Why is the US government “reluctant” to sell its 5 billion dollars worth of Bitcoin?

Why won't the US government sell their 5 billion dollars worth of Bitcoin?This is more likely a matter of inertia than strategy.

Written by: Michael del Castillo, Forbes

Compiled by: Luffy, Foresight News

With the US government cracking down on cryptocurrency businesses more than ever, it might seem like they have reached their limit on tolerating cryptocurrencies. However, on the love-hate flip side: the Treasury Department holds 207,189 bitcoins, worth $5 billion, the largest government bitcoin holdings in history.

- Why do 90% of institutional investors have a positive view on cryptocurrency but still not buy it?

- South Korean Professor tracking Do Kwon’s funds: Signs of Terra’s collapse were evident in early 2019

- Can the new BRC-20S open up the “DeFi summer” on Bitcoin?

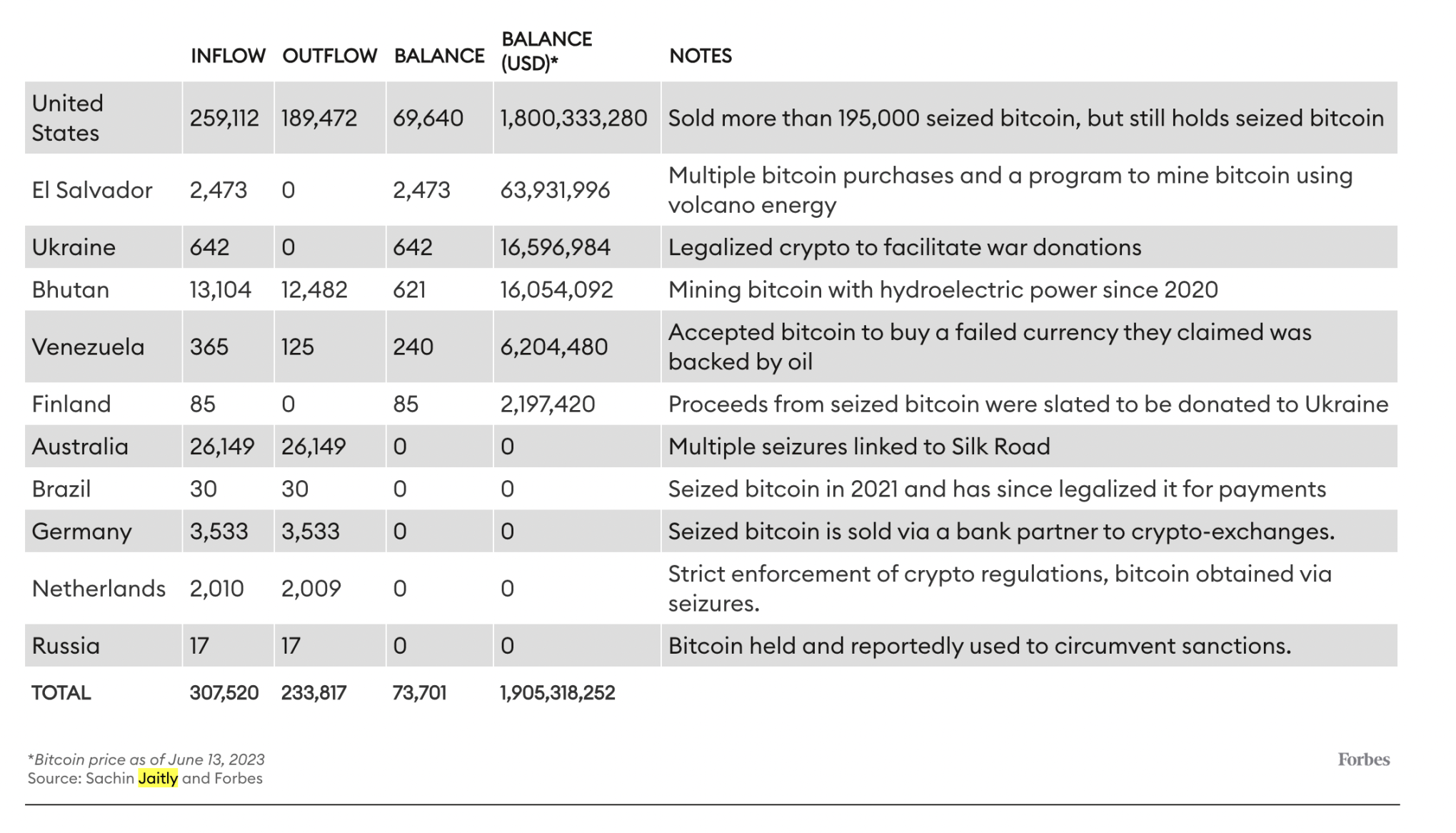

According to Forbes’ latest research, while many other countries/regions are dealing with bitcoin, the US government has been steadily increasing its bitcoin reserves through seizures. According to Sachin Jaitley, a general partner at investment consultancy Morgan Creek Capital, the US held 69,640 bitcoins last year, accounting for 94% of the total amount of bitcoins held in government treasuries around the world.

Elementus, a New York-based crypto analysis startup and a portfolio company of Morgan Creek, has provided data for its research by comparing events such as the seizure of $1 billion worth of bitcoins by the Justice Department in 2020 with transaction records visible on the public bitcoin blockchain. According to the Elementus paper, “Using publicly available information from the media and the blockchain, Elementus is able to map the landscape of sovereign crypto wallets and maintain it over time.”

By 2022, this research work covered 11 countries with bitcoins. “All of these bitcoins are held by these government agencies,” said Max Galka, CEO of Elementus. “But that doesn’t mean these governments only hold these bitcoins, nor does it mean that other governments have not used bitcoins.”

By comparing these holdings with currency supply information and inflation data over the past 10 years, 42-year-old Jaitley concluded that “as currency supply grows and concerns about inflation intensify, the adoption rate of sovereign-level bitcoins is also increasing,” he said, “so there is a statistically significant relationship.” The study does not include North Korea, which they say they could not obtain inflation data for.

