Opinion: 5 predictions for DeFi in 2020

Decentralized Finance (DeFi) has become one of the main driving forces for Ethereum applications. The core of DeFi is to build a brand new financial ecosystem without the permission of any central authority for everyone in the world.

In 2019, DeFi became the focus of attention. Despite the impressive growth, real challenges to realizing DeFi's potential are still significant.

Looking forward to 2020, I am optimistic that on / off ramps such as scalability, consumer-friendly interface, and fiat will be resolved. However, I believe we have a long way to go before addressing other challenges such as credit scores, financial privacy, and most importantly, risks.

Here are my predictions for 2020 DeFi:

- Case study | How government governance applies blockchain technology

- Latest Global Central Bank Digital Currency Guide

- Perspective | Bitcoin Operating System: What kind of applications will emerge from liberating information and communications?

1.The market value of stablecoins will exceed $ 15 billion

In 2019, the total market value of stablecoins has increased by about 50%, from $ 3.3 billion to more than $ 5 billion, of which Tether's dominance has reached about 80%.

The three-fold increase in stablecoins will come from multiple fields:

- Launch of Libra

- New stablecoins from CELO, Velo, Saga, Franklin Templeton and more

- Growth of non-speculative and speculative use cases

- Multi-collateral Dai accepts new assets as collateral (BTC, Treasury bonds)

- Increased desire for yields in a negative interest rate environment

2.Interoperability will be achieved in 2020

In 2020, in addition to Keep ’s tBTC, Thorchain, Ren mainnets, the growing Cosmos ecosystem, Interledger Protocol, Kava, 1 way pegs, 2 way pegs, bridges, and atomic swaps, in 2020, Polkadot will also be released. .

I firmly believe that inter-protocol interoperability will be "resolved" by 2020, but I am not sure which approach will win market share.

Although interoperability is unavoidable, I think the biggest impact will be around Bitcoin, because in the context of DeFi, there are very few other digital assets worth interoperating (most stablecoins are already ERC-20 tokens, And privacy solutions are coming soon).

With a particular focus on Bitcoin, Deribit research concisely highlights the trade-off space for interoperability solutions:

- Anti-censorship: anyone can create, redeem, and use tokens, regardless of their identity or permissions.

- Non-confiscation: Neither the custodian nor other third parties can seize coins in the security deposit.

- Bitcoin price stability: Agent tokens closely track the price of Bitcoin, thus inheriting its monetary attributes.

- Acceptable operating costs: The system can provide services at a price that appeals to users and administrators.

Among the many cross-chain competitions, I believe that a solution will emerge in 2020 to meet these trade-offs and eventually enable BTC to conduct trust exchanges across chains.

3.BTC will replace ETH as the main value locked in DeFi

Although I may be called a "maximist" at this point, it is useful to take a step back and look at the current centralized lending market and look for clues about the impact of introducing Bitcoin as collateral in DeFi. Help.

BTC is the main collateral in derivative markets such as BitMEX, with an annual transaction value of more than $ 1 trillion. Similarly, Genesis Capital noted that as of the third quarter of 2019, they had approximately $ 215 million in bitcoin profits on their books, and Celsius emphasized that Bitcoin had the most deposits of their $ 163 million in net deposits.

I still believe that speculative use cases such as margin loans and bitcoin as collateral will drive the growth of DeFi, and long leverage will greatly increase the total value locked by various DeFi protocols.

Bitcoin's liquidity is 3 times that of ETH, and its market value is 8 times that of ETH. Historically, its volatility is also less than ETH (surprisingly, the current ETH's volatility is flat with BTC), which makes Bitcoin a A better collateral, assuming that BTC can perform untrusted interoperability with the DeFi protocol, as described in prediction 2.

As of this writing, the currently locked ether on all DeFi platforms is approximately $ 390 million.

