Perspective | MakerDAO's Multi-Pledged Collateral System Upgrade from Data Visualization

This article was written in collaboration with the Block Analitica team, which has developed analysis tools for activities on the Ethereum blockchain (mainly MakerDAO and DeFi projects). The founder of Bolck Analitica is Primož Kordež, who regularly contributes Dai-related statistics to the governance of MakerDAO and the broad DeFi community.

Introduction: MakerDAO Upgrade

On November 18, 2019, MakerDAO's multi-collateral DAI (MCD) upgrade was activated on the mainnet, which is the most anticipated milestone of the largest DeFi project to date.

Before November 18, on the MakerDAO platform, users could only obtain SAI stablecoin loans by pledged ETH (SAI refers to the token issued by the single-collateral DAI (SCD) system before activation). After the upgrade in November, the types of pledges were relaxed, and users could obtain DAI stablecoin loans by pledging multiple tokens. During the upgrade, SAI holders can exchange SAI for DAI at a price of 1: 1. SAI still exists, but in the future, the administrators of the MakerDAO community will shut down the SAI platform by voting to ensure that the DeFi community will switch to the multi-collateral DAI system.

- Analyst: China's central bank digital currency will not affect the crypto market in the long run

- Digital Democracy and Governance 2.0: How Does Blockchain Innovation Affect From Bitcoin to DAO?

- Are Bitcoin's soaring and plunging all "giant whale" control disks? Data revealed on the chain

Note: To clarify, "SAI" refers to the token issued by the single-collateral DAI platform (abbreviated as SCD); "DAI" refers to the token issued by the multi-collateral DAI system (abbreviated as MCD).

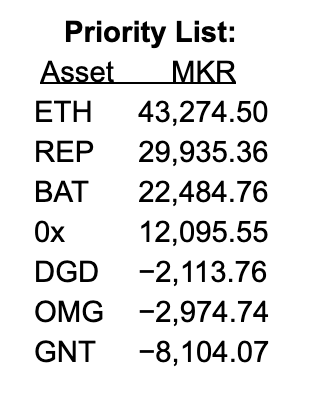

The types of pledged types supported by the new platform can be changed. Use the MakerDAO governance process (that is, voting by MKR holders) to add or remove supported pledged product categories. As of January 2020, the types of collateral supported by the MCD platform are ETH and BAT (digital advertising tokens for the Brave project). However, as long as the vote passes, other tokenized assets can also be used as collateral.

After supporting multiple collateral, MakerDAO has two additional upgrades. First, the new system now supports the use of DAI instead of MKR tokens to pay the stabilization fee (which is actually loan interest) (the original SCD platform used MKR to pay the stabilization fee). In addition, unpaid stability fees will continue to add to your debt. Originally in SCD, as long as the price of ETH remained stable, you would never be closed out; in MCD, your debt will always grow. If you do not pay interest, you will be closed one day.

The second major upgrade is the DAI Savings Rate (DSR), which means that DAI holders can use DAI to earn interest. This mechanism is actually a new way for MakerDAO to regulate the demand side of DAI. Originally, their monetary policy only had a way to change the stable rate. Now, the stabilization fee can regulate the supply side, and the DSR can regulate the demand side. Using DSR is also very simple. Users only need to send the DAI to a smart contract, and they do not need to bear the risk of the counterparty to obtain benefits.

DeFi Governance and Operation Success Stories

Statistics related to DAI

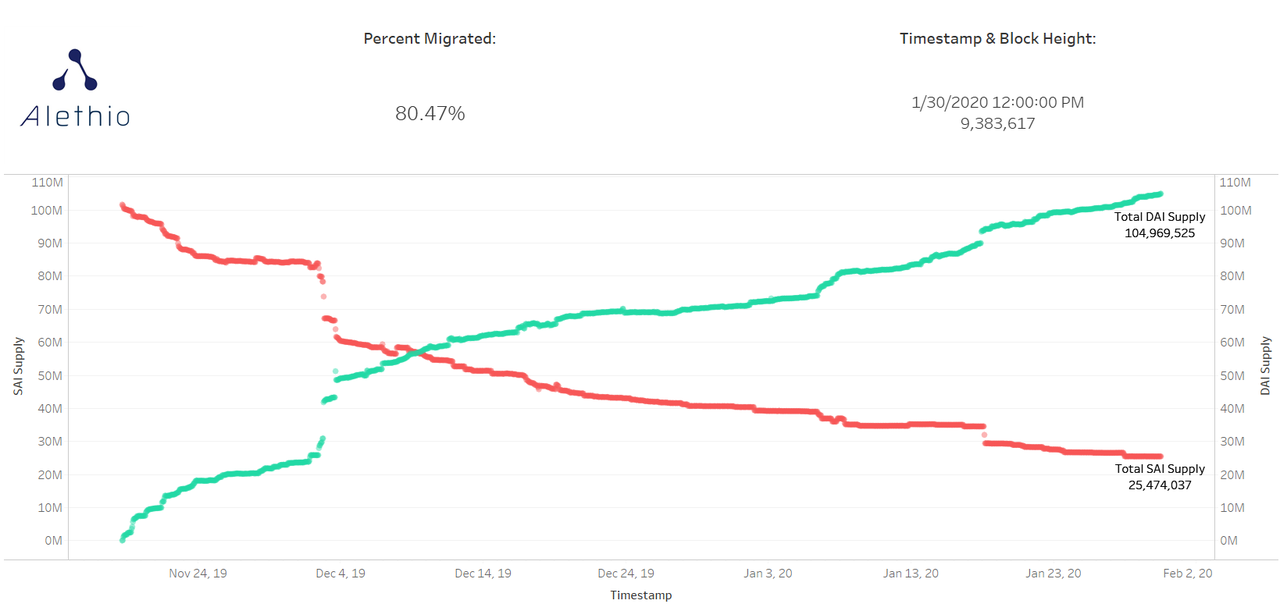

To this day, DAI has proven successful. By December 17, up to 50% of the circulating SAIs had successfully migrated to DAI, which was just one month after the activation of MCD.

