Research | Stabilizing and Stabilizing Coins

The new round of economic crisis has weakened people's confidence in legal tender, and "monet liberalism" has become popular. In this context, the early digital currency of the decentralized release was born, but the instability of the currency made it impossible to perform the monetary function effectively. Stabilizing coins emerged on the basis of stable currency demand. Although they have certain advantages in stabilizing currency prices, they have raised the credit and “trust” risks of digital currencies, resulting in new “unstable”. For the chain-type stable currency, the traditional supervision system, the special management and use of funds, information disclosure, etc. can deal with the credit risk; but for the chain-type and algorithm-based stable coins, the traditional supervision method can not effectively solve the private currency. Regulate the existence of the "trust" risk, and currently some countries in the "chain-chain" supervision technology can try to regulate this. In the case that early digital currencies could not effectively perform monetary functions and stabilized coins, there are still many doubts as to whether the “pass-certification world” envisaged by blockchain optimists can come.

I. Introduction

Stablecoin is a blockchain digital currency that achieves relatively stable currency prices by anchoring it with legal currency, mainstream digital currency, commodities, or by means of third-party entities regulating money supply. At present, depending on the anchoring object and the operating mechanism, the stable currency can be divided into an off-chain-backed stable coin (hereinafter referred to as "chain-type stable coin"), and the asset-supported type on the chain is stable. On-chain-backed Stablecoin (hereinafter referred to as "chain-type stable currency") and algorithmic stabilization currency (Algorithmic Stablecoin). [1]

Since the birth of Bitcoin designed by Nakamoto in 2009, various blockchain products including blockchain digital currency have been continuously tested or applied. At present, the digital currency market has formed a pattern in which bitcoin is dominant, multi-currency and multi-market coexist, and its influence on the world economy is increasing. [2] Among them, although the market value of the stable currency is low, the representative product TEDA (USDT) trading volume ranks second in all currencies, second only to Bitcoin. Stabilizing coins have played a positive role in acting as a trading medium for legal tenders and mainstream digital currencies, and avoiding the risk of price fluctuations in mainstream digital currencies. At the same time, the financial information of the stable currency represented by USDT is opaque and delayed, and the lack of supervision in the stable currency field has also brought challenges to the realization of the stable currency function.

- Paving for the currency? Samsung accelerates the layout encryption industry and injects 2.6 million euros into the hardware wallet company Ledger

- Why did Charlie Munger and Buffett always reject digital assets?

- Why should the development of the next generation blockchain platform be led by the community?

In 2013 and 2017, China issued separate regulatory documents on the prevention of bitcoin risk and the risk of token issuance financing, completely prohibiting the trading of digital currency in China, and subsequently issued relevant risk warnings [3]; abroad, the United States Countries such as Japan and Japan have confirmed the legality of digital currency through the revision of laws or new laws, and implemented corresponding regulatory rules, but there have not been any regulatory rules for stable currency. A series of questions, such as why stable coins are generated, how to achieve price "stable" functions, and how to implement targeted supervision of stable currencies, need to be clarified.

In view of the legal issues of private digital currency such as stable currency, China's legal scholars mainly use bitcoin as an example to explore the legal attributes of digital currency, and accordingly propose corresponding regulatory recommendations. [4] However, only the use of bitcoin as an example to explore digital currency regulation ignores the reality of the diversification of digital currency; [5] the existing literature does not compare digital currency and historical perspectives of digital currency and internal operating mechanisms. The difference in the circulation of fiat currencies, and this is crucial for establishing a digital currency regulatory framework. Based on this, this paper starts from the reasons of the emergence of stable currency, analyzes the operating mechanism of three stable coins and the actual effect of price stabilization from the perspective of issue and circulation. On this basis, it points out the additional “unstable” risk and supervision of stable currency. Ideas.

Second, the cause of "stability": the limitations of early digital currency instead of legal tender

(1) The "crisis" and response path of the legal currency era

The legal currency is a value symbol issued by the state and guaranteed by the state to circulate, embody national credit and has unlimited legal ability. It can fulfill the three functions of trading medium, value scale and value storage currency in the economic sense. . Since the beginning of the 20th century, the legal currency issuance and circulation system centered on the central bank and safeguarding national credit has gradually taken shape. [6]

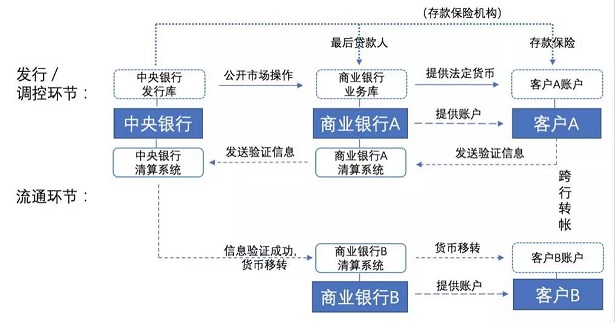

Figure 1 Schematic diagram of legal currency issuance and circulation

After decades of practice, the legal currency issuance and circulation system with the central bank as the core has played an important and positive role in maintaining the creditworthiness of the monetary countries and maintaining the stability of the currency, but at the same time there are many problems. First of all, due to monetary policy mistakes and other reasons, during the inflation crisis in many countries at the end of the 20th century and even during the global financial crisis in 2008, the value of the legal currency of some countries fluctuated greatly, and a large number of commercial banks experienced a crisis of crises and even bankruptcy, which partially shaken the public. Confidence in legal tender. Secondly, the original legal currency payment clearing system cannot meet the high-frequency and small-paying payment needs. Cross-border payment through the Global Interbank Financial Telecommunications Association (SWIFT) has high cost of money and time. Finally, in addition to the cash law currency, the central bank and the commercial bank fully grasp the currency transfer data of the currency holder through the payment and clearing system of their maintenance operations. For countries with incomplete data protection legislation, the data holders’ data privacy rights There is no effective guarantee and there is a possibility of tampering.

