QKL123 market analysis | Crypto asset license issuance, trading platform South Korea Zhao'an (0306)

Abstract: The broader market fluctuated upward, with Bitcoin standing at $ 9,000, which is expected to continue to test the pressure level in the short term. Since last year, Singapore, Germany, South Korea and other countries have begun or are preparing to issue crypto asset operating licenses. These will help crypto assets be accepted by mainstream investors and will be long-term positive for the entire market.

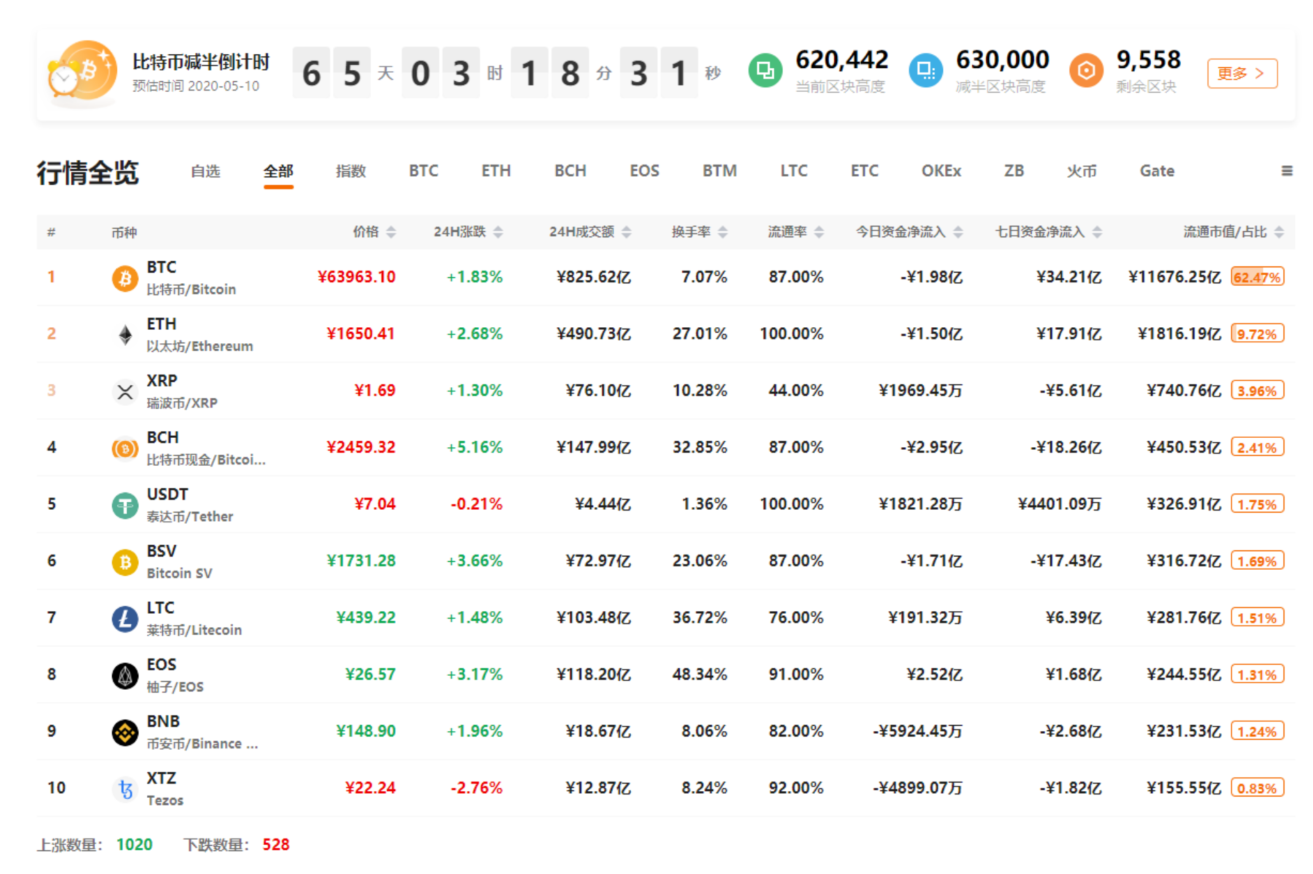

At 15:00 today, the 8BTCCI broad market index was reported at 13730.25 points, with a 24-hour rise or fall of + 2.13%, reflecting an upward trend in the broad market; total turnover was 965.298 billion yuan, a 24-hour change of -0.91%, and market activity declined slightly. Bitcoin strength index was reported at 85.74 points, with a 24-hour change of -0.55%. The relative performance of altcoin in the entire market has become stronger; the Alternative sentiment index is 39 (previous value 41), and the market sentiment is expressed as fear; The external discount premium index was reported at 101.04, with a 24-hour rise or fall of -0.34%, and the intensity of OTC fund inflows slightly weakened.