BAT token is the first collateral other than ETH that was voted and included in the MCD system. Although BAT is a new collateral, the acceptance rate is quite good, but WETH (ETH encapsulated as ERC-20 token) is still the largest collateral (the size of BAT collateral is about 4.5 million US dollars, while WETH is 300 million $ 55 million (as of January 30, 2020). However, if we compare the relative market value of the two tokens, we find that the lock ratio is similar: 1.5% of BAT is locked into the MakerDAO system, and ETH is 1.8%.

Note: Although the overwhelming majority (99.82%) of the vote on BAT supports this token as a collateral, it is not the one that gets the most votes when voting. Augur's REP token won the vote at the beginning, but Maker's risk governance team assessed that Augur is about to release v2, so the risk of REP price fluctuations is too great and should not be accepted as collateral.

-Figure 2. Maker's new pledged ticket ranking. Data source-

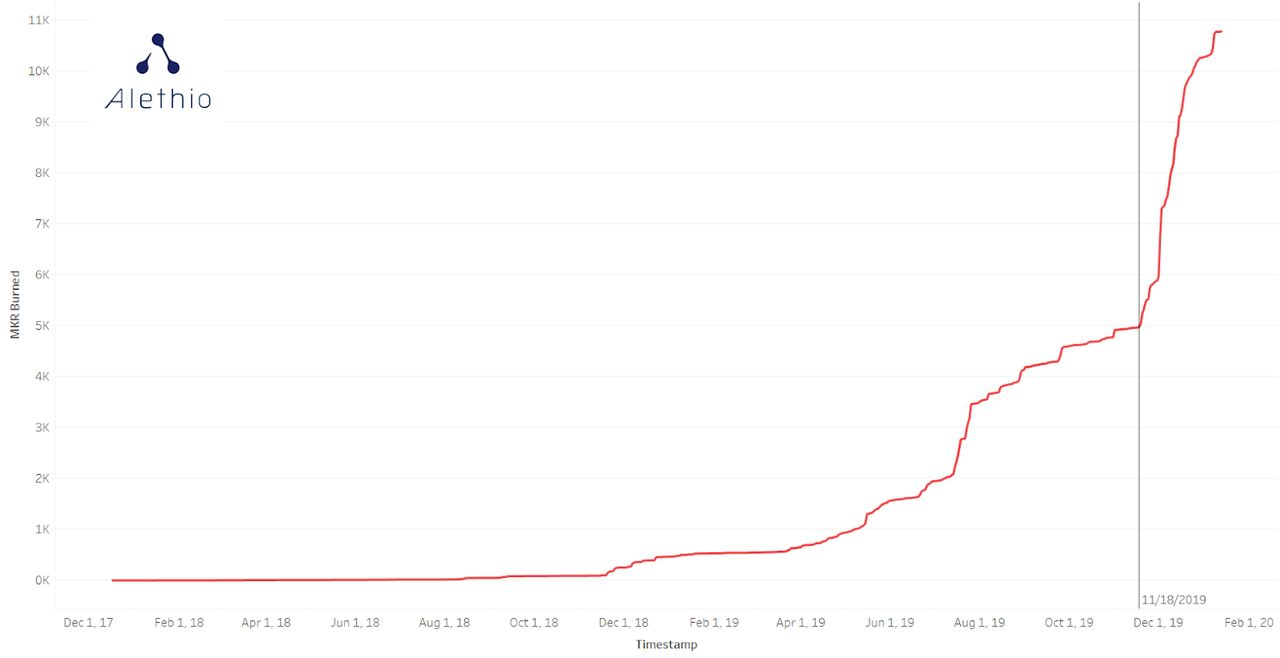

MKR has two functions: governance and profit. Holding MARK can get voting rights proportional to the number of MARKs. As a functional token, MKR is also used to pay SAI's debt stabilization fees. These MKRs used to pay the stabilization fee will then be destroyed, causing MKR deflation. The initial supply of MKR was 1 million; now 11,000 MKR have been destroyed, so the current supply is 989,000. MCD upgrades and migrations require SAI debt positions to be closed to trigger stabilization fee payments. It is expected that the destruction of MKR will increase. And within a week of upgrading, we did see an increase in destruction rates.

