Understanding Gyroscope: A Newcomer in the Field of Stability Starting from the Polygon Ecosystem

Understanding Gyroscope in the Polygon EcosystemNote: This article mainly introduces the Gyroscope protocol and does not provide any investment advice.

1. Gyroscope

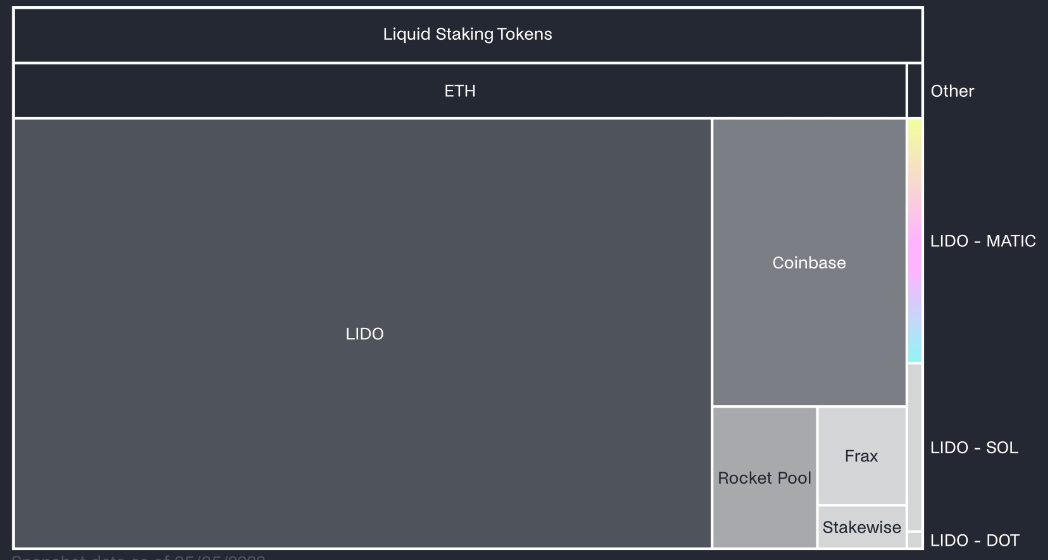

The stablecoin protocol, Gyroscope, released a white paper last year. Based on this protocol, GyroStable recently collaborated with Balancer to launch a concentrated liquidity strategy, building a market-making model and strategy management for LST assets in the Polygon ecosystem. Gyroscope has launched three types of CLPs (Continuous Liquidity Pools) on Polygon, and attracted market attention last week by launching $stMATIC/$wMATIC about two weeks ago.

(Data source: defillama)

According to Defillama, its TVL is currently $735,763, and the stablecoins minted are $593,63.

- Understanding Opside’s ZK-PoW Algorithm in One Article

- Hong Kong’s new regulations on virtual assets are officially in effect, marking a historic moment for Web3 in Hong Kong.

- Will Sam bring surprises to Web3 from ChatGPT to WorldCoin?

(Data source: defillama)

1) Stability Mechanism

The core of Gyroscope is a protocol for minting algorithmic stablecoins. The ideal Crypto stablecoin market does not rely on central bank digital currencies or centralized stablecoins. This requires appropriate innovation in the elasticity, design, and value transfer of decentralized stablecoins. Gyroscope’s GYD is fully supported by reserves, achieving collateral diversity and increasing liquidity:

Gyroscope’s stablecoin is GYD, whose collateral is mortgaged by many interrelated but independent vaults. The vault comes from Balancer’s pool composed of various assets (other stablecoins are the preferred assets at the beginning). This can be seen as an innovation and supplement to Maker and DAI:

A: Fully collateralized stablecoin: Each unit of stablecoin is backed by collateral worth $1, aiming to achieve a 100% long-term reserve ratio.

B: Reserve: The reserve is a “basket” of assets controlled by the protocol, collectively providing collateral for the issued stablecoin.

C: Price Constraints through Algorithms: The price of minting/redemption of stablecoins is set by algorithms to achieve balance and respond to short-term crises.

Its collateral is composed of a basket of other assets, including other stablecoins, yield-generating instruments, or volatile assets, initially supporting USD-pegged stablecoins, followed by other categories of stablecoins (including EUR, JPY, etc.):

This “layered” reserve asset is designed to achieve a flexible reserve design, allowing for a single safe failure of a vault, and a single point of failure will not cause spillage risk to other vaults.

