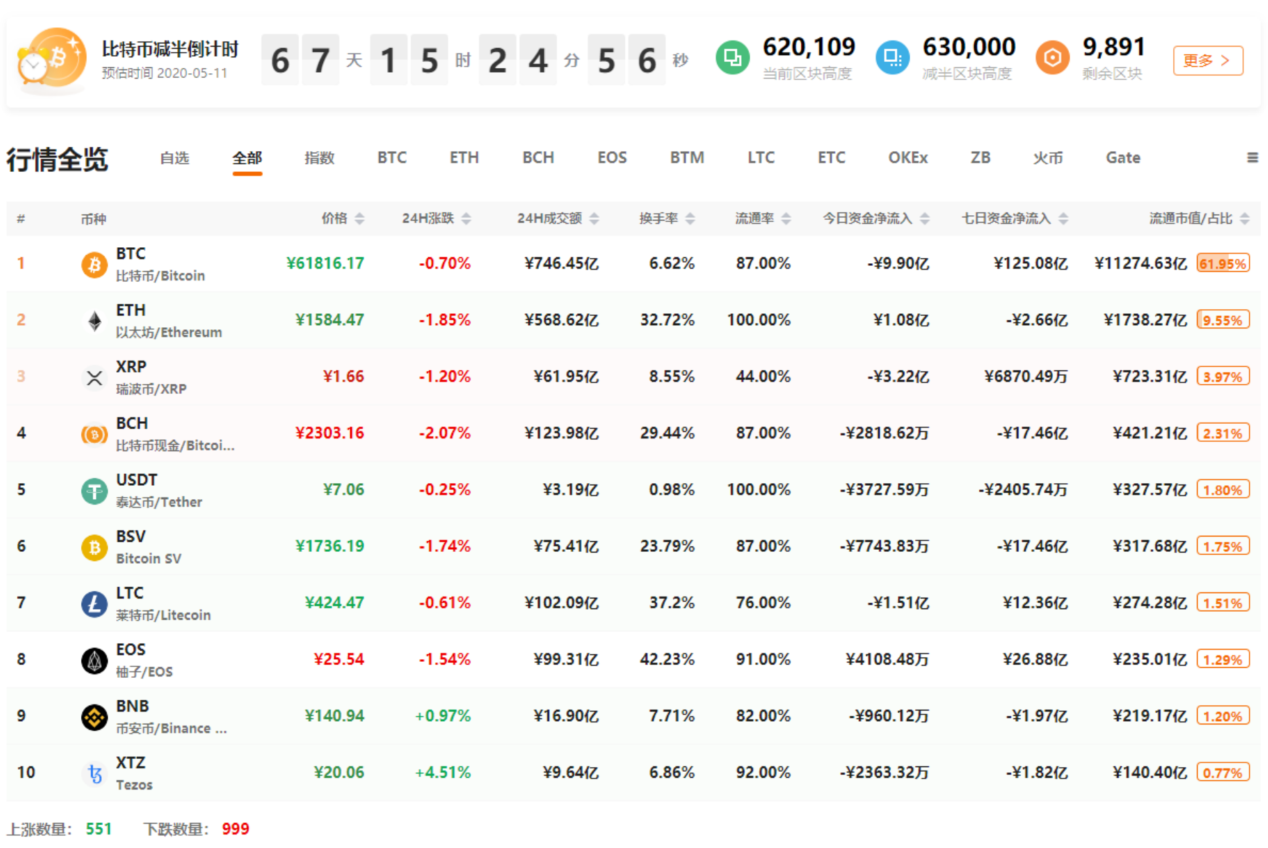

At 15:00 today, the 8BTCCI broad market index was reported at 13328.23 points, which rose to -0.40% over the 24-hour period, reflecting a slight decline in the broad market; the total turnover was 1.2129.84 billion yuan, with a 24-hour change of -0.66%. Bitcoin strength index was reported at 86.02 points, with a 24-hour rise or fall of + 0.49%. The relative performance of Bitcoin in the entire market has become stronger; the Alternative sentiment index is 40 (previous value 38), and the market sentiment is expressed as fear; The external discount premium index was reported at 101.35, with a 24-hour rise or fall of + 0.16%, and the intensity of OTC fund inflows increased.

