Asia has set off a boom in virtual banking, and native banks have broken the cocoon in the digital currency era

Text: Interchain Pulse · King Go

On March 31, Xiaomi and Starbucks, a Hong Kong virtual bank owned by AMTD Wealth, officially opened trial business. Starbank is the second Hong Kong virtual bank to open trial business after Zhongan Bank. If nothing else, six more virtual banks will be launched gradually.

Not only Hong Kong, but also the "wave" of virtual banking in the Asia-Pacific region. Taiwan, Singapore, Malaysia, and many other countries have actions and plans to issue virtual banking licenses. And its effect will also appear in 2020.

The layout of virtual banks in the field of fintech in many places is seen as a benefit to the field of blockchain. In fact, the development of Hong Kong's virtual banks has a deeper connection with the advancement of the central bank's digital currency. Virtual banks may be an important part of the development of the central bank's digital currency.

- Coinbase CEO: Almost every economic field is struggling, and Bitcoin is the currency people need at this moment

- New Korean law proposes ban on crypto asset mortgage lending, DeFi platform may be banned

- Blockchain Weekly Report | “Mentougou” Welcomes Draft Compensation

The "wave" of virtual banks in the Asia-Pacific region

The so-called virtual banks are clearly defined in the revised version of the Guidelines for the Recognition of Virtual Banks by the Hong Kong Monetary Authority. They mainly refer to banks that provide retail banks through the Internet or other forms of electronic transmission channels rather than physical branches. That is, only online operations are supported, no physical branches are set up.

This concept is not new. Prior to Hong Kong, China, the United States and the United Kingdom had opened their doors to virtual banking. In addition, in 2015, South Korea also issued Internet banking licenses.

After Hong Kong, financial regulators in the Asia-Pacific region have come together to issue and plan to issue virtual banking licenses in 2019. On the FinTech track, competition is particularly intense in several regions.

(Tabulation: interlink pulse)

The first is Hong Kong, China. As early as May 2000, the Hong Kong Monetary Authority issued the "Virtual Bank Recognition" guidelines, but no action has been taken since then. Until 2012, the Hong Kong Monetary Authority updated the guidelines. In May 2018, the Hong Kong Monetary Authority revised and formally issued the guidelines.

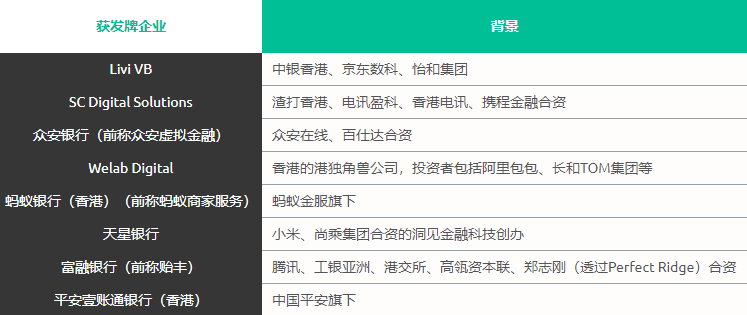

As of the application date in August 2018, nearly 30 companies have applied for virtual banking licenses to the Hong Kong Monetary Authority. In the end, after multiple rounds of competition, the Hong Kong Monetary Authority issued a total of eight virtual banking licenses in March-May 2019.

From the shareholders' background of the licensed company, the fintech attributes of the eight companies are obvious. Technology shareholders include Alibaba (Ant Financial), Tencent, Xiaomi, JD.com and other Internet companies. These companies have the strength of blockchain construction. Financial shareholders include ICBC, Bank of China, Ping An and other financial institutions. These institutions have also explored Blockchain field.

(Image source: Public Network)

Among them, Tencent, a shareholder of Furong Bank, said at a blockchain conference in November 2019 that Tencent has been granted a virtual banking license by the Hong Kong Monetary Authority and is preparing for a virtual banking blockchain project. . This should indicate that Tencent may use blockchain technology as the underlying technology for virtual banking.

In addition, in terms of the development of specific business of virtual banking, companies such as Ping An Yitong Bank, JD.com, Insight Financial Technology Co., Ltd., and Livi VB Limited have publicly stated that they will use related technology applications such as blockchain as the core driving force.

And shortly after the issuance of the Hong Kong Virtual Banking License, the Monetary Authority of Singapore stated in June 2019 that it would open two types of applications for up to 5 virtual banking licenses in August. Among them, two are complete virtual banking licenses, which can provide a relatively wide range of financial services and absorb deposits from retail customers; three are enterprise edition virtual banking licenses, which are limited to enterprises and are not allowed to face the retail market. The first batch of licenses is expected to be announced in mid-2020, and the approved banks are expected to be officially operational by mid-2021.

With the opening of its application, it was reported at the beginning of this year that Ant Financial, Tencent, Xiaomi, Toutiao, etc. have successively announced that they have applied for Singapore's digital banking license. In addition, one of the disclosed applicants is a blockchain technology company and is also a state-owned holding company in China-Beijing Qidi Blockchain Technology Development Co., Ltd.

