What is the current state of development of on-chain government bonds? We have studied 5 agreements.

What's the progress of on-chain government bonds? We've looked at 5 deals.On Thursday, MakerDAO decided to establish a BlockTower Andromeda real-world asset (RWA) Vault through a nominal survey vote. The Vault will be managed by BlockTower Capital and is expected to invest up to $1.28 billion in short-term US Treasuries.

US Treasury yields are typically seen as risk-free rates by the capital markets. As US short-term rates continue to rise and DeFi rates decline, demand for stablecoins to earn yield through off-chain markets has increased. This direction has indeed seen rapid development this year. In the following, BlockingNews will take stock of the development of several major on-chain national debt projects.

Ondo Finance

Ondo Finance announced the launch of tokenized funds in January this year, bringing risk-free rates to the chain and allowing stablecoin holders to invest in bonds and US Treasuries. According to DeFiLlama data, as of June 1, Ondo’s TVL was $100 million, down from $138 million in late May.

- Interpretation of Trust Minimization Middleware by Distributed Capital Researcher: Consensus Verification and Bridging

- Yuga Labs May Data Report: The Darkest Moment for NFT Industry Leader?

- Celestia: Modular Data Availability for OP Stack

Ondo currently offers four bond funds: US Money Market Fund (OMMF), Short-term US Treasuries Fund (OUSG), Short-term Investment Grade Bond Fund (OSTB), and High-yield Corporate Bond Fund (OHYG). Investors invest in USDC, and Ondo charges a 0.15% management fee, up to 0.15% intermediation fee, and up to 0.48% ETF management fee.

The most invested fund by investors is OUSG, which holds the most iShares Short Tearsury Bond ETF, with a trading code of SHV on Nasdaq, and an average annualized return of about 4.92% over 30 days. After investing in OUSG, investors can also mortgage OUSG through Flux Finance and borrow stablecoins such as USDC and DAI. As of June 1, the total deposits in Flux were $67.49 million, and the total borrowings were $25.92 million.

Ondo’s funds are only open to qualified purchasers. If a fund has only qualified purchasers, it can be exempt from registering with the US SEC as an investment company under the 1940 Investment Company Act of the US. Note that the concept of qualified purchasers is not the same as that of accredited investors, with the former having higher thresholds. For example, for individuals, qualified purchasers need to have investments of $5 million or more, while accredited investors only need to have annual income of over $200,000 or net assets of over $1 million excluding their main residence.

Related reading: Can stablecoins be used to buy government bonds? Ondo Finance launches tokenized fund for US Treasuries and bonds

