SharkTeam: On-Chain Data Analysis of RWA Raceway

SharkTeam: Data Analysis of RWA RacewayReal World Assets (RWA) tokenization refers to the process of tokenizing assets with stable value and income in the real world, such as real estate, cars, and art, and using them for trading or other purposes on the blockchain.

RWA is a bridge connecting the real world and the DeFi field, but this sector did not receive much attention at the beginning. As early as the end of 2020, MakerDAO announced a plan and guideline to make RWA a strategic focus. Aave announced the launch of an RWA market at the end of 2021, allowing the use of real assets as collateral for loans. Not until March of this year did three hot events in the industry promote the further development of RWA: Citigroup released a report stating that almost everything of value can be tokenized; Binance announced that it would become a Polymesh node operator; and TradFi (traditional finance) institutions such as Goldman Sachs, Hamilton Lane, Siemens, and KKR all stated that they are working to put their real world assets on the blockchain.

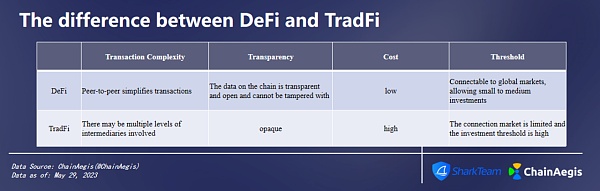

SharkTeam has compiled some of the characteristics of DeFi and TradFi as follows:

- LD Capital: Analysis of L2 Head Liquidity Customization DEX Mechanism of Trader Joe, Izumi, and Maverick

- Aave community initiates a temperature check proposal to integrate MakerDAO’s DSR into Aave V3 Ethereum pool.

- Everything you need to know about LSD Summer

As can be seen, trading real assets on the blockchain greatly reduces the transaction costs of TradFi, reduces the involvement of intermediaries by using peer-to-peer transactions on the blockchain, and increases capital efficiency by making the trading of assets transparent and tamper-proof, while also reducing transaction risks.

Currently, there are over 50 RWA projects on the market, and the native token prices of some projects have increased by more than 10 times in the past three months, but most projects have not yet issued tokens.

1. RWA Analysis

In the report, SharkTeam analyzed popular series such as stocks, bonds, and real estate, summarized each series model, and selected head or characteristic projects for analysis as follows.

1. Stocks

Swarm Markets launched in October 2021 and, as of February 2023, has introduced the world’s first DeFi public investment product targeting Apple, Tesla, and two US Treasury ETFs. It is worth mentioning that Swarm is decentralized but licensed, and it links users’ wallets to their identities through the KYC process to achieve user self-custody (decentralization), while providing anti-money laundering and counter-terrorism information to law enforcement agencies through KYC (licensing and regulation). Users need to be approved through the process before their wallets can interact with the Swarm platform’s smart contracts.

Swarm Markets offers Swap, liquidity pools, and staking functions. Unlike other exchanges, Swarm will remind users to set up their proxy contract before making the first transaction. The first transaction will include the cost of deploying the personal proxy contract, but Swarm will use the proxy contract for subsequent transactions to save gas fees. In addition, Swarm can also exchange crypto vouchers. Swarm crypto vouchers are similar to gift cards, but priced in cryptocurrencies, currently available in two forms: WBTC and ETH. Users can purchase vouchers after verifying their identity using Yoti (a digital identity application that provides individuals with a secure way to prove their identity and age online and in person to thousands of UK businesses) and their partner’s free EasyID app. Swarm also provides a decentralized over-the-counter (dOTC) service that enables institutions to conduct large-scale on-chain transactions, facilitating high-value transactions through peer-to-peer (P2P) contracts, reducing slippage, eliminating counterpart risk, and charging a 0.3% transaction fee.

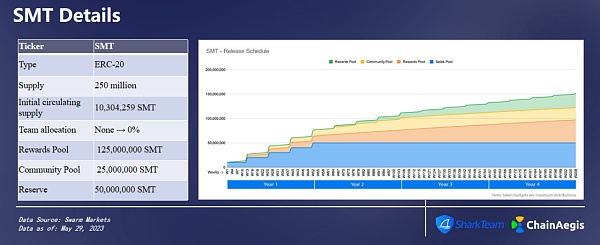

SMT is an ERC20 token based on the Ethereum blockchain. The allocation details of SMT are as follows:

The total supply of SMT is 250 million, of which 50% is allocated to the reward pool, 10% to the community pool, and 20% is reserved for future use, with a linear release expected over five years.

