Speed Reading | Twitter founder Zuckerberg teach how to properly enter the money circle; the fat of the agreement: Reflections from a cost value

Author: True Satoshi

Editor's Note: The original title is "Shenzhen Congjiji | Twitter founder teaches Zuckerberg how to enter the coin circle correctly"

Today's content includes:

1. The founder of Twitter teaches Zuckerberg how to enter the currency correctly.

2, the protocol of fat: Reflections from a cost value

3. Connect Binance data to the next-generation DeFi application using the Chainlink oracle

4. All 21 million bitcoins already exist

5, electronic money

Twitter founder teaches Zuckerberg how to enter the currency circle correctly

This is an article written by qz, a commercial media about stepping on Facebook Zuckerberg and for Twitter founder Jack Dorsey. He pointed out that Jack’s approach to entry is the right way for the giant to participate in the cryptocurrency field, rather than coming in. . His comment on Zuckerberg was quite interesting: he copied things and claimed that they belonged to him (which reminds me of grandchildren).

Since the creation of Facebook, Mark Zuckerberg’s script has not changed: he copied things and claimed that they belonged to him.

- The blockchain has completely detonated the Chinese stock market and the currency market. How long can the magic continue?

- People's Network: Blockchain will usher in five major advantages, such as industry upgrades and industrial chain reshaping.

- Analysis: How does the blockchain and economic and social integration develop?

When Zuckerberg suffered another public humiliation, he just proved what he should not do for companies that intend to adopt encryption strategies. Creating private funds (such as Libra) is not the answer.

Although he is also pursuing the future of cryptocurrencies, Twitter and Square CEO Jack Dorsey have not been hit. Unlike Facebook, he didn't reinvent the wheel and tried to profit from it.

Square did not propose a new digital currency as a savior of the financial system, but accepted something that already existed: Bitcoin. In the past year, the company has hired a team to contribute to the original cryptocurrency through Square Crypto. Although they are technically employed by Square, these engineers are actually working on Bitcoin as a public service.

They are considering how to make an open financial system (the heart of Bitcoin) for everyone, not just a corporate elite club. Jack Dorsey believes that money should be free flowing, just like the Internet itself.

If Mark Zuckerberg or members of the Libra Association (past or present) actually want to make a difference, then you should learn Square, they may be better, Square can point them in the right direction.

Full text link: https://qz.com/1735908/what-square-gets-right-about-bitcoin-facebook-and-libra-get-wrong/

Fat of the agreement: Reflections from a cost value

The author is Joel Monegro of Placeholder VC, who is also the author of the famous Fat Protocol. When he wrote the fat agreement, he was at USV (United Square Capital). This article is Joel's DeFi.WTF speech on Devcon 5 in Osaka. In this talk, I focus on economic theory, thinking about value through cost. It's a bit dry (I think I'm a bit hard to translate so I guess a lot of mistakes), but it's worth reading slowly.

In the long run, the market allocates value according to cost. So look for value and find cost. This insight is useful because the cost of observation is more practical than speculating future profits.

Value acquisition is not equal to return on investment. We can use this logic to predict the overall value distribution or “capture” of the entire economy, market, value chain, and even within the enterprise. But more value gains are the total potential market input, but not related to earnings. The return is a function of cost basis, growth rate and ownership concentration.

The cryptocurrency network as a market will seek to balance or collapse. Therefore, their economic model as a policy must be conducive to equilibrium. When designing a cryptographic economic model, value should be distributed along the cost. This means taking into account the cost of the supply for the supplier, the cost of the investor of the fund, and the value to the user. In cases where it is expected that most of the cost will be borne by the supplier, for example by over-allocating value to investors, making one group superior to another may be destructive.

A good example of a correct completion of value distribution is Decred, which is a bitcoin alternative, in which block reward inflation is allocated to the workforce to prove that the miners (pay the highest cost) 60%, the voter assigned to the equity prover 30% of the cost) the cost of purchasing and mortgage DCR, and $1 billion in Decred treasury bonds to cover the cost of long-term network development.

The value base of online tokens lies in their production costs and capital costs. If a token is created through mining or other types of work, part of its intrinsic value will be the supplier's production cost. For example, if you have invested $1 million in mining and will generate 10,000 tokens, then $100/token will be your preferred minimum price and you are unlikely to sell below that price. However, when it comes to economic costs, you must also consider issues such as the capital cost of its investors. For example, if you invest $1 million in the same 10,000 tokens and the expected rate of return is 3 times, your lowest price will become $300/token. All of these things happen at the margin, but the sum of these parts brings us back to TV = TC (reconsidering economic costs, not accounting costs). Now, in the short term, we will of course see a lot of deviations from equilibrium, especially in the cryptocurrency where the market is not mature. For example, over-production of smart contract platforms means that the market will require lower prices to find a balance, which is already seen in front of us. This is good or bad, depending on where you are sitting.

