Need Bitcoin to transform? Here are three main reasons

Source: ALTCOIN Magazine

Compilation: First Class (First.VIP) _Saline

Editor's note: The original title was "Three Factors Tell You Why Bitcoin Needs Transformation"

Bitcoin network security, Bitcoin price, and energy consumption are the three major factors that determine the transformation of Bitcoin.

- Want to do a good job of blockchain data analysis? First look at how to solve the big problem of "deanonymization"

- What happened to the netizen who "lost" 4 bitcoins on the Lightning Network?

- U.S. lawmakers seek to classify stable currencies like Libra as securities

Foreword

We often say that the security of the Bitcoin network is the most perfect of all cryptocurrencies, and its security mainly relies on proof of work (PoW) and the huge mining capacity (computing power) required for Bitcoin mining, which is The 51% attack was said to be unsuccessful.

The most famous attack method of the blockchain is "double spend with 51% attack". That is, a malicious actor or organization is trying to obtain more than 50% of the transaction approval capacity (mining capacity), enabling them to repeatedly issue Bitcoin (one-time confirmation), while other miners cannot take any action on this, and may not even pay attention to it at all Here.

But Bitcoin's PoW system is worth exploring. The current security level of Bitcoin may only be maintained when the price of Bitcoin rises sharply in the future, and people are reluctant to consume too much energy. So this article will discuss Bitcoin's total computing power, miners, rewards and mining equipment.

Network computing power

The security of the Bitcoin network includes the mining capabilities (computing power) on the Bitcoin network. The amount of computing power and the security of the Bitcoin network depends on the profitability of the miners.

The profit and cost of miners depends on many factors:

1. Bitcoin value. The high price of Bitcoin will bring profit to miners.

2. The total computing power, which is how many miners the cake can be distributed to.

3. The amount of Bitcoins that can be mined per unit of time. Now 12.5 BTC can be mined every 10 minutes. But by May 2020, the Bitcoin block reward will be adjusted to 6.25 per 10 minutes, which means that at the same price, the miner's income will become lower.

4. Computing power of mining equipment. The higher the computing power, the greater the chance of mining blocks, and the higher the returns.

5. Costs to be paid by miners. Mining costs include energy costs, hosting costs and equipment depreciation costs. This cost is related to the first three points. Higher mining capacity usually means higher energy costs, hosting costs and equipment depreciation costs.

6. Efficiency of mining equipment. The more advanced the mining equipment, the higher the hash / energy cost ratio, which also means that the more profitable the mining equipment is.

Once a miner invests in mining equipment, the cost must be recovered before the equipment can be replaced again. Therefore, points 4, 5, and 6 are actually fixed data. The third point is also fixed because halving occurs every 4 years.

This means that the profit of miners depends to a large extent on the price of Bitcoin and the total computing power. In other words, it is directly related to price and computing power. If the price of Bitcoin rises, the computing power will increase. On the other hand, if the price falls, the computing power will decrease. At each price level, there will be a stabilization point between the number of miners and the price. But it has been changing, because the mining machine is getting more advanced, and the new mining machine can bring more profits to the miners, so the change is inevitable.

Moreover, in a rising market, the development of computing power always lags behind price changes. After all, buying and installing mining equipment takes time. However, it is only an instant to shut down the mining equipment. Therefore, a decline in the price of Bitcoin will always lead to a direct decline in computing power.

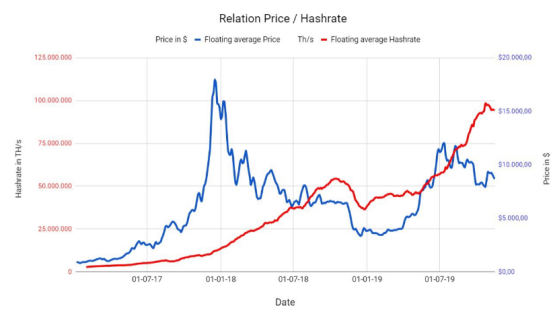

figure 1

We can see that after the peak price in December 2017, more and more miners joined the ranks of mining. Bitmain, one of the mining machine suppliers, was unable to cope with the influx of orders for a while, and the delivery time was very normal in 6 months, which is why the computing power reached its peak after 8 months. . As of now, the price of Bitcoin has been falling, plunging from $ 8,000 in December 2018 to $ 4,000, which has a direct impact on computing power. From April to May 2019, the price of bitcoin rose again, and the computing power also rose. In July 2019, the price of Bitcoin reached its highest point again, and the computing power did not reach its highest point until the end of September. In addition to rising prices, the increasing computing power is also due to the high efficiency brought by new mining equipment, which will be explained in detail below.

