Read the connection between the technological revolution and financial capital: the world is changing, and the world should be changing.

People in the blockchain world seem to be more inclined to interpret the news of Deutsche Bank's layoffs as one of the "signs" of the collapse of traditional financial institutions and the impending encryption world to take over the world.

In fact, the problems of Deutsche Bank are mostly related to their own business problems. It is difficult to say that the impact caused by the blockchain or cryptocurrency is directly related. However, the new technology represented by the blockchain will eventually bring the traditional financial industry. A huge impact and changing the development track of the traditional financial world is a development trend that cannot be ignored.

How to correctly understand this trend? Find answers from the book "Technology Revolution and Financial Capital" by the Venezuelan-born British economic theorist Carlota Perez. This book is very influential in the investment community. It is not only for those who are trying to understand technology and economic evolution, but also for entrepreneurs or investors. It is a common wave for us, and we have to be involved in the wave. In the case of individuals, there is also real inspiration.

- Bitcoin plunged 12%, and futures broke nearly 3 billion. What is the market?

- With the use of a single scene, the source of limited value of the Ripple Coin (XRP), why is it the third in the market value?

- Blockchain Technology Index | Defending Privacy: The Rise of Anonymous Technology

Technological Revolution and Financial Capital: The Dynamics of Bubbles and the Golden Age

The final chapter of "Technology Revolution and Financial Capital" is called "The World at a Turning Point." When the author wrote this title, the Internet bubble just shattered. And what happened afterwards, as the model in the book reveals, the world has ushered in a long period of prosperity.

Standing nearly 20 years later, we can clearly see how information technology and the Internet revolution have developed along the same trajectory as the previous four technological revolutions. At the same time, we have observed both models and reality. It seems that it has come to an end – depletion and turmoil, and economic development needs to be promoted by the next technological revolution.

And the new technology seems to be appearing in batches, thanks to the help of financial capital. Although we don't know which of them can enter the next technological revolution.

As individuals in the historical wave, we are at the end/mature stage of the last technological revolution, the beginning/outbreak of the next technological revolution.

If universal prosperity is the norm, this may not be a good time; but for those who are committed to the new technological revolution, this may be the best time, because everything is just beginning.

When a technological revolution broke out, it not only added some new industries to the original production structure, but also provided a means for the modernization of all industries and activities through the formation of a technology-economic paradigm. Huge tide. In the past two hundred years, we have experienced five such technological revolutions. This evolution through strides is precisely the way capitalism advances.

