Scanning the data on the Bitcoin chain in January (Part 1): Unexpected currency price breakthrough

In the beginning of 2020, a sudden event disrupted the daily lives of the Chinese, including our most important festival each year: the Spring Festival. The impact of this event is comprehensive, from public health events to economic, financial and digital issues. Assets and have a global impact.

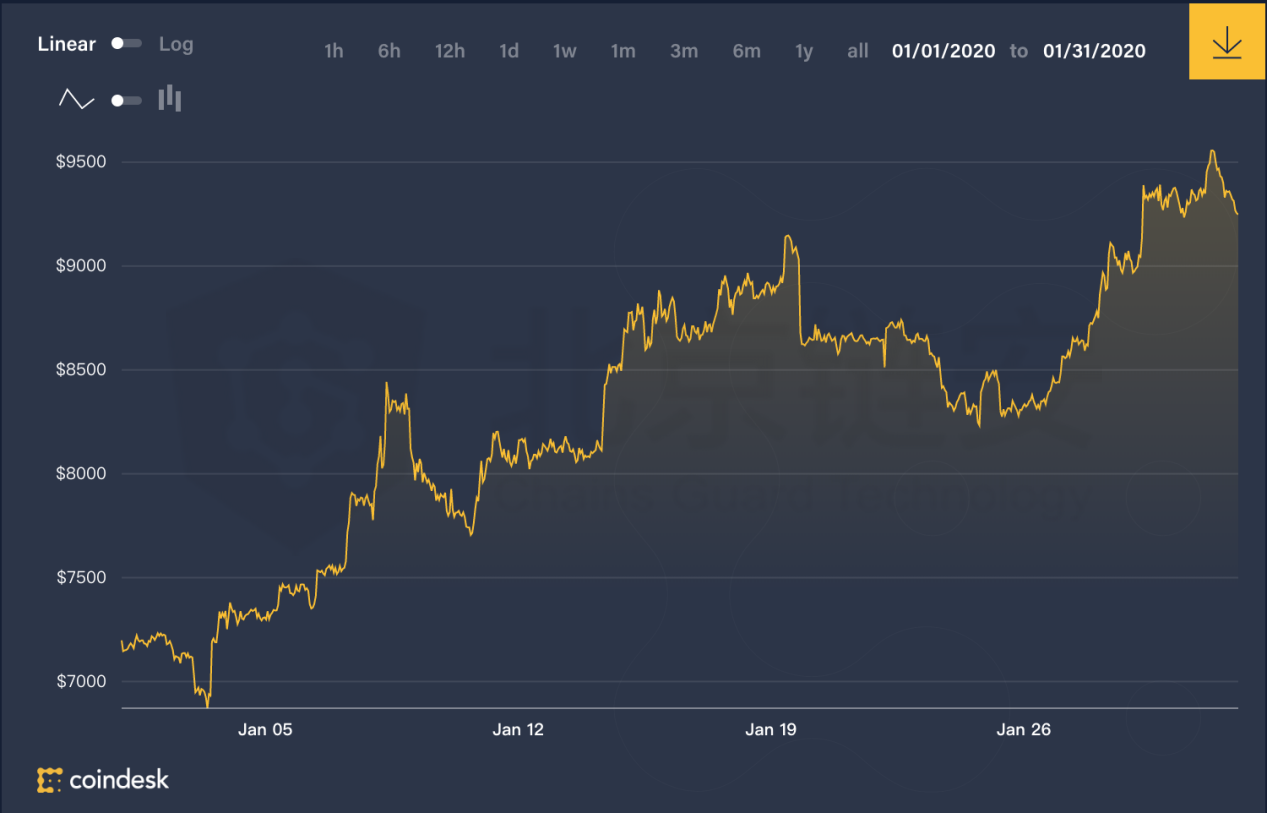

According to CoinDesk's data, the price of Bitcoin in January 2020 showed a clear upward trend. Then, what is the trend of Bitcoin's on-chain transactions throughout January, let's review and analyze it.

