Blockchain Weekly Report | “Mentougou” Welcomes Draft Compensation

Guide

On March 25, 2020, the crypto asset trading platform Mt.Gox (Mentougou) announced the draft debt repayment at the latest annual meeting of creditors.

Summary

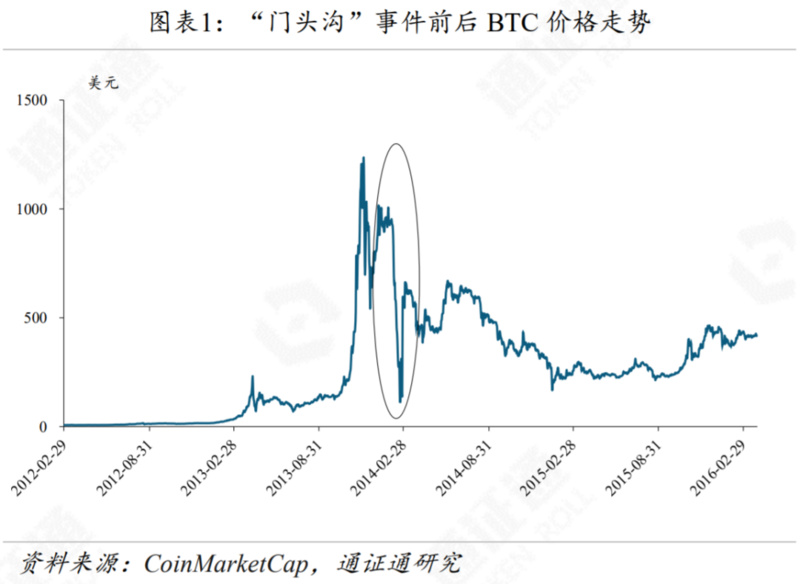

Topic: "Mentougou" welcomes the draft of compensation, and the shadow of the disk is reproduced. In February 2014, a huge BTC theft occurred on the Mt.Gox exchange, the exchange was seriously insolvent and went bankrupt, and investors suffered heavy losses. On March 25, 2020, Mt.Gox announced a draft debt repayment. The main contents are as follows: creditors can choose to obtain compensation through fiat currency or BTC / BCH, and the debt trustee will give priority to paying fiat currency claims and small claims. . Once the draft is approved, 141,000 BTC, 142,000 BCH, and a large number of other crypto token assets will flow directly to the market, impacting the market.

