Mutual treasures use blockchain to process New Crown virus claims, can it subvert traditional insurance companies?

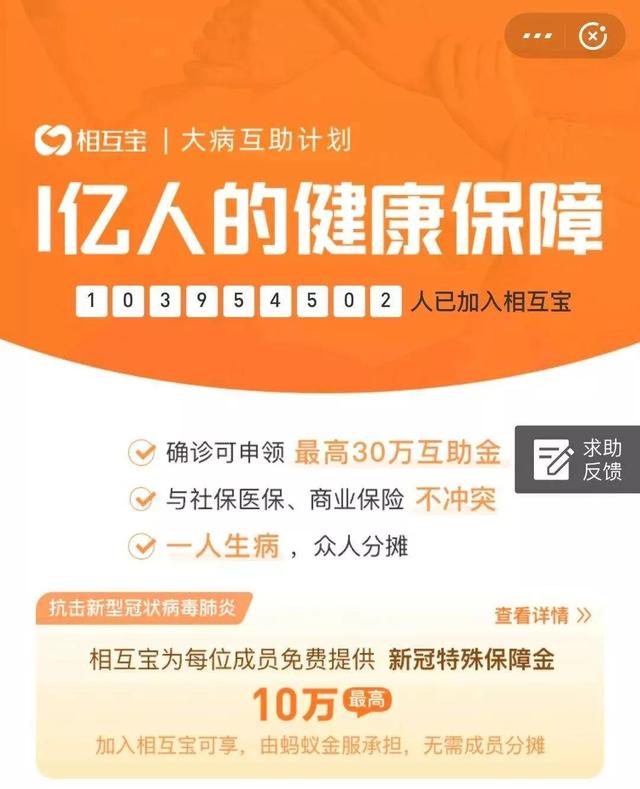

Speaking of mutual treasure, everyone must have some understanding. As a major disease mutual assistance plan for Alipay, its function is similar to consumer-type serious illness insurance. But it is not insurance but "mutual assistance". To put it simply, "one person is sick, and everyone is even."

The scope of Hubaobao's protection covers cancer +99 major diseases, which includes 25 kinds of high-incidence and severe diseases that are mandated by the China Insurance Regulatory Commission. Compared with the specific terms, it is not much different from the traditional insurance company's definition of severe diseases. But the price is quite different from traditional insurance.

According to the Beishu Blockchain, more than 100 million people across the country have joined Alipay's critical illness mutual assistance program "Mutual Treasure". Through the technical characteristics of openness, transparency, and non-tamperability of the blockchain, Huobao guarantees that there will be no scams or fraudulent accounts.

- Study | Charities in Epidemic Need Blockchain More

- Popular Science | Concise Ethereum 2.0 Introduction

- Weekly development of industrial blockchain 丨 Anti-epidemic prevention, although the blockchain is late, it is not absent

Since the outbreak, the mutual treasure team has been working hard to study the security plan. "Special Protection for Mutual Bao New Crown Pneumonia" is specially set up for all members of Mutual Bao to fight this major national epidemic.

On January 31st, the "Mutual treasure" homepage of the Alipay insurance platform launched "Special Protection for Mutual Bao New Crown Pneumonia". All members of Mutual Po, after joining Mutual Po, if they are diagnosed with new pneumonia and unfortunately cause death, members of the Mutual Aid Scheme can apply for a new crown special security deposit of up to 100,000 yuan. All costs of special protection are borne by Ant Financial Services Mutual treasure members share. Currently, Huobao has added a new coronavirus to eligible diseases.

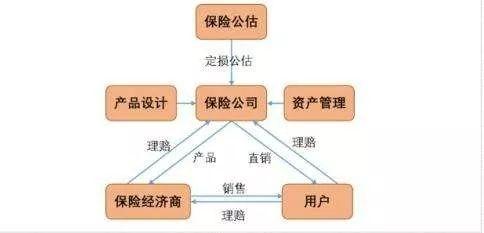

At present, insurance companies face problems such as inefficient information exchange, complex reinsurance liability assessments, scattered data sources, use of middlemen, and manual claims review and processing environments.

The emergence of mutual treasure, from the model and process, are trying to solve this problem. It can be said that it is a typical case of the application of the blockchain concept. Maybe when it comes to the blockchain, many people still stay on the blockchain, which is a coin deception project. The first reaction of most people is various tokens such as Bitcoin. Someone who knows a little bit will say that blockchain has the characteristics of decentralization. At the same time, blockchain can also help reduce costs, improve risk assessment, and increase customer onboarding rates. It can also change the claim submission process from registration to evaluation and payment. Having a simplified (and secure) environment to automate these tasks will fundamentally reduce fraud and provide a better customer experience.

Two traditional challenges in the insurance industry-fraud and customer service-can be improved through blockchain. Since the blockchain ensures that records cannot be altered in any way and can be verified with complete accuracy, it provides an important opportunity for insurance companies to embrace this technology.

Since the data stored in the blockchain cannot be changed, it almost eliminates the possibility of insurance fraud. No element of the data can be modified in any way. Let us not forget the trading capabilities enabled by technology. Suddenly, smart contracts became a reality, customers could directly sign digital contracts with insurance companies, and due to the removal of middlemen, claims could be completed almost instantly.

Application prospect of blockchain in insurance industry

1. Zhong'an Insurance's subsidiary Zhong'an Technology and Lianmo Technology established the "Step by Step Chicken" brand, which for the first time applied blockchain, artificial intelligence, anti-counterfeiting and other technologies to rural free-range chicken farming. Based on the immutable characteristics of the blockchain, this technology can truly record all data from chicks to adult chickens, and then to the dining table, ensuring the traceability of each chicken's information. At the same time, various indicators of the breeding ring can be monitored to provide early warning of the epidemic situation.

