Ping An’s account book is submitted to the prospectus, and the “blockchain first share” dispute opens.

On November 13, 2019, Eastern Time, Ping An Accountant Financial Technology Co., Ltd. (hereinafter referred to as "Accounts") announced that it has submitted a prospectus to the US Securities and Exchange Commission, which will be in the form of American Depositary Shares (ADS). Initial public offering of common stock.

In the NYSE / NASDAQ global market, the financial transaction account will apply for the stock trading code "OCFT" and the proposed fund is $100 million.

This is the second unicorn company launched by Ping An, following the safe doctor.

- There is no “coin” in the blockchain advocated by the state, but the four big dividends or the ten-year encounter

- Blockchain Weekly: The currency circle is on the high side of supervision, and the first share of the mining machine will go to the US this week.

- Getting started with blockchain | What is blockchain, mining and trusting machines

The news that the mining company Jianan Zhizhi will go public in the US, so that it is called "the first block of the blockchain", now the landing of the financial account of the account to let people realize that the battle for the first share has started.

(Follow the public number, reply to the keyword China Ping An, get the White Paper of the Pingfang Blockchain Institute)

Imperial chess game

Ping An, China, a non-state-owned enterprise with a medium-sized head, is intertwined in the fields of finance and financial technology. The strong social financing foundation and the extensive layout of the technology finance track make it a good example of a well-developed big company.

Since the beginning of the year, Ping An’s A stock market has risen by 63% and its total market capitalization has exceeded 1.6 trillion. In the A-share market, the market value is second only to the “Cosmic Bank” Industrial and Commercial Bank. However, its dynamic P/E ratio of 9.3 is much lower than 22 times of Alibaba (US stocks) and Tencent Holdings (Hong Kong stocks) and 29 times.

Although Ping An is still profitable by selling life, health and property and accident insurance, it still hopes to incubate and then divest the technology unicorn company.

It currently hatches four unicorn companies, namely Lu Jinsuo, Yanketong, Ping An Medical Insurance and Ping An Good Doctor. Financial account pass is one of the four.

In 2015, Shanghai Mintong Financial Technology Co., Ltd. was incorporated. According to public information, there are two main entities registered in the company, namely Shenzhen Xintongtong Intelligent Technology Co., Ltd. and Shanghai Haotongtong Technology Co., Ltd. The legal representatives are Ye Wangchun. Shanghai Mintong Financial Technology Co., Ltd. is now a wholly-owned subsidiary of Shenzhen Yitongtong Intelligent Technology Co., Ltd.

In the company introduction of the financial accountant official website, Ye Wangchun is the chairman and chief executive officer of the account.

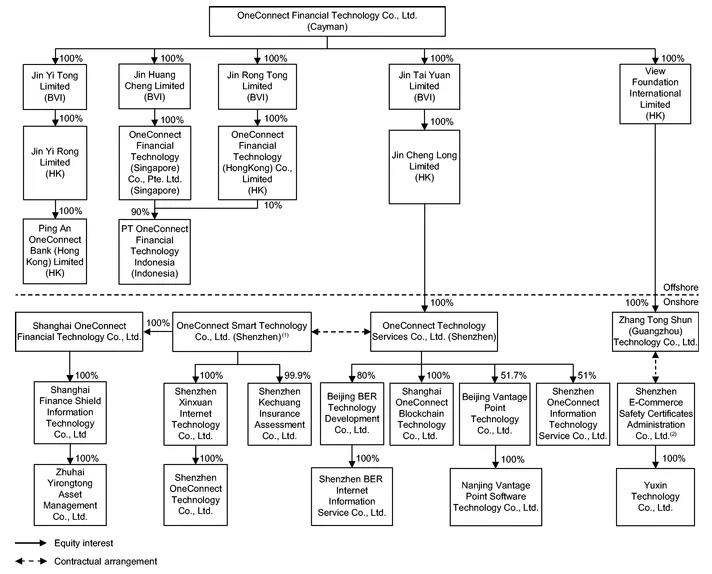

In October 2017, Financial Accounts restructured its shareholding structure, established an offshore company in the Cayman Islands, and adopted the VIE structure. Ping An Group actually owns 39.8% of the shares.

At the Shenzhen Airport in September this year, the slogan released in Ping An’s billboard was: to create a commercial blockchain platform. The financial account book is responsible for the scientific and technological exploration of Ping An Group's blockchain.

Ping An established its own blockchain team in March 2016, and joined the blockchain R3 alliance in May of the same year, becoming the first Chinese member company.