- After the epidemic trust crisis broke out: the "anti-epidemic" of the blockchain has just begun

- Babbitt Column | America First? Discrimination of the attitude of the Federal Reserve's two parties to the CBDC

- OKEx announces the destruction of all 700 million OKBs that have not yet been issued, and OKB is up nearly 40%

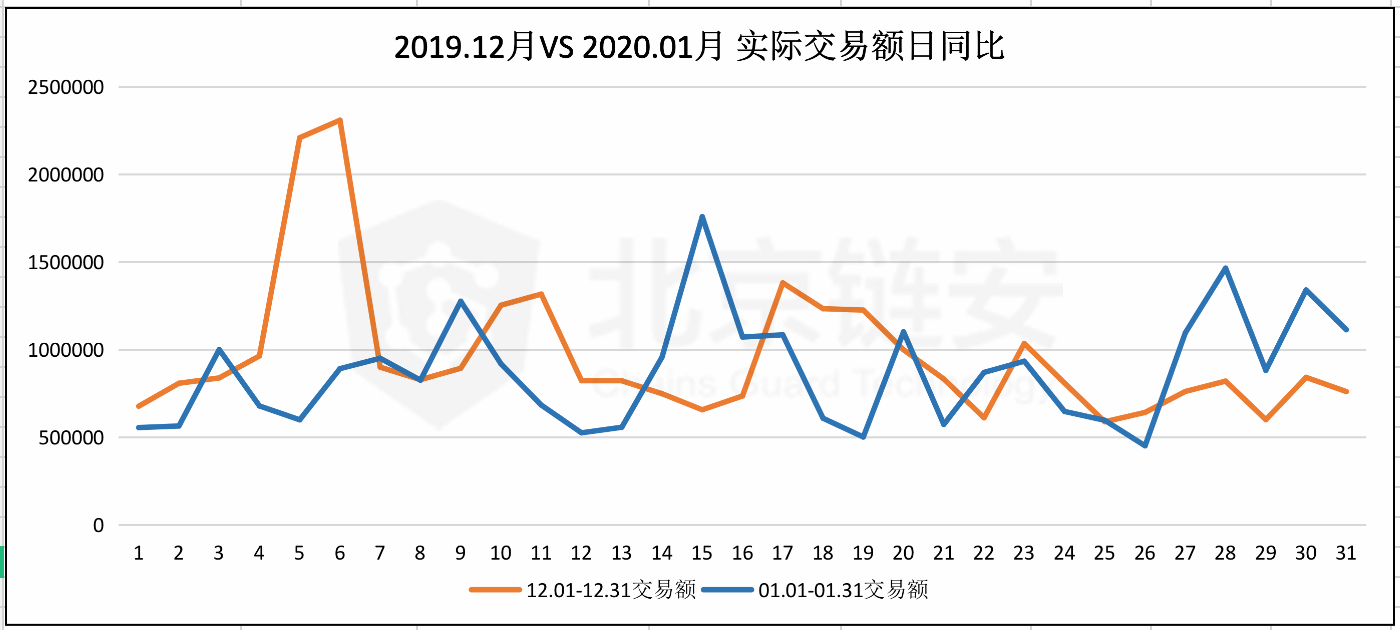

In January 2020, the transaction value on the bitcoin chain was 27104092.46 BTC, compared with 29950325.13 BTC in December 2019, a decrease of 9.50%. This is the second consecutive month of decline in the transaction value on the bitcoin chain.

