Weekly data report on the BTC chain: The data on the chain rebounded quickly after the rebound, and the sluggish situation is still difficult to get out of

In the past week (01.06-01.12), according to the data on the main chain, compared with the previous week (12.30-01.05), each data has a significant increase in transaction volume, but in the number of transactions, especially the number of large transactions The increase is limited.

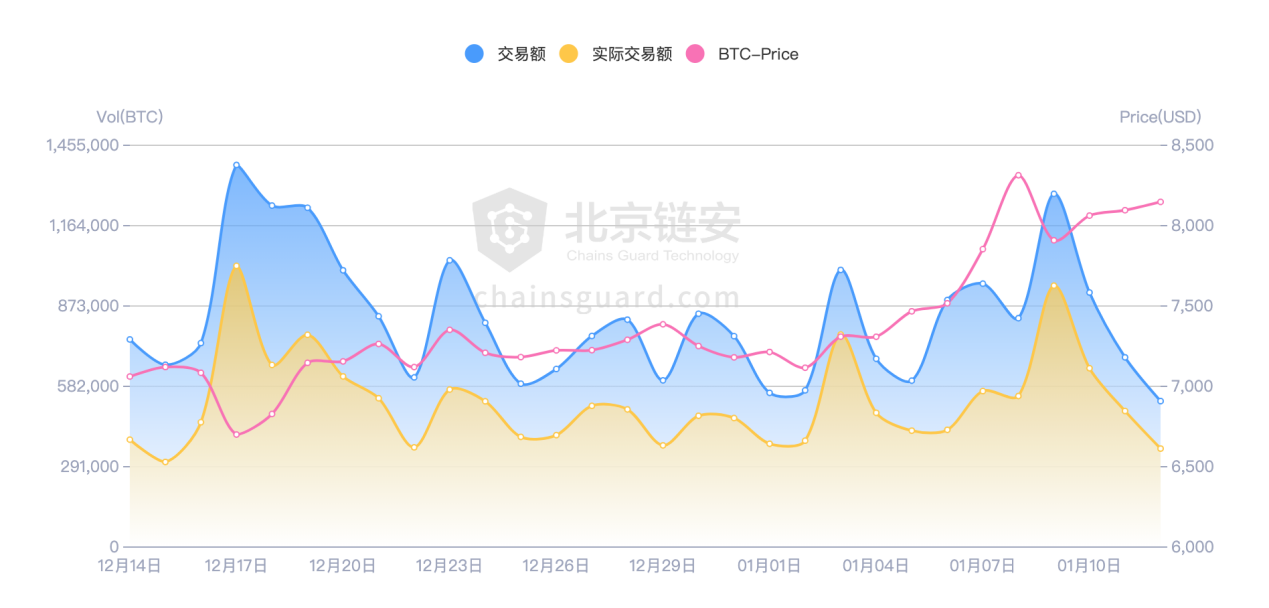

From the perspective of transaction volume, with the rise in the price of Bitcoin in the past week, the on-chain transaction volume is relatively out of the downturn at the end of last year. It remains to be seen whether it can continue.

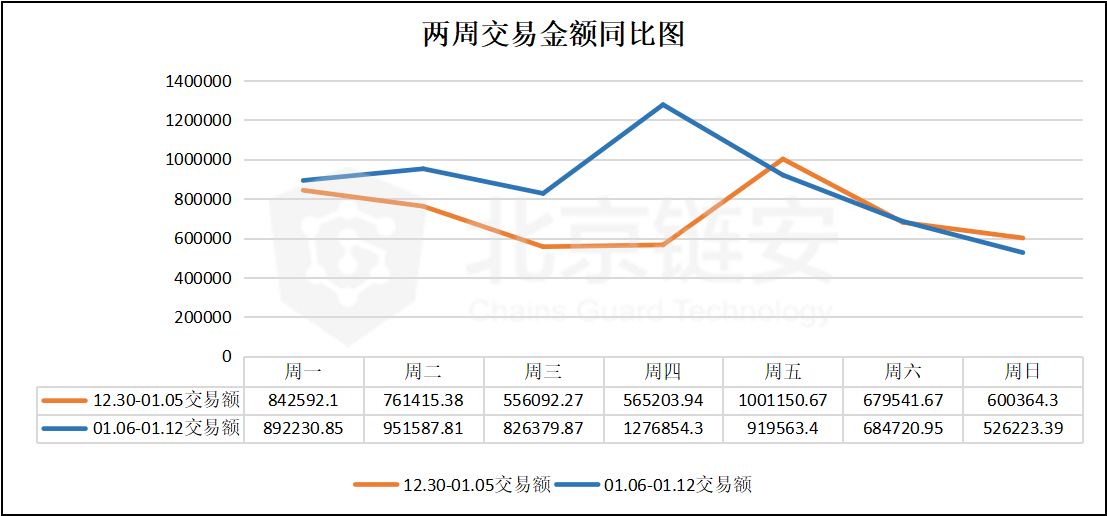

Transaction amount:

- ChainLink, the oracle connecting the two worlds

- Beijing will promote blockchain technology applications in more than 20 areas including real estate transactions

- Featured | Top 10 content producers in the currency of Twitter; Is Bitcoin 2020 really like the early Internet?

12.30-01.05: 5006360.33 BTC 01.06-01.12: 6077560.57 BTC

Increase from the previous week: 21.40%

The detailed data chart is as follows:

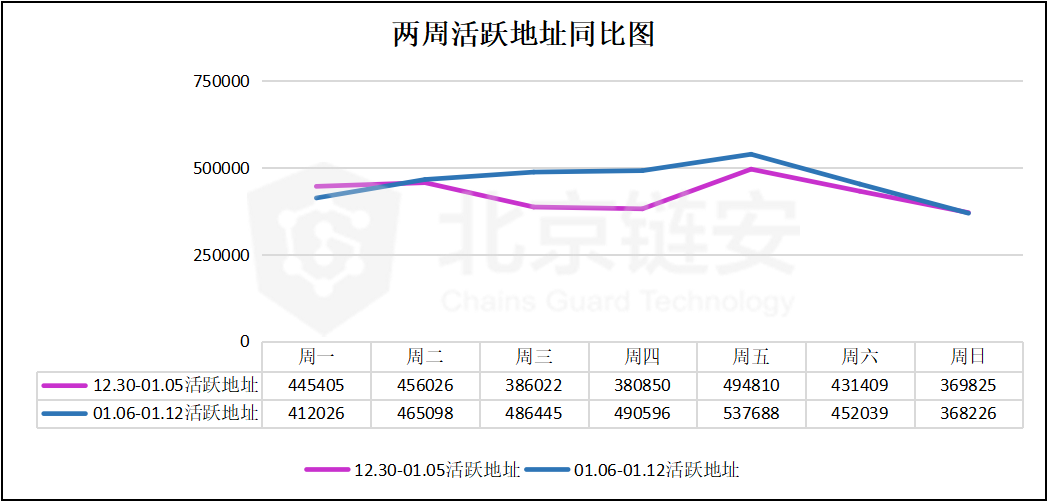

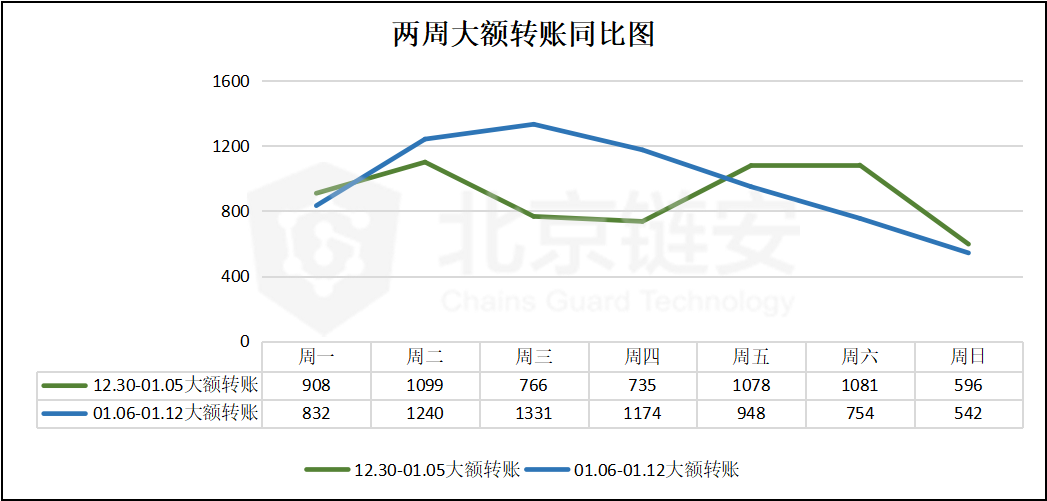

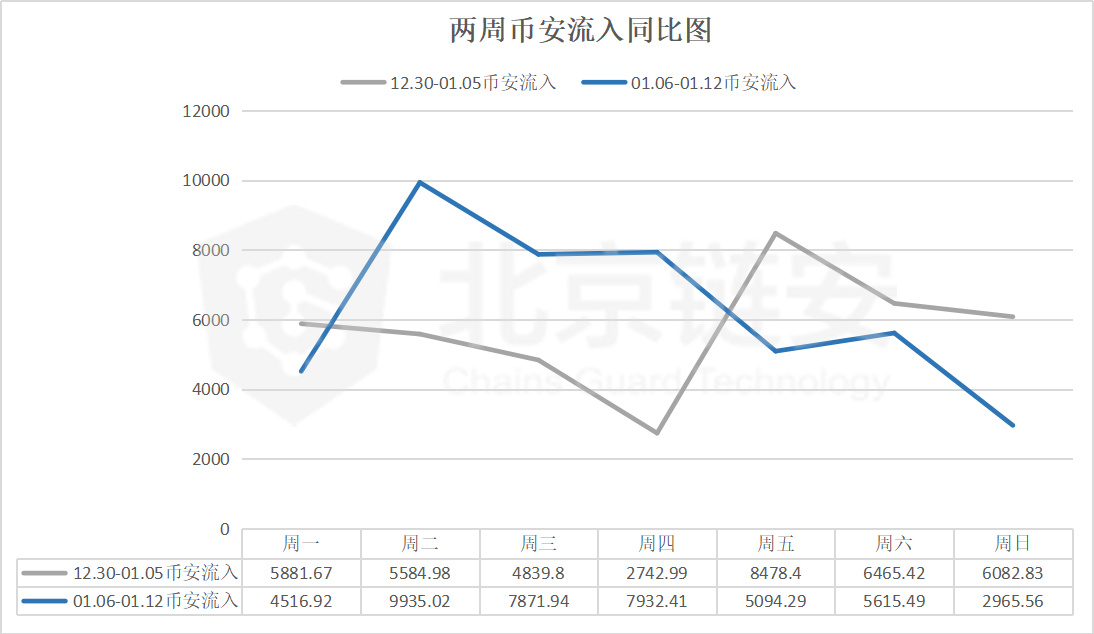

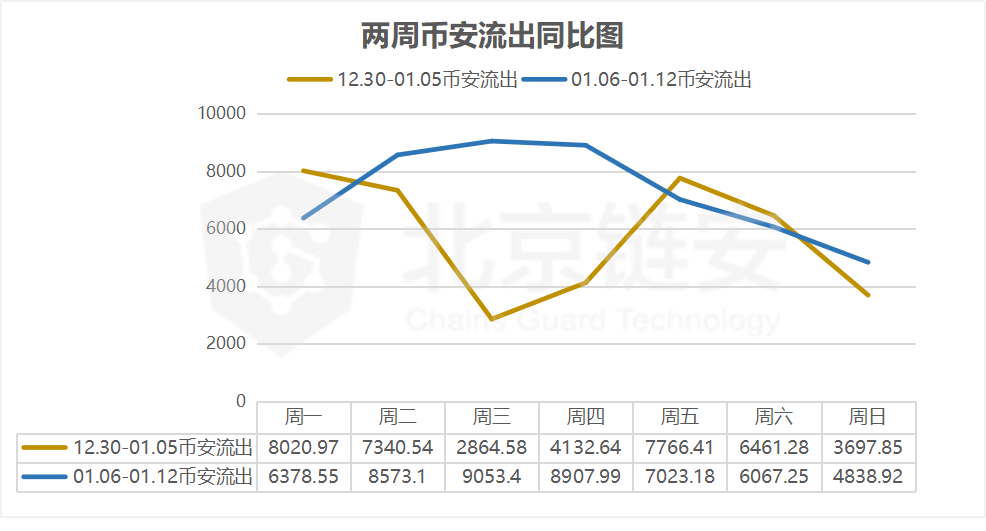

We can see that compared to last week's data, the main rebound has occurred in the middle of the week. Since then, the relevant data has continued to decline, and the continued strength of the active data on the chain is still unclear.

