Perspectives | Five conjectures for the blockchain industry in 2020

Conjecture 1: Bitcoin halving may not usher in a bull market

If you want to talk about the hot words in the currency circle this year, I am afraid that it is "halving". Whether it is an ordinary retail investor or a cryptocurrency trading institution, starting from the bear market in 2018, they will hope that the third round of bitcoin halving in 2020 will bring a new round of bull market, and I am convinced that . The halving public opinion also continues to ferment, or due to the good news, Bitcoin has risen from $ 3,000 at the beginning of the year to a peak of $ 14,000 in 2019!

However, history will not simply repeat, it will always be surprisingly similar.

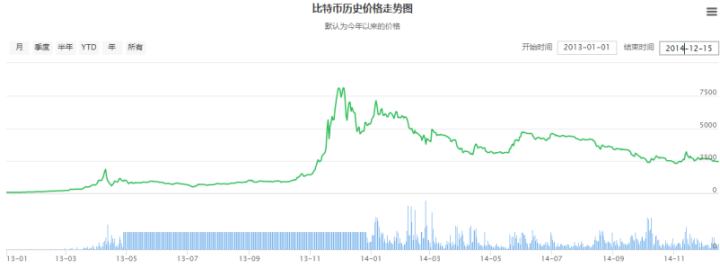

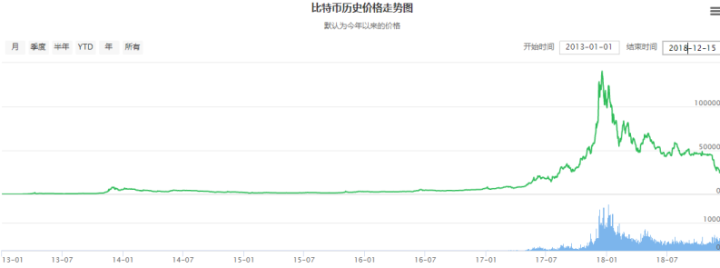

On November 28, 2012, Bitcoin was halved for the first time, and the reward for mining a block every 10 minutes dropped from 50 bits to 25; then in 2013, the price of Bitcoin went from around $ 20 at the beginning of the year Rose to about $ 260, with a maximum increase of 1200%

- Blockchain can't save traffic NetEase circle and other products failure revelation

- Comment: Why did Satoshi Nakamoto give up being the richest man in the world?

- Looking for "new rich mines" in the automotive industry: blockchain may become a breakthrough

On July 10, 2016, Bitcoin was halved for the second time, and the reward for mining a block every 10 minutes was reduced from 25 Bitcoins to 12.5. Nearly 2017, Bitcoin increased from $ 1457 to $ 20,000. Reached the highest historical price of bitcoin, with a year-to-date increase of 1272.68%.

If you refer to the previous halving rule, the third halving will come on May 14, 2020, and the Bitcoin block reward will be halved from 12.5 bitcoins to 6.25. From the historical market perspective, the first two bitcoin halvings have stimulated the market to usher in a new round of bull market. Will the bull market next year also come on schedule?

Is halving related to Bitcoin's skyrocketing strength?

After Bitcoin's two halvings, it has indeed achieved an amazing increase, so it must be corroborated: Is halving strongly related to Bitcoin's skyrocketing? Just as the amount of funds flowing into the gold market has decreased, can it certainly prove that the cryptocurrency market will usher in a rise?

First of all, behind the rise of bitcoin in 2013, there is actually a political and economic reason that cannot be ignored: the currency crisis in Cyprus has caused the rise of bitcoin prices.

In March 2013, the Cypriot government was unable to rescue the banking crisis that broke out in the country and had to apply for assistance from international financial institutions.

International organizations such as the European Union have agreed to give Cyprus a loan of 10 billion euros, provided that banks in the country must levy a deposit tax of 5.8 billion euros on bank depositors.

The final result after several negotiations was the introduction of the Cyprus banking restructuring plan: the national bank of Cyprus, the second largest bank in Cyprus, will be closed, and deposits of less than 100,000 euros will be transferred to the largest bank, Cyprus Banks, 100,000 euros of depositors with more than 100,000 euros will be transferred without loss, and more than 100,000 will be frozen to solve the debt problem, and this part is almost lost.