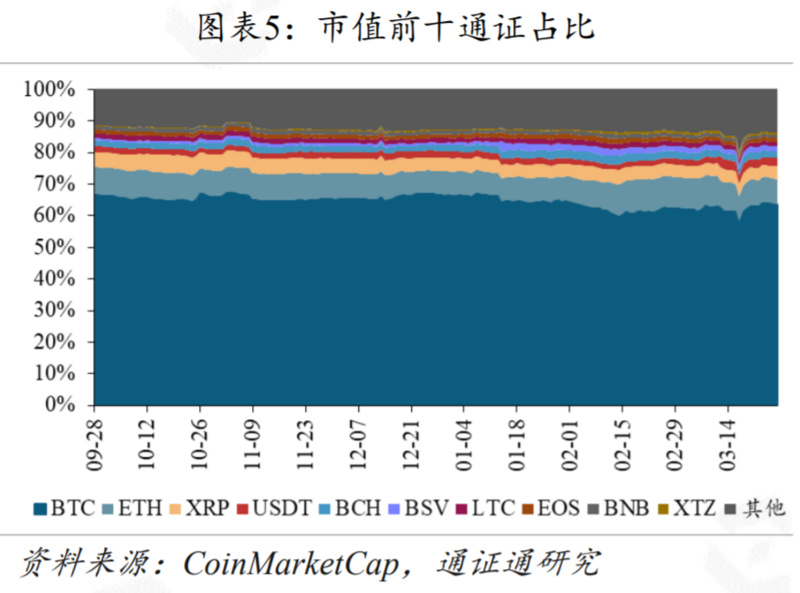

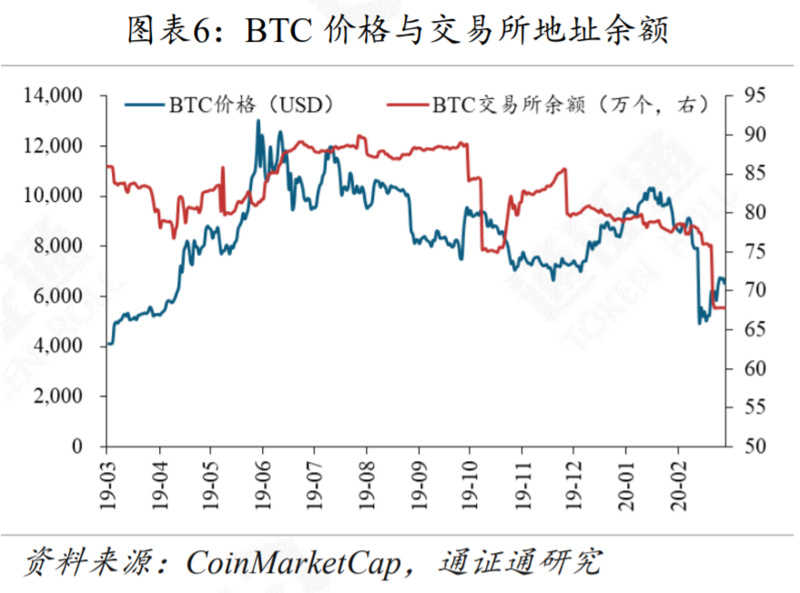

Quotes: The market is volatile and rebounding. The total market value of digital tokens this week was 186.01 billion US dollars, an increase of 7.27 billion US dollars compared with last week, an increase of about 4.1%; the average daily turnover rate was 71.4%, a 13.5% decrease from last week. BTC's current price is $ 6469.8, a weekly increase of 4.4%, and the average daily trading volume is $ 41.7 billion. The current price of ETH is 133.94 USD, with a weekly increase of 0.9%, and the average daily trading volume is 13 billion USD. The BTC balance of the exchange this week was 679,000, which was 9818 less than last week. The exchange ETH balance was 15.0745 million, an increase of 116,000 over the previous week. Among the BICS secondary industries, the proportion of healthcare industry has increased significantly.

- Popular science | Customs passwords in the digital age: privacy calculations help data "refining"

- Babbitt Column | Bitcoin has experienced two extreme quotations in half a year. What do they have in common?

- Babbitt Column | Blockchain-Mathematics Reshapes Trust from Human History

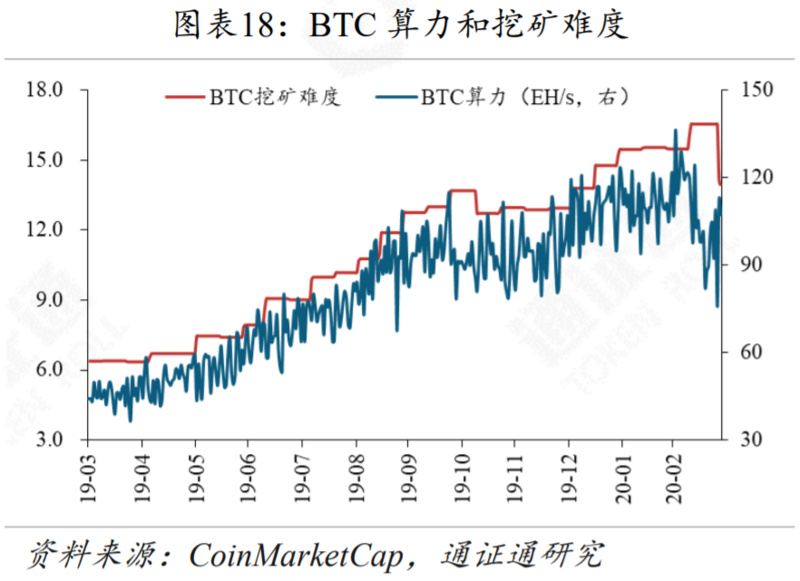

Output and popularity: The difficulty of BTC decreased, and the computing power picked up. The mining difficulty of BTC this week was 13.91T, which is 2.64T lower than last week, and the average daily computing power is 100.4EH / s, which is 5.8EH / s higher than last week. The mining difficulty of ETH is 2201.9 this week, which is an increase of 11.61 The average daily computing power is 176.1 TH / S, which is 2.5 TH / S higher than last week.

Industry: The world economy continues to be volatile. The United States launched a huge rescue plan, with a total size of 2 trillion U.S. dollars; blockchain will become an important player in supply chain finance and trade finance innovation; CME's BTC futures trading volume hits a recent low.

Risk warning: regulatory policy risks, market trend risks

text

1 "Mentougou" welcomes draft compensation

On March 25, 2020, the crypto asset trading platform Mt.Gox (Mentougou) announced the draft debt repayment at the latest annual meeting of creditors.