Analyst perspective:

- The wave of "absolute deflation" of platform currency is coming. How should the exchange make a choice?

- Important Ethereum Capacity Expansion Solution: Optimistic Rollup Status Report (Part 2)

- February is another milestone, ConsenSys releases latest data report on Ethereum ecology

Yesterday evening, the Fed suddenly announced a 50 basis point rate cut, and the federal funds rate target range fell to 1% -1.25%. The urgency and intensity of this rate cut are already extraordinary. At the press conference on the day, Fed Chairman Powell said: "Although the U.S. economic fundamentals remain strong, the new crown virus has brought downward pressure on the world economy, and the degree of economic impact and durability is still highly uncertain"; In the face of substantial changes in the risks to the US economic outlook, we will relax our stance on monetary policy and provide more support to the economy. "

For the current global economic situation, the Fed has been slow for several beats. In the past week, major global assets, represented by US stocks, have plummeted. Most of the stock index declines have been more than 10%, similar to the scenario when the financial crisis broke out in 2008. Recently, U.S. stocks have rebounded sharply under the expectation of global interest rate cuts, but they fell sharply again yesterday. Although the interest rate cut is not small this time, the market is not giving the US "Yangma" face, and it has not been able to reverse the market's downward trend. In a short time, it is difficult for the market to get out of the expectation of an economic recession shrouded in the epidemic. The global interest rate cuts are offset by the negative economic downturn, and the panic has not subsided.

At present, there is only 1.5 percentage points for the Fed to cut interest rates, and the "Yangma" in the US has few useful cards. In the face of such "persecution" in the market, I am afraid that "father dad" will be required to help the rescue. The domestic "financial dad" is relatively strong, the 25 trillion yuan infrastructure plan has been launched, and the A-share "new infrastructure" has been heated up for a short time. So far, major economies have been preparing to promote the dual stimulus of "central mother" and "wealth dad" to hedge the economic downside risks brought by the global epidemic.

For Bitcoin, the economic downturn will also bring liquidity risks, but it is relatively small compared to the stock market. Yesterday the Fed's interest rate cuts brought short-term positives, which were partially offset by liquidity risks. Compared to gold, Bitcoin can be regarded as a niche anti-inflation safe-haven asset, and it will be difficult to get the favor of traditional investors in the short term. However, there is a possible outbreak opportunity at present: once the global economic downturn deepens, prudent measures will eventually be exhausted, and it will inevitably repeat the flooding in the 2008 economic crisis, when Bitcoin will be sought after by more people.

First, the spot BTC market

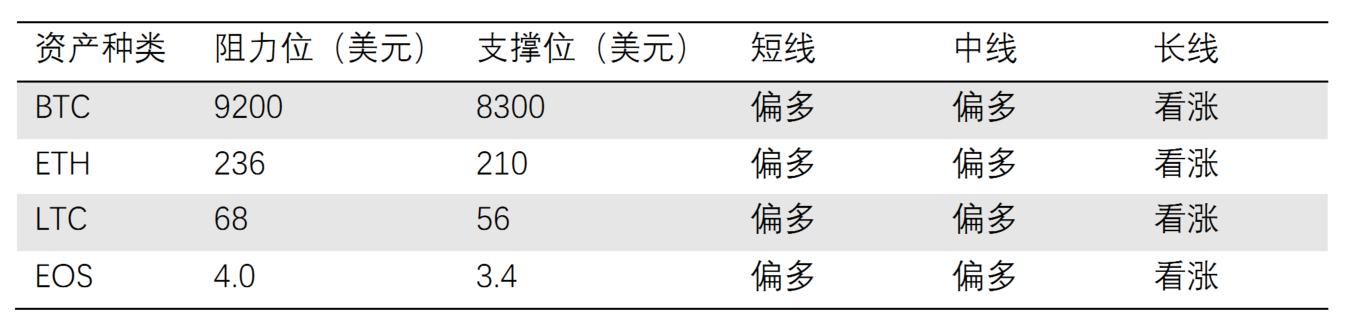

Yesterday, BTC has continued to fall from $ 8,900, with the lowest reaching $ 8,600. During the period, the main force has a pin up and down movement, constantly testing the strength of the disk. At present, Bitcoin is hovering at the 200-day moving average. In the near future, the trend of prolonged periods is likely to rise upward, and the halving of the positive is expected to rise.