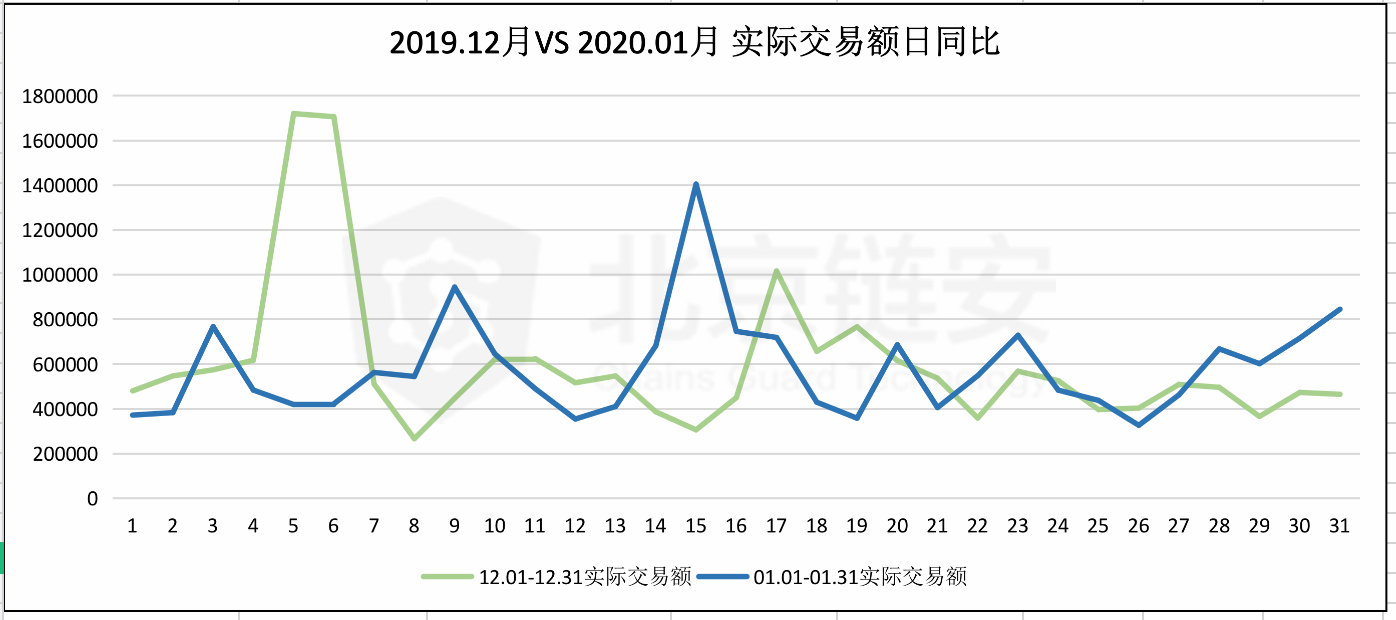

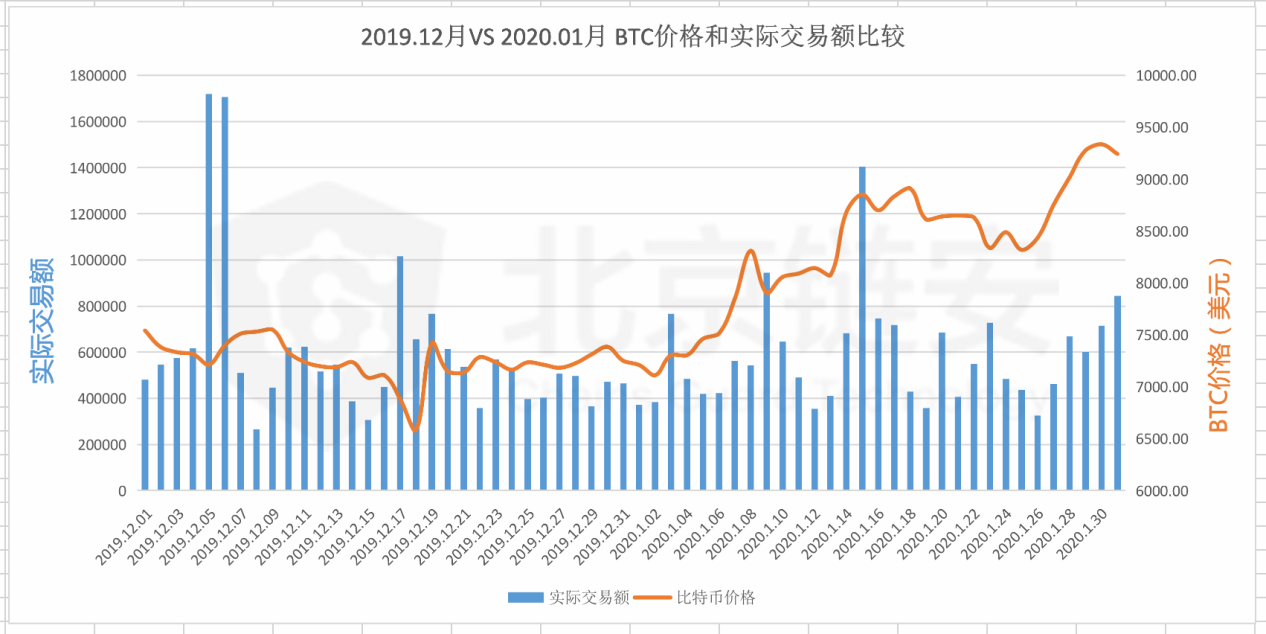

In January 2020, the actual transaction amount on the Bitcoin chain was 18047330.32 BTC, which was a decrease of 2.30% compared to 18471757.71 BTC in December 2019. The actual transaction amount we defined is to exclude transactions such as “changing” The actual bitcoin transferred out is relatively more accurate.