2) Protocol Design

Gyroscope has a self-contained reserve pool, and its stability mechanism is maintained by two modules in the primary market AMM (BlockingMM) and the secondary market AMM (SAMM):

BlockingMM:

BlockingMM provides quotes for the issuance and redemption of stablecoin GYD, taking into account potential impacts in exceptional situations. To mint, users must deposit supported collateral assets into one of Gyroscope’s various vaults, and users can mint stablecoins at a 1:1 ratio (excluding minting fees).

SAMM:

SAMM is a secondary market AMM that provides core liquidity for the Gyroscope protocol. The CLP is similar to Uniswap v3’s concentrated liquidity design, but by customizing Balancer v2 pools, liquidity is concentrated within the price range of BlockingMM to achieve higher capital efficiency.

SAMMS provides a diverse liquidity network around GYD as shown below:

There are three types of GYD trading pools:

2-CLPs: AMMs that concentrate liquidity within a pricing range, determined by the pricing range [α, β] and the two assets in the pool

3-CLPs: Concentrate liquidity among three assets to improve capital efficiency

E-CLPs: Used in the GYD trading market, is a funding pool for pairing GYD with other assets

The GYD trading pool follows DSM-defined price ranges and concentrates liquidity in a narrower and reasonable range when the reserves are healthy. If the reserves are impacted and DSM sets a new redemption price, this price range will expand.

GYD trading pool is redundant (providing multiple different paths for Gyroscope stablecoin exchange) and independent from each other (assuming one asset pairing fails, the remaining SAMM trading pool can still operate normally, unlike Curve’s single pool).

Gyroscope’s dynamic stability mechanism (DSM):

Unlike existing non-custodial stablecoins, Gyroscope’s stability does not depend on leverage demand. Gyroscope has no central issuing agency, users can mint and redeem directly in the protocol, and there is no counterparty.

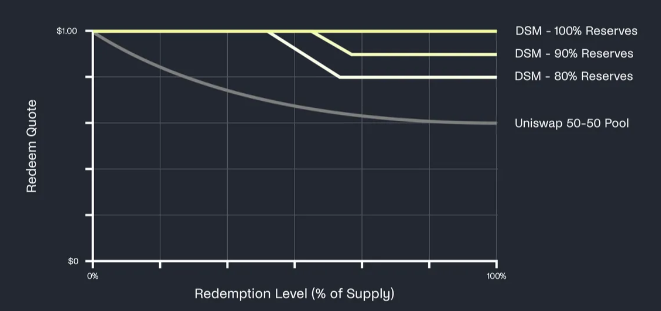

DSM (a joint curve that quotes the minting/redemption price) depends on the current reserve ratio and fund outflow:

Normally, users can mint and redeem stablecoins for reserve assets at a 1:1 ratio (excluding minting/redeeming fees).

Redemption with a collateral ratio close to 100%: When the reserve ratio is less than 100%, BlockingMM will automatically redeem GYD at a ratio lower than the collateral value of 100%. That is, the redemption curve starts at around $1, and GYD trades around $1, achieving good liquidity.

Redemption with a collateral ratio far below 100%: If redemption continues and the “outflow” increases, the second line of defense is algorithmic pricing. The redemption curve will move to the “breaker” stage, where the redemption rate will automatically drop below the reserve ratio, and the redemption quote will gradually decrease to ensure that redemption can always be carried out (but will still lead to a reduction in calculation), and prevent market panic and attacks on currency anchoring, as well as reward users who are waiting for short-term declines.

Other stabilizing mechanisms include: Similar to Maker’s Peg Stability Module (PSM) logic, Gyroscope mechanisms allow stablecoins to be exchanged for assets valued at $1. In the case of insufficient reserve collateral, a leveraged loan mechanism is available: This is similar to how MIM operates, if the GYD price falls significantly below $1 (during certain market crashes), leveraged holders will be able to close their positions at a discount, which will reduce the supply of GYD and bring the GYD price back to $1.

The final line of defense is the operation of the reserve fund, which can be used through various mechanisms to restore an under-collateralized state to a fully collateralized state, such as auctioning governance tokens, income generated by reserve assets, and protocol fees.