2. Bonds

Bonds are low-risk haven assets and the main investment type for fixed income. Among them, US treasuries are generally recognized as the market’s risk-free rate, but their overall performance is not satisfactory due to changes in market conditions. In the crypto industry, for example, in the lending projects Compound and Aave, according to LoanScan data, the deposit rate of USDC on Compound and Aave dropped to 0.81% and 0.65% below the US Treasury yield in January 2023. To balance risk exposure, many crypto projects have turned to government bonds, with MakerDAO previously allocating 500 million DAI to invest in US treasuries and corporate bonds.

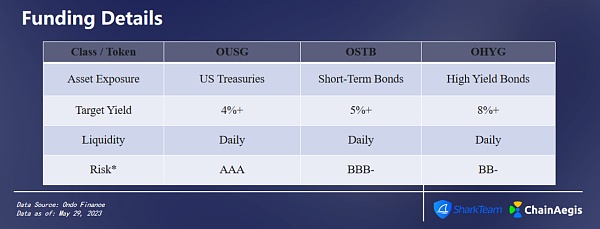

In January 2023, Ondo Finance announced the launch of tokenized funds, offering users the opportunity to invest in US treasuries and institutional bonds on the chain. It is understood that Ondo Finance has launched three tokens through large, highly liquid ETFs managed by asset management institutions such as Blackrock and PIMCO: the US government bond fund (OUSG), the short-term investment-grade bond fund (OSTB), and the high-yield corporate bond fund (OHYG). Ondo Finance will charge a management fee of 0.15% (0.0125% per month) calculated on an annualized basis, which can be found on the product pages of the funds.

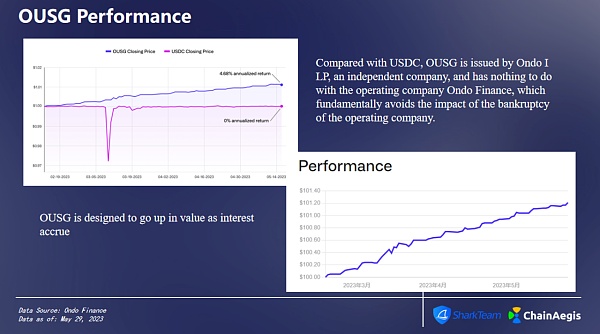

OUSG, as a national bond fund, aims to appreciate with the increase of interest rates, and as of May 29, its token price is $96.83.

In order to increase the liquidity of the national bond fund OUSG, Ondo Finance has specially launched Flux Finance, a decentralized lending protocol for it. Flux is a fork version of Compound V2. Like Compound, Flux also follows the peer-to-peer model and aims to bridge the gap between on-chain and off-chain yields. In Flux, users can earn a certain percentage of interest by sharing a unique referral link and recommending users who use it within the first 30 days to get fUSDC rewards. fUSDC is obtained by users who lend their stablecoins on Flux (lenders), while borrowers can borrow stablecoins with OUSG as collateral. Flux provides two levels of rewards: benchmark level (reward rate of 20%) and promotional level (reward rate of 30%). For example, when the level is 20%, if a user’s recommended Flux depositor earns $6,000 in stablecoin interest in the first 30 days of use, the user will receive $1,200 in fUSDC rewards. If users want to receive promotional level rewards, they must recommend users who accumulate at least $20,000 in interest within the first 30 days.

3. Real Estate

By tokenizing real estate, RWA turns real estate into NFTs for trading or as collateral for loans; on-chain real estate can fragment property ownership, making it very beneficial for retail investors.

The Tangible protocol uses the real estate-backed native income stablecoin Real USD (USDR) to provide users with access to tokenized and segmented RWA real estate through its markets. On Tangible, anyone can use USDR to purchase valuable physical goods from world-leading suppliers. USDR is a stablecoin anchored to the US dollar launched by Tangible in 2022, which can be minted at a ratio of 1:1 with TNGBL or DAI and can be redeemed for DAI at any time at a 1:1 ratio. The redemption function incurs a fee of 0.25%.