At the same time, Interchain Pulse is concerned that Ant Financial has stated that after obtaining a license, it will use cutting-edge technologies in the blockchain and other fields to improve user experience and use technology to bring more equality to Southeast Asian consumers and small and micro enterprises. Development opportunities to empower the real economy.

It can be seen that both the virtual banks that have obtained a license in Hong Kong and the virtual banks that have applied for a license in Singapore have plans to explore a combination of technologies such as blockchain. Taiwan, Malaysia, and other places seem to have few introductions and attempts in this direction.

In July 2019, the Taiwan Financial Regulatory Commission issued the first batch of virtual banking licenses, which were obtained by Rakuten International Commercial Bank, LINE Financial Taiwan, and Next Commercial Bank. Behind these three companies are also the power of large consortia and large enterprises, such as Japan's Rakuten and LINE, as well as state-owned banks and telecommunications operators.

In December 2019, the Central Bank of Malaysia plans to issue regulatory guidelines for the operation of Malaysian virtual banks, and the draft is expected to be submitted to the Central Bank by February 2020. Once regulations for the industry are in place, the Malaysian Central Bank is expected to issue 5 permits. Currently known applicants also have the presence of technology giants.

Or prepare for central bank digital currency use cases

The reason why virtual banking licenses can attract many enterprises and institutions in many regions and countries is because of their scarcity, and more importantly, because they have unique advantages in the field of fintech development.

First of all, the most superficial advantage is cost. Virtual banks have lower expenditures on human resources and infrastructure. Enterprises that have obtained virtual banking licenses can use low-cost models to conduct banking business.

Secondly, for non-bank institutions in China that have difficulty obtaining a banking license, virtual banking will be an important part of improving the financial layout. Especially in Hong Kong and Singapore, which are "Asian financial centers", the development of virtual banks will expand their markets to the entire Asia-Pacific region and English-speaking countries.

What is more critical is that the pulse of the mutual chain pays attention to the significance of promoting the development of virtual banks in Hong Kong, China and the digital currency of the central bank.

In December 2019, the Hong Kong Monetary Authority and the Central Bank of Thailand are conducting a joint research project Project LionRock-Inthanon to explore the application of central bank digital currencies in the field of cross-border payment and settlement. Hong Kong virtual bank ZA Bank will rely on its blockchain technology and R & D capabilities to undertake project delivery and participate in testing.

The Zhongan banking industry started the trial business in the same period.

In addition, the mutual chain pulse is concerned that the development of Hong Kong's virtual bank and the Hong Kong Central Bank's digital currency cooperation project can be described as accompanying. From March to May 2019, the Hong Kong Monetary Authority issued a virtual banking license. Also in May, the Hong Kong Monetary Authority and the Thai Central Bank signed a Project LionRock-Inthanon Memorandum of Understanding, and the project was officially launched in September.

It is reported that before the start of the project, Hong Kong, China and Thailand had been conducting research on digital currency of the central bank. In 2017, the Hong Kong Monetary Authority conducted a CBDC study, namely the LionRock project, and concluded that the issuance of CBDCs for retail payment purposes has limited prospects and has greater potential for cross-border payments. In 2018, the Central Bank of Thailand (BOT) also launched the Inthanon project and recognized the value of the central bank's digital currency in the cross-border payment scenario.

Both parties believe that by using blockchain, liquidity management and savings mechanisms can be automated, thereby making the payment process more fluid. Cross-border capital transfers can be done in real time, with fewer intermediaries and settlement layers involved.

As a result, the Hong Kong Monetary Authority and the Central Bank of Thailand led the participation of 10 banks from both places to advance research on central bank digital currency cross-border payment scenarios. The project report shows that the project will build a cross-border "corridor network" with technical support provided by R3, which is built on Corda, R3's blockchain platform. The participants of the network are the LionRock network including Zhongan Bank, and participating banks of the Inthanon network. The participating banks can hold the DR-THB and DR-HKD tokens for cross-border fund transfers and transactions.

Among them, the participation of virtual banks is not only a key node in the central bank's digital currency cross-border payment scenario, but also provides blockchain R & D support for the practical use cases of central bank digital currencies. From this perspective, virtual banks seem to be Hong Kong's active preparations for the development of the central bank's digital currency.

However, except for Hong Kong, China, virtual banks in several other regions have not yet been clearly linked to blockchain and digital currencies. However, given the adaptability of the blockchain to the application scenarios of virtual banks, more explorations and combinations will emerge in the future.

This article is the original [Interlink Pulse], please indicate the source when reprinted!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Watch | Singapore Payment License Waiver Buffers for 4 Months, Exchange Faces Final Test

- Popular science | Customs passwords in the digital age: privacy calculations help data "refining"

- Babbitt Column | Bitcoin has experienced two extreme quotations in half a year. What do they have in common?

- Babbitt Column | Blockchain-Mathematics Reshapes Trust from Human History

- China's blockchain landscape moves west: Gansu 14 cities deploy blockchain service network

- DeFi Monthly Report | MakerDao encounters the most severe test in history

- Article describes the type, scale and trend of stablecoins