Stablecoin’s Snowball May Lead Crypto to the Mainstream

Stablecoin's Impact on Crypto MainstreamingOn August 7, 2023, American payment giant LianGuaiyLianGuail announced the launch of its stablecoin LianGuaiyLianGuail USD (PYUSD), becoming the first tech giant to issue a stablecoin. While we are still entangled in the political mud of the SEC with Binance, Coinbase, Ripple, LianGuaiyLianGuail in the traditional financial field has broken the deadlock of cryptocurrency regulation by launching PYUSD stablecoin in collaboration with LianGuaixos, and the market is booming again.

This article will take a close look at PYUSD stablecoin to understand the logic behind LianGuaiyLianGuail’s launch of stablecoin at this time, analyze the advantages of PYUSD stablecoin, and the challenges it will face from decentralization and regulatory uncertainties.

1. LianGuaiyLianGuail’s PYUSD Stablecoin

On August 7, 2023, American payment giant LianGuaiyLianGuail announced the launch of its stablecoin LianGuaiyLianGuail USD (PYUSD). PYUSD stablecoin is fully collateralized by deposits in US dollars, short-term US government bonds, and similar cash equivalents, and qualified US users can exchange 1:1 with US dollars through LianGuaiyLianGuail. Thus, LianGuaiyLianGuail becomes the first tech giant to issue a stablecoin.

- An Introduction to THORChain’s Loan Mechanism Interest-free, No Liquidation, No Maturity Date

- What impact will the SEC’s approval of Ethereum futures ETF have?

- Mint Ventures Analysis of the Historical Development and Model of Decentralized Reserve Stablecoins

As the only supported stablecoin in the LianGuaiyLianGuail ecosystem, PYUSD leverages LianGuaiyLianGuail’s over 20 years of experience in the global payment industry, combines the efficiency, low cost, and programmability of blockchain, and serves as a seamless bridge connecting LianGuaiyLianGuail’s existing 431 million users with consumers, merchants, and developers in Web2, providing a connection between fiat currency and digital currency.

In addition, as an ERC-20 token issued on the Ethereum blockchain, PYUSD can also assist LianGuaiyLianGuail’s ecosystem applications to expand to external Web3 projects. Currently, most stablecoins are used in specific Web3 scenarios, but PYUSD is compatible with both Web2 and Web3 from day one.

LianGuaiyLianGuail CEO Dan Schulman said, “The transition to digital currency requires a stable tool that is both digital and easy to peg to fiat currencies such as the US dollar. PYUSD provides the necessary foundation for the growth of digital payments.”

Qualified US customers can:

- Transfer: Transfer PYUSD between LianGuaiyLianGuail and compatible external wallets;

- Send: Make peer-to-peer payments using PYUSD;

- Fund Purchases: Choose PYUSD as a payment option at checkout;

- Convert: Convert to any supported cryptocurrency by LianGuaiyLianGuail.

PYUSD, a stablecoin with a Web2 perspective, may change the overall payment methods of Web3. In terms of compliance, LianGuaiyLianGuail, with over 20 years of experience in communicating with regulators, is even more advanced than other Web3 enterprises.

LianGuaiyLianGuail Trust Company, the issuer of PYUSD, was established in 2013 and mainly provides services such as cash custody, cryptocurrency services, digital asset issuance, securities and commodity settlement, etc. The company holds a BitLicense for cryptocurrency operations issued by the New York State and is regulated by the New York State Department of Financial Services (NYDFS). Although LianGuaiyLianGuail received regulatory requirements from NYDFS to remove the Binance-Peg BUSD stablecoin in February of this year and received a Wells Notice from the SEC considering BUSD as a security, it is believed that the cooperation with LianGuaiyLianGuail is cautious in terms of market size and qualification review.

Starting from September 2023, LianGuaiyLianGuail will publish a monthly public reserve report for PYUSD, as well as third-party proof of the value of the reserve assets. The certification will be issued by an independent third-party accounting firm and will be conducted in accordance with the evaluation criteria established by the American Institute of Certified Public Accountants (AICPA) to ensure the security and integrity of the assets.