Matrixdock and Tprotocol

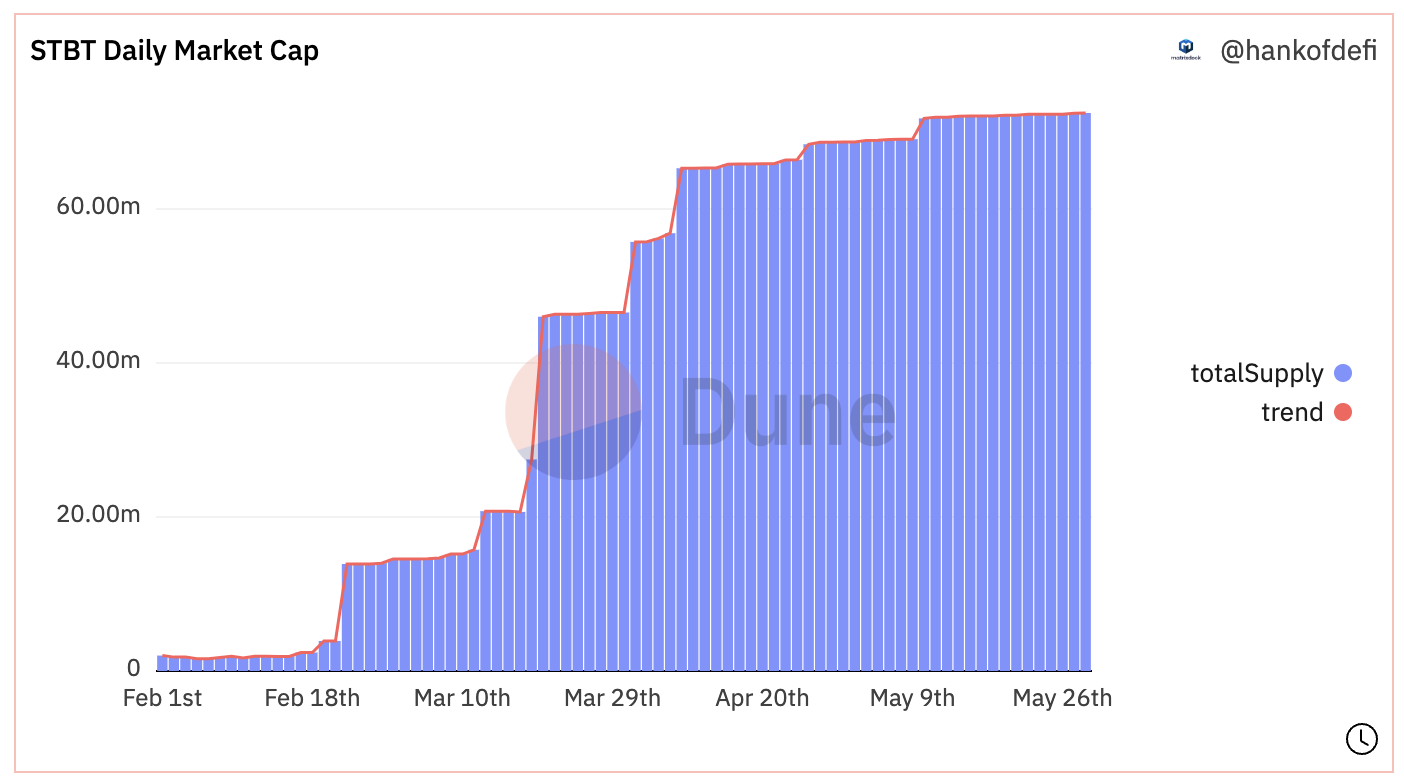

Matrixdock is a bond platform launched by asset management company Matrixport, which also launched government bond-related businesses in late January this year. According to Dune@hankofdefi’s dashboard, Matrixdock’s TVL is currently $72.44 million.

The first product of Matrixdock is STBT. Investors cast STBT by depositing USDC, USDT, or DAI into Matrixdock’s address from a whitelist address. Only qualified investors who have undergone KYC can invest in Matrixdock’s products, and STBT can only be transferred between whitelist users.