4. The market share of Rollups + unmanaged exchanges will be 10 times the current "DEX" market share

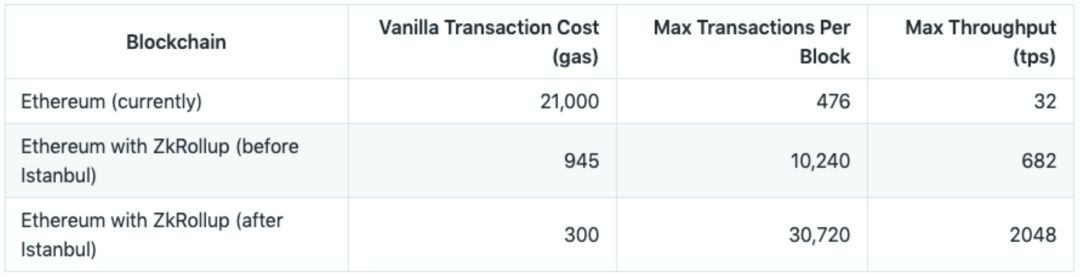

Crypto twitter is very excited about the introduction of Optimistic / Zero-Knowledge / BLS Rollups as a potential Ethereum extension solution.

Coupled with the recent Istanbul hard fork, which includes EIPs that make ZK-snark cheaper, ZK is particularly expected to increase ETH throughput to 2k + TPS.

IDEX recently released a version 2.0 demo that leverages Rollups. DeversiFi (formerly Ethfinex, spun off from Bitfinex) is working with Starkware to use ZK-Rollups to serve their hybrid unmanaged exchange, which uses Bitfinex's orders.

Suppose that unmanaged “decentralized” exchanges can provide similar trading experience, avoid pre-run issues, and use liquidity from a centralized order book (basically, if ZK Rollups are as magical as they seem, and interoperability The solution does work) and I believe we will start to see traders move for two reasons:

- Unmanaged transactions reduce counterparty risk

- Being able to trade with your chosen custodian (or self-custodian) is a better experience

In addition, cryptocurrencies have been scrutinized by more and more regulators. Many exchanges have delisted assets such as privacy coins, while exchanges as custodians bear high regulatory / insurance costs. As this technology finally catches up with the hype in 2017, decentralized exchanges will gain considerable market share by 2020.

5. Guarantee ratio will remain above 100%

Taking into account the inherent volatility of crypto collateral, the guarantee ratio always needs to provide a meaningful buffer, and his liquidation may change significantly before the liquidation takes place.

Although I believe there will be some improvements in 2020, I think we need at least a few more years to achieve decentralized identity authentication and credit scoring, so that undersecured loans will become a reality.

My intuition is that we will start to see centralized providers implement a hybrid model that uses a combination of traditional credit score data and alternative data sources to provide undersecured loans. I bet my money on Calibra and ended up using Facebook's huge data set to provide loans to those who applied.

However, at the same time, the introduction of less volatile collateral, such as US Treasuries, IMF-backed stable bonds, such as USDC, gold, marked real estate / invoices, etc., is expected to gradually reduce the collateral ratio.

In addition, I hope we will continue to see more experiments similar to the alliance, which is a combination of on-chain identity (wallet address, KYC, etc.) + social guarantee (new DAO members must be borne by 2 existing members) Credit Union DAO.

Author: Roy Learner

Original link: https://medium.com/wave-financial/5-predictions-for-defi-in-2020-b888398413cd

Compilation: Share Finance Neo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dry goods | Starting from three bottlenecks to solve blockchain scalability issues

- Summary of blockchain security incidents in 2019, global loss exceeds $ 6 billion

- CCTV re-approves blockchain scams: closing big V, online celebrity Weibo, and stepping up efforts

- Fed director: Libra faces "a series of core legal and regulatory challenges", including how to link to underlying assets

- Bitcoin surpasses Ethereum as the mainstay of DeFi? Here are 5 predictions for DeFi in 2020

- Ethereum's six myths: is decentralization really omnipotent?

- Interview with Ms. Bitcoin in Japan's Cryptocurrency Circle: Crazy learning, continuous pursuit, and efforts to build a trusting society | 8 questions