Research Report | Digital Pass Industry Status and Blockchain Index Product Inventory

Guide

The digital pass market is still an immature market, with a market capitalization of only 0.15% of the total market value of global stocks. The digital compulsory secondary market is active in transactions and the exchanges are scattered. The supervision of digital transacting transactions varies greatly between countries and regions. Like traditional markets, digital censorship also needs index as a tool to measure market changes.

Summary

- The first half of the open market financing totaled $2.59 billion behind: Algorand only ranked fifth, STO nobody cares

- [Chainge] Technical Salon Roundtable "DeFi: Decoding New Opportunities for Cross-Chain Investment"

- Why don't I recommend that you touch the "good project" of cryptocurrencies?

The Market Index is a measure of the value of a portfolio of assets with similar characteristics and is a powerful tool for describing the overall price level and movement of a portfolio. According to the method of selecting constituent stocks, the stock market index can be divided into “national index”, “global index” and “industry index”. The constituents of the “National Index” are usually selected from stocks traded on a stock exchange in a certain country and can be used as a “barometer” reflecting the economic and investor sentiment of a country; the “industry index” is selected according to the industry of the listed company. . According to the weighted manner of the index, the stock market index can be divided into a market value weighted index, a price weighted index, an equal weight index, an adjusted market value weighting, and a fundamental weighting index. The emergence of the index allows investors to have a clearer judgment on the overall trend of the market, and can also be used as a benchmark for investors and fund managers to measure investment performance. The index is a powerful tool for passive investors and the basis for derivatives such as stock index futures and options.

The digital pass market is still an immature market . The secondary market was active in transactions and the exchanges were scattered. There was a big difference in the supervision of digital-licensing transactions between countries and regions. The digital pass market also needs an index as a yardstick for measuring the market. The market index should have: reproducibility . The portfolio represented by the index should be easy to copy. The constituents are listed on multiple exchanges and have certain liquidity; objectivity . Objective is the value of the index, the choice of the component certificate and the weight adjustment are carried out according to the prescribed rules, and try to avoid subjective judgment and human manipulation; integrity . The index should reflect as much as possible the overall trend of the market.

The existing major blockchain index products include the comprehensive index compiled by the exchange, the GBI global blockchain index, and the BLX liquidity index. Because of the special nature of digital certificates, more blockchain index products use the transaction amount weighting method. The blockchain index should be compiled to meet the reproducibility, objectivity and integrity of the index.

Risk Warning: Market Volatility Risk

table of Contents

1 stock market index

1.1 What is the market index?

1.2 Classification of stock market indices

1.3 The preparation process of the stock market index

1.4 Stock Market Index and Passive Investment

2 Digital Certified Industry Status and Index Products

2.1 Existing blockchain index products

2.1.1 Index compiled by the exchange

2.1.2 BLX Fluidity Index

2.1.3 GBI Global Blockchain Index

2.2 Selection of weighting methods

2.3 Digital pass is highly correlated

3 Thinking about the existing index preparation plan

text

1

Stock market index

On May 17, 1792, 24 stockbrokers held a rally under the plane tree at 68 Wall Street. At that time, the US securities market was not yet mature, and the disorderly over-the-counter stock trading and speculative winds prevailed. In 1791, William Dürr, then Assistant Secretary of the Treasury of the United States, used his interpersonal relationships and positions to participate in the speculative activities of the Bank of America in the United States, and eventually followed the failure of speculation and the bankruptcy of the capital chain, leading to follow William. The ordinary people who bought bank stocks in Dürr had no return.

Stockbrokers are aware of this problem: stock trading is not speculative, and stockbrokers need to draw a line between gamblers and speculators. At that rally, the stockbrokers drafted the famous "The Sycamore Tree Agreement" after some discussion: "From today, we do not buy or sell any shares for anyone with a commission rate of less than 0.25%. In the negotiation of any transaction, we will give members priority to each other.” The Wutongshu Agreement triggered people’s thinking about the qualifications of securities brokers, seat management, securities trading rules, and regulatory principles. The Securities Trading Union is also the prototype of the New York Stock Exchange (NYSE), which was established 25 years later.

Today, more than 200 years later, Wall Street's phoenix tree no longer exists, and the NYSE has become one of the world's major securities trading markets. After the Great Depression in the 1930s, people’s perceptions of stocks have also changed from speculation to investment. Investment theories such as “value investment”, “growth investment” and “passive investment” have emerged, and stocks have become important to ordinary people. The asset allocation category, news of the stock market's rise or fall in the news all touched the hearts of investors. As of the end of 2018 (after the data is not stated, the statistical date is up to 2018), the global market capitalization of the stock is close to 80 trillion US dollars, and the stocks traded on the major stock exchanges are tens of thousands. How to judge the overall trend of the stock market? At this time, Stock Market Indices is needed to help investors measure the overall market's rise and fall.

1.1 What is the market index?

The Market Index is a measure of the value of a portfolio of assets with similar characteristics and is a powerful tool for describing the overall price level and movement of a portfolio. A stock market index is a measure of the value of a portfolio of stocks of listed companies with similar characteristics. The preparation, calculation and release of market indices are generally carried out by a professional index provider (Index Provider) in accordance with the established plan. Different index preparation schemes are different, but most calculation methods are based on the weighted average of the asset prices of each component.

The main role of the market index is to measure the performance of the market (or some of its assets) and the investor's comparison of the specific portfolio returns. Some mutual funds and ETFs (exchange-traded funds) also track specific indexes, thus facilitating investors. The index is invested.

1.2 Classification of stock market indices

Most stock market indexes use the two criteria of region and industry as the basis for selecting stocks. According to the country or region to which the index component stock belongs, the index can be divided into “global index” and “national index”. The constituents of the “Global Index” are usually selected from different countries or regions, such as the MSCI World Index compiled by Morgan Stanley Capital International (including translation), whose constituent stocks include 1649 stocks in 23 developed countries or regions. . And Standard & Poor's SP Global 100 index and so on. The constituents of the “National Index” are usually selected from stocks traded on a stock exchange in a country and can be used as a “barometer” to reflect a country’s economy and investor sentiment. Such indices generally also include shares of offshore companies listed in a country. Such as the US Dow Jones Industrial Average (DJIA), Standard & Poor's Index (SP500), Nasdaq 100 Index (NASDAQ100), UK FTSE 100 Index (FTSE100), Japan Nikkei 225 Index (N225) and so on.