Analyst perspective:

Yesterday's news, the Plenary Session of the Korean Parliament passed the amendments to the "Special Financial Law", which involves a license system for crypto asset trading platforms and real-name registration of bank-supported trading accounts. The bill will go into effect in March 2021, with a six-month grace period for the trading platform to transition. This means that with the formal legalization of crypto assets in South Korea, crypto asset trading platforms will be brought under financial supervision. In the long run, regulatory compliance is conducive to the development of the crypto asset industry, but in the short term, it may cause a run on the non-conforming trading platforms, because not many of them may meet South Korean requirements at present.

- CBDC: A central bank for everyone? | National Bureau of Economic Research Working Paper

- In-depth understanding of the blockchain's second-tier expansion plan, Rollup: Why did Vitalik praise the plan?

- Secret history of Bitcoin: early Bitcoin participants' impressions of Satoshi Nakamoto

The current crypto asset trading platforms can be broadly divided into two categories, decentralized and centralized. Centralized trading platforms have problems such as counterfeit trading volume, illegal transactions, and even misappropriation of funds and running away. Decentralized trading platforms have problems such as poor trading experience, lack of liquidity, and technical bottlenecks. Therefore, for crypto assets to be accepted by mainstream investors, in addition to crypto asset self-compliance, platform regulatory compliance is also a river that must be crossed. According to incomplete statistics, currently there are less than one-tenth of the trading platforms that hold licenses around the world. Most of the head trading platforms only have compliance permits for individual countries or regions.

Today, the United States and Japan have become the two countries with the most licenses for crypto asset trading platforms, and Germany, Singapore, Hong Kong and other countries and regions have now accepted applications for crypto asset business licenses. At the same time, head trading platforms have begun to develop toward compliance, traditional financial institutions will also be involved in this field, and the crypto asset market will become more transparent and more competitive. In addition, the Supreme Court of India overturned the Indian central bank's ban on crypto assets the day before, a move that may accelerate the introduction of targeted regulatory measures in the country.

It can be seen that in the future, more countries and regions will introduce regulatory measures and more compliant trading platforms will emerge. This will attract more investors to join, especially traditional investment institutions, and then provide strong support for the continued improvement of the crypto asset market.

First, the spot BTC market

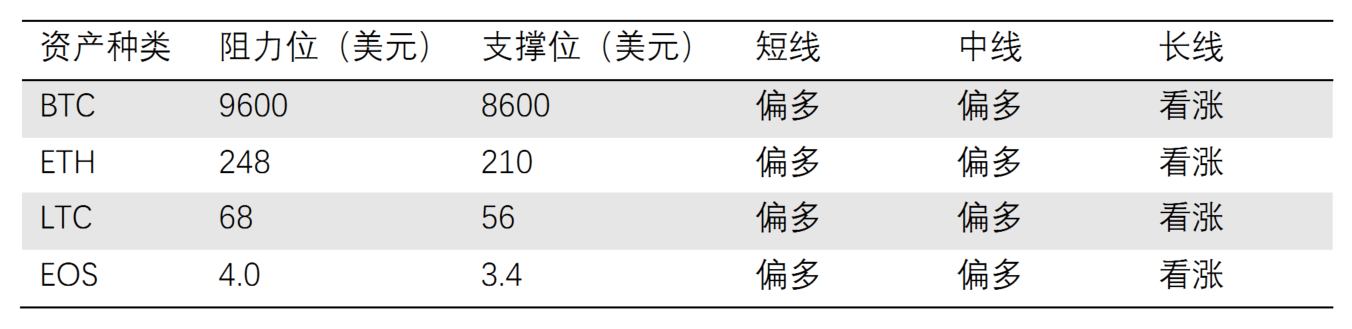

BTC has been shrinking upwards on the daily line, currently standing at $ 9,000, and many troops have begun to control the market rhythm in a short time. The MACD is near the golden fork below the zero line, the crocodile indicator narrows upwards, and the TD indicator shows that there is still room for upward movement. This is the market's pace to test the pressure of $ 9,600.

