Watch | Singapore Payment License Waiver Buffers for 4 Months, Exchange Faces Final Test

Summary

Digital currency exchanges, wallet dealers and other service organizations face certain difficulties in obtaining licenses, and face life and death tests 4 months later. According to the Monetary Authority of Singapore, all digital currency exchanges, wallets and OTC platforms and other related service providers that are payment tokens (including BTC, ETH, etc.) must meet relevant anti-money laundering regulations and apply for corresponding licenses for compliance Operation; at the same time, in order to protect consumers and merchants, the holder must protect customer funds from bankruptcy through four prescribed methods. For the current digital currency exchanges, no matter whether it is anti-money laundering regulations or Singapore's "exemption from bankruptcy guarantees", there are no small thresholds for conditions. After this exemption period, obtaining licenses faces certain difficulties. Therefore, whether digital currency exchanges can meet the above conditions during the 4-month exemption buffer period becomes their final test in Singapore.

The International Organization of Securities Commissions report believes that global stablecoins may fall into the category of securities regulation. According to the latest report of the International Organization of Securities Commissions (IOSCO), global stablecoins will be very likely to be subject to securities laws. The International Securities Regulatory Commission said that if a cryptocurrency project develops into a financial market infrastructure (FMI), it "may follow" the principles of FMIs (PFMIs) set by the Bank for International Settlements. The report also pointed out another potential obstacle in the development and implementation of stablecoins. "For some systemically important stablecoins, compliance with the high standards of PFMI may be a challenge, especially those that are partially or highly decentralized Systemically important stablecoins. "

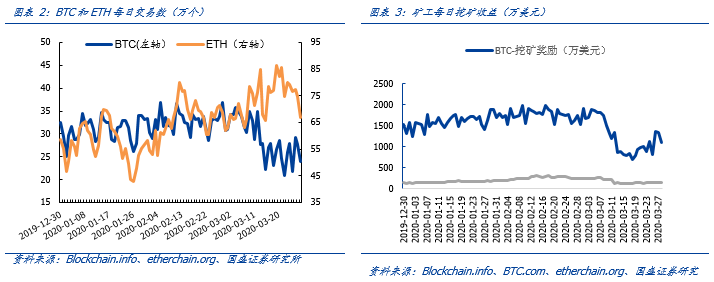

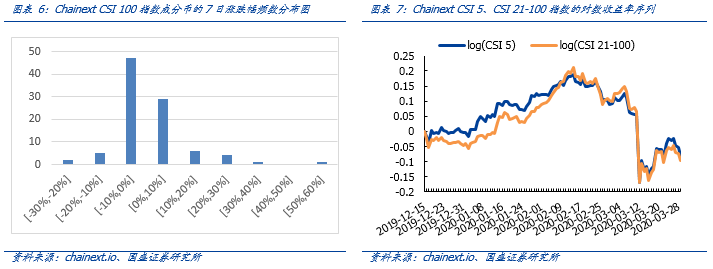

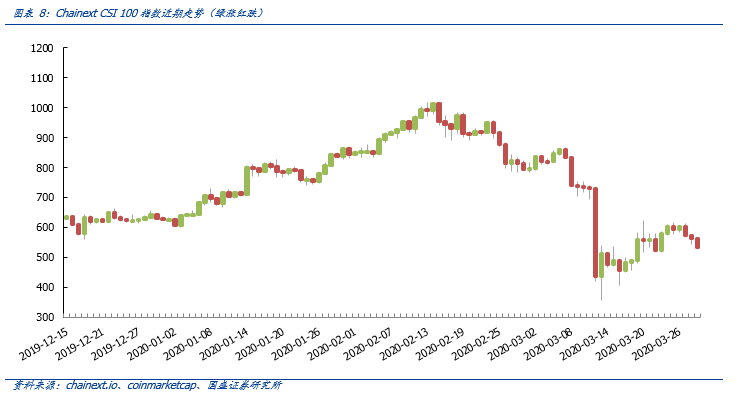

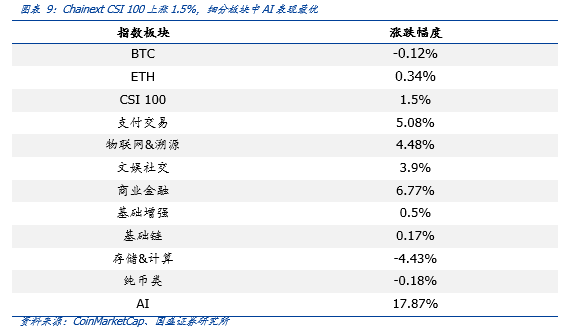

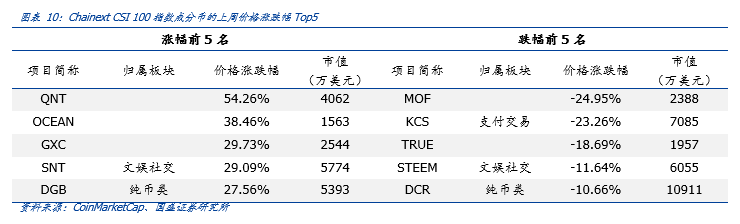

Last week's market review: Chainext CSI 100 rose 1.5%, and the AI performance in the segment was the best. From the perspective of subdivisions, payment transactions, IoT & traceability, entertainment and social, commercial finance, and AI are better than Chainext CSI 100 average levels, which are 5.08%, 4.48%, 3.9%, 6.77%, and 17.87%, respectively. The performance of the basic chain, storage & computing, and pure coins were all lower than the Chainext CSI 100 average levels, which were 0.5%, 0.17%, -4.43%, and -0.18%, respectively.