In addition, it is also common to select stocks of constituent stocks in a more general geographical division. For example, the MSCI Emerging Markets Index, which includes a number of listed companies in emerging economies such as China, Brazil, India, Saudi Arabia, and Argentina, includes the Dow Jones Stoxx 50 Index of 50 blue chip stocks in the Eurozone.

The “Industry Index” selects constituent stocks according to the industry of the listed company. For example, the Nasdaq 100 Index is mainly composed of technology stocks. The domestic “sector index” also belongs to the industry index.

1.3 The preparation process of the stock market index

The market index reflects the relative amount of the net value of the portfolio, which measures the change in the asset price level in the portfolio over time.

To prepare an index, you first need to select constituent stocks, that is, select the stock types included in the portfolio based on characteristics such as geography and industry. Second, we need to determine the weight of each component in the portfolio. The index can be divided into the following categories according to the weighting method:

Market value weighted index . The weight of constituent stocks in the portfolio is determined by its market value. This method is the most widely used in index compilation. SP500, Hong Kong Hang Seng Index and most domestic indices are weighted by market value. An index that takes all stocks in the market as a sample and uses the (circulating) market capitalization as a weight usually reflects the average rate of return of all investors and reflects the overall market situation. In the capital asset pricing model, the combination of the replicated market capitalization index is a Market Portfolio, and this combination will be the combination with the highest Sharpe ratio under market-effective assumptions.

The disadvantage of market value weighting is that the weight stocks have a higher impact on the index. While the real market does not satisfy the validity assumption, the stock market value may be overvalued or undervalued, and funds tracking these indices may exacerbate the level of overvalued and undervalued stocks.

Price-weighted index . The weight of a constituent stock in a portfolio is determined by its price, such as the Dow Jones Industrial Average. This method is simple to calculate, but the drawbacks are also obvious. The change of the index is affected by the absolute change of the stock price of the component rather than the relative change.

Equal weight index . The equity of each component in the portfolio is equal. Although this method eliminates the influence of heavyweights on the index, it also exacerbates the volatility of the index due to the increase in the weight of small-cap stocks. As the price of constituent stocks changes, the index needs to be revised periodically to ensure equal weights.

In addition, there is an adjustment market weighting method that combines the weighting of equal rights and market value . This kind of weighting method usually limits the weight of higher market capitalization stocks, sets a certain market value threshold, divides stocks above a certain market value into one group, reduces the total weight of high market capitalization stocks, and uses them in high market capitalization groups. Weights are assigned in a weighted manner, and low-capital stocks are weighted by market capitalization to allocate residual weights. In order to balance the weight of stocks in various industries, some indexes also use the weights assigned by the stocks of the stocks, and are weighted by market value in each industry. However, these weighting methods are complicated to calculate and are actually used less.

Fundamental weighted index . As the name implies, the weights are distributed according to the fundamental indicators of the constituent stocks. Common indicators include net assets per share, net profit per share, dividends, historical volatility, etc. The fundamental factors are calculated quantitatively and weighted as weights.

After determining the weight of each constituent stock, it is necessary to select a date to calculate the total market value of the stock in the portfolio, and convert it into a relative number according to a certain ratio, for example, 100 or 1000 points, which is called the base date, and the point of the base date index. Called the base point. Based on this, the points of the index during the reporting period are calculated, and the net value level of the portfolio represented by the different date indices can be conveniently compared by index points. For example, the base date of the Shanghai Composite Index is December 19, 1990, and the base point is 100 points.

When the index constituents or weights change during the reporting period, it is generally necessary to correct the index to maintain continuity in its price. For example, adding or removing constituent stocks, stock ex-rights, etc.

1.4 Stock Market Index and Passive Investment

The East India Company, founded in 1602, was the first joint-stock company to issue equity financing to the public, and its shares were issued on the world's first stock exchange in Amsterdam, the Netherlands. In the 19th century, the securities trading activities of the United Kingdom and the United States gradually prospered. However, the government-recognized exchanges have not yet appeared. Early securities investors spontaneously formed small trading venues and even bought and sold stocks in bars and cafes. In the minds of the people at the time, the stock market was no different from the market for buying and selling agricultural products and daily groceries. It is difficult for people to understand that buying stocks is essentially a concept of investing in a company.

In 1896, at the end of the industrial revolution, financial journalist Charles Dow measured the performance of the entire market by calculating the average price of the top 12 stocks of the NYSE. This index is the famous Dow Jones Industrial Average. The sample stocks are mainly from the industrial sectors of steel, mining, railways, etc., and its constituent stocks have also expanded to 30. In the 1920s, Standard Statistics began to use the market-weighted method to calculate the index of 90 stocks in the NYSE. Due to the limited computing power at that time, the index could only be calculated and published once a day. In 1941, Poole Publishing merged with Standard Statistics to become Standard & Poor's, relaunching the S&P 90 index. In 1946, Standard & Poor's purchased a perforated computer that greatly improved its computing power. S&P expanded the index's constituent stocks to 500 and was able to calculate the index every hour.

The emergence of the Dow Jones Index and the Standard & Poor's Index has undoubtedly given investors a clearer picture of the overall market situation. Charles Dow's Dow Theory is the originator of technical analysis using market indices, and the market index provides a basis for trend traders. With the development of electronic computers, the index of thousands of constituent stocks has been updated in real time, and the index has become the benchmark for investors and fund managers to measure investment performance. Some fund replication index constituents and corresponding weights are used as investment portfolios, which are “index funds”. Tracking index funds in different countries, regions and industries is a powerful tool for passive investors. A study shows that the long-term average return rate of US active management funds is 1.8% lower than the S&P 500 index, which is equivalent to the average management rate of these funds. The number of fund managers who can outperform the index for a long time is extremely small. In addition, with the development of financial derivatives, stock index futures, options as speculative tools, and the way to hedge risks appear in the investor's field of vision.