-Figure 3. MKR destruction before and after MCD migration-

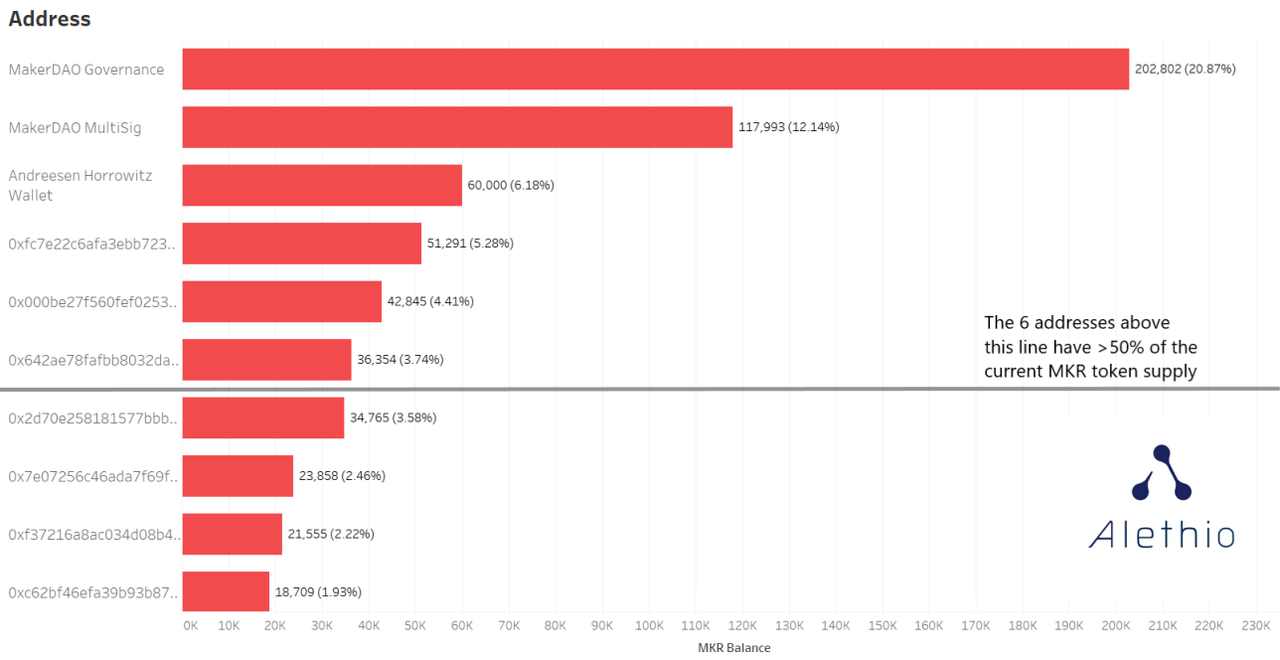

There are now 17,000 addresses holding MKR tokens *. The amount held by the first three large currency holders totaled 38% of the total supply of the station (the first six large currency holders held more than 50%). The first three addresses belong to: (1) MakerDAO governance contract (202,000 MKR); (2) MakerDAO team multi-signature wallet (117,000); (3) Andreessen Horowitz (also known as "A16Z") Wallet, 60,000) (They bought 6% of MKR at a 25% discount last September).

-Figure 4. The holdings of the top 10 MKR holders; above the horizontal line, they account for 50% of the total-

* The number of holders is based on the number of different addresses that have participated in a total of approximately 611,000 MKR flows; their holdings are also obtained from the addresses. Most holders hold more than zero.

CDP-related statistics

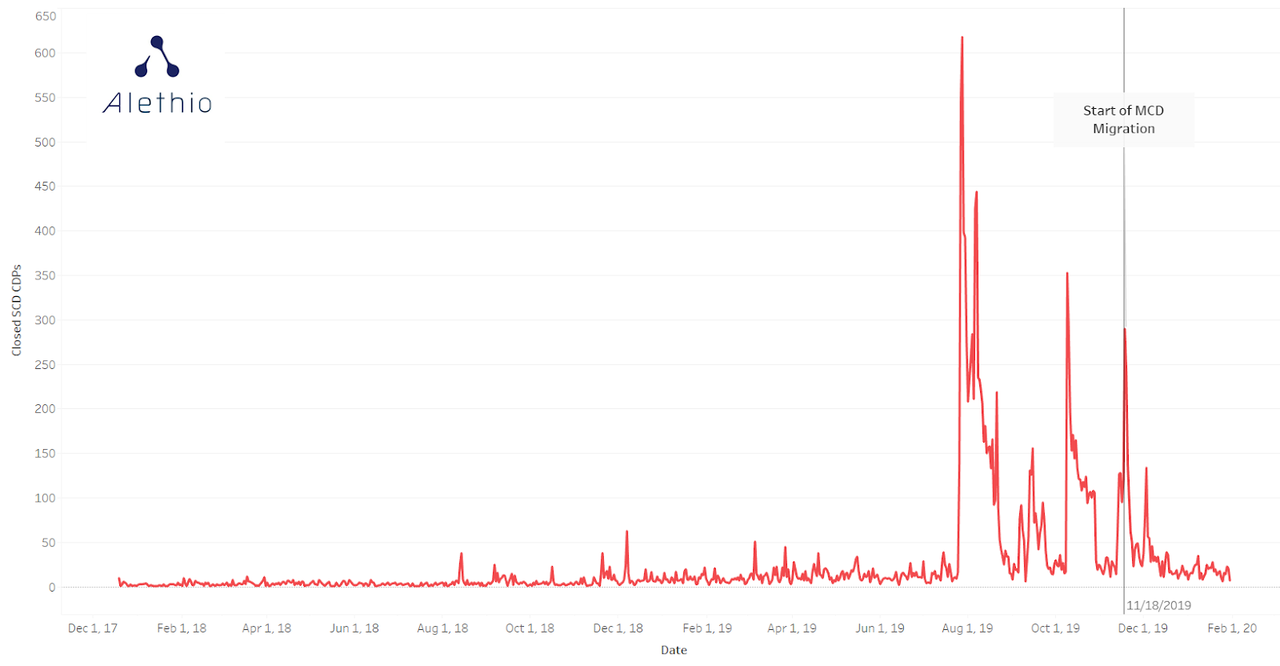

On the SCD platform, users have opened more than 154,000 CDPs in total (CDP is the unit of SAI debt). Most CDPs are still open and have not been closed; only 19609 CDPs have been closed, of which 2587 CDPs were closed after the migration started.

-Figure 5. Timeline of closing SCD CDP-

Measured by the number of locked collaterals, the largest CDP is # 3088, which was opened on August 28, 2018, and there are still 187.72 peths locked in the system as collaterals. The debtor of the CDP (address 0x … 50a9 ) has lent out more than 10 million SAIs and repaid 23% (with outstanding debt up to 8.28 million SAIs) and a stabilization fee of up to $ 800,000.

The CDP pledge rate is 331%, far exceeding the system requirement of 150%. Compared to the value of the pledge required by the system's minimum pledge rate, the user has locked in an additional $ 15 million. If you add up all the current CDPs, the pledge rate will exceed 300%. This means that more than half of the ETH pledged in the SCD system is only used as insurance to prevent the ETH price from plummeting and CDP being closed. Keeping other conditions unchanged, the price of ETH will plummet to less than $ 80, and the CDP pledge rate remaining in the SCD system will drop below 150%.