TNGBL is the governance token of the Tangible market, with a maximum supply of 33,333,333. TNGBL can be used as a reward token to incentivize the use of the market and subsidize USDR returns, while also having a dividend mechanism (incentive lock TNGBL) and can be used as support for USDR, which can be used to mint USDR. The initial allocation plan promises to allocate the majority to DAO and the community (70.8%). The rest is mainly reserved for the team, investors, advisors, and Tangible Labs. Another 1.25% was sold through PeakDeFi’s IDO in April 2022.

After users browse and purchase goods on Tangible’s marketplace, TNFT (“Tangible non-fungible tokens”) representing the physical items are minted. The physical item is then sent to Tangible’s physical vault, and the TNFT is sent to the buyer’s wallet. When a user buys goods from another user on the Tangible marketplace (i.e. secondary market), the existing TNFT is transferred to the buyer’s wallet. At the same time, USDC tokens are sent from the buyer’s wallet to the seller’s wallet. The smart contract handles transaction fees, item purchase fees, and storage fees. Unless the buyer decides to redeem, the item will be kept in storage. Tangible charges a 2.5% marketplace fee for each transaction. Of this, 33.3% is used to buy and burn TNGBL, and the remaining 66.6% is distributed to TNGBL holders (3.3% + NFT holders).

2. On-Chain Data Performance

Based on data statistics from SharkTeam’s on-chain analysis platform ChainAegis, we will analyze the on-chain performance of the RWA track.

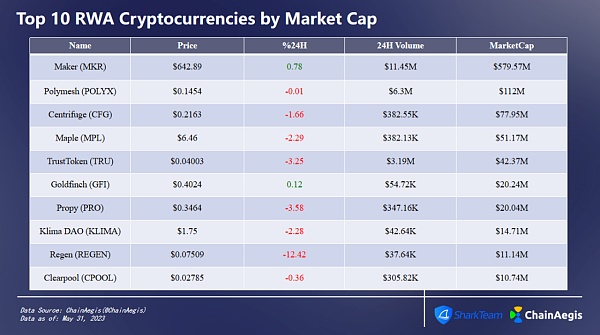

1. Top 10 RWA cryptocurrencies by market capitalization

The following are the top 10 RWA tokens ranked by market capitalization:

$MKR issued by Maker DAO is currently the largest RWA token with a 24-hour trading volume of 11.45M; $POLYX issued by regulated institutional-grade Layer1 blockchain Polymesh ranks second with a 24-hour trading volume of 6.3M. $CFE issued by the credit protocol Centrifuge ranks third with a 24-hour trading volume of 382.55K.

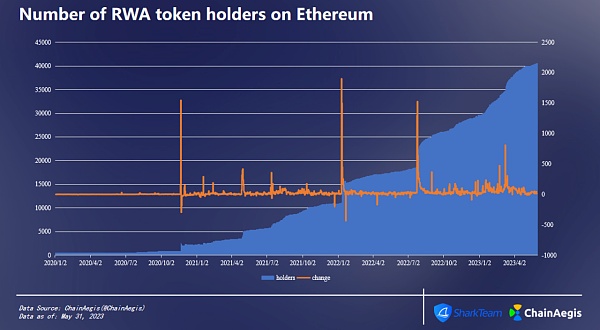

2. Changes in the number of RWA token holders on Ethereum

The following chart shows the changes in the number of RWA token holders on Ethereum. Overall, the number of holders has continued to grow, increasing by approximately 72.53 times since the beginning. Among them, the top 3 daily growth numbers are 1899, 1546, and 1525 on January 11, 2022, November 22, 2020, and July 26, 2022, respectively.

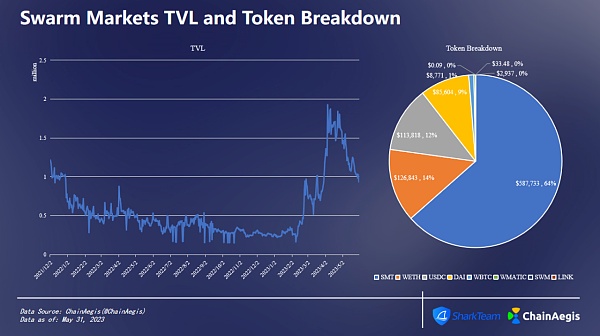

3. Swarm Markets

Since the beginning of this year, Swarm Markets TVL has been on the rise. On April 5th, TVL reached a record high of $1.9267 million before showing a downward trend. As of May 31, 2023, Swarm Markets TVL was $933,000, with 64% provided by SMT, 14% from WETH, and stablecoins USDC and DAI accounting for 12% and 9%, respectively.