CoinVoice reporter inquired in the third quarter report of Ping An 2019, China, as of September 30, 2019, the financial account book has accumulated 618 banks and 84 insurance companies, including all large banks in China and 99% of city banks. And 46% of insurance companies, through which they reach hundreds of millions of end customers. Since December 2015, the financial accountant platform has assisted financial institution clients to reach 1.8 trillion yuan of business transactions with their terminal retail and SME customers.

In the IPO prospectus, Morgan Stanley, Goldman Sachs (Asia) LLC, JP Morgan Securities LLC, and Ping An Securities (Hong Kong) will be the lead bookkeepers for the public offering of the stock; Bank of America Securities and HSBC Securities (USA) Inc. will serve as other joint bookkeepers; CITIC CLSA and US Capital Capital Markets will act as joint managers of the public offering of the shares. Can be described as a luxury all-star lineup.

Is the lineup strong enough to be trusted?

Sustained loss

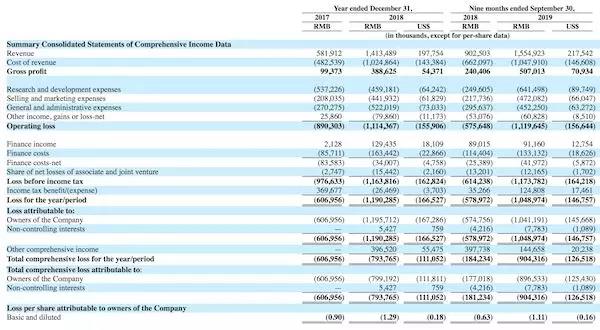

The revenue of Financial Accounts in 2017 and 2018 was 580 million yuan (US$0.8 billion) and 1.41 billion yuan (about 200 million US dollars), a year-on-year increase of 143%. For the first three quarters of September 30, 2019, its revenue was $1.55 billion ($210 million).

Despite the rapid growth in revenue, the other “unicorn” safe doctor who hatched in China was listed in Hong Kong. The industry’s most questionable question is that financial accountability has not yet achieved profitability.

The financial account-opening prospectus shows that in 2017, 2018 and the nine months ended September 30, 2019, the company's net loss was 607 million yuan, 1.19 billion yuan (166.5 million US dollars) and 1.049 billion yuan (146.8 million). USD). The accumulated net loss was 2.846 billion yuan.

Financial accountants still need to rely on peace to continue blood transfusions. For the financial account, Ping An Group is both a strategic partner and the most important customer and supplier.

According to the prospectus, in 2017, 2018 and 9 months ended September 30, 2019, the company's revenue from Ping An Group was RMB 235.7 million, RMB 527.6 million (US$73.8 million) and RMB 6.773. 100 million yuan (US$94.8 million) accounted for 40.5%, 37.3% and 43.6% of the total revenue for the same period.

Ping An also provides support for technology infrastructure such as cloud infrastructure. In 2017, in 2018 and in the nine months ended September 30, 2019, the company purchased RMB 358.1 million, RMB 675.8 million (US$94.5 million) and RMB 391.5 million (US$54.8 million) from Ping An Group. The products and services accounted for 23.9%, 27.6% and 15.0% of the total revenue cost and operating expenses, respectively. In addition, many of the company's innovative solutions are first launched and tested in the Ping An Group ecosystem.

In the view of financial account, the strong synergy with Ping An Group is both an advantage and a risk.

“If Ping An Group reduces its ownership of the company, our relationship with Ping An Group may be affected.” Financial Accounts said: “The company and Ping An Group cooperated under the Strategic Cooperation Agreement and are valid until the initial public offering is completed. The next ten years, but only if Ping An Group continues to hold or beneficially own at least 30% of the shares." Prior to the issue, Ping An Group owned 39.8% of the company through Bo Yu Limited.

At the 2019 interim results conference, Ms. Chen Xinying, co-CEO of Ping An Group, mentioned that many people care about when Ping An’s technology business can be profitable.

Ms. Chen said this: "We want to make a profit very simple. Just stop R&D, or stop part of it, then we will be profitable immediately. But we can't do this."

Indeed, at this stage, most of the unicorns of Ping An are still focusing on R&D investment. Only in this way can we maintain the core competitiveness of technology, establish a moat, and sacrifice short-term profits for long-term future consideration.

Is the concept still a finished product?

Last month, the central government clearly emphasized that the news of accelerating the development of blockchain technology and industrial innovation has been issued. The digital currency collective has soared. A large number of domestic A-share listed companies have also responded quickly. More than 500 A-share listed companies have announced themselves and Blockchains have a direct or indirect relationship.

Is the blockchain technology of financial account-books hard enough? This is of concern to the industry.

In the official website of the financial account, the company provides commercial applications and technical support services for financial institutions. It has 12 major solutions including intelligent marketing, intelligent products and intelligence for financial institutions such as banks, insurance and investment. Wind control, intelligent operation, etc. Its three core technologies are artificial intelligence, blockchain, and big data analysis .

Financial Accounts is a financial technology subsidiary of Ping An, a technology-as-a-service cloud platform for financial institutions. Provide cloud-based technology solutions that combine rich experience in the financial services industry with leading-edge technology to provide end-to-end technology applications and business services to financial institutions, empower financial institutions, and help financial institutions increase revenue, manage risk, and improve Efficiency, improved service quality and reduced costs to achieve digital transformation.

In Ping An’s 2018 Annual Report, Ping An has built the world’s largest commercial blockchain platform with more than 44,000 nodes through financial accounts, serving more than 200 banks, 200,000 companies and 500 governments at home and abroad. Other commercial organizations provide services. Ping An's self-developed credit chain (FiMAX) blockchain technology achieves 50,000 TPS (transactions per second) through its self-designed zero-knowledge check algorithm while maintaining low latency of less than 0.05 seconds.

In March 2019, the Ping An Financial Accounts Link (FiMAX) and the Small and Medium Bank jointly launched the "China Small and Medium Bank Internet Finance (Shenzhen) Alliance" (IFAB), the Internet Finance Alliance (IFAB), to create "based on the block. The chain's IFAB trade finance project was launched on the line.

The Small and Medium-Sized Bank Internet Finance (Shenzhen) Alliance is a social group jointly initiated by Ping An Group and small and medium-sized banks across the country under the guidance of the Shenzhen Financial Office. It is registered by the Shenzhen Civil Affairs Bureau. The Alliance Secretariat is located in the financial account. .

In its official website introduction, the alliance focused on blockchain, cloud platform, big data, Internet and other financial technology cooperation, helping small and medium-sized banks to upgrade and apply information technology.

In August, some media reported that the blockchain of financial account-paying has landed in the five major ecosystems. Financial credit-to-account chain FiMAX has been implemented in the fields of supply chain finance, trade finance, SME loans, smart environmental protection, mortgage, super vehicle management, drug traceability, electronic medical records, etc., covering financial, smart cities, real estate, The five ecological circles of automobiles and medical care.

It is worth noting that before, Wang Menghan, product manager and senior product director of the financial account blockchain team, stressed that as a financial technology service company under the Ping An Group, financial accountability is not a platform, but a network. Ping An does not collect data, and the second is to link everyone together through the blockchain to allow data to flow. In addition to the fact that the participant's encrypted data on the chain will not be seen by others, this is also an innovation and application in the security blockchain technology.

In September, Financial Accounts announced that it has entered into a partnership with UBX, a subsidiary of Union Bank, to build the Philippines' first technology-driven platform driven by blockchain technology to meet the financing needs of small and medium-sized enterprises in the Philippines.

For financial institutions, the value of blockchain technology is to create a credible, open network platform that connects SMEs with financial institutions, core companies, government agencies, and various third-party service providers. To help financial institutions serve many SME customers more efficiently and cost-effectively and increase their income. However, how to combine the block technology with the existing scenes becomes the key to how the block technology can really land.

In the blueprint for the construction of IFAB's financial network, its plan is seamlessly connected with the asset securitization (ABS) platform. The blockchain will be used to record the life cycle information of ABS products, and achieve the underlying penetration of credit assets. Highly efficient recovery of funds to enhance overall competitiveness.

Through the credit card chain's unique full-encryption blockchain framework, the trade finance network has fundamentally no data privacy concerns and can achieve multi-party cross-validation, which can help financial institutions effectively prevent trade fraud and excessive financing. Significantly reduce the risk of trade and business. The one-stop financing experience can also effectively reduce the difficulty and cost of financing for SMEs and promote their long-term development.

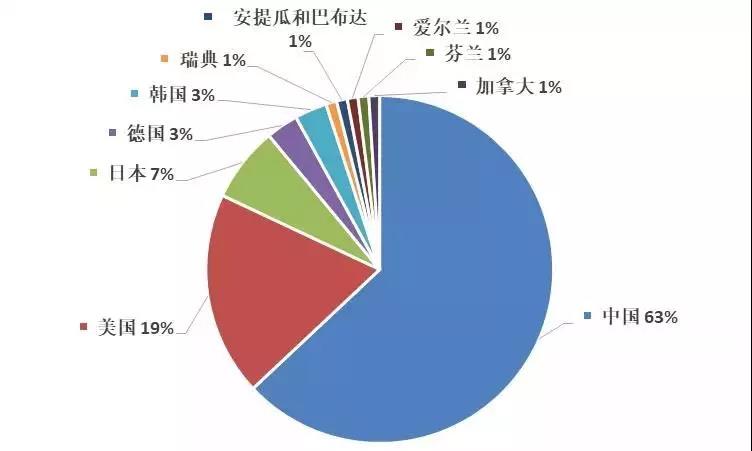

According to the Intellectual Property Industry Media IPRdaily and the incoPat Innovation Index Research Center, the "2019 Global Blockchain Enterprise Invention Patent Ranking (TOP100)" is a global blockchain company open from January 1 to October 25, 2019. The number of technical invention patent applications is statistically ranked. Compared with 2018, the total number of invention patent applications for enterprises has increased significantly.

The report also shows that in 2019, the number of patent applications in China's blockchain accounted for 63% of the global total, far exceeding the second in the United States, accounting for 19%.

Among them, Alibaba ranked first with 1005 patents, Ping An ranked second with 464 patents, and the third company in China was Weizhong Bank led by Tencent. Let me talk about the two main competitors of the account.

The ant blockchain was established in 2016, and the core products for its BaaS (blockchain-as-a-service) platform have already reached almost 40 scenarios, including the joint efforts of the Zhejiang Finance Department, the Provincial Health and Health Commission, and the Medical Insurance Bureau. Bills; launching a dual-chain “blockchain + supply chain” network to help end-small SMEs get financing quickly; join Ali's ecological technology to help the poor.

In 2015, Weizhong Bank began research and development in the blockchain direction and built the first blockchain prototype for use in the financial management field. In 2016, Weizhong Bank has the first blockchain application to enter the production environment – an inter-agency reconciliation platform based on blockchain. In the same year, Weizhong Bank, together with more than 20 financial institutions and technology companies such as Shenzhen Financial Technology Association and Shenzhen Zhengtong, jointly established the Financial Blockchain Alliance (Shenzhen) (referred to as the Golden Chain Alliance) and jointly launched in 2017. The Golden Chain Alliance Open Source Working Group jointly developed FISCO BCOS (Blockchain Underlying Technology Open Source Platform).

Let's talk about Baidu. Baidu blockchain is based on Baidu cloud, combined with cloud computing resources, deployment, delivery and security system capabilities, the blockchain platform for cloud systematization and productization, output to the financial, Internet of Things, games and other industries to provide credibility Templated services for multiple scenarios such as deposit certificates, digital rights, clearing and settlement, supply chain finance, digital assets, and blockchain games.

Internet giant BAT is currently in the blockchain industry.

Huawei has also entered this track. Its blockchain application scenarios are mainly in data deposit, IOT (new energy, supply chain traceability, car networking), telecommunications, supply chain finance, and inclusive finance.

It seems that the first battle of the blockchain, the main battlefield may not be in the current mining machine market.

Before the listing of the financial account, the title of “the first block of the blockchain” was not the name of Jianan, but it was in the mining circle, not the blockchain industry combined with the real economy, not in the People’s Daily, Xinhua. The official media and other media have repeatedly expressed their vigilance against virtual currency. The Shanghai Financial Stability Joint Office and the Shanghai Central Bank Mutual Rehabilitation Office jointly issued the "Shanghai Notice on Conducting the Renovation of Virtual Currency Trading Sites".

The financial account of the IPO will be rooted in the orthodox sense.

Financing technology is bringing a storm to the global financial industry, which has the opportunity to block blockchain projects.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Observation | How Xiong'an integrates “blockchain thinking” into urban genes

- DAG: The next tipping point in the blockchain industry?

- Wuzhen Review: From Defi to MOV

- Anime coin scuffle: What have you been busy with in each of these two months?

- From "after-the-fact forensics" to "synchronized deposit certificate", the change of procuratorial handling mode brought by blockchain technology

- Zhongan Technology Li Xuefeng: Based on insurance, using blockchain to innovate industrial applications

- Observation|Ternary Paradox: The Dilemma of Current Blockchain