Emerging economies in Africa, South Asia, and Southeast Asia are leading the global trend of cryptocurrencies.

Africa, South Asia, and Southeast Asia are driving the global trend of cryptocurrencies.Author: Adaverse Research Team

Consultants: 6th man Ventures and Coin98 Ventures

Emerging markets provide unique opportunities for cryptocurrency and blockchain technology development. In Africa, cryptocurrencies have become a viable alternative to traditional financial systems and are popular in local markets, especially for those who are unbanked. Blockchain technology can address issues such as traceability in supply chains, managing identity, and ownership disputes, making it a promising area for development.

- Exploring the evolution of the stablecoin market structure: Why can USDT always dominate the first place?

- Evolution of demand, yield, and products in the ETH Staking market after Shanghai upgrade

- How to search and join some popular events, using Bitcoin Pizza Day as an example?

In Vietnam, as the economy grows and technology develops, cryptocurrency has captured the hearts of young people and an increasing number of Vietnamese people see it as a secure and reliable financial option. In India and Africa, the use of cryptocurrencies is increasing due to a lack of banking services and high volatility of local currencies.

In these regions, digital assets provide a secure and convenient financial solution for locals. Conversely, emerging markets provide unique use cases and opportunities for digital asset chains.

Opportunities and Use Cases in Emerging Markets

Africa

In Africa, practicality is key to successful products, including Web3 projects. As the GDP per capita is relatively low and financial, social, and environmental infrastructure is not well developed, solutions in the African market must address problems or meet clear market scenario demands, including:

- International payments: Compared to traditional financial systems, Web3 can achieve faster and cheaper international payments, which is advantageous for the African financial market as many African countries lack developed banking infrastructure.

- Digital identity: Web3 can help solve the issue of legal identity by creating secure, private, verifiable digital identities.

- Traceability in supply chains: Blockchain technology can trace products along the supply chain, helping to ensure product quality and authenticity and reducing corruption in African agriculture and other sectors.

- Decentralized markets: Web3 can facilitate the establishment of decentralized markets, where buyers and sellers can interact directly without intermediaries. This is particularly advantageous for African agricultural markets as farmers can sell their products directly to consumers without paying high commissions to intermediaries.

These Web3 use cases can effectively address specific and pressing problems faced by various communities in Africa. Web3’s decentralization allows platforms to be more flexible in handling regional issues, helping to promote inclusive finance and economic development in Africa.

Web3 in Africa is mainly integrated, allowing ordinary consumers to use the technology. A successful example in this regard is Fonbnk, which allows users to exchange their call time credits for cryptocurrency assets.

Africa lacks traditional financial infrastructure, which exactly provides an opportunity for new technologies such as blockchain. 57% of African mobile phones are not connected to the Internet, and in some African countries, only 30% of adults have smartphones. In the face of these technological deficiencies, integration and gradual advancement are key.

Not just FinTech

Web3 use cases are not only related to financial markets, and blockchain technology has great potential in other non-financial fields on the African continent. In addition to the aforementioned technological infrastructure backlog, another major problem in the African region is the lack of reliable and verifiable land ownership records, which has also led to many disputes and conflicts.

Currently, companies such as HouseAfrica and Seso Global use blockchain technology to create transparent and immutable records that clearly indicate the ownership of land. In addition, blockchain technology can also be used in other fields such as healthcare, education, and digital identity, helping these fields establish trustworthy and verifiable records. In short, blockchain technology can help address different problems in multiple fields in Africa.

India

Although India is also an emerging market with rapid economic growth, India’s economic development is different from that of other developing economies. On the one hand, India has shown sustained interest in the cryptocurrency field and tends to support new technologies such as Web3 and blockchain. On the other hand, the Indian government has not formulated and implemented effective cryptocurrency regulations, causing market chaos and hindering industry development.

Since the Indian Supreme Court overturned the central bank’s ban on digital currency in 2020, the Indian government has debated the regulation and legal status of cryptocurrency, but no clear conclusion has been reached so far.

For instance, given the risks such as money laundering and financial instability, the Reserve Bank of India has been particularly cautious about cryptocurrencies, repeatedly highlighting scams and frauds in the Indian cryptocurrency industry, which further exacerbates concerns about blockchain security. Banks and financial companies have found it difficult to provide services to Indian cryptocurrency exchanges.