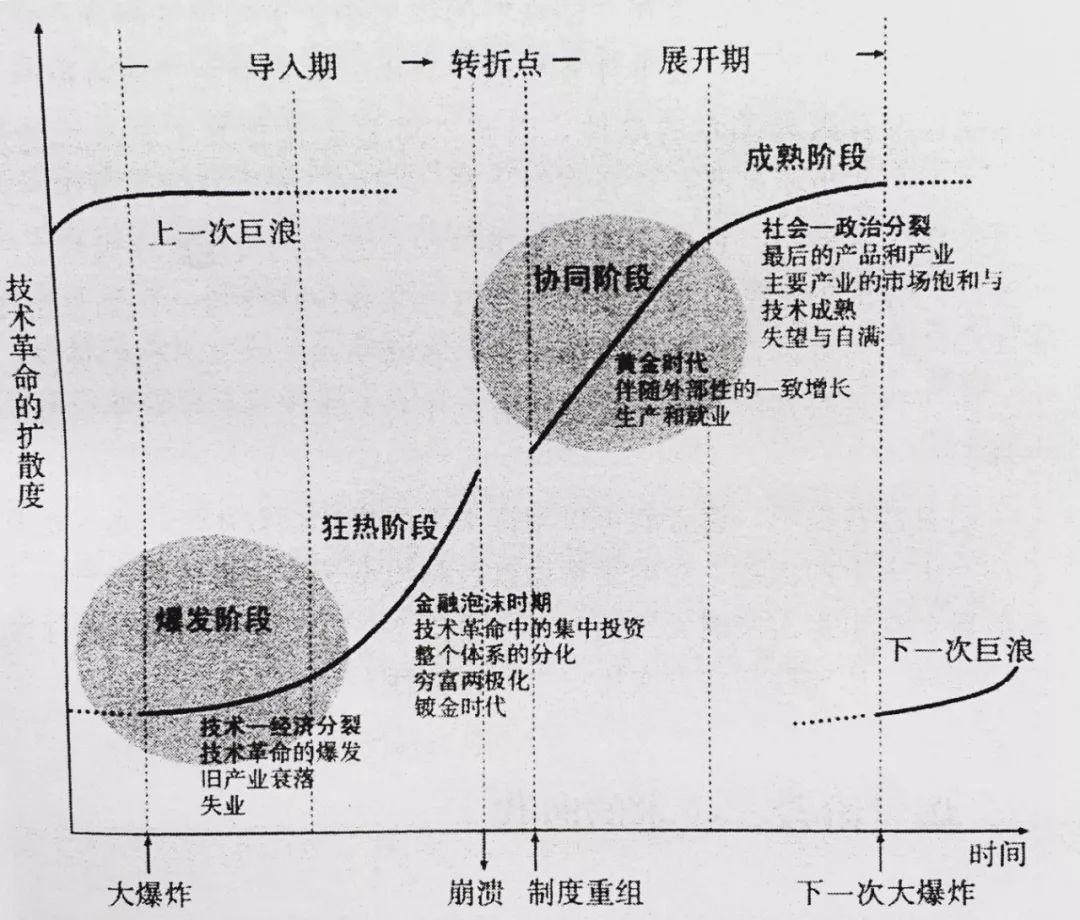

Every wave has two different periods. The first two or three decades were the introduction period, during which a large number of key industries and infrastructures of the technological revolution were formed. They encountered resistance from the old paradigm, but were increasingly driven by the standards and enormous vitality of financial capital. In the middle of the wave, the turning point appeared, and the previously formed contradictions were overcome to create conditions for the expansion period.

The next step is the same period of 20 or 30 years. The transformational potential of the technological revolution spreads throughout the economy, and the benefits for economic development have reached an extreme. The growth of this period is mainly driven by the long-term standards of production capital. At the same time, the institutional framework tends to pursue a better balance between private interests and collective interests.

Each of the above periods consists of two distinct phases, showing the changing characteristics of the technological revolutionary absorption process. Therefore, the recurring wave sequence consists of four phases, each lasting approximately 10 years. These four stages are: the outbreak phase , the fanatic phase , the (turning point), the synergy phase , and the maturity phase . As shown below.

Carlota Perez , a Venezuelan-born British economic theorist, studied all major technological revolutions since the Industrial Revolution, knowing how they were affected and how they affected the capital markets. Her " Technology Revolution and Financial Capital: The Dynamics of the Bubble and the Golden Age " is influential in the investment community.

Economic theorist Carlotta Perez

Economic theorist Carlotta Perez

Based on the sequence of events that have occurred again, Carlotta Perez has shown that the advent of the technological revolution has obvious regularity and that the economy responds in four foreseeable stages. This model not only has a research significance for scholars, but also a realistic road map for entrepreneurs and investors. It reveals what will happen next.

One or five waves and three key concepts

Before each stage of the specific discussion wave and the different roles that financial capital plays at each stage, let us briefly introduce the five technological revolutions that have occurred since the end of the 18th century, and three to help understand why the wave is divided into four. The key concepts of the stage.

Five successive technological revolutions (the first 10 years from the 1870s to the 21st century):

1. The era of industrial revolution. It started in 1771. The opening event was the opening of Accrath's plant in Cloneford, and the future of cotton textiles and other industries through mechanization to cut costs is clearly visible. 2. Steam and railway era. It began in 1829. The opening event was the success of Stephenson's steam locomotive on the railway from Liverpool to Manchester, announcing the arrival of the railway and steam power world. 3. The era of heavy industry. It began in 1875. The opening event was the start of the Carnegie Acid Converter Steel Works in Pittsburgh, Pennsylvania, representing the arrival of the steel age. 4. The era of mass production. It began in 1908. The opening event was that Ford's Model T was mass-produced from a fully-propelled assembly line, which represents a future production model. 5. The age of information. It began in 1971. The opening event is that Intel produced the first microprocessor, and the computer on the chip can be seen as a sign of the birth of the information age.