The combination of this project and insurance is that the application of blockchain can not only provide farmers with the entire process of breeding data, but also share the data with the insurance companies insured by farmers, so that insurance companies can also monitor the entire agricultural production process in real time. The risk assessment of farmer assets is also more accurate and serves as the basis for risk pricing and risk control.

2. Sunshine Insurance's "Sunshine Shell" points system based on the underlying technology structure of the blockchain. Users can transfer bonus points to friends and share with other companies on the basis of ordinary points. exchange.

3. The blockchain insurance business platform launched by Shanghai Insurance Exchange, Baojiao Chain, can support and implement applications in financial clearing and settlement, anti-fraud, compliance supervision, and insurance transactions. Baojiao Chain includes four major service systems, of which the identity authentication service system realizes the authentication, audit, issuance and management functions of identity certificates; the consensus service system ensures the consistency of distributed data; the smart contract service system implements the installation and instance of smart contracts Management functions such as upgrading and upgrading.

Blockchain technology plays a decentralized role in the business world and is a distributed accounting technology. The "mutual treasure" logic is essentially a decentralized logic. It is through the use of blockchain technology to achieve high transparency, to ensure that there will be no fraudulent insurance and ransom. Therefore, it is very safe to ensure that the transaction is transparent and immutable.

The insurance industry's application prospects for blockchain are very broad, but it should be noted that blockchain insurance still needs to complete a large number of basic constructions, including the underlying environment, industry consensus, and user habit cultivation. Widespread applications still require A long way to go. Future application scenarios, cost reduction, efficient operations, sharing of information, and anti-fraud are the five key words that will become insurance blockchain applications.

First, blockchain technology drives the operating costs of the insurance industry

At present, the main way for insurance companies to obtain customers and show industry is to send a large number of sales staff for difficult offline promotion. After the transaction is generated, paper contracts are usually used for customer management, and at the same time, expensive equipment is used to maintain customer data , Resulting in amazing human and material costs. However, using the decentralization and consensus mechanism of the blockchain, customers can easily place orders at their own portals on the platform, and later data will be automatically updated. Not only can smart contracts convert paper contracts into programmable codes, but also insurance claims It happens automatically under the smart contract. At the same time, the blockchain is a natural "accounting expert". The value of the compensation target can be traced to the source and a permanent audit trail can be achieved. PricewaterhouseCoopers estimates that the use of blockchain technology in the insurance industry can save 15% to 20% of operating expenses.

Second, blockchain technology improves claims efficiency of insurance companies

"Accepting the case → opening the case → preliminary examination → investigation → review → approval → filing of the case” is an insurance claim process that is currently in operation, and the time it takes may range from a few weeks to a few months. Differences in terms of claims, exemption clauses, etc. may require more setbacks. With the empowerment of the blockchain, the insurance industry's claims process can complete a new iteration and achieve a rapid improvement in claims efficiency. On the one hand, the electronic invoice based on the blockchain technology will be stamped as a voucher during the entire process of generation, transmission, storage and use, which not only guarantees the authenticity of the invoice, but also saves the manual review process. Simplification; on the other hand, the blockchain smart contract guarantees the transparency and transparency of insurance contracts and terms. Once the claim conditions are met, the compensation process is automatically triggered, thereby greatly improving the user's sense of experience and experience.

Third, blockchain enhances the effectiveness of insurance company services

Store user information, insurance policy information, and claims information records through the blockchain, and rely on the blockchain's secure multi-party computing technology to mine data value and serve the development of insurance products. Because blockchain data is open, the industry It can achieve data sharing, develop more effective products according to buyer needs, and realize rapid product iteration and evolution.

Finally, blockchain can enhance the self-resilience of insurance products and improve the efficiency of fund allocation.

After the blockchain technology is combined with the location information, the person can be observed in real time. Once entered, the information is recorded in the blockchain, and the current policy can be put into a frozen state. Generate another temporary insurance policy to provide protection against his risks in the theater, and once he leaves the theater and returns to the country, short-term protection is invalidated, and the original protection can continue. This flexible payment mechanism can enable insurance companies to better distribute existing funds and improve the accuracy of payments.

The development of the insurance industry still faces many pain points and difficulties. In this big era of technological development, the insurance industry must research and deploy the blockchain as early as possible, and combine it with big data, Internet of Things, artificial intelligence and other technologies to achieve complementary advantages and technological synergy in order to cope with the changes brought about by technological changes to the industry. Shock, solve the pain points and difficulties in the development of the industry, and realize the value service and value enhancement of the insurance industry to the development of human society.

Follow the official Weibo (WeChat ID: shuliancj) of the Beishu Blockchain, join the community and become a great god with me.

Disclaimer: The information published in this article does not represent any investment suggestion of the company, nor does it constitute any investment advice. The source network of the picture, if infringement please contact to delete, reprint please note the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt weekly selection 丨 Bitcoin returns to US $ 10,000; blockchain industry explodes financing wave

- Babbitt Column | New Macroeconomics Emerging: How to Become a World Reserve Currency in the Future?

- Bitcoin price rushes 10,000, why is the peak of the on-chain data week two days ahead?

- Ethereum's Economic Bandwidth Theory: Billion Dollar Market for ETH

- Bitcoin spending accuracy levels are improving

- Forbes: 5 major trends in blockchain and distributed ledger technology in 2020

- Interview with Babbitt 丨 Ten thousand bucks against the trend, focusing on supply chain finance