Overview of BTC NFT Ecology: Development Status, Trading Market and Value Analysis

BTC NFT Ecology: Development, Trading, and Value AnalysisAuthor: Elaine Yang, Investment Director of Waterdrop Capital

1. Introduction to Bitcoin NFT Protocol Ordinals

NFT, as a cryptographic token that can represent unique digital or physical assets, has uniqueness and non-substitutability on the blockchain. NFT has been developed for many years on smart contract platforms such as Ethereum, and many famous projects and applications have been born. However, on Bitcoin, the earliest and most secure blockchain, NFT has not been widely developed and applied due to its lack of native smart contract functionality and high transaction fees.

To solve this problem, a protocol called Ordinals was officially launched on December 14, 2022. It utilizes the technical characteristics of SegWit and Taproot 3 on the Bitcoin network (which reduces transaction data size, speeds up transactions, improves scalability, and reduces costs) to directly mint, transfer, and destroy NFT on the Bitcoin chain. The Ordinals protocol numbers each minimum unit (satoshi) in Bitcoin and links it with metadata to form a unique and traceable NFT. The Ordinals protocol does not require any centralized or trusted parties to participate, nor does it depend on any Layer 2 or sidechain solutions. It fully complies with the rules and security of the Bitcoin network itself.

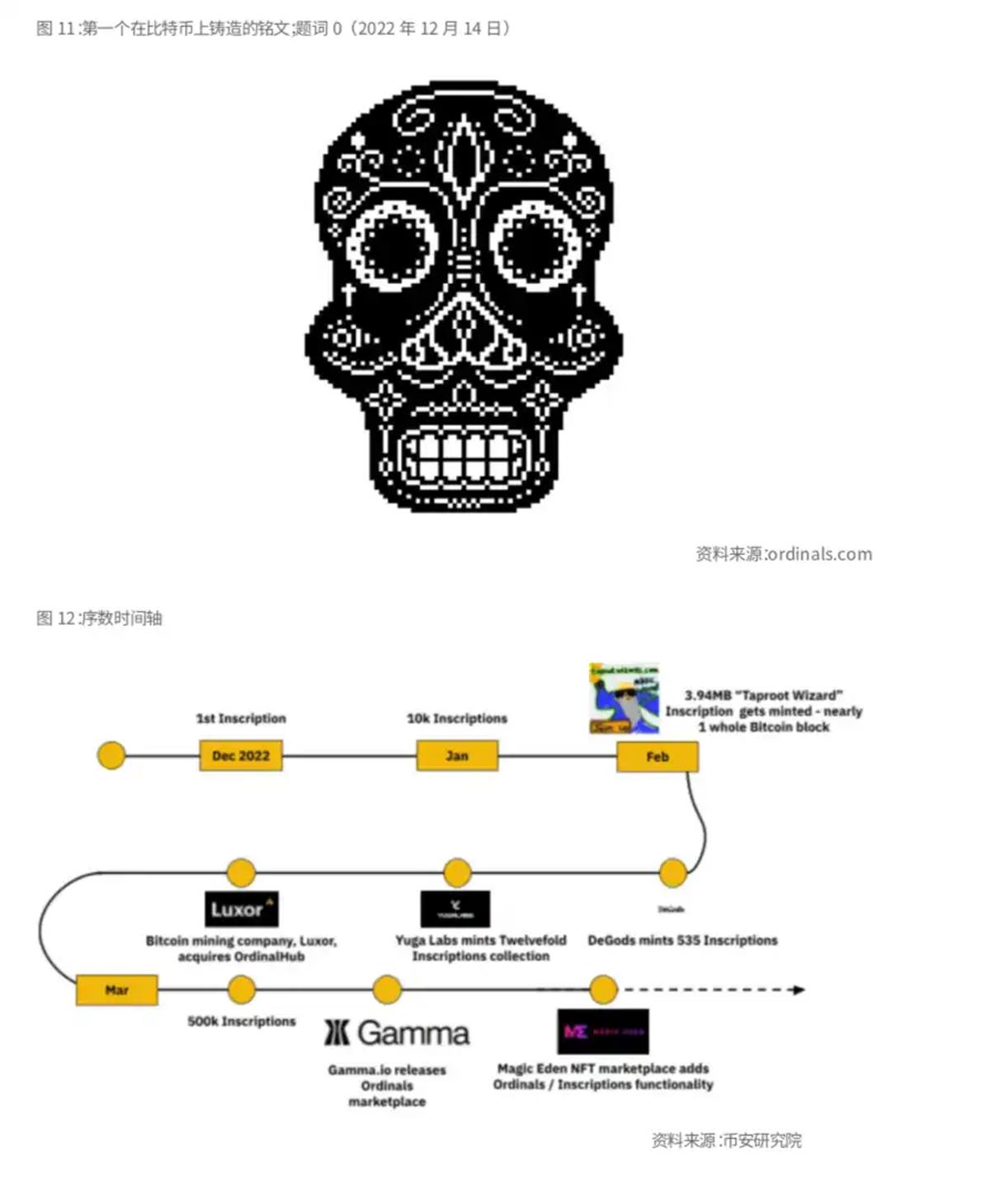

The next major move for Bitcoin NFTs came in December 2022, when the first numbered inscription was minted.