In June 2022, LianGuaiyLianGuail also successfully obtained a BitLicense from NYDFS and disclosed that extensive discussions have been conducted with US regulatory agencies and policy makers before the launch of PYUSD.

2. LianGuaiyLianGuail Wants to Do Profitable Business in the Cryptocurrency Industry

As we all know, stablecoins are the most profitable business in the cryptocurrency industry. In addition to basic revenues such as transaction fees and service fees, the interest income similar to the interest spread in traditional banking deposit and loan businesses is particularly substantial in the current interest rate environment. It can be said that the current interest rates dominate everything.

From a business perspective, there is nothing wrong with LianGuaiyLianGuail targeting the cryptocurrency business. From the perspective of the industry, it is also reasonable for technology companies leading the traditional payment industry to fully embrace blockchain, as Bitcoin and blockchain technology were created to solve the decentralized peer-to-peer electronic cash payment system.

2.1 Income from Reserve Asset Investment

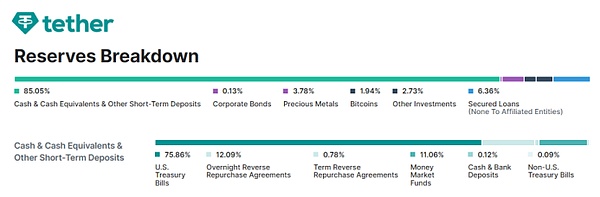

According to the Q2 2023 report disclosed by Tether, the issuer of USDT, the total assets of USDT have increased from $66 billion at the beginning of the year to the current $86 billion, with over $55 billion of US dollar assets invested in risk-free assets such as US Treasury bonds, from which most of the profits are derived.

It is reported that Tether achieved over $1 billion in profits in the second quarter, and even achieved $1.48 billion in profits in the first quarter, with a potential profit of $4 billion this year. This is more than the profit of the global asset management giant BlackRock, while the company’s workforce is only slightly over 50 people.

How to create huge income?

Under the scale effect, the marginal issuance cost of stablecoin issuers is zero. They only need to issue debt denominated in US dollars to obtain fiat assets at zero cost, and then invest these fiat assets in risk-free interest-bearing assets such as US bonds while retaining all the earnings.

It is worth noting that Coinbase earned $374 million in transaction fees in Q2 2023, and $240 million from interest income with Circle. This is the current reality of the cryptocurrency industry – buying government bonds has a higher profit margin than operating exchanges. The profitability of stablecoins, which can be described as “making a fortune overnight,” is capable of surpassing 90% of listed companies on the market.

So, how can fiat assets be obtained at zero cost?

SEC gave LianGuaixos, the stablecoin issuer, an excuse to avoid the risk of being accused by SEC of issuing unregistered securities. As a centralized issuer, if they provide interest-bearing stablecoin assets to users, such stablecoins are likely to be regarded as securities by SEC.

Therefore, we can see from the user terms of LianGuaiyLianGuail Cryptocurrency that LianGuaixos, as the issuer, has the right to enjoy the fees generated from the custody of fiat assets, and these fees will be shared with LianGuaiyLianGuail, with no connection to the holders of PYUSD stablecoin.

2.2 Monetization of Traditional Payment Business

LianGuaiyLianGuail SVP Jose said in an interview, “In the past, the traditional profit mechanism of stablecoins has always been achieved through the interest income of reserve assets, which has been a considerable source of profit within the industry in the current interest rate environment. However, we do not think this is the only profit mechanism. LianGuaiyLianGuail will achieve profitability in a way closer to traditional payment businesses. This also means that when merchants want to accept stablecoin settlements, there will be a certain merchant discount rate, and individual users will also incur certain related fees when converting different types of stablecoins.”