1.1 "Mentougou" incident

"Mentougou" is the Chinese translation of MT.Gox. MT.Gox was established on July 17, 2010 and is located in Tokyo, Japan. It is the first exchange to carry out BTC business. Because it entered the market earlier and had fewer competitors, Mt.Gox developed rapidly, and once became the world's largest BTC exchange, accounting for 80% of the world's trading volume.

However, Mt.Gox has serious security holes. In February 2014, due to the theft of nearly 750,000 BTC users and 100,000 BTC held by the exchange (nearly 7% of the global BTC circulation at the time), the exchange was seriously insolvent, and the MT.Gox website stopped trading and subsequently File for bankruptcy.

The cause of the theft is a mystery, and there is no conclusive conclusion. Regarding the "Mentougou" incident, MT.Gox claimed that it had been hacked and lost it, and some analysts believe that the exchange itself guarded against theft. A large number of investors have defended their rights in front of Mt.Gox, but with little effect.

The "Mentougou" incident shocked the world. In just one month, the price of BTC fell by over 36%, and the crypto asset market entered a cold winter. The impact of the "Mentougou" incident has also spread to the entire ecosystem of the blockchain. Investors' trust in BTC and exchanges has dropped to the freezing point, questioning the concept of decentralization promoted by the blockchain, and the entire industry is overcast.

1.2 After 6 years, the draft debt repayment is released

As of March 2019, Mt.Gox still has 127,000 creditors.

On March 25, 2020, after a lapse of 6 years, the "Mentougou case" turned around again. Attorney Nobuaki Kobayashi, Mt.Gox's debt trustee, announced a draft debt repayment at the latest annual meeting of creditors. The main contents of the draft are as follows:

Creditors can choose to obtain compensation through fiat currency or BTC / BCH, and will pay priority to fiat currency claims and small claims (less than 2,000 US dollars).

The trustee once sold some BTC and BCH in early 2018. At present, all other crypto assets except BTC and BCH will be sold. The cash generated from the sale of crypto assets and BTC and BCH will become the source of funds for liquidation and distribution.

For fiat currency claims, the trustee will pay in cash. To ensure that fiat currency claims are paid first, when fiat currency assets are insufficient to pay, the trustee will sell part or all of the remaining BTC and BCH.

Regarding the BTC / BCH claim, the trustee will allocate the assets directly to creditors in proportion according to the disposal status of the assets, and the specific proportion has not yet been determined. If BTC / BCH is insufficient to pay off, the trustee will pay the insufficient part in cash.

1.3 140,000 BTC may flow to the market, the crypto market is facing even worse

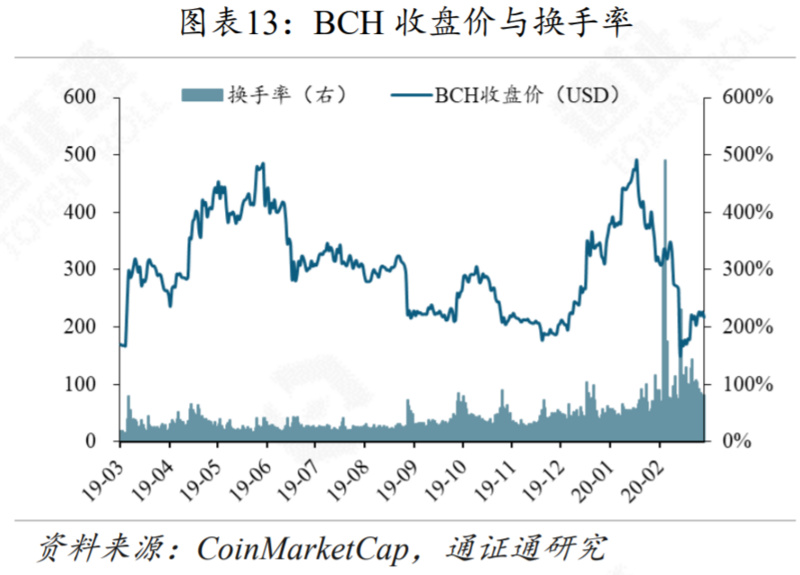

At present, there are approximately 141,000 BTC, 142,000 BCH, and a large number of other crypto token assets in Mt.Gox trustee accounts for debt settlement. This means that once the repayment draft is passed, these crypto assets will flow directly to the market and impact the market.