2

Digital Pass Industry Status and Index Products

According to Coinmarketcap, there are currently 234 digital clearing exchanges and more than 2,000 digital passes on exchanges. The annual digital trading volume of 2018 is about 6.6 trillion US dollars, and the average daily turnover is about 18 billion US dollars. Compared with the global securities market, the total number of listed companies is about 43,000, and the annual trading volume of stocks is nearly 80 trillion US dollars. The total market value of digital certificates is about $125 billion, which is only 0.15% of the total market value of global stocks. The digital pass market is still an immature market. The secondary market is active and the exchanges are scattered. The supervision of digital pass transactions varies greatly between countries and regions.

Just as securities investment is gradually moving towards maturity, people's attitude toward the trading of certificates also needs to be transferred from speculation to investment. Digital Passage also requires an index as a yardstick for measuring the market. Active investors need to use the overall market return as a benchmark to measure their long-term portfolio performance. Passive investors want to invest in a market portfolio to get an average return.

In the early days, there were not many types of digital certificates. BTC is the vane of the whole market in the eyes of investors. With the emergence of a large number of cottage certificates, BTC as a single variety can no longer fully reflect the overall trend of the market, the emergence of the digital pass index It is an inevitable trend. In order to meet the needs of active and passive investors, the following conditions should be met: reproducibility. The portfolio represented by the index should be easy to copy. The constituents are listed on multiple exchanges and have certain liquidity; objectivity. Objective is the value of the index, the choice of the component certificate and the weight adjustment are carried out according to the prescribed rules, and try to avoid subjective judgment and human manipulation; integrity. The index should reflect as much as possible the overall trend of the market.

2.1 Existing blockchain index products

2.1.1 Index compiled by the exchange

Some digital clearing houses will choose digital certificates with high market value, large scale and good circulation, and compile an index according to the real-time transaction price on their platform to reflect the overall price level of the digital assets being traded on the exchange.

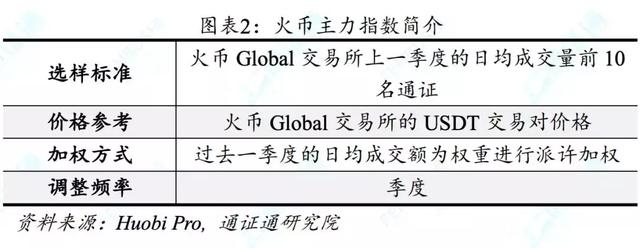

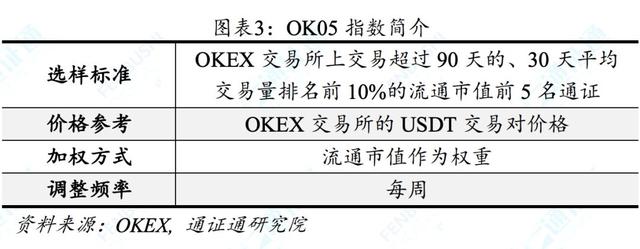

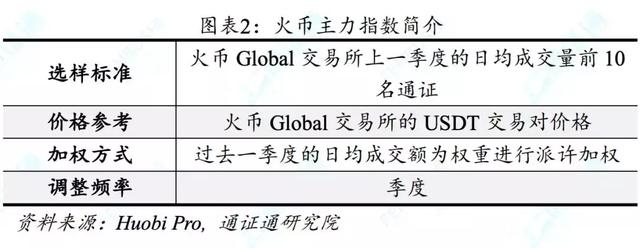

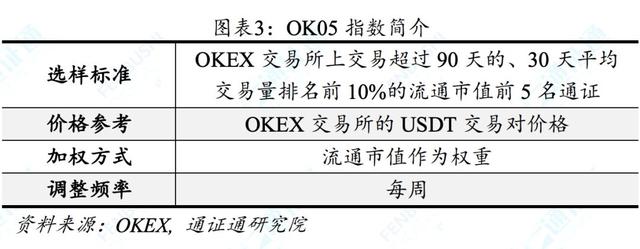

Well-known indices compiled by the exchange include: the main index of the fire currency, the OK05 index, and the Coinbase index.

The limitations of the exchange's index include the selection of a pass for a particular exchange, and the index calculation based on the volume and transaction price of a single exchange. The transaction data of a single exchange cannot fully reflect the transaction status of the entire market. In addition, the index compiled by the exchange usually uses the USDT price to calculate the index instead of the French currency such as USD. The USDT itself is also a type of digital certificate. Its price will change with the fluctuation of market conditions, and it cannot accurately reflect the true value of the legal currency value of the digital certificate.

2.1.2 BLX Fluidity Index

BLX (BTC Liquidity Index) is the BTC price index released by Brave New Coin. It integrates the real-time price calculation BTC price index of six global mainstream exchanges of Bitstamp, Coinbase, Bitfinex, Kraken, Gemini and itBit. Nasdaq has included this index in the Global Index Date Service Offerings platform in February 2019.

The BTC Liquidity Index is a single-pass index. Its constituent assets include only BTC. It is a price index calculated by combining the prices of six world-renowned exchanges with the trading market. It solves the real-time price differences of various exchanges and invests. It is difficult to accurately judge the market trend and have the function of price discovery. The BTC Liquidity Index is denominated in US dollars.