effectiveness

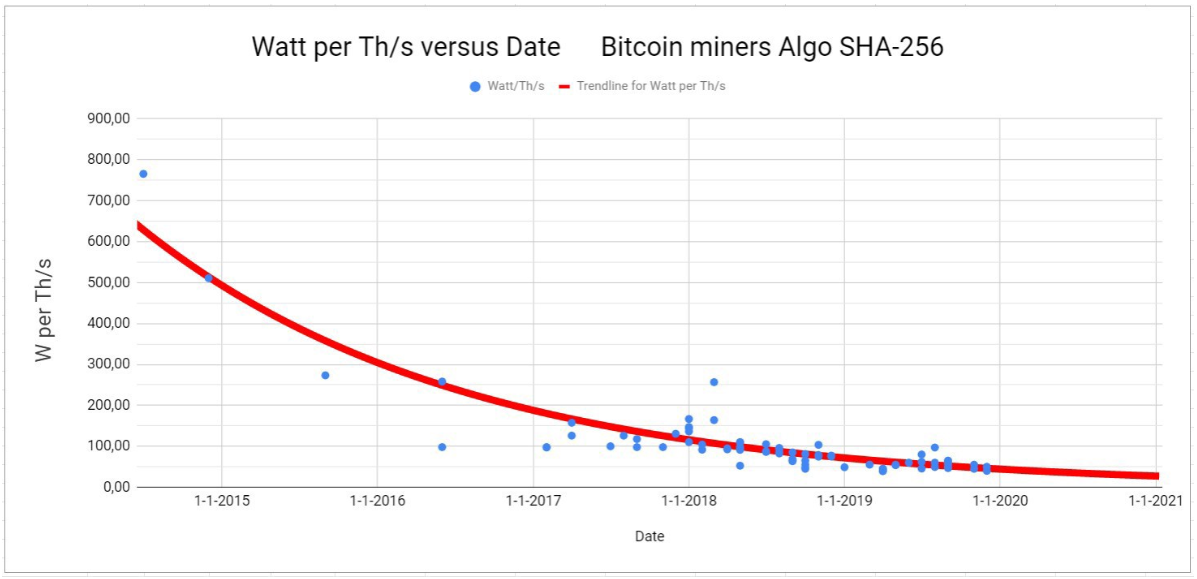

In order to compare the efficiency of various mining equipment, the following table has listed all mining equipment sold in the past and present in the market. These are Asic SHA256 miners. Although the last two models are not yet on the market, I still include them. The following figure shows the efficiency in terms of how many watts of power are needed to reach 1 Terahash / s.

It can be seen that in order to reach 1 Terahash / s (TH / s) of network computing power, miners in 2014 need nearly 800 watts of power. Now the new generation of mining machines can be achieved with only about 40 watts of power. The efficiency data of these mining equipment are shown in the blue dots in the figure below.

figure 2

This chart also adds an exponential trend line so that we can understand the future trends. According to the chart, by January 2021, if the mining technology continues to develop at the current speed, the mining efficiency will reach 1TH / s and only need 30 watts of power.

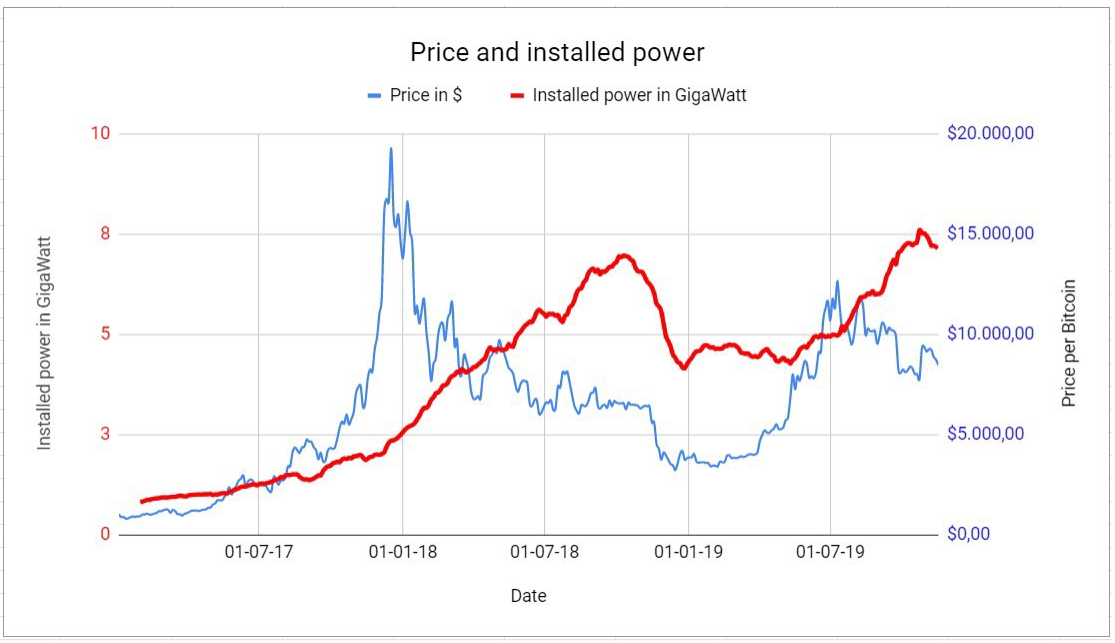

By observing the above data, the installed capacity of the mining equipment and the related energy consumption can be seen at a glance. However, it needs to be noted that advanced equipment will not run all the time, because these equipments will only be used for a period of time after purchase in order to control depreciation costs. The calculation is based on the assumption that the mining equipment is depreciated within 2 years, so the equipment in the entire mining park is used for an average of 1 year. In this way, we can roughly estimate the daily installed capacity of the entire mining park. The power values are shown in the following figure.