Since the implementation of the new transaction tax law in July 2022, the trading volume of cryptocurrency exchange platforms in India has significantly decreased. The law stipulates a 1% tax on all cryptocurrency-related transactions exceeding 126 US dollars (10,000 Indian rupees). In addition, the Indian government levies a 30% tax on all cryptocurrency-related income, which has led to a decrease in trading volume.

The Great Indian Crypto Exodus

Many cryptocurrency companies based in India have considered moving to other jurisdictions that are more friendly, such as Singapore or the United Arab Emirates. Dubai is the prime choice as the UAE is supportive of cryptocurrencies and has established multiple tax-free zones that issue cryptocurrency licenses.

Sandeep Nailwal, the CEO of Polygon, has said on multiple occasions that he moved to Dubai two years ago because of the uncertain legal regulation in India, which could put his company and team at risk at any time. Although he wishes he could live in India to promote the development of the local Web3 ecosystem, he expressed concern about the talent drain in India’s blockchain field. He lamented that India’s laws and regulations are driving investors, entrepreneurs, and talent out.

Therefore, we can see a stark contrast between India and the UAE in terms of Web3 technology and cryptocurrencies; India is fraught with contradictions in cryptocurrencies, while the UAE has taken a more proactive stance, recently passing a virtual commodities law and establishing an industry supervisory agency.

Additionally, the UAE has introduced special visas for tech entrepreneurs, allowing them to set up businesses in the country and obtain resources and funding, which has attracted many entrepreneurs from around the world. Dubai is poised to become a new emerging tech hub in the Middle East.

However, the current situation is not the final outcome for India. Many industry insiders hope that the Indian government will consider India’s potential and try to establish clear and favorable regulations for the industry, actively and significantly changing India’s landscape.

In fact, blockchain technology, cryptocurrency, and Web3 can be applied in various industries, such as:

- DeFi: The growing DeFi worldwide is also booming in India, where users can use cryptocurrency and blockchain to obtain decentralized and intermediary-free financial services such as loans, savings, and interest income.

- Digital Identity: In India, Web3 can also improve the security and privacy of user digital identities. Storing identities on the blockchain can prevent third parties from obtaining personal data without authorization.

- Intellectual Property: Web3 can improve the protection of content creators’ intellectual property by allowing them to store and manage their creations on the blockchain, giving them more control over ownership and dissemination of creative content.

India has a huge talent pool of technology and high-skilled IT workforce, so it has great potential in the field of digital assets. India has a high adoption rate of technology, with a large number of internet users and constantly growing smartphone penetration rate.

In addition, India has always been at the forefront of developing products for the international market. India’s software and IT services industry has always been a major exporter and has achieved great success in providing information technology services globally. Therefore, India has the opportunity to be at the forefront of Web3 innovation and provide solutions to the global market.