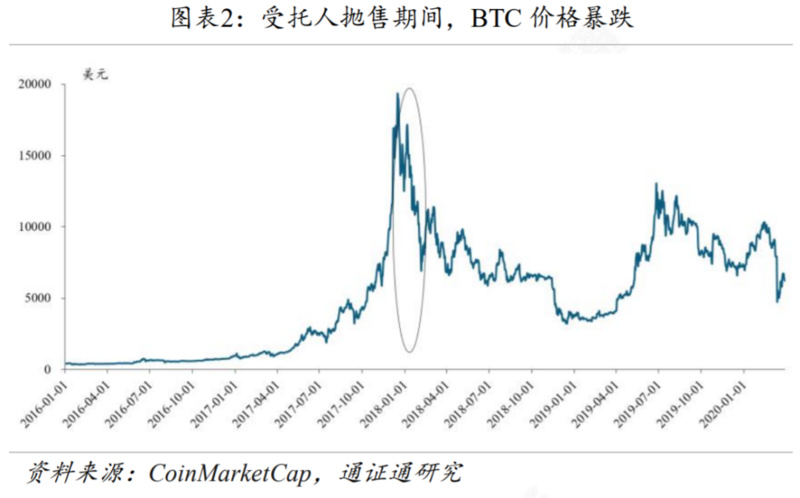

Previously, for the purpose of debt compensation, the trustee Nobuyuki Kobayashi sold 35,841 BTC and 34,008 BCH between December 2017 and February 2018. During this period, the price of BTC dropped sharply. By the end of April 2018, the price of BTC had dropped from $ 10,000 to around $ 6,000, a drop of nearly 40%.

The new crown epidemic swept across the globe, a liquidity crisis appeared in the macro market, and the crypto asset market experienced a diving market. Now that the shadow of Mt.Gox's “smashing disk” is reappearing, it may cause the risk of market selling, and the crypto market will be even worse in the winter.

2 Quotes: Market shocks rebound

2.1 Overall market: Digital token market value rebounded slightly

The ChaiNext Digital Asset 100 Index closed at 571.27 points this week, up 2.2%. The ChaiNext Digital Asset 100X Index closed at 1472.12 points, up 1.2%.

The total market value of digital tokens this week was 186.01 billion US dollars, an increase of 7.27 billion US dollars compared with last week, an increase of about 4.1%.

The average daily turnover of the digital token market was 131.38 billion US dollars, a decrease of 5.4% from last week, and the average daily turnover rate was 71.4%, which was a decrease of 13.5% from last week.

The BTC balance of the exchange this week was 679,000, which was 9818 less than last week. The exchange ETH balance was 15.0745 million, an increase of 116,000 over the previous week.