In response to the above problems, first, in terms of regulatory legislation, countries have improved the existing legal currency issuance and circulation system. For example, the United States promulgated the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 to increase the amount of federal deposit insurance. Strictly limit the high-risk business of commercial banks and introduce stress tests to monitor bank capital. Second, in the construction of payment systems, the central bank or commercial banks establish a currency clearing system that is suitable for small payments. Third, in the development of new payment formats, third-party payment has begun to develop and is gradually recognized by regulators, and “completion currency” such as community currency and mutual credit system as a trading medium has emerged within a certain range; with 2009 With the birth of Bitcoin, a “peer-to-peer electronic cash system”, more and more institutions and individuals began to use blockchain technology to create private currencies that can be “decentralized” on a global scale to eliminate The various drawbacks of the legal currency led by the government.

(2) The limitation of the price stability of the early digital currency

In the early stages of digital currency development from 2009 to 2014, Bitcoin (BTC) opened the door to digital currency development, and Ripple (XRP) enabled innovation in cross-border payment settlement, while Ethereum (ETH) was a digital currency. It is possible to carry smart contracts. During this period, digital money designers attempted to develop new technologies that would allow digital currencies to have the same monetary functions as legal tenders. [7]

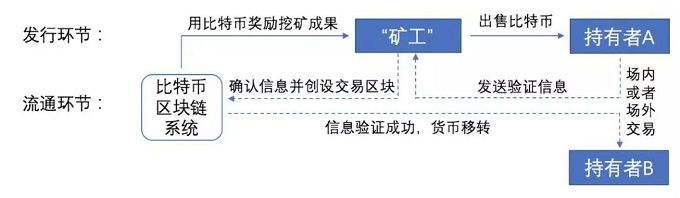

Figure 2 Schematic diagram of Bitcoin issuance and circulation

Taking Bitcoin as an example, the early private digital currency issuance and circulation mechanism realized “algorithm trust” [8], and has certain advantages in improving payment clearing efficiency and protecting transaction privacy, but based on narrow circulation and lack of intrinsic value, Due to the lack of supervision and other reasons, the digital currency is still unable to achieve the stability of the currency value, and can not effectively perform the monetary function: First, the intrinsic value of money and the lack of money regulators make the digital currency naturally have price volatility. Bitcoin is not anchored with any fiat currency or commodity, does not have any intrinsic value, and is not supported by private or national credit; and according to the existing bitcoin issuance mechanism, unless all "miners" stop creating new bitcoins, the bits are When the issuance of the currency is stopped, no entity can interfere with the increase or decrease of the amount of Bitcoin. This makes it impossible for third parties to intervene in the price of Bitcoin by using a method similar to legal tender when faced with large price fluctuations.

Second, the alienation of the use of digital currency has increased its price volatility and brought new credit risks in the transaction process. At present, most digital currency holders regard digital currency as a commodity with investment value rather than a payment instrument. [9] A large number of speculative behaviors increase the price volatility of digital currency, which in turn makes digital currency and legal currency There is a great room for development in the on-exchange exchange business and off-exchange exchange behavior. [10] And in recent years, national regulators have gradually established a digital currency regulatory framework, and the compliance costs of digital currency exchanges have increased, causing most exchanges to stop on-exchange business, while off-site private transactions are less efficient. The strong price volatility of digital currencies has increased the credit risk of off-exchange private transactions. [11] In this context, the market needs a new type of digital currency that is stable in price and can act as a legal currency and an early digital currency trading medium, allowing digital currencies to effectively perform monetary functions and reduce credit risk in legal currency and digital currency exchange. . [12]

Third, the stable price mechanism and practice of stable currency

In order to enhance the price stability of digital currencies and effectively play the monetary function of digital currencies, a variety of stable currencies began to appear at the end of 2014. The earliest stable currency is the chain-type stable currency, which is prepared in 100% of the reputable legal currency such as the US dollar and the euro. The 1 unit stable currency is priced at US$1. The typical representative is the USDT issued by Tether and the Gemini company. GUSD; In order to improve the degree of decentralization of the stable currency, reduce the centralized credit risk and cyber security risk, the digitally encrypted assets as the chain-type stable currency and the asset-free mortgage-based algorithmic stable currency prepared for over-issuance began to circulate in the market. The former is represented by DAI issued by Maker, and the latter is represented by USNBT (hereinafter referred to as "NBT") issued by Nubits. Among the 57 stable coins currently in existence worldwide, the number of chain-type stable coins accounts for 33%, the chain-type stable coins account for 44%, and the algorithm-based stable coins account for 23%; while the chain-type stable coins account for 23%. The USDT is a single company with a daily trading volume accounting for 98% of the total trading volume of the stable currency. [13] The following is an example of USDT, DAI and NBT, which discusses the “stable” mechanism and effectiveness of the three types of stable currency issuance, redemption and regulation.