However, what is more interesting is that we can see how the SAI debt positions left in the SCD react to the actual fluctuations in the ETH price-just look at the recent situation in November and December 2019. In the first month after the MCD was launched, the price of ETH fell by more than 30%, from $ 183 to $ 122 (first from $ 183 to $ 140 between November 18 and 25; then in December Falls between $ 11 and $ 18). However, slow and steady declines do not affect users very much, and rapid, almost cut-down price drops will cause damage.

During this period, a total of about 38,000 ETH was liquidated. The day with the largest liquidation volume was November 22, and a total of 19404 PETHs were liquidated that day (the largest liquidation volume in a single CDP was CDP # 16,843, a total of Liquidated 9839.89 PETH ).

On average, a 7.2% drop in the ETH price is sufficient to trigger CDP liquidation (this number is derived from the average price drop of more than 1000 PETH on the date of liquidation).

Just a rough calculation, you know, the market liquidator made about $ 170,000. Note that the liquidator's income comes from the discounted discount of the liquidated CDP collateral when it is sold at a discount. The income here is based on the assumption that the liquidator receives a full 3% discount, but it does not always get so much. Because of Gas price, liquidity, accuracy of ETH price injection, etc. This estimate also uses the average ETH price during this period, $ 149.

Migration process

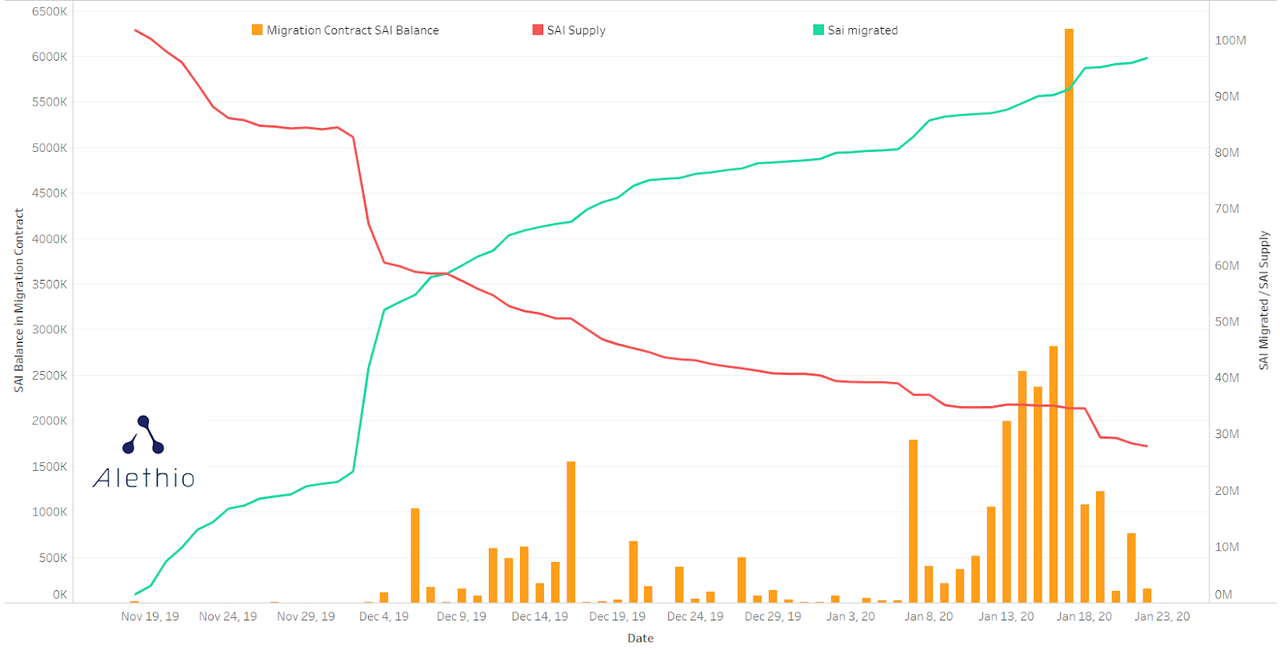

The reason why we can witness the smooth migration of MakerDAO in the last two months of 2019, thanks to the realization of the equity contract, the contract will hold the migrated SAI, and allow SCD CDP to use this SAI to quickly transfer debt The position is transferred to the multi-collateral DAI system.

The SAI held by this contract is called saiJoin, and during the migration period, the total SAI inflow was about 99 million SAI (accounting for 97% of the total SAI supply at the beginning of the migration period). However, there were also a large number of CDP openings during the migration period, supplementing a large amount of SAI liquidity. This is to be expected, as SCD CDP requires SAI liquidity to liquidate positions (ie purchase of collateral in CDP), and in addition, there are SAI borrowers on secondary platforms like Compound. Therefore, more than 38 million SAIs were cast during the migration period, providing sufficient SAI liquidity for borrowers' deleveraging and migration.

Figure 6 shows how the SAI inventory in the migration contract was quickly consumed before the last two weeks; in the last two weeks, SAI began to hoard in the migration contract, indicating that CDP's debtor interest in migration has diminished.

