Observation | Digital currency moves forward in regulatory pressure and international recognition

The US SEC rejected the latest proposal to create a Bitcoin ETF. On October 10, according to Tencent Securities, the US Securities and Exchange Commission (SEC) once again rejected the proposal to create Bitcoin to support ETFs. The SEC said in a statement on Wednesday that Bitwise Asset Management and the proposed Bitcoin exchange-traded fund (ETF) on the New York Stock Exchange Arca do not meet the standards for fraud prevention and market manipulation.

The three major payment giants such as Visa and eBay collectively withdrew from the Libra project. On October 11th, the US e-commerce eBay and the three major payment giants MasterCard, Visa, and Stripe announced that they would withdraw from Facebook's lead cryptocurrency Libra management organization Libra Association, expressing respect for the Libra project and seeing its potential, but Both choose to focus on other directions.

The United Nations has set up a cryptocurrency fund to accept bitcoin and Ethereum donations; the US-based presidential candidate Andrew Yang (Yang Anze) will be officially released. On October 9, UNICEF announced the establishment of the Cryptocurrency Fund, which accepts, retains and pays donations in the form of “ether” and “bitcoin”. It is the first institution in the UN system to launch a cryptocurrency fund. It is reported that Yang Dividend is Yang Anze's support organization. The purpose of this organization is to promote Yang Anze's presidential campaign and promote the popularization of cryptocurrency. The organization began researching The Andrew Yang Coin in August 2019 and released a smart contract in September 2019. According to the contract address, 3,141,592,653 MATHs have been issued.