This directly caused the panic of the Cypriots, rushing to exchange their national currency for Bitcoin. Due to the limited supply of Bitcoin in a certain period of time, the mass purchase of Bitcoin caused Bitcoin to start from more than $ 30 in just a few days. Soared to $ 265.

Then let's look at the skyrocketing Bitcoin price in 2017. For the reasons for this round of market, the industry has basically reached a consensus-it is brought by the Ethereum one-click coin issuance mechanism.

That is to say, the blockchain project party can issue its own token based on the Ethereum ERC20 system to raise funds from ordinary public investors.

Since the early ICO investment has achieved good returns, the opening has several times, or even dozens of times, the wealth effect attracted a large number of projects and funders to enter the market, thus opening the 2017 super bull market.

In summary, every big rise in Bitcoin is not necessarily related to the halving of output, and there are related economic and political factors behind its soaring.

Therefore, halving the output of Bitcoin in 2020 may not be able to stimulate a new round of bull market.

Conjecture 2: Bitcoin halved, miners fall in love with each other

Bitcoin halving is a "shock for every step" for miner manufacturers.

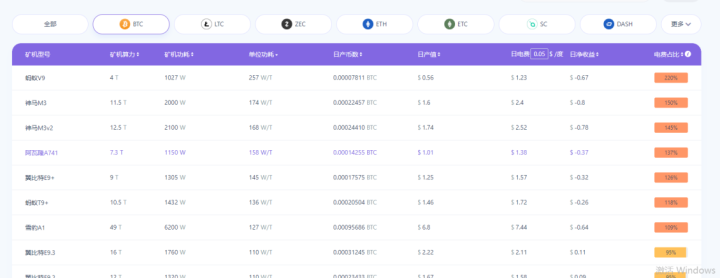

Each time Bitcoin is halved, the block reward is halved, and it is conscious that the difficulty of mining will double. Whether mining can make money needs to be considered in combination with the ratio of mining machinery and electricity and energy consumption.

The electricity cost ratio of a mining machine refers to the ratio of the daily electricity consumption cost of the mining machine to the daily mining revenue. For the miner, the electricity cost is the most important cost, and it is also the most important link between the Bitcoin price and the miner's revenue. According to the electricity cost ratio, the current revenue of the mining machine can be roughly calculated.

Energy consumption ratio refers to the ratio of power required for each unit of computing power of each mining machine. If you just look at the power consumption ratio of the miner, it is actually not significant, but it is directly linked to the cost ratio of the miner's electrical machinery. The lower the power consumption, the more energy-saving it is. However, the lower the power consumption of the miner, the more expensive the product price is. .

According to the data of Yuchi, the current electricity cost ratio of the mining machine is 50%, and the energy consumption ratio is about 60W / T. In other words, at current prices, after halving Bitcoin in 2020, the miners whose theoretical energy consumption ratio exceeds 60W / T will be forced to shut down. By then, the market value of major domestic mining machine manufacturers Bitmain, Jianan Yunzhi, and Shenma Mining Machine will be greatly affected by this halving.

Mining difficulty rises, miners fall in love with each other

At present, the domestic miner manufacturers are mainly Bitmain, Jianan Yunzhi, and Shenma Mining Machines, which are showing a trend of standing among the three countries. However, before 2019, there is not much news about the Shenma mining machine on the market. Everyone pays more attention to Bitmain and Jia Nan Yunzhi. In 2019, the shipment of Shenma mining machine The surge has attracted much attention. Rumors in the industry: The surge in sales of Shenma mining machines is threatening Bitmain's position as a mining domineering company.

It is reported that on December 12, Bitmain sued Bitwei (Shenma Mining Machinery) on the grounds of suspected embezzlement. The founder of the latter, Yang Zuoxing, was arrested by the Nanshan Procuratorate and the case is currently under investigation.