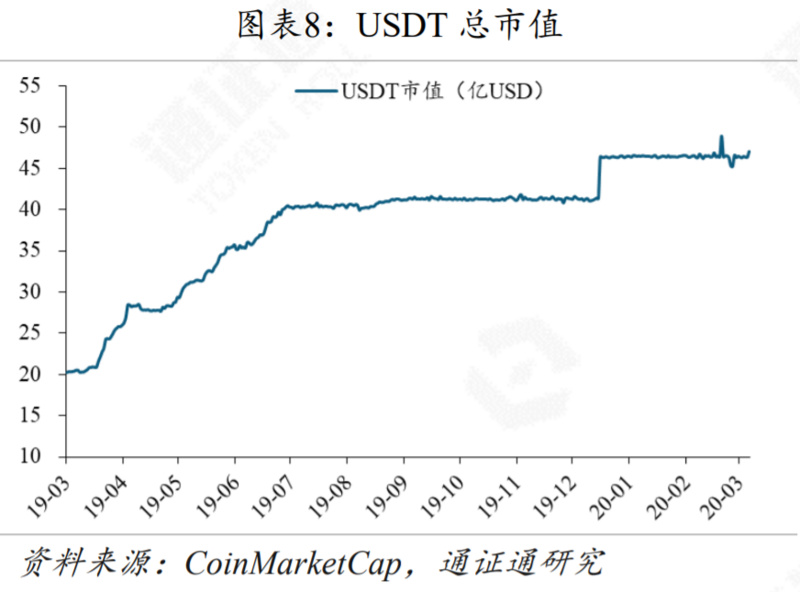

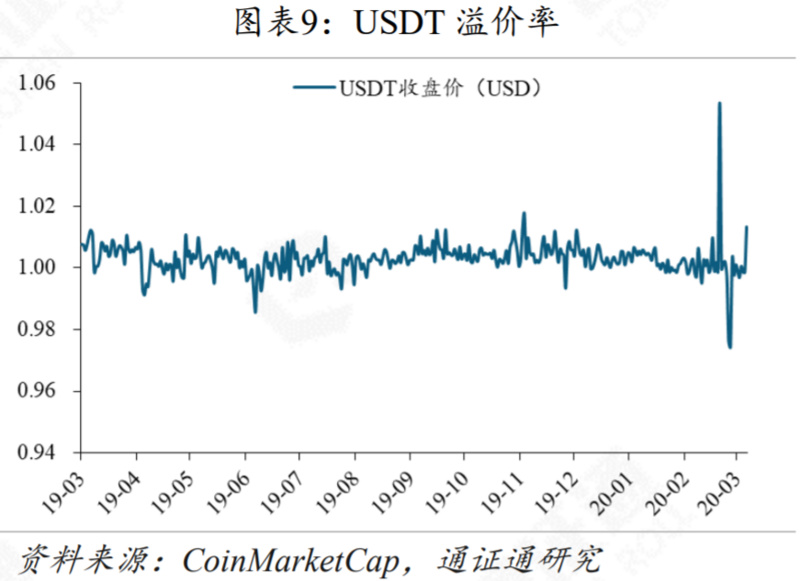

The market value of USDT is USD 4.7 billion, an increase of USD 73.17 million over last week, and the USDT relative to the USD premium rate has increased.

2.2 Core Tokens: XRP Leads Rise, Main Circulation Certificates Rebound

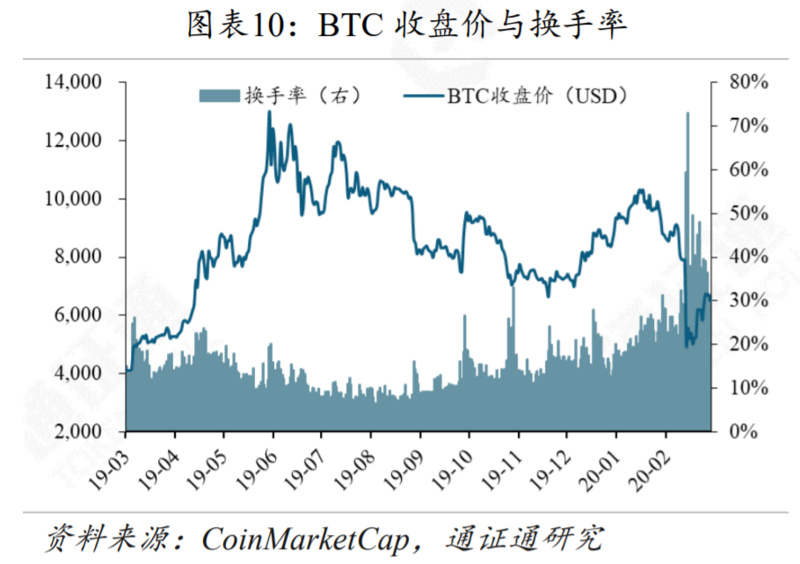

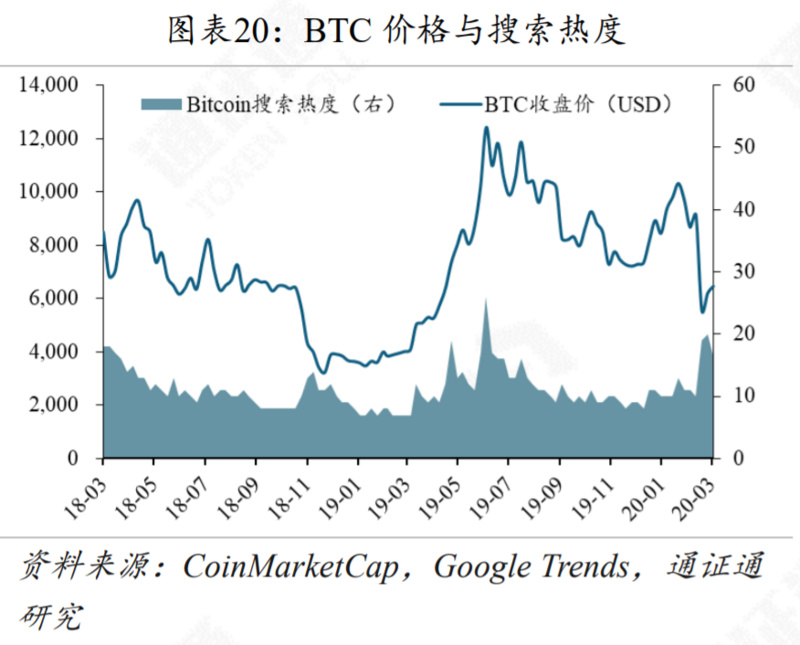

BTC's current price is $ 6469.8, with a weekly increase of 4.4% and a monthly decline of 26.7%. The average daily turnover is $ 41.7 billion and the average daily turnover rate is 35.5%. BTC prices have picked up.