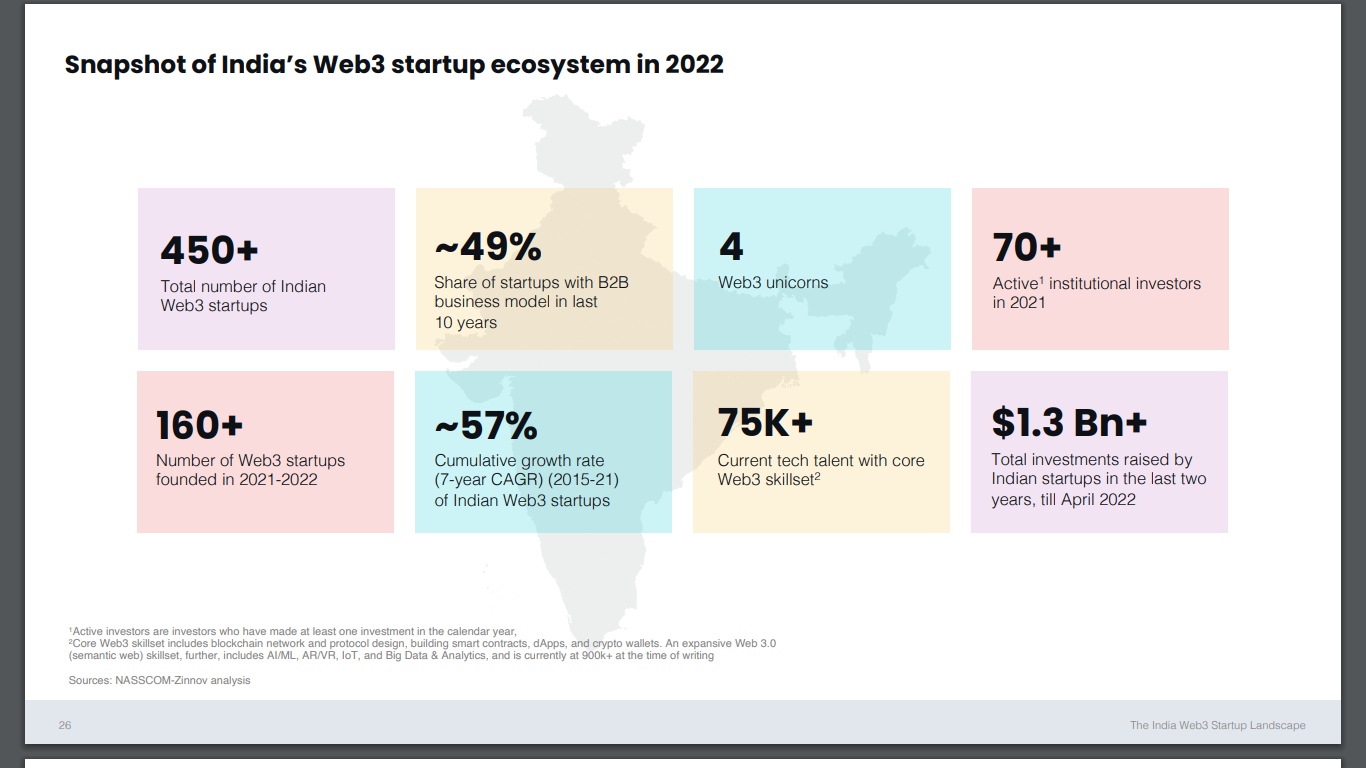

Finally, the development of India’s Web3 startup ecosystem is also showing signs of momentum. In recent years, investment in cryptocurrency and blockchain startups has increased significantly, and there are more than 450 Web3 startups in India, including the most successful ones such as CoinDCX and CoinSwitch.

India's Web3 startup ecosystem as of 2022, source: Nasscom

Recent research by NASSCOM shows that India has a huge talent pool and a high adoption rate of digital technology, making it a potentially prosperous Web3 market. Because the gap between the supply and demand of talent in the Indian technology field is smaller than in other countries, this means that there are a large number of technology talents available for Web3 projects.