-Figure 6. SAI balance in migration contract vs. migration process-

Remaining SAI holders and borrowers

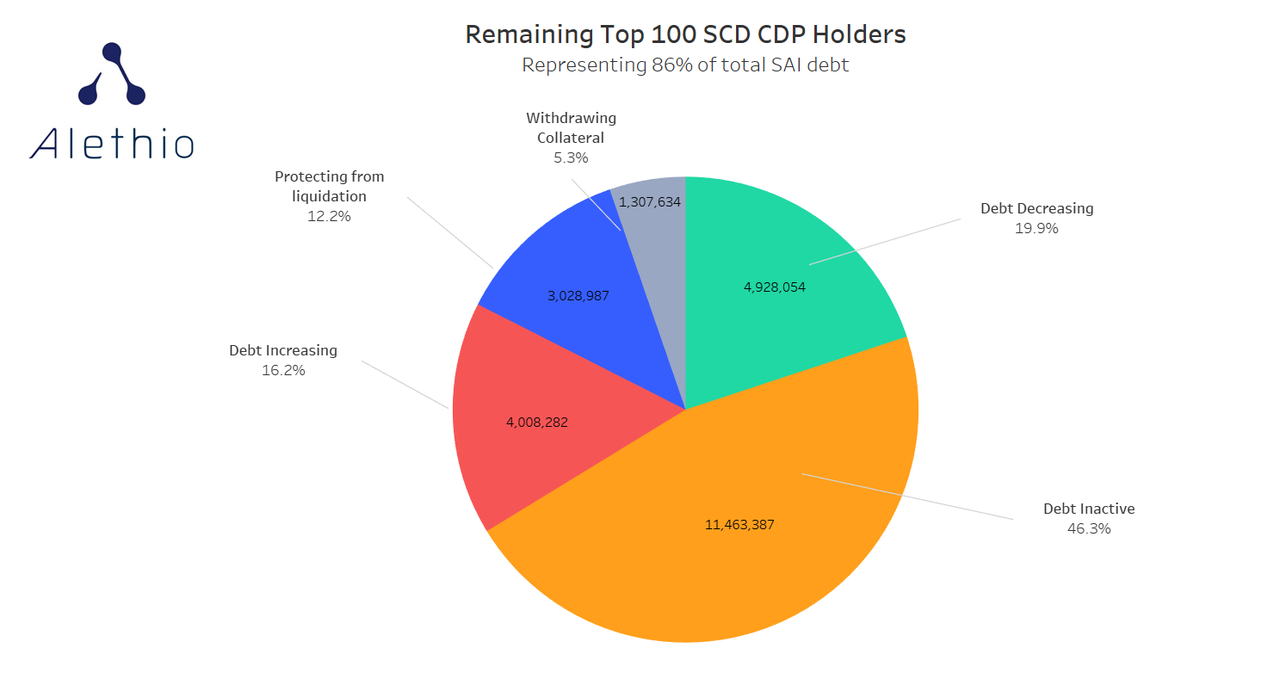

MakerDAO's governance process is considering when to urgently shut down the SCD platform to fully migrate to the MCD platform. Analyzing the remaining SAI holders, the CDP distribution of SAI debt, and their activities will become an important reference in decision-making.

Of the largest 100 CDPs (which together constitute 86% of the total SAI debt), 30 CDPs were completely silent during the migration period; they constituted $ 11.5 million of the 100 largest CDPs of the remaining SAIs, and their final One operation was 6 to 12 months ago. This group of debtors has also accumulated large amounts of stability fees that have not been repaid. They accounted for 1.2 million SAIs out of the total outstanding stability fees of SAIs (2.2 million SAIs). The largest unpaid stabilization fee is from CDP # 3088, which has an unpaid stabilization fee in excess of $ 800,000 (equivalent to 10% of its remaining SAI debt).

CDPs that have repaid stabilization fees are only $ 5 million, or only 20% of all SAI debt. Perhaps only these CDPs are seriously considering moving quickly. Other CDPs are either casting more SAIs or adding more ETH collateral to the debt warehouse (about 7 million SAIs, an increase of 28%).

-Figure 7. Status of the largest 100 remaining CDPs (46.3% do not move; 19.9% reduces the size of debt; 16.2% increases the size of debt; 12.2% increases collateral to prevent liquidation; 5.3% are reducing pledges)-

Like SAI CDP debtors, SAI holders are also very concentrated. The addresses of the top 100 SAI households controlled 75% of the remaining SAI supply and are now 28.5 million SAIs. However, many of these addresses belong to the DeFi project liquidity pool, such as Compound's cSAI funding pool (which holds 2.4 million SAI, but there are actually hundreds of users). More than 6 million SAI holders of addresses with known identities, most of which are secondary lending and trading platforms, were disclosed by Etherscan. This part of the supply should be migrated to DAI, because SAI's liquidity is getting worse and worse, and compared with the DAI lending market, the interest earned is getting less and less.