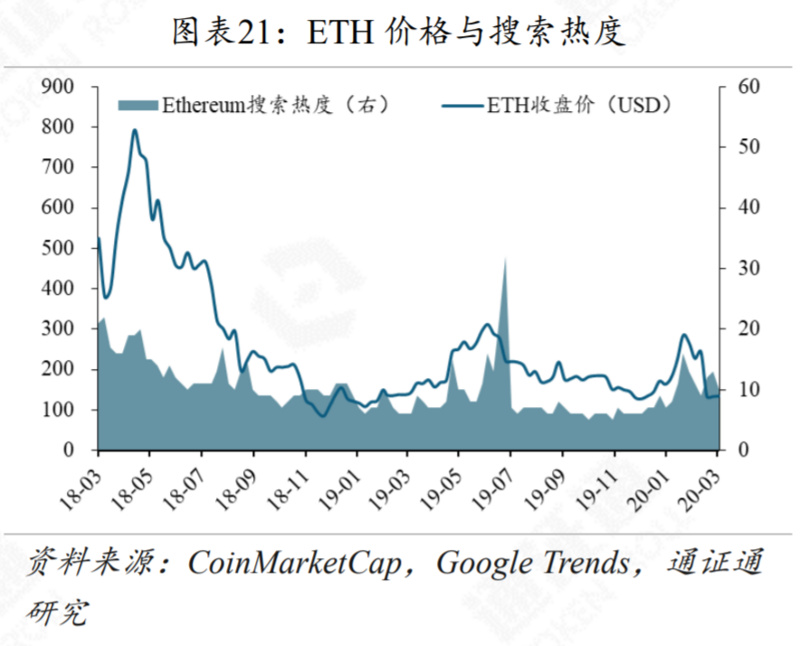

The current price of ETH is $ 133.94, with a weekly increase of 0.9% and a monthly decrease of 40.7%. The average daily turnover is US $ 13 billion, with an average daily turnover rate of 88.2%. ETH rebounded slightly with the market.

The current price of EOS is 2.24 US dollars, with a weekly increase of 1.8% and a monthly decrease of 36.9%. The average daily turnover is 2.78 billion US dollars, with an average daily turnover rate of 133.3%. EOS rebounded slightly.

BCH's current price is $ 217.58, with a weekly increase of 1.5% and a monthly decline of 31.3%. The average daily turnover is US $ 3.75 billion and the average daily turnover rate is 93.5%.

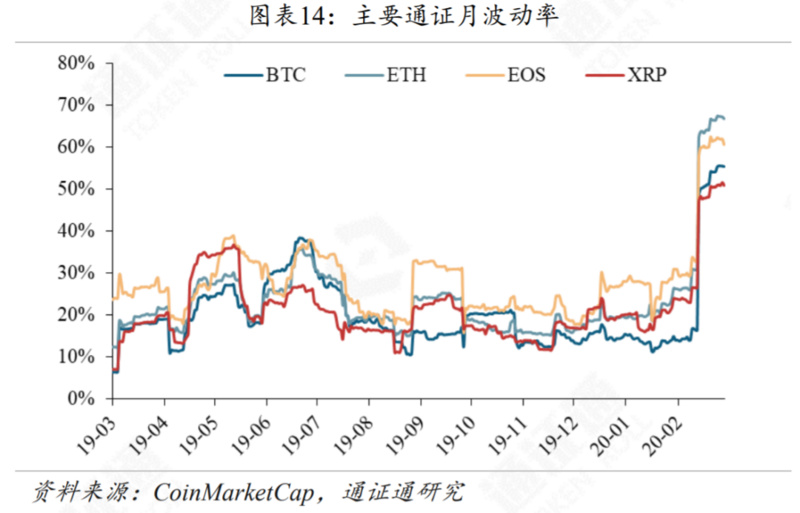

The monthly volatility of the main tokens this week is basically flat, and the price fluctuations are still relatively large.