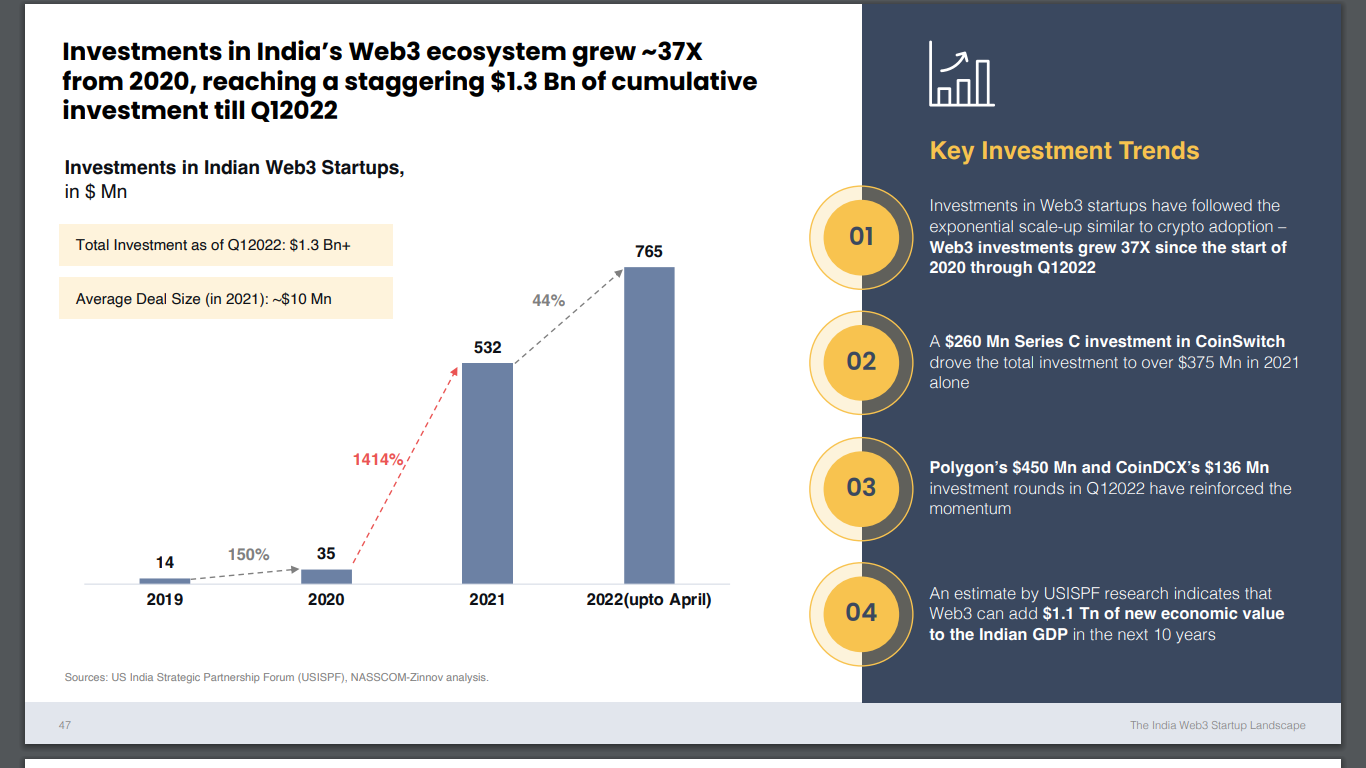

The adoption of cryptocurrencies in India has been significant. In particular, investment in Web3 startups has been increasing over the past two years, and the Indian cryptocurrency market is now very large, with about 20 million users. According to USISPF data, this user market could add $1.1 trillion in economic value to India’s GDP over the next decade.

Data source: Nasscom

The Indian government has launched various initiatives and plans to promote the development of emerging digital technologies, including Web3 and blockchain. Given India’s enormous potential for adopting and developing emerging technologies, blockchain technology will have a significant impact on India’s economy.