In January 2020, the actual transaction amount on the Bitcoin chain was 18047330.32 BTC, which was a decrease of 2.30% compared to 18471757.71 BTC in December 2019. The actual transaction amount we defined is to exclude transactions such as “changing” The actual bitcoin transferred out is relatively more accurate.

Judging from the large amount of transactions in January 2020, the huge UTXOs of the Bitfinex and Bittrex exchanges are the main exchanges that cause a large change in the transaction value on the chain.

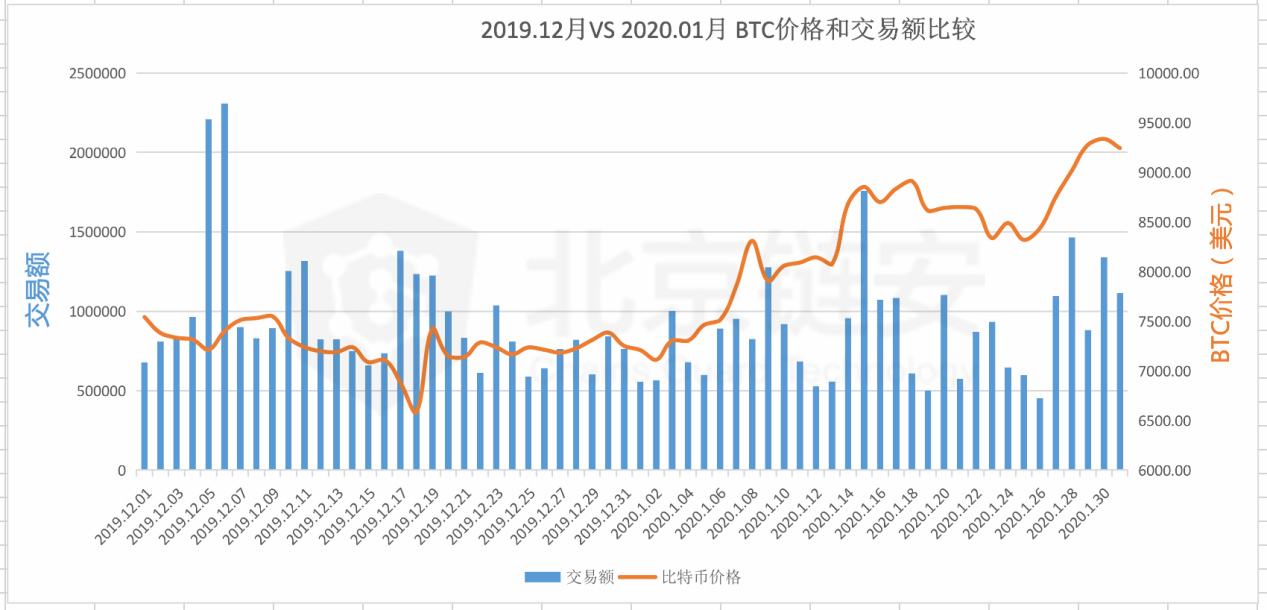

From the perspective of bitcoin price, the price in January 2020 continued to rise during the intermittent correction. In this process, although the total amount of on-chain transactions decreased, the price increased significantly in the upward process. At the same time, we can also see that the change in actual transaction volume is more consistent with the change in the Bitcoin price curve.