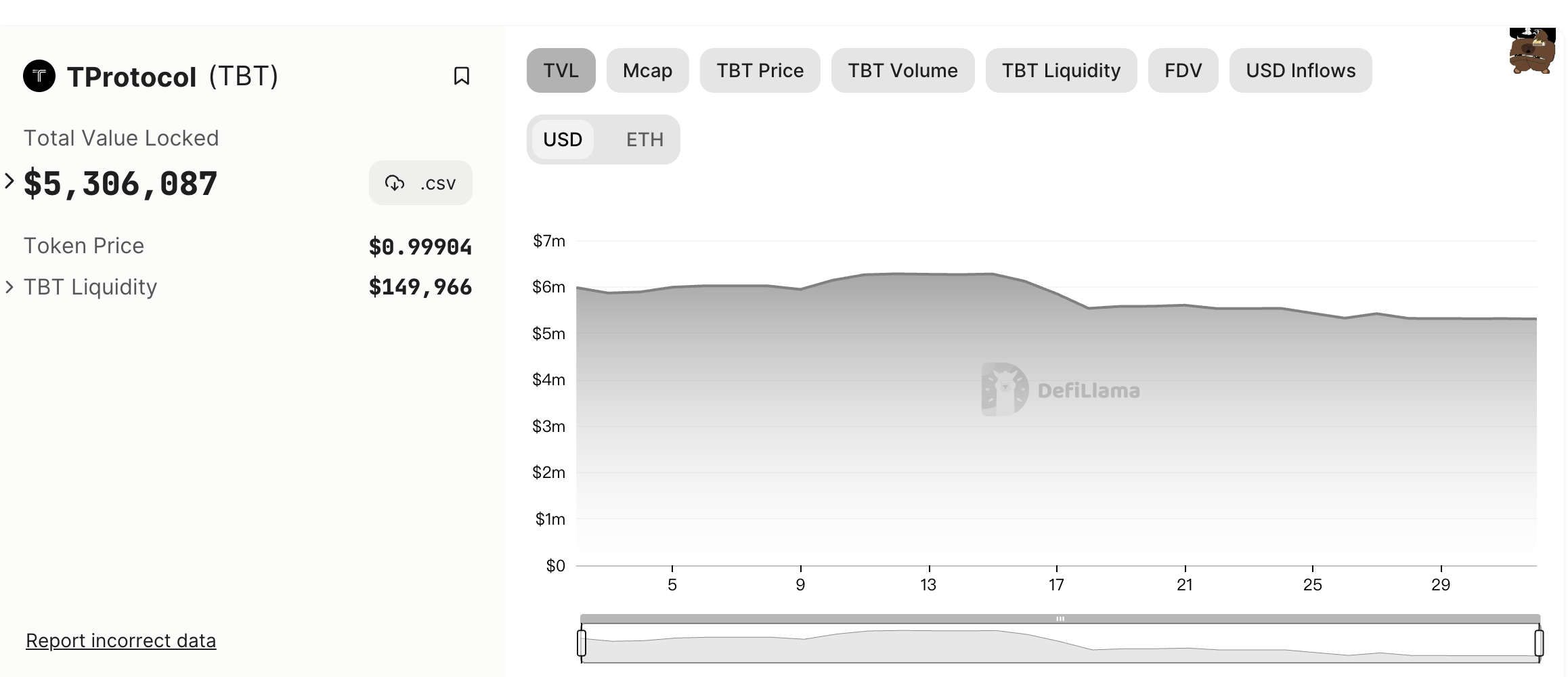

Another project, TProtocol, was born for this purpose. It can be understood as an unlicensed version of Matrixdock, allowing retail investors to access the product. Although the official website states that the United States or other sanctioned areas cannot use it, actual usage does not require KYC. Users can cast TBT in TProtocol with USDC as the underlying asset, and STBT in Matrixdock as the underlying asset. TBT is a rebase token that always redeems for $1 of USDC, and returns are distributed through rebase. TBT can be packaged into an income-generating asset, wTBT, and can participate in various DeFi activities while earning bond income, such as liquidity mining on DEXs such as Optimism’s Velodrome and zkSync’s veSync. TProtocol’s TVL is currently $5.3 million.

TProtocol is in a 6-Epoch launch period, with each Epoch being 14 days long. Holders of TBT or wTBT can participate and will receive a total of 2% of the governance token TPS as an airdrop at the end.

OpenEden

OpenEden, founded by former Gemini employees, launched tokenized US Treasuries in April of this year. Stablecoin holders can cast TBILL by using OpenEden TBILL Vault to obtain risk-free returns on US Treasuries.

The investment manager of OpenEden TBILL Vault is OpenEden Pte Ltd, which is regulated by the Monetary Authority of Singapore and publishes reserve reports daily. The issuer of TBILL tokens is professional fund company Hill Lights International Ltd, which holds US Treasuries through a special purpose company.

Currently, the funds in OpenEden TBILL VAULT are $5.5 million, and the yield is about 5.32%. Participation in OpenEden TBILL Vault also requires completion of KYC, and only non-US professional investors defined by the British Virgin Islands’ 2010 Securities and Investment Business Act and US qualified investors who have undergone KYC can participate in this project.

Maple’s Cash Management Pool

Maple was originally a project focused on unsecured lending, but last year, in the case of important clients like Alameda Research going bankrupt, it generated a large number of bad debts and funds fled seriously.