(1) The mechanism for the issuance and circulation of stable coins

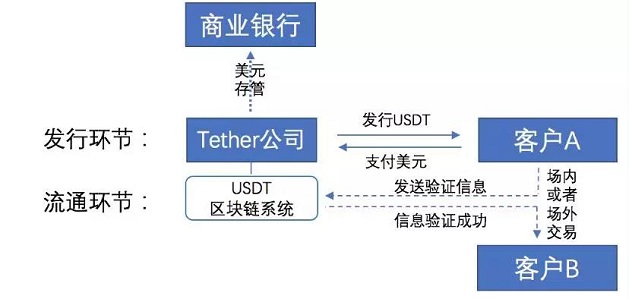

Figure 3 Schematic diagram of USDT issuance and circulation

In the chain-type stable currency issuance and circulation mechanism, there are three parties of the issuing company, the customer and the depository bank. Take USDT as an example. As you can see from Figure 3, the customer remits a certain amount of US dollars to Tether's bank account. After confirming receipt of the corresponding funds, Tether will provide the Tether's core wallet to the company and belong to the customer. All Tether wallets are transferred to the USDT equivalent to the US dollar, which is the release of the USDT. If the customer intends to redeem the US dollar, after the USDT held by it is transferred to Tether's core wallet and the handling fee is paid, Tether will remit the same amount of USDT to the customer's bank account and destroy the corresponding USDT. At the level of currency regulation, Tether itself cannot intervene in the price of USDT through daily issuance and redemption behavior, and there is no price control of USDT by external affiliates. [14]

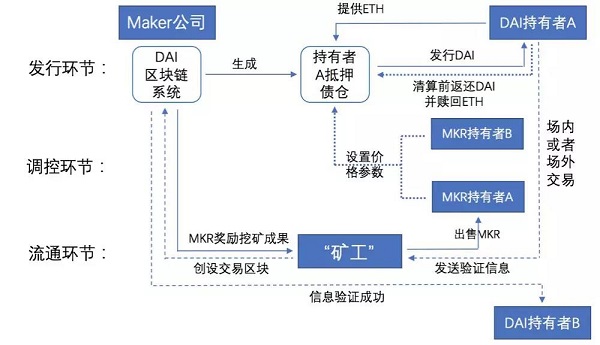

Figure 4 Schematic diagram of DAI issuance, circulation and regulation

In the chain-type stable currency issuance, circulation and regulation mechanism, there are two parties who are customers and “associative tokens” holders. Take DAI as an example. As you can see from Figure 4, the customer transfers Ethereum (ETH) to the “Debt Debt” (CDP) set up by Maker for the customer. The mortgage debt warehouse will verify the Ethanaire amount and lock the Ethereum. And generate a digital currency wallet that is sent to the customer with a DAI that is proportional to a certain value of the Ethereum. If the customer is ready to redeem the Ethereum, the mortgage debt warehouse will destroy the corresponding amount of DAI and be closed after the DAI it holds is transferred to the mortgage debt warehouse and pays the “stable fee”. At the level of currency regulation, the holder of another token MKR issued by Maker [15] has the right to vote to determine the price parameters such as mortgage rate, liquidation rate and stable cost, and form incentives for customers to buy DAI or redeem DAI. Affect the price of DAI. When the market price drop of the Ethereum triggers a pre-set clearing rate and the DAI holder fails to redeem the Ethereum in time, the system will force an internal auction for the Ethereum in the customer's mortgage debt bin.

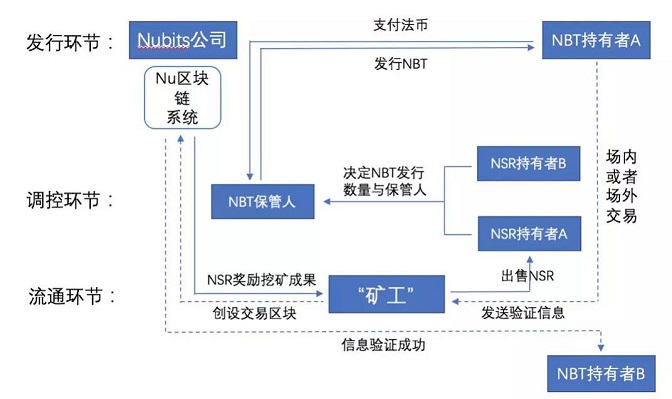

Figure 5 Schematic diagram of NBT issuance, circulation and regulation

In the algorithmic stable currency issuance, circulation and regulation mechanism, there are external issuance institutions, customers, and the three parties of the "associative token" holders. [16] Taking NBT as an example, it can be seen from Figure 5 that when the “predictor” [17] in the Nu system finds that the market demand for NBT is about to increase, the holder of another token NSR issued by Nubits has the right to vote. Decide whether to issue NBT and the number of issues, the designated external issuer, the NBT custodian (usually a digital currency exchange). [18] When the NSR holder decides to issue, the system generates a corresponding number of NBTs and sends them to the wallet address of the designated issuer. The external issuer can provide the newly issued NBT to customers with purchase needs through related business. After the external issuer obtains the proceeds from the currency issue, it will pay part of the proceeds to the NSR holder as a reward for issuing NBT and maintaining the issuance and operation system. If the market demand of NBT decreases, NSR holders have the right to vote to increase the interest rate of NBT and encourage customers to hold NBT. In the case of severe shortage of demand, NSR holders have the right to vote to reduce the NBT and NSR in the system. The exchange rate converts the original NBT holders into NSR holders, thereby reducing the number of NBTs in circulation and raising the price of NBT. [19]

