Singapore Digital Bank Application Guide: Eligibility Criteria, Compliance Criteria, Inspection Criteria, and Operation Planning

Editor's Note: Original title was "Singapore Digital Bank Application Guide | Standard Consensus"

Overview

On January 7, 2020, the Monetary Authority of Singapore (MAS) announced that as of December 31, 2019, applications had been closed and 21 digital banking license applications had been received. These include 7 applications for full digital bank (DFB) licenses and 14 applications for digital wholesale banks (DWB). Applicants for Singapore's digital banking licenses not only own giants in financial services, but also include domestic large companies such as Tencent and Ali. Since 2017, going to sea is also one of the directions of many large factories. Applying for a license is a good opportunity for China to export its technology and expand the Southeast Asian market. It is also an important springboard for overseas business expansion.

This article introduces the digital banking license and its related application eligibility standards, compliance standards, inspection standards and operating plans, and is committed to depicting a panoramic view of applying for digital banking in Singapore.

- Google Cloud announces joining Hedera Hashgraph Management Board and will run a network node

- Bitcoin returns strong to five digits, but US government loses $ 1.7 billion

- Electricity is 2 cents, and the policy is gradually opening up. Is Central Asia becoming a "mining paradise" for Bitcoin miners?

Report

Introduction to MAS

Monetary Authority of Singapore, referred to as the Monetary Authority of Singapore (MAS). MAS is the government agency that exercises Singapore's central bank functions and is also the authority responsible for monitoring financial institutions.

Prior to 1970, various monetary functions related to the central bank in Singapore were managed by multiple government departments and agencies. However, as Singapore's economy has taken off and the international financial environment has become increasingly complex, it has become imperative to clarify and streamline the functions of financial authorities. So in 1970, the Singapore Parliament passed the Monetary Authority of Singapore Act. On January 1, 1971, the Monetary Authority of Singapore was formally established and began to exercise the functions of central bank and financial supervision.

In April 1977, the government decided to transfer the regulatory function of the domestic insurance industry to the Monetary Authority of Singapore, and in September 1984, the government transferred the regulatory function of the securities industry to it. On October 1, 2002, the Singapore Monetary Authority merged with the Monetary Commission, and the Monetary Authority began to assume the function of issuing currency.

Simply put, MAS is the Singapore version of the People's Bank of China + Securities Regulatory Commission + Banking Regulatory Commission + Securities Regulatory Commission + Insurance Regulatory Commission, and even occasionally guest appearances on the Development and Reform Commission. There is no doubt that this is a behemoth with great power.

MAS Digital Bank License Type

There are two types of banking licenses involved under the Banking Act: DFB licenses and DWB licenses.

All types of banks

Under the Banking Act, all types of banks can engage in all banking activities, including deposits, checking services and loans. Although a complete bank can do all Singapore dollar and non-Singapore dollar denominated banking, a foreign bank with a full banking license can only operate a limited number of branches and automatic teller machines (ATMs). However, a qualified full-type bank plan allows foreign banks to conduct business in more locations, share their ATM networks, and freely relocate their branches.

Wholesale bank

Wholesale banks can do the same banking business as regular banks, but they cannot do Singapore dollar retail banking. They operate within the guidelines of wholesale banking practices issued by the Monetary Authority of Singapore (MAS). A licensed bank may apply to the HKMA for approval to operate an Asian Currency Unit (ACU). This is an accounting unit that banks use to record all foreign exchange transactions in the Asian dollar market. Singapore dollar transactions for licensed banks are separately accounted for in their domestic banking unit (DBU). The demarcation between ACU and DBU will be removed.

Financial institutions can also operate as commercial banks under the Monetary Authority of Singapore Act. Commercial banks are governed by specific MAS regulations. Their scope of activity is usually narrower than that of licensed banks. However, commercial banks can also apply to MAS for approval to operate Asian Currency Units to compete with licensed banks in the non-Singapore dollar banking market. The system for commercial banks will be integrated into the Banking Act, so commercial banks will be licensed under the Banking Act rather than the Monetary Authority of Singapore Act.

The HKMA will issue up to two "full digital banking" licenses and three "digital wholesale banking" licenses. These licenses allow entities, including non-bank financial institutions, to conduct digital banking in Singapore.

The following table shows the banks and financial companies that have announced their applications for digital banking licenses.

Source: MAS announcement

MAS Digital Bank License Compliance Scope

Regulatory law

Banks registered in Singapore fall under the scope of the Banking Act and the MAS Act. As a comprehensive supervisor and supervisor of the financial services industry, MAS has the responsibility to supervise and regulate banks and their businesses. With the exception of the Banking Law and the HKMA Law and its subsidiary laws, banks must also comply with the notices, notices, guidelines, practice guidelines and codes issued by the HKMA from time to time.

Regulatory Authority

As far as the regulator is concerned, all applicants are subject to review and subsequent supervision by the banking department under MAS. The number of banks in Singapore is huge, so the Banking Department is also the largest department under MAS.