Second, the spot ETH market

Judging from the four-hour K-line, the ETH triangle changed its upward direction after the convergence of the ETH triangle. At present, it is nearing the previous high point of rebound. MACD has reached above the zero axis. The short-term linkage BTC is expected to continue to explore.

Third, the spot LTC market

The trend of LTC today is weaker than that of BTC and ETH, and the bulls' reaction is slightly inadequate, indicating that the market is still divided, and the short-term linkage of BTC is mainly.

Fourth, the spot EOS market

The trend of EOS is similar to that of BTC. Standing on the rebound high of the previous few days will help the market continue to rebound.

Five, analyst strategy

1. Long line (1-3 years)

The long-term trend of BTC has improved, and it is expected to usher in the crazy bull market in the next one to two years. Smart contract platform leader ETH, altcoin leader LTC, DPoS leader EOS can be configured at dips.

2. Midline (January to March)

BTC is hovering at the 200-day moving average, which is expected to increase by halving. There is still a certain amount of upside. Those who do not have heavy positions will increase their positions on dips.

3. Short-term (1-3 days)

There is room for a short-term rebound, small positions attract low and sell high.

Appendix: Interpretation of Indicators

1. 8BTCCI broad market index

The 8BTCCI broad market index is composed of the most representative tokens with large scale and good liquidity in the existing global market of the blockchain to comprehensively reflect the price performance of the entire blockchain token market.

2.Bitcoin Strength Index

The Bitcoin Strength Index (BTCX) reflects the exchange rate of Bitcoin in the entire Token market, and then reflects the strength of Bitcoin in the market. The larger the BTCX index, the stronger the performance of Bitcoin in the Token market.

3.Alternative mood index

The Fear & Greed Index reflects changes in market sentiment. 0 means "extremely fearful" and 100 means "extremely greedy." The components of this indicator include: volatility (25%), transaction volume (25%), social media (15%), online questionnaire (15%), market share (10%), and trend (10%).

4.USDT OTC Premium Index

The ChaiNext USDT OTC INDEX index is obtained by dividing the USDT / CNY OTC price by the offshore RMB exchange rate and multiplying by 100. When the index is 100, it means the USDT parity, when the index is greater than 100, it means the USDT premium, and when it is less than 100, it means the USDT discount.

5.Net Funds Inflow (Out)

This indicator reflects the inflow and outflow of funds in the secondary market. By calculating the difference between the inflow and outflow of funds from global trading platforms (excluding false transactions), a positive value indicates a net inflow of funds, and a negative value indicates a net outflow of funds. Among them, the turnover is counted as inflow capital when rising, and the turnover is counted as outflow capital when falling.

6.BTC-coin hoarding indicator

The coin hoarding indicator was created by Weibo user ahr999 to assist bitcoin scheduled investment users to make investment decisions in conjunction with the opportunity selection strategy. This indicator consists of the product of two parts. The former is the ratio of Bitcoin price to the 200-day fixed investment cost of Bitcoin; the latter is the ratio of Bitcoin price to Bitcoin fitting price. In general, when the indicator is less than 0.45, it is more suitable to increase the investment amount (bottom-sweeping), and the time interval accounts for about 21%; when the indicator is between 0.45 and 1.2, the fixed investment strategy is suitable, and the time interval accounts for about 39 %.

Note: Crypto assets are high-risk assets. This article is for decision-making reference only and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Who has been the ultimate beneficiary of Stellar's four years of inflation?

- Viewpoint | Witnessing History: Global interest rate cuts will give birth to Bitcoin's elder bull

- ING economist: If the dollar does not go digital, it will fall out of favor

- BitMEX follow-up impact, UK strengthens supervision of cryptocurrency exchanges

- Introduction | tBTC: A New Bitcoin Sidechain Design

- Exchange service provider AlphaPoint raises $ 5.6 million, Galaxy Digital takes another shot

- Loss of $ 98 billion per year! Nike, CK, Tommy Hilfiger seek to use blockchain technology to tackle counterfeiting