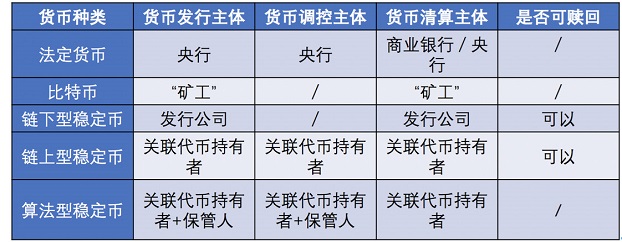

Table 1 Comparison table of five “currency” issuance mechanisms

(2) Stabilizing the price of stable coins

As can be seen from the above, the issuer of the chain-type stable currency is unable to manipulate the price of the stable currency at will, and the price change is mainly due to the supply of the stable currency holder to the issuing company, the depository bank and the credit recognition of the US dollar or Demand change; the associated token holder of the chain-type stable currency implements mandatory liquidation to stabilize the currency price by setting relevant parameters of the stable currency mortgage asset; [20] while the algorithmic stable currency also determines the stable currency through another token The issuance, using variable interest rates and associated token conversions, affects the supply and demand of stable currencies, thereby maintaining the price of stable currencies within a certain range.

The three stable coins have different price stability effects in actual operation. Among them, the stable USDT of the largest market value has a correlation with the price change of Bitcoin which accounts for more than half of the trading volume of the digital currency market, as shown in the following four figures:

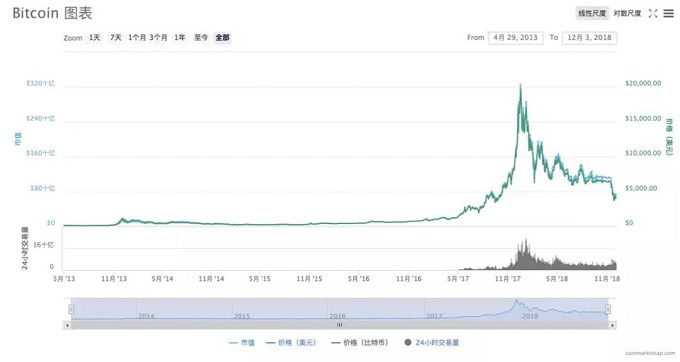

Figure 6 Bitcoin price change chart [21]

Figure 7 USDT price change chart

Figure 8 DAI price change chart

Figure 9 NBT price change chart

First of all, since the birth of Bitcoin, it has experienced a price change from the overall stability to the steep rise and fall. As can be seen from Figure 6, since February 2017, bitcoin prices have entered an alternating period of rapid and accelerated declines, and the overall trend has fallen. It reached a peak price of nearly $19,000 in December 2017 and has now fallen to about $4,000. Second, the USDT price has been stable around $1 and serves as a safe haven for Bitcoin. As can be seen from Figure 7, the price of USDT has been stable at around US$1 since it was gradually traded on major exchanges in early 2015. Except for short-term price fluctuations in August 2016 and April-June 2017, it has risen. The drop rate is within 2%; it is worth noting that since the bitcoin price entered the downturn in 2018, the USDT daily trading volume has increased significantly, indicating that many Bitcoin holders have chosen to temporarily convert Bitcoin to USDT. Value-preserving tools. Again, as can be seen from Figure 8, the DAI price has also remained stable around $1, but the price volatility is stronger than the USDT. Finally, the price of NBT experienced a process from overall stability to last year's cliff-like decline. As can be seen from Figure 9, in addition to the large price fluctuations from May to September 2016, the price of NBT has remained at around US$1 until March 2018, but after March 2018, the price of NBT has increased significantly. Falling into the "death spiral" cycle mode, by December 2018, the NBT price has hovered around $0.05, and its price stability mechanism has virtually failed. [twenty two]

In summary, the price of the three types of stable coins is more stable than that of Bitcoin. Among the three stable coins, the centralized chain-type stable currency price is the most stable, and some decentralized chain-type stable currency times. However, the partially decentralized algorithmic stable currency has the strongest price volatility. The reason is that the chain-type stable currency anchors the legal currency with relatively stable price, and the chain-type stable currency anchors the private digital currency with strong price volatility; while the algorithm-based stable coin has no intrinsic value, and only The regulation of private entities has intensified the volatility of their prices, making it impossible to achieve the original intention of stabilizing prices.

4. The embodiment of the unstable currency and the regulatory response

In the early days, most digital currencies had no intrinsic value. They adopted a decentralized distribution method, and no entity could regulate the amount of money. Individuals hold and use digital currency based on the “algorithm trust” of the underlying blockchain protocol. Algorithm trust can be affected by events such as cyber attacks and the issuance of alternative new currencies. Although the stable currency has certain advantages in terms of price stability, it still cannot improve the limitations of “algorithm trust” and the risks in terms of data security and financial stability. On the contrary, it strengthens the credit and “trust” risks in the operation of digital currency. Correspondingly, there are different regulatory approaches that respond to the credit risk of the three stable currencies.