- Opinion: Why PoS and Staking are the trend of the times

- Market analysis: market response to news tends to passivate

- Babbitt Column | Cai Kailong: How Libra Get Out of the Dilemma

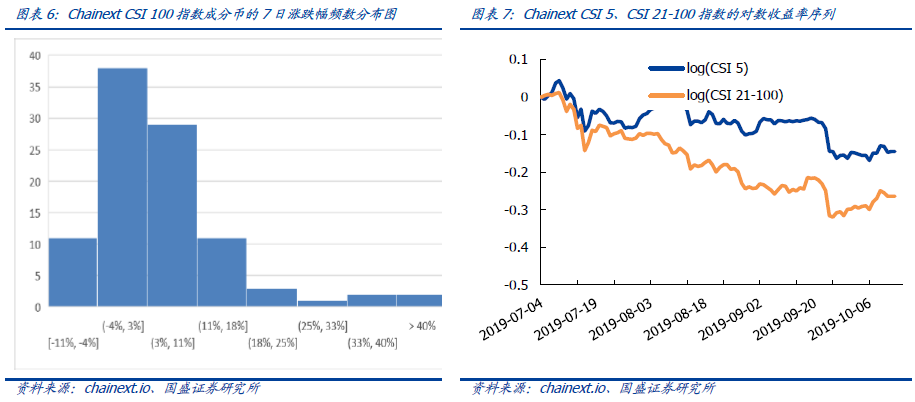

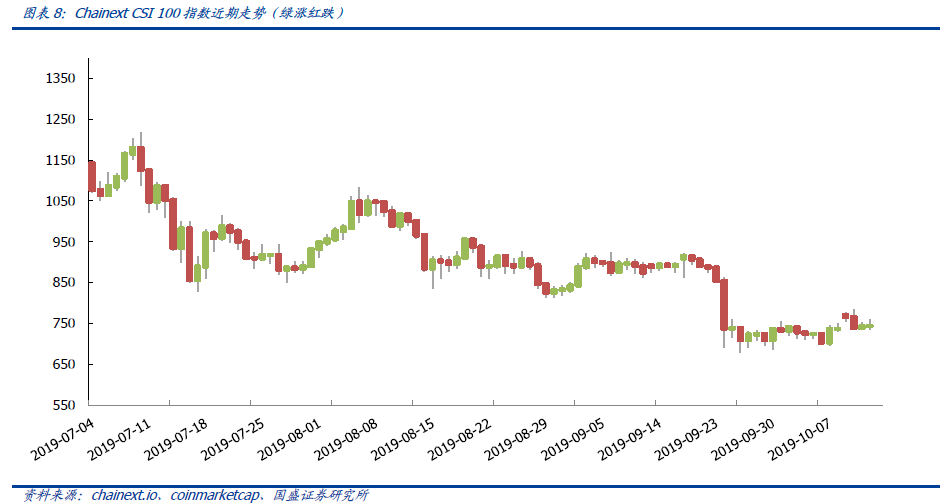

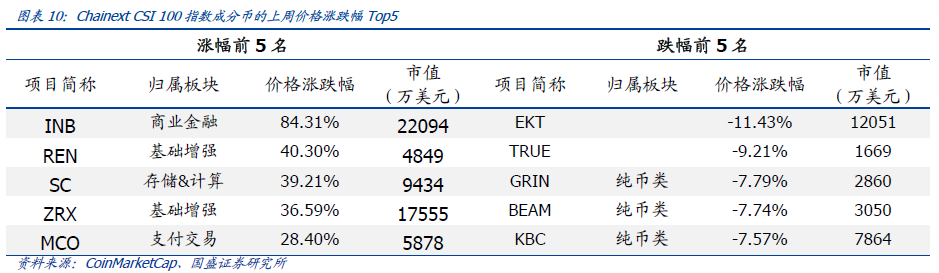

Last week's market review: Chainext CSI 100 increased by 5.84%, and the commercial finance performance in the segment was the best. From the breakdown of the segment, payment transactions, IoT & traceability, entertainment social, commercial finance, basic enhancement, storage & computing performance is better than the Chainext CSI 100 average, +9.73%, +6.95%, +7.89%, +31.90%, +11.24%, +28.19%, the underlying chain, pure currency, AI sector performance was inferior to the Chainext CSI 100 average, +5.01%, +4.20%, +2.78%.

Risk warning: regulatory policy uncertainty, project technology progress and application landings are not as expected, and cryptocurrency-related risk events occur.

The US SEC rejected the latest proposal to create a Bitcoin ETF. On October 10, according to Tencent Securities, the Securities and Exchange Commission (sec) once again rejected the proposal to create Bitcoin to support ETFs. The SEC said in a statement on Wednesday that Bitwise Asset Management and the proposed Bitcoin exchange-traded fund (ETF) on the New York Stock Exchange Arca do not meet the standards for fraud prevention and market manipulation. The SEC said, "its opposition is not based on an assessment of bitcoin or more general blockchain technology, and whether bitcoin has the utility or value of innovation or investment," but "the New York Arca Stock Exchange failed to fulfill its Responsibility under the Transaction Act and the Commission’s business rules to demonstrate that its proposal meets the requirements of Section 6(b)(5) of the Exchange Act, in particular, the rules of the National Stock Exchange are intended to prevent Fraud and manipulation behavior 'this one.'

The three major payment giants such as Visa and eBay collectively withdrew from the Libra project. On October 11th, the US e-commerce eBay and the three major payment giants MasterCard, Visa, and Stripe announced that they would withdraw from Facebook's lead cryptocurrency Libra management organization Libra Association, expressing respect for the Libra project and seeing its potential, but Both choose to focus on other directions. According to media reports such as Bloomberg, eBay’s statement expressed support for the Libra project, but said it will focus on the company’s own payment products and will no longer be a founding member of the Libra Association. A Visa spokesperson said that Visa will continue to assess whether it will join the Libra project in the future and make a final decision based on a number of factors. One of the factors determining is that the Libra Association is fully capable of meeting all necessary regulatory expectations. MasterCard said it will continue to focus on the company's own efforts to contribute to global financial inclusiveness. It is believed that such activities have potential and will continue to focus on Libra's efforts. According to Stripe, Libra has the potential to support online business for more people around the world. Stripe will closely follow Libra's progress and be open to the Libra Association's subsequent phases.