二、分析总结

Gyroscope’s GYD trading pool E-CLPs can be seen as a high-liquidity DEX that can withstand asset single-point failures.

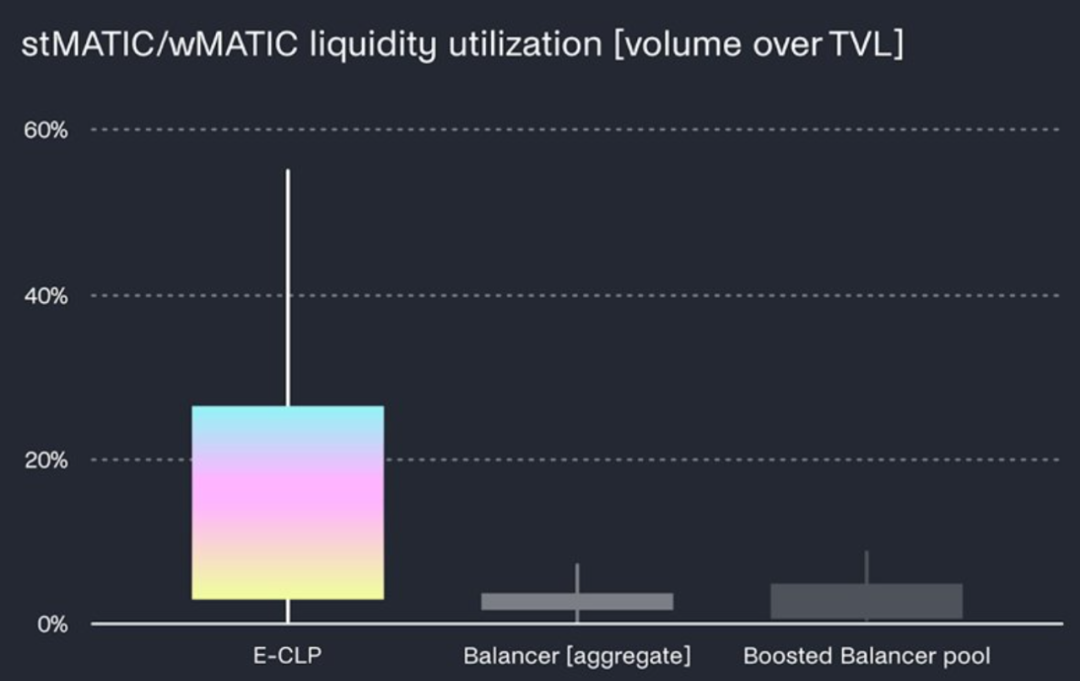

The stMATIC/wMATIC pool, as its first LST E-CLP, benefits to some extent from the maturity of the Polygon ecosystem, with Gyroscope E-CLP liquidity utilization rates crossing 2-3 times those of other similar pools.

Relative to the reliability of the stablecoin mechanism, the use cases, scenarios, and user expansion of the stablecoin are equally important. Gyroscope, based on its stable mechanism, has attracted attention in the primary market. After testing, it chose to enter the mature and effective Polygon ecosystem that has absorbed a large amount of overflow from Ethereum, and has the potential to become a new blood in the algorithmic stablecoin market and compete with Fei Protocol.

Considering the critical role of Balancer in promoting the concentration of liquidity in assets such as $rETH, and the new and effective flywheel provided by LST protocol to liquidity, it is necessary to pay attention to its deep penetration into LST assets. Gyroscope’s LST pool is expected to further improve the efficiency of the new LST market (including stETH, etc.), and more LST E-CLPs are expected to appear in the future and occupy an advantage in the Polygon ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exploration of Legal Issues Arising from “Digital Collections” in Practice

- What is the current state of development of on-chain government bonds? We have studied 5 agreements.

- Interpretation of Trust Minimization Middleware by Distributed Capital Researcher: Consensus Verification and Bridging

- Yuga Labs May Data Report: The Darkest Moment for NFT Industry Leader?

- Celestia: Modular Data Availability for OP Stack

- Encrypted wallet developer Demox Labs secures $4.5 million in funding led by HackVC

- Circle will launch native USDC on Arbitrum on June 8th.