(1) Credit risk and regulatory response of the chain-type stable currency

The issuing company of the chain-type stable currency prepares the stable currency with the legal currency as the full issuance, so that the stable currency reflects both private credit, bank credit and national credit, among which the private credit risk is the strongest:

First, the national credit risk of the chain-type stable currency is currently relatively low, but this risk will increase in the future with the diversification of anchoring currency. The chain-type stable currency is currently anchored mainly by the legal currency that is commonly used in the world, such as the US dollar and the euro, and the price is relatively stable. Therefore, the credit risk is low, but if it is introduced in the future, it will anchor multiple legal currencies, including sovereign credit. Stabilizing coins, such as lower-rated national currency, will increase their national credit risk.

Second, the bank credit risk of the chain-type stable currency is affected by many aspects such as the supervision level of the bank location and the bank's risk control capability. Since the legal currency collected by the stable currency issuing company is deposited in a specific commercial bank, and the commercial bank is located in a country with imperfect deposit insurance system, if the bank suffers from a major business crisis such as bankruptcy, the stable currency issuing company cannot apply in full. The redeemed customer pays the legal currency. In September 2018, Gemini and Paxos became the first stable currency issuer of the New York State virtual currency license. Gemini announced that it had deposited funds from its issued GUSD stable currency at State Street Bank and obtained federal The deposit insurance company's deposit-through insurance, that is, the insurance guarantee for the fund depositor extends to the actual owner of the fund. [twenty three]

Third, the chain-type stable currency has a relatively strong private credit risk. In the absence of supervision, the stable currency issuing company may use the raised French currency funds for high-risk investment activities, in addition to the possibility of spamming and over-stabilizing coins, which affects the stability of stable currency prices. Although the underlying blockchain technology of the stable currency guarantees the disclosure of the number of currency issuances and currency transfer information [24], its private chain attributes cannot guarantee that the relevant information cannot be falsified. For example, the USDT, which has not been regulated by the regulatory authorities, has been questioning Tether's over-issuing and manipulating the market since its issuance, and its alleged periodic public audit report has been postponed several times. Therefore, in terms of issuance preparation and distribution of circulation information, there are credit risks in the chain-type stable currency.

As a payment instrument with independent pricing unit, the chain-type stable currency has a similar distribution mechanism and credit risk. It is similar to new-type payment instruments such as third-party payment and commercial prepaid cards. Therefore, it can be similar to the legal currency payment tool. Regulatory logic. Taking a third-party payment as an example, a third-party payment platform provides a virtual account for the customer, and the customer deposits the legal currency into the virtual account, thereby forming a “virtual account currency”, and the customer can pay the virtual account with the third party. Personal transfer of currency. The biggest risk of third-party payment is also the platform's own credit risk, which means that each unit's virtual account currency has one unit of legal currency as support, and can redeem in real time.

Specifically, for the credit risk of chain-type stable coins, some countries have referenced the regulatory methods of legal currency payment instruments,[25] issued corresponding regulatory norms to maintain the solvency of stable currency issuing companies:

First, implement licensing system for access control. In the United States, the State of New York's Virtual Money Regulatory Act stipulates that all entities engaged in digital currency business activities such as digital currency exchange, issuance or management must apply for a license from the New York Financial Services Authority; [26] in Japan, the revised The "Funding Algorithm" stipulates that entities that purchase or sell digital currency or provide services such as matching and redemption for digital currency transactions need to register after satisfying the statutory conditions. [27]

Secondly, special management of the legal currency raised by the issuing company is restricted, and the use of the legal currency by the issuing company is restricted. For example, the New York State Virtual Money Regulatory Act stipulates that money service providers should hold certain dollar-guaranteed bonds or trust accounts in accordance with the requirements of the regulators, and the trust accounts must be kept by qualified custodians; [28] Japanese funds The knot algorithm stipulates that digital money service providers should perform separate management of customer assets and intrinsic assets.

Finally, the issuing company is required to disclose the legal deposit information and other information that may affect the solvency in real time or on a regular basis. In the United States, the New York State Virtual Money Regulatory Act provides that digital money service providers should report significant business changes or controller change information and financial accounting reports to regulators, and disclose general transaction information and significant risk information to protect consumers; Japan The "Funding Algorithm" stipulates that digital money service providers should fulfill their obligations of information disclosure and explanation.

(2) "trust" risk and regulatory response of chain-type and algorithm-based stable coins

The issuance and regulation of the chain-type stable currency and the algorithmic stable currency do not involve legal currency, and the issuing company itself cannot directly contact the consideration currency of the stable currency, and the decentralized mortgage assets and circulation information of the chain-type stable currency are open and It cannot be falsified, so there is no solvency risk in the chain-type stable currency, but there is a “trust” risk, that is, the neutrality risk of the currency control ability and regulation of the associated token holder and external participants:

On the one hand, the regulatory ability of the associated token holders is insufficient. For example, according to the mechanism design of DAI, the associated token holders vote to determine the price coefficient of DAI, prompting customers to buy and sell DAI, which affects the market price of DAI, similar to the central bank's monetary policy tools such as adjusting the reserve ratio and benchmark interest rate. Affect the money supply. For legal tender, a series of laws and regulations provide legal guarantee for the central bank's monetary policy, and expert selection and decision-making procedures in line with industry standards provide reasonable guarantees for the effectiveness of monetary policy implementation. For DAI, simply becoming the associated token MKR can become the currency regulator of DAI, and the threshold is extremely low. If you master more than half of the MKR, you can manipulate the price of DAI at will. Although Maker has not taken the majority of MKR for the stability of regulation, it has also raised the question of “centralized currency” and increased the private credit risk of the chain-type stable currency.