The United Nations has set up a cryptocurrency fund to accept bitcoin and Ethereum donations; the US-based presidential candidate Andrew Yang (Yang Anze) will be officially released. On October 9, UNICEF announced the establishment of the Cryptocurrency Fund, which accepts, retains and pays donations in the form of “ether” and “bitcoin”. It is the first institution in the UN system to launch a cryptocurrency fund. UNICEF said the fund's funds will be used to fund open source technologies that will benefit children and youth around the world. The first donation will be donated by the Ethereum Foundation through the UNICEF French National Committee. In addition to France, among the 33 national committees currently available to UNICEF, national committees in the United States, Australia and New Zealand also accept donations in the form of cryptocurrencies. UNICEF said that the launch of the cryptocurrency fund is part of its application to blockchain technology, and UNICEF and WFP jointly lead the UN innovation network to explore potential opportunities and risks in the blockchain and other emerging technologies. UNICEF's cryptocurrency fund accepts donations and funds in the same cryptocurrency. The first pen cryptocurrency is invested in three institutions, Prescrypto, Atix Labs and Utopixar, which are mainly used for prescription tracking, matching investors and needs. Funders and community tokens. According to Yang Dividend official news, the Chinese presidential candidate Andrew Yang (Yang Anze) campaign token The Andrew Yang Coin (referred to as MATH) will be officially released, which means that MATH will become the first presidential campaign token. It is reported that Yang Dividend is Yang Anze's support organization. The purpose of this organization is to promote Yang Anze's presidential campaign and promote the popularization of cryptocurrency. The organization began researching The Andrew Yang Coin in August 2019 and released a smart contract in September 2019. More than 3.1 billion MATHs have been issued under the contract address.

The future potential of digital currency is unquestionable, but its rationale is bound to be dangerous. In the process of regulatory pressure and international recognition, it will become the main theme.

The US Internal Revenue Service updated the cryptocurrency tax guidelines for the first time in five years to resolve the problem of forked coins. The US Internal Revenue Service (IRS) issued additional guidance on tax treatment for cryptocurrencies on the 9th, including a new tax bureau regulations and FAQs, the new rules aimed at tax treatment on a cryptocurrency hard fork. Solve common problems for taxpayers and tax operators. Q&A addresses the issue of cryptocurrency transactions for those who hold cryptocurrencies as capital assets. The new guidelines address issues such as tax-related liabilities caused by cryptocurrency forks, acceptable methods of cryptocurrency received as income estimates, and taxable income when selling cryptocurrencies.

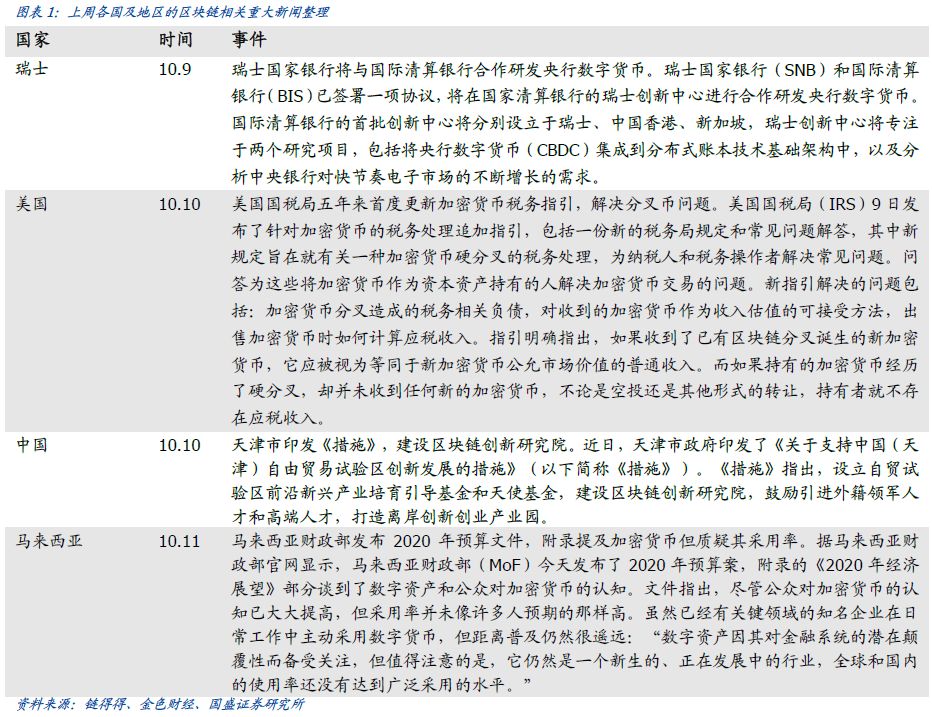

Last week, BTC added 2.25 million new transactions, a slight increase of 0.2% from the previous month; ETH added 4.7 million new transactions, an increase of 8.6% from the previous month.