Leaving aside the truth of the case, behind the two miners' struggle from dark to light, in fact, it also reflects that the competition in the mining machine market has further intensified and has entered a stage of fierce fighting. However, Bitmain's move will increase the negative news of Shenma Mining Machinery to a certain extent. The confidence of investors and consumers has diminished sharply, and its shipments may be greatly affected in the short term.

Due to this year's "internal fighting" confusion in Bitmain, the company's leaders had no time to take into account the development of new products, which caused its mining machine sales to decline once, while another mining machine giant Jia Nan Yunzhi was busy listing, which undoubtedly gave rise to the rising star Shenma mining machine. Opportunity. The two courts may be the first step for Wu Jihan to seize the market after he holds power alone.

In fact, as early as 2017, Shenma Mining Machine and Bitmain had conflicts. In July of that year, Bitmain sued Shenma Mining Machinery for patent infringement and demanded compensation for a total of 2.68 million yuan in economic losses. The contradiction was magnified once again the arrest of Shenmao founder Yang Zuoxing a few days ago.

Founder arrested, market share robbed? The opponent is the overlord of the mining machine, and it coincides with the downturn in the market. The difficulty of mining continues to rise. It seems that the Shenma mining machine has reached the stormy weather. If it is not careful, it may be swallowed by the market. Way:

First, strengthen the research and development of the existing mining machine technology level, improve the core competitiveness of the product, and maintain the previous good and cheap sales form. Perhaps there is a first-line vitality-the rise of Shenma Mining Machine and its own cost-effective products are inseparable.

Secondly, at present, Wu Jihan, who advocates the development of mining machine business in Bitmain, has returned and grabbing the mining machine market that originally belonged to him is the top priority of Bitmain's work at present. As a newly-developed Shenma Mining Machine, it is not a good strategy to rely on its own strength in a short period of time to support the crushing of the overlord and maintain the existing market share. And alliances are not necessarily a better choice.

Because after the alliance, it is not only a technical exchange, but also helps to develop faster mining power with lower power consumption. It is also able to strengthen information sharing in the cost channels such as market channels and raw material supply, and further reduce Mining machine research and development costs, so as to take advantage of cost-effectiveness, to produce high-quality and low-cost mining machine products, so as to strive to maintain the existing market share and seek greater development.

Conjecture 3: DCEP is fully implemented, and related industries are on the rise

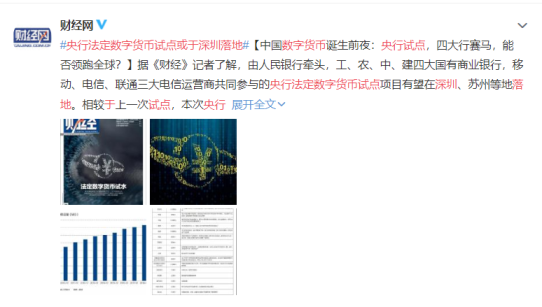

In 2019, the central bank's legal digital currency, DCEP, appeared frequently, from accelerating the advance to coming out. At this stage, the release of DCEP is still highly anticipated.

In 2020, DCEP may usher in a truly comprehensive landing.

It is reported that the central bank has now launched a formal pilot program, which is divided into two phases. At the end of 2019, it will be a small-scale scenario closed pilot, and it will be widely promoted in Shenzhen in 2020. The pilot project will go out of the central bank system and be led by the People's Bank of China. The four major state-owned commercial banks and the three major telecom operators will jointly participate in the project and will be launched in Shenzhen and Suzhou. DCEP can not only be used as an inter-bank settlement tool, but also enter real service scenarios such as transportation, education, and medical treatment, reaching C-end users and generating frequent applications.

If the pilot is successful, DCEP will expand the area and application area in 2020, and quickly enter the payment system under the promotion of policies. The full implementation of DCEP, on the one hand, can be used as a payment and settlement tool, strengthen the supervision of fund transfers, improve financial stability, and enhance anti-corruption and anti-money laundering capabilities. On the other hand, it can also replace traditional digital currencies such as bitcoin to a certain extent, reduce the threshold for international friends to use electronic money in China, and help Chinese consumers to spend abroad when they go abroad.