fluidity

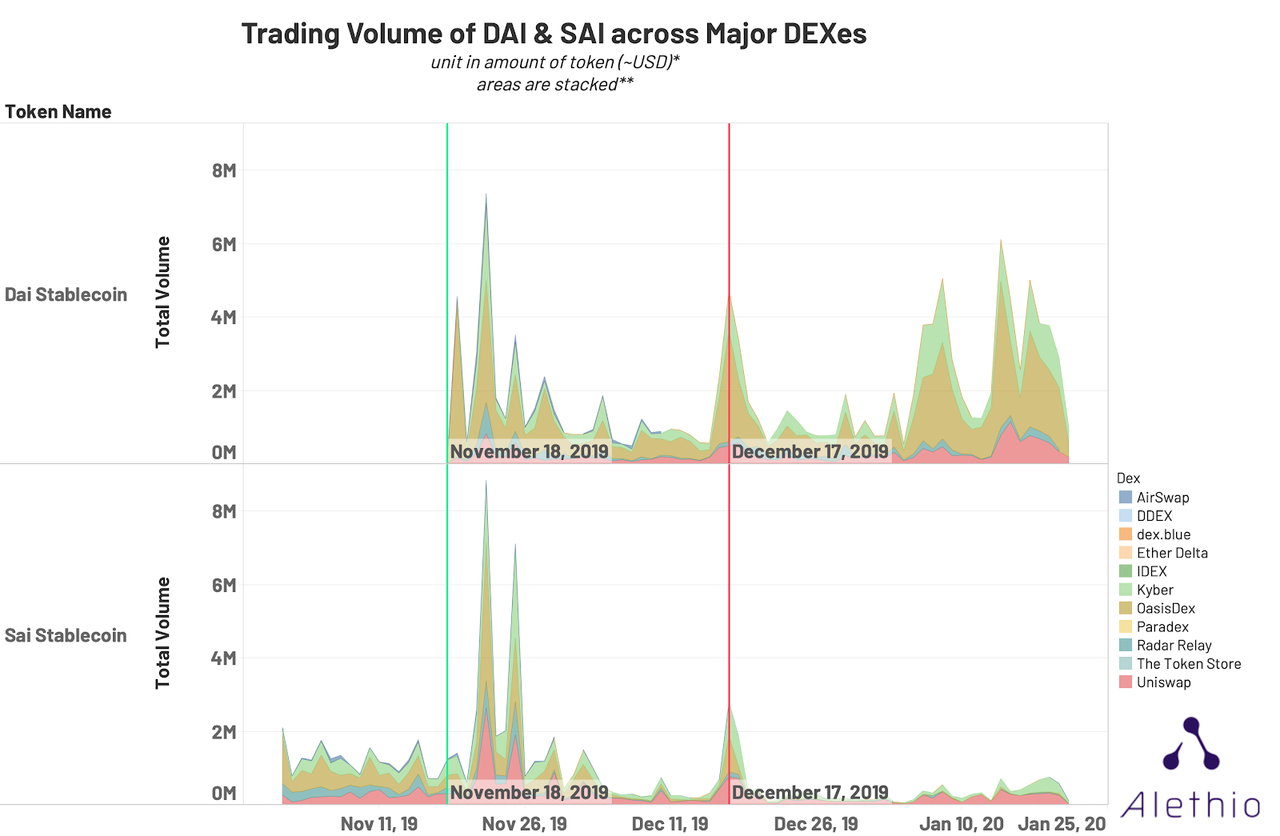

During the migration period, SAI trading activity on various decentralized exchanges (DEX) decreased significantly. Right now, only SAI liquidity is good on Uniswap and Kyber, with an average daily trading volume of about $ 250,000 last week. Uniswap has SAI liquidity of approximately $ 1.2 million; DAI has liquidity of $ 2.9 million. This has become a big problem for the remaining CDPs in deleveraging, especially those CDPs that are still raising their pledge rate and preventing themselves from being liquidated.

-Figure 8. SAI and DAI trading volume on major decentralized exchanges-

Subprime lending market

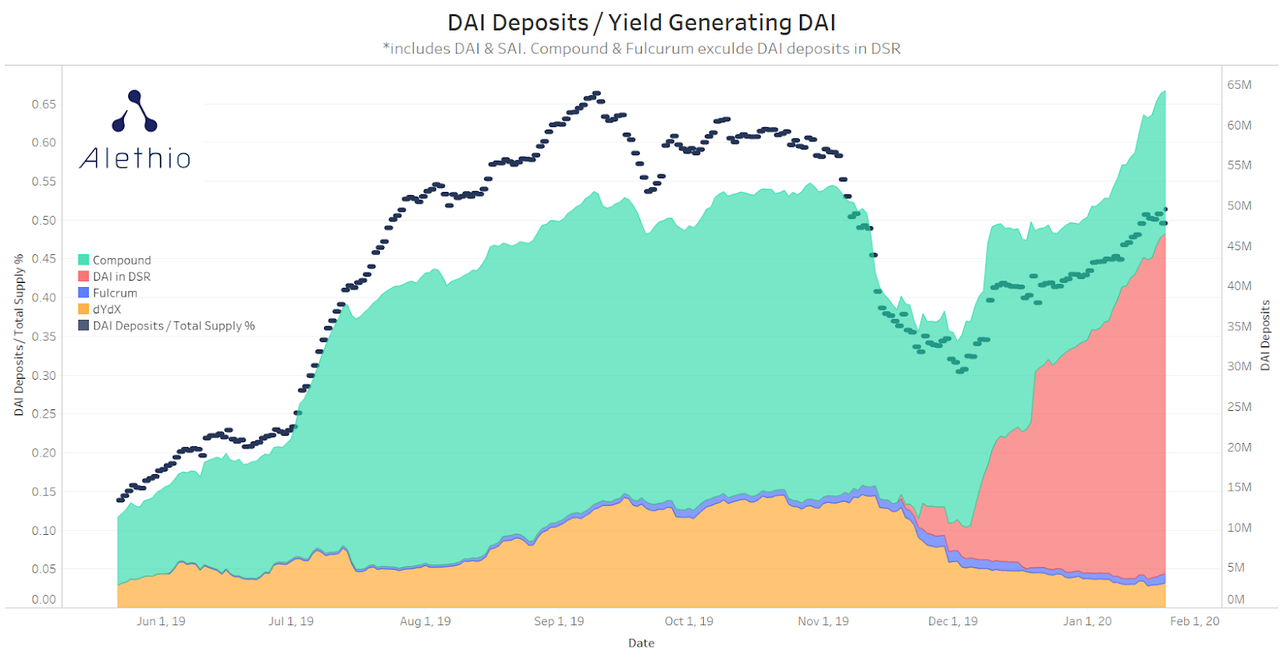

The introduction of DSR on the MCD platform has brought a strong competitor to major subprime lending platforms. MakerDAO seems to have replaced Compound as the first choice for DAI savers; of course, this is also because Compound has deposited its unused savings in the market into DSR. dYdX's market share has also dropped significantly, and its DAI deposits have fallen by 80%. At present, the total amount of all DAI deposits is about half of the current total value of DAI and SAI, which is lower than the 66% of last September. This may be due to the less active lending market for the remaining SAIs and the high interest rates last year (savers could get a 13% yield last summer, now only 6%).