Transaction exchanges have high-frequency application scenarios and stable fee deductions, which can contribute sustainable income. LianGuaiyLianGuail will continue to connect bindable cryptocurrencies and enrich the application scenarios of cryptocurrencies, making the functionality of cryptocurrency transaction exchanges (Convert/Swap) just around the corner. According to the listing documents disclosed by Coinbase to SEC, Coinbase earned a huge income of $1.5 billion from transactions in Q1 2021, accounting for 86% of the total income at that time. Taking MetaMask as an example, its transaction fee rate is 0.875%, and its 2021 revenue reached 250 million yuan.

Through the above analysis of LianGuaiyLianGuail’s entry into the encryption industry, it can be seen that the launch of PYUSD may not only change the current stablecoin market pattern, but also change the profit logic of traditional payment businesses and open up a new round of business model evolution in the traditional payment field.

Obviously, compared to other stablecoin issuers, LianGuaiyLianGuail has obvious advantages. It is believed that LianGuaiyLianGuail can maximize the value of PYUSD stablecoin through massive traffic entry (Web2) combined with rich payment scenarios (Web2+Web3) and the monetization advantage of its own traditional payment business.

3. LianGuaiyLianGuail’s stablecoin advantages

The centralized PYUSD stablecoin issued by LianGuaiyLianGuail is fundamentally no different from Tether’s USDT and Circle’s USDC. The only way to deal with transparent competition is to attract new users through Web2 and increase market share, driving mass adoption of the encryption market.

In the current stablecoin market with a value of 120 billion US dollars, USDT and USDC account for approximately 68% and 21% of the market share respectively. Currently, PYUSD, which is only available to eligible LianGuaiyLianGuail customers in the United States, wants to gain a foothold in the existing market and will directly face competition from USDC and BUSD, because these American customers tend to use regulated stablecoins onshore in the United States.

As for offshore stablecoins, Tether CTO Paolo Ardoino stated that the launch of LianGuaiyLianGuail stablecoin will not affect Tether because the company does not serve US users.

So what are the advantages of LianGuaiyLianGuail’s stablecoin?

3.1 LianGuaiyLianGuail’s traffic and scenario entry

Former LianGuaiyLianGuail executive Austin Campbell said, “One of the most undeveloped scenarios in the cryptocurrency ecosystem is the deposit and withdrawal channel. From this perspective, it is difficult to find a better choice than LianGuaiyLianGuail. I think the biggest innovation here is the addition of a native stablecoin, PYUSD, directly on the LianGuaiyLianGuail platform.”

The key to breaking the circle for stablecoins is to obtain traffic entry, and this is exactly what LianGuaiyLianGuail possesses. No matter how stablecoin products in Web3 boast about their advancement and security, without the support of traffic entry and participation in scenarios, everything is just empty talk. With scenarios, there is traffic, and with traffic, there are deposits and withdrawals.

If PYUSD can become popular, it will once again prove that the growth path of Web2 payment business is also applicable to Web3, which requires the support of a strong commercial ecosystem. This is a comprehensive competition of company ecosystem strength and the creation of a sustainable business model, rather than the current Web3 projects that rely on low-level stacks of cutting-edge technology and the rapid advancement of a single business.

3.2 Advantages of LianGuaiyLianGuail based on blockchain

In terms of cross-border payments, PYUSD based on blockchain technology can achieve simultaneous information and fund flow synchronization and concurrency while transferring funds in stable coins, and “payment is settlement”, making transactions simple and secure.

On the other hand, SWIFT only involves the transmission of international payment instructions between banks, which is not only more complex (requiring multiple links and approvals from multiple banks), but also takes longer to complete transactions (often several days, while PYUSD usually takes seconds) and incurs higher transaction costs. In addition, PYUSD, based on the public ledger of blockchain technology, maintains higher transparency compared to SWIFT’s private ledger for payment settlement.

In theory, based on the technological architecture of blockchain and the business ecosystem expanded by LianGuaiyLianGuail itself, PYUSD can directly compete with Tether and Circle, and is expected to become a dark horse in the Web3 payment field.