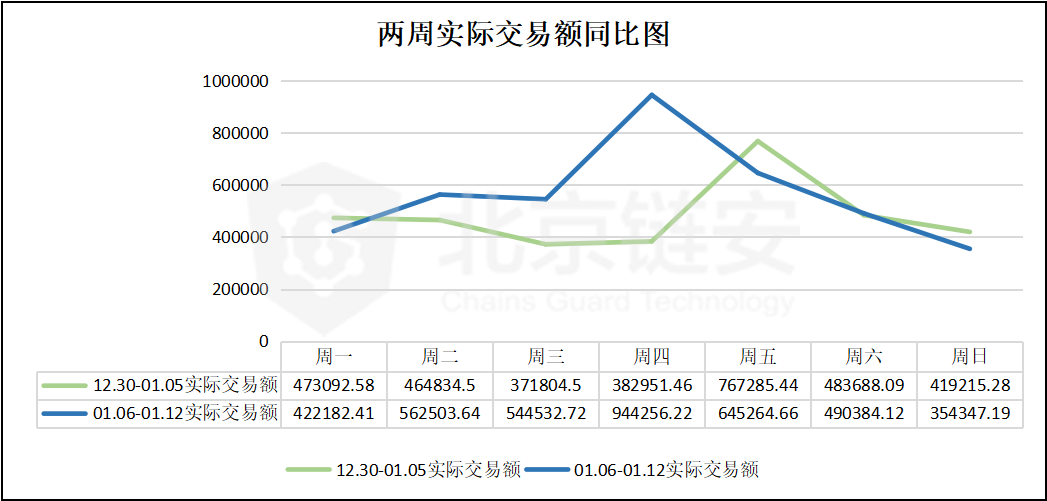

Actual transaction amount:

12.30-01.05: 3362871.85BTC

01.06-01.12: 3963470.96BTC

Increase from the previous week: 17.86%

The detailed data chart is as follows:

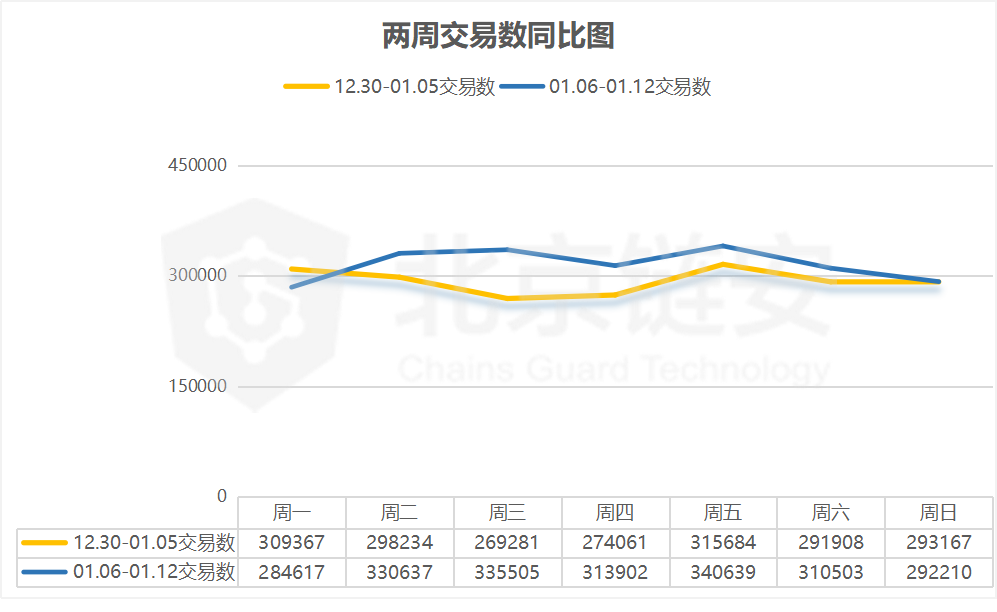

Number of transactions:

12.30-01.05: 2051702

01.06-01.12: 2208013

Increase from the previous week: 7.62%

The detailed data chart is as follows:

Number of active addresses:

(The address that initiated the transaction is considered the active address)

12.30-01.05: 2964347

01.06-01.12: 3212118

Increase from the previous week: 8.36%

The detailed data chart is as follows:

Large transfers:

(Single transaction initiated amount greater than 100BTC is considered a large transfer)

12.30-01.05: 6263

01.06-01.12: 6821 Increase compared with the previous week: 8.91% The detailed data chart is as follows:

Binance exchange BTC flow data

Inflow:

12.30-01.05: 40076.09 01.06-01.12: 43931.63 Increase from the previous week: 9.62% Detailed data chart is as follows:

Outflow: 12.30-01.05: 40284.27

01.06-01.12: 50842.39 Increase from the previous week: 26.21% The detailed data chart is as follows:

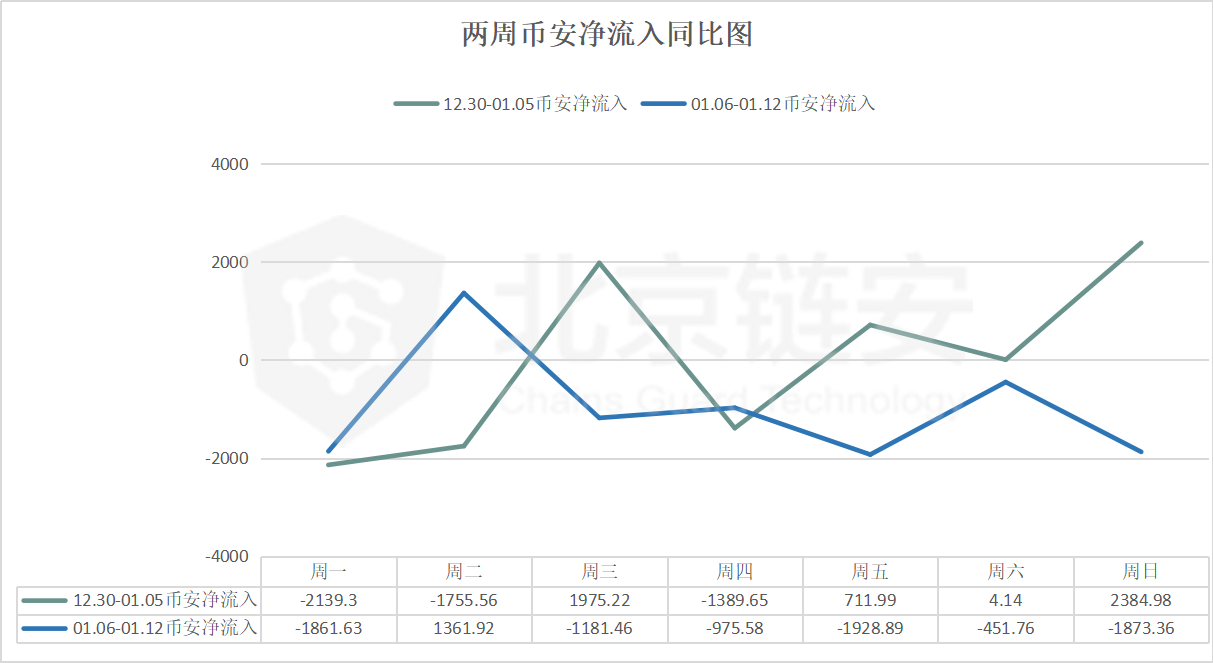

Net inflow:

12.30-01.05: -208.18 12.30-01.05: -6910.76 Decrease from the previous week: 3219.61% Detailed data chart is as follows:

Security and data highlights

Upbit's stolen asset money laundering activity is active again, involving more than 25,000 ETH

Beijing Chainan Chainsmap monitoring system found that Upbit's stolen ETH money laundering process has been relatively quiet for nearly two weeks, and continues to be active this week. Previously, on December 25, 2019, Beijing time, the active money laundering core address beginning with 84f4 was suspended, and other stolen ETH addresses were relatively quiet.

Starting around this Sunday, several batches of ETH concentrated on the fourth layer of the stolen ETH money laundering path of Upbit began to frequently transfer again, involving more than 25,000 ETH. From the observations in recent days, its strategy no longer focuses on one address as the money laundering pool address, but after three or four transfers, it pools at the addresses of several money laundering centers, and then transfers the money in units of several to dozens. To several exchanges.

According to data analyst SXWK, Upbit's stolen ETH money laundering strategy has been adjusted. This strategy has not been implemented such as switching to a stablecoin on a decentralized exchange. Instead, it emphasizes the relative decentralization of centralized processing (centralized More address processing), efficiency (usually a batch of ETH pooled within two days), overall, money laundering is still processing each batch of ETH in the fourth level one by one.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can distributed search engines challenge Google's dominance?

- If Buffett wanted to buy Bitcoin, what would he buy?

- Opinion | Synthetic tools will become the ladder to the future of DeFi and achieve the popularity of DeFi

- 36 transactions cleared the HEX investment address, 48,000 ETH were scattered and transferred. It is suspected that the scam project is finally hammered?

- DeFi weekly selection 丨 DeFi lockup value is approaching US $ 1 billion. Will the "ruler" Maker be overthrown in 2020?

- Bitcoin's eternal battle: fighting entropy, rising on the borders of order and chaos

- Perfecting Blockchain Cognition with Bitcoin's Middle Tier Knowledge