Social influence: unique elements of the digital asset market structure

Author: OKEx

Translation: Lisa Liu

Source: Crypto Valley

- CFTC Chairman: Global stablecoin is the only systemic risk

- Santander successfully redeems $ 20 million in bonds issued via Ethereum

- Sweep the haze of physical delivery futures debut, Bakkt cash delivery bitcoin contract hotly opened

Capital flows, supply and demand changes, and technical analysis are key indicators that digital asset investors use to make trading decisions. However, in this process, social factors are often overlooked.

Can social factors influence the price of digital assets? If there is an association between the two, what is its logic?

In fact, with the development of the community, the blockchain and crypto economy industry summits are becoming more and more popular. How key conferences and events drive the change in digital asset prices is worthy of careful study.

This article was compiled exclusively by Crypto Valley and is not intended as investment advice.

Social Emotion: The Missing Link

Digital assets are an emerging asset class that is becoming increasingly popular among institutional and retail investors. Its decentralized nature gives it the potential to disrupt the traditional financial world.

In traditional asset classes, market data is relatively concentrated, but market information for the crypto economy is relatively scattered. Investors often overlook this. In a noisy market, social influence is often the missing piece.

Social influence has always been a unique factor in the complex structure of the broader digital asset market. A study by Tomaso Aste, a professor of complexity science at University College London, shows that social sentiment plays a very important role in the digital asset market. In some cases, the correlation between the BTC sentiment index and other digital asset prices exceeds its The price itself.

One of the things that makes digital assets emotionally driven may be the way investors analyze them. Unlike stock or foreign exchange market participants, which can evaluate a company by performance and financial statements, or by measuring macroeconomic data to measure a country's economic growth, digital asset investors usually have limited options in market analysis. Sporadic information patterns may reinforce the tendency for investors to make trading decisions based on their emotions.

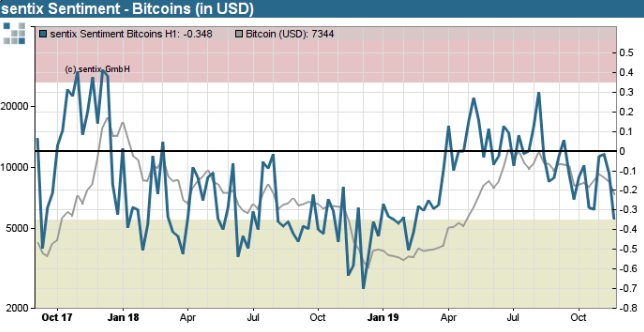

Figure 1: Sentix BTC sentiment index (Source: Sentix)

Exhibit 1 compares the price of BTC with the SentixBTC sentiment index, which tracks the market expectations of BTC investors for a specific period of time. We see that prices and indices are highly correlated, and negative extreme sentiment usually means price increases (2018Q4). On the contrary, high optimism may be a warning sign for the upcoming price adjustment (2017Q4).

After the November correction, the investment sentiment index reached -0.35, indicating that market participants have started to worry about the BTC price plummeting. However, if negative emotions deepen, a rebound may occur.

Social media indicators

Social media is another important and easily overlooked indicator of sentiment in the digital asset market.

Yukun Liu and Aleh Tsyvinski of Yale University's Department of Economics studied Google Trends data and its impact on BTC prices. They found that these data have strong predictions for the return of digital assets, especially in short-term forecasts. The study stated that "a standard deviation jump in search volume in one week is equivalent to a weekly return increase of 1.84%, and in the next week and two weeks, this number will rise to 2.30%."

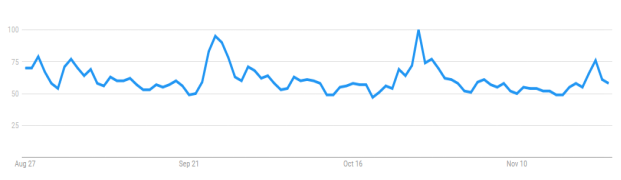

Figure 2: BTC Google Trends with 90-day Dimensions (Source: Google Trends)

Figure 2 shows the "BTC" search rate on Google Trends for the last 90 days. On November 22, this number reached 76, which was before the announcement of China's blockchain, which caused the price of BTC to exceed $ 10,000. Despite recent declines, the search rate seems to be on the rise, which is a phenomenon worthy of close attention.

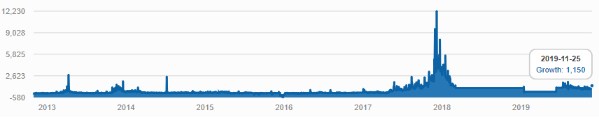

Exhibit 3: Growth of Reddit users with the keyword "BTC" since 2013 (Source: Redditmetrics)

We found a similar pattern in Reddit's "BTC" user growth data. Reddit is another social media widely used by the crypto community. Chart 3 above clearly reflects the price of BTC over time, which may be another social indicator for crypto investors.

Important industry summits may affect the price performance of digital assets

For investment bank analysts, the economic calendar is a must-have item, it records all important events and data releases that may affect the market. However, in the field of digital assets, there is no official profit report or regular data release for investors' reference, which makes the role of the blockchain industry summit and various theme conferences prominent.

Although there is no direct evidence that the meeting can drive up the price, the project party will take this opportunity to update the project progress and announce a new research and development plan. Information such as this may exacerbate the market's hype for this particular token, potentially affecting the price .

Take ETH as an example. For Ethereum, important events occur frequently in September this year. This means a lot to developers. On September 6-8, the ETH Boston Summit was held; immediately afterwards, on September 15, the Ethereal Tel Aviv Conference was held. Ethereum founder Vitalik Buterin attended the Tel Aviv summit and delivered a keynote speech.

Exhibit 4 shows the performance of ETH during and after these two events. During this period, the price of ETH has increased by almost 36%.

Figure 4: Daily average performance of ETH in September 2019 (Source: Tradingview)

BCH is another similar example. The Bitcoin Cash City Conference will be held in Townsville, Australia from September 4th to 5th. Developers and entrepreneurs discussed how to improve their payment use cases. About two weeks after the conference, BCH prices rose by about 15%.

Figure 5: Daily average performance of BCH in September 2019 (Source: Tradingview)

Although it is difficult to quantify the price impact of blockchain conferences, one thing is certain: large conferences often cause a sensation on social media. Twitter, event updates and highlights, and media coverage, all of which can increase the social sentiment index of a particular token during and shortly after the event. In assets where prices and sentiment are closely affected, rising sentiment can easily lead to significant price fluctuations.

in conclusion

As a new asset class, social influence is a unique factor in the structure of the digital asset market. It distinguishes between digital assets and traditional assets, but it is often ignored by traders and investors. By adding social and emotional considerations to the trading decision process, investors will be able to better understand the market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Intensive Reading | "2019 China Blockchain Industry Development Report": a comprehensive review of the current status and trends of the development of industry, university and research

- Perspective | DeFi's Pillar: Decentralized Liquidity

- Re-understanding Bitcoin: 8 answers to Satoshi Nakamoto's wisdom

- Small mining companies help themselves: use financial derivatives to hedge hash rate fluctuations

- People's Daily Observation: How Manufacturing Plants Blockchain

- Can the founders easily take half of the "decentralized scam" that raised 30 million?

- Amun AG receives regulatory approval again to provide cryptocurrency ETP products in EU countries