image 3

As can be seen from the above figure, the growth rate of power in recent months is not as fast as that of Figure 1. This is because the efficiency of mining equipment is gradually increasing. We can also see that the level in the last month of the above chart is lower. This may be because the price of bitcoin is always under pressure and is in a negative trend.

Energy consumption and cost

The energy consumption of Bitcoin can also be clearly seen from Figure 3. The current installed capacity of Bitcoin is 7 billion watts, which consumes 168 gigawatt hours per day, and consumes 62,320 gigawatt hours per year. These numbers are roughly the same as other research data, such as those calculated by well-known digital economists.

In comparison, a large modern 3 MW wind turbine consumes 6000 MWh of electricity per year. This means that in order to maintain the operation of the Bitcoin blockchain, approximately 10,000 wind turbines must be operated at the same time. This is ridiculous from a social and environmental perspective.

When it comes to mining costs, energy costs are among the most important factors, followed by depreciation costs and hosting costs.

The cost must not exceed the income, because mining is for profit. The daily revenue of mining is 144 blocks * 12.5 BTC per block = 1800 BTC. At the current price of $ 8,000, the total value is $ 14.4 million. In addition, the daily energy consumption for mining is 168 gigawatt hours. If we calculate it at US $ 0.1 per kWh, the daily electricity cost of mining is US $ 16.8 million, and the final loss is US $ 2.4 million. We have not even calculated other costs. In other words, to dig bitcoin to make a profit, at present, it can only go to places where the price of electricity is much lower than $ 0.1 per kWh. For example in China and Canada ($ 0.05 per kWh). The breakeven point is approximately $ 0.055 per kWh.

The cost of 1 BTC is $ 7333.

Everyone knows the cost of a transaction today. A block can now handle up to 3,000 transactions, and the cost of mining a block is $ 91,666. The cost of each transaction is just over $ 30.

This cost is too high, so Bitcoin urgently needs to change.

Reward in half

Would things improve if Bitcoin rewards were halved in May 2020? In principle, many older miners voluntarily withdrew. In theory, the computing power will also be halved. In fact, the decline will be smaller because the most efficient miners will stay. In addition, as the supply of mineable BTC in the market will decrease, the price of Bitcoin may increase slightly. Eventually the negative trend will be driven again by the positive trend. Of course, people know that halving is coming, and it's predictable. In other words, this is all a prediction of the future. This is a complex interdependent relationship.

In fact, we should not associate network security with computing power. Instead, we should associate it with the cost of mining energy consumption. After all, the cost of energy determines the amount of computing power.

To put it simply, because mining energy cost is directly proportional to mining revenue, mining revenue is the product of block reward and price.

Therefore, we can draw the following theorem:

The security of the Bitcoin network is determined by block rewards and prices.

Assume that mining takes place on the fringe. There will always be some minor situations, especially for those miners with older equipment, mining will be at a loss. This is the difficulty of the Bitcoin network. Assume that the price of Bitcoin has plummeted, ranging from the current $ 8,000 to $ 3,000. Then many miners will turn off the equipment. This will cause excess mining equipment in the market, and malicious participants can buy or rent these mining equipment at extremely low prices in an attempt to execute a 51% attack. Perhaps this speculation is a bit far-fetched, but Murphy's Law applies here.

Conclusion

Bitcoin consumes a lot of energy.

We urgently need to take steps to significantly reduce our ecological footprint. In addition to PoW, we need other systems that do not consume a lot of energy to ensure network security. In addition, in order to reduce the transaction cost of Bitcoin, the number of transaction processing per second also needs to increase significantly.

Reprinted please retain copyright information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introduction to Blockchain | Advanced Understanding of Smart Contracts-Implementation

- Interview 丨 Chain Node CEO Qu Zhaoxiang: To make the blockchain popular, it should be made a trend symbol

- Every year, more than 700,000 people die from taking fake medicines in the world. How can blockchain change the rules of the medical field?

- 1/3 of the blockchain application is contracted by this trillion market

- Ethereum 2.0 is about to start the transition, these issues are worth paying attention to

- Ethereum will be upgraded this Saturday, and developers have agreed to delay the launch of the difficulty bomb

- Computing Power is King: Global Treasure Map