On the other hand, the regulation and neutrality of external participants is also debatable. For example, according to the NBT mechanism design, the external issuer, the digital currency exchange, provides customers with newly issued NBTs and obtains legal currency funds. The transaction requires the retention of most of the legal currency funds as preparation for issuance. In the absence of supervision, the exchange's need for profit will inevitably confuse NBT's issuance preparation funds with its own funds, or for other high-risk investment behaviors. If the exchange predicts that the NBT price will rise in the short term, it may hoard the NBT sent by the NSR holders and increase the volatility of the NBT price. In addition, the regulation of stable currencies with the goal of price stability still has the problem of lack of effectiveness in theory. In 1999, Mundell proposed the "impossible triangle" theory, and believed that it is impossible to maintain a country's free flow of capital, monetary policy independence and exchange rate stability at the same time; if it is necessary to maintain free flow of capital and exchange rate stability, it must abandon monetary policy independence. . It can be seen that if the stable currency realizes the price stability under the premise of cross-border point-to-point payment settlement, the goal of the currency regulator to control the currency price will not be realized. [29]

For the risk of currency control “trust” in chain-type stable coins and algorithmic stable currencies, countries have not yet introduced targeted regulatory measures. Under the traditional regulatory perspective, the licensing system and information disclosure may have a certain effect on regulating the neutrality of external participants, but for decentralized and liquid currency holders, the cost of supervision is too high. [30] At present, regulators in some countries have made some innovative attempts in the way of supervision, such as the “privileged node” in the underlying blockchain of stable currencies. [31] In extreme cases, the above two types of stable currency “trust” risks may cause the price of a particular stable currency to collapse, as well as the price fluctuations of associated tokens and even fiat currencies. If real-time monitoring and analysis of transaction data in stable currency can be made, early risk warning and chain behavior intervention can reduce the “trust” risk brought by private entity's currency regulation ability and neutrality. At present, Suptech, which is encouraged by some national regulators, reflects this by acquiring more comprehensive and accurate data through “formation reporting” and data management, and through virtual assistants, misconduct detection analysis, etc. Means to improve data analysis processing efficiency and regulatory effectiveness. [32] The exploration of regulation as a blockchain node began a few years ago. In November 2016, the European Clearing Bank stated in its report that regulators can set up nodes in the blockchain and have the right to fork the nodes that violate the regulatory rules. [33] The Guiyang Municipal Government's “White Paper on the Development and Application of Blockchains in Guiyang District” issued in December 2016 proposed the concept of “sovereign blockchain”, emphasizing the supervision of networks and accounts at the regulatory level, and providing supervisory nodes. Control and intervention capabilities. [34]

V. Remarks

Early private digital currencies such as Bitcoin were born based on doubts about the credit of French currency countries, and strive to achieve openness, democratization and stability of currency issuance. However, most of the early digital currencies fluctuated sharply due to factors such as lack of intrinsic value. In this context, stable currencies targeting stable currency prices began to appear. Compared with early digital currencies such as Bitcoin, the price of the chain-type stable currency that anchors the fiat currency is the most stable, and the chain-type stable currency that anchors other digital currencies is second, but has no intrinsic value and is only controlled by the private currency. The algorithmic stable currency has the strongest price volatility. In the process of stabilizing prices, the stable currency has created a risk of credit risk and “trust”, which has fallen into a logical dilemma that “can not be separated from legal tender” and “realize price stability”. The multi-centered and even fully centralized operating mechanism of stable currency has in fact violated the original intention of private digital currency issuance.

On the other hand, stable currencies based on specific business models and restricting circulation are favored by large Internet companies and financial institutions. These institutions began to try to exploit the technical advantages of the blockchain, issue stable coins anchored with fiat money, and circulate within their business ecosystem, with a view to expanding the company's business volume by increasing the efficiency of payment clearing. For example, in February 2019, according to media reports, Facebook is working on a cryptocurrency linked to the value of the US dollar, allowing users to transfer money on the WhatsApp mobile chat tool; in the same month, JPMorgan Chase said it will launch a US dollar-linked encryption. The currency JPM Coin is used to realize real-time transaction settlement between customers of wholesale payment business. [35] In fact, in addition to the degree of intervention that the issuer can impose on currency circulation, this digital currency is similar in business model to the already existing “network virtual currency” or “electronic money”.

Blockchain optimists believe that most of the offline physical assets will be “token” [36] into digital assets on the blockchain, and each digital asset can be divided into a certain number. The circulation of the certificate is circulated around the world, which will greatly promote the optimal allocation of resources; while the assets under the Internet are being certified, a digital currency with stable price is needed, and the digital currency and the certificate are realized through smart contracts. The "goods for payment of goods" effectively fulfills the monetary functions of the trading medium, value scale and value storage. [37] In the early days when digital currency could not effectively perform its monetary function, and there were many risks in stabilizing the currency, and the regulators were still unable to respond effectively, the “pass-certification world” envisaged by the blockchain optimists could still arrive. There are big questions.

[1] The chain-type stable currency is prepared by issuing commodities such as fiat currency and crude oil. The chain-type stable currency is prepared by issuing early digital currency such as Ethereum, and the algorithm-based stable currency has no assets as preparation for issuance. See Blockchain Team, The State of Stablecoins.

