BlackRock boosts the market but Bitcoin “looks fragile”

BlackRock supports the market but Bitcoin is unstable.Price: The Bitcoin trading price is 26,800 USD, but Craig Erlam, senior market analyst at Oanda, is skeptical about a significant rise in Bitcoin prices in the coming months due to uncertain industry and economic news.

Insight: Do many cryptocurrency exchanges have market makers who generate conflicting interests? The Financial Times’ report focuses on Crypto.com’s market makers.

- Why is the US government “reluctant” to sell its 5 billion dollars worth of Bitcoin?

- Why do 90% of institutional investors have a positive view on cryptocurrency but still not buy it?

- South Korean Professor tracking Do Kwon’s funds: Signs of Terra’s collapse were evident in early 2019

BlackRock boosted the market, but Bitcoin “looks fragile”

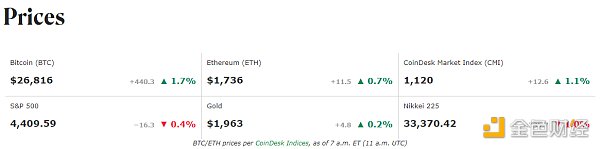

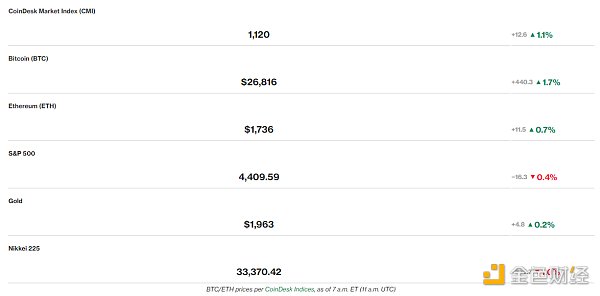

Bitcoin and Ethereum opened in green during Asian trading hours, with the world’s largest digital asset rising 1.7% to 26,816 USD, while Ethereum rose 0.7% to 1,736 USD.

Although the market still optimistically believes that BlackRock will successfully apply for Bitcoin spot exchange-traded funds (ETFs), Craig Erlam, senior market analyst at OANDA, said in a report that Bitcoin still looks “fragile.”

“After falling to a three-month low on Wednesday, Bitcoin closed last week quite positively, but it still looks vulnerable to further declines,” Erlam said. “The two-month trend is not good for it, and the news flow is of little help. This is an extraordinary year, still up more than 50% above expectations, so it’s not a terrible situation.”

Erlam still believes that Bitcoin is in a bull market, but the bull market has not yet arrived.

He believes that the recent lows are just a corrective phase in an overall optimistic bull market.

“However, there is little evidence that the situation will improve immediately, especially considering the Securities and Exchange Commission’s increased scrutiny of major exchanges,” he concluded.

Viewpoint:

Should cryptocurrency exchanges have market makers?

According to a report by the Financial Times on Monday, Crypto.com has joined the club of cryptocurrency exchanges with internal market makers.

Market makers are entities that facilitate token trading on exchanges by using their own capital to hold counterparty positions in trades, allowing investors to exit positions quickly without a counterparty on the other end. If an exchange does not have market makers, liquidity for all tokens except the largest will be greatly reduced.

The company told the Financial Times: “We have an in-house market maker operating on the Crypto.com exchange, with the same treatment as third-party market makers, who also facilitate low spreads and an efficient market on our platform.”

In the world of decentralized finance (DeFi), automated market makers allow platforms like Uniswap to exist.

Most cryptocurrency exchanges operate in-house market makers by nature. Notably, Binance has Sigma Chain and Merit Peak, both of which have recently been in the news.

Participants in the platform, including market makers, are treated equally, “Crypto.com also told the Financial Times. “The exchange] does not rely on proprietary trading as a revenue source.”

Listing small-cap tokens without an in-house market maker and expecting a market to form around them is simply not profitable – or even possible. There just isn’t enough activity to quickly match buyers and sellers, making bid depth unattractive to traders.

Some exchanges, on the other hand, choose to allow external market makers to operate on their platforms.

Running an in-house market maker can trigger many allegations of conflicts of interest. Alameda is an investor in many of the tokens it trades as a market maker. Allegations of market manipulation by Sigma Chain or Merit Peak have not been proven in court.

Of course, this is not a good thing for the industry. But that’s how it works. So many retail stock trades operate in the same way – that’s how the industry works. Automated market makers in DeFi may be a better choice because their algorithms are open source, but even these can be accused of bias.

If Crypto.com is really lying to external parties about its market-making business, as claimed by the Financial Times, it’s a story. But for now, as it has said in rebutting the Financial Times’ claims, it’s simply doing what others are doing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can the new BRC-20S open up the “DeFi summer” on Bitcoin?

- Full-Chain Cryptocurrency Market Protocol TapiocaDAO Completes $6 Million Funding

- Wu’s Weekly Picks: Fed Announces Pause on Interest Rate Hikes, China’s Central Bank Cuts Medium-term Lending Rate, Judge Rejects Freezing of Binance Assets, and Top 10 News (June 9-16)

- Binance and Coinbase face SEC charges: Detailed analysis of market reaction and impact

- Why did the crypto community react negatively to BlackRock’s “wind-facing” application for a Bitcoin ETF?

- Arthur Hayes’ Blog: US Regulatory Pressure Intensifies, Hong Kong Welcomes Cryptocurrency – What Does This Mean?

- Why is the cryptocurrency community generally negative about applying for a Bitcoin ETF under the supervision of BlackRock?