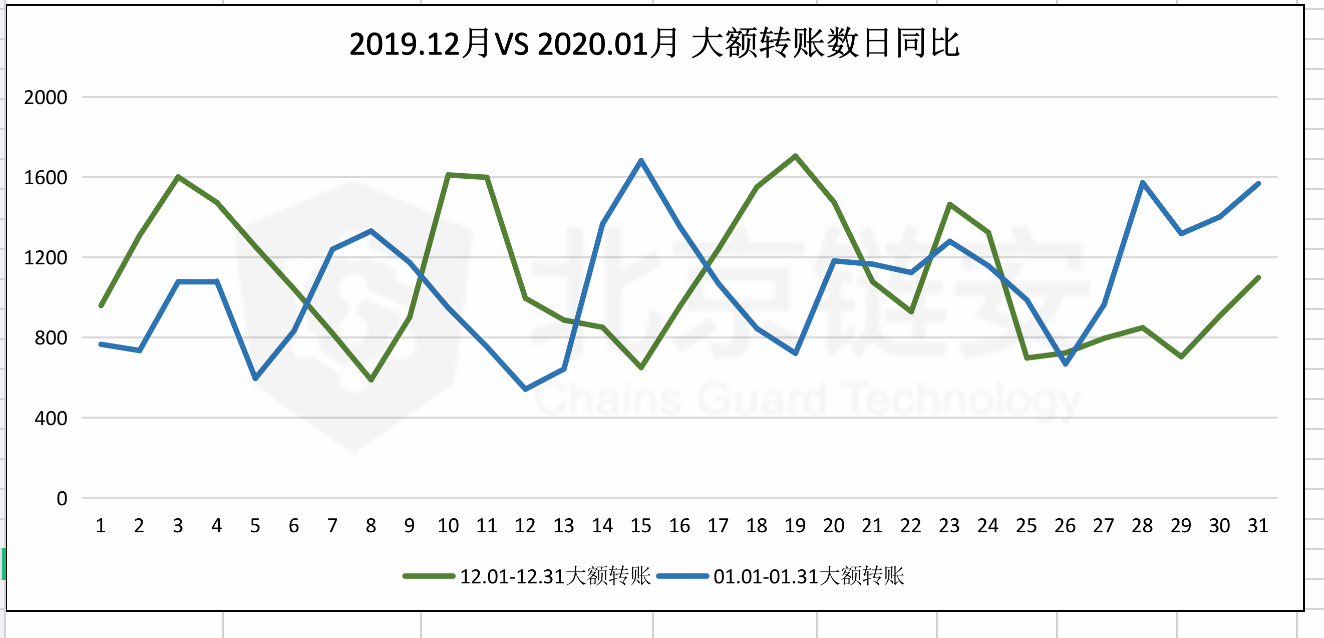

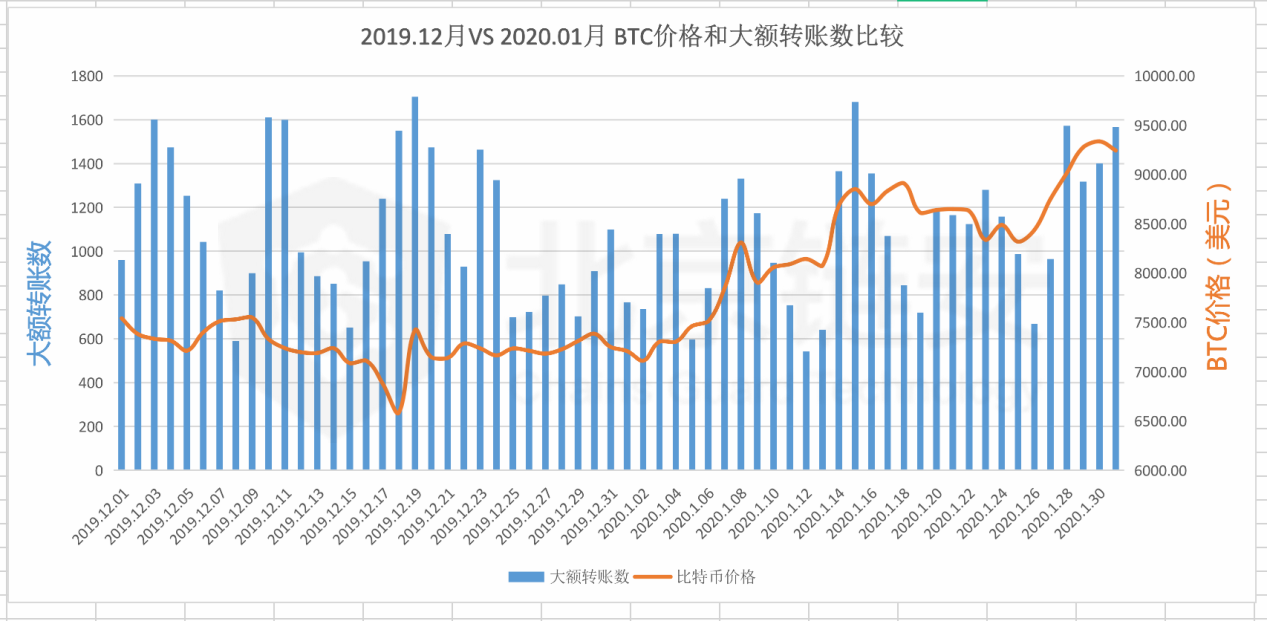

Compared with the on-chain data transaction volume that may be affected by some special transactions, the large number of transfers above 100BTC often reflects the activity of on-chain transactions. In January 2020, the number of large-scale transfers on the chain was 33,148. 34,041 times in December 2019 fell by 2.63%.

From the comparison with the price of bitcoin in the same period, the number of large transfers will obviously increase at the time when the price is upward, and it will often respond faster with the price.