According to blockchain analytics firm Elementus, this table shows the bitcoin flow of 11 countries from 2013 to 2022. Most of the assets come from government seizures, and the information is incomplete.

This argument is not very rigorous. First, according to software engineer and researcher Jameson Lopp’s data, the United States sold $366 million worth of bitcoin in 11 auctions from 2014 to 2023. On the other hand, the government has never bought bitcoin, so while retaining most of the bitcoin may be intentional, there has never been an intention to purchase bitcoin. In addition, Lope’s data shows that sales could result in a potential appreciation loss of $4.8 billion.

While Jaitley believes that the government owning bitcoin is a means of hedging against inflation, given the size of the US government’s balance sheet, a $500 million reserve is unlikely to have any meaningful hedging effect. German prosecutor Jana Ringwald said that in Germany, the immediate sale of seized assets is not mandatory. She said “it is 100% certain that some unsold items will be seized in the near future,” and “the prosecutor may order ’emergency sales,’ but may not do so.”

Leslie Sammis is a criminal defense attorney in Tampa, whose practice includes several Binance forfeiture cases. He said that Justice Department bureaucrats are more likely to wait for the overall situation of cryptocurrencies to become clearer. “I think they may decide they need congressional legislation or Justice Department policy to transfer all of these assets,” Sammis said.

Forbes TechCrunch contacted the US Marshals Service and the Department of Justice Inspector General’s Office to confirm the exact amount, but has not received a response.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Full-Chain Cryptocurrency Market Protocol TapiocaDAO Completes $6 Million Funding

- Wu’s Weekly Picks: Fed Announces Pause on Interest Rate Hikes, China’s Central Bank Cuts Medium-term Lending Rate, Judge Rejects Freezing of Binance Assets, and Top 10 News (June 9-16)

- Binance and Coinbase face SEC charges: Detailed analysis of market reaction and impact

- Why did the crypto community react negatively to BlackRock’s “wind-facing” application for a Bitcoin ETF?

- Arthur Hayes’ Blog: US Regulatory Pressure Intensifies, Hong Kong Welcomes Cryptocurrency – What Does This Mean?

- Why is the cryptocurrency community generally negative about applying for a Bitcoin ETF under the supervision of BlackRock?

- What does it mean when people say USDT is decoupling?