Next, introduce three key concepts .

1. Technology-economic paradigm. Every technological revolution inevitably triggers a "paradigm shift." The so-called "paradigm" consists of a set of common, same types of technical and organizational principles that together change the best habits of all people and represent the most effective way in which a particular technological revolution can be applied, and Take advantage of this revolution to revitalize the entire economy and modernize it in the most effective way.

Once universally adopted, these principles form the basis of common sense for organizing all activities and building all systems. The impact of the new technology-economic paradigm on innovation and investment behavior can be analogized to the discovery of a vast new continent that ignites the imagination of engineers, entrepreneurs and investors who try new wealth in a trial and error manner. Create potential.

For example, "mechanization and productivity" during the industrial revolution, "national market and standard parts and components" in the steam and railway era, "science is a productivity and cost accounting" in the era of heavy industry, and "economies of scale and mass production" "Specialization of functions", "intangible value added value and globalization" in the information age.

The technology-economic paradigm allows the technological revolution to transform beyond the economic realm. It also permeates the political realm and even the ideological realm, thus affecting the direction in which the potential of the technological revolution can be unfolded. The great tide of development is the process of a technological revolution and its paradigm spreading and triggering changes throughout the economy and society.

2. Institutional innovation. The new economy that comes with each technological revolution involves major changes in investment, production, trade, and consumption patterns. These new ways have created new market behaviors. People need a sound system to deal with them, improve and shape the economy. The transformation that took place in the field.

The institutional sphere is the place where political, ideological, and social thinking at every stage is entrenched. It is also a network of standards, laws, rules, supervisory bodies, and the entire structure responsible for social governance. Along with each technological revolution, it not only brought about a comprehensive transformation of the production structure, but also gradually brought about the transformation of the social, even ideology and culture, governance system.

3. Financial capital. Financial capital represents the standards and behaviors of those who hold wealth in the form of money or other book assets, and they engage in activities that they believe are most likely to increase wealth. Production capital represents the motives and actions of those who create wealth through the production of products or services.

The separation of financial capital and production capital yields the most effective results: it is precisely because non-producers hold the funds for profit seeking that new entrepreneurs can turn their ideas into commercial reality, relying on financing, new businesses. Only then can it become a real driving force.

Financial capital is essentially unfounded, and production capital is rooted in the areas in which it can be competent; financial capital will escape danger, and production capital will have to face every storm; but at the dawn of major changes, Responsible production capital will become conservative, and it is financial capital that allows new entrepreneurs to rise.

Second, the four stages of the wave and the behavior of financial capital at each stage

The beginning of the article briefly introduces the four stages involved in each wave. Next we will analyze each specific stage of the technological revolution and the performance of financial capital in it.

We choose to start from the maturity stage rather than the outbreak stage, because at the maturity stage, the old paradigm begins to meet the limits of its potential, and the appropriate conditions are created, and the brewing of the next technological revolution begins at this time.

1. Maturity stage: financial capital stimulates technological revolution

At the maturity stage, many of the original core industries in the mainstream paradigm showed signs of exhaustion, and only a few new industries in the end maintained high growth rates. The life cycle of the latest technology systems and products is very short, because the accumulated experience brings a curve of rapid learning and demand saturation, and the paradigm gradually reveals its limitations.

Financial capital and companies join forces to try to boost their threatened profits. Because in the last stage of synergy, financial capital and production capital have established lucrative cooperative habits, and several years of successful experience have allowed financial capital to continue to support the strategy of production capital.

Strengthening control of the market is one of the early solutions that most powerful companies find in the face of difficulties. They achieve this through various means such as mergers and acquisitions, acquisitions, and smaller competitors. The driving force behind the formation of a monopoly is a reaction of the market to shrinking growth.