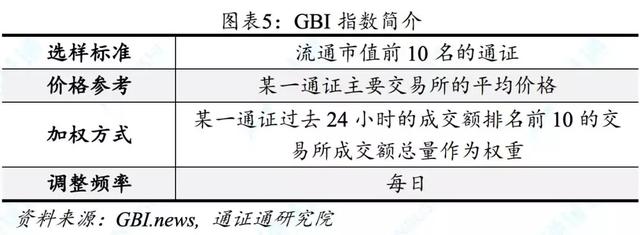

2.1.3 GBI Global Blockchain Index

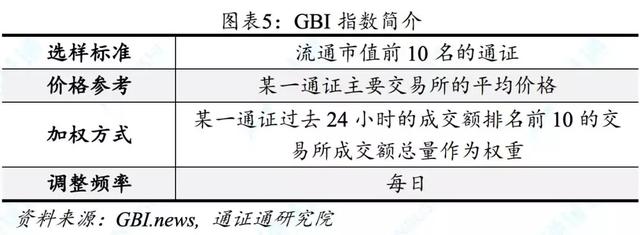

The GBI (Global Blockchain Index) was launched by the Inblockchain team on January 1, 2017 and is the first index to reflect the macro trend of the blockchain market.

The GBI Index is selected based on the market value of circulation, and is calculated by synthesizing the price and trading volume of major exchanges. The selection and weight calculation of the ingredient pass is automatically carried out in accordance with the rules, avoiding human intervention. However, the weight of the GBI index is adjusted daily, and the cost of tracking the portfolio is higher.

2.2 Selection of weighting methods

Traditional index weighting methods include market value weighting, price weighting, equal weight, and so on. However, the more well-known blockchain index products listed above use the transaction amount weighting method.

The equal weight and price weighting methods are not suitable for blockchain index compilation. The market value and price gap of digital certificates are larger than those of traditional market stocks. These two methods will result in overestimation of the small market value of the pass and the overweight of the unit price of the high unit. The minimum separable unit of most digital certificates is not 1, and the unit price of the certificate does not have a reference value.

The method of market value weighting is also not suitable for the blockchain index compilation. The total number of shares of a listed company is fixed, and the frequency of additional is not high. The actual index is also weighted by the market value of circulation. The situation of digital certificates is more complicated, and its distribution mechanism can be roughly divided into three categories:

In the first category, the certificate has a fixed upper limit and is continuously issued in the form of mining. At a fixed time, a certain amount of passes will be produced and entered into the market, such as BTC and LTC. In the second category, the pass has a fixed cap and does not generate new passes through mining. There may be some sort of destruction mechanism, such as NEO, BNB, etc. In the third category, there is no cap on the total amount of passes, and new passes are produced in the form of mining, such as ETH and EOS. For the third type of digital certificate without a cap on the total amount, the total market value is difficult to calculate; if it is weighted by the market value of circulation, it will face a continuous change in the number of circulation certificates, and some of the certificates are locked by the issuer. , pre-digging, destruction, the current market value relative to stocks is more difficult to calculate. If the (circulation) market value-weighted calculation method is to achieve the expected goal, the weight adjustment will be very frequent, which is not conducive to tracking the portfolio's portfolio adjustment, and does not satisfy the reproducibility.

At present, many blockchain index products adopt the weighted method of turnover. Usually take one quarter or half year as the observation period, and the average daily transaction amount during the statistical observation period is used as the weight. The average turnover reflects the liquidity of the certificate and can reflect its activity in the secondary market. Therefore, some index compilers refer to it as the Liquid Index.

The disadvantage of the weighting of the turnover is that it is impossible to identify the "brushing" behavior of some exchanges, resulting in distortion of the turnover data. Therefore, in the statistics, you can choose the trading information of mainstream exchanges with certain popularity and high degree of information transparency as a reference, or use some technical means to filter the false transaction volume of the exchange.