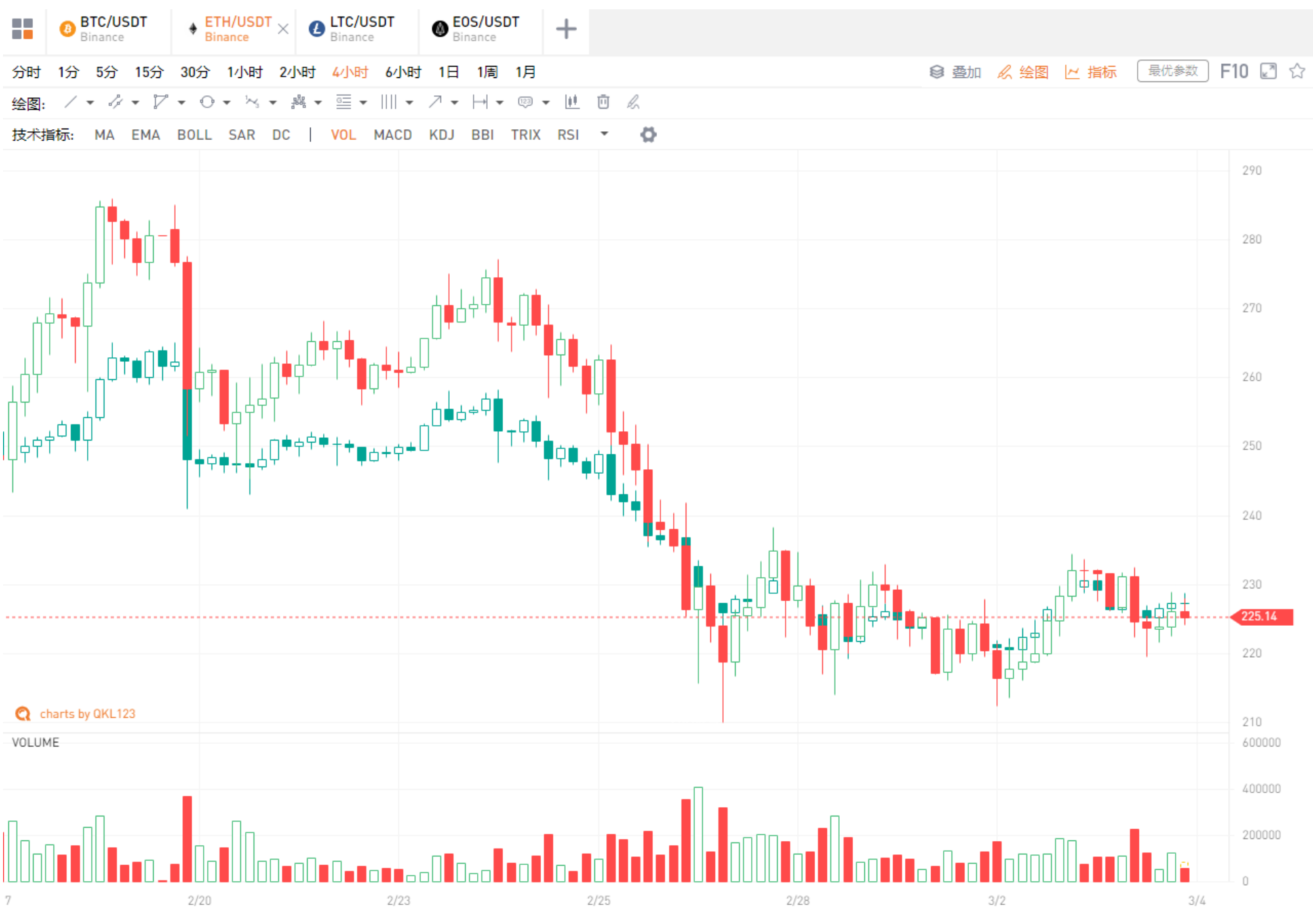

Second, the spot ETH market

ETH continued to interact with the BTC shock, and there was a clear divergence between the main force and retail funds. When it fell today, the support below was obvious, and there were signs of stabilization and upward movement in the short term.