Risk Warning: Uncertainty in regulatory policies, and the development of blockchain infrastructure is not up to expectations.

- Popular science | Customs passwords in the digital age: privacy calculations help data "refining"

- Babbitt Column | Bitcoin has experienced two extreme quotations in half a year. What do they have in common?

- Babbitt Column | Blockchain-Mathematics Reshapes Trust from Human History

I. Singapore payment license exemption buffer for 4 months, exchange faces final test

Digital currency exchanges, wallet dealers and other service organizations face certain difficulties in obtaining licenses, and face life and death tests 4 months later. According to the Monetary Authority of Singapore, all digital currency exchanges, wallets and OTC platforms and other related service providers that are payment tokens (including BTC, ETH, etc.) must meet relevant anti-money laundering regulations and apply for corresponding licenses for compliance Operations. For electronic payment services with an average daily turnover of more than S $ 5 million, it is necessary to apply for a "large payment institution" license; and for "large payment institution" licensees applicable to large service providers, to protect consumers and merchants, the Someone must protect client funds from bankruptcy in four prescribed ways. For the current digital currency exchanges, no matter whether it is anti-money laundering regulations or Singapore's "exemption from bankruptcy guarantees", there are no small thresholds for conditions. After this exemption period, obtaining licenses faces certain difficulties. Therefore, whether digital currency exchanges can meet the above conditions during the 4-month exemption buffer period becomes their final test in Singapore.

The International Organization of Securities Commissions report believes that global stablecoins may fall into the category of securities regulation. According to the latest report of the International Organization of Securities Commissions (IOSCO), global stablecoins will be very likely to be subject to securities laws. IOSCO assumes a stable coin managed by the Corporate Governance Committee, supported by a basket of global reserve currencies, and able to settle on its own private chain. This case model is very similar to Libra. This stablecoin can only be issued to "authorized participants" who buy and sell stablecoin, and can transfer transactions between users' digital wallets. IOSCO found from its hypothetical analysis that this stablecoin may fall within the purview of securities regulators. The International Securities Regulatory Commission said that if a cryptocurrency project develops into a financial market infrastructure (FMI), it "may follow" the principles of FMIs (PFMIs) set by the Bank for International Settlements. The report also pointed out another potential obstacle in the development and implementation of stablecoins. "For some systemically important stablecoins, compliance with the high standards of PFMI may be a challenge, especially those that are partially or highly decentralized Systemically important stablecoins. "

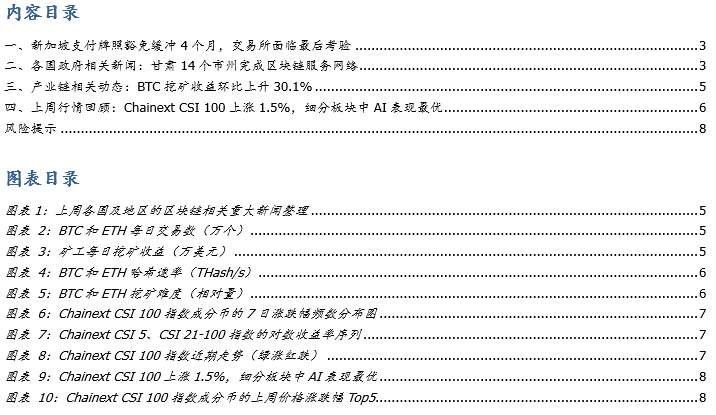

Second, the relevant government news: 14 cities and states in Gansu complete the blockchain service network

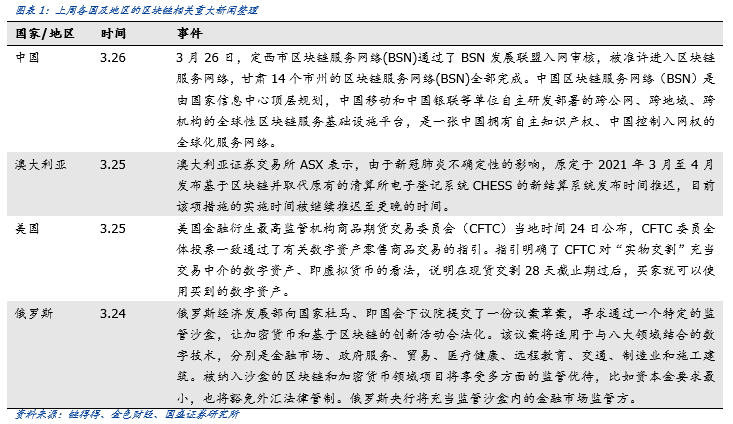

Third, the industry chain related developments: BTC mining revenue rose 30.1% MoM

Last week, the average daily income of BTC miners was 10.91 million US dollars, up 30.1% month-on-month; the average daily income of ETH miners was 1.48 million US dollars, up 7.4% month-on-month.

Fourth, the market review last week: Chainext CSI 100 rose 1.5%, the best performance of AI in the segment

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- China's blockchain landscape moves west: Gansu 14 cities deploy blockchain service network

- DeFi Monthly Report | MakerDao encounters the most severe test in history

- Article describes the type, scale and trend of stablecoins

- On the Equity of Currency Stocks and Token Economy: How to Coordinate to Generate Synergy

- USDT issues more than 10 billion in six days. In a bear market environment, stablecoins become the biggest winners

- Free and Easy Weekly Review | "House N" Reflects the Weakness of Privacy and Sees How the "Sky Eye" of the Chinese Academy of Sciences Breaks the Game

- Discussion on anti-counterfeiting, anti-intrusion and tampering, and blockchain technology to improve the security of drone operations