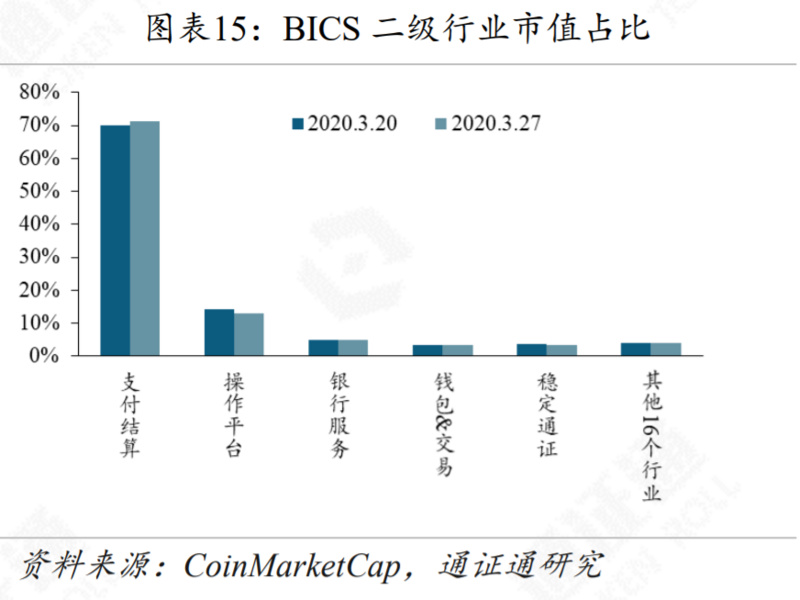

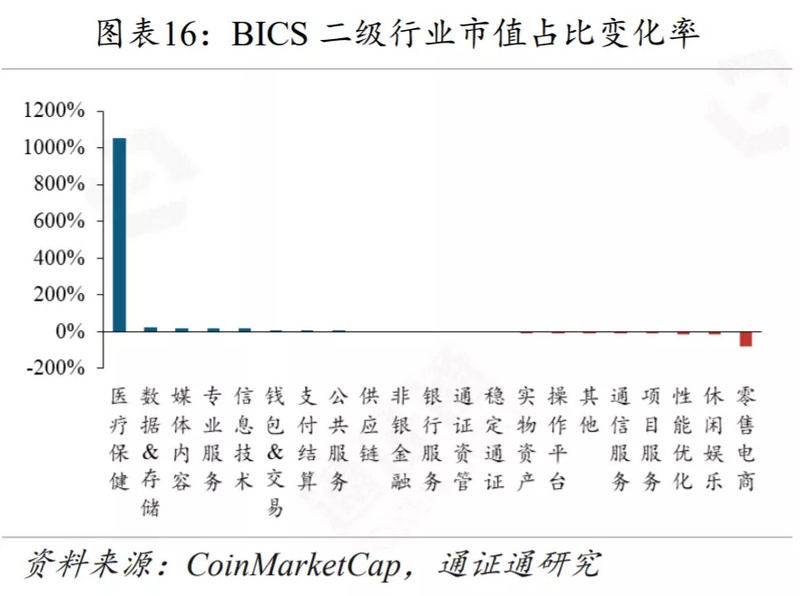

2.3 BICS industry: the proportion of healthcare industry has risen significantly

Among the top five BICS (Blockchain Industry Classification Standard) secondary industries in terms of market capitalization, the market value of the healthcare industry increased significantly; the market value of the retail e-commerce industry decreased significantly.

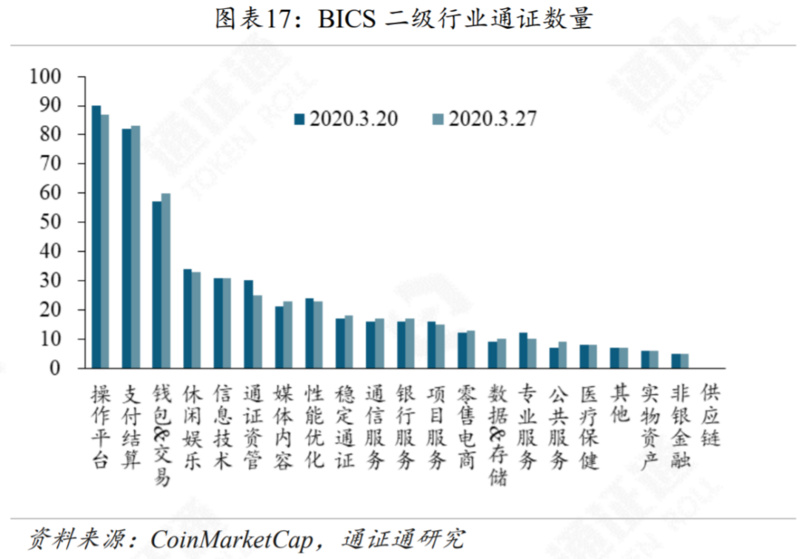

The BICS secondary industry that saw a significant increase in the number of tokens this week was payment settlement, wallets & transactions. The more obvious declines were operating platforms and token asset management.