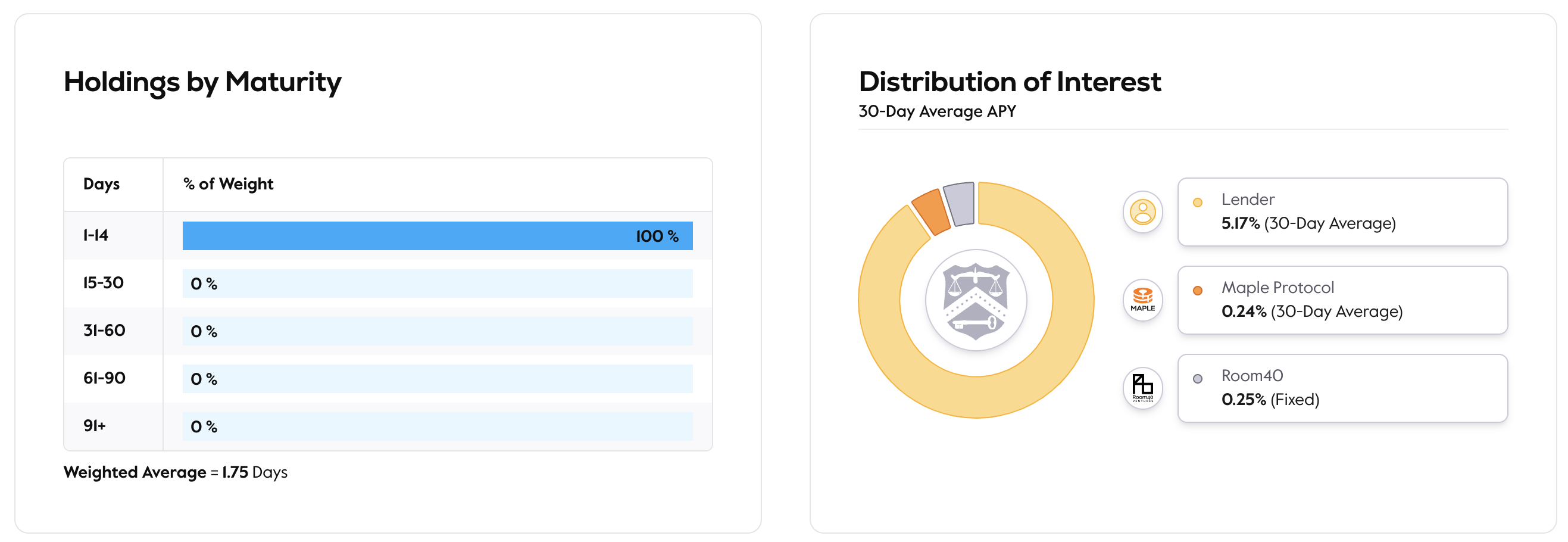

In April of this year, Maple introduced a new liquidity pool – the cash management pool. Cryptocurrency hedge funds and bond trading experts Room40 Capital established an independent special purpose company (SPV) as the sole borrower of the cash management pool. The funds received will be invested entirely in US short-term Treasury bills. Maple and Room40 Capital each receive 0.5% management fees, and the remaining profits are distributed to depositors. Only non-US qualified investors who have passed KYC can participate.

Currently, the deposits in the cash management pool are 4.26 million US dollars, all of which are invested in short-term Treasury bills and overnight reverse repo agreements of 1-14 days. The annualized return rate of depositors is 5.17%.

MakerDAO’s RWA and DSR

In its recent update, MakerDAO plans to add a new parameter – the benchmark interest rate, which will be calculated based on the 3-month US Treasury bill yield and the average yield of cash-like stablecoins.

Currently, MakerDAO has initiated discussions on changing parameters in the forum. According to data as of May 30, the yield of US 3-month Treasury bills is 5.55%, and the yield of cash-like stablecoins is 0.47%, resulting in a benchmark interest rate of 4.09% and a DSR (DAI savings rate) of 3.49%. If this is taken as the benchmark, the interest rates for borrowing DAI using assets such as collateralized ETH and wstETH will also rise significantly above the new DSR.

If the final vote is passed, MakerDAO’s competitiveness in borrowing stablecoins using collateralized assets such as ETH may weaken, and interest rates may be higher than borrowing protocols such as Aave. However, for DAI holders, this may be a major positive. Previously, the DSR was 1%, and MakerDAO earned income through RWA and other means, distributing some of the income to DSR. Users holding DAI can deposit it into the DSR contract and earn an annualized return of 1%. If the DSR is directly increased from 1% to 3.49%, it may greatly increase the attractiveness of DAI, and users may be more willing to exchange other stablecoins for DAI through PSM or other means to obtain the DSR yield. MakerDAO can also have more funds earning income from RWA.