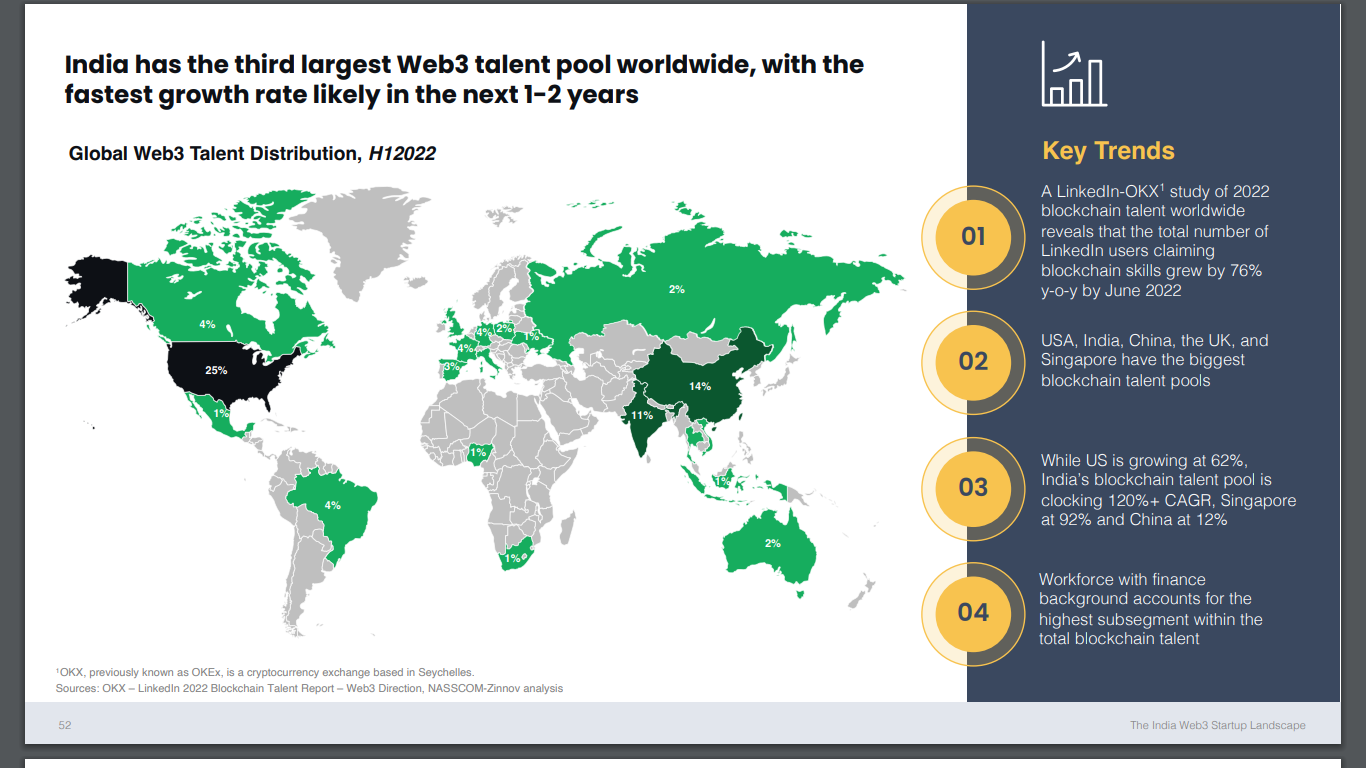

Data source: Nasscom

Although India ranks third in the global Web3 talent pool, research predicts that India’s talent pool growth rate will be the fastest in the coming years. In addition, India already has a huge talent reservoir in emerging technologies such as artificial intelligence and data analytics, and has the ability to lead the development of Web3 and blockchain in the future.

Furthermore, we should also be aware that cryptocurrencies and blockchain technology have the potential to improve India’s fiscal and taxation systems. India has a fairly complex tax structure and is also one of the countries with the highest indirect tax rates in the world. High taxes can reduce consumer purchasing power and business competitiveness, which can harm economic and population development, and may also stimulate capital flight and shadow economy.

Blockchain technology and cryptocurrencies may be a solution to these problems. By providing transparent transaction tracking and full traceability, eliminating unnecessary intermediaries, blockchain technology can reduce entry costs and processing time, benefitting small business owners and taxpayers, improving efficiency, and increasing trust and transparency in the tax and fiscal systems by allowing all participants to access the same information. However, the implementation of these technologies will require the government to develop appropriate strategies and regulations.

The function of the central bank digital currency (CBDC) issued by the Reserve Bank of India is to replace traditional fiat currency. CBDCs can bring some benefits, including reducing costs, increasing efficiency and financial inclusivity, controlling the money supply, reducing the shadow economy, and improving security and transparency. However, its implementation requires appropriate planning and regulation by the government to ensure its effectiveness and bring benefits to economic and social development.

Vietnam

According to Chainalysis’ 2022 Global Cryptocurrency Adoption Index, emerging markets in Asia are leading in cryptocurrency adoption. Vietnam ranked first and the Philippines ranked second. However, despite its promising performance, the State Bank of Vietnam explicitly prohibited the use of cryptocurrency as a means of payment in 2018, and companies trading in cryptocurrency were fined.

Top five countries in the Global Cryptocurrency Adoption Index, source: Chainalysis

In addition, Vietnam does not have official regulations related to blockchain technology and cryptocurrency. However, the Vietnamese Prime Minister approved improvements to the legal framework, which is a positive signal that the Vietnamese government recognizes the importance and potential of blockchain technology and is working to establish a clear and secure regulatory framework.

This legal clarity can help promote further growth and development of cryptocurrency and blockchain in Vietnam while limiting the risks these technologies may pose, such as money laundering and terrorism financing.

Overall, Vietnam’s balanced approach to regulating cryptocurrency and blockchain can help promote a healthy and thriving ecosystem and contribute to Vietnam’s economic and technological development in the future.