Singapore's commercial banks are divided into three categories. The first category is all types of banks. This type of banking has all kinds of banking services and has few restrictions. It can provide various types of deposit and loan services, foreign exchange transactions and so on to customers at home and abroad in Singapore. The second category is restricted banks. These banks cannot set up branches. They do not absorb savings deposits, but only time deposits. The minimum amount for each transaction is S $ 250,000. The third type is offshore banks, which can only engage in foreign exchange transactions. It is not allowed to open new currency deposit accounts. The Banking Administration separately supervises the banks according to their country. The supervision is divided into multiple groups. Business personnel in order to cooperate with the relevant departments within the banking department, bank credit is effectively regulated, and capital markets penetrate each other.

MAS Digital Bank Application Qualification and Inspection Items

Related laws and regulations

DFB and DWB compliance documents are as follows:

- Banking Law

- Monetary Authority of Singapore Act

- "Basel"

- Payment Services Act

- Securities and Futures Act

- Notice MAS 635

- MAS 637

- Notice MAS 644

- MAS Notice 649

- MAS Notice 655

- Consultation Paper of the HKMA on the Bank's Anti-Merger Structure

- Tax Administration Regulations

- Bank (Credit and Debit Card) Regulations 2018

Compliance standards

Applicants for any kind of license must meet the following requirements:

- At least one entity in the applicant group has three or more years of experience in operating technology or e-commerce.

- The key people are "suitable."

- Ability to meet minimum paid-up capital requirements in the initial stage and minimum capital requirements in subsequent stages.

- Provide a clear value proposition, combined with innovative technologies to meet customer needs, and reach underserved parts of the Singapore market.

- Demonstrated the sustainability of the proposed digital banking business model.

- Submit a workable exit plan.

- Apply for corporate shareholder commitments to provide a letter of responsibility and commitment that the HKMA may require for the operation of the proposed digital bank.

- The applicant group must provide a 5-year financial forecast for the proposed digital bank and be profitable. Financial projections must be reviewed by external and independent experts.

Regarding the scope of the “applicant body”, the MAS provides that the entity will hold a digital banking license (hereinafter referred to as the “proposed digital bank”) and all its 20% controllers. Among them, the 20% controller refers to holding not less than 20% of the total issued shares of the proposed digital bank or control of not less than 20% of the voting rights of the proposed digital bank.

Regarding the scope of "major shareholders", MAS has given the following requirements: the applicant group and its directors, the major shareholders and 12% of the controllers of the proposed digital bank, and the directors and executive officers of the proposed digital bank.

Regarding paid-up capital: For groups applying for DFB, paid-up capital must include funding commitments or specific funding plans to meet a minimum paid-up capital of S $ 1.5 billion.

There are no additional rules for foreign applicants. However, for digital banking licenses, the DFB applicant group must take root in Singapore, which means that it will be controlled by Singaporeans (mostly equity) and the headquarters will also be located in Singapore; the DWB applicant group must be registered in Singapore.

Review criteria

Applicants will be evaluated as follows:

- Apply for a group business model's value proposition, including innovative use of technology to meet customer needs, and reach underserved parts of the Singapore market that are different from existing banks. The HKMA will also consider the applicant's ability to implement the recommendations.

- The ability to manage a robust and sustainable digital banking business, including a level of understanding of the key risks of the banking business and of its compliance and risk management plans The HKMA will also consider the applicant's reputation, track record, financial resources and shareholder commitments.

- Contributions to Singapore's efforts to become a financial center include, for example, driving local employment, skills training for the local workforce, retaining technology in Singapore, establishing a headquarters in Singapore, and its regional expansion plans.

- Applicants do not have to hire a complete management team at the time of application, but should at least employ a future chief executive officer (CEO) and have identified a chief risk officer (CRO), chief financial officer (CFO), chief technology officer (CTO), Candidate for the Chief Information Security Officer (CISO).

- Applicants do not have to have a fully built and deployed technical infrastructure at the time of application, but they need to provide a high-level IT plan, including an architectural diagram of key systems.

- Regarding guidelines for technical risk management (hereinafter referred to as TRM), MAS Notice 644 on TRM and MAS Notice 655 on cybersecurity serve as key applicable technical risk management measures.

In addition, as part of the application, MAS expects the applicant community to demonstrate that they can meet all regulatory requirements and to fully develop IT systems, risk management policies, processes, and the risk profile of the system as it becomes operational when appropriate. However, at the time of application, there are 12 months to obtain preliminary approval for the permit, and applicants need only demonstrate their ability to implement a plan before starting operations.

Venture capital and liquidity rules

DFB has the same venture capital requirements as D-SIB. (D-SIB refers to systemically important banks. Once such banks can no longer continue to operate, it will have a significant negative impact on the stability of the local financial system (D-SIB).) Includes 6.5% CET1 capital adequacy ratio (hereinafter referred to as CAR) , 10% of total CAR, 2.5% of capital protection buffer, and 2.5% of countercyclical capital buffer. Although DFBs will not initially be designated as D-SIBs, given their untested business model, MAS will set higher risk capital requirements.