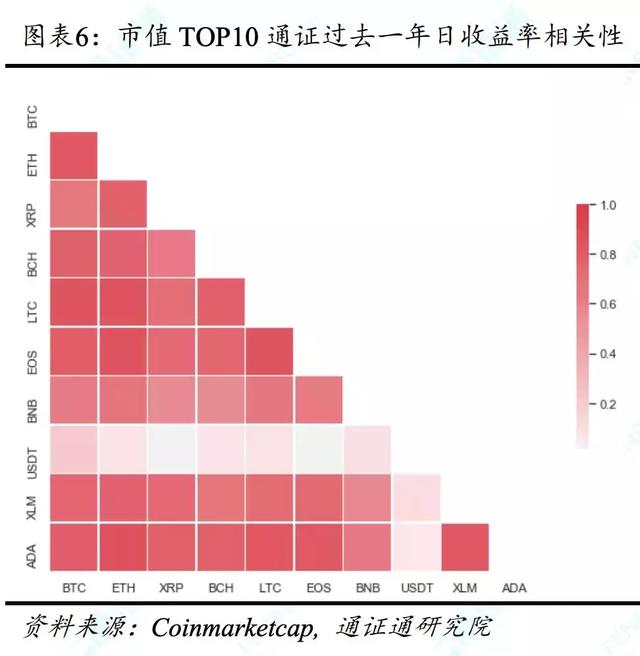

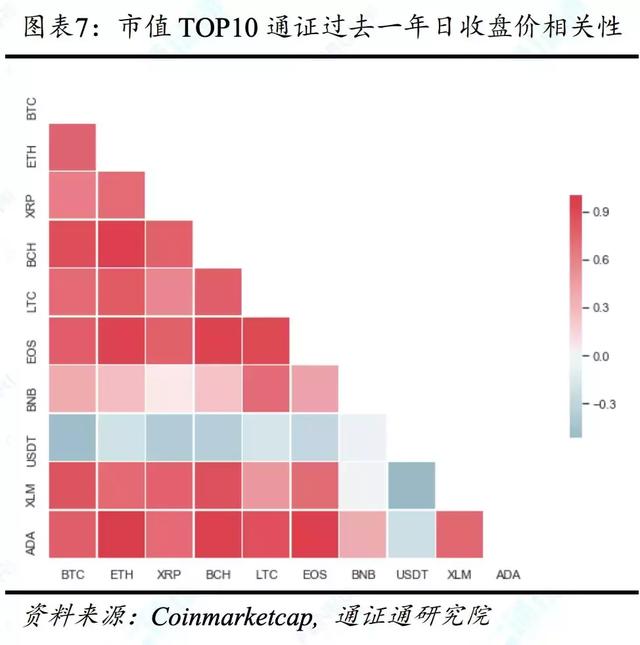

2.3 Digital pass is highly correlated

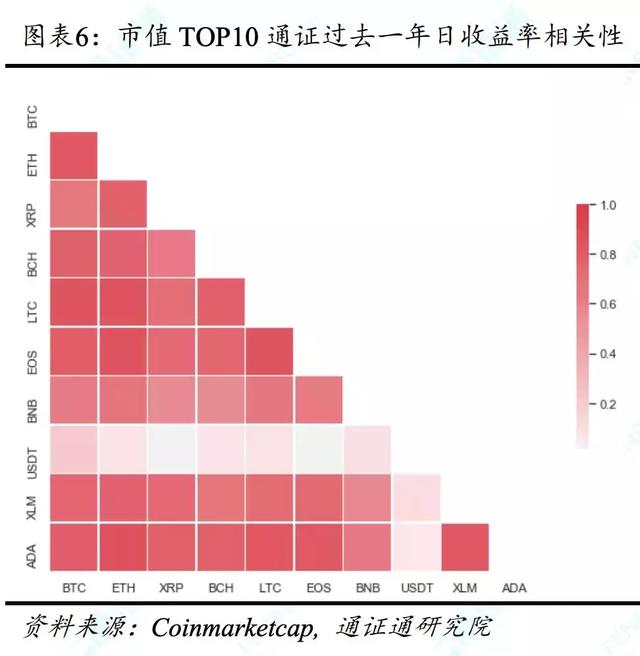

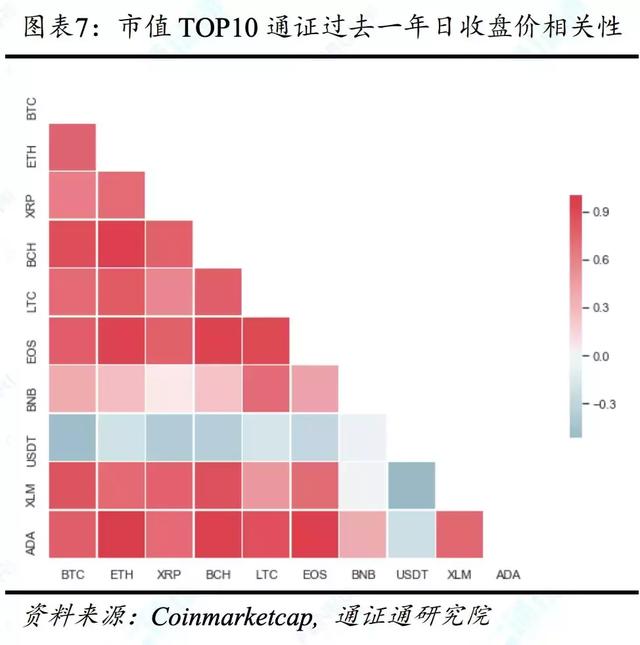

Historical price data shows that the correlation between most mainstream digital passes is very high. The market value of BTC has occupied more than 50% of the market in the past year. It has a decisive influence on the market, resulting in the homogenization of various index preparation schemes and index products. The degree of discrimination is not obvious.

3

Thoughts on the Method of Compiling Existing Indexes

The preparation of an index with both objectivity and practicality needs to meet the reproducibility, objectivity and integrity. Index preparation rules, including sample selection rules, weight determination rules, periodic adjustment rules, and emergency judgment principles, are all determined to minimize human intervention.

In addition, the index should be calculated at the legal currency price of the certificate, but not at a stable pass or a stable pass or a legal currency price. Most of the current index products are valued in USDT trading. When the USDT price fluctuates sharply, it is easy to cause distortion of the index price. Using USD pricing can reflect the true value of the portfolio represented by the index.

The index should also guarantee the quality of the samples in the sample pool by a series of defined rules. If during the index reporting period all transactions including but not limited to false reporting volume, manipulation of the market, and intentional concealment of important information related to the investor's interests are discovered, the exchange will be removed from the sample pool. If a general certificate has major hidden dangers in terms of safety and development progress, it will also be removed from the pass sample pool immediately.

After rethinking the shortcomings of the existing index products, the Tongxuntong Institute absorbs the advantages of the current blockchain index products and improves its shortcomings. It will release the “Commonization Plan for the Certificate of the Institute” and launch a series of indices. product.

Note:

For some reasons, some of the nouns in this article are not very accurate, such as: pass, digital pass, digital currency, currency, token, Crowdsale, etc. If you have any questions, you can call us to discuss.

This article is original for the General Research Institute (ID: TokenRoll). Unauthorized reproduction is prohibited.

Guide

The digital pass market is still an immature market, with a market capitalization of only 0.15% of the total market value of global stocks. The digital compulsory secondary market is active in transactions and the exchanges are scattered. The supervision of digital transacting transactions varies greatly between countries and regions. Like traditional markets, digital censorship also needs index as a tool to measure market changes.

Summary

The Market Index is a measure of the value of a portfolio of assets with similar characteristics and is a powerful tool for describing the overall price level and movement of a portfolio. According to the method of selecting constituent stocks, the stock market index can be divided into “national index”, “global index” and “industry index”. The constituents of the “National Index” are usually selected from stocks traded on a stock exchange in a certain country and can be used as a “barometer” reflecting the economic and investor sentiment of a country; the “industry index” is selected according to the industry of the listed company. . According to the weighted manner of the index, the stock market index can be divided into a market value weighted index, a price weighted index, an equal weight index, an adjusted market value weighting, and a fundamental weighting index. The emergence of the index allows investors to have a clearer judgment on the overall trend of the market, and can also be used as a benchmark for investors and fund managers to measure investment performance. The index is a powerful tool for passive investors and the basis for derivatives such as stock index futures and options.

The digital pass market is still an immature market . The secondary market was active in transactions and the exchanges were scattered. There was a big difference in the supervision of digital-licensing transactions between countries and regions. The digital pass market also needs an index as a yardstick for measuring the market. The market index should have: reproducibility . The portfolio represented by the index should be easy to copy. The constituents are listed on multiple exchanges and have certain liquidity; objectivity . Objective is the value of the index, the choice of the component certificate and the weight adjustment are carried out according to the prescribed rules, and try to avoid subjective judgment and human manipulation; integrity . The index should reflect as much as possible the overall trend of the market.