-Figure 9. DAI Deposits in the Subprime Lending Market-

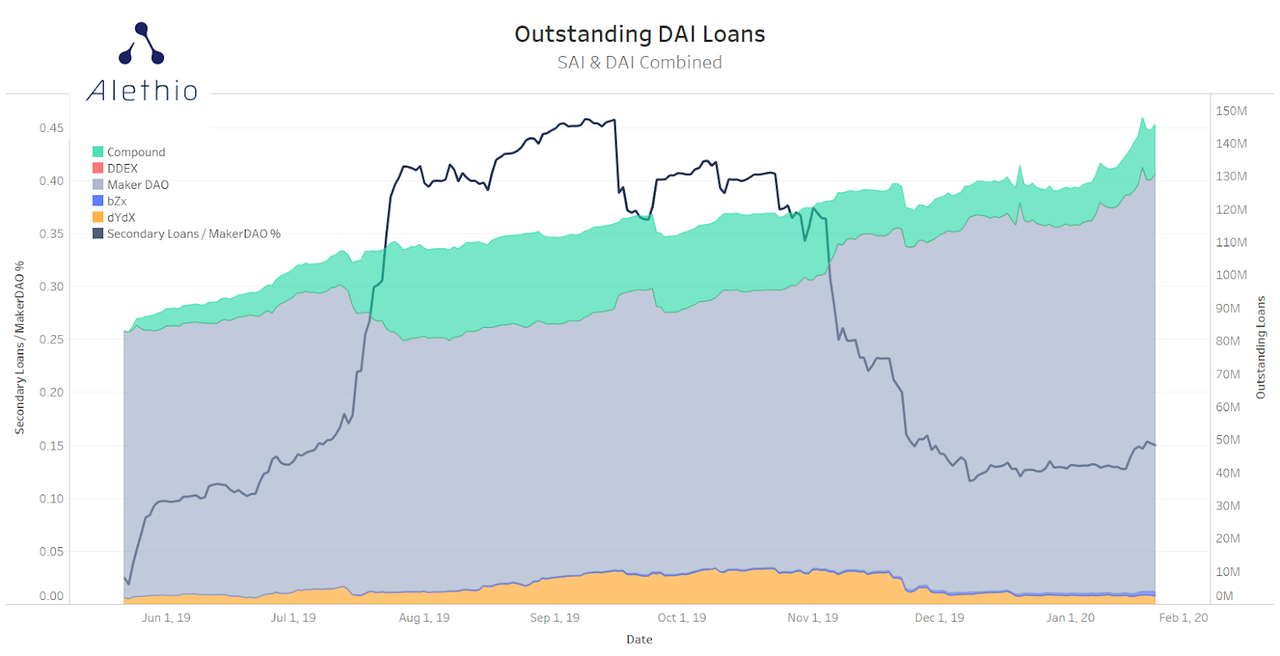

The market share of DAI lending activities in the secondary hospitality market also declined. In the subprime lending market, the total value of outstanding DAI and SAI debt is approximately $ 22 million-only 15% of the total MakerDAO debt or total supply of stablecoins. This ratio has been much higher in the past. In September last year, there were 36 million SAI debts in the subprime lending market (46% of the total supply). The increase in MakerDAO's own market share is likely related to its low stable rate (this is the result of voting for migration).

-Figure 10. DAI Deposits in the Subprime Lending Market-

On-chain activities

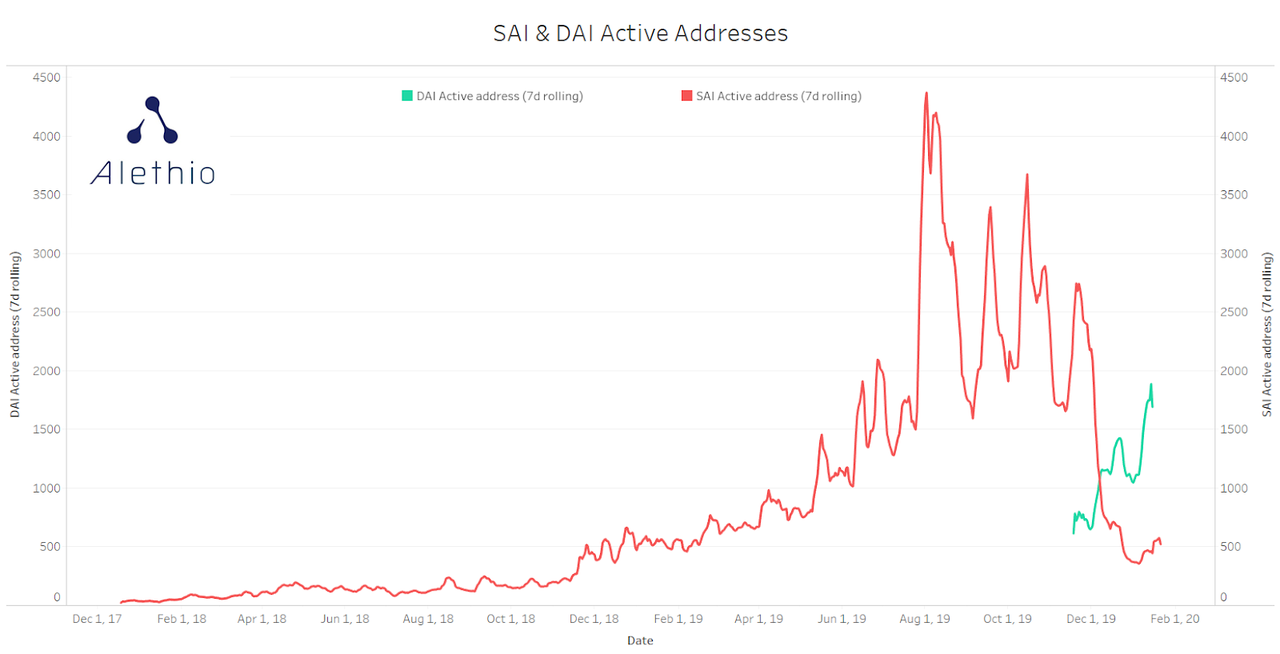

The number of daily active DAI addresses is stable at about 2000, which is 10% lower than the average daily active number of SAIs in the 6 months before the migration. Note that the peak number of SAI active addresses that appeared in the summer of 2019 in the following figure is related to Coinbase's earning DAI (also known as SAI now) activity, so it cannot be directly compared with the current number of DAI active addresses.