LianGuaiyLianGuail SVP Jose also cited the advantages of PYUSD in an interview: “First of all, PYUSD is the only stable coin accepted by the LianGuaiyLianGuail ecosystem, including Venmo and the bilateral network of LianGuaiyLianGuail, which will connect millions of consumers and merchants. Secondly, PYUSD can fully utilize LianGuaiyLianGuail’s complete global payment channels and convenient payment experience for deposits and withdrawals. And thirdly, compliance and regulation. PYUSD is issued by LianGuaixos Trust Company regulated by the State of New York, and has absorbed more than 20 years of experience from LianGuaiyLianGuail in handling and preventing cyber financial crimes.”

Despite the mutual praise in the above business context, overall, both the traditional financial industry and the cryptocurrency industry believe that LianGuaiyLianGuail’s launch of stable coins is a positive development, but there are also concerns about PYUSD. These concerns arise from the deviation from the spirit of decentralization and regulatory uncertainties.

4. Increasing centralization of PYUSD

Although LianGuaiyLianGuail’s stable coin PYUSD is based on the Ethereum network, it is not a completely decentralized token. @Bitcoin discovered through examining the smart contract deployed by PYUSD that LianGuaiyLianGuail has the authority to freeze wallet addresses it deems malicious and even forcibly remove PYUSD assets from the Ethereum network, even if the address is not on the LianGuaiyLianGuail platform.

A similar example can be seen when Circle froze $63 million of USDC due to security concerns with Multichain.

Centralized institutions can do many things that were completely impossible on the blockchain before, which is inevitably a compromise with regulation. The compromised PYUSD is more like a central bank digital currency (CBDC) issued by a technology company. Although centralized institutions like LianGuaiyLianGuail and Circle can avoid many scams and hacking incidents in the cryptocurrency industry, this is still considered a violation of the decentralized spirit of blockchain and the cryptocurrency industry in the traditional sense.

Although the centralized core of PYUSD may not satisfy the cryptocurrency industry, PYUSD may still be an important bridge for the future mass adoption of blockchain and the cryptocurrency industry.

Before LianGuaiyLianGuail launched PYUSD, MakerDAO had already returned to the center stage of the cryptocurrency industry with the narrative of RWA. According to MakerDAO’s SLianGuairk Protocol page, the deposit interest rate (DSR) for DAI has now increased to 8%, and the motive behind the increase in DSR rate is the value capture of its RWA interest-bearing assets.

This change seems to revive DAI. According to the latest data, the total value locked (TVL) in the DAI pool has exceeded $400 million, and the market value of DAI has also surpassed BUSD. Although traditional DeFi projects have the potential to lead a new wave of DeFi Summer again with the narrative of RWA, what we currently see is still the one-way rush of the cryptocurrency world towards traditional finance, with lots of sound but little substance.

The decentralized nature of DeFi projects and the magic of composability (such as decentralized stablecoins reflecting the value of RWA interest-bearing assets) are sought after by crypto punks, but for Web2 users, DeFi is still a dark forest like a maze, full of anxiety and unknowns. Incremental users of Web2 don’t care whether it is decentralized, convenience, usability, and ease of operation are the key.

5. PYUSD will accelerate the landing of stablecoin regulations

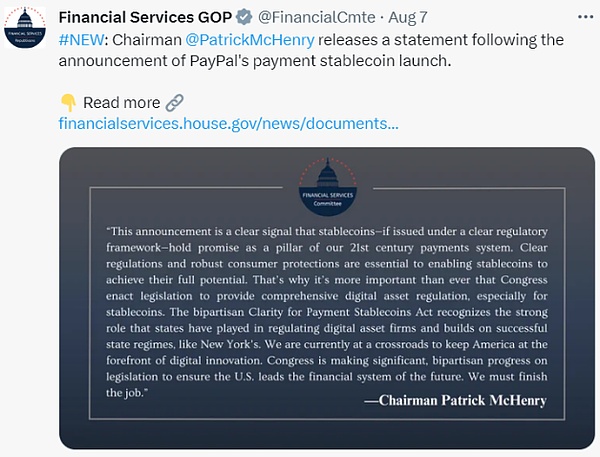

On July 27, 2023, the U.S. House Financial Services Committee introduced the “Clarity for Payment Stablecoins Act of 2023”. The purpose of this bill is to provide a clear regulatory framework for stablecoins and to protect U.S. investors and consumers by establishing unified standards.