The fact is that Vietnam has maintained its top position for two consecutive years, establishing a solid foundation for the use of cryptocurrency. In addition, Vietnam’s high purchasing power promotes people’s ability to use centralized cryptocurrency, DeFi, and P2P tools.

The popularity of cryptocurrency-based games in Vietnam also favors widespread adoption of cryptocurrency. Vietnam has already seen some successful cryptocurrency companies, such as Coin98 Finance, Axie Infinity, and Kyber Network, which will incentivize more businesses to enter the cryptocurrency market, further increasing the popularity of blockchain technology. The Chainalysis report also notes that Vietnam’s cryptocurrency adoption includes both centralized and decentralized tools, with both types having a high proportion. Cryptocurrency-based games, such as P2E and M2E games, are particularly popular.

Most of Vietnam’s cryptocurrency projects focus on gaming and metadata, followed by DeFi, NFT, and infrastructure. As more traditional companies turn to blockchain and integrate the technology into their business, Vietnam’s cryptocurrency projects have also performed remarkably well in fundraising, with these achievements being encouraging for the country’s future cryptocurrency market prospects.

However, despite the high adoption rate of cryptocurrencies in Vietnam, accessibility and usability of cryptocurrencies still need to be improved. The cryptocurrency industry needs to create concrete solutions that meet the needs of Vietnamese users and users in other middle and high-income countries, and increase the global adoption of cryptocurrencies.

Blockchain technologies suitable for emerging markets

After discussing the opportunities and use cases that blockchain technology brings to emerging markets, we can observe the potential of blockchain technology for future economic growth. For retail investors, institutional investors, and governments, blockchain can serve as a financial tool and bring huge added value to underdeveloped areas.

Although there is currently no unified blockchain technology that suits all emerging markets (as each market has its own unique needs and challenges), some common characteristics of blockchain technology determine its matching degree with emerging markets, such as cost-effectiveness, scalability, accessibility, ease of use, and interoperability.

Among various blockchain projects, Cardano is particularly suitable for emerging markets and is a blockchain technology designed specifically to cater to emerging markets. It emphasizes improving the development of emerging economies through interoperability, sustainability and financial inclusion via its smart contract platform.

In addition, Cardano uses a proof-of-stake consensus mechanism, which consumes less energy than other consensus mechanisms used by other blockchain technologies such as Bitcoin, making it more affordable for users in developing countries. Cardano also focuses on education and training, making it suitable for emerging markets with blockchain technology training and skill development needs.

In terms of functionality, Cardano has a transaction layer that uses the cryptocurrency ADA, and a computing layer based on the Haskell programming language Plutus, which is mainly used to execute smart contracts (dApps). Overall, Cardano is an emerging technology that proposes innovative solutions to the limitations of Bitcoin and Ethereum.

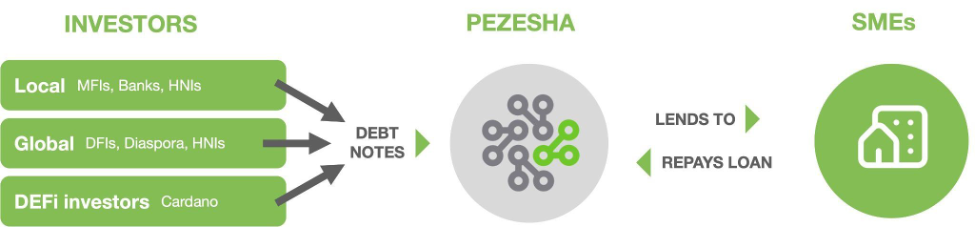

Another highlight of Cardano is its vision. Cardano and Hoskinson’s vision is to create a more fair and human-centric economy using blockchain technology, and microfinance is a key part of this vision. Working with Pezesha to create a P2P financial system in Africa is an example of how Cardano is committed to solving real-world problems and improving people’s economic access.

The collaboration with Pezesha in creating a P2P financial system in Africa is an example of how Cardano is working to solve practical problems and improve economic access for everyone. The collaboration project allows people to borrow in a standardized way, promoting local financing channels and economic growth.

Pezesha is a Kenyan fintech company that focuses on microfinance, aiming to provide small loans to small businesses and individuals in Africa. The joint investment in Africa by both parties shows Cardano’s commitment to economic development in Africa and demonstrates its vision of using blockchain technology to solve practical problems such as the lack of financing channels. In short, Cardano has the potential to be a blockchain technology that is very suitable for emerging markets.