Another trend is that companies in mature industries are trying to expand outward from existing investment areas (domain and geography). Financial capital began to support investments in the marginal sector, selling to new customers in the distance and shifting production to cheaper locations. Early overseas investment opportunities were accompanied by market expansion momentum in which mature industries rushed to the periphery.

However, these last investment opportunities are not sufficient to absorb the available financial capital, mainly because their life cycle is too tight and fleeting. Therefore, as the maturity phase slowly passes, there are fewer and fewer valuable borrowers with good projects, and financial capital loans are becoming less and less strict, which is brewing the future debt crisis.

At the same time, financial institutions are increasingly willing to try new and attractive things because of the signs of depletion in the areas of profit that are created by the dominant paradigm, and are willing to take on the risks. .

Financial capital has spread in the twilight season of the existing paradigm in search of profit opportunities, breaking the potential limitations that hinder the development of new technologies, and new technologies have gained vitality, some of which may enter the next technological revolution together. The decline of the entire growth pattern and the stage of the next technological revolution have been set.

2. The outbreak phase: the love of financial capital and the technological revolution

In a world threatened by stagnation, the outbreak phase opened the wave of technological revolution. The two old and new paradigms have coexisted for a long time at this stage, and the core countries have begun to experience the real dilemmas of the economy and society, and some catching up with the countries are reaching their peak of glory.

Financial capital is still deeply involved in the spread of the old field, but the emergence of new areas soon becomes a reality. The incredible growth and production performance of the new industry has attracted investors, and new and more affordable new products have begun to attract consumers and attract new and competitive entrepreneurs who are gradually combining new ideas with successful actions. To make it the best habit, that is, the new technology-economic paradigm.

Finance and banking have quickly modernized their operations. The development and dissemination of every technological revolution tends to stimulate innovation in the financial sector, as well as the momentum generated by financial innovation. For example, in the steam and railway era, a single company can rarely afford the large amount of investment required for railway development, but the innovation of the joint stock company has brought about effective ways to concentrate capital and spread risk.

But the upgrading of technology is a difficult and often delayed process, and the external factors and institutions that promote the spread of the new paradigm have not yet appeared. Although the new industry has accumulated strength during this period, the technological revolution, including all the resources it has mobilized, is still only a small part of the existing economy.

The technological revolution cannot absorb all of the existing investment funds, and these funds are increasingly favoring this technological revolution as a cash cow that generates profits. By the end of the outbreak phase, the amount of financial capital has once again exceeded the number of good opportunities, but because of the staggering growth rate and profit before, financial capital regards the huge gains from the new industry as normal.

Therefore, financial capital has developed complex financial instruments to generate money, and the break of financial capital and production capital has begun. Financial capital will continue to support the strong growth of new industries, but it will set its own conditions, impose its own standards on production capital, and become an autonomous force through its strict financial logic.

3. Fanatic stage: self-satisfied financial capital dominates the casino

The frenzy is a period of time when financial capital takes off from itself.

During this period, people began to explore all possible roads opened up by the technological revolution. In order to create new markets and reinvigorate the old industry, through a large variety of trial and error investments, people have fully tapped the potential of the new paradigm that is spreading, and the paradigm is also firmly in the mind map of the entire economy and investors. Got roots.

The explosive growth of productivity has affected more and more activities, which has led to the reconstruction process in the production field. The reconstruction process has been further strengthened by the acquisition of new infrastructure. These infrastructures have covered a large enough range with significant externalities. All those who have benefited from this opportunity believe that the world is moving towards an incredible stage.

This is also a period of extremely unbalanced prosperity and extreme trends in all areas. The old and new differentiation brought about by the outbreak of the technological revolution has now gradually become a "crack", disconnecting successful and backward enterprises, industries, and countries.

The success of successful people has generated enormous wealth. These wealth are concentrated in a small number of economic entities, which in turn want to continue to add value to these wealth at the speed at which they create wealth. In the frenetic phase, the profit-taking pressure of wealth is greater because they are in the hands of the new rich, rather than in the mature stage, when the remaining funds to seek opportunities are in the safes of the traditional strong.

When the imagination of financiers shifts to the task of making money from money , the relationship between the monetary economy that has become confusing and the real economy that is being rebuilt is becoming more and more tense, and financial capital is getting farther away from it as a source of real wealth. The role of the person. For those who seek to accumulate wealth, higher profits in the financial sector make them less willing to participate in production activities, except those that are more profitable in terms of the most active technology and can attract more capital flows. field.

At the same time, the ability of new money to generate money has attracted more and more people to join in. Everyone recognizes this incredible possibility, and they gradually dare to enter the former or foreign territory, in order to get a share. Confidence is soaring, investors have accepted high price-to-earnings ratios in the sky, overpriced price bottoms and some weird business plans, because who really knows what is possible? It is these that constitute the enthusiasm of people.

The railway heat in the second technological revolution may be a good description of this stage: the expansion of the railway was originally carried out along a route with obvious needs and practical construction, and then the demand is doubtful and the project is full of problems. The route, and finally, "As the public cried and called for railway shares," some companies were set up so that the builders could throw their stocks at a high price at an appropriate time.

At this stage, financial capital dominates the world, and its direct interests dominate the operation of the entire system. The separation between finance and production has gradually widened the gap between economic power and regulatory framework.

One party is a large amount of money competing for high returns in the financial system, and the other is the overall speed of wealth creation in the production and trade of goods and services. The expansion of asset prices creates unguaranteed capital gains that are completely divorced from the profits and dividends of the real economy they represent.

Therefore, the late stage of the fanatic phase is a period of financial bubble . The tension between financial capital and production capital needs to be re-established in some way. This is often violent and painful. It is often a real big collapse.

Although the fanatic stage is a true "golden age": the golden jade is out of the way, but it has completed its mission, creating a basic external environment for the technological revolution that will be fully developed in the future, and enhancing the society's concentrated understanding of the technological revolution.

4. Turning point: reflection and adjustment of development route

The recession after the frenzy and the collapse that caused the recession are the consequences of an unsustainable structural arrangement. There are three structural tensions that make the fanatic process impossible to proceed indefinitely. They exist between real wealth and book wealth. The size of the existing demand for the core products of the technological revolution and the potential supply scale; between the socially excluded groups and those who have harvested the fruit of the bubble.

The capitalist system has been operating under basic structural tensions, and this tension can only be overcome through institutional restructuring.

The turning point represents a fundamental change necessary, that is, the transition of the economy from a frenetic way of shaping financial standards to a synergistic approach, that is, a way of relying on increasing production capacity.

The turning point is neither an event nor a certain stage. It is a process of change that takes place in a specific environment and can last from a few months to a few years. For social system decisions, it is An important crossroads.

Profits that become confused and unrealistic during the fanatic phase must be pulled back to the standard line, which means establishing adequate control over financial capital and setting up an institutional framework that favors the real economy over the book economy. It is only after the collapse has caused a large amount of gains to be paid out, and when the recession indicates that it is impossible to reinvigorate the casino, it is possible for financial capital to accept such regulation.

In this way, the collapse of the end of the introduction period created conditions for regulation, reversing the situation and becoming beneficial to production capital.

Every big bubble in the avid phase floats on the enormous potential of real growth and general prosperity, and once the distortion is removed, a healthy economy can emerge. After the recession, no matter which group owns or seizes the opportunity to re-represent the collective interests of society, it will gain the right to deeply shape the future world.

5. Collaborative phase: the era of production

The synergy phase is the first half of the paradigm expansion phase, which can be called the true "golden age."

The fundamental externalities that contribute to the technological revolution, especially infrastructure, have been formed during the frenetic phase, as have the basic investments made in the industrial sector as a growth engine. The conditions required for dynamic expansion and economies of scale are already in place. With an appropriate framework, growth will stabilize, and society can feel that economic growth is progressing at a good pace.

The new paradigm now occupies a dominant position, and its logic permeates into activities, from business to administration to education, and higher levels of new productivity and quality are gaining popularity throughout the economy. People see technology as a positive force, and finance is also because it now truly supports production capital.

New rules have been established in the financial sector, often including a new framework for banking and monetary activities. People have also established rules of the game that restrict business, employment, and other aspects. In addition, institutional innovation has been carried out at the international level.

This is a period of order and action, and it is also a period of continuous investment in production capacity and continuous increase in employment and expansion of the market. Production is the key word at this stage, and actual growth in production becomes the basic source of wealth.

The synergy phase is also a time when people feel good because it tends to allow more and more parts of the economy and society to enjoy the benefits of growth. The promise of capitalism—through individual pursuits to achieve common interests—seems to be credible during this period, and technology and production are tools for fulfilling these promises, and they are the engines that drive the economic and social classes.

This is an era of promise, work and hope. For many people, the future is bright.

6. The road to maturity

If the lead-in period can be seen as a huge experimental arena, it examines the various paths of the new paradigm and establishes a basic cluster, then the expansion period can be described as the completion of the cluster and the extension of the chosen road. Technological innovation has evolved from a period of intense exploration guided by financial capital and its objectives to a stage of market consolidation and expansion that follows production capital standards.

When the maturity period of the post-expansion period comes, as mentioned above, the scope of new investment opportunities will gradually narrow, and both production capital and financial capital will once again enter the period of capital outflow. They are often overseas or already Look for new investment channels in innovations beyond the paradigm.

In this way, driven by the willingness of financial capital, huge waves will spread to the periphery, while in the core region, the next technological revolution will be ready and will challenge the existing production structure.

Third, in the world of "recurring ups and downs"

The large-scale economic transformation brought about by each technological revolution involves complex social absorption processes, including dramatic changes in production, organization, management, communication, transportation, consumption patterns, etc., ultimately leading to a different way of life. Therefore, often, the whole process of the wave takes about half a century to develop and involves more than one generation.

For a long time, people have forgotten what happened. Therefore, despite the repeated ups and downs of social and economic performance, people still seem to have a belief that as a result of social development, the era without cycles and social problems will eventually arrival.

This ideal or belief reinforces their stubbornness in two special phases of the technological revolution, the avid phase and the synergy phase.

In the previous stage, the expansion of the financial bubble and the incredible profits that made people illusory about the new economy, people are increasingly confident about this, and more and more money is deposited in the "believers' banks"; In the latter stage, the steady growth and spread of welfare lasted for quite a long time, and people created an illusion about an unprecedented progressive society that they believed to be guaranteed.

The first illusion will be shattered by the bursting of the bubble; with the economic downturn of the existing production structure, the second illusion will be broken by the growing social dissatisfaction.

This is why we recommend the book "Technology Revolution and Financial Capital" because it is not only for those who are trying to understand technology and economic evolution, but also for entrepreneurs or investors. It is for every ordinary one of us. It is also truly instructive for individuals who are not involved in the wave.

As for the blockchain, blockchain as a technology has many key elements to promote the technological revolution. For example, it is a new technology (technical innovation) that can reduce costs, and it can stimulate some new financial means (financial innovation). ), it may bring new social and organizational structures (institutional innovation), which is a rare but interesting thing. Can the blockchain become an important member of the new wave of technological revolution? It is worth our expectation.

Written by: Lee, author of the original painting: Kaluo Ta-Pei Leisi

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- We counted the price of Bitcoin in the past two years and found that it fluctuated the most during this time period.

- Security Events | MyDashWallet Online Wallet User Assets Theft Details Disclosure

- The US congressman candidate wants to send money, and the Federal Election Commission has promised.

- Blockchain Xiaobian Adventures, I never thought I was picked up by the police…

- Diversity is a trend in Staking

- Dry goods | Shanghai Jiaotong University Professor Hu Jie dismantled Libra Libra: This is a new thing in the sun

- Blockchain financing in the first half of the year: the United States overtakes China, Hong Kong dominates Greater China, and Hangzhou presses Beishangguang