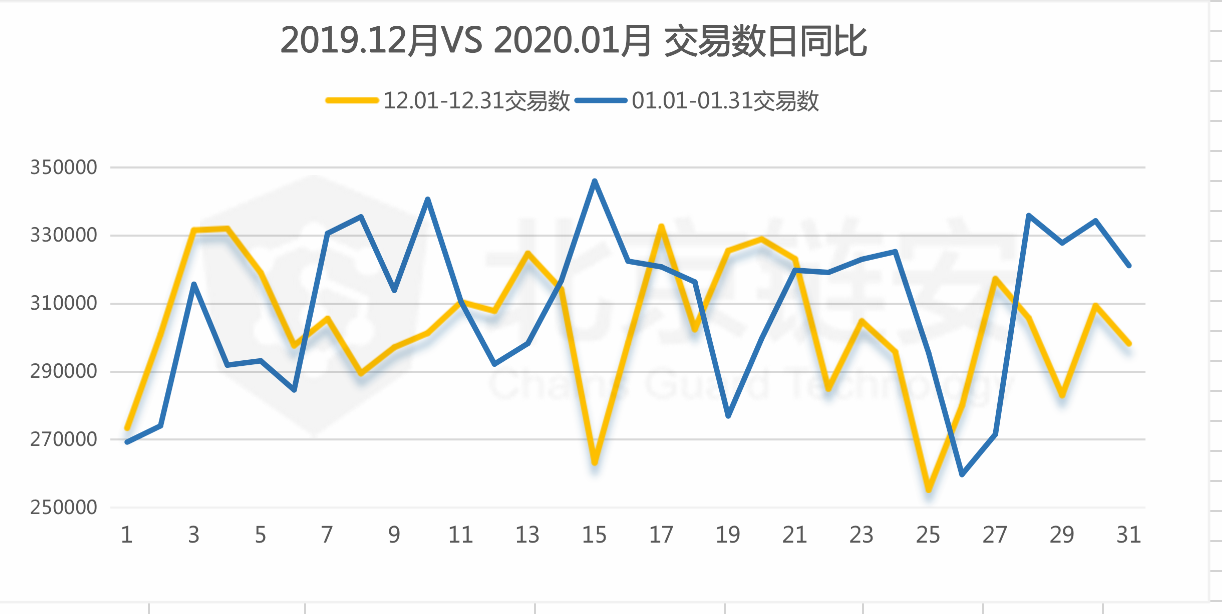

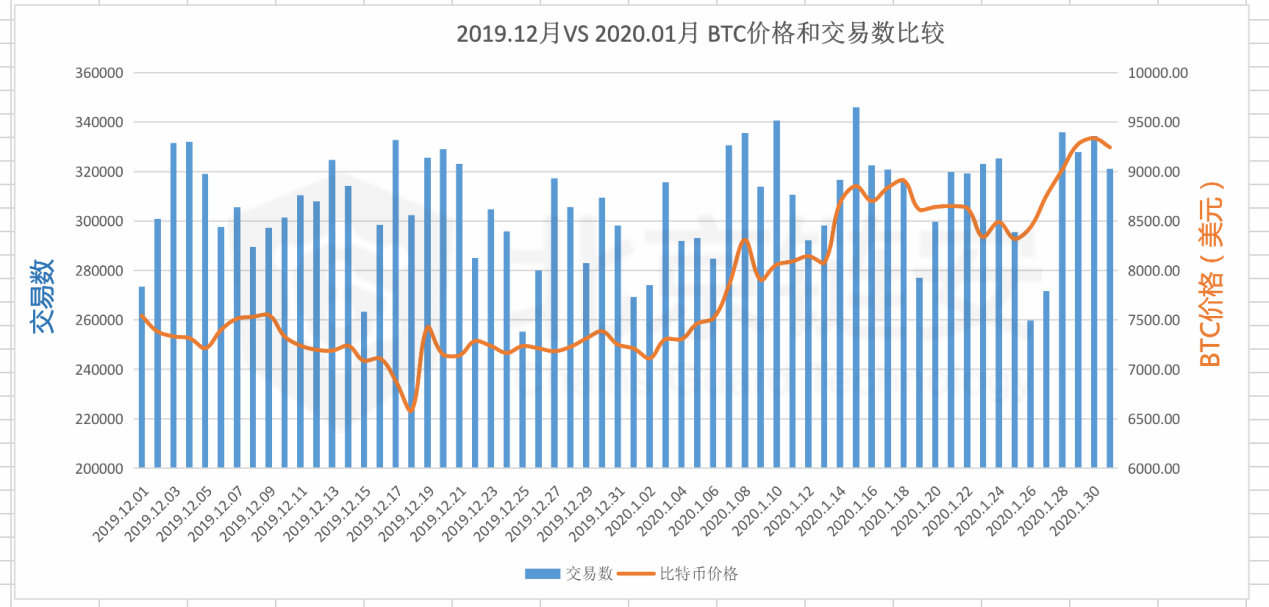

In January 2020, the total number of transactions on the Bitcoin chain was 9,582,599, which was slightly 1.79% higher than the number of 9,914,206 in November.

From the comparison of the number of transactions on the chain and the price of bitcoin in the past two months, we find that the overall fluctuation is still within a range, and in the first half of January when the price went up, the on-chain exchanges were significantly more active.

From the comparison of the number of transactions on the chain and the price of bitcoin in the past two months, we find that the overall fluctuation is still within a range, and in the first half of January when the price went up, the on-chain exchanges were significantly more active.