Blockchain technology can bring benefits to areas that are difficult to obtain traditional financing, especially in Africa, where small businesses are the backbone of the local economy and the lack of financing channels is a huge obstacle to their development.

In addition to Cardano, there are other blockchain technologies that are suitable for emerging markets, and here we focus on the top three blockchain projects: EOS, Stellar, and Aion.

EOS is a blockchain technology that is very attractive to emerging markets. It focuses on the scalability of transactions, with high transaction throughput and low transaction latency, which can greatly expand and accelerate payment applications and microtransactions. Block.one has launched multiple initiatives to encourage the adoption of EOS in emerging markets. For example, in 2019, Block.one announced a partnership with the online gaming platform Ultra to create an EOS-based gaming platform. In addition, Block.one has launched a $1 billion investment fund to support the development of applications on the EOS platform.

However, like any emerging technology, EOS also faces a series of challenges, including increasingly fierce industry competition, such as Ethereum, which has a large developer base and an active community. In addition, security and scalability are the focus areas for EOS and its community.

In contrast, Stellar’s technology allows for token trading anywhere in the world, aiding the development of financially underdeveloped countries and regions; another attractive feature of Stellar is that the platform allows for the issuance of tokens and the creation of decentralized applications (dApps) for various purposes, including financial inclusion and humanitarian aid.

Finally, Aion is considered to be very useful for emerging markets as it can provide solutions to interoperability issues that frequently arise in the traditional financial systems of emerging economies. By achieving interoperability between blockchains, Aion can help drive financial inclusion in these markets and develop new financial services.

However, each case must be evaluated separately and the specific needs of the market and users must be considered before deciding which blockchain technology to use.

Conclusion

In recent years, blockchain technology and cryptocurrencies have become increasingly popular in emerging economies in Asia, such as India and Vietnam. Many local markets are beginning to use blockchain technology to address financial inclusion issues and improve efficiency in various industries, such as agriculture and trade.

Blockchain technology and cryptocurrencies can play a meaningful role in promoting financial inclusion in these emerging markets, providing people with financial alternatives and allowing for safer and more efficient transactions without the need for traditional banking infrastructure.

In addition, technologies such as blockchain can help those who do not have traditional financial support to obtain funding, especially small businesses in Africa, which are the backbone of the local economy but lack funding that poses a huge obstacle to their growth. In contrast, the 16 million cryptocurrency users in the Vietnamese market, spread across gaming, metaverse, DeFi, and NFTs, are a welcome performance.

For India, with its large talent pool, high adoption of digital technology, and increasing interest in cryptocurrency and Web3 startups, India is prepared to use Web3. However, despite having these technological foundations, the Indian government needs to establish a clear regulatory framework, otherwise it will continue to suffer from brain drain, and the market of 20 million cryptocurrency users will gradually dissolve.

Although these emerging markets face challenges in adopting blockchain technology and cryptocurrencies, it can be foreseen that cryptocurrencies will continue to grow in the next few years. In addition, education on blockchain technology is also booming, and individuals and institutions will have a more open and inclusive attitude towards blockchain.

In short, blockchain technology and cryptocurrencies have tremendous potential for development in emerging markets in Asia, such as India and Vietnam, helping to address common problems and challenges in these regions, namely financial inclusion and efficiency in various industries. The development of blockchain technology and the popularization of related education will further promote the growth of these emerging markets.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exclusive Interview with Arbitrum Founder: One Whiteboard, Three “Zhuge Liangs”, Creating the King of Billions in Layer2

- The RWA vision is promising, but it requires a joint effort from the encrypted market, traditional finance, and regulation.

- Financing Weekly Report | 24 public financing events; Bitcoin financial services provider River completes $35 million Series B financing, led by Kingsway Capital.

- Overview of BTC NFT Ecology: Development Status, Trading Market and Value Analysis

- One year after Terra’s Black Swan event: Market is on the mend, but still struggles to shake off the gloom

- Overview of DePIN Track: Is it Disruptive Innovation or a “Castle in the Air”?

- Bitcoin’s new generation of multi-signature scheme MuSig2: providing better security, efficiency, and privacy features