No fear of bad! The BTC bull market features become more and more obvious, and the opportunity to make up the altcoin has not come yet.

Ethereum broke two major positives on Saturday: CME has plans to conduct a survey on the Ethereum reference exchange rate and index in the near future. Some analysts said that this implies that CME has plans to launch ETH futures. Another good thing is the researcher Justin Drake from Ethereum 2.0. According to his research, if the PoW method is abandoned, Ethereum may reduce production by 10 times within two years.

ETH began to rise in the early hours of the morning. From the 4 hours, the pull-up broke the short-term pressure of $302, and with the enlargement of the volume, the price is currently falling. From the point of view of the transaction, it is now possible to gradually build a position and wait for the second wave of the 4-hour cycle. However, since the rise in the early morning did not have a big impact on the daily pattern, it still belongs to the fluctuations within the range, so the current establishment Positions are only short-term operations.

- Li Xiaolai will be cut, why not?

- Wang Xin: The central bank's digital currency helps to improve the effectiveness of monetary policy

- Encrypted currency and class crossing: After the layout is over, are you expecting a bull market there?

ETH pulled up in the early hours of the morning, from the market point of view or by the BTC. And XMR and TRX also showed a rise of more than 5% in the same period, but these changes are fluctuations in the shock range on the daily line, and there is no real tradable opportunity.

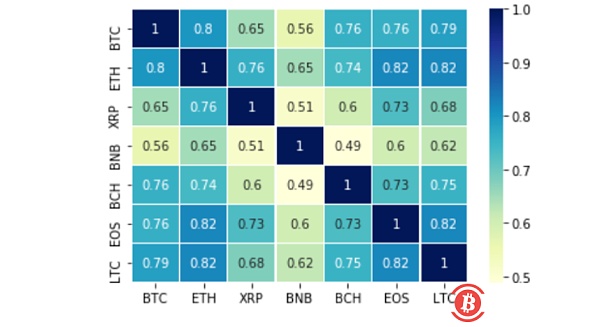

From our analysis of the correlation between the yields of some mainstream currencies in the past year, the mainstream currency correlation performance is extremely strong.

The graph is a correlation matrix based on price data for the past year of the top 7 currencies with the largest market value. From the figure, we can see very intuitively that BTC has a strong correlation with the other six currencies (the altcoin), and the correlation among the other six currencies except BTC is also relatively strong. From a transactional perspective, the stronger the correlation, the less necessary it is to configure during the portfolio configuration process. In other words, among the seven cryptocurrencies, only one of the strongest currencies needs to be selected for configuration, and buying other currencies may increase the risk of the portfolio. And from the current market, when the BTC is even falling, the probability that these six mainstream coins can get out of the independent market has become very small. Therefore, counting on the altcoin to make up, it is better to lower the position of the bitcoin and pull up again. (CoinNess)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can Christina Lagarde support the idea of cryptocurrencies to help?

- ETH 2.0: A vision for the world's computers

- How to build a new stable currency that competes with Libra

- The Singapore Taxation Office exempts the draft of the digital payment token commodity service tax from involving stable currency

- For the "half of the market" power, BTC computing power and other network indicators hit a record high

- Bitcoin hash rate hit another record high!

- Why banks are not eager to implement blockchains