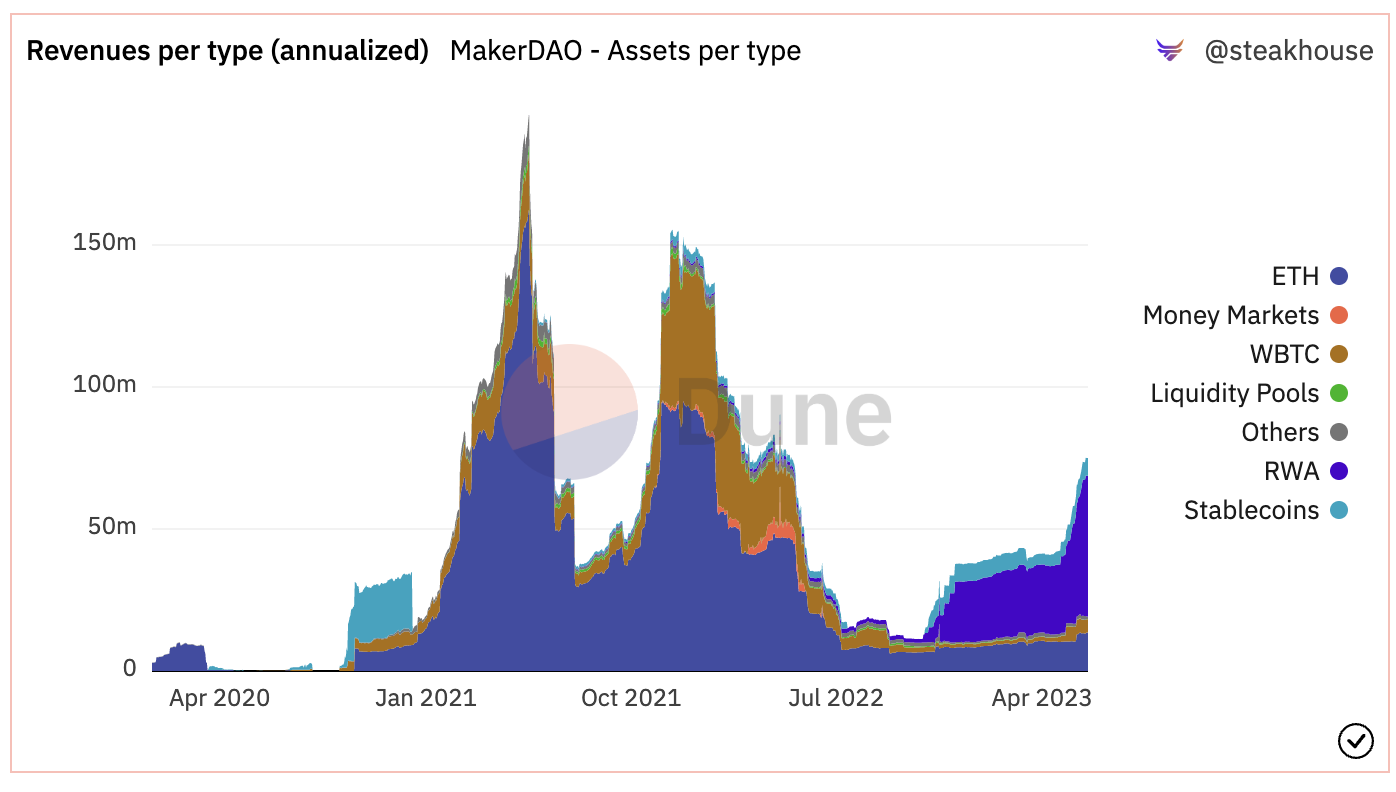

According to Dune@steakhouse’s dashboard, MakerDAO’s investment in RWA has exceeded 1.3 billion US dollars, most of which have been invested in liquid bonds, and the share of income generated by RWA has also risen to 65.9%. With the continued introduction of new RWA Vaults, this proportion may continue to increase.

If the above proposal is passed in the voting process, MakerDAO will be one step closer to a project that raises stablecoins on-chain, invests in bonds off-chain, and distributes returns to DAI holders.

Summary

The representative projects of earning off-chain returns through US Treasury bonds have made great progress this year. Except for MakerDAO, all of them have officially launched relevant businesses this year, indicating that this direction is developing rapidly.

In terms of compliance, only TProtocol and MakerDAO can participate without verifying as qualified investors. However, the packaging method of TProtocol may also face significant legal risks.

MakerDAO, with a larger volume and longer development time, is more reliable. If the DSR is adjusted to 3.49%, it may greatly increase the attractiveness of DAI, but it will reduce its competitiveness in the field of cryptocurrency collateral lending.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Encrypted wallet developer Demox Labs secures $4.5 million in funding led by HackVC

- Circle will launch native USDC on Arbitrum on June 8th.

- Unprecedented demand for AI computing power, what is the role of Web3?

- Concept and Application of Threshold Signatures

- Overview of the NFTFi ecosystem

- Derivatives DEX Battle: Kwenta and Level Surpass GMX in Weekly Trading Volume

- Meme Topic Issue 1: May’s Winner