We counted the price of Bitcoin in the past two years and found that it fluctuated the most during this time period.

It is difficult to define intraday transactions for cryptocurrencies such as Bitcoin. Because cryptocurrencies are different from traditional stocks, they do not have the concept of "day", that is, there is no opening and closing time. The Bitcoin market is open 24 hours a day, which means that people have a good chance to understand the price trend of Bitcoin every day.

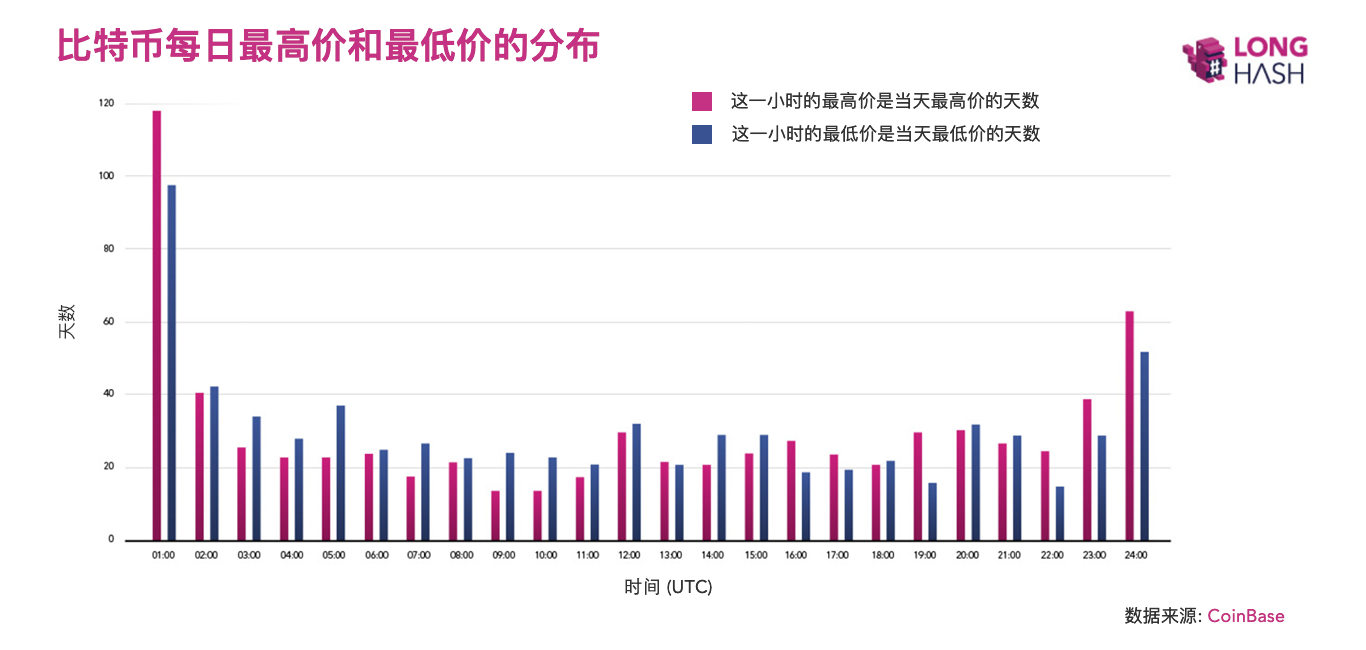

To better understand this trend, LongHash collected price data for Coinbase over the past two years (July 6, 2017 – July 2, 2019). We collect the highest and lowest prices for each hour of the day and compare them to other time periods.

From the chart, you can get the following information.

- The US congressman candidate wants to send money, and the Federal Election Commission has promised.

- Blockchain Xiaobian Adventures, I never thought I was picked up by the police…

- Diversity is a trend in Staking

1. In the past two years, zero and one o'clock in the morning were the biggest fluctuations in bitcoin prices.

Especially at 1 am UTC time, the daily maximum price and the daily minimum price appear more often than other time periods. This shows that bitcoin prices fluctuate the most during this time period.

This may be because at 1 o'clock UTC time, North America just entered the evening, while Asia is the beginning of the day. Western traders and Asian traders are most likely to be active at the same time. Asian traders may have just woke up and are learning about the day's news; North American traders are still watching the dynamics of the Asian market.

Second, the chart also shows: Maybe some investors have found the best time to buy bitcoin.

But in fact, buying Bitcoin doesn't have the "best time" of the day (you can buy it at any time of the day). In the past two years, when people bought bitcoin in the morning (between 3 am and 12 noon UTC), they were more likely to buy at a lower price in the day. But in fact, the difference is not big. It is very unwise to infer this period of time as the best trading time of the day.

In view of this, perhaps this chart proves the view of old investors that market time is better than market timing. Buying bitcoin at a low price and selling it at a high price is risky at a fixed time of the day. But those who bought Bitcoin two years ago and have been holding it now have tripled their return on investment.

LongHash , read the blockchain with data

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dry goods | Shanghai Jiaotong University Professor Hu Jie dismantled Libra Libra: This is a new thing in the sun

- Blockchain financing in the first half of the year: the United States overtakes China, Hong Kong dominates Greater China, and Hangzhou presses Beishangguang

- Say that Staking doesn't make money, why do so many people play?

- Buy Starbucks with Bitcoin and hit Uber, this lightning network payment app will do it for you.

- 180 degree turn! The godfather of emerging market investment: If bitcoin goes up again, I will go buy it.

- The road to Ethereum 2.0

- STO new regulations, encryption, corporate bank account opening or release | Interview with Taiwan's "legislators" Xu Yuren