-Figure 11. Number of active addresses participating in SCD (red line) and number of active addresses participating in MCD (green line)-

DAI participating in DSR

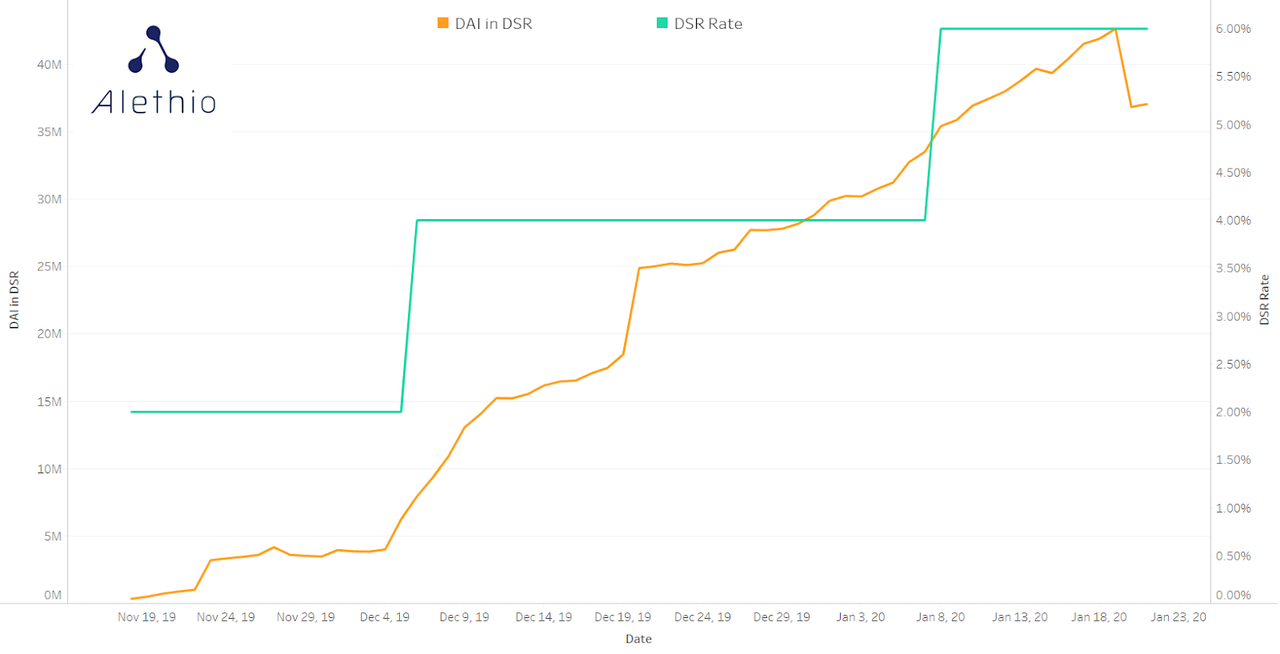

The number of DAIs invested in DSR to earn deposit interest is steadily increasing. The most obvious increase occurred in the third week of December. At that time, Compound began to deposit DAIs that were not borrowed from its market into DSR; there was December In the second week, DSR's interest rate rose from 2% to 4%. Interestingly, the further increase in DSR interest rates (from 4% to 6%) did not increase the speed of DAI deposits into DSR. In fact, the number of DAI stored in DSR also declined in the third week of January, and because the supply of DAI has increased by 45% since the beginning of the year, exceeding the flow of DAI stored in DSR, the utilization of DSR has declined It ’s even worse.

-Figure 12. Number of DAI deposited in DSR vs. DSR interest rate-

in conclusion

Overall, MakerDAO's migration from a single pledge system to a multiple pledge system has proven very successful. The vast majority of users in the entire ecosystem responded to this upgrade as expected, injecting potential energy and legitimacy into the new system. This migration can be seen as an important signal that shows that the interest in the DeFi platform is increasing.

MakerDAO's migration is not complete. Another important governance decision is to determine the downtime of the pledge system. To decisively move the DeFi ecosystem to a more efficient and versatile platform, it is necessary to shut down the old platform. However, a large amount of private funds remain locked in the SCD system.

MakerDAO has proven to be a successful example of DeFi's evolution, popularity, and community communication. Now, it will also continue to serve as a test field for on-chain governance.

(Finish)

Original link: https://medium.com/alethio/maker-mcd-a-success-in-protocol-upgrade-on-chain-governance-7021874ae4a1 Author: alethio Translation: A Sword

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Investors ask two core questions after FCoin Zhang Jian's "truth"

- Babbitt Weekly Selection 丨 A DeFi crisis triggered by a new species of "lightning loan"; Blockchain + Epidemic application opens the door to blockchain social governance

- FCoin thunders, Zhang Jian confesses that over 900 million yuan cannot be paid, and foreign exchanges have significant financial risks

- How to achieve effective supervision through distributed key technology?

- Detailed DCEP future use scenarios-low-cost cross-border payments

- Research | How Blockchain Solves Financing Problems

- Half a year of research and development can't beat BM's mouth? Isn't Voice worth looking forward to?