Regulatory uncertainty leads to continuous 18-month decline of stablecoins

Stablecoins continuously decline for 18 months due to regulatory uncertainty.Author: Oluwapelumi Adejumo, beincrypto Translation: Shannouba, LianGuai

-

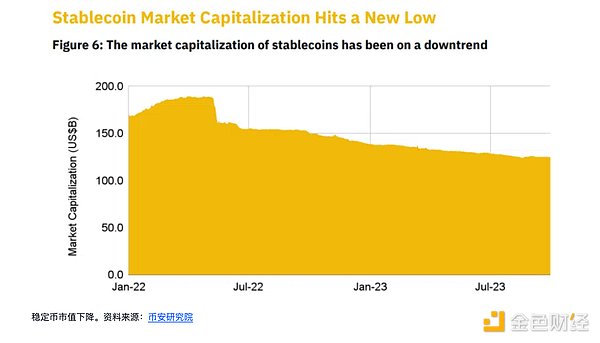

Stablecoins have been experiencing an 18-month decline, with a 35% decrease in market capitalization since May 2022.

-

In September, the trading volume of stablecoins on centralized exchanges reached a 28-month low, dropping to $331 billion.

-

Despite the overall decline in the stablecoin market, USDT continues to dominate with a market share of 67.3%.

According to DefiLlama, stablecoins have experienced an 18-month decline, with a 35% decrease in market capitalization since May 2022. During this period, the industry has had to deal with increasing regulatory uncertainty and scrutiny from global regulatory agencies.

In September, crypto research firm CCData reported that the trading volume of stablecoins on centralized exchanges dropped by 28.4%, amounting to $331 billion. This is the lowest monthly total since July 2020.

The underlying factors for the decline

The collapse of TerraUSD is a key factor in the 35% decline in the overall market capitalization of stablecoins. After reaching a peak of $189 billion in May 2022, its current market capitalization is around $124 billion.

Many industry experts point out that regulatory uncertainty is a significant factor hindering the growth of these assets. Last month, Binance wrote that it may be forced to delist multiple stablecoins in Europe due to the upcoming Markets in Crypto-Assets (MiCA) regulations to be implemented next year.

In addition, legislators in several jurisdictions, including the United States and Hong Kong, are developing regulations to guide this industry. Market observers believe that these regulatory measures will suppress the stablecoin market and play a significant role in this downward trend.

However, Binance Research Institute stated that despite the decrease in market capitalization, stablecoins still play a fundamental role in the crypto ecosystem.

USDT continues to dominate

Despite the overall decline in the stablecoin market, USDT remains the leader in the field. USDT has a market capitalization of $83.54 billion, three times that of its closest competitor USDC ($25.017 billion). This firmly establishes USDT’s dominant position, with a market share of approximately 67.3% according to Dellama data.

On October 6th, Tether’s USDT celebrated its ninth anniversary, with Chief Technology Officer LianGuaiolo Ardoino describing it as a technology that fundamentally changes finance. Ardoino further emphasized the importance of these assets, stating, “Central banks around the world are considering stablecoins as the future of their central bank digital currencies (CBDCs).”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- MetaMask’s growth engine is losing momentum, and generalized user applications are becoming the new center of ‘entry’.

- LayerZero Security Prospects and Ecological Opportunities Capture

- Hainan issues a red-headed document to cut off NFT digital collectibles.

- It is not surprising that OpenAI is making chips, what is surprising is if OpenAI does not make chips.

- Vitalik proposed a decentralized solution to the Ethereum staking protocol.

- Ethereum’s native LST adopts a two-tier staking design Lido killer?

- Court ruling confirms Ripple does not own XRP ledger.