Last week, BTC miners' average daily income was $15.78 million, an increase of 4.0% from the previous month; ETH miners' average daily income was $2.55 million, an increase of 2.5% from the previous month.

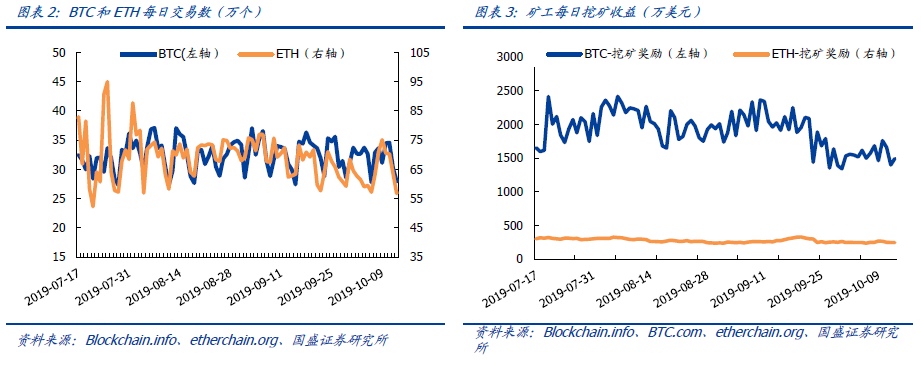

Last week, the average daily computing power of BTC reached 96EH/s, an increase of 3.7% from the previous month; the average daily computing power of the ETH network reached 188.9TH/s, a decrease of 0.5% from the previous month.

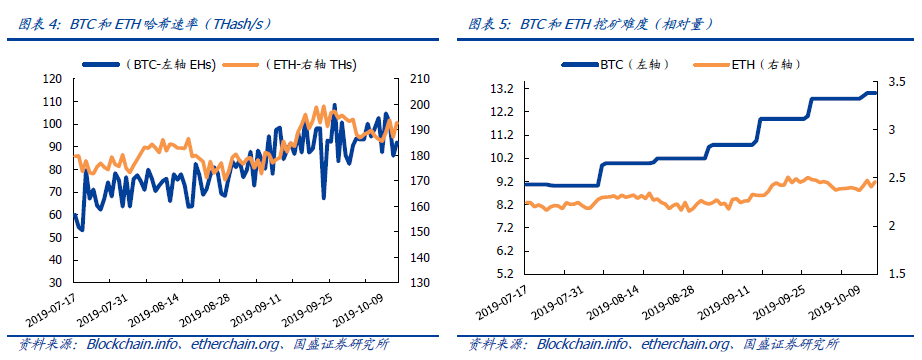

Last week, the difficulty of mining the whole network of BTC was 13.01T, which was 1% higher than the previous month. The next difficulty adjustment day was on October 24, the expected difficulty value was 13.40 T, and the difficulty increased by 3.01%. The average mining difficulty of ETH whole network last week was 2.42T, an increase of 0.3% from the previous month.

From the breakdown of the segment, payment transactions, IoT & traceability, entertainment social, commercial finance, basic enhancement, storage & computing performance is better than the Chainext CSI 100 average, +9.73%, +6.95%, +7.89%, +31.90%, +11.24%, +28.19%, the underlying chain, pure currency, AI sector performance was inferior to the Chainext CSI 100 average, +5.01%, +4.20%, +2.78%.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BMW, GM, etc., the world's top five automakers, collaborate to test block identity-based automotive identity systems

- Behind the blockchain summit of Shen Nanpeng and Wang Xing, there is a “capital giant crocodile” sitting on a $100 million

- Analysis: Is there a cost to store Bitcoin? Currently 2.1% per year

- I understand the super-book DLT, library, development tools, how many members of the Hyperledger family do you know?

- Market Weekly | Market recovery last week lost ground, countries have frequently regulated the blockchain industry

- Opinion | a16z: Libra should give up a basket of currencies, only anchored with the dollar

- Marching to China! Entering China has become a consensus in overseas mining circles | International Mining Summit