On August 8, 2021, Swarm Markets just went live and its market value rose to 33.3778 million US dollars. Its trading volume on that day was $842,500, a decrease of 122.62% from the previous day (the highest trading volume in history was $1,649,300). Since then, the on-chain data has been mediocre, with an average TVL of $1.28 million and an average trading volume of $11.9239 million in 2022. Since March 2023, the market has shown signs of improvement. On April 6th, the trading volume for that day was $1.2076 million, and TVL reached $10.5134 million, a new high in nearly a year.

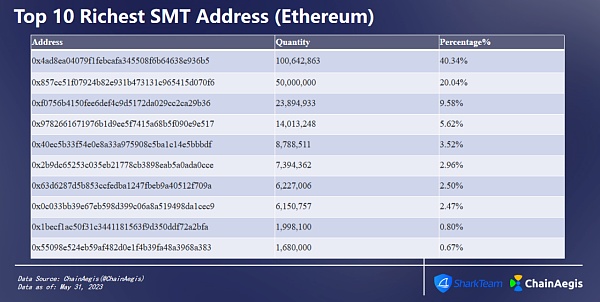

As of May 31, the total number of SMT holders is 2,309. The following figure shows the top 10 addresses ranked by holding amount on Ethereum:

As can be seen from the chart, the address 0x4a…36b5 has a holding amount of approximately 100 million coins, ranking first; address 0x85…70f6 has a holding amount of 50 million coins, ranking second. The total holding amount of the two accounts is 60%.

4.Ondo Finance

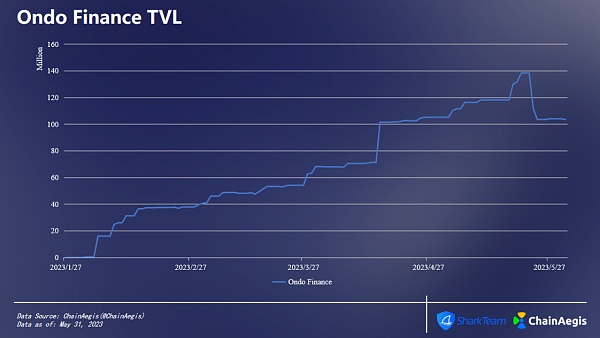

Ondo Finance launched on-chain bonds in January this year. On May 20th, TVL reached a new historical high of $138 million, and then declined slightly. As of May 31, TVL was $103 million.

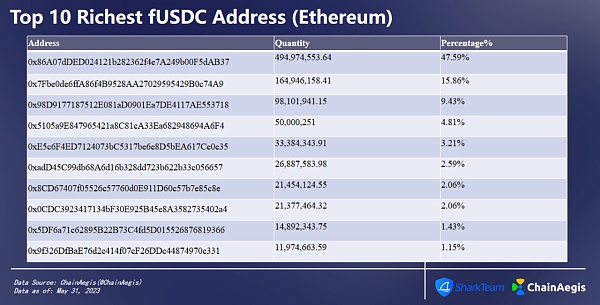

SharkTeam’s statistics on the top 10 fUSDC holders on Ethereum are as follows, with the top 3 addresses holding a total of 72.88%.

Address 0x86…AB37 has a holding amount of 494 million coins, accounting for 47.59% and ranking first; address 0x7F…74a9 has a holding amount of 164 million coins, accounting for 15.86% and ranking second; address 0x98…3718 has a holding amount of 98.101 million coins, accounting for 9.43%, and ranking third.

5. Tangible

Tangible has been performing mediocre since it went online, until its TVL began to grow steadily on February 3 this year. As of May 31, it reached $33.3168 million, an increase of 370.95 times compared to February.