[2] As of December 17, 2018, there were 2,072 digital currencies and 16016 trading markets in the world, with a total market capitalization of approximately US$122.2 billion, of which Bitcoin market value accounted for approximately 53.6% of the total market capitalization. Coinmarketcap: https://coinmarketcap.com/zh/, last visit on December 18, 2018.

[3] See Beijing Internet Finance Industry Association: “Prevention of Risk Warnings for Illegal Financial Activities in the Name of “Virtual Currency”, “ICO”, “STO”, “Stable Dollars” and Other Variants, http://www.bjp2p. Com.cn/news/20190321001, visited on March 22, 2018; Banking Insurance Regulatory Commission, Central Network Information Office, Ministry of Public Security, People's Bank, and General Administration of Market Supervision: "Preparing to prevent illegal use of "virtual currency" and "blockchain" The risk warning for fundraising, http://www.cbrc.gov.cn/chinese/newShouDoc/02DD1CADB1AC45DF948E3AD36F93BEDD.html, accessed on March 22, 2018.

[4] See Fan Yunhui and Li Yaoxin: “Exploring the Legal Supervision of Digital Money with Bitcoin as an Example”, in Law Application, No. 7, 2014; see Zhao Lei: “On the Legal Attributes of Bitcoin——From the HashFast Manager "Marc Lowe Case", in "Law of Law", No. 4, 2018; Xie Jie: "The Choice of Economic Criminal Law in the Decentralized Digital Payment Age——Based on the Legal and Economic Analysis of Bitcoin", in Law Science 2014 No. 8 of the year.

[5] Including stable currency, current digital currency types include Exchange Token, Security Token, and UtilityToken. See HM Treasury & FCA& Bank of England , CryptoassetsTaskforce : final report.

[6] It can be seen from Figure 1 that in the process of currency issuance and regulation, the central bank issues or withdraws cash legal currency from commercial banks through open market operations, rediscounting and adjustment of benchmark interest rates, and converts the currency issuance funds in the issuance bank into commercial banks. The funds available in the business circulation; while the commercial banks provide multi-form legal tender money to bank customers and the public through deposit and loan business. In the currency circulation, the currency holder directly transfers the cash legal currency in person, or transfers the deposit currency through the clearing system operated by the commercial bank or the central bank. In the process of currency credit risk control, the law limits the scope and application conditions of monetary policy instruments, and implements procedural norms for the organization and operation of monetary policy formulation and enforcement agencies; in addition, to protect bank credit and avoid its failure to make national credit Threat, the law allows the central bank to act as the “final lender” to provide commercial banks with certain time limits and conditions, and the deposit insurance institutions or independent deposit insurance companies set up by the central bank provide a certain amount of deposit insurance for commercial bank customers. To maintain the confidence of the currency holder in the fiat currency.

[7] Taking Bitcoin as an example, as can be seen from Figure 2, in the currency issuance, the “miners” use the bitcoin mining machine to calculate the random number required by the system, and obtain the mining after creating the trading block and winding the chain. Reward, and the use of Bitcoin as a reward for mining is regarded as the issuance of Bitcoin; there is no currency control entity within the Bitcoin system, and there is no redemption and destruction mechanism, but Bitcoin has a maximum amount of issuance. In the currency circulation, currency holders can perform point-to-point transfer around the world based on Bitcoin's own blockchain system, independent of any third-party payment clearing system, while currency transfer information is in each block. All of the chain nodes are recorded but completely anonymous. See Alvind Narayanan waiting: "Blockchain: Technology Driven Finance", Lin Hua and other translations, CITIC Publishing Group 2016 edition, p. 69.

[8] “Algorithm trust” means that distributed accounting enables the currency issuance and circulation quantity, and the transaction information is fully disclosed on each blockchain node, ensuring that it is difficult for anyone to tamper with the information on the blockchain, and the currency cannot Repeated payment.

[9] At present, the “cross-chain” technology in the field of digital currency still needs to be improved, and transactions between currencies need to be carried out through centralized exchanges, which makes the application of digital currency in the payment field very limited.

[10] See Mo Tao: “The Bridge of the Blockchain World: Understanding and Prospects of Stabilizing Coins”, in Modern Commercial Bank, No. 13 of 2018.

[11] See Wang Tongyi: “Study on the Impact of Stabilizing Coins and Its Development Trends”, published in Tsinghua Financial Review: https://mp.weixin.qq.com/s/qL4P3-82B-fUhNi1cQw18g, last December 15, 2018 access.

[12] See Yao Qian, Sun Hao, “The Experiment and Enlightenment of Digital Stabilization of Tokens”, in China Finance, No. 19, 2018.

[13] USDT is currently the largest under-chain stable currency with market capitalization. DAI is the largest chain-type stable currency with the largest market value. NBT is the first and currently the only algorithm-based stable currency. See Blockchain Team, The State of Stablecoins.

[14] See Tether, Fiat currencies on the Bitcoin blockchain.

[15] At present, in order to ensure the smooth operation of the DAI system in the early stage, MKR tokens are mostly held by the core development team of Maker. See Maker, The Dai Stablecoin System Whitepaper.