- One year after Terra’s Black Swan event: Market is on the mend, but still struggles to shake off the gloom

- Overview of DePIN Track: Is it Disruptive Innovation or a “Castle in the Air”?

- Bitcoin’s new generation of multi-signature scheme MuSig2: providing better security, efficiency, and privacy features

The number of inscriptions minted by the Bitcoin NFT protocol Ordinals on May 10th has reached over 5 million, with a total cost of about 213.1 BTC.

How do numbers and inscriptions work?

ORD, an open source software that can run on any Bitcoin full node, can track individual Satoshis according to the “ordinal theory” as described by founder Casey Rodarmor. Satoshis (“sats”) are the smallest unit of the Bitcoin network, with 1 Bitcoin = 100,000,000 sats. The ordinal theory assigns a unique identifier to every individual on Bitcoin. In addition, these individual sats can be “inscribed” with arbitrary content, such as text, images, and videos, to create “inscriptions”, which are native Bitcoin digital artifacts, also known as NFTs. Individual sats can be “inscribed” with arbitrary content, such as text, images, and videos, to create an “inscription”, which is a native Bitcoin digital artifact, or also known as an NFT.

Currently, there is some data on the number of inscriptions in the Ordinals protocol:

2. Development Status of BTCNFT

1. Blue chip projects on ETH and Solana compared to NFT projects issued on the Bitcoin network:

Examples include Yuga Labs’ “TwelveFold” and DeGods’ Bitcoin version. TwelveFold is an NFT released by Yuga, with only 300 available and is the only NFT project with the endorsement of a large institution. It follows an art route, with the ceiling of art far exceeding that of PFP avatars. If successful in the future, it will be a top luxury good!

These types of projects already have a great deal of influence, so their selling prices are also high. Yuga Labs’ “TwelveFold” was sold in an auction for 288 NFTs, with the highest bid being 7.1159 BTC and the lowest bid being 2.2501 BTC, for a total auction revenue of approximately $16.5 million. Currently, on ordinals.market, the floor price for “TwelveFold” is over 30 ETH, with a total turnover of 108.49 ETH. DeGods sold 500 Bitcoin version DeGods for 0.333 BTC in two minutes.

2. “Sub 10K”:

Each inscription (Bitcoin NFT) has an inscription number, and the earlier the time of Minting, the smaller the sequence number, so NFTs with sequence numbers between 10,000 and 100,000 are given a layer of “antique” meaning. Although these early inscriptions often have no theme in terms of content, their value is based on their “time” value.

Currently, the second and eighth Bitcoin NFTs minted–Inscription #2 and Inscription #8–have been listed on the Ordinals Wallet market.

The highest trading price for “Sub 10K” Bitcoin NFTs is currently the Ordinals Punk #87 (Inscription #613), which sold for 2.77 BTC. On March 17th, the Bitcoin logo image Inscription #3384 sold for 0.31 BTC. The influential “Sub 10K” series includes Ordinals Punks, Bitcoin Shrooms, and Planetary Ordinal, with Bitcoin Punks being “Sub 100K.”

3. BTC native encryption colors

Bitcoin Punks, also a perfect replica of CryptoPunks on the ETH chain, with inscription numbers ranked within the first 40K, very early on, mostly held by OG old players, and backed by OKX. Currently, like Bitcoin Apes, it is one of the most consensual NFTs.

Taproot Wizard officially shared founder Udi Wertheimer’s thought process on social media: “On the day Silicon Valley Bank announced its bankruptcy and the USDC panic day, I decided to launch the Taproot Wizard NFT project today and have people record videos of themselves bathing in wizard costumes.” It is reported that Taproot Wizard is an NFT project created on the Bitcoin chain, initiated by crypto asset developer Udi Wertheimer, to commemorate the Taproot upgrade of Bitcoin and a classic image of the Bitcoin community – the Bitcoin Wizard.