The cost of the agreement is higher than the application. Agreements provide scale and require more investment, so they need more value to maintain equilibrium. Applications are less valuable because they cost less. To get the right size, always consider the value of a single application and the total value of all the protocols it uses.

Today, the protocol layer still has high risks, so there is a lot of return at the protocol level. In the long run, they may scale up to store trillions of dollars in value, but growth will remain stable. As the revenue shifts to the more competitive application layer, most of the value may remain at that level. But we are still far from equilibrium.

Allocate costs to assign value. We explored this idea in an article comparing web and encrypted web service models. If our goal is to design systems that distribute value more widely, then a deeper understanding of the economic physics of cost and value is critical. In the long run, the market naturally assigns value to those who bear the costs and risks.

Full-text link: https://www.placeholder.vc/blog/2019/10/21/how-to-think-about-value

Connect Binance data to next-generation DeFi applications using the Chainlink oracle

This is an article by the coin security blog, which supports the development of decentralized finance (DeFi) by working with Chainlink to connect various cryptocurrency data on the platform to the blockchain. I think a little better is the popularity of the prophecy.

– Exploring the value of Binance data

In addition to being the most traded transaction in the world, Binance also offers industry-leading APIs covering 637 price pairs via websocket and rest API. As the Binance ecosystem evolves, its data will continue to expand to cover more projects, more jurisdictions and more derivatives. Providing these data sets on a common blockchain enables interoperability between centralized and decentralized worlds, while DeFi Dapps can benefit from data generated by highly mobile centralized transactions.

– Transferring Binance's data link

To allow smart contracts to integrate data from the Binance API, Chainlink built an external adapter to enable connectivity so that any node operator can provide data. The external adapter extends the functionality of the Chainlink node by providing application-specific services from the API to the smart contract. The external adapter was built with a serverless architecture in mind, allowing the node operator to run any number of external adapters and was charged by the cloud provider only when using the external adapter. Anyone can use Binance's API to connect to unauthenticated endpoints, and external adapters make it easy for smart contracts to request and use the data they provide.

– bring more possibilities to Defi

With Binance, you can open up a whole new range of products that were previously unavailable in the current DeFi market. For example, users will not be limited to smart contracts built around only specific assets, but rather can create very customizable terms around more than 100 cryptocurrencies listed on Binance. This may include direct exchange of different assets or derivatives, such as futures, options and swaps. Not only will this give you more flexibility in application development, but you can also open different hedging strategies for assets outside the current infrastructure that are limited to top-level market tokens. The DeFi app introduces a host of new options for traders who want to auto-trade around a variety of different data points. This may include large trading alerts, hash rate fluctuations or transactions triggered by automatic portfolio adjustments based on market data.

Full text link: https://www.binance.com/en/blog/394373386380349440/Connecting-Binance-Data-to-NextGen-DeFi-Applications-Using-Chainlink-Oracles

All 21 million bitcoins already exist

The author is a partner at Unchained Capital, which talks about the 21 million limit after bitcoin has dug up 18 million pieces. Compared to the scarcity of gold, the scarcity of bitcoin is not flexible.

Bitcoin supply and supply of gold

The key difference between gold and bitcoin supply ultimately comes down to people's understanding of supply. Due to the expansion of the universe and the limits of the speed of the universe (speed of light), humans cannot estimate the total supply of gold because the location of gold is unknown and most of the supply may be remote.

We know the bitcoin supply and other information based on the information on the chain. Difficulty adjustment is the use of personal incentives to maintain Bitcoin's own growth. By adapting the difficulty to the size of the network, it hinders people's efforts to create more supply, but uses their efforts to improve the security of the network.