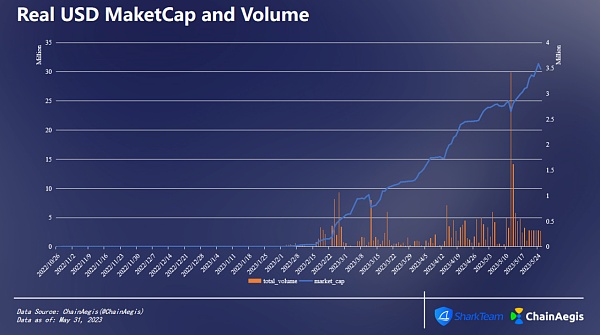

Since February 2023, the market value and trading volume of USDR have shown a significant upward trend. On May 12th, the trading volume reached $3.4174 million, a historical high since its launch. The TVL for that day was $23.1973 million. On May 30th, the TVL reached a historical peak of $31.3644 million. In just half a month, the TVL increased by 35.2%.

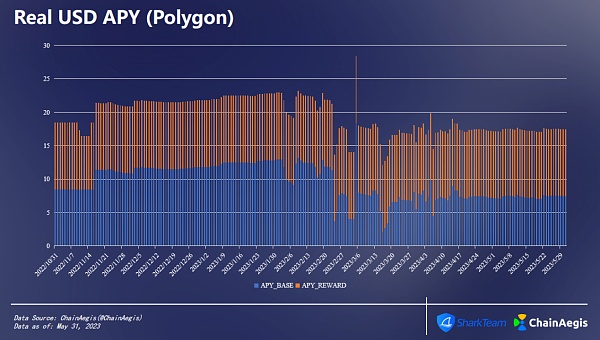

The following figure shows the changes in USDR’s APY on the Polygon chain. Annual Percentage Yield (APY) refers to the amount earned from compound interest (interest + principal) in one year. As can be seen, the current APY has not changed much from the initial launch, with a slight downward trend of 5.78%.

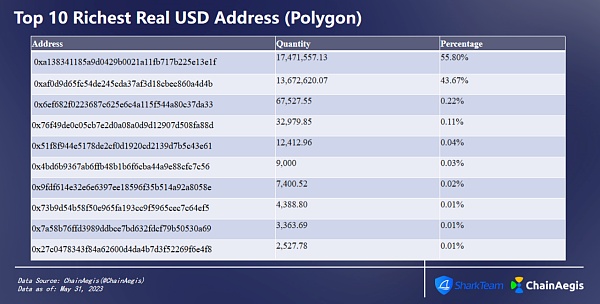

As of June 1st, USDR was issued on the Polygon chain with a total of 251 holders. Among them, the address 0xa1…3e1f holds 17.471 million USDR, accounting for 55.8%, ranking first; the address 0xaf…4d4b holds 13.672 million USDR, accounting for 43.67%, ranking second; the total proportion of the two is as high as 99.47%.

III. Impact and Controversy

RWA reduces the barriers between TradFi and DeFi, and the tokenization method attracts more traditional funds to enter the DeFi market, adding more available types of assets to the DeFi market, and promoting interoperability between traditional finance and the crypto industry. At the same time, RWA reduces the cost of financial transactions, avoids complex intermediaries and fees, and breaks through geographical restrictions, making assets flow globally and forming a faster and simpler trading system. It is worth mentioning that RWA is not a new concept. Common stablecoins USDC and USDT are also RWA, which is a mapping of real US dollars on the chain.

RWA has many benefits, but only compliant RWA can continue to develop on a large scale. The biggest criticism of USDT is that it is superficially centralized and the core assets are still opaque. How to put real assets on the chain, how to ensure the authenticity and legality of assets while putting them on the chain, and how to prevent money laundering and other illegal activities are the difficult problems that RWA development needs to solve, which will also involve various legal, regulatory and technical requirements.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decoding Tornado Governance Attack: How to Deploy Different Contracts on the Same Address

- Evening Must-Read | Reasons, Impacts, and Solutions to the Crisis of American Banks

- Assessment of the Decentralization Level of the Top 5 PoS Public Chain Validators

- eZKalibur: Ecosystem-centered DEX and LaunchBlockingd

- Understanding Gyroscope: A Newcomer in the Field of Stability Starting from the Polygon Ecosystem

- Understanding Opside’s ZK-PoW Algorithm in One Article

- Hong Kong’s new regulations on virtual assets are officially in effect, marking a historic moment for Web3 in Hong Kong.