In addition, from the beginning of its release to widespread use by the public, DCEP will definitely experience a process of popularization and application, and there will be a wave of entrepreneurship and infrastructure construction in the DCEP and blockchain fields. Payment technology-related services and manufacturers will gain new development. opportunity. For example, payment institutions with C-end (personal) payment service experience, companies with a large number of B-end (enterprise) merchant resources, commercial banks, and payment system developers.

But there is still reason to believe that a large number of related unicorn companies will be born in these fields in the next year.

Conjecture 4: The emergence of state-owned digital currency exchanges

The digital currency exchange, which has always been known as the "top harvester in the currency circle", will not have a good time in 2019. In the second half of 2019, the market for digital currencies continued to be sluggish. Issues such as low transaction volume, frequent security incidents, and tightening regulations once pushed the exchange to the forefront. Since October, the country's continued high pressure on digital currency transactions and the frequent arrests and failures of exchanges have led everyone to speculate that the exchanges may usher in the end, and the ultimate fate may be like a P2P online loan platform.

But on the whole, in 2020, the digital currency exchange will not only usher in the doomsday, but also have the possibility of moving towards nationalization through the "Noah's Ark".

With the continuous action of the central bank this year, the legal digital currency DCEP is poised for release, and there are news that the country has always been ambiguous about digital currencies, mainly because it is still under investigation and strong supervision is not a blockade. Under the general situation, national exchanges are in urgent need.

On the morning of November 6th, the Hong Kong Securities and Futures Commission issued the "Position Letter on Supervising Virtual Assets Trading Platforms" and the "Hong Kong Securities Regulatory Commission Issued Terms and Conditions for Supervising Virtual Assets Trading Platform Licenses". Documents show that in Hong Kong, a national compliance exchange is coming and the first batch of licenses is about to be issued. This means that if the compliance of large-scale digital currency exchanges is successful, Hong Kong will become the destination of national exchanges.

At the same time, as civil strife in Hong Kong becomes more serious and the economy becomes more turbulent, the role of financial advancement and demonstration will be curbed. However, DCEP is ready to come out, and the compliance process of domestic digital currency exchanges needs to be accelerated.

On December 1, the Hainan International Offshore Innovation and Entrepreneurship (Sanya) Pilot Zone was officially unveiled. Wang Lu, Vice Governor of Hainan Province, issued a paragraph saying: "What do we do next in the blockchain and digital asset transactions? It is clear, but there is a wish that Hainan will become the center of the offshore innovation and entrepreneurship demonstration area, and Hainan will become the center of national blockchain research and application demonstration, and we will also become the national digital asset trading demonstration area. "

Under the situation of global digital currency grabbing opportunities and the development of DCEP, the establishment of Hainan's digital currency "regulatory sandbox" just shows the country's attitude towards the development of digital currency-related industries: Avoid "one size fits all" and explore under control Positive meaning.

At the same time, the possibility of a national digital currency exchange has been pulled back from Hong Kong to the mainland.

Regardless of the size of the transaction, 2020 is destined to be a special year. Small exchanges are born and dead, and large exchanges are compliant and legitimate.

Conjecture 5: "Blockchain +" will usher in a major breakthrough

2019 is called the first year of the application and promotion of blockchain technology landing industry.

Over the past year, Internet giants such as BAT have accelerated the application scenarios of the blockchain and the construction and promotion of the BAAS platform. Ant Blockchain vigorously promotes the application of the top 10 landing scenarios of successful cases, including judicial blockchain, contract deposit, supply chain finance, electronic bills, commercial insurance quick compensation, etc. Since the Tencent blockchain electronic invoice went online, it has also achieved good results of 10 million electronic invoices. It can be said that Blockchain + has made great progress this year.

On October 24, the blockchain was tuned as a national strategic technology, and the speech clearly stated, "To build a blockchain industry ecology, accelerate the deep integration of blockchain with cutting-edge information technologies such as artificial intelligence, big data, and the Internet of Things. Promote integrated innovation and converged applications. "This means that the country attaches importance to the enabling of the blockchain to realize the economy, the deep integration of the real economy, and the use of blockchain technology to achieve the goal of overtaking in curves.