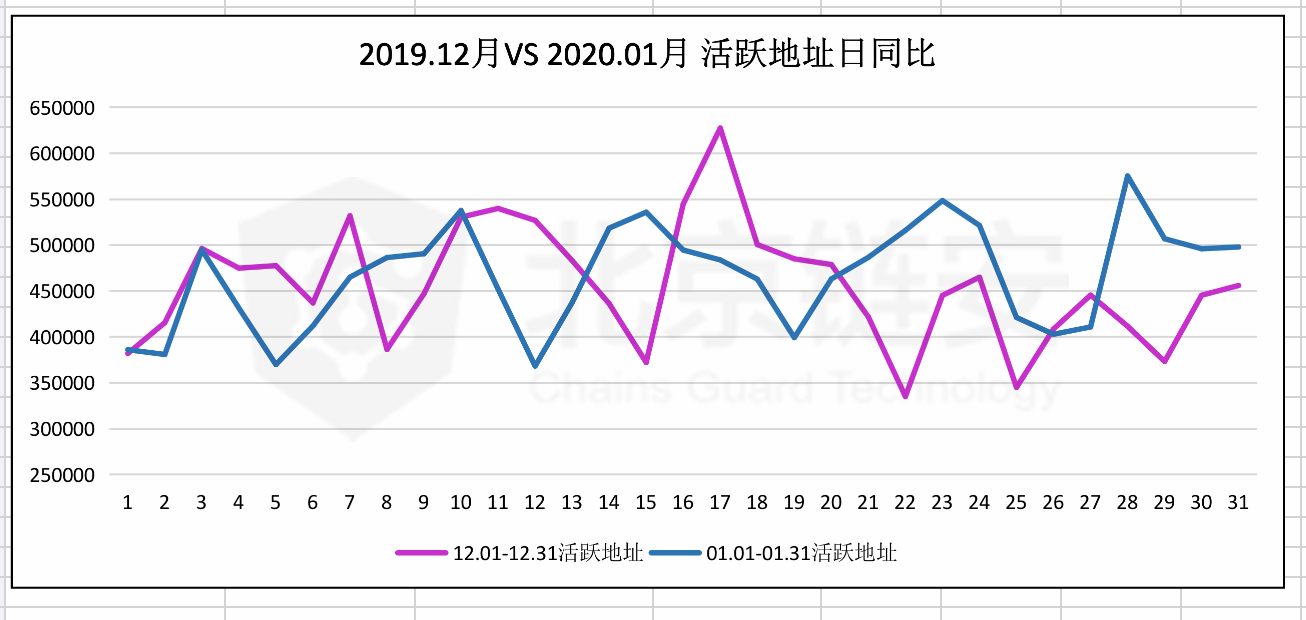

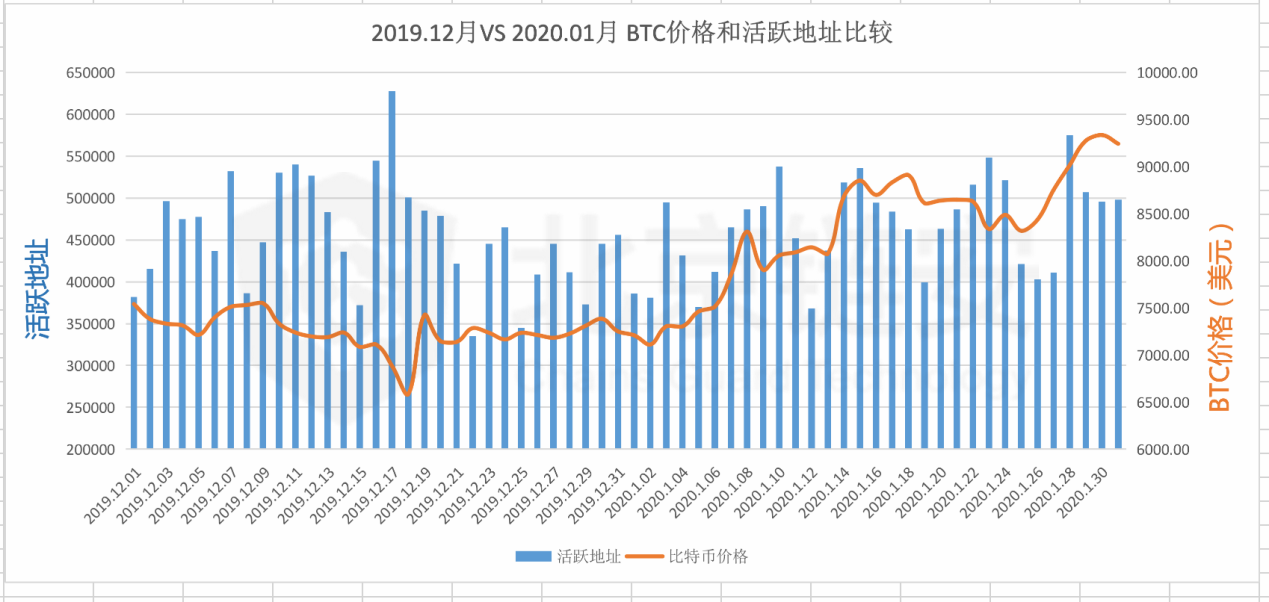

Finally, let's look at the number of active addresses, that is, the number of addresses that initiate transfers actively. In January 2020, the number of active addresses was 14,454,357, an increase of 2.32% from 14,126,83 in December 2019.

From the comparison of the number of active addresses and the price of bitcoin in the past two months, we can see that with the relatively low fluctuation of the overall price of bitcoin in January, the number of active addresses has fluctuated little, and has not increased too much, of which The important reason is that the active address exchanges during the period are often related to the exchange, and these addresses often operate around some core addresses of the exchange, and usually do not show excessive changes in quantity.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis: What caused Bitcoin to soar above $ 10,000 over the weekend?

- Blockchain Weekly Report | New Crown Inspiration: Creating a Blockchain Infectious Disease Early Warning System

- Mutual treasures use blockchain to process New Crown virus claims, can it subvert traditional insurance companies?

- Study | Charities in Epidemic Need Blockchain More

- Popular Science | Concise Ethereum 2.0 Introduction

- Weekly development of industrial blockchain 丨 Anti-epidemic prevention, although the blockchain is late, it is not absent

- Babbitt weekly selection 丨 Bitcoin returns to US $ 10,000; blockchain industry explodes financing wave