Third, the spot LTC market

Yesterday to date, LTC is basically in a sideways state, long and short continue to stand still, and continue to link bitcoin for a short time.

Fourth, the spot EOS market

Four-hour K-line, EOS recorded a hammer line near today's low. The air force was significantly suppressed for a short time, and it is more likely to continue to explore.

Five, analyst strategy

1. Long line (1-3 years)

The long-term trend of BTC has improved, and it is expected to usher in the crazy bull market in the next one to two years. Smart contract platform leader ETH, altcoin leader LTC, DPoS leader EOS can be configured at dips.

2. Midline (January to March)

BTC is hovering at the 200-day moving average, which is expected to increase by halving. There is still a certain amount of upside. Those who do not have heavy positions will increase their positions on dips.

3. Short-term (1-3 days)

The shock stabilized and the small positions were low-sucking and high-selling.

Appendix: Interpretation of Indicators

1. 8BTCCI broad market index

The 8BTCCI broad market index is composed of the most representative tokens with large scale and good liquidity in the existing global market of the blockchain to comprehensively reflect the price performance of the entire blockchain token market.

2.Bitcoin Strength Index

The Bitcoin Strength Index (BTCX) reflects the exchange rate of Bitcoin in the entire Token market, and then reflects the strength of Bitcoin in the market. The larger the BTCX index, the stronger the performance of Bitcoin in the Token market.

3.Alternative mood index

The Fear & Greed Index reflects changes in market sentiment. 0 means "extremely fearful" and 100 means "extremely greedy." The components of this indicator include: volatility (25%), transaction volume (25%), social media (15%), online questionnaire (15%), market share (10%), and trend (10%).

4.USDT OTC Premium Index

The ChaiNext USDT OTC INDEX index is obtained by dividing the USDT / CNY OTC price by the offshore RMB exchange rate and multiplying by 100. When the index is 100, it means the USDT parity, when the index is greater than 100, it means the USDT premium, and when it is less than 100, it means the USDT discount.

5.Net Funds Inflow (Out)

This indicator reflects the inflow and outflow of funds in the secondary market. By calculating the difference between the inflow and outflow of funds from global trading platforms (excluding false transactions), a positive value indicates a net inflow of funds, and a negative value indicates a net outflow of funds. Among them, the turnover is counted as inflow capital when rising, and the turnover is counted as outflow capital when falling.

6.BTC-coin hoarding indicator

The coin hoarding indicator was created by Weibo user ahr999 to assist bitcoin scheduled investment users to make investment decisions in conjunction with the opportunity selection strategy. This indicator consists of the product of two parts. The former is the ratio of Bitcoin price to the 200-day fixed investment cost of Bitcoin; the latter is the ratio of Bitcoin price to Bitcoin fitting price. In general, when the indicator is less than 0.45, it is more suitable to increase the investment amount (bottom-sweeping), and the time interval accounts for about 21%; when the indicator is between 0.45 and 1.2, the fixed investment strategy is suitable, and the time interval accounts for about 39. %.

Note: Crypto assets are high-risk assets. This article is for decision-making reference only and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Breaking the Impossible Triangle of the Blockchain (6)-Blowing a Whistle on the Activity of the Blockchain

- Beijing issued the first blockchain electronic invoice, parking tickets and park tickets will be included

- "Half" and "Fed rate cut", the two big exams Bitcoin faces

- Heavy! Indian cryptocurrency ban unconstitutional by Supreme Court, Indian crypto community wins victory

- Open up on-chain and off-chain assets, Chainlink and DMM aim to create the first blockchain-based currency market

- Lies of the trading platform——how to dynamically check the authenticity of transactions on the exchange

- U.S. Federal Reserve cuts interest rates sharply