[16] NBT and associated token NSR form a Nu blockchain system. The main difference between the Nu system and the Bitcoin blockchain system is that the Bitcoin holder cannot intervene or control the blockchain system, while the Nu system realizes the integration of the currency holder and the system controller. See Nubits, Nu Whitepaper.

[17] The “Prophecy” is a smart contract on the blockchain that provides external (price) information for the blockchain.

[18] At present, most of the holders of NSR are volunteers who volunteer to participate in the operation of the system during the NBT start-up period. See Nubits, Nu Whitepaper.

[19] See Nubits, Nu Whitepaper.

[20] See Wang Tongyi: “Study on the Impact of Stabilizing Coins and Its Development Trends”, published in Tsinghua Financial Review: https://mp.weixin.qq.com/s/qL4P3-82B-fUhNi1cQw18g, last December 15, 2018 access.

[21] Figures 6 through 9 are both from the coinmarketcap website. Coinmarketcap: https://coinmarketcap.com/zh/, last visit on December 6, 2018.

[22] See Yao Qian, Sun Hao, “The Experiment and Enlightenment of Digital Stabilization of Tokens”, in China Finance, No. 19, 2018.

[23] See §330.5, Title 12: Banks and Banking, Code of Federal Regulations.

[24] The currency transfer information between each account address is just a string of codes, not the personal identity information of the individual.

[25] The Singapore Financial Services Authority (MAS) believes that the chain-type stable currency may be eligible for both capital market bonds and “e-money”, thereby being subject to both the Securities and Futures Act and the Payment Services Act. 》 constraints. See Case study 11, MAS, A Guide to Digital Token Offerings, November2018.

[26] See Section 200.3. New York Codes, Rules And Regulations, Title 23. Department Of Financial Services, Chapter I. Regulations Of The Superintendent Of Financial Services Part 200. Virtual Currencies. See Section 201-209. Uniform Supplemental Commercial Law For The Uniform Regulation of Virtual-Currency Businesses Act (October 9, 2017).

[27] See Yang Dong, Chen Zeli: “Virtual Currency Legislation: Japanese Experience and Implications for China”, in Securities Market Herald, No. 2, 2018.

[28] See Section 200.4-200.19,. New York Codes, Rules And Regulations, Title 23. Department Of Financial Services, Chapter I. Regulations Of The Superintendent Of Financial Services Part 200. Virtual Currencies. See Section 301-502. Uniform Supplemental Commercial Law For The Uniform Regulation OfVirtual- Currency Businesses Act (October 9, 2017).

[29] See Sheng Songcheng, Long Yu: "Monetary Policy and Decentralization is the Paradox of Digital Money", Cai Caixin.com: http://opinion.caixin.com/2018-10-15/101334950.html, 2018 Last visit on December 7th.

[30] In March 2019, the SEC Senior Advisor stated: “A stable currency (ie “chain-type stable currency”) that controls prices by issuing, developing or redeeming other digital assets associated with it, and by controlling supply and demand. A stable currency (ie "algorithm-type stable currency") whose price is kept within a certain range. If the investor is told that others will profit or can control the price, then the token may belong to the securities." See By Kirill Bryanov, What Do We Know About Valerie Szczepanik, the FirstCrypto Czar, https://cointelegraph.com/news/what-do-we-know-about-valerie-szczepanik-the-first-crypto-czar,2019-3-22.

However, even if the two stable currencies are securities and need to be subject to securities laws, whether the regulation of highly decentralized associated token holders and external participants can pass CBA (cost-benefit analysis) is still a A question worth discussing.

[31] See Douglas W. Arner, Janos Barberis, and Ross P. Buckley. The Evolution of Fintech: A New Post-crisis Paradigm, Social Science Electronic Publishing, 2015, 47 (4): 1271-1319.

[32] See He Haifeng, Yin Danni, Liu Yuanxing, “Suptech Research on the Connotation, Application and Development Trends”, in Financial Supervision Research, No. 10, 2018, p. 66.

[33] See Euroclear Bank, Blockchain Settlement:Regulation,innovationand application.

[34] See the Guiyang Municipal People's Government Press Office: “Guiyang Blockchain Development and Application White Paper (December 2016)”, p. 21.

[35] See The New York Times, Facebook and Telegram Are Hoping to Succeed WhereBitcoin Failed, https://www.nytimes.com/2019/02/28/technology/cryptocurrency-facebook-telegram.html,2019-3-22 See CNBC, JP Morgan is rolling out the first US bank-backedcryptocurrency to transform payments business, https://www.cnbc.com/2019/02/13/jp-morgan-is-rolling-out-the-first- Us-bank-backed-cryptocurrency-to-transform-payments–.html,2019-03-22.

[36] The so-called "pass-through" means that each unit's offline assets correspond to a unit "rights certificate" on the blockchain.

[37] See Wang Huaqing and Li Liangsong: “Analysis of Digital Stabilization Tokens”, in China Finance, No. 19, 2018.

Author:

Kodak (Peking University Financial Law Research Center)

Source: Peking University Financial Law Research Center

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | Is digital currency investment legal?

- Market analysis: incremental funds are not in place, the market is under pressure

- The fund holdings have not yet ended, and the market is hard to say.

- NASDAQ: Joined Bitcoin's "Wish List" this year

- Blockchain species of marijuana sounds so heavy, reliable?

- Why is it that Poca’s opponent is not Cosmos, but Ethereum?

- I spent 10 minutes and bought a record on Amazon with 0.005BTC.