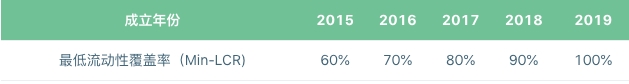

DFB is also required to comply with current minimum liquid asset (MLA) and liquidity coverage (LCR) requirements. If a DFB involves international business or is designated as a D-SIB, whether the bank is a restricted DFB or a fully operational DFB, it will be required to comply with LCR requirements (a minimum of 16% of liquid assets).

Application steps

application time

Application fee

There is no application fee for applications.

Operational planning

Digital Bank of All Kinds (DFB)

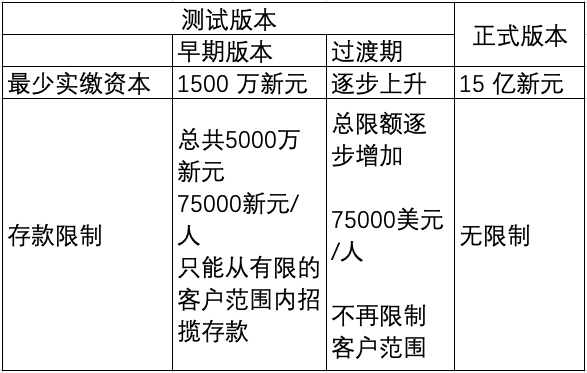

DFB must be registered in Singapore. At the beginning, it will enter the sandbox and begin limited operation. After passing the inspection, it will enter the formal operation. MAS does not predetermine a time period. The growth rate of the restricted version will depend on its ability to meet its commitments and the regulatory considerations of the Monetary Authority of Singapore. However, MAS believes that DFB will enter formal operation within three to five years after opening.

During earlier versions, DFB will not be able to attract deposits to the public. However, it will be able to raise deposits from shareholders, employees, related entities, and anyone else familiar with the business of the DFB parent or major shareholder (such as an existing customer of the parent company).

However, large deposits can be excluded from the total deposit limit provided that it has a minimum capital of S $ 100 million. The S $ 50 million deposit limit is limited to personal S $ -denominated deposits.

During the transition period, the DFB may apply for an increase in the total deposit during the annual review. MAS will evaluate the DFB based on factors such as the strength of internal controls, the frequency and type of violations, customer complaints, and the sustainability of business performance. At the same time, this assessment also includes a review of the audit reports on the effectiveness of digital banking finance and internal controls.

During the transition period, if the DFB provides unsecured credit arrangements to individuals, it can only give individuals an unsecured credit limit of twice the monthly income. Regulatory supervision in accordance with MAS Notice 635 and other unsecured credit rules of the Banking Regulations 2013.

During the transition period, DFB shall not engage in any proprietary trading activities.

The investment products provided to individuals can only be simple capital market products, and there can be no more than two countries where DFB conducts banking business overseas.

Digital Wholesale Bank (DWB)

DWB must be registered in Singapore. It can only operate one physical store.

DWB applications need to meet the same regulatory requirements as existing wholesale banks, including a minimum paid-up capital of S $ 100 million, risk-based capital and liquidity requirements, as well as technical risks, money laundering and terrorist financing risks, non-financial business practices Related requirements.

DWB will be allowed to provide SGD (ie Singapore Dollar) accounts for business purposes, including individual owners and partnerships. These accounts can generate interest. The HKMA will revise the operating guidelines of wholesale banks to allow all wholesale banks to provide the same types of accounts.

DWB does not allow unsecured credit to retail individuals. MAS does not want DWB to serve retail customers and provide them with financial advice.

Conclusion

We can take a look at the determination of MAS's development of fintech from the standards disclosed by MAS in the regulation. Singapore is currently accelerating and working towards the Asian financial innovation center, which has an important role in promoting the development of capital and industry, but the focus of finance is still on supervision and implementation. When compliance is complete, a period of rapid growth for the industry is just around the corner.

risk warning:

- Beware of illegal financial activities under the banner of blockchain and new technologies. The standard consensus firmly resists the use of blockchain for illegal fundraising, online pyramid schemes, ICOs, various variants, and dissemination of bad information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Digital gold, scarcity, and Bitcoin halving

- Report: Darknet activity in 2019 is higher than in the past, how should law enforcement agencies respond in 2020?

- From 1 to 21, an article captures the role of blockchain in government reports

- Shanghai takes the lead in putting crisis into action: suggestions for accelerating the construction of smart cities, including support for blockchain traceability

- Strong alliance! JP Morgan discusses merger of blockchain unit Quorum to ConsenSys

- The two mining pools control 60% of the Monero network's computing power. Will the centralization of the mining pools cause security problems?

- Lava PoC2 + protocol upgrade hard fork solution