After LianGuaiyLianGuail announced its stablecoin plan, Patrick McHenry, the chairman of the House Financial Services Committee, immediately expressed his support: “LianGuaiyLianGuail’s statement is a clear signal that stablecoins issued under a clear regulatory framework are expected to become the cornerstone of our 21st-century payment system. LianGuaiyLianGuail’s stablecoin makes it more important than ever to continue pushing for legislation.”

The launch of PYUSD has also drawn strong criticism from Maxine Waters, the top Democrat on the House Financial Services Committee. Indeed, considering LianGuaiyLianGuail’s massive audience at the federal and global levels (LianGuaiyLianGuail has 435 million customers worldwide, surpassing the total number of online accounts of all the largest banks combined), the regulation of stablecoins at the state level, such as in New York, is only a small part. The United States does not yet have a clear regulatory framework for supervising and enforcing stablecoin regulations at the federal level, but this is crucial for protecting consumer rights and maintaining financial stability.

Furthermore, considering the “currency” attributes of stablecoins, they to some extent replace some of the responsibilities of central bank legal tenders, making it more likely to cause turbulence in the financial system. Therefore, regulatory agencies for stablecoins will no longer be limited to the SEC and the CFTC, but may also involve central banks and finance departments in other jurisdictions.

It is believed that LianGuaiyLianGuail’s move will bring a sense of urgency to regulators, and the subsequent wave of stablecoins may soon drive the legislation of stablecoins in Congress to balance innovation and risk.

Sixth, in conclusion

LianGuaiyLianGuail’s entry is just the beginning, and there will be more financial companies entering the market, including well-known names like Visa, Mastercard, and Square, who have been exploring the application of stablecoins. However, considering the importance of compliance in traditional finance, it may start from the U.S. market and gradually expand overseas, and the pace will not be fast.

Although we have seen several previous bull markets driven by the cryptocurrency industry itself, such as the ICO boom, DeFi Summer, and the rise and fall of NFTs, this time may be different. LianGuaiyLianGuail’s launch of stablecoins may lead to a new bull market, but this process will not happen overnight, but will last for years, even decades.

It is precisely at this time that the snowball was pushed down from the top by LianGuaiyLianGuail.

REFERENCE:

[1] “Alipay” in the United States, LianGuaiyLianGuail, seeking survival through stablecoins, saving the cryptocurrency industry? https://foresightnews.pro/article/detail/40210

[2] LianGuaiyLianGuail bets on stablecoins, how should China, the leader in mobile payments, view it? https://mp.weixin.qq.com/s/hBJ-upsQix7nlBqRHDKUZg

[3] LianGuaiyLianGuail Steps On-Chain with PYUSD, Marking a Major Shift For Stablecoins https://flywheeldefi.com/article/payLianGuail-steps-on-chain-with-pyusd

[4] Will LianGuaiyLianGuail’s PYUSD Steal Market Share From Tether and Circle? https://www.youtube.com/watch?v=KoqmqqJJNjY

[5] LianGuaiyLianGuail’s Stablecoin Is a Watershed Moment for Financehttps://twitter.com/CoinDesk/status/1689326430641954834

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Holding $1.2 billion in assets but already running out of ammunition, is 10T Holdings becoming the white knight for early investors?

- Interpreting decentralized reserve stablecoins Faced with the impossible trinity dilemma, what tricks have various protocols used?

- Pendle PT YT Mechanism Analysis Why Choose to Buy YT-GLP?

- The popularity of FriendTech is due to its cleverly avoiding these social product traps.

- LianGuaiWeb3.0 Daily | friend.tech trading volume exceeds 30,000 ETH

- Friend.tech becomes explosively popular, how much longer can the bullet fly?

- Can recursive inscriptions trigger the next bull market?