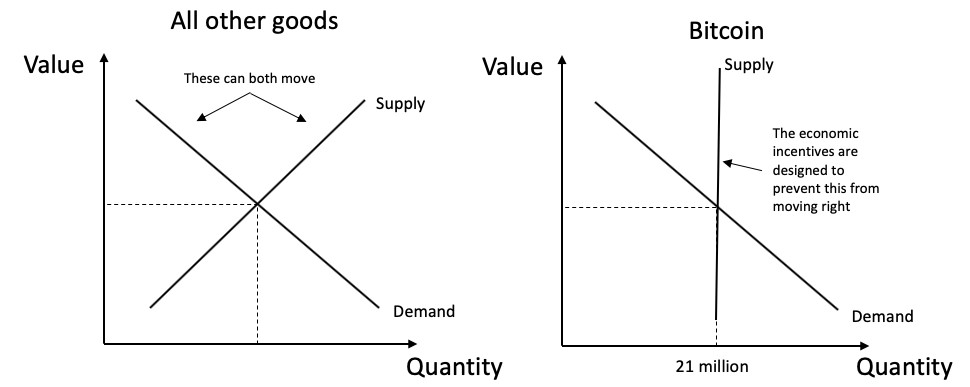

The Bitcoin network itself is its 21 million supply. Supply is a vertical line in the supply and demand model, which means it is completely inelastic.

In the history of Bitcoin, a number of technical inflation loopholes have been discovered and an inflation loophole has been exploited, but the network eventually treated these transactions as ineffective minority splits and maintained a socially understood supply plan.

Bitcoin innovation is the absolute scarcity of borderless, neutral and de-licensing. This innovation has had an astounding destructive effect on all aspects of human interaction, and it is this innovation that drives the value of the web. The supply of bitcoin must never exceed 21 million, because this will run counter to our current understanding and understanding of how the network works, and it will not solve the problem of “digital scarcity”.

Bitcoin is able to achieve absolute scarcity through its network architecture, which aims to increase decentralization over time and actively reject the desire of humans to generate more demanding goods. Over time, the increase in decentralization will effectively crowdify the decision on the total supply of Bitcoin to the entire network of participants. The basic assumption is that when each participant is unable to obtain the opportunity to mint, decentralization The personal network will not choose to belittle your own currency.

As a result, prudent full-node miners and HODLers can take action under the assumption that the 21 million limit is not negotiable. Knowledge about scarcity damage is gradually emerging organically through free markets and “unlimited people” networks, but the entire experiment relies on a rigid foundation of 21 million, which has a clear understanding of how people make clear, neutral and Constant rules can be traded.

Because we voluntarily choose to join the network, it can be said that all 21 million bitcoins are already in existence today, because the rules followed by the network consensus must comply with the supply schedule. The only difference between accessible/inaccessible offers is the value of who or what current HODLs are bitcoin, and how humans compete with blockchain tracking bitcoin or block number tracking behind PoW to track bitcoin transactions Difficulty adjustment.

Digital scarcity is a very strange idea. The bitcoin tracked by the blockchain is ultimately only the 1 and 0 and mathematical functions supported by economic stimulus. Bitcoin is the intersection of code and social consensus. 21 million already existed, or none existed.

Full text link: https://www.unchained-capital.com/blog/all-21-million-bitcoin-already-exist/

Electronic money

The author is the developer of the OXT project, mainly an article on PoW, to briefly discuss the total cost of Bitcoin PoW. This will give us an opportunity to introduce another basic feature of PoW that makes it truly unique.

Are we worried about such an expensive system?

There are problems with these models. With the PoS and DPoS systems, most incumbents still can stop new actors from becoming leaders. This means that in PoS and DPoS systems, most incumbents still have the ability to maintain their dominant position indefinitely.

PoW is essentially an open system. With this truly unique feature, Bitcoin's workload proves to create an open and dynamic competitive environment in the long run, far less unilaterally political than any other existing digital system (blockade, blockade, etc.) )Impact.

About "efficiency." Efficiency is not an absolute indicator. When we say "X is more efficient than Y", it means that both X and Y produce the same expected result/attribute, but X wastes less resources. However, if X is required to sacrifice the important properties of Y, then it is meaningless to say "X is more efficient than Y".

This is exactly what I am saying about the trend of "PoS (DPoS or other) is more efficient than PoW". These statements obscures that this efficiency "profit" is the result of a compromise between the inherent openness of PoW.

Full text link: https://medium.com/@laurentmt/electric-money-e2cd34f78f56

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Unknown computing power exceeds 60%, BCH is facing 51% attack threat

- Fed report: digital currency, stable currency and growing payment patterns

- Bitcoin is expected to hit 10,000 dollars again, and the market is ready to move.

- Analysis of the market in early trading on October 28: Thinking about this wave of "carnival"

- A picture to understand: blockchain listed companies are all sorted out

- Xiao Feng: Blockchain is not only a new technology, but also a new mechanism design.

- People's Daily official science blockchain (with full text)