The BICS secondary industry that saw a significant increase in the number of tokens this week was payment settlement, wallets & transactions. The more obvious declines were operating platforms and token asset management.

2.4 Market View: XRP Leads Rise in Crypto Assets, Market Turbulence Rebounds

XRP rose 12.3% in a week, leading the crypto asset market. The crypto market has continued to rebound slightly over the past week. Although the Fed announced unlimited QE this week, BTC price returned to $ 6,900. However, the poor fundamentals have affected the rebound of the crypto market. On the 28th, the bears made a comeback, and BTC dived 6% quickly, ending the big gains.

The market is volatile, so you need to control your position. The BTC halving market is approaching. The recent turbulent market has provided investors with a more suitable price. At present, it is still a good time to invest in digital assets such as BTC. Long-term currency holders can consider fixed investment or bargain hunting.

3 Output and popularity: BTC's difficulty decreases, and hashrate picks up

The difficulty of BTC decreased, and the computing power picked up. The mining difficulty of BTC this week was 13.91T, which is 2.64T lower than last week, and the average daily computing power is 100.4EH / s, which is 5.8EH / s higher than last week. The mining difficulty of ETH this week is 2201.9, which is 11.61 higher than last week. The average daily computing power is 176.1 TH / S, which is 2.5 TH / S higher than last week.

This week, Google Trends calculated that the search term for Bitcoin terms was 16, and the search term for Ethereum terms was 10, which was basically the same as last week.

4 Industry Highlights: Continued Turbulence in the World Economy

4.1 The United States launched a huge rescue plan, with a total size of US $ 2 trillion

The huge US stimulus bill to deal with the new crown epidemic has been signed into effect by President Trump, and has a bill of 880 pages, with a total size of $ 2 trillion. At the same time, the Fed will also launch $ 4 trillion to stabilize financial markets.

4.2 Blockchain will become an important player in supply chain finance and trade finance innovation

On March 28th, the "Power Blockchain Financial Scenario Application Report" of the Think Tank was released. The report points out that in 2020, blockchain will become an important player in supply chain finance, ABS, and trade finance innovation. In the constantly accelerating digitalization process, financial institutions have to accelerate the pace of financial business innovation. Blockchain technology, as an important driving force for the development of the digital economy, will also become an important bridge for the financial industry to embrace the digital economy.

4.3 CME's BTC futures trading volume hits recent lows

TradeBlock research director John Todaro recently tweeted that by far the largest trading venue for BTC derivatives, CME's futures trading volume is much lower than that of spot exchanges: "Although March BTC (XBT / USD) spot The trading volume reached a recent high, but the CME futures trading volume hit a recent low. "Todaro pointed out that since the BTC price reached nearly $ 14,000 in July last year, the spot trading volume of crypto exchanges has been at the highest level. However, CME's futures contract trading volume is close to its lowest level in the same period. So he questioned that institutional traders might not be involved in the recent extreme trend of BTC.

Notes:

For some reasons, some of the terms in this article are not very accurate, such as: tokens, digital tokens, digital currency, currency, tokens, crowdsale, etc. If you have any questions, you can call the letter and discuss together.

For the original report, please refer to the research report released by [Tongtongtong Research]: "Mentougou" welcomes the compensation draft, and the shadow of the disk is reproduced-Blockchain Weekly Report 200329

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- China's blockchain landscape moves west: Gansu 14 cities deploy blockchain service network

- DeFi Monthly Report | MakerDao encounters the most severe test in history

- Article describes the type, scale and trend of stablecoins

- On the Equity of Currency Stocks and Token Economy: How to Coordinate to Generate Synergy

- USDT issues more than 10 billion in six days. In a bear market environment, stablecoins become the biggest winners

- Free and Easy Weekly Review | "House N" Reflects the Weakness of Privacy and Sees How the "Sky Eye" of the Chinese Academy of Sciences Breaks the Game

- Discussion on anti-counterfeiting, anti-intrusion and tampering, and blockchain technology to improve the security of drone operations