With the gradual maturity of technology and the support of national policies, Blockchain + will accelerate its rapid development in 2020. It will be integrated in all walks of life, and there will be large-scale commercial outbreaks. At present, blockchain is the most widely used and has the best application effect in the financial field, and the application benefit in social and people's livelihood is electronic certificate, but the blockchain will first break out in the field of e-government.

Blockchain + Finance

Blockchain is born with financial attributes. With the birth of Bitcoin, the blockchain has 11 years of history. Its decentralization, immutability, and information traceability have made it a popular place in the digital currency field. Since then, it is even more optimistic for many financial people.

For example, Industrial and Commercial Bank of China, one of the four major state-owned banks, introduced blockchain technology this year to help improve the existing bank depositor information management model, while ensuring the personal information security of bank depositors, and providing related services conveniently and efficiently. At present, this pilot has been carried out in a small area. If the pilot is successful, it will be possible to truly realize the decentralization of personal information. At that time, user data will be stored on the blockchain, and other people viewing user data must obtain user authorization. Before proceeding.

In fact, not only in state-owned units, the development of blockchain technology in the financial field is also favored by many private institutions.

As early as 2018, China's insurance giant Ping An joined hands with Foton Motor Group to create a "Fujin All-Link System Blockchain Platform". With the advantages of blockchain technology, it can solve many problems in automotive supply chain finance and serve Futian. The financing difficulties of multi-tier suppliers and dealers in the automotive upstream and downstream industries are focused on enhancing the coordinated development of the entire automotive industry chain.

Blockchain + e-government

At present, blockchain technology has been researching in e-government for a long time. If it can be applied to traditional tedious government work as soon as possible, the government's work efficiency will be greatly improved. While the personal information of residents is protected, the demand for residents' government affairs will also become convenient and efficient. At present, the government has made great efforts in this regard, and there have been many cases of practical application, which are expected to be fully rolled out next year.

On December 9th, Shenzhen ’s unified government service app “i Shenzhen” officially launched the blockchain electronic certificate application platform, which has covered 24 types of common electronic certificate and certificate on-chain services such as resident ID cards and resident account books, and also supports the establishment of No criminal record certificate, birth registration and more than 100 high-frequency government affairs. Liu Qingsheng, member of the Standing Committee of the Shenzhen Municipal Committee and executive deputy mayor, said that blockchain technology has great potential for government service innovation. The prospect of using blockchain technology to improve the level of government service is promising, enabling residents to "run a job at most once and easily."

Blockchain + electronic certificate

At present, the existing information storage methods mainly rely on two types-personal local storage and institutional cloud storage, but its disadvantages cannot be ignored-information loss and information leakage. In recent years, information security issues that have frequently erupted have caused numerous property losses. The awareness of public information security has also been gradually increased during the "persecution". Electronic certificates need to be upgraded, but blockchain technology has the magic to change this situation. Blockchain is favored by many information storage organizations because of its decentralization and immutability.

Researchers have discovered that blockchain technology can change the situation where traditional information is controlled by one (centralized institution), and has no fixed information storage nodes. Each node is a center to avoid information loss, and at the same time, encryption technology can ensure information security. In order to achieve decentralization and secure storage of information, this technology has become a key research topic for many cloud storage organizations.

Blockchain is the most explosive in the government and financial fields, but it is also being promoted in pilot areas in product traceability, intellectual property, health care, social education, 5G and other fields. However, it is believed that in the near future, blockchain technology will everywhere.

Author / Darcy, Snowshoe Editor / Darcy

Operations / Harry Production / Star Media

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion: 5 predictions for DeFi in 2020

- Case study | How government governance applies blockchain technology

- Latest Global Central Bank Digital Currency Guide

- Perspective | Bitcoin Operating System: What kind of applications will emerge from liberating information and communications?

- Dry goods | Starting from three bottlenecks to solve blockchain scalability issues

- Summary of blockchain security incidents in 2019, global loss exceeds $ 6 billion

- CCTV re-approves blockchain scams: closing big V, online celebrity Weibo, and stepping up efforts