Popular science | What is DeFi and how does it work?

Source: Medium

Translation: First Class (First.VIP)

Most people haven't understood the concept of blockchain and cryptocurrencies for a long time. It has been nearly two years since the collapse of the crypto bubble in 2017, and the price of most cryptocurrencies has dropped by about 88. However, in recent years, there is a hot topic that is based on blockchain / encryption technology. It is called DeFi. In this article, what is popular science DeFi, how does it work, and why do we understand DeFi.

What is DeFi?

DeFi is the abbreviation of Decentralized Finance, which refers to the ecosystem of protocols, platforms, applications and tools that reconstruct traditional financial products outside of the traditional financial system. DeFi solutions are not provided by banks, but are built using open source software and an unauditable network. As a result, DeFi products are transparent in nature and open to anyone who can connect to the Internet. DeFi products enable people around the world to participate in financial activities (such as consumption, borrowing, lending, gambling, and transactions) in a peer-to-peer manner without relying on intermediaries such as banks and governments.

- Custody and trading are not enough, investment giant Fidelity independently develops digital currency to motivate employees

- Li Lihui, Former President of Bank of China: To Study Issuance of Global Digital Currency Dominated by China (full text)

- Research: US Treasury submits report in support of blockchain sandbox

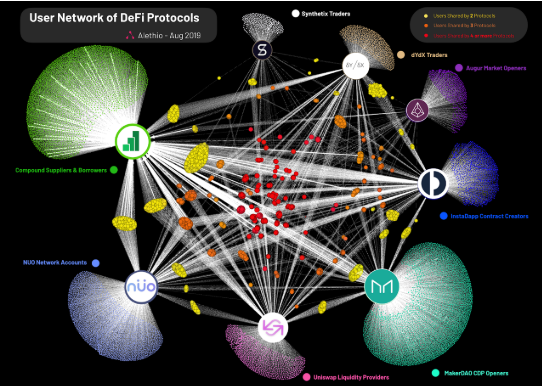

Stunning growth in the DeFi space (Source: Alethio)

The growth in the DeFi space is shocking, with more than $ 675 million worth currently locked into the DeFi protocol. Many people have closely followed the development of this field in the past 12 months. Now DeFi is becoming a parallel financial system that coexists with traditional central banks, Santander, Deutsche Bank and pension funds. Almost all DeFi solutions are built on Ethereum. Ethereum is an open blockchain platform that is best in terms of development and active users.

How does DeFi work?

The DeFi solution is powered by blockchain technology and uses the most powerful features of the technology: programmable digital assets such as Bitcoin (BTC) and Ethereum (ETH). These digital assets have monetary value, mainly because of their value storage characteristics. Since these assets are programmable, we can lock them in smart contracts as collateral (similar to a home mortgage).

We can also use provable lock values to do all kinds of interesting things. With this collateral, loans are obtained in the form of so-called "stable coins". A "stable currency" is a digital currency whose value is linked to world currencies such as the US dollar. We can use these stable assets to exchange other digital assets and spend them on the Internet, or lend them to loan agreements to earn interest. There are also more advanced things that can go beyond the range of financial products we know today.

The general meaning is that digital reserve assets are used to mortgage fully digital and non-intermediate innovative financial products. You can interact directly with the code anytime, anywhere without the need for an intermediary company, which is a representative change.

Why is DeFi better?

DeFi as a concept and an ecosystem is still in its very early stages, and it provides us with a new financial service and currency model. A new model that is fully mortgaged, transparent, unreviewable, and composable. In our view, it is clear that there are inherent flaws in the global financial system, which are mainly caused by opacity and excessive borrowing. Although it is not believed that the global financial system will be completely replaced by encryption-based alternatives, it is believed that it will exist in parallel with encryption-based solutions and provide an alternative for those seeking encryption-based solutions.

From the user's perspective, the DeFi solution also has some interesting features. First, it's unlicensed, which means I don't need anyone's approval or license to use these products. You also don't need to create an account anywhere, share a copy of your passport, or trust the bank that my money is actually stored in the bank. Instead, use your own cryptocurrency wallet to interact directly with the code. Interactions are anonymous, instant and can begin anytime.

Why are these important?

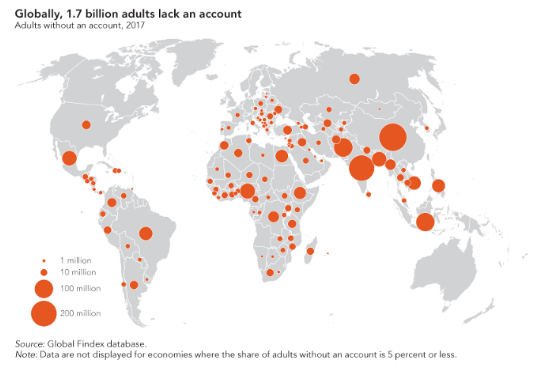

Let us first consider that a large part of the world does not have access to decent financial infrastructure. Billions of people have no access to banking services and billions of people are vulnerable to government financial scrutiny. The concept of DeFi is particularly relevant to these people because DeFi provides them with an unlicensed (in most cases) unreviewed financial solution that can help them increase productivity, wealth and quality of life.

Let us also consider those economically depressed countries such as Venezuela, Argentina and Turkey. We see that SoV assets like gold and Bitcoin have been used to evade the hyperinflationary rate of fiat currencies. What if there was a fully digital, globally available currency to choose from? This can help them maintain their purchasing power when local governments mess up the economy.

Why should we care about DeFi? In addition to some practical improvements to traditional bank accounts and services, I believe that our generation will become more vigilant and skeptical of the global financial system.

This may not be urgent, but in the event of (possibly) another financial crisis, I expect many of us will seek financial freedom and sovereignty outside the traditional financial system.

to sum up

It must be acknowledged that before decentralized finance really takes off and realizes its potential in the global financial system, there are still many challenges to be overcome, but this does not mean that you cannot start using it today! In fact, it is highly recommended to see technology enthusiasts use the core concepts of DeFi to deal with top technology, and to play the role of DeFi advocates in the community and the network.

Reprinted please retain copyright information, thanks for reading.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Former President of Zhejiang Commercial Bank Liu Xiaochun: Seven Conjectures of the Bank of China on Digital Currency

- IBM Global Central Bank Digital Currency Survey: Retail Central Bank Digital Currency-The Next Payment Boundary

- DeFi observation for a week: stablecoins and smaller market value tokens become the next major growth point

- People's Political Consultative Conference: How to Promote the Development of Digital China with Blockchain Technology

- German media: Germany is entering a "cryptocurrency paradise", new bill allows banks to sell cryptocurrencies such as Bitcoin

- Accelerated landing of alliance chain, "arms race" and challenges coexist

- Interview with Babbitt 丨 Pure Capital Jiang Chun: The starting gun has been fired, blockchain entrepreneurs need to hurry up