Opinion: Why PoS and Staking are the trend of the times

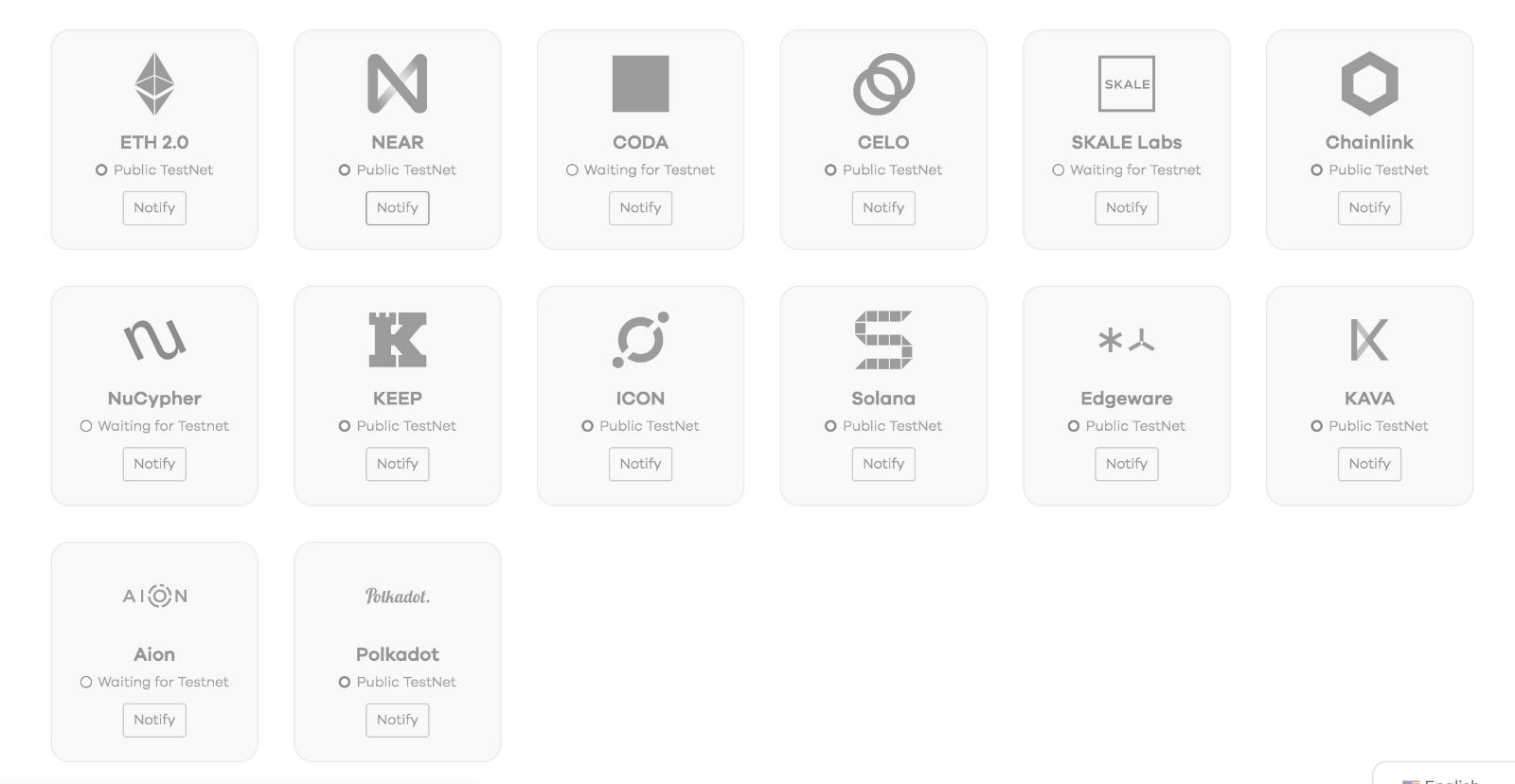

Every time I open the website of Figment.network, I often think about it: If PoS and Staking are not the future direction, then why in the nearly 20 projects of the main network in 2020, all the PoS consensus has been adopted.

Think about it, only two discernible POW currencies were born in 19 years: Grin and Beam. Other than this is PoS.

The public still has a lot of misunderstandings about Staking. It needs to be popularized and educated, but don't be too hasty. The process of popularization and acceptance is also the process by which value is discovered.

- Market analysis: market response to news tends to passivate

- Babbitt Column | Cai Kailong: How Libra Get Out of the Dilemma

- BMW, GM, etc., the world's top five automakers, collaborate to test block identity-based automotive identity systems

Understanding Staking as a lock-in is too shallow, how to make investors realize the importance of Staking for maintaining PoS network security and Stake token is essentially an ASIC chip, which is something the whole industry needs to do.

In the future, the value discovery point of the Staking network lies mainly in the valuation of its network security. The currency media also needs to improve their own quality. In the promotion, don't just stop Staking in the lock.

I have no obvious preference or preference for POW and POS. POW and POS have their own advantages and disadvantages. If this topic is arguing, neither side can convince each other, and in the end, they can only be foolish.

But the wheels of history are clearly rolling towards POS and Staking. You can keep your own preferences and opinions, you can not like POS, you can also 骂 POS is a scam, no problem at all.

But I think that in the future, POS and Staking will not escape the following situation: before you realize that this is what it is, it will eventually become mainstream. Everyone will eventually accept Staking either passively or actively.

The interests of POS and capital institutions are unexpectedly highly consistent. From the recent NuCypher financing in the management of the leopard: institutional investors promised to lock the warehouse for more than 1 year, and will participate in the network Staking during this period. For the organization, since locking the chip is destined to be a thing that cannot escape, why not take part in Staking.

Staking makes the lock of the organization a logical and self-consistent thing . Before Staking, the lockout was just a literal lock. You can't do anything during the lockout.

After Staking, even if you don't lock the position, for the sake of personal interest (POS inflation), you will choose Staking with a high probability. Staking made the organization lock the warehouse "no sense".

The result is that the organization participates in the verification of the PoS network at a very low chip cost. And promise to verify at least one year or more.

Staking has forced institutions to become long-term holders. This allows the entire industry to move in the right direction. Institutions should lead by example. If the organization takes the lead in playing short-term operations, there is no reason to blame the whole industry for its bad atmosphere.

It makes sense to think about Staking from an institutional point of view. Of course, there are other angles: cost, decentralization, efficiency, and so on. There are many points to discuss.

Soso just talked about why PoS and Staking might be the future trend from an institutional perspective. Regarding the pros and cons of POS and POW, and the topic of Staking, everyone and Soso are welcome to discuss.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Behind the blockchain summit of Shen Nanpeng and Wang Xing, there is a “capital giant crocodile” sitting on a $100 million

- Analysis: Is there a cost to store Bitcoin? Currently 2.1% per year

- I understand the super-book DLT, library, development tools, how many members of the Hyperledger family do you know?

- Market Weekly | Market recovery last week lost ground, countries have frequently regulated the blockchain industry

- Opinion | a16z: Libra should give up a basket of currencies, only anchored with the dollar

- Marching to China! Entering China has become a consensus in overseas mining circles | International Mining Summit

- US Treasury Secretary: Visa, PayPal, etc. withdraw from Libra because they have not yet reached regulatory standards and are worried about government action