4. Shovel Empowerment

Refers to an NFT series that constantly receives valuable airdrops after being held. Currently, the most well-known “shovel” is BTC Machine, which has subsequently airdropped two projects, BTC Operators and BTC Virus. Currently, BTC Machine’s floor price on the Ordinals Wallet market is 0.088 BTC, while the floor prices of BTC Operators and BTC Virus are 0.018 BTC and 0.0012 BTC, respectively. It is worth noting that various Bitcoin NFT-related tools are likely to be airdropped “shovels”. In late February, Ordinals Wallet airdropped 1,563 pixel PFPs themed “Pixel Pepes” to its early users. Currently, the floor price for this series is 0.066 BTC. As one of the top three Bitcoin NFT trading markets in terms of transaction volume, the value of Pixel Pepes largely comes from the expectation of “shovels”. As the current Bitcoin NFT-related tools overlap heavily in terms of functionality, it is very likely to attract traffic by airdropping NFTs to users. Therefore, from now on, we should pay more attention to interacting with Bitcoin NFT-related tools.

Here is a list of the currently noteworthy BTC NFT series:

Three, BTCNFT Trading Market

1. Exchange NFT MARKET PLACE

OKX founder Xu Mingxing said that the OKX Web3 wallet will soon support the market trading of Ordinals and BRC-20 tokens.

2. Native Ethereum trading market supports ordinals protocol

Magic Eden has launched LaunchBlockingd for Bitcoin Ordinals NFT creators.

3. Bitcoin native trading market

Gamma.io:

The Stacks NFT market Gamma, formerly known as STXNFT, announced its name change to Gamma on April 27, 2022. The platform aims to bring collectors, creators, and investors together in the Bitcoin ecosystem to explore, trade and showcase NFTs. The Gamma platform consists of three core products: an NFT market, LaunchBlockingd, and a social platform. Gamma.io supports both primary and secondary markets for Bitcoin NFTs.

Gamma.io provides a minting method called Gamma bot. Users can use Gamma bot to mint their own unique digital works for collection or sale. Users can mint NFTs with simple commands without coding or technical knowledge: just add Gamma bot on Discord and enter commands such as create to create an NFT. Gamma.io has also launched a.btc domain market that allows users to have their own decentralized identity and website. Users can register, buy, sell and transfer .btc domain names on Gamma.io, and bind them with their NFTs.

4. Integrated platform for inscription, engraving, and BRC20 trading markets

Unisats:

Currently, it is a platform for issuing and transferring BRC20 tokens, as well as for inscription and engraving. Registration of domain names can also be done on this platform, which supports peer-to-peer trading of BRC20 tokens. It has the highest daily active users and trading users for now, but it does not support trading in the Bitcoin NFT market. Of course, due to its large user base, it also faces frequent lagging and crashes, and we look forward to more product iterations in the future. Currently, the Chinese team has the fastest product speed on this platform.

IDclub:

A platform for domain name registration and token minting, but it does not support peer-to-peer trading of BRC20 tokens or trading in the Bitcoin NFT market.

A list of tools for ordinals ecology mapping and BRC20 token minting:

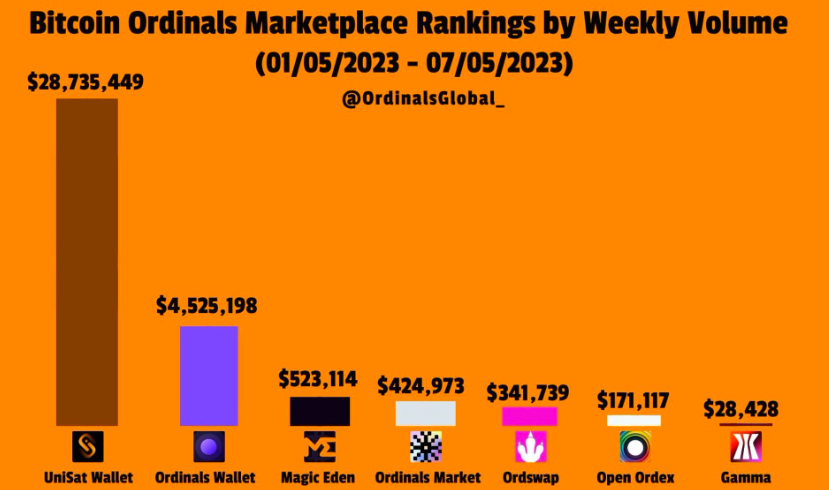

Current transaction market trading volume ranking

IV. The value of BTCNFT

A BRC20 token contains at least 546 satoshis and cannot be zero, so at least it is not as worthless as the “air coins” on ERC20. Therefore, we should have a tolerant attitude towards BRC20 tokens, neither completely denying nor completely accepting them. Let’s see how it goes.

It has given everyone the right to freely explore the diversity of Bitcoin’s value. Of course, you can create a “NFT series”, and you can also use the Bitcoin network as your “diary book” to record the words you write, the pictures you draw, the songs you sing… From ancient times to the present, people have recorded their information on the walls of caves, on bamboo slips, on paper, on computers, and now on the Bitcoin network. As long as you believe that the Bitcoin network is eternal, the information recorded on the Bitcoin network is also eternal, and the carrier of information is Bitcoin itself, which is cooler than anything else.

If you had to describe the difference between Bitcoin NFTs and Ethereum NFTs in one word, what would you choose?

Some people say that Bitcoin NFTs are “eternal”. As long as you believe that the Bitcoin network is eternal, all data “engraved” on Bitcoin will exist forever. Don’t play off-chain, only play on-chain.

Some people say that this is a numbered banknote, if you write something on it, will it be different? I don’t know about Hong Kong dollars, but Bitcoin does! 1 Satoshi = Whatever you inscribed. This is the biggest underlying value logic difference between Bitcoin NFTs and Ethereum NFTs.

Some people say that Bitcoin NFTs are “historically valuable”. Because the “engraving” of Bitcoin NFTs will lead to differences in the size of the numbered sequence of Bitcoin NFTs. The earlier the Bitcoin is “engraved”, the more valuable it may be in the future, just like Jurassic dinosaur fossils, Shang Dynasty bronze ware, and modern reinforced steel.

Some people say that Bitcoin NFTs are “free”. From Silk Road, to some online malls, to Amazon, and eBay, Bitcoin has been developing along the path of “more widely accepted currency”. The emergence of the Ordinals protocol makes Bitcoin more free. Who knows what additional value a “engraved” Satoshi will have? The free flow of the market will give these “engraved” bitcoins new value. One day, we will get the answer to this question. These answers are showing us the unique charm of Bitcoin NFTs compared to Ethereum NFTs. (Source)

5. Challenges facing Bitcoin NFT

Lack of scalability

Due to the cost factor of Bitcoin NFT (fully on-chain), large-scale application and popularization may currently be impractical.

Lack of infrastructure

The current Bitcoin NFT ecosystem is not yet complete, lacking related infrastructure and application scenarios, mostly relying on off-chain transactions.

High operation threshold

As mentioned above, since most Bitcoin NFT transactions need to be carried out off-chain, the operation is more complicated. For ordinary users, understanding and use may be more difficult.

Boosting Bitcoin network transaction fees

The rise in Bitcoin network transaction fees is a side effect of adding NFT to the Bitcoin blockchain, causing the most severe Bitcoin transaction block congestion since FTX bankruptcy.

Violation of Bitcoin’s basic tenets

Bitcoin maximalists believe that Bitcoin NFT violates Satoshi Nakamoto’s original intention of creating “peer-to-peer electronic cash” and writing NFT-related data into Bitcoin is undoubtedly a waste of block capacity.

6. Market outlook

1. The blue-chip project of BTC NFT has not yet been determined, but Bitcoin Vava looks like it has the potential for the 10k series blue-chip. In terms of 10k series, 1BTC FP is a big threshold, but it can be challenged. With the exchange standing on the BTC NFT platform

2. The future BTC NFT that can run out must be the original series of the BTC ecosystem, rather than the series of copying Blockingste on the Ethereum chain. At the same time, it is still continuing the PFP gameplay of NFT, and only the BTC NFT of the head avatar series that can do PFP has the potential to become a blue chip.

3. If the floor price of BTC NFT starts at 0.001, the pull-up effect is the best, because with such odds, there is basically a potential to rise by 20 times. The current floor price of 0.01B is a threshold, 0.02B is a threshold, and 0.1B can be promoted to a blue chip series.

4. There is currently no new narrative gameplay on the eth chain. It can already be observed on the chain that many NFT project parties have begun to migrate to BTCNFT entrepreneurship in the past half month. NFT artists should dig more BTC element colors for creation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Litecoin’s LTC20 protocol: the next speculative market with hundredfold or thousandfold growth?

- Blocking Daily Report | Bitcoin Mining Difficulty Increased by 3.22% to 49.55T; LayerZero Launches Bug Bounty Program of up to $15 Million

- DeFi on Bitcoin: Is BTCFi a breakthrough or a bubble?

- From the perspective of “de-dollarization” in Web3, speculate on the ultimate form of currency in the future

- Layout for many years but little known? Exploring the full picture and opportunities of the Japanese Web3 encryption market

- PA Daily | Tether will allocate 15% of its net profits to purchase Bitcoin; Ripple acquires crypto custody company Metaco for $250 million

- Jump Trading’s Crypto Waterloo: Forced to Exit US Crypto Trading Market, Facing Terra Class Action Lawsuit