The existing major blockchain index products include the comprehensive index compiled by the exchange, the GBI global blockchain index, and the BLX liquidity index. Because of the special nature of digital certificates, more blockchain index products use the transaction amount weighting method. The blockchain index should be compiled to meet the reproducibility, objectivity and integrity of the index.

Risk Warning: Market Volatility Risk

table of Contents

1 stock market index

1.1 What is the market index?

1.2 Classification of stock market indices

1.3 The preparation process of the stock market index

1.4 Stock Market Index and Passive Investment

2 Digital Certified Industry Status and Index Products

2.1 Existing blockchain index products

2.1.1 Index compiled by the exchange

2.1.2 BLX Fluidity Index

2.1.3 GBI Global Blockchain Index

2.2 Selection of weighting methods

2.3 Digital pass is highly correlated

3 Thinking about the existing index preparation plan

text

1

Stock market index

On May 17, 1792, 24 stockbrokers held a rally under the plane tree at 68 Wall Street. At that time, the US securities market was not yet mature, and the disorderly over-the-counter stock trading and speculative winds prevailed. In 1791, William Dürr, then Assistant Secretary of the Treasury of the United States, used his interpersonal relationships and positions to participate in the speculative activities of the Bank of America in the United States, and eventually followed the failure of speculation and the bankruptcy of the capital chain, leading to follow William. The ordinary people who bought bank stocks in Dürr had no return.

Stockbrokers are aware of this problem: stock trading is not speculative, and stockbrokers need to draw a line between gamblers and speculators. At that rally, the stockbrokers drafted the famous "The Sycamore Tree Agreement" after some discussion: "From today, we do not buy or sell any shares for anyone with a commission rate of less than 0.25%. In the negotiation of any transaction, we will give members priority to each other.” The Wutongshu Agreement triggered people’s thinking about the qualifications of securities brokers, seat management, securities trading rules, and regulatory principles. The Securities Trading Union is also the prototype of the New York Stock Exchange (NYSE), which was established 25 years later.

Today, more than 200 years later, Wall Street's phoenix tree no longer exists, and the NYSE has become one of the world's major securities trading markets. After the Great Depression in the 1930s, people’s perceptions of stocks have also changed from speculation to investment. Investment theories such as “value investment”, “growth investment” and “passive investment” have emerged, and stocks have become important to ordinary people. The asset allocation category, news of the stock market's rise or fall in the news all touched the hearts of investors. As of the end of 2018 (after the data is not stated, the statistical date is up to 2018), the global market capitalization of the stock is close to 80 trillion US dollars, and the stocks traded on the major stock exchanges are tens of thousands. How to judge the overall trend of the stock market? At this time, Stock Market Indices is needed to help investors measure the overall market's rise and fall.

1.1 What is the market index?

The Market Index is a measure of the value of a portfolio of assets with similar characteristics and is a powerful tool for describing the overall price level and movement of a portfolio. A stock market index is a measure of the value of a portfolio of stocks of listed companies with similar characteristics. The preparation, calculation and release of market indices are generally carried out by a professional index provider (Index Provider) in accordance with the established plan. Different index preparation schemes are different, but most calculation methods are based on the weighted average of the asset prices of each component.

The main role of the market index is to measure the performance of the market (or some of its assets) and the investor's comparison of the specific portfolio returns. Some mutual funds and ETFs (exchange-traded funds) also track specific indexes, thus facilitating investors. The index is invested.

1.2 Classification of stock market indices

Most stock market indexes use the two criteria of region and industry as the basis for selecting stocks. According to the country or region to which the index component stock belongs, the index can be divided into “global index” and “national index”. The constituents of the “Global Index” are usually selected from different countries or regions, such as the MSCI World Index compiled by Morgan Stanley Capital International (including translation), whose constituent stocks include 1649 stocks in 23 developed countries or regions. . And Standard & Poor's SP Global 100 index and so on. The constituents of the “National Index” are usually selected from stocks traded on a stock exchange in a country and can be used as a “barometer” to reflect a country’s economy and investor sentiment. Such indices generally also include shares of offshore companies listed in a country. Such as the US Dow Jones Industrial Average (DJIA), Standard & Poor's Index (SP500), Nasdaq 100 Index (NASDAQ100), UK FTSE 100 Index (FTSE100), Japan Nikkei 225 Index (N225) and so on.

In addition, it is also common to select stocks of constituent stocks in a more general geographical division. For example, the MSCI Emerging Markets Index, which includes a number of listed companies in emerging economies such as China, Brazil, India, Saudi Arabia, and Argentina, includes the Dow Jones Stoxx 50 Index of 50 blue chip stocks in the Eurozone.

The “Industry Index” selects constituent stocks according to the industry of the listed company. For example, the Nasdaq 100 Index is mainly composed of technology stocks. The domestic “sector index” also belongs to the industry index.

1.3 The preparation process of the stock market index

The market index reflects the relative amount of the net value of the portfolio, which measures the change in the asset price level in the portfolio over time.

To prepare an index, you first need to select constituent stocks, that is, select the stock types included in the portfolio based on characteristics such as geography and industry. Second, we need to determine the weight of each component in the portfolio. The index can be divided into the following categories according to the weighting method:

Market value weighted index . The weight of constituent stocks in the portfolio is determined by its market value. This method is the most widely used in index compilation. SP500, Hong Kong Hang Seng Index and most domestic indices are weighted by market value. An index that takes all stocks in the market as a sample and uses the (circulating) market capitalization as a weight usually reflects the average rate of return of all investors and reflects the overall market situation. In the capital asset pricing model, the combination of the replicated market capitalization index is a Market Portfolio, and this combination will be the combination with the highest Sharpe ratio under market-effective assumptions.

The disadvantage of market value weighting is that the weight stocks have a higher impact on the index. While the real market does not satisfy the validity assumption, the stock market value may be overvalued or undervalued, and funds tracking these indices may exacerbate the level of overvalued and undervalued stocks.

Price-weighted index . The weight of a constituent stock in a portfolio is determined by its price, such as the Dow Jones Industrial Average. This method is simple to calculate, but the drawbacks are also obvious. The change of the index is affected by the absolute change of the stock price of the component rather than the relative change.

Equal weight index . The equity of each component in the portfolio is equal. Although this method eliminates the influence of heavyweights on the index, it also exacerbates the volatility of the index due to the increase in the weight of small-cap stocks. As the price of constituent stocks changes, the index needs to be revised periodically to ensure equal weights.

In addition, there is an adjustment market weighting method that combines the weighting of equal rights and market value . This kind of weighting method usually limits the weight of higher market capitalization stocks, sets a certain market value threshold, divides stocks above a certain market value into one group, reduces the total weight of high market capitalization stocks, and uses them in high market capitalization groups. Weights are assigned in a weighted manner, and low-capital stocks are weighted by market capitalization to allocate residual weights. In order to balance the weight of stocks in various industries, some indexes also use the weights assigned by the stocks of the stocks, and are weighted by market value in each industry. However, these weighting methods are complicated to calculate and are actually used less.

Fundamental weighted index . As the name implies, the weights are distributed according to the fundamental indicators of the constituent stocks. Common indicators include net assets per share, net profit per share, dividends, historical volatility, etc. The fundamental factors are calculated quantitatively and weighted as weights.

After determining the weight of each constituent stock, it is necessary to select a date to calculate the total market value of the stock in the portfolio, and convert it into a relative number according to a certain ratio, for example, 100 or 1000 points, which is called the base date, and the point of the base date index. Called the base point. Based on this, the points of the index during the reporting period are calculated, and the net value level of the portfolio represented by the different date indices can be conveniently compared by index points. For example, the base date of the Shanghai Composite Index is December 19, 1990, and the base point is 100 points.

When the index constituents or weights change during the reporting period, it is generally necessary to correct the index to maintain continuity in its price. For example, adding or removing constituent stocks, stock ex-rights, etc.

1.4 Stock Market Index and Passive Investment

The East India Company, founded in 1602, was the first joint-stock company to issue equity financing to the public, and its shares were issued on the world's first stock exchange in Amsterdam, the Netherlands. In the 19th century, the securities trading activities of the United Kingdom and the United States gradually prospered. However, the government-recognized exchanges have not yet appeared. Early securities investors spontaneously formed small trading venues and even bought and sold stocks in bars and cafes. In the minds of the people at the time, the stock market was no different from the market for buying and selling agricultural products and daily groceries. It is difficult for people to understand that buying stocks is essentially a concept of investing in a company.

In 1896, at the end of the industrial revolution, financial journalist Charles Dow measured the performance of the entire market by calculating the average price of the top 12 stocks of the NYSE. This index is the famous Dow Jones Industrial Average. The sample stocks are mainly from the industrial sectors of steel, mining, railways, etc., and its constituent stocks have also expanded to 30. In the 1920s, Standard Statistics began to use the market-weighted method to calculate the index of 90 stocks in the NYSE. Due to the limited computing power at that time, the index could only be calculated and published once a day. In 1941, Poole Publishing merged with Standard Statistics to become Standard & Poor's, relaunching the S&P 90 index. In 1946, Standard & Poor's purchased a perforated computer that greatly improved its computing power. S&P expanded the index's constituent stocks to 500 and was able to calculate the index every hour.

The emergence of the Dow Jones Index and the Standard & Poor's Index has undoubtedly given investors a clearer picture of the overall market situation. Charles Dow's Dow Theory is the originator of technical analysis using market indices, and the market index provides a basis for trend traders. With the development of electronic computers, the index of thousands of constituent stocks has been updated in real time, and the index has become the benchmark for investors and fund managers to measure investment performance. Some fund replication index constituents and corresponding weights are used as investment portfolios, which are “index funds”. Tracking index funds in different countries, regions and industries is a powerful tool for passive investors. A study shows that the long-term average return rate of US active management funds is 1.8% lower than the S&P 500 index, which is equivalent to the average management rate of these funds. The number of fund managers who can outperform the index for a long time is extremely small. In addition, with the development of financial derivatives, stock index futures, options as speculative tools, and the way to hedge risks appear in the investor's field of vision.

2

Digital Pass Industry Status and Index Products

According to Coinmarketcap, there are currently 234 digital clearing exchanges and more than 2,000 digital passes on exchanges. The annual digital trading volume of 2018 is about 6.6 trillion US dollars, and the average daily turnover is about 18 billion US dollars.而对比全球证券市场,上市公司总数约4.3万家,股票年交易额近80万亿美元。数字通证总市值约1250亿美元,规模仅为全球股票总市值的0.15%。数字通证市场仍然是一个不成熟的市场,二级市场成交活跃且交易所分散,各国家与地区对数字通证交易的监管差异较大。

正如证券投资逐步迈向成熟的过程,人们对通证交易的态度也需要由投机向投资过渡。数字通证同样需要指数作为衡量市场的风向标。主动投资者需要以市场整体回报作为衡量自己投资组合长期成绩的基准,被动投资者希望投资市场组合以获取平均回报。

早期,数字通证的种类并不多,BTC在投资者眼中是整个市场的风向标,随着大量山寨通证出现,BTC作为单一品种不再能够完全反映市场的整体走势,数字通证指数的出现是必然趋势。为了满足主动及被动投资者的需求,应满足以下条件: 可复制性。指数代表的投资组合应该是易于复制的,成分通证在多个交易所上市、具有一定的流动性; 客观性。客观是指数的价值所在,成分通证的选择及权重调整依规定的规则执行,尽量避免主观判断与人为操纵; 整体性。指数应尽可能反映市场整体的趋势。

2.1 现有的区块链指数产品

2.1.1 交易所编制的指数

一些数字通证交易所会选择市值高、规模大、流通性好的数字通证,根据自身平台上的实时成交价格编制指数,以反映交易所中正在交易的数字资产的总体价格水平。

知名的由交易所编制的指数包括:火币主力指数、OK05指数、Coinbase指数等。

交易所编制指数的局限性包括,仅仅选择某一家交易所上线的通证,并且按照单一交易所的成交量与成交价格进行指数计算,单一交易所的交易数据不能全面反映整个市场的成交状况。此外,交易所编制的指数通常采用USDT标价进行指数计算而不是USD等法币。USDT本身也是数字通证的一种,其价格会随着市场行情波动而变化,无法准确反映数字通证真实的法币价值变动情况。

2.1.2 BLX流动性指数

BLX(BTC流动性指数)是Brave New Coin公司发布的BTC价格指数,综合Bitstamp、Coinbase、Bitfinex、Kraken、Gemini、itBit六个全球主流交易所的实时价格计算BTC价格指数。纳斯达克已于2019年2月将这个指数加入全球指数服务产品(Global Index Date Service Offerings)平台中。

BTC流动性指数是单一通证的指数,其成分资产仅包括BTC一项,是综合六个全球知名交易所的价格与交易盘口计算出的价格指数,解决各个交易所实时价格不一、投资者难以准确判断市场趋势的问题,具有价格发现的功能。BTC流动性指数采用美元计价。

2.1.3 GBI全球区块链指数

GBI(GlobalBlockchain Index)由Inblockchain团队于2017年1月1日推出,是首个反映区块链市场宏观走势的指数。

GBI指数以流通市值为标准选择成分,综合主要交易所的价格与交易量进行指数计算。成分通证的选择和权重计算完全按照规则自动进行,避免人为干预。但GBI指数权重每日调整,投资组合进行跟踪的成本较高。

2.2 加权方式的选择

传统的指数加权方式包括市值加权、价格加权、等权等。但前面列出的较为知名的区块链指数产品均使用成交额加权方式。

等权与价格加权方法不适合区块链指数编制。数字通证市值、价格差距较传统市场股票之间更大,这两种方法会造成小市值通证权重被高估,及单价高的通证权重被高估。大部分数字通证的最小可分割单位不是1,通证的单价不具有参考价值。

市值加权的方式也不一定适合区块链指数编制。上市公司的总股本数固定,增发频率不高,实际编制指数时也有以流通市值加权的方式。而数字通证的情况较为复杂,其发行机制大致可分为三类:

第一类,通证有固定总量上限,以挖矿的形式持续发行,每隔固定的时间就会生产出一定数量的通证进入市场流通,例如BTC、LTC等。第二类,通证有固定总量上限,并且不通过挖矿产生新的通证,可能存在某种销毁机制,例如NEO、BNB等。第三类,通证没有总量上限,以挖矿的方式产出新通证,例如ETH、EOS。对于第三类没有总量上限的数字通证而言,总市值难以计算的;若以流通市值进行加权,则会面临流通通证数量持续发生变化的情况,并且一些通证由于发行方的锁定、预挖、销毁,流动市值相对股票更加难以计算。以(流通)市值加权的计算方式如果要实现预期的目标,权重调整就会非常频繁,不利于跟踪指数的投资组合调仓,不满足可复制性。

目前较多区块链指数产品采用成交额加权方式。通常取一个季度或半年作为观察期,统计观察期内的日均交易额作为权重。平均成交额反映通证的流动性,能够体现其在二级市场的活跃程度,因此有些指数编制方又将其称为"流动性指数"(Liquid Index)。

成交额加权的缺点在于无法识别一些交易所的"刷量"行为,导致成交额数据出现失真。因此在统计的时候可以选择有一定知名度、信息透明程度高的主流交易所的交易信息作为参考,或者采用一些技术手段过滤交易所的虚假成交量。

2.3 数字通证相关性较高

历史价格数据显示,大部分主流数字通证之间的相关性非常高。BTC市值近一年来占据市场总体超过50%的份额,对市场拥有决定性的影响力,造成各种指数编制方案与指数产品同质化,区分度不明显。

3

对现有指数编制方法的思考

编制一个客观性与实用性兼具的指数需要做到满足可复制性、客观性、整体性。指数编制规则,包括样本选取规则、权重确定规则、定期调整规则、突发事件判断原则等都是确定的,能够最大限度地避免人为因素干预。

此外,应当以通证的法币价格计算指数,而不能以稳定通证或者稳定通证、法币价格混用。当前的大部分指数产品以USDT交易对计价,当USDT价格发生剧烈波动时,容易造成指数价格的失真,使用USD计价能够反映指数代表的资产组合的真实价值。

指数还应当由一系列确定的规则保证样本池内样本的质量。如果在指数报告期内发现交易所有包括但不限于虚报成交量、操纵市场、故意隐瞒与投资者利益相关的重要信息等问题,则将该交易所移出样本池。如果某一通证在安全性、开发进度等方面存在重大隐患,同样立刻将其移出通证样本池。

在反思现有指数产品的不足后,通证通研究院吸收目前区块链指数产品的优点,并改善其不足之处,并推出一系列指数产品。

附注:

因一些原因,本文中的一些名词标注并不是十分精准,主要如:通证、数字通证、数字currency、货币、token、Crowdsale等,读者如有疑问,可来电来函共同探讨。

本文为通证通研究院( ID:TokenRoll )原创。未经授权,禁止擅自转载。

通证通研究院× FENBUSHI DIGITAL 联合出品

文:宋双杰

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | The most complete analysis: a clear view of Libra panorama

- Davos looks at the blockchain: Libra is hot, privacy is worrying

- Ba Shusong, chief Chinese economist at the Hong Kong Stock Exchange: Blockchain is a cure for the problem of the credit market

- Market Analysis: BTC pulls the line again, is the adjustment finished?

- The digital currency in the eyes of economists – price articles: ups and downs in the bubble

- Industry Weekly | Facebook currency is yellow? – Waiting for the official hearing in July

- Mid-term inventory in 2